Key Insights

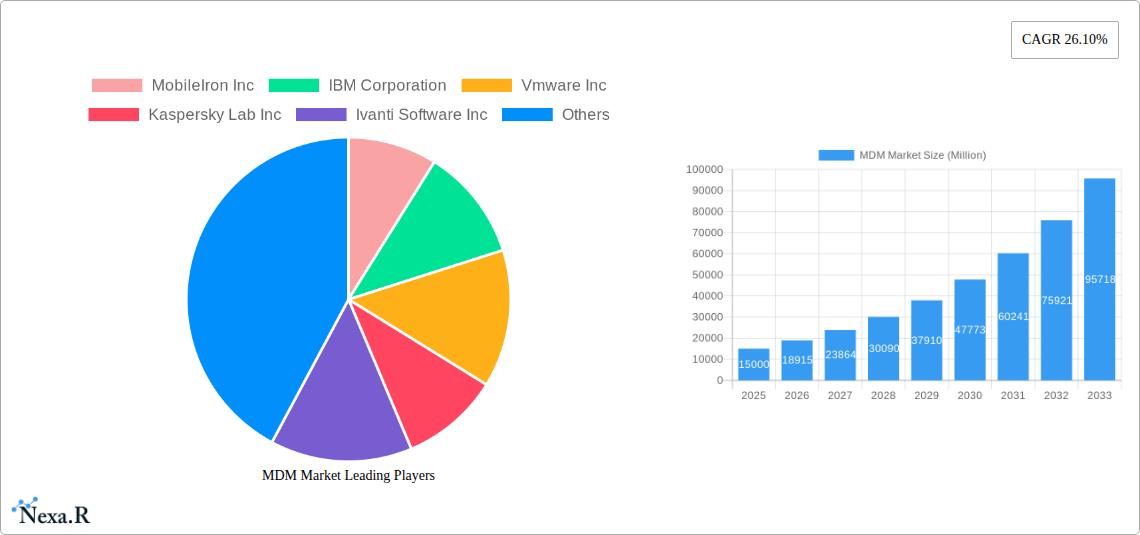

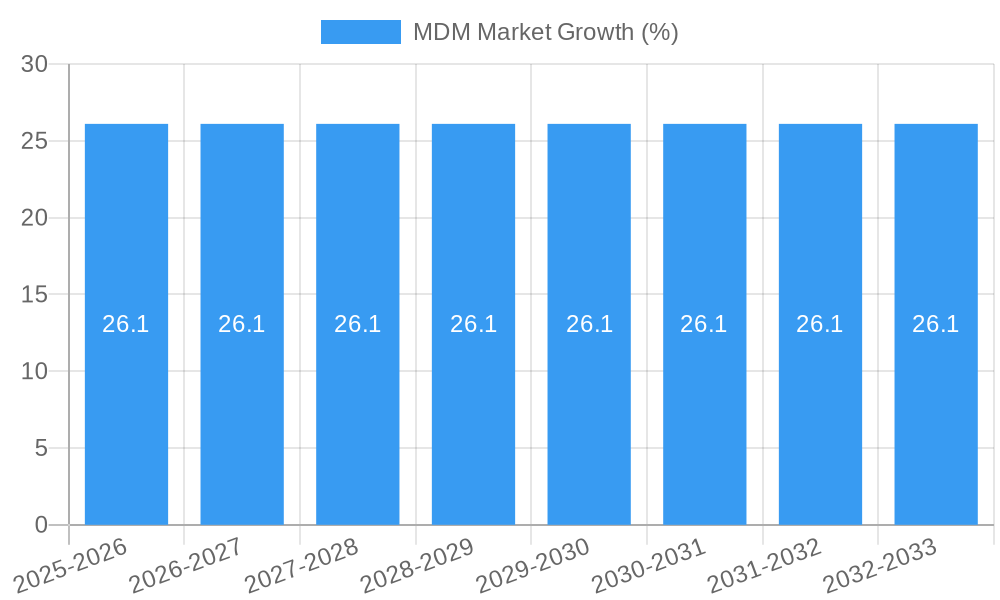

The Mobile Device Management (MDM) market is poised for substantial expansion, projected to reach a market size of XX million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 26.10% extending through 2033. This robust growth is primarily fueled by the escalating adoption of Bring Your Own Device (BYOD) policies and the increasing proliferation of mobile endpoints across enterprises. The imperative to secure sensitive corporate data residing on these devices, coupled with the need for efficient device lifecycle management, are significant drivers. The "Other End-user Verticals" segment, encompassing rapidly evolving industries, is expected to witness particularly strong adoption, alongside established sectors like Telecom and Information Technology, and Banking and Financial Services. Cloud-based MDM solutions are dominating the deployment landscape due to their scalability, cost-effectiveness, and ease of management, offering businesses greater flexibility and reduced infrastructure overheads. The cybersecurity landscape's increasing complexity further accentuates the need for comprehensive MDM strategies to mitigate potential threats and ensure regulatory compliance.

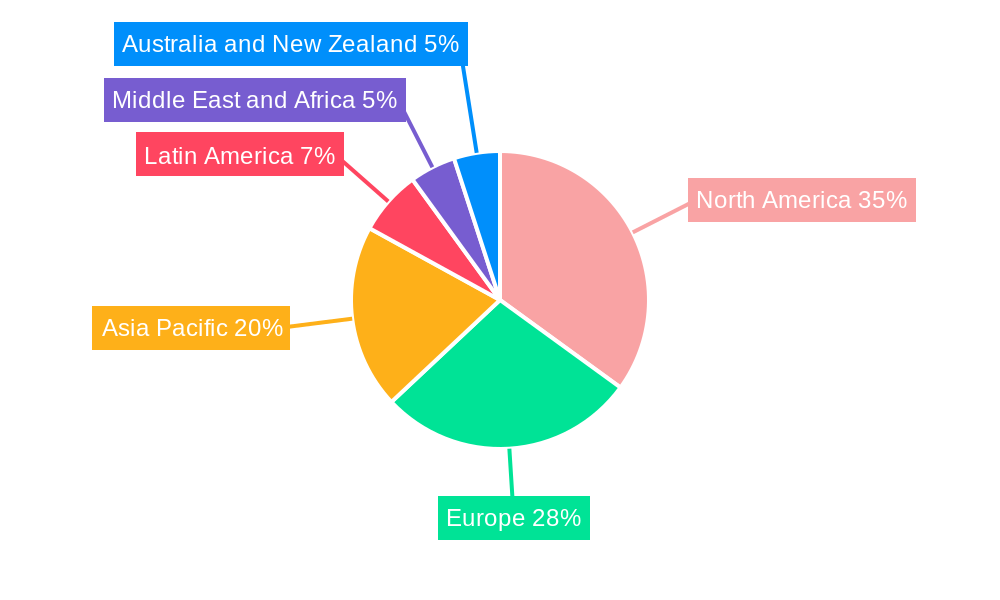

The MDM market is characterized by dynamic trends, including the integration of advanced security features like zero-trust architecture and artificial intelligence-driven threat detection, alongside the growing demand for Unified Endpoint Management (UEM) solutions that consolidate the management of various device types and operating systems. Key players such as MobileIron Inc, IBM Corporation, VMware Inc, and Kaspersky Lab Inc are actively innovating to offer comprehensive suites that address the evolving needs of organizations. However, the market also faces certain restraints. These include concerns surrounding data privacy and compliance with stringent regulations like GDPR, as well as the initial investment costs and the complexity of integrating MDM solutions into existing IT infrastructures. Despite these challenges, the ongoing digital transformation initiatives and the remote work paradigm continue to propel the demand for effective MDM solutions across all major geographical regions, with North America and Europe leading in adoption, while Asia Pacific demonstrates significant growth potential.

Comprehensive MDM Market Report: Navigating Device Management Trends & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Mobile Device Management (MDM) market, covering historical performance, current dynamics, and future projections. Delve into the intricate workings of enterprise mobility, endpoint security, and IT asset management as we dissect market drivers, segment growth, and competitive landscapes. This report is meticulously crafted for IT professionals, business strategists, and stakeholders seeking a granular understanding of the MDM ecosystem, its evolving impact on business operations, and the strategic imperatives for success. All values are presented in Million units.

MDM Market Dynamics & Structure

The Mobile Device Management (MDM) market is characterized by a moderately concentrated landscape, with a few key players dominating market share, yet a growing number of innovative challengers continually disrupting the status quo. Technological innovation remains the primary driver, propelled by the increasing adoption of BYOD (Bring Your Own Device) and COPE (Company-Owned, Personally Enabled) policies, coupled with the escalating threat of mobile-borne cyberattacks. Regulatory frameworks, such as GDPR and CCPA, are also shaping the market by mandating robust data protection and privacy measures for mobile endpoints. Competitive product substitutes, including Enterprise Mobility Management (EMM) and Unified Endpoint Management (UEM) solutions, offer broader functionalities beyond core MDM, pushing MDM vendors to enhance their offerings.

- Key Market Dynamics:

- Market Concentration: While established players hold significant market share, the rise of specialized MDM providers catering to niche verticals and deployment types fosters a dynamic competitive environment.

- Technological Innovation Drivers: The demand for enhanced security features, seamless integration with cloud services, and advanced analytics for device performance is a constant impetus for innovation. The proliferation of IoT devices further expands the scope of MDM.

- Regulatory Frameworks: Compliance with data privacy regulations and industry-specific mandates directly influences the feature sets and security protocols offered by MDM solutions.

- Competitive Product Substitutes: The evolution towards EMM and UEM signifies a trend towards consolidated endpoint management, forcing MDM vendors to either adapt or focus on specific strengths.

- End-User Demographics: The increasing reliance on mobile devices across all industries, from SMBs to large enterprises, creates a broad and diverse end-user base.

- M&A Trends: Strategic acquisitions are prevalent as larger technology firms aim to bolster their mobility management portfolios and acquire innovative technologies. Approximate M&A Deal Volume: 15-20 significant deals annually over the historical period.

MDM Market Growth Trends & Insights

The MDM market is poised for significant expansion, driven by the ubiquitous integration of mobile devices into everyday business operations and the escalating need for robust security and management solutions. The CAGR for the forecast period is projected to be 12.5%, reflecting a healthy and sustained growth trajectory. This growth is fueled by organizations increasingly recognizing the critical importance of securing and managing their diverse mobile fleets, encompassing smartphones, tablets, and ruggedized devices. The shift towards remote and hybrid work models has further amplified the demand for efficient, cloud-based MDM solutions that enable seamless device provisioning, policy enforcement, and application distribution to a distributed workforce.

- Market Size Evolution: The global MDM market, valued at approximately $4,500 million in 2024, is projected to reach over $12,000 million by 2033.

- Adoption Rates: Enterprise adoption rates for MDM solutions are expected to surpass 85% by 2033, driven by the critical need for data protection and operational efficiency.

- Technological Disruptions: The integration of AI and machine learning for predictive threat detection and automated policy management is a significant technological disruption. Furthermore, the convergence of MDM with UEM is leading to more comprehensive endpoint management capabilities.

- Consumer Behavior Shifts: The expectation of seamless, secure, and personalized mobile experiences by employees is compelling organizations to invest in sophisticated MDM solutions that support BYOD policies while maintaining corporate security standards. The increasing sophistication of mobile applications and the data they handle necessitates advanced management and security protocols.

- Market Penetration: While developed regions show high penetration, emerging economies are rapidly adopting MDM solutions as their digital transformation initiatives gain momentum, presenting substantial growth opportunities.

Dominant Regions, Countries, or Segments in MDM Market

The North America region currently dominates the MDM market, driven by a robust technological infrastructure, a high concentration of large enterprises, and stringent regulatory requirements related to data security and privacy. The Telecom and Information Technology vertical consistently leads in MDM adoption due to the inherently mobile nature of its workforce and the critical need for managing vast fleets of devices used for network operations, customer service, and field support. The increasing reliance on cloud-based MDM solutions is a significant factor contributing to market growth across all regions.

- Dominant Region: North America (Market Share estimated at 35% in 2025).

- Key Drivers:

- High adoption of advanced technologies and cloud services.

- Presence of major technology hubs and a large enterprise base.

- Strict data security and privacy regulations (e.g., CCPA).

- Significant investments in cybersecurity solutions.

- Key Drivers:

- Dominant Vertical: Telecom and Information Technology (Market Share estimated at 25% in 2025).

- Key Drivers:

- Extensive use of mobile devices for field operations and customer interaction.

- Critical need for device security and data protection.

- Rapid technological advancements and the introduction of new mobile services.

- Demand for efficient device lifecycle management.

- Key Drivers:

- Dominant Deployment Type: Cloud (Market Share estimated at 65% in 2025).

- Key Drivers:

- Scalability and flexibility for businesses of all sizes.

- Reduced IT overhead and infrastructure costs.

- Ease of deployment and remote management capabilities.

- Faster access to updates and new features.

- Key Drivers:

MDM Market Product Landscape

The MDM market is characterized by a dynamic product landscape featuring advanced solutions focused on comprehensive device management, robust security, and seamless integration. Leading products offer capabilities such as remote device provisioning, policy enforcement, application management, and real-time threat detection. Innovations are geared towards simplifying IT administration, enhancing user experience, and providing deep visibility into device health and security posture. The focus is increasingly on unified endpoint management (UEM) to consolidate the management of various device types, including mobile, desktops, and IoT devices, under a single platform.

- Key Product Innovations: AI-powered anomaly detection, zero-trust security integration, advanced application wrapping for enhanced security, and cross-platform compatibility for diverse operating systems.

Key Drivers, Barriers & Challenges in MDM Market

The MDM market is propelled by several key drivers, including the escalating threat of cyberattacks on mobile devices, the widespread adoption of BYOD policies, and the increasing need for regulatory compliance. The continuous evolution of mobile technology and the growing complexity of IT environments also contribute to demand.

- Key Drivers:

- Enhanced Security Posture: Protecting sensitive corporate data on mobile devices.

- BYOD/COPE Policy Enablement: Facilitating flexible work arrangements securely.

- Regulatory Compliance: Adhering to data privacy laws and industry-specific mandates.

- Operational Efficiency: Streamlining device deployment, management, and support.

The market also faces significant barriers and challenges. These include the complexity of managing diverse device types and operating systems, concerns about user privacy and employee morale with increased monitoring, and the cost associated with implementing and maintaining comprehensive MDM solutions. Integration challenges with existing IT infrastructure can also pose a hurdle.

- Key Barriers & Challenges:

- Device and OS Fragmentation: Managing a heterogeneous fleet of devices.

- Privacy Concerns: Balancing security needs with employee privacy rights.

- Implementation Costs: Initial investment and ongoing maintenance expenses.

- Integration Complexity: Seamlessly integrating with existing IT ecosystems.

- Skill Gap: Lack of skilled IT professionals for advanced MDM management.

Emerging Opportunities in MDM Market

Emerging opportunities in the MDM market lie in the expansion of IoT device management, the increasing demand for specialized MDM solutions for specific industries like healthcare and manufacturing, and the integration of AI and machine learning for proactive threat intelligence. The growing need for secure remote access solutions and the development of more intuitive, user-friendly interfaces also present significant growth avenues.

- Untapped Markets: Expansion into emerging economies with growing mobile device penetration.

- Innovative Applications: MDM for ruggedized devices in logistics, smart factory IoT devices, and connected vehicle fleets.

- Evolving Consumer Preferences: Demand for self-service portals and streamlined onboarding for managed devices.

Growth Accelerators in the MDM Market Industry

The MDM market's long-term growth is significantly accelerated by technological breakthroughs such as advancements in AI-driven security analytics, the widespread adoption of 5G technology enabling faster data transfer and more complex mobile applications, and the continued evolution of cloud-native MDM platforms. Strategic partnerships between MDM vendors and cybersecurity firms, as well as collaborations with mobile operating system providers, are also crucial for expanding market reach and enhancing product capabilities.

- Technological Breakthroughs: AI for predictive threat analysis, enhanced device authentication methods.

- Strategic Partnerships: Bundling MDM with endpoint detection and response (EDR) solutions, joint offerings with mobile hardware manufacturers.

- Market Expansion Strategies: Focus on underserved verticals and geographical regions.

Key Players Shaping the MDM Market Market

- MobileIron Inc

- IBM Corporation

- Vmware Inc

- Kaspersky Lab Inc

- Ivanti Software Inc

- Cisco Systems Inc

- Miradore Ltd

- SOTI Inc

- BlackBerry Limited

- JAMF

- Centrify Corporation

- Sophos Group PLC

- Broadcom Inc (Symantec Corporation)

- Citrix Systems Inc

- SAP SE

Notable Milestones in MDM Market Sector

- February 2023: Check Point Software Technologies and Samsung Electronics partnered to deliver organizations robust protection against the growing wave of mobile-related attacks. With this new partnership, Check Point Harmony Mobile is integrated with the Samsung Knox security and device management platform to prevent malicious apps from running, installing, or interfering with other apps, offering organizations the best security.

- September 2022: GoTo, the all-in-one business communications and IT support platform, announced the acquisition of the cloud-based device management provider Miradore. The close of this deal builds on numerous recent updates from GoTo's IT support and management portfolio, including new Remote Management and Monitoring capabilities and an enhanced GoTo Resolve solution built specifically for managed service providers.

In-Depth MDM Market Market Outlook

The future outlook for the MDM market is exceptionally promising, driven by an unyielding demand for secure and efficient mobile device management in an increasingly digital and mobile-first world. Growth accelerators such as the burgeoning adoption of IoT devices, the ongoing shift towards cloud-centric IT infrastructures, and the continuous evolution of cybersecurity threats will further bolster market expansion. Strategic initiatives focused on developing AI-powered security features, enhancing cross-platform compatibility, and delivering highly customizable solutions will be critical for vendors to capture market share and meet the dynamic needs of enterprises. The market is set to witness deeper integration with broader IT management suites, solidifying MDM’s role as a foundational component of modern enterprise IT security and operations.

MDM Market Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud

-

2. End-user Vertical

- 2.1. Telecom and Information Technology

- 2.2. Banking and Financial Service

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Government

- 2.6. Manufacturing

- 2.7. Other End-user Verticals

MDM Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

MDM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of BYOD; Growing Security Concerns to Protect Enormous Amount of Corporate Data

- 3.3. Market Restrains

- 3.3.1. High Initial Investment During the Deployment in the Infrastructure

- 3.4. Market Trends

- 3.4.1. Cloud-based Deployment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MDM Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Telecom and Information Technology

- 5.2.2. Banking and Financial Service

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Government

- 5.2.6. Manufacturing

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America MDM Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Telecom and Information Technology

- 6.2.2. Banking and Financial Service

- 6.2.3. Healthcare

- 6.2.4. Retail

- 6.2.5. Government

- 6.2.6. Manufacturing

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe MDM Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Telecom and Information Technology

- 7.2.2. Banking and Financial Service

- 7.2.3. Healthcare

- 7.2.4. Retail

- 7.2.5. Government

- 7.2.6. Manufacturing

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia MDM Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Telecom and Information Technology

- 8.2.2. Banking and Financial Service

- 8.2.3. Healthcare

- 8.2.4. Retail

- 8.2.5. Government

- 8.2.6. Manufacturing

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Australia and New Zealand MDM Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Telecom and Information Technology

- 9.2.2. Banking and Financial Service

- 9.2.3. Healthcare

- 9.2.4. Retail

- 9.2.5. Government

- 9.2.6. Manufacturing

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Latin America MDM Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Telecom and Information Technology

- 10.2.2. Banking and Financial Service

- 10.2.3. Healthcare

- 10.2.4. Retail

- 10.2.5. Government

- 10.2.6. Manufacturing

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Middle East and Africa MDM Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11.1.1. On-premise

- 11.1.2. Cloud

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Telecom and Information Technology

- 11.2.2. Banking and Financial Service

- 11.2.3. Healthcare

- 11.2.4. Retail

- 11.2.5. Government

- 11.2.6. Manufacturing

- 11.2.7. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Deployment Type

- 12. North America MDM Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe MDM Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia MDM Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand MDM Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America MDM Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa MDM Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 MobileIron Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 IBM Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Vmware Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Kaspersky Lab Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Ivanti Software Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Cisco Systems Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Miradore Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 SOTI Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 BlackBerry Limited

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 JAMF*List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Centrify Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Sophos Group PLC

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Broadcom Inc (Symantec Corporation)

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Citrix Systems Inc

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 SAP SE

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.1 MobileIron Inc

List of Figures

- Figure 1: Global MDM Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America MDM Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 15: North America MDM Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 16: North America MDM Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 17: North America MDM Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 18: North America MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe MDM Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 21: Europe MDM Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 22: Europe MDM Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 23: Europe MDM Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 24: Europe MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia MDM Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 27: Asia MDM Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 28: Asia MDM Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 29: Asia MDM Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 30: Asia MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand MDM Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 33: Australia and New Zealand MDM Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 34: Australia and New Zealand MDM Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 35: Australia and New Zealand MDM Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 36: Australia and New Zealand MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America MDM Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 39: Latin America MDM Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 40: Latin America MDM Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 41: Latin America MDM Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 42: Latin America MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America MDM Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa MDM Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 45: Middle East and Africa MDM Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 46: Middle East and Africa MDM Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 47: Middle East and Africa MDM Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 48: Middle East and Africa MDM Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa MDM Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MDM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 3: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global MDM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: MDM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: MDM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: MDM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: MDM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: MDM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: MDM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 18: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 19: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 21: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 22: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 24: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 25: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 27: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 28: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 30: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 31: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global MDM Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 33: Global MDM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 34: Global MDM Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MDM Market?

The projected CAGR is approximately 26.10%.

2. Which companies are prominent players in the MDM Market?

Key companies in the market include MobileIron Inc, IBM Corporation, Vmware Inc, Kaspersky Lab Inc, Ivanti Software Inc, Cisco Systems Inc, Miradore Ltd, SOTI Inc, BlackBerry Limited, JAMF*List Not Exhaustive, Centrify Corporation, Sophos Group PLC, Broadcom Inc (Symantec Corporation), Citrix Systems Inc, SAP SE.

3. What are the main segments of the MDM Market?

The market segments include Deployment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of BYOD; Growing Security Concerns to Protect Enormous Amount of Corporate Data.

6. What are the notable trends driving market growth?

Cloud-based Deployment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

High Initial Investment During the Deployment in the Infrastructure.

8. Can you provide examples of recent developments in the market?

February 2023 - Check Point Software Technologies and Samsung Electronics partnered to deliver organizations robust protection against the growing wave of mobile-related attacks. With this new partnership, Check Point Harmony Mobile is integrated with the Samsung Knox security and device management platform to prevent malicious apps from running, installing, or interfering with other apps, offering organizations the best security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MDM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MDM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MDM Market?

To stay informed about further developments, trends, and reports in the MDM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence