Key Insights

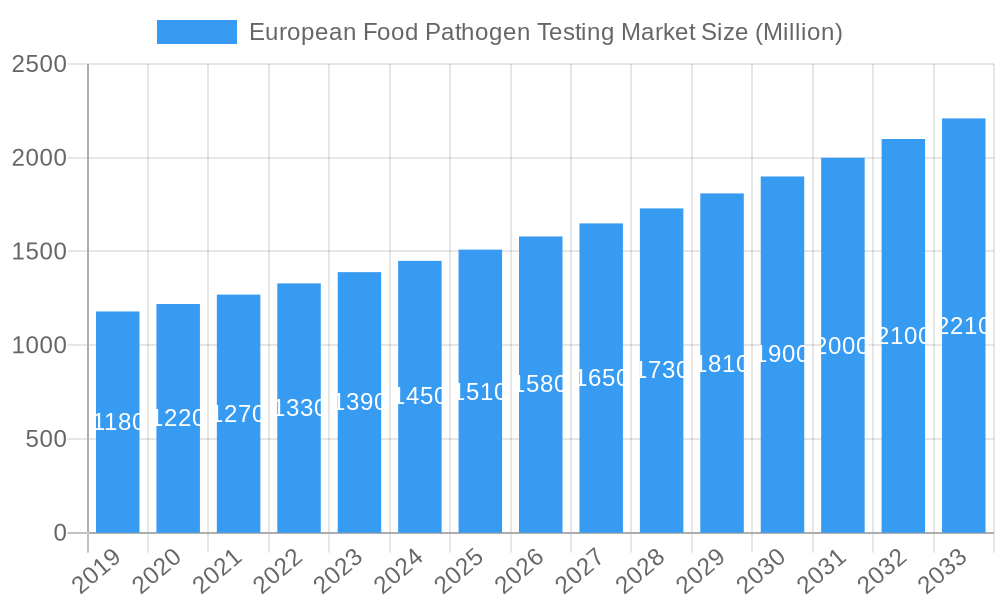

The European Food Pathogen Testing Market is projected for significant expansion, anticipated to reach approximately 6.45 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.84% from the 2024 base year. This growth is driven by escalating consumer demand for safe, high-quality food products and the implementation of increasingly rigorous regulatory standards across Europe. Heightened consumer awareness of foodborne pathogens fuels reliance on precise and timely testing to ensure supply chain integrity. Technological advancements in testing methods, such as Polymerase Chain Reaction (PCR) and immunoassay-based techniques, provide faster, more sensitive, and specific detection, crucial for mitigating evolving foodborne illness threats and maintaining consumer trust.

European Food Pathogen Testing Market Market Size (In Billion)

Key growth drivers include the rising incidence of foodborne outbreaks, necessitating proactive pathogen detection. The increasing prevalence of processed foods and complex global supply chains also elevates the need for robust testing protocols. While market momentum is strong, potential restraints like the high cost of advanced testing equipment and the requirement for skilled personnel may present challenges. Nevertheless, continuous innovation in testing methodologies and a growing recognition of the long-term economic benefits of preventing food contamination are expected to drive the market forward. Segment analysis highlights particular focus on ensuring the safety of Pet Food and Animal Feed, Dairy, Fruits and Vegetables, and Processed Food, reflecting significant consumer and regulatory attention.

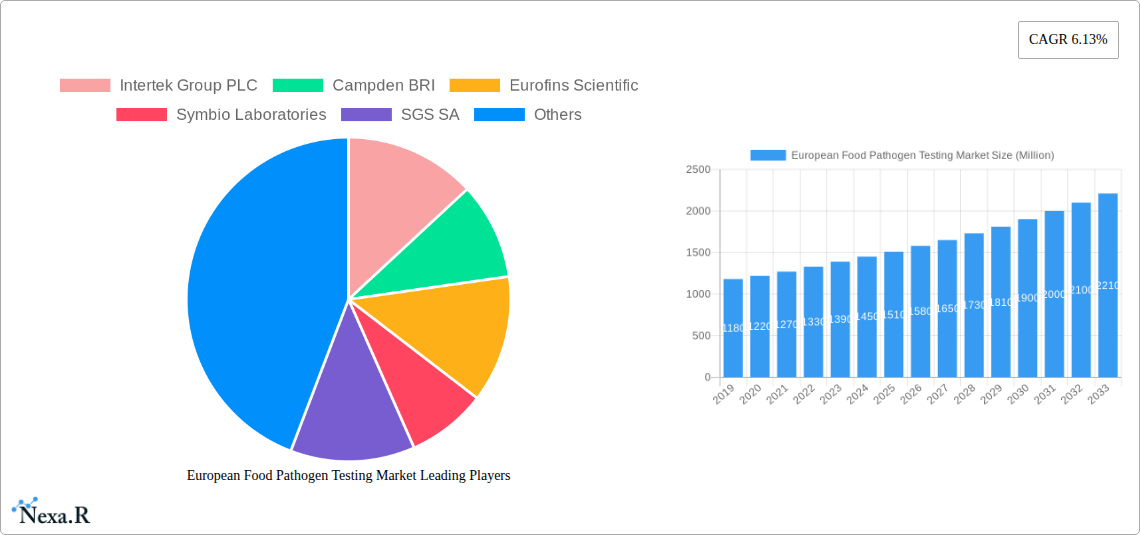

European Food Pathogen Testing Market Company Market Share

This comprehensive report offers a critical analysis of the European Food Pathogen Testing Market, detailing growth dynamics, competitive landscapes, and future trends from 2024 to 2033. Leveraging a 2024 base year and a 2024-2033 forecast period, this research utilizes high-traffic keywords and detailed market segmentation to provide actionable insights for industry stakeholders. Covering segments such as Pathogen Testing, Pesticide and Residue Testing, GMO Testing, and Allergen Testing, alongside technologies like Polymerase Chain Reaction (PCR) and Chromatography and Spectrometry, this report is essential for understanding the evolving food safety testing industry across applications like Meat and Poultry, Dairy, and Fruits and Vegetables. Gain a competitive advantage by identifying market drivers, emerging opportunities, and key player strategies within the critical European food supply chain.

European Food Pathogen Testing Market Market Dynamics & Structure

The European Food Pathogen Testing Market is characterized by a moderately concentrated structure, driven by the need for stringent food safety regulations and increasing consumer awareness regarding foodborne illnesses. Technological innovation is a primary driver, with continuous advancements in PCR technology and immunoassays enhancing the speed, accuracy, and sensitivity of pathogen detection. Regulatory frameworks, such as those established by the European Food Safety Authority (EFSA), mandate rigorous testing protocols, creating sustained demand for advanced testing solutions. While competitive product substitutes exist within broader contaminant testing categories like pesticide and residue analysis, dedicated pathogen testing remains a critical and distinct segment. End-user demographics are diverse, encompassing major food manufacturers, retailers, governmental agencies, and contract research organizations. Mergers and acquisitions (M&A) activity is notable, as key players consolidate their market positions and expand their service portfolios. For instance, the acquisition of Covance Food Solutions by Eurofins Scientific underscores the trend of consolidation aimed at enhancing market reach and technological capabilities. The market's growth is also influenced by evolving consumer preferences for transparent and safe food products, compelling businesses to invest more heavily in food quality control. Innovation barriers are primarily related to the high cost of advanced equipment and the need for skilled personnel to operate them, alongside the continuous challenge of adapting to new and emerging pathogens.

European Food Pathogen Testing Market Growth Trends & Insights

The European Food Pathogen Testing Market is poised for robust growth, driven by a confluence of escalating consumer demand for safe food, stringent regulatory oversight, and rapid technological advancements. The market size has witnessed a significant evolution, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period 2025–2033. This growth is underpinned by an increasing adoption rate of advanced testing methodologies, particularly Polymerase Chain Reaction (PCR), which offers unparalleled specificity and speed in identifying bacterial, viral, and fungal pathogens. Technological disruptions, such as the development of rapid, on-site testing solutions and the integration of artificial intelligence (AI) for data analysis, are further accelerating market penetration. Consumer behavior shifts, including a growing preference for organically produced and minimally processed foods, indirectly boost the demand for comprehensive testing to ensure the absence of pathogens and other contaminants. The market penetration of specific testing technologies is increasing as their cost-effectiveness and efficiency become more apparent to food businesses. Furthermore, heightened awareness surrounding foodborne outbreaks, amplified by media coverage and public health campaigns, compels manufacturers and retailers to prioritize proactive pathogen testing to safeguard their brands and comply with regulations like the EU's General Food Law. The expanding scope of food safety testing to encompass a wider array of potential contaminants, including mycotoxins and allergens, further contributes to the market's expansion. The overall trend indicates a move towards more comprehensive and integrated food quality assurance solutions, with pathogen testing playing a central role.

Dominant Regions, Countries, or Segments in European Food Pathogen Testing Market

Within the European Food Pathogen Testing Market, Pathogen Testing as a sub-segment of Contaminant Testing emerges as a dominant force, driven by its critical role in ensuring public health and regulatory compliance. This dominance is further amplified by the widespread application of Polymerase Chain Reaction (PCR) technology, which has become the gold standard for rapid and accurate pathogen identification across various food categories. The Meat and Poultry and Dairy application segments exhibit particularly strong growth and market share due to the inherent susceptibility of these products to microbial contamination and the high consumer sensitivity to pathogens like Salmonella, Listeria, and E. coli.

Key Drivers of Dominance:

- Stringent Regulations: The European Union's comprehensive food safety legislation, including regulations on microbial contamination, mandates rigorous pathogen testing across the entire food chain. This regulatory environment directly fuels demand for specialized pathogen testing services.

- Consumer Demand for Safety: Heightened consumer awareness regarding foodborne illnesses and a preference for safe, high-quality food products compel businesses to invest in robust pathogen testing protocols.

- Technological Advancement: The widespread adoption and continuous innovation in PCR technology have made it a cost-effective and highly reliable method for pathogen detection, significantly contributing to its dominance.

- Industry Developments: Strategic partnerships and acquisitions within the testing industry, such as those involving Eurofins Scientific and Bureau Veritas, are consolidating expertise and expanding service offerings, further bolstering the market for pathogen testing.

- Application-Specific Needs: Products like Meat and Poultry and Dairy inherently require extensive pathogen testing due to their vulnerability, leading to higher testing volumes and market penetration in these segments.

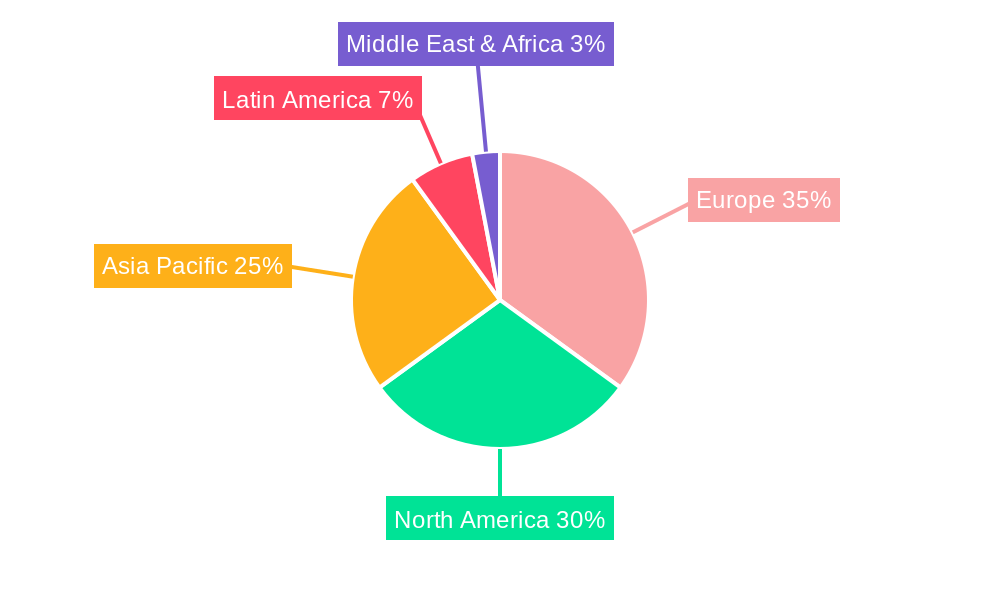

The United Kingdom and Germany are identified as leading countries within the European Food Pathogen Testing Market. This leadership is attributed to their well-established food industries, proactive regulatory bodies, and a significant concentration of food manufacturers and testing laboratories. Their robust economic policies and advanced infrastructure support the widespread implementation of sophisticated food safety testing solutions. The market share in these regions is substantial, driven by both domestic demand and the presence of global food companies headquartered there.

European Food Pathogen Testing Market Product Landscape

The European Food Pathogen Testing Market product landscape is characterized by a relentless pursuit of innovation focused on enhanced sensitivity, speed, and multiplexing capabilities. Leading laboratories and technology providers are introducing advanced PCR-based kits and real-time detection systems that can identify multiple pathogens simultaneously from a single sample, significantly reducing testing time and costs. These innovations are crucial for applications in meat and poultry, dairy, and fruits and vegetables, where rapid pathogen identification is paramount. Unique selling propositions revolve around improved limit of detection (LOD), reduced assay development time, and the ability to test for both target pathogens and resistance genes. Technological advancements are also focusing on the development of portable, field-deployable testing devices, enabling on-site analysis and faster decision-making throughout the food supply chain. The performance metrics of these products are continuously improving, with assays demonstrating higher specificity and inclusivity, and shorter turnaround times, thereby strengthening the overall food quality assurance framework in Europe.

Key Drivers, Barriers & Challenges in European Food Pathogen Testing Market

Key Drivers:

The European Food Pathogen Testing Market is propelled by several key drivers, including the ever-present threat of foodborne illnesses, necessitating stringent food safety testing. Evolving consumer demand for transparency and safe food products encourages higher investment in pathogen detection. Furthermore, increasingly rigorous food regulations enforced by bodies like EFSA mandate comprehensive testing protocols. Technological advancements, particularly in PCR and immunoassay-based technologies, offer faster, more accurate, and cost-effective solutions, driving their adoption. The growth of the processed food sector and increased global trade in food products also contribute significantly by expanding the scope and volume of necessary testing.

Key Barriers & Challenges:

Despite robust growth, the market faces significant barriers and challenges. The high cost associated with sophisticated food pathogen testing equipment and reagents can be a deterrent for smaller businesses. The need for skilled personnel to operate and interpret results from advanced technologies presents a human capital challenge. Navigating the complex and often fragmented regulatory landscape across different European countries can be burdensome. Supply chain disruptions, as witnessed in recent global events, can impact the availability of testing consumables and equipment. Competitive pressures from a large number of service providers also lead to price sensitivity. Emerging pathogens and evolving resistance mechanisms require continuous adaptation and investment in new testing methodologies, posing an ongoing challenge for food safety laboratories.

Emerging Opportunities in European Food Pathogen Testing Market

Emerging opportunities within the European Food Pathogen Testing Market lie in the development and adoption of novel, rapid, and on-site testing technologies. The increasing demand for plant-based alternatives and novel food ingredients presents a new frontier for pathogen testing and allergen testing. The integration of AI and machine learning in data analysis of testing results offers opportunities for predictive modeling and proactive risk assessment in the food supply chain. Furthermore, the expansion of e-commerce in the food sector necessitates enhanced traceability and testing to ensure consumer safety. Untapped markets within specific niche food categories and the growing focus on animal feed testing to prevent the spread of pathogens to humans represent significant growth potential. The development of more sustainable and environmentally friendly testing methods also aligns with evolving consumer and regulatory preferences.

Growth Accelerators in the European Food Pathogen Testing Market Industry

The long-term growth of the European Food Pathogen Testing Market is being accelerated by continuous technological breakthroughs in areas like next-generation sequencing (NGS) and biosensor technology, offering unprecedented speed and comprehensiveness in food pathogen identification. Strategic partnerships between technology developers, food manufacturers, and testing service providers are fostering innovation and expanding market reach. Market expansion strategies, including geographical diversification and the offering of integrated food safety solutions, are also key accelerators. The increasing emphasis on supply chain integrity and the drive towards greater transparency in food production are creating sustained demand for reliable food safety testing. Furthermore, governmental initiatives promoting food safety and public health awareness campaigns are acting as significant catalysts for market growth, encouraging greater investment in pathogen testing and related services across the European food industry.

Key Players Shaping the European Food Pathogen Testing Market Market

- Intertek Group PLC

- Campden BRI

- Eurofins Scientific

- Symbio Laboratories

- SGS SA

- Tuv Sud

- Bureau Veritas

- ALS Limited

- ifp Privates Institut fr Produktqualitt GmbH

- NFS International

Notable Milestones in European Food Pathogen Testing Market Sector

- April 2018: Eurofins signed a contract with LabCorp to acquire Covance Food Solutions, a food testing and consulting business for USD 670 million. This significantly expanded Eurofins' presence and capabilities in the food testing sector.

- July 2018: Eurofins Scientific successfully closed the acquisition of LABORATORIOS ECOSUR S.A., solidifying its position as a leader in the Food testing market in Spain and further strengthening its European footprint.

- July 2020: Bureau Veritas and The Ascott Limited signed a Europe agreement for providing audits and certification for the hygiene and safety standards of Ascott's worldwide properties. This development highlights the expanding role of testing and certification companies in ensuring broader hygiene and safety compliance beyond direct food testing.

In-Depth European Food Pathogen Testing Market Market Outlook

The European Food Pathogen Testing Market is set to experience sustained and robust growth, driven by an unwavering commitment to public health and food safety. Key growth accelerators include the relentless pace of technological innovation in rapid detection methods, such as advancements in PCR technology and the emergence of novel biosensors, which are making testing more accessible, faster, and more accurate. Strategic collaborations between testing laboratories, food producers, and regulatory bodies will further streamline food safety assurance processes and foster the development of integrated solutions. The increasing consumer demand for transparency and traceability throughout the food supply chain will continue to fuel investment in comprehensive contaminant testing, including pathogen testing, allergen testing, and GMO testing. Furthermore, the expanding landscape of processed foods and novel food ingredients necessitates continuous adaptation and development of testing protocols. The market outlook is highly positive, with significant opportunities for companies that can offer scalable, cost-effective, and technologically advanced food quality control services.

European Food Pathogen Testing Market Segmentation

-

1. Contaminant Testing

- 1.1. Pathogen Testing

- 1.2. Pesticide and Residue Testing

- 1.3. Mycotoxin Testing

- 1.4. GMO Testing

- 1.5. Allergen Testing

- 1.6. Other Types of Testing

-

2. Technology

- 2.1. Polymerase Chain Reaction (PCR)

- 2.2. Chromatography and Spectrometry

- 2.3. Immunoassay-based

- 2.4. Other Technologies

-

3. Application

- 3.1. Pet Food and Animal Feed

- 3.2. Dairy

- 3.3. Fruits and Vegetables

- 3.4. Processed Food

- 3.5. Crops

- 3.6. Meat and Poultry

- 3.7. Other Foods

European Food Pathogen Testing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Food Pathogen Testing Market Regional Market Share

Geographic Coverage of European Food Pathogen Testing Market

European Food Pathogen Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Food Safety Testing Emerging as a Pivotal Point Against Surging Number of Food Frauds Cases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Food Pathogen Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Testing

- 5.1.1. Pathogen Testing

- 5.1.2. Pesticide and Residue Testing

- 5.1.3. Mycotoxin Testing

- 5.1.4. GMO Testing

- 5.1.5. Allergen Testing

- 5.1.6. Other Types of Testing

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Polymerase Chain Reaction (PCR)

- 5.2.2. Chromatography and Spectrometry

- 5.2.3. Immunoassay-based

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Pet Food and Animal Feed

- 5.3.2. Dairy

- 5.3.3. Fruits and Vegetables

- 5.3.4. Processed Food

- 5.3.5. Crops

- 5.3.6. Meat and Poultry

- 5.3.7. Other Foods

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Testing

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Campden BRI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurofins Scientific

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Symbio Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SGS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tuv Sud

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bureau Veritas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALS Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ifp Privates Institut fr Produktqualitt GmbH*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NFS International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: European Food Pathogen Testing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: European Food Pathogen Testing Market Share (%) by Company 2025

List of Tables

- Table 1: European Food Pathogen Testing Market Revenue billion Forecast, by Contaminant Testing 2020 & 2033

- Table 2: European Food Pathogen Testing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: European Food Pathogen Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: European Food Pathogen Testing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: European Food Pathogen Testing Market Revenue billion Forecast, by Contaminant Testing 2020 & 2033

- Table 6: European Food Pathogen Testing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: European Food Pathogen Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: European Food Pathogen Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark European Food Pathogen Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Food Pathogen Testing Market?

The projected CAGR is approximately 5.84%.

2. Which companies are prominent players in the European Food Pathogen Testing Market?

Key companies in the market include Intertek Group PLC, Campden BRI, Eurofins Scientific, Symbio Laboratories, SGS SA, Tuv Sud, Bureau Veritas, ALS Limited, ifp Privates Institut fr Produktqualitt GmbH*List Not Exhaustive, NFS International.

3. What are the main segments of the European Food Pathogen Testing Market?

The market segments include Contaminant Testing, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.45 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

Food Safety Testing Emerging as a Pivotal Point Against Surging Number of Food Frauds Cases.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

In April 2018, Eurofins signed a contract with LabCorp to acquire Covance Food Solutions, a food testing and consulting business fro USD 670 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Food Pathogen Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Food Pathogen Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Food Pathogen Testing Market?

To stay informed about further developments, trends, and reports in the European Food Pathogen Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence