Key Insights

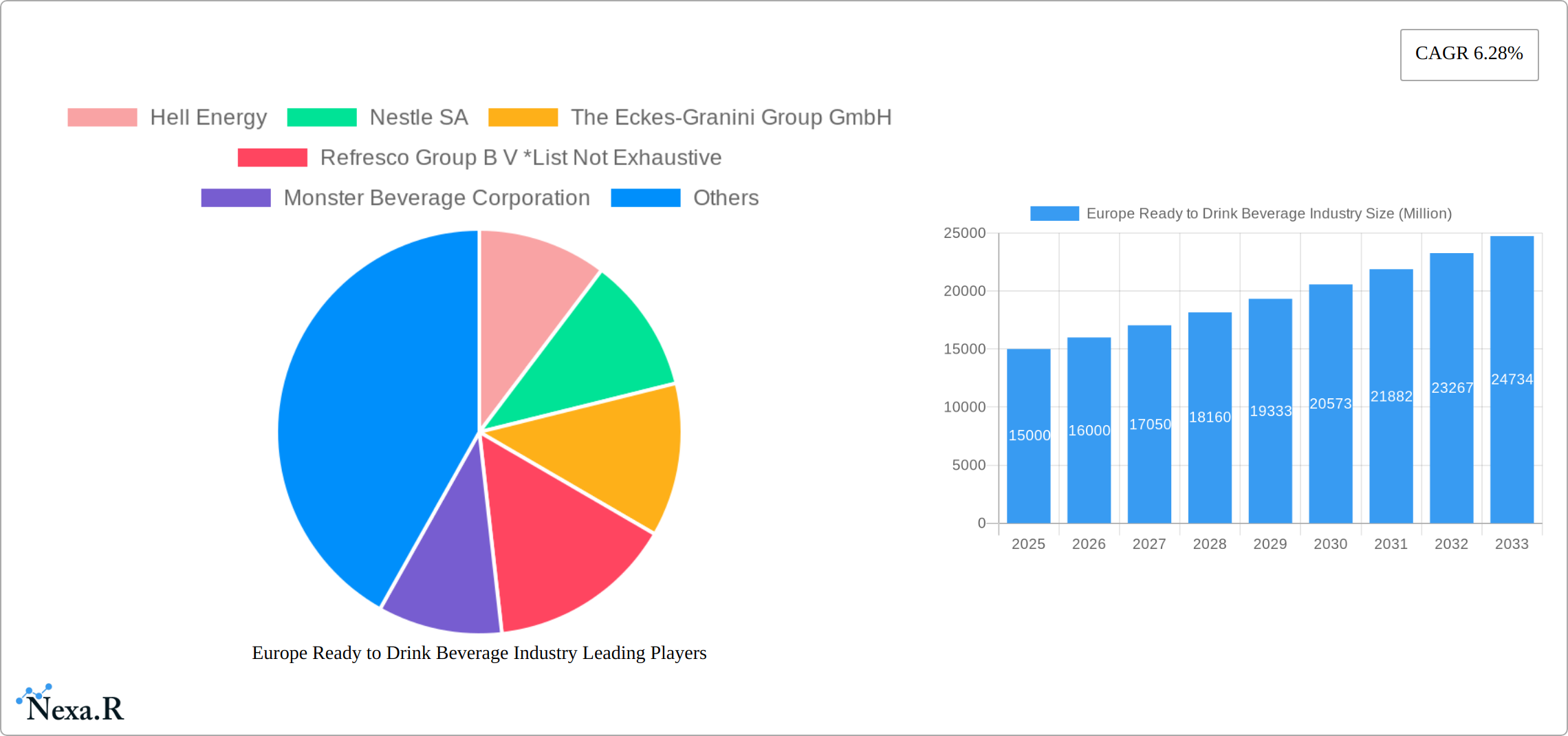

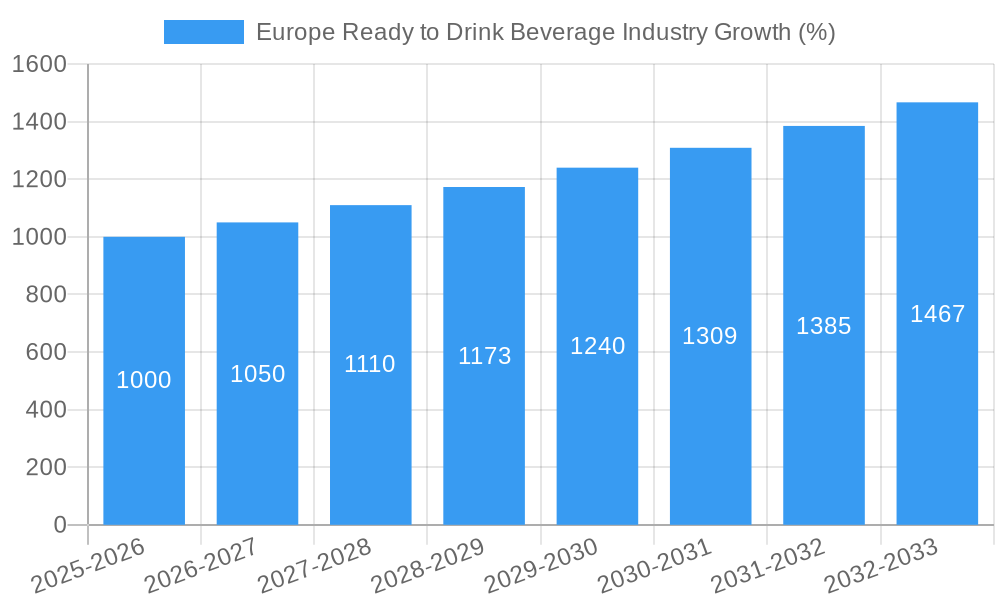

The European ready-to-drink (RTD) beverage market, valued at approximately €XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 6.28% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for convenient and on-the-go consumption options among busy consumers is a significant factor. Health and wellness trends are also shaping the market, with growing popularity of functional beverages like fruit and vegetable juices and enhanced water. Furthermore, innovative product launches featuring unique flavors, natural ingredients, and functional benefits are attracting new customer segments. The market is segmented by product type (tea, coffee, energy drinks, fruit & vegetable juices, dairy-based beverages, and others), distribution channel (supermarkets/hypermarkets, convenience stores, online retail stores, and others), and key European countries including the United Kingdom, Germany, Spain, France, Italy, Russia, and the rest of Europe. Competition is fierce, with major players like Coca-Cola, PepsiCo, Red Bull, Nestle, and smaller specialized brands vying for market share. The dominance of established players creates a challenging environment for new entrants. However, the continued growth in consumer demand and market innovation presents opportunities for companies that can adapt to shifting preferences and leverage emerging distribution channels.

The market's growth is expected to be influenced by several factors. Economic fluctuations and changing consumer spending habits can influence purchasing decisions. Government regulations concerning sugar content and labeling are likely to impact product formulations and marketing strategies. The increasing adoption of e-commerce and online retail channels provides further growth potential, although this will depend on factors such as logistical efficiency and digital marketing effectiveness. The continued expansion of the health-conscious consumer base is likely to drive demand for healthier and more functional beverages, while the competitive landscape requires continuous product innovation and efficient supply chain management for long-term market success. Geographical variations in consumer preferences and regulatory frameworks are also anticipated to affect market dynamics. The projected CAGR of 6.28% assumes a relatively stable macroeconomic environment and continued consumer demand for convenient and diverse beverage options.

Europe Ready to Drink Beverage Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the European Ready-to-Drink (RTD) beverage industry, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking a thorough understanding of this dynamic market. The report segments the market by product type (tea, coffee, energy drinks, fruit & vegetable juice, dairy-based beverages, others), distribution channel (supermarkets/hypermarkets, convenience stores, online retail stores, others), and country (United Kingdom, Germany, Spain, France, Italy, Russia, Rest of Europe). Key players such as Hell Energy, Nestle SA, The Eckes-Granini Group GmbH, Refresco Group B.V., Monster Beverage Corporation, PepsiCo Inc, Red Bull GmbH, The Coca-Cola Company, Suntory Beverages & Food Limited, and Starbucks Corp are analyzed.

Europe Ready to Drink Beverage Industry Market Dynamics & Structure

The European Ready-to-Drink (RTD) beverage market is a dynamic and highly competitive arena, shaped by accelerating consumer demand for convenience, health-conscious options, and innovative flavor profiles. Market concentration is moderately consolidated, with a few dominant multinational corporations strategically acquiring and integrating smaller, agile players to expand their reach and diversify their portfolios. Simultaneously, a vibrant ecosystem of emerging brands effectively caters to specialized niche segments. Technological advancements are pivotal, particularly in the realms of sustainable packaging solutions, advanced product formulation to deliver enhanced functional benefits, and sophisticated distribution networks. The evolving regulatory landscape, with a keen focus on sugar content reduction, transparent labeling, and substantiated health claims, significantly influences product development pathways and marketing strategies. The industry continues to witness robust merger and acquisition (M&A) activity, as established players strategically fortify their market positions and expand into high-growth categories.

- Market Concentration: Moderate to high, with the top 5 players estimated to hold approximately 60-65% of the market share in 2024, reflecting ongoing consolidation.

- Technological Innovation: Driving forces include the development of plant-based formulations, sophisticated delivery systems for functional ingredients, advanced sustainable packaging materials (e.g., biodegradable, refillable), and the integration of smart technologies for enhanced consumer engagement.

- Regulatory Landscape: Increasingly stringent regulations globally and within Europe concerning sugar taxation, artificial ingredient restrictions, clear nutritional labeling, and verifiable health and wellness claims.

- Competitive Landscape: Characterized by intense competition driven by aggressive marketing, significant investment in brand building, continuous product innovation, and a strong emphasis on unique selling propositions (USPs) such as health benefits, ethical sourcing, and premium positioning.

- M&A Activity: An active M&A landscape with an estimated 25-30 significant deals recorded between 2019 and 2024. These transactions are primarily fueled by strategic imperatives for market consolidation, portfolio expansion into high-demand categories, and the acquisition of innovative technologies or brands. (Estimated average deal value: €50-€75 Million).

- Innovation Barriers: Significant hurdles include high research and development (R&D) expenditures, complex and time-consuming regulatory approval processes for new ingredients and claims, challenges in achieving broad consumer acceptance for novel product concepts, and the ongoing need to navigate volatile raw material costs and supply chain complexities.

Europe Ready to Drink Beverage Industry Growth Trends & Insights

The European RTD beverage market exhibited robust growth between 2019 and 2024, driven by factors such as rising disposable incomes, changing lifestyles, and increased demand for convenient and healthy beverage options. The market is expected to continue its expansion throughout the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several factors, including the increasing popularity of functional beverages, the rise of e-commerce, and the growing awareness of health and wellness among consumers. Technological disruptions, such as the use of innovative packaging materials and the development of personalized beverage options, are further accelerating market expansion. Consumer behavior shifts, notably towards healthier options and premiumization, are also shaping market trends. Market penetration for RTD beverages is already high in major European markets, but further growth is anticipated in emerging segments and geographies.

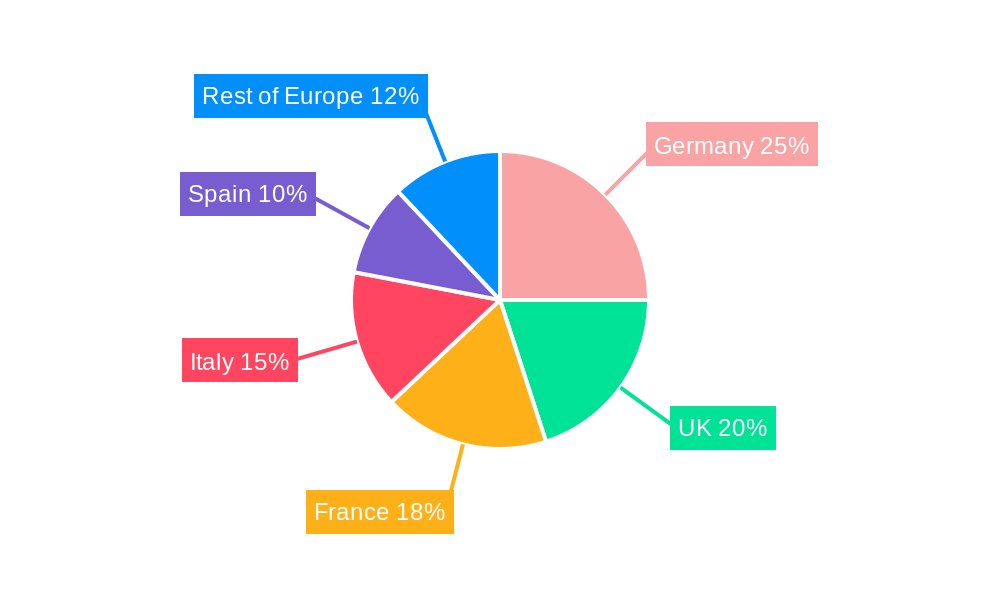

Dominant Regions, Countries, or Segments in Europe Ready to Drink Beverage Industry

The United Kingdom and Germany emerged as the leading markets for RTD beverages in Europe during the historical period. The strong presence of major beverage companies, coupled with high consumer spending and established retail infrastructure, contributed to this dominance. Within product segments, energy drinks and fruit & vegetable juices demonstrate particularly strong growth, driven by increasing health consciousness and the appeal of functional beverages. Supermarkets and hypermarkets remain the primary distribution channels, but convenience stores and online retail are gaining traction, particularly among younger demographics.

- Leading Countries: United Kingdom and Germany (market share: xx% and xx% respectively in 2024).

- Leading Product Type: Energy drinks and Fruit & Vegetable Juice (combined market share: xx% in 2024).

- Leading Distribution Channel: Supermarkets/Hypermarkets (market share: xx% in 2024).

- Growth Drivers: Rising disposable incomes, evolving consumer preferences, and advancements in product technology.

Europe Ready to Drink Beverage Industry Product Landscape

The European RTD beverage market presents an expansive and rapidly evolving product panorama. Beyond traditional offerings, there's a pronounced surge in functional beverages, health-centric formulations, and ethically sourced products. Product innovation is a direct response to escalating consumer demand for beverages that not only offer convenience but also contribute to well-being, utilize eco-friendly packaging, and deliver distinctive flavor experiences. Recent noteworthy product introductions exemplify this trend: OPERATE's innovative nootropic sports drinks, designed to enhance cognitive function; Carni-Tone by Applied Nutrition, a spring water infused with L-Carnitine to support metabolic health; and Daione's range of organic, Fairtrade-certified RTD coffee drinks, appealing to socially conscious consumers. These examples underscore a significant industry shift towards prioritizing tangible functional benefits, incorporating natural and premium ingredients, and adhering to ethical sourcing principles. Concurrently, advancements in packaging technology are enhancing product appeal through the adoption of sustainable alternatives and innovations that extend shelf life and improve consumer convenience.

Key Drivers, Barriers & Challenges in Europe Ready to Drink Beverage Industry

Key Drivers:

- Heightened Health Consciousness: An intensifying consumer focus on personal wellness is fueling robust demand for RTD beverages offering functional benefits, reduced sugar content, natural ingredients, and plant-based alternatives.

- Rising Disposable Incomes and Premiumization: Growing economic prosperity in many European regions enables consumers to allocate more discretionary spending towards premium, convenient, and health-oriented RTD beverages.

- Expansion of E-commerce and Digital Channels: The continued growth of online retail platforms and direct-to-consumer (DTC) models is significantly enhancing product accessibility, convenience, and brand reach across diverse consumer demographics.

- Demand for Convenience: Busy lifestyles and on-the-go consumption patterns continue to drive the inherent appeal of RTD beverages as a convenient hydration and refreshment solution.

Key Barriers & Challenges:

- Intense and Fragmented Competition: The market is characterized by fierce competition from both established global brands and a multitude of agile startups, leading to potential price wars, pressure on profit margins, and a constant need for differentiation.

- Complex and Evolving Regulatory Frameworks: Navigating diverse and often stringent regulations across different European countries regarding sugar content, artificial additives, labeling requirements, and health claims adds significant compliance costs and can impede the pace of product innovation.

- Supply Chain Volatility and Cost Pressures: Geopolitical events, climate change impacts, and global economic shifts can lead to significant supply chain disruptions, affecting the availability of raw materials, increasing production costs, and impacting delivery timelines (estimated impact of supply chain disruptions on production costs in 2024: 5-10%).

- Consumer Skepticism and Trust: Building and maintaining consumer trust, particularly for new functional claims or novel ingredients, requires substantial scientific backing and transparent communication to overcome potential skepticism.

Emerging Opportunities in Europe Ready to Drink Beverage Industry

- Growth in Niche and Specialized Segments: Significant untapped potential exists in expanding offerings for plant-based beverages, personalized nutrition drinks tailored to individual dietary needs or health goals, and functional beverages catering to specific demographics (e.g., aging population, athletes).

- Innovation in Functional Benefits and Ingredients: Further exploration and development of RTD beverages that offer enhanced immunity support, cognitive enhancement, stress reduction, improved sleep quality, and gut health benefits, utilizing scientifically validated ingredients.

- Sustainability and Ethical Consumption: Capitalizing on the escalating consumer demand for environmentally friendly packaging, ethically sourced ingredients, and brands with strong social responsibility credentials.

- Expansion into Underpenetrated Geographies: Identifying and developing markets within Eastern and Southern Europe that show increasing adoption of RTD beverages and a growing middle class with disposable income.

- Leveraging Digitalization and Personalization: Utilizing data analytics to understand consumer preferences and offer personalized product recommendations, subscription services, and direct-to-consumer engagement.

Growth Accelerators in the Europe Ready to Drink Beverage Industry Industry

Long-term growth is expected to be driven by several factors, including continued technological advancements leading to innovative product formulations and sustainable packaging. Strategic partnerships and collaborations between beverage companies and health and wellness brands offer considerable potential for market expansion. Expanding into new geographic markets and leveraging e-commerce channels provide further opportunities for growth.

Key Players Shaping the Europe Ready to Drink Beverage Industry Market

- Hell Energy

- Nestle SA

- The Eckes-Granini Group GmbH

- Refresco Group B.V.

- Monster Beverage Corporation

- PepsiCo Inc

- Red Bull GmbH

- The Coca-Cola Company

- Suntory Beverages & Food Limited

- Starbucks Corp

Notable Milestones in Europe Ready to Drink Beverage Industry Sector

- August 2021: Daione successfully launched its premium range of organic and Fairtrade-certified RTD coffee drinks, targeting conscious consumers seeking ethical and high-quality coffee solutions.

- February 2022: Applied Nutrition expanded its performance beverage portfolio with the introduction of Carni-Tone, a L-Carnitine-infused spring water designed to support energy metabolism and fitness goals.

- May 2022: OPERATE made a notable entry into the UK market with the launch of its plant-powered nootropic sports drink, addressing the growing demand for functional beverages that enhance mental clarity and focus.

- October 2023: Global beverage giant XYZ Corp announced a significant investment in a sustainable packaging startup, signaling a strong commitment to reducing the environmental footprint of its RTD portfolio.

- March 2024: A consortium of European RTD manufacturers announced a collaborative initiative to develop standardized guidelines for front-of-pack nutritional labeling, aiming to enhance consumer transparency and trust.

In-Depth Europe Ready to Drink Beverage Industry Market Outlook

The future of the European RTD beverage market appears bright, with continued growth driven by evolving consumer preferences, innovative product development, and the expansion of e-commerce. Strategic partnerships, focus on sustainability, and expansion into new geographical markets will be crucial for success. The market offers significant opportunities for both established players and emerging companies to capitalize on the growing demand for convenient, healthy, and functional beverages.

Europe Ready to Drink Beverage Industry Segmentation

-

1. Product Type

- 1.1. Tea

- 1.2. Coffee

- 1.3. Energy Drinks

- 1.4. Fruit & Vegetable Juice

- 1.5. Dairy based beverages

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Others

Europe Ready to Drink Beverage Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Ready to Drink Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products.

- 3.3. Market Restrains

- 3.3.1. Rising Concern Over Health Issues Associated with Processed Foods

- 3.4. Market Trends

- 3.4.1. Growing Preference for Convenient and Healthy On-The-Go Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tea

- 5.1.2. Coffee

- 5.1.3. Energy Drinks

- 5.1.4. Fruit & Vegetable Juice

- 5.1.5. Dairy based beverages

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hell Energy

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestle SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 The Eckes-Granini Group GmbH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Refresco Group B V *List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Monster Beverage Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PepsiCo Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Red Bull GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Coca-Cola Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Suntory Beverages & Food Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Starbucks Corp

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Hell Energy

List of Figures

- Figure 1: Europe Ready to Drink Beverage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Ready to Drink Beverage Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Ready to Drink Beverage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Ready to Drink Beverage Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ready to Drink Beverage Industry?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the Europe Ready to Drink Beverage Industry?

Key companies in the market include Hell Energy, Nestle SA, The Eckes-Granini Group GmbH, Refresco Group B V *List Not Exhaustive, Monster Beverage Corporation, PepsiCo Inc, Red Bull GmbH, The Coca-Cola Company, Suntory Beverages & Food Limited, Starbucks Corp.

3. What are the main segments of the Europe Ready to Drink Beverage Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products..

6. What are the notable trends driving market growth?

Growing Preference for Convenient and Healthy On-The-Go Beverages.

7. Are there any restraints impacting market growth?

Rising Concern Over Health Issues Associated with Processed Foods.

8. Can you provide examples of recent developments in the market?

In May 2022, OPERATE, a nootropic sports drink was launched in the United Kingdom. This sports drink is powered by plants and filled with natural extracts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ready to Drink Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ready to Drink Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ready to Drink Beverage Industry?

To stay informed about further developments, trends, and reports in the Europe Ready to Drink Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence