Key Insights

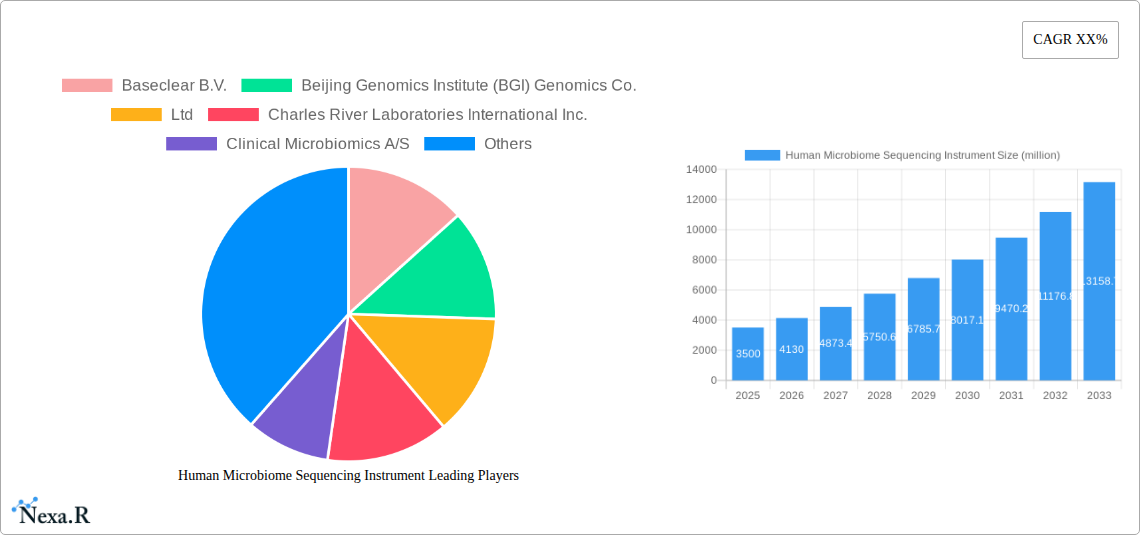

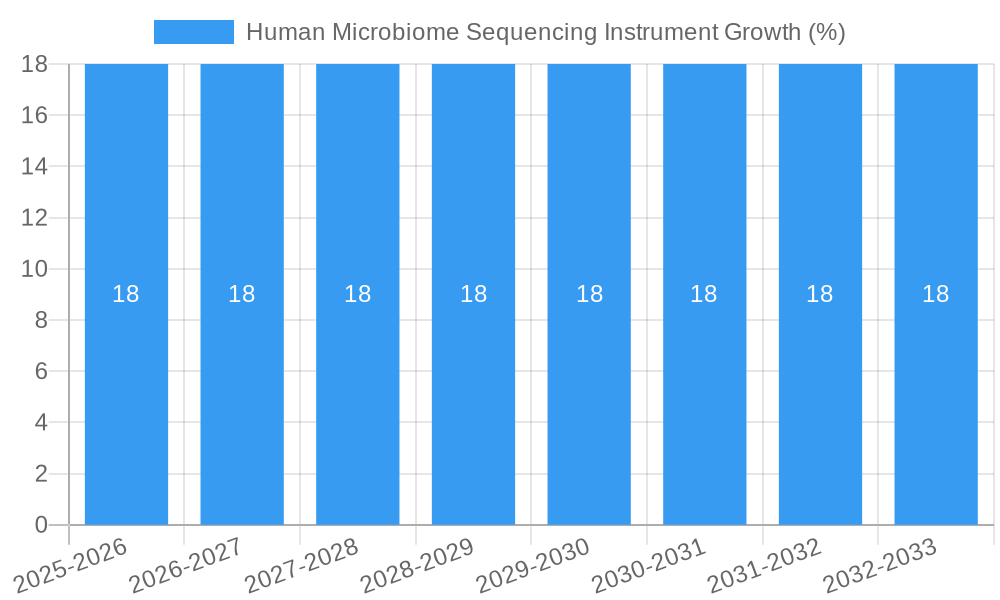

The global Human Microbiome Sequencing Instrument market is experiencing robust expansion, projected to reach an estimated USD 3,500 million in 2025. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period of 2025-2033, indicating a dynamic and rapidly evolving landscape. A primary driver for this surge is the escalating understanding of the microbiome's profound impact on human health and disease. Research institutions and pharmaceutical companies are increasingly investing in advanced sequencing technologies to unravel the complexities of microbial communities, paving the way for novel diagnostic tools and therapeutic interventions. The expanding applications in personalized medicine, drug discovery, and infectious disease research are further propelling demand for sophisticated instruments capable of high-throughput and accurate microbiome profiling.

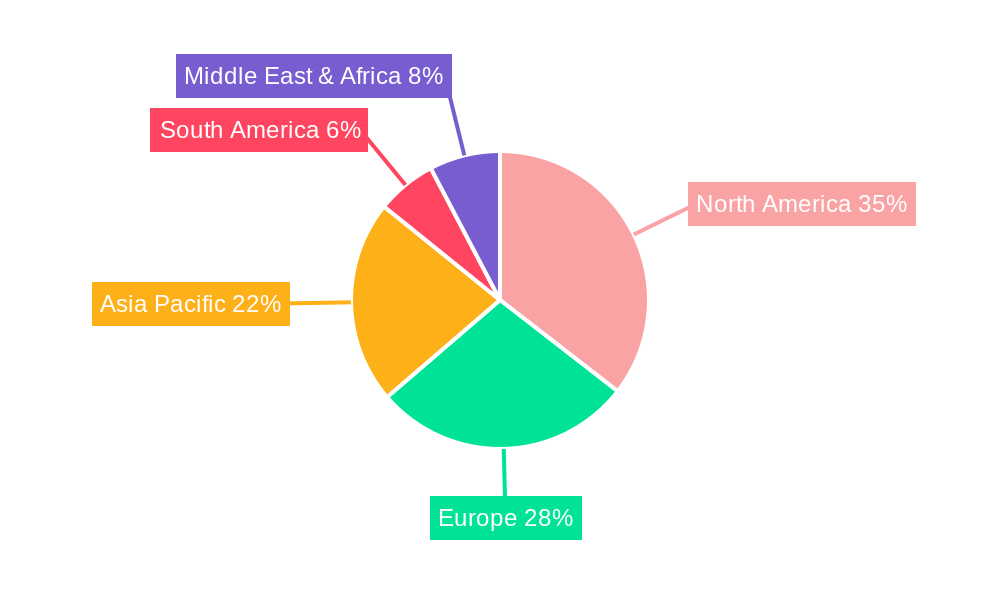

The market is segmented across key applications, with Pharmaceutical and Biotechnology Companies and Research and Academic Institutions emerging as dominant segments due to their extensive R&D activities in microbiome science. Within types, Reagents and Kits and Instruments, particularly Liquid Handling Instruments and Cytometers, are witnessing substantial demand, reflecting the need for efficient sample preparation and analysis. Geographically, North America is expected to lead the market, driven by significant government funding for microbiome research, a well-established biotechnology infrastructure, and a high adoption rate of advanced technologies. Asia Pacific, with its rapidly growing research ecosystem and increasing healthcare expenditure, is poised for significant growth. While market growth is strong, challenges such as the high cost of sophisticated sequencing instruments and the need for standardized protocols could pose restraints. However, ongoing technological advancements, including improvements in sequencing accuracy and cost-effectiveness, are expected to mitigate these challenges and sustain the market's upward trajectory.

This in-depth report offers an unparalleled analysis of the Human Microbiome Sequencing Instrument market, a rapidly evolving sector crucial for groundbreaking research and diagnostics. With the global market poised for significant expansion, this study delves into market dynamics, growth trajectories, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape. We leverage high-traffic keywords such as "microbiome sequencing," "next-generation sequencing (NGS)," "gut microbiome analysis," "metagenomics," "diagnostics," and "drug discovery" to ensure maximum search engine visibility for industry professionals. This report provides a granular view of the parent market, including the broader life science research tools market, and the child market segments within microbiome analysis.

Human Microbiome Sequencing Instrument Market Dynamics & Structure

The Human Microbiome Sequencing Instrument market is characterized by a moderate to high concentration, driven by a few dominant players and a growing number of specialized innovators. Technological innovation is the primary engine, with advancements in sequencing accuracy, speed, and cost-efficiency continually redefining market capabilities. The development of advanced sequencing platforms, such as those offering long-read capabilities and improved throughput, fuels demand across various applications. Regulatory frameworks, while still evolving, are becoming more defined, particularly concerning diagnostic applications, influencing product development and market entry strategies. Competitive product substitutes include traditional culturing methods and other omics technologies, though sequencing offers unparalleled depth and breadth of information. End-user demographics are diverse, spanning academic institutions, pharmaceutical and biotechnology companies, and clinical settings, each with distinct needs and adoption patterns. Mergers and acquisitions (M&A) are a recurring trend, as larger players seek to acquire cutting-edge technologies or expand their market reach. For instance, approximately 5-8 M&A deals are anticipated annually within the broader life science tools sector, with a growing subset focusing on microbiome-specific technologies. Innovation barriers include the high cost of research and development, the need for specialized bioinformatics expertise, and the ongoing validation of microbiome-based biomarkers.

- Market Concentration: Dominated by key players with a significant share, but with increasing fragmentation due to niche startups.

- Technological Innovation Drivers: Improvements in sequencing throughput, accuracy (e.g., error rates below 1%), cost reduction per gigabase, and the development of portable and benchtop sequencers.

- Regulatory Frameworks: Increasing focus on standardization for clinical applications and data security.

- Competitive Product Substitutes: Traditional microbial identification methods, PCR-based assays, and other omics disciplines like proteomics and metabolomics.

- End-User Demographics: Predominantly researchers in academia and industry, with a rapidly expanding segment in clinical diagnostics and personalized medicine.

- M&A Trends: Strategic acquisitions to gain technological advantages and expand product portfolios.

Human Microbiome Sequencing Instrument Growth Trends & Insights

The Human Microbiome Sequencing Instrument market is projected for robust growth, driven by an escalating understanding of the microbiome's profound impact on human health and disease. The market size, estimated at $1,200 million in the base year 2025, is expected to experience a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period of 2025–2033. This impressive growth is fueled by a surge in research funding dedicated to microbiome science, leading to increased adoption rates of advanced sequencing technologies. Technological disruptions, particularly the miniaturization of sequencing devices and the development of more user-friendly bioinformatics pipelines, are democratizing access to microbiome analysis. Consumer behavior shifts are also playing a pivotal role, with growing public awareness and demand for personalized health solutions and early disease detection influencing both research priorities and the development of direct-to-consumer microbiome testing services.

The historical period (2019–2024) saw steady progress, with the market size evolving from approximately $600 million in 2019 to an estimated $1,100 million by 2024. This growth was underpinned by foundational research and the initial commercialization of sequencing-based microbiome profiling. The shift towards clinical applications, driven by accumulating evidence linking microbiome dysbiosis to conditions such as inflammatory bowel disease, obesity, and various cancers, is accelerating adoption among pharmaceutical and biotechnology companies for drug discovery and development. Furthermore, hospitals and clinics are increasingly incorporating microbiome analysis into diagnostic workflows, albeit at an earlier stage of adoption. The "Others" segment, encompassing food and agriculture biotechnology, also contributes to market expansion.

The adoption of sequencing instruments is projected to reach over 70% penetration in research institutions by 2030, with clinical adoption following closely. Technological disruptions, such as the development of single-cell microbiome sequencing, promise to unlock new levels of biological insight, further stimulating market demand. Consumer preferences are increasingly leaning towards proactive health management, making microbiome testing an attractive proposition for individuals seeking to optimize their well-being. The integration of microbiome data with other omics data streams is another key trend, paving the way for a more holistic understanding of human physiology and disease pathogenesis. This comprehensive approach will necessitate sophisticated sequencing instruments capable of generating high-quality, multi-omics data.

Dominant Regions, Countries, or Segments in Human Microbiome Sequencing Instrument

North America, led by the United States, is currently the dominant region in the Human Microbiome Sequencing Instrument market. This leadership is propelled by significant investment in life science research and development, a robust ecosystem of pharmaceutical and biotechnology companies, and a high prevalence of research and academic institutions at the forefront of microbiome science. The US government’s sustained funding for scientific research, coupled with substantial private sector investment, creates a fertile ground for innovation and adoption of cutting-edge sequencing technologies.

Within the Application segment, Pharmaceutical and Biotechnology Companies represent a dominant force. These entities are leveraging microbiome sequencing for drug discovery, target identification, biomarker development, and companion diagnostics. The potential of microbiome-targeted therapies is immense, driving substantial demand for high-throughput and accurate sequencing instruments. The Research and Academic Institutions segment also remains a significant driver, contributing foundational knowledge and pioneering new applications for microbiome analysis. Hospital and Clinic adoption is growing, albeit at a slower pace, as clinical validation and regulatory pathways for microbiome-based diagnostics mature.

In terms of Types, Instruments themselves are the cornerstone of the market, with steady demand for next-generation sequencers, including short-read (e.g., Illumina) and long-read (e.g., Oxford Nanopore, PacBio) platforms. Reagents and Kits are equally critical, with a substantial market share driven by the consumables required for library preparation and sequencing. While liquid handling instruments, cytometers, imaging devices, and microplate readers are supporting technologies, their direct contribution to the core microbiome sequencing market is indirect, focusing on sample preparation or downstream analysis rather than the primary sequencing process.

- Dominant Region: North America (USA) due to strong R&D funding, pharmaceutical presence, and academic research.

- Dominant Application: Pharmaceutical and Biotechnology Companies, driven by drug discovery and therapeutic development.

- Key Application Drivers: Growing understanding of microbiome's role in disease, demand for precision medicine, and unmet therapeutic needs.

- Dominant Type: Instruments (sequencers) and Reagents & Kits, essential for generating microbiome data.

- Growth Potential: Asia Pacific showing rapid growth due to increasing R&D investment and government initiatives.

Human Microbiome Sequencing Instrument Product Landscape

The Human Microbiome Sequencing Instrument product landscape is defined by continuous innovation aimed at enhancing speed, accuracy, and cost-effectiveness. Leading companies are introducing advanced benchtop sequencers and high-throughput platforms capable of generating millions of reads per run. Innovations include improved sample preparation kits that streamline workflows, specialized bioinformatics software for efficient data analysis, and the development of portable sequencing devices for point-of-care applications. Unique selling propositions often revolve around lower sequencing costs per gigabase, superior accuracy in identifying low-abundance microbes, and integrated software solutions that simplify data interpretation for researchers and clinicians alike. Technological advancements are also focusing on enabling multi-omics analyses from a single sample, integrating metagenomic sequencing with metatranscriptomic or metaproteomic data for a comprehensive understanding of microbial function.

Key Drivers, Barriers & Challenges in Human Microbiome Sequencing Instrument

Key Drivers:

- Technological Advancements: Continuous improvements in sequencing accuracy, speed, and cost-efficiency, making microbiome analysis more accessible and powerful.

- Growing Scientific Understanding: Escalating research highlighting the critical role of the human microbiome in health, disease, and therapeutic responses.

- Personalized Medicine Demand: Increasing interest in tailoring treatments and health recommendations based on individual microbiome profiles.

- Biomarker Discovery: Potential for identifying novel microbiome-based biomarkers for disease diagnosis, prognosis, and treatment monitoring.

- Government and Private Funding: Significant investment in microbiome research globally fuels market growth.

Barriers & Challenges:

- High Cost of Advanced Instruments: While decreasing, the initial investment for high-end sequencers can still be a barrier for smaller labs.

- Bioinformatics Expertise Gap: The need for specialized skills in data analysis and interpretation remains a bottleneck for some users.

- Standardization and Reproducibility: Establishing consistent protocols and ensuring reproducibility across different studies and platforms.

- Regulatory Hurdles for Clinical Applications: Navigating complex regulatory pathways for microbiome-based diagnostics and therapeutics.

- Data Interpretation Complexity: The vast amount of data generated requires sophisticated analytical tools and expertise.

- Supply Chain Disruptions: Potential for disruptions in the supply of reagents and consumables, impacting research continuity.

Emerging Opportunities in Human Microbiome Sequencing Instrument

Emerging opportunities in the Human Microbiome Sequencing Instrument market lie in the development of integrated, multi-omics platforms that combine metagenomics with other analyses like transcriptomics and metabolomics for a holistic view of microbial communities. The growing demand for point-of-care diagnostics and portable sequencing devices presents a significant untapped market, enabling faster and more accessible microbiome profiling. Furthermore, the exploration of the microbiome in non-disease contexts, such as sports performance, mental well-being, and aging, is opening new avenues for innovation and market expansion. The development of AI-powered predictive analytics for microbiome data also holds immense potential for personalized health insights and early disease detection.

Growth Accelerators in the Human Microbiome Sequencing Instrument Industry

Long-term growth in the Human Microbiome Sequencing Instrument industry is being significantly accelerated by breakthroughs in long-read sequencing technologies, which provide deeper insights into microbial genomes and complex community structures. Strategic partnerships between instrument manufacturers, bioinformatics companies, and research institutions are fostering collaborative innovation and accelerating the translation of research findings into clinical applications. Market expansion strategies, particularly in emerging economies with growing research infrastructure and increasing healthcare expenditure, are also serving as critical growth accelerators. The increasing focus on gut-brain axis research and its implications for neurological and psychiatric disorders is another major catalyst, driving demand for specialized microbiome sequencing solutions.

Key Players Shaping the Human Microbiome Sequencing Instrument Market

- Baseclear B.V.

- Beijing Genomics Institute (BGI) Genomics Co.,Ltd

- Charles River Laboratories International Inc.

- Clinical Microbiomics A/S

- Eurofins Scientific SE

- GENEWIZ,Inc.

- Illumina,Inc.

- Novogene Corporation

- OraSure Technologies,Inc.

- Oxford Nanopore Technologies,Inc.

- Pacific Biosciences of California,Inc.

- QIAGEN N.V.

- Second Genome,Inc.

- Thermo Fisher Scientific Inc.

- Viome,Inc.

- CosmosID

- Leucine Rich Bio Pvt. Ltd.

- Microba

- Microbiome Insights Inc.

- Molzym GmbH & Co. KG

Notable Milestones in Human Microbiome Sequencing Instrument Sector

- 2020 (Q1): Launch of new high-throughput sequencers with improved read accuracy, significantly reducing sequencing costs per sample.

- 2021 (Q3): Major pharmaceutical company initiates large-scale clinical trials utilizing microbiome profiling as a biomarker for drug efficacy.

- 2022 (Q2): Introduction of portable, benchtop sequencers, expanding accessibility for smaller research labs and point-of-care applications.

- 2023 (Q4): Acquisition of a leading bioinformatics analysis platform by a major instrument manufacturer, offering an integrated solution.

- 2024 (Q1): Significant increase in government funding for gut microbiome research initiatives globally.

In-Depth Human Microbiome Sequencing Instrument Market Outlook

- 2020 (Q1): Launch of new high-throughput sequencers with improved read accuracy, significantly reducing sequencing costs per sample.

- 2021 (Q3): Major pharmaceutical company initiates large-scale clinical trials utilizing microbiome profiling as a biomarker for drug efficacy.

- 2022 (Q2): Introduction of portable, benchtop sequencers, expanding accessibility for smaller research labs and point-of-care applications.

- 2023 (Q4): Acquisition of a leading bioinformatics analysis platform by a major instrument manufacturer, offering an integrated solution.

- 2024 (Q1): Significant increase in government funding for gut microbiome research initiatives globally.

In-Depth Human Microbiome Sequencing Instrument Market Outlook

The future outlook for the Human Microbiome Sequencing Instrument market is exceptionally bright, fueled by ongoing technological advancements and a deeper understanding of the microbiome's role in human health. Growth accelerators, including the refinement of long-read sequencing capabilities, strategic collaborations, and expansion into nascent markets, will continue to propel market expansion. The increasing integration of AI for data analysis and interpretation promises to unlock unprecedented insights, further solidifying the market's trajectory. Strategic opportunities lie in developing cost-effective, user-friendly solutions for clinical settings and exploring niche applications in areas like personalized nutrition and mental wellness. The market is poised to witness sustained innovation and significant growth in the coming years.

Human Microbiome Sequencing Instrument Segmentation

-

1. Application

- 1.1. Research and Academic Institutions

- 1.2. Pharmaceutical and Biotechnology Companies

- 1.3. Hospital and Clinic

- 1.4. Others

-

2. Types

- 2.1. Reagents and Kits

- 2.2. Instruments

- 2.3. Liquid Handling Instruments

- 2.4. Cytometers

- 2.5. Imaging Devices

- 2.6. Microplate Reader

- 2.7. Others

Human Microbiome Sequencing Instrument Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Human Microbiome Sequencing Instrument REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Human Microbiome Sequencing Instrument Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Research and Academic Institutions

- 5.1.2. Pharmaceutical and Biotechnology Companies

- 5.1.3. Hospital and Clinic

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Reagents and Kits

- 5.2.2. Instruments

- 5.2.3. Liquid Handling Instruments

- 5.2.4. Cytometers

- 5.2.5. Imaging Devices

- 5.2.6. Microplate Reader

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Human Microbiome Sequencing Instrument Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Research and Academic Institutions

- 6.1.2. Pharmaceutical and Biotechnology Companies

- 6.1.3. Hospital and Clinic

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Reagents and Kits

- 6.2.2. Instruments

- 6.2.3. Liquid Handling Instruments

- 6.2.4. Cytometers

- 6.2.5. Imaging Devices

- 6.2.6. Microplate Reader

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Human Microbiome Sequencing Instrument Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Research and Academic Institutions

- 7.1.2. Pharmaceutical and Biotechnology Companies

- 7.1.3. Hospital and Clinic

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Reagents and Kits

- 7.2.2. Instruments

- 7.2.3. Liquid Handling Instruments

- 7.2.4. Cytometers

- 7.2.5. Imaging Devices

- 7.2.6. Microplate Reader

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Human Microbiome Sequencing Instrument Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Research and Academic Institutions

- 8.1.2. Pharmaceutical and Biotechnology Companies

- 8.1.3. Hospital and Clinic

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Reagents and Kits

- 8.2.2. Instruments

- 8.2.3. Liquid Handling Instruments

- 8.2.4. Cytometers

- 8.2.5. Imaging Devices

- 8.2.6. Microplate Reader

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Human Microbiome Sequencing Instrument Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Research and Academic Institutions

- 9.1.2. Pharmaceutical and Biotechnology Companies

- 9.1.3. Hospital and Clinic

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Reagents and Kits

- 9.2.2. Instruments

- 9.2.3. Liquid Handling Instruments

- 9.2.4. Cytometers

- 9.2.5. Imaging Devices

- 9.2.6. Microplate Reader

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Human Microbiome Sequencing Instrument Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Research and Academic Institutions

- 10.1.2. Pharmaceutical and Biotechnology Companies

- 10.1.3. Hospital and Clinic

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Reagents and Kits

- 10.2.2. Instruments

- 10.2.3. Liquid Handling Instruments

- 10.2.4. Cytometers

- 10.2.5. Imaging Devices

- 10.2.6. Microplate Reader

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Baseclear B.V.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beijing Genomics Institute (BGI) Genomics Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Charles River Laboratories International Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clinical Microbiomics A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Scientific SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GENEWIZ

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Illumina

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Novogene Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OraSure Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Oxford Nanopore Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Inc.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Pacific Biosciences of California

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Inc.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 QIAGEN N.V.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Second Genome

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Inc.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Thermo Fisher Scientific Inc.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Viome

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Inc.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 CosmosID

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Leucine Rich Bio Pvt. Ltd.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Microba

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Microbiome Insights Inc.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Molzym GmbH & Co. KG

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.1 Baseclear B.V.

List of Figures

- Figure 1: Global Human Microbiome Sequencing Instrument Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Human Microbiome Sequencing Instrument Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Human Microbiome Sequencing Instrument Revenue (million), by Application 2024 & 2032

- Figure 4: North America Human Microbiome Sequencing Instrument Volume (K), by Application 2024 & 2032

- Figure 5: North America Human Microbiome Sequencing Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Human Microbiome Sequencing Instrument Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Human Microbiome Sequencing Instrument Revenue (million), by Types 2024 & 2032

- Figure 8: North America Human Microbiome Sequencing Instrument Volume (K), by Types 2024 & 2032

- Figure 9: North America Human Microbiome Sequencing Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Human Microbiome Sequencing Instrument Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Human Microbiome Sequencing Instrument Revenue (million), by Country 2024 & 2032

- Figure 12: North America Human Microbiome Sequencing Instrument Volume (K), by Country 2024 & 2032

- Figure 13: North America Human Microbiome Sequencing Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Human Microbiome Sequencing Instrument Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Human Microbiome Sequencing Instrument Revenue (million), by Application 2024 & 2032

- Figure 16: South America Human Microbiome Sequencing Instrument Volume (K), by Application 2024 & 2032

- Figure 17: South America Human Microbiome Sequencing Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Human Microbiome Sequencing Instrument Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Human Microbiome Sequencing Instrument Revenue (million), by Types 2024 & 2032

- Figure 20: South America Human Microbiome Sequencing Instrument Volume (K), by Types 2024 & 2032

- Figure 21: South America Human Microbiome Sequencing Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Human Microbiome Sequencing Instrument Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Human Microbiome Sequencing Instrument Revenue (million), by Country 2024 & 2032

- Figure 24: South America Human Microbiome Sequencing Instrument Volume (K), by Country 2024 & 2032

- Figure 25: South America Human Microbiome Sequencing Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Human Microbiome Sequencing Instrument Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Human Microbiome Sequencing Instrument Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Human Microbiome Sequencing Instrument Volume (K), by Application 2024 & 2032

- Figure 29: Europe Human Microbiome Sequencing Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Human Microbiome Sequencing Instrument Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Human Microbiome Sequencing Instrument Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Human Microbiome Sequencing Instrument Volume (K), by Types 2024 & 2032

- Figure 33: Europe Human Microbiome Sequencing Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Human Microbiome Sequencing Instrument Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Human Microbiome Sequencing Instrument Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Human Microbiome Sequencing Instrument Volume (K), by Country 2024 & 2032

- Figure 37: Europe Human Microbiome Sequencing Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Human Microbiome Sequencing Instrument Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Human Microbiome Sequencing Instrument Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Human Microbiome Sequencing Instrument Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Human Microbiome Sequencing Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Human Microbiome Sequencing Instrument Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Human Microbiome Sequencing Instrument Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Human Microbiome Sequencing Instrument Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Human Microbiome Sequencing Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Human Microbiome Sequencing Instrument Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Human Microbiome Sequencing Instrument Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Human Microbiome Sequencing Instrument Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Human Microbiome Sequencing Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Human Microbiome Sequencing Instrument Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Human Microbiome Sequencing Instrument Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Human Microbiome Sequencing Instrument Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Human Microbiome Sequencing Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Human Microbiome Sequencing Instrument Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Human Microbiome Sequencing Instrument Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Human Microbiome Sequencing Instrument Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Human Microbiome Sequencing Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Human Microbiome Sequencing Instrument Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Human Microbiome Sequencing Instrument Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Human Microbiome Sequencing Instrument Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Human Microbiome Sequencing Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Human Microbiome Sequencing Instrument Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Human Microbiome Sequencing Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Human Microbiome Sequencing Instrument Volume K Forecast, by Country 2019 & 2032

- Table 81: China Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Human Microbiome Sequencing Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Human Microbiome Sequencing Instrument Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Microbiome Sequencing Instrument?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Human Microbiome Sequencing Instrument?

Key companies in the market include Baseclear B.V., Beijing Genomics Institute (BGI) Genomics Co., Ltd, Charles River Laboratories International Inc., Clinical Microbiomics A/S, Eurofins Scientific SE, GENEWIZ, Inc., Illumina, Inc., Novogene Corporation, OraSure Technologies, Inc., Oxford Nanopore Technologies, Inc., Pacific Biosciences of California, Inc., QIAGEN N.V., Second Genome, Inc., Thermo Fisher Scientific Inc., Viome, Inc., CosmosID, Leucine Rich Bio Pvt. Ltd., Microba, Microbiome Insights Inc., Molzym GmbH & Co. KG.

3. What are the main segments of the Human Microbiome Sequencing Instrument?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Microbiome Sequencing Instrument," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Microbiome Sequencing Instrument report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Microbiome Sequencing Instrument?

To stay informed about further developments, trends, and reports in the Human Microbiome Sequencing Instrument, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence