Key Insights

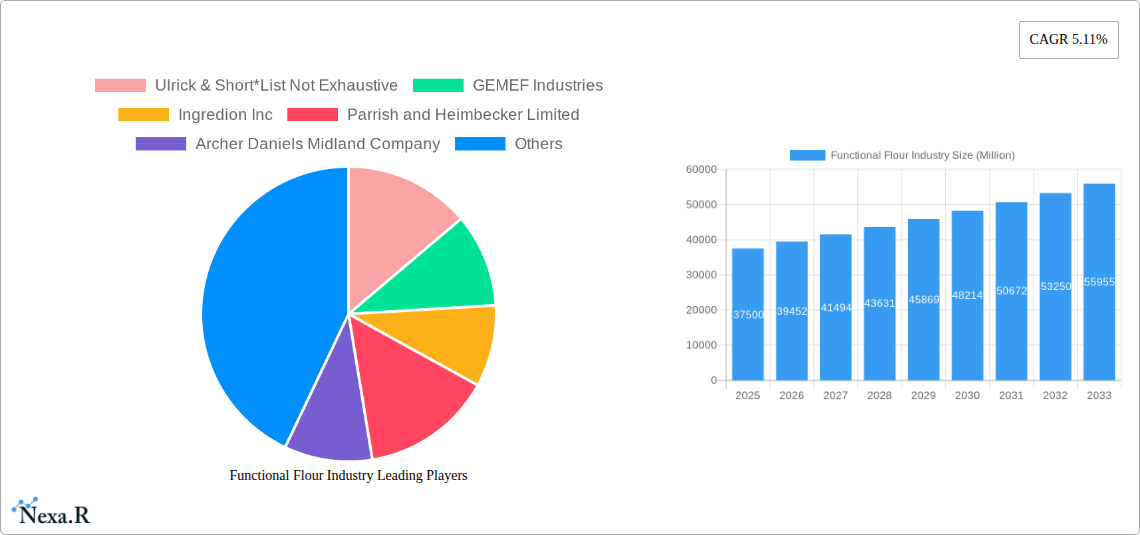

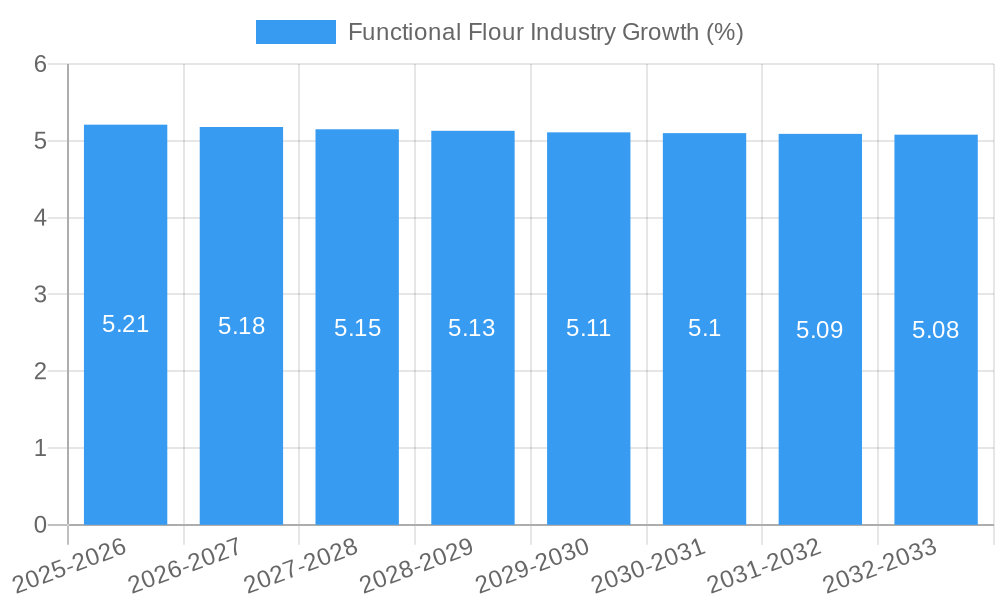

The global functional flour market is poised for significant expansion, projected to reach a substantial market size of approximately $37,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.11% through 2033. This robust growth is primarily propelled by escalating consumer demand for healthier food options, leading to increased adoption of specialty flours derived from sources like cereals and legumes. Functional flours offer enhanced nutritional profiles, improved texture, and extended shelf life, making them attractive ingredients for a wide array of applications. The rising popularity of bakery products, savory snacks, and ready-to-eat meals, coupled with a growing awareness of the benefits of alternative flours such as gluten-free and high-protein varieties, are key drivers fueling this market surge. Furthermore, advancements in processing technologies are enabling the development of more diverse and specialized functional flour products, catering to specific dietary needs and preferences.

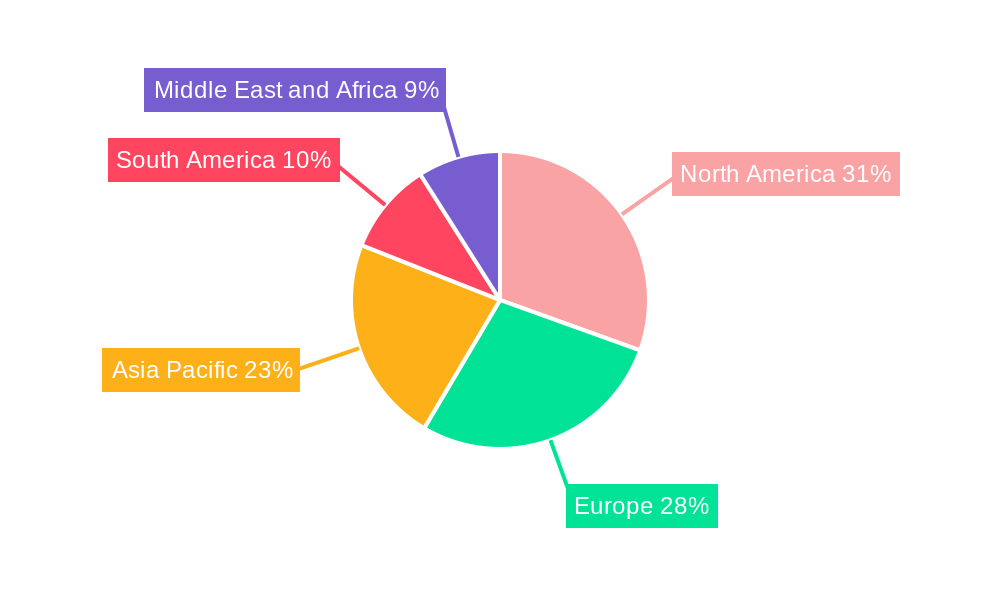

Despite the promising outlook, certain restraints may temper the market's trajectory. These include the fluctuating prices of raw materials, particularly agricultural commodities, and the potential for higher production costs associated with specialized processing techniques. Regulatory landscapes concerning food fortification and labeling of functional ingredients can also present challenges. However, the market is actively adapting through innovation and strategic partnerships. Key players are investing heavily in research and development to create novel functional flour solutions and expand their product portfolios. The market segmentation reveals a dynamic landscape with strong potential in both specialty and conventional flour types, serving diverse applications across bakery, savory snacks, soups, sauces, and ready-to-eat products. Geographically, North America and Europe are expected to remain dominant markets, driven by well-established food industries and high consumer spending on health-conscious products, while the Asia Pacific region presents considerable untapped growth opportunities.

This comprehensive report provides an in-depth analysis of the global functional flour market, detailing its current landscape, historical performance, and future trajectory. Covering the study period from 2019 to 2033, with a base year of 2025, this report offers critical insights into market dynamics, growth trends, regional dominance, product innovation, key drivers, challenges, emerging opportunities, and growth accelerators. Dive deep into the specialty flour market and conventional flour market, understanding their interplay and impact on various applications like bakery, savory snacks, soups and sauces, and ready-to-eat products. This report is an essential resource for stakeholders seeking to navigate the evolving wheat flour market, rice flour market, and legume flour market, identifying strategic advantages and investment opportunities within the food ingredients market.

Functional Flour Industry Market Dynamics & Structure

The functional flour industry is characterized by a moderately concentrated market, driven by significant technological innovation and evolving regulatory landscapes. Key players are investing heavily in research and development to create flours with enhanced nutritional profiles, improved processing capabilities, and novel functionalities catering to specific dietary needs and consumer preferences. The rise of clean-label ingredients and demand for gluten-free alternatives are significant technological innovation drivers. Competitive product substitutes, such as starches and gums, pose a moderate threat, but the unique textural and nutritional benefits of functional flours offer a distinct advantage. End-user demographics are increasingly health-conscious, seeking products with added fiber, protein, and reduced allergenicity. Mergers and acquisitions (M&A) are actively shaping the market landscape as larger companies seek to expand their portfolios and gain access to proprietary technologies. The market size for functional flours reached approximately USD 15,000 million in 2024, with projections indicating robust growth.

- Market Concentration: Moderately concentrated with a few large players holding significant market share, but with increasing entry of specialized and regional manufacturers.

- Technological Innovation Drivers: Demand for gluten-free, high-protein, high-fiber, low-glycemic index (GI) flours, and clean-label ingredients. Advancements in milling and processing technologies to enhance functionality.

- Regulatory Frameworks: Increasing scrutiny on food labeling, health claims, and allergen information, impacting product development and marketing strategies.

- Competitive Product Substitutes: Modified starches, hydrocolloids, and other texturizing agents.

- End-User Demographics: Growing demand from health-conscious consumers, individuals with dietary restrictions (e.g., celiac disease), and the burgeoning elderly population seeking nutrient-dense food options.

- M&A Trends: Strategic acquisitions by major food ingredient companies to enhance their functional flour offerings and market reach. Approximately 20-25 M&A deals were observed between 2019-2024, with an average deal value in the hundreds of millions of USD.

Functional Flour Industry Growth Trends & Insights

The global functional flour market is experiencing robust growth, driven by escalating consumer awareness regarding health and wellness, coupled with the demand for customized dietary solutions. The market size, valued at approximately USD 12,500 million in 2023, is projected to expand significantly, reaching an estimated USD 22,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period (2025-2033). This expansion is fueled by the increasing adoption of functional flours across various food applications, including bakery products, which represent a substantial segment of the market, and a growing interest in innovative uses within savory snacks and ready-to-eat meals.

Technological disruptions, such as advanced enzymatic treatments and innovative milling techniques, are enhancing the nutritional and functional properties of flours derived from cereals, legumes, and other sources. These advancements allow for better texture, improved digestibility, and the incorporation of beneficial compounds like prebiotics and resistant starch. Consumer behavior is shifting towards proactive health management, leading to a preference for foods that offer tangible health benefits, positioning functional flours as a key ingredient in the modern food industry. The "free-from" trend, particularly the demand for gluten-free and allergen-free options, continues to be a major catalyst, driving innovation in specialty flour formulations. Furthermore, the rising disposable incomes in emerging economies are broadening the consumer base for premium and health-oriented food products, thereby accelerating market penetration for functional flours. The specialty flour segment is anticipated to outpace the conventional flour segment in terms of growth rate due to its targeted health benefits and premium positioning. The market penetration for functional flours in developed economies is estimated to be around 35-40%, with significant room for growth in developing regions.

Dominant Regions, Countries, or Segments in Functional Flour Industry

North America currently holds a dominant position in the functional flour industry, driven by a confluence of high consumer awareness regarding health and nutrition, a well-established food processing industry, and significant investments in research and development. The region’s robust economic policies, strong regulatory support for food innovation, and advanced infrastructure facilitate the widespread adoption of functional flours across various applications, including bakery, savory snacks, and ready-to-eat products. The cereals segment, particularly wheat and oat-based functional flours, continues to lead due to their widespread availability and versatility. However, the legumes segment, encompassing flours from chickpeas, lentils, and peas, is witnessing rapid growth due to their high protein content and appeal to vegan and vegetarian consumers.

The United States, in particular, accounts for a substantial market share, driven by strong demand for gluten-free and high-fiber products. Canada and Mexico also contribute significantly to the regional market. Key drivers of dominance in this region include:

- High Consumer Spending on Health Foods: Consumers are willing to pay a premium for products perceived as healthier, directly benefiting the specialty flour market.

- Advanced Food Processing Infrastructure: State-of-the-art manufacturing facilities and a well-developed supply chain enable efficient production and distribution of functional flours.

- Technological Advancements: Significant investment in R&D by major companies like Cargill and Ingredion Inc. to develop novel functional flour solutions.

- Supportive Regulatory Environment: Clear guidelines and incentives for food manufacturers focusing on health and wellness products.

In terms of segments, specialty flours are experiencing a higher growth rate compared to conventional flours, reflecting the increasing consumer demand for tailored nutritional benefits. Within applications, bakery remains the largest segment, but savory snacks and soups and sauces are demonstrating impressive growth potential as manufacturers explore new avenues for incorporating functional ingredients. The market share of North America is estimated at 30-35% of the global functional flour market in 2025.

Functional Flour Industry Product Landscape

The functional flour industry is witnessing a surge in product innovation, characterized by enhanced nutritional profiles and specific functionalities. Manufacturers are focusing on developing flours with increased protein content, higher fiber levels, reduced glycemic impact, and allergen-free properties. For instance, Cargill's SimPure rice flour offers a clean-label solution as a maltodextrin substitute, providing similar taste, texture, and functionality. Ulrick & Short's Nutrigel targets gluten-free bakery applications, improving viscosity, texture, and moisture retention. Ingredion's Homecraft Create series offers multifunctional rice flours for clean-label baby food, providing process tolerance and stability akin to modified starches. These innovations cater to the growing demand for healthier, more convenient, and specialized food ingredients, underpinning the market's dynamic evolution.

Key Drivers, Barriers & Challenges in Functional Flour Industry

Key Drivers:

- Growing Health and Wellness Trends: Increasing consumer focus on nutrition, weight management, and disease prevention fuels demand for functional flours with added health benefits like fiber and protein.

- Rising Prevalence of Food Allergies and Intolerances: Demand for gluten-free, dairy-free, and other allergen-free alternatives is a significant market driver, particularly for specialty flours.

- Technological Advancements: Innovations in processing techniques enhance the functional properties and nutritional value of various flour types, expanding their application scope.

- Clean Label Demand: Consumers prefer ingredients perceived as natural and minimally processed, driving the development of functional flours derived from recognizable sources.

Barriers & Challenges:

- Higher Production Costs: Specialized processing and sourcing of raw materials can lead to higher production costs for functional flours compared to conventional alternatives.

- Consumer Awareness and Education: A lack of widespread understanding regarding the benefits and applications of certain functional flours can limit adoption rates in some markets.

- Supply Chain Volatility: Dependence on specific agricultural commodities can lead to price fluctuations and availability issues, impacting market stability.

- Regulatory Hurdles: Navigating diverse and evolving food regulations across different regions can pose challenges for market entry and product standardization. For instance, claims related to health benefits require rigorous scientific substantiation.

Emerging Opportunities in Functional Flour Industry

Emerging opportunities within the functional flour industry lie in tapping into the burgeoning plant-based protein trend and catering to the aging population's nutritional needs. The development of functional flours enriched with omega-3 fatty acids or specific antioxidants presents a significant avenue for differentiation. Furthermore, exploring novel applications in areas like functional beverages, nutritional supplements, and pet food offers untapped market potential. The increasing interest in gut health also opens doors for prebiotic-rich functional flours derived from ingredients like chicory root or specific resistant starches. Regions with a rapidly growing middle class and increasing health consciousness, particularly in Asia-Pacific, represent significant emerging markets for functional flour adoption.

Growth Accelerators in the Functional Flour Industry Industry

Several catalysts are accelerating long-term growth in the functional flour industry. Technological breakthroughs in areas such as enzymatic modification and advanced extrusion processes are enabling the creation of flours with highly tailored functionalities and improved bioavailability of nutrients. Strategic partnerships between ingredient manufacturers and food product developers are crucial for co-creating innovative solutions that meet evolving consumer demands. Market expansion strategies, including targeting emerging economies and developing specialized product lines for niche dietary needs (e.g., low-FODMAP flours), will further propel growth. The ongoing trend towards sustainable sourcing and production methods also presents an opportunity for companies that can demonstrate environmental responsibility, further solidifying their market position and attracting conscious consumers.

Key Players Shaping the Functional Flour Industry Market

- Ulrick & Short

- GEMEF Industries

- Ingredion Inc.

- Parrish and Heimbecker Limited

- Archer Daniels Midland Company

- Bunge Limited

- Associated British Foods plc

- The Caremoli Group

- Cargill Inc.

- The Scoular Company

- Südzucker AG (Agrana Beteiligungs-AG)

Notable Milestones in Functional Flour Industry Sector

- Oct 2021: Cargill launched a rice flour-based maltodextrin substitute, SimPure rice flour, offering a clean-label alternative with similar functional properties, impacting the clean-label ingredient market.

- Jul 2021: Ulrick & Short introduced Nutrigel, a functional flour designed to enhance viscosity, texture, and structure in gluten-free bakery applications, addressing a key challenge in the gluten-free bakery market.

- Mar 2021: Ingredion EMEA expanded its portfolio with Homecraft Create 835 and Homecraft Create 865 multifunctional rice flours, supporting the production of clean-label baby food and influencing the baby food ingredients market.

In-Depth Functional Flour Industry Market Outlook

The future outlook for the functional flour industry is exceptionally promising, characterized by sustained growth driven by an expanding consumer base prioritizing health and wellness. The increasing demand for plant-based ingredients and products addressing specific dietary needs, such as high-protein and low-carbohydrate options, will continue to be a dominant force. Strategic collaborations between ingredient suppliers and food manufacturers will be pivotal in driving product innovation and market penetration. Emerging markets, particularly in Asia-Pacific and Latin America, represent significant untapped potential for functional flour adoption. Furthermore, advancements in sustainable sourcing and processing technologies will not only enhance product appeal but also align with global environmental consciousness, positioning the functional flour market for substantial and long-term expansion, contributing to the broader food ingredients market evolution.

Functional Flour Industry Segmentation

-

1. Source

- 1.1. Cereals

- 1.2. Legumes

-

2. Type

- 2.1. Specialty Flour

- 2.2. Conventional Flour

-

3. Application

- 3.1. Bakery

- 3.2. Savory Snacks

- 3.3. Soups and Sauces

- 3.4. Ready-to-Eat products

- 3.5. Other Applications

Functional Flour Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Functional Flour Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Application of the Additive

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Nutrient-enriched Foods to Improve Overall Health

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Cereals

- 5.1.2. Legumes

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Specialty Flour

- 5.2.2. Conventional Flour

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Savory Snacks

- 5.3.3. Soups and Sauces

- 5.3.4. Ready-to-Eat products

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Cereals

- 6.1.2. Legumes

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Specialty Flour

- 6.2.2. Conventional Flour

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery

- 6.3.2. Savory Snacks

- 6.3.3. Soups and Sauces

- 6.3.4. Ready-to-Eat products

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Cereals

- 7.1.2. Legumes

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Specialty Flour

- 7.2.2. Conventional Flour

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery

- 7.3.2. Savory Snacks

- 7.3.3. Soups and Sauces

- 7.3.4. Ready-to-Eat products

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Cereals

- 8.1.2. Legumes

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Specialty Flour

- 8.2.2. Conventional Flour

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bakery

- 8.3.2. Savory Snacks

- 8.3.3. Soups and Sauces

- 8.3.4. Ready-to-Eat products

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Cereals

- 9.1.2. Legumes

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Specialty Flour

- 9.2.2. Conventional Flour

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bakery

- 9.3.2. Savory Snacks

- 9.3.3. Soups and Sauces

- 9.3.4. Ready-to-Eat products

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Cereals

- 10.1.2. Legumes

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Specialty Flour

- 10.2.2. Conventional Flour

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Bakery

- 10.3.2. Savory Snacks

- 10.3.3. Soups and Sauces

- 10.3.4. Ready-to-Eat products

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. North America Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Rest of Europe

- 13. Asia Pacific Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Functional Flour Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ulrick & Short*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 GEMEF Industries

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Ingredion Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Parrish and Heimbecker Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Archer Daniels Midland Company

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bunge Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Associated British Foods plc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 The Caremoli Group

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cargill Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 The Scoular Company

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Südzucker AG (Agrana Beteiligungs-AG)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Ulrick & Short*List Not Exhaustive

List of Figures

- Figure 1: Global Functional Flour Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Functional Flour Industry Revenue (Million), by Source 2024 & 2032

- Figure 13: North America Functional Flour Industry Revenue Share (%), by Source 2024 & 2032

- Figure 14: North America Functional Flour Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Functional Flour Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Functional Flour Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Functional Flour Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Functional Flour Industry Revenue (Million), by Source 2024 & 2032

- Figure 21: Europe Functional Flour Industry Revenue Share (%), by Source 2024 & 2032

- Figure 22: Europe Functional Flour Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Functional Flour Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Functional Flour Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Functional Flour Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Functional Flour Industry Revenue (Million), by Source 2024 & 2032

- Figure 29: Asia Pacific Functional Flour Industry Revenue Share (%), by Source 2024 & 2032

- Figure 30: Asia Pacific Functional Flour Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Functional Flour Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Functional Flour Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Functional Flour Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Functional Flour Industry Revenue (Million), by Source 2024 & 2032

- Figure 37: South America Functional Flour Industry Revenue Share (%), by Source 2024 & 2032

- Figure 38: South America Functional Flour Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: South America Functional Flour Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: South America Functional Flour Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: South America Functional Flour Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: South America Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: South America Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Functional Flour Industry Revenue (Million), by Source 2024 & 2032

- Figure 45: Middle East and Africa Functional Flour Industry Revenue Share (%), by Source 2024 & 2032

- Figure 46: Middle East and Africa Functional Flour Industry Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Functional Flour Industry Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Functional Flour Industry Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Functional Flour Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Functional Flour Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Functional Flour Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Functional Flour Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Functional Flour Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Global Functional Flour Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Functional Flour Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Functional Flour Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Russia Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: China Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Africa Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Functional Flour Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 34: Global Functional Flour Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Functional Flour Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United States Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Canada Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Mexico Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of North America Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Functional Flour Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 42: Global Functional Flour Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global Functional Flour Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Kingdom Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: France Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Russia Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Functional Flour Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 53: Global Functional Flour Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Functional Flour Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: India Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: China Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Australia Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Functional Flour Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 62: Global Functional Flour Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Functional Flour Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Brazil Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Argentina Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Rest of South America Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Global Functional Flour Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 69: Global Functional Flour Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 70: Global Functional Flour Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 71: Global Functional Flour Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 72: South Africa Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Saudi Arabia Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East and Africa Functional Flour Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Functional Flour Industry?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Functional Flour Industry?

Key companies in the market include Ulrick & Short*List Not Exhaustive, GEMEF Industries, Ingredion Inc, Parrish and Heimbecker Limited, Archer Daniels Midland Company, Bunge Limited, Associated British Foods plc, The Caremoli Group, Cargill Inc, The Scoular Company, Südzucker AG (Agrana Beteiligungs-AG).

3. What are the main segments of the Functional Flour Industry?

The market segments include Source, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification.

6. What are the notable trends driving market growth?

Increasing Consumption of Nutrient-enriched Foods to Improve Overall Health.

7. Are there any restraints impacting market growth?

Low Awareness and Application of the Additive.

8. Can you provide examples of recent developments in the market?

Oct 2021: Cargill launched a rice flour-based maltodextrin substitute. Cargill's new soluble SimPure rice flour is a clean label that has a similar taste, texture, and functionality as maltodextrin. This ingredient can be used as a one-to-one replacement for maltodextrin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Functional Flour Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Functional Flour Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Functional Flour Industry?

To stay informed about further developments, trends, and reports in the Functional Flour Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence