Key Insights

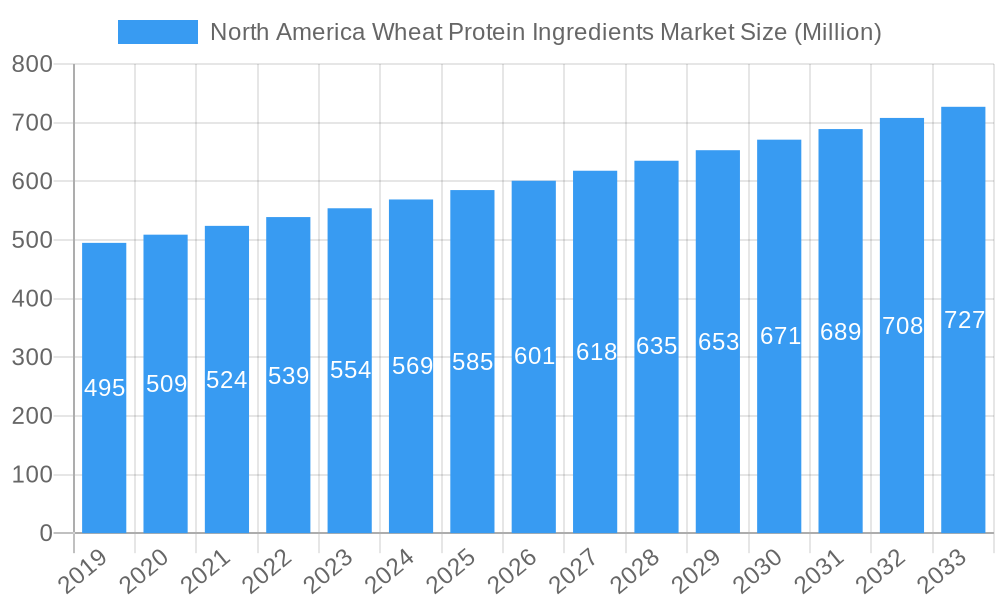

The North America Wheat Protein Ingredients Market is poised for steady expansion, projected to reach a valuation of approximately $570 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.30%, indicating a consistent and robust upward trajectory. The market is driven by a confluence of factors, most notably the escalating consumer demand for plant-based protein sources, fueled by health consciousness and ethical considerations. This trend is particularly pronounced in North America, where the embrace of vegetarian and vegan diets continues to surge. Furthermore, the versatility of wheat protein ingredients, finding applications across a broad spectrum of industries, from bakery and confectionery to dairy products and nutritional supplements, plays a pivotal role in market expansion. Innovations in processing technologies are also contributing to the development of higher-quality and more functional wheat protein products, further stimulating market interest and adoption.

North America Wheat Protein Ingredients Market Market Size (In Million)

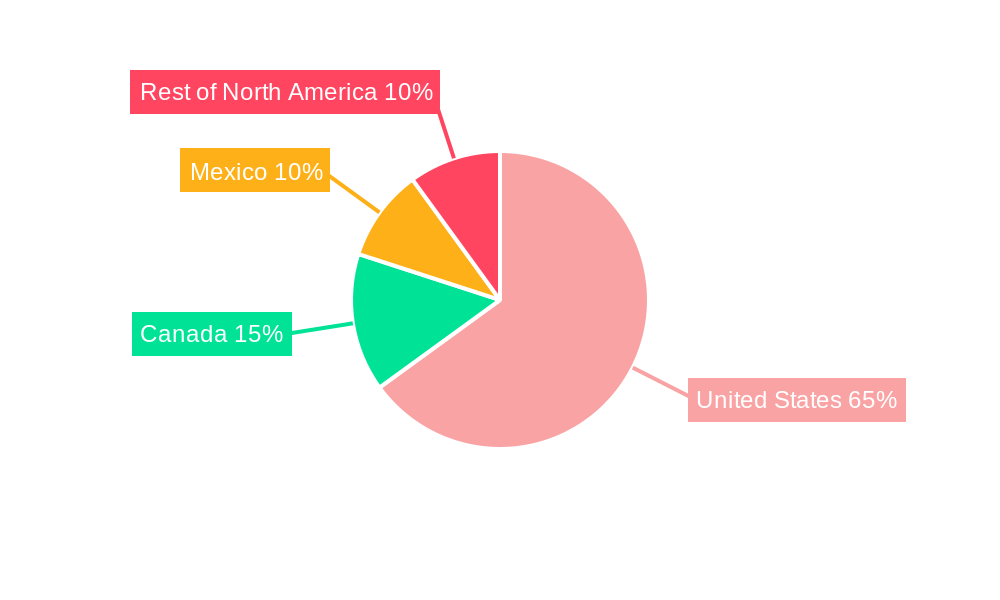

Despite the promising outlook, certain restraints could temper the market's full potential. The volatility of wheat prices, influenced by agricultural yields and global supply-demand dynamics, can impact the cost-effectiveness of wheat protein ingredients. Additionally, competition from other plant-based protein alternatives, such as soy and pea protein, presents a challenge as manufacturers and consumers explore a diverse range of options. However, the inherent advantages of wheat protein, including its allergen-friendly profile compared to soy for some consumers and its functional properties, continue to secure its market position. Key segments like Wheat Protein Isolate and Textured Wheat Protein are expected to witness significant growth due to their advanced functionalities and suitability for specialized applications, particularly in the burgeoning plant-based meat alternative sector. Geographically, the United States is anticipated to remain the dominant market, owing to its large consumer base and advanced food processing industry, followed by Canada and Mexico.

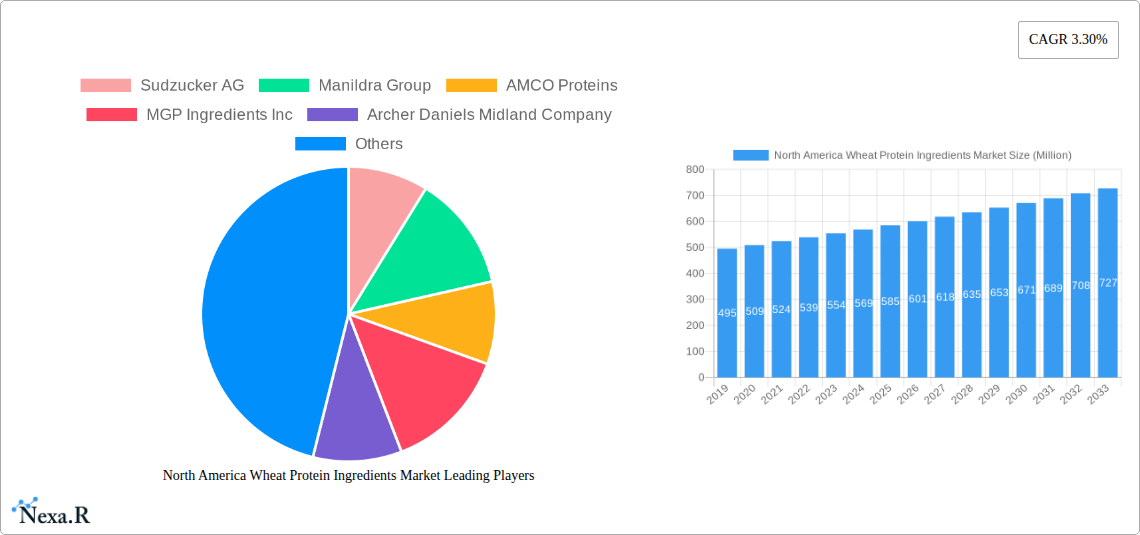

North America Wheat Protein Ingredients Market Company Market Share

North America Wheat Protein Ingredients Market: Growth Drivers, Key Segments, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the North America Wheat Protein Ingredients Market, meticulously examining market dynamics, growth trends, dominant segments, product innovations, and future opportunities. With a study period spanning from 2019 to 2033, the report provides crucial insights for industry stakeholders, including manufacturers, suppliers, and investors, to navigate this rapidly evolving landscape. Leveraging high-traffic keywords like "wheat protein," "plant-based protein," "vital wheat gluten," and "textured wheat protein," this SEO-optimized report ensures maximum visibility and engagement.

North America Wheat Protein Ingredients Market Dynamics & Structure

The North America wheat protein ingredients market is characterized by a moderately concentrated landscape, with key players like Cargill Incorporated, Archer Daniels Midland Company, and Sudzucker AG holding significant market shares. Technological innovation is a primary driver, fueled by increasing consumer demand for plant-based protein alternatives and advancements in processing techniques to enhance protein functionality. Regulatory frameworks, particularly concerning food safety and labeling, play a crucial role in shaping market entry and product development. While direct competitive product substitutes like pea protein and soy protein exist, wheat protein offers distinct textural and functional advantages, particularly in bakery and confectionery and meat alternative applications. End-user demographics are shifting towards health-conscious consumers, millennials, and Generation Z actively seeking sustainable and protein-rich food options. Mergers and acquisitions are on the rise, as companies aim to expand their product portfolios and geographical reach. For instance, the acquisition of specialized ingredient manufacturers by larger food corporations is a notable trend, driving market consolidation and innovation. The market is projected to reach USD 5,500 million by 2025, with a projected CAGR of XX% from 2025 to 2033.

North America Wheat Protein Ingredients Market Growth Trends & Insights

The North America wheat protein ingredients market is poised for significant expansion, driven by a confluence of robust market size evolution, increasing adoption rates of plant-based diets, and transformative technological disruptions. The market's trajectory is intrinsically linked to the global surge in demand for protein ingredients that are both nutritious and sustainable. By 2025, the market is estimated to be valued at USD 5,500 million, a substantial increase from historical figures. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. The rising awareness among consumers regarding the health benefits associated with protein consumption, coupled with the ethical and environmental considerations driving a shift away from animal-based proteins, are key factors influencing adoption rates. Technological advancements in extraction and processing methods have enabled the production of higher-quality wheat protein ingredients with improved functional properties, such as enhanced emulsification, water-binding, and texturization capabilities. This has broadened the application spectrum of wheat proteins beyond traditional uses. Consumer behavior shifts are prominently visible in the increasing preference for convenience foods, fortified snacks, and plant-based meat alternatives, all of which are significant end-use sectors for wheat protein ingredients. The market penetration of wheat protein in various food categories is expected to deepen as product innovation continues and consumer education around the benefits of these ingredients grows. The increasing demand for nutritional supplements and performance-enhancing foods also contributes to the sustained upward trend. The market is continuously being shaped by new product launches and strategic collaborations designed to cater to evolving consumer palates and dietary requirements, further cementing its growth trajectory.

Dominant Regions, Countries, or Segments in North America Wheat Protein Ingredients Market

The North America Wheat Protein Ingredients Market is significantly influenced by a dominant geographical region and specific product segments. The United States stands out as the most dominant country, accounting for an estimated XX% of the total market share in 2025. This dominance is attributed to several key drivers, including a large and health-conscious consumer base, a well-established food manufacturing infrastructure, and significant investments in research and development for plant-based ingredients. The presence of major food corporations and ingredient suppliers headquartered in the US further bolsters its leadership.

Within the product segments, Textured Wheat Protein is emerging as a powerhouse, driving substantial market growth. Its market share is projected to reach XX% by 2025, propelled by the burgeoning demand for plant-based meat alternatives. The ability of textured wheat protein to mimic the texture and mouthfeel of meat makes it a highly sought-after ingredient in this rapidly expanding sector.

In terms of applications, Bakery and Confectionery continues to be a strong segment, benefiting from the functional properties of wheat protein in enhancing dough elasticity, improving crumb structure, and increasing protein content in baked goods. However, the Other Applications segment, which encompasses meat alternatives and plant-based dairy products, is experiencing the fastest growth rate, driven by consumer trends and innovative product development.

- Dominant Country: United States

- Key Drivers: Large consumer base, high disposable income, robust R&D investment, presence of key industry players.

- Market Share (Est. 2025): XX%

- Dominant Product Segment: Textured Wheat Protein

- Key Drivers: Rising popularity of plant-based meat alternatives, versatile texture mimicking capabilities.

- Market Share (Est. 2025): XX%

- Fastest Growing Application Segment: Other Applications (Meat Alternatives, Plant-Based Dairy)

- Key Drivers: Evolving consumer preferences, sustainability concerns, innovation in food technology.

- Growth Potential: High, driven by disruptive product launches and market penetration.

North America Wheat Protein Ingredients Market Product Landscape

The North America wheat protein ingredients market is characterized by a dynamic product landscape focused on enhancing functionality and meeting diverse application needs. Innovations center around improving the nutritional profile, texture, and processing characteristics of wheat-based proteins. Key product types include Wheat Concentrate, Wheat Protein Isolate, and Textured Wheat Protein, each offering unique benefits. Wheat protein isolates, with their high protein content (often exceeding 90%), are gaining traction in specialized nutritional supplements and functional food formulations where minimal carbohydrate and fat are desired. Textured wheat protein, a cornerstone for the burgeoning plant-based meat sector, is engineered to provide desirable fibrous structures and a meat-like bite. Ongoing research aims to further refine the taste profile and emulsification properties of all wheat protein types, making them more versatile for a wider array of food products.

Key Drivers, Barriers & Challenges in North America Wheat Protein Ingredients Market

Key Drivers:

- Growing demand for plant-based diets: Increasing consumer preference for vegetarian, vegan, and flexitarian diets fuels the demand for plant-derived proteins, with wheat protein being a key ingredient.

- Health and wellness trends: Consumers are actively seeking protein-rich foods for muscle building, satiety, and overall health, driving the market for protein ingredients.

- Functional properties of wheat protein: Its excellent emulsifying, binding, and texturizing capabilities make it suitable for a wide range of food applications, including bakery, confectionery, and meat alternatives.

- Sustainability concerns: Wheat protein offers a more sustainable protein source compared to animal-based proteins, aligning with growing environmental consciousness among consumers.

Barriers & Challenges:

- Competition from other plant proteins: Soy protein and pea protein are established alternatives, posing significant competition and requiring continuous innovation to differentiate wheat protein.

- Allergen concerns: Wheat is a common allergen, which can limit its appeal in certain consumer segments and necessitate clear labeling.

- Supply chain volatility: Fluctuations in wheat prices and availability due to weather patterns, geopolitical events, and agricultural policies can impact production costs and supply reliability.

- Technological limitations: While advancements are being made, further research is needed to overcome taste and texture challenges in certain novel applications and to achieve cost-competitiveness with established protein sources.

Emerging Opportunities in North America Wheat Protein Ingredients Market

The North America wheat protein ingredients market presents several exciting emerging opportunities. The continued expansion of the plant-based food sector offers a vast untapped market for innovative wheat protein applications, particularly in developing realistic meat analogues with enhanced texture and flavor profiles. Opportunities also lie in the functional foods and beverages segment, where wheat protein can be incorporated into high-protein snacks, ready-to-drink shakes, and fortified dairy alternatives. Furthermore, advancements in processing technologies are paving the way for novel wheat protein derivatives with specialized functionalities, such as improved solubility or heat stability, opening doors for niche applications in the food service industry and specialized dietary products. The growing interest in sustainable sourcing and upcycled ingredients also presents an opportunity for companies to develop wheat protein products from by-products of the milling industry.

Growth Accelerators in the North America Wheat Protein Ingredients Market Industry

The sustained growth of the North America wheat protein ingredients market is being significantly accelerated by ongoing technological breakthroughs in protein extraction and modification. These innovations are yielding wheat protein ingredients with superior functional properties, such as enhanced texturization and improved flavor profiles, making them more attractive for a broader range of food applications, especially in the rapidly expanding plant-based meat alternative sector. Strategic partnerships and collaborations between ingredient manufacturers and food product developers are crucial catalysts, fostering innovation and accelerating the market penetration of new wheat protein-based products. Furthermore, the proactive expansion of production capacities by key players, anticipating future demand, is laying the groundwork for sustained market growth. Increasing consumer education initiatives by industry stakeholders are also playing a vital role in driving awareness and adoption of wheat protein ingredients, further solidifying their position in the market.

Key Players Shaping the North America Wheat Protein Ingredients Market Market

- Sudzucker AG

- Manildra Group

- AMCO Proteins

- MGP Ingredients Inc

- Archer Daniels Midland Company

- Cargill Incorporated

- Roquette Frères

- Kerry Group PLC

- The Scoular Company

- A Costantino & C SpA

Notable Milestones in North America Wheat Protein Ingredients Market Sector

- February 2022: MGP Ingredients, Inc. announced the construction of a state-of-the-art extrusion plant dedicated to producing its ProTerra line of texturized proteins, aiming to meet surging demand and enhance manufacturing control.

- December 2021: Summit Ag Investors, through its portfolio company Summit Sustainable Ingredients, initiated the construction of a new wheat protein (vital wheat gluten) ingredients facility adjacent to their recently acquired Prairie Horizon property.

- September 2020: Archer Daniels Midland Company launched a range of textured and non-textured wheat proteins, Prolite MeatTEX and Prolite MeatXT, in the US market to enhance meat alternatives.

- June 2020: Archer Daniels Midland Company formed a joint venture with beef producer Marfrig to supply a diverse range of plant-based products, including wheat protein isolates, to North and South American markets.

In-Depth North America Wheat Protein Ingredients Market Market Outlook

The outlook for the North America wheat protein ingredients market is exceptionally robust, fueled by the enduring global shift towards plant-based proteins and escalating health consciousness. Key growth accelerators include continuous innovation in product development, enabling more realistic and appealing plant-based meat alternatives and fortified food products. Strategic alliances between ingredient suppliers and food manufacturers are expected to drive the rapid commercialization of novel wheat protein applications. Furthermore, investments in expanding manufacturing capabilities by major players are set to meet the anticipated surge in demand. The market is ripe with opportunities for companies that can effectively address consumer preferences for sustainability, nutritional value, and superior taste and texture, positioning wheat protein as a staple ingredient in the evolving food landscape.

North America Wheat Protein Ingredients Market Segmentation

-

1. Type

- 1.1. Wheat Concentrate

- 1.2. Wheat Protein Isolate

- 1.3. Textured Wheat Protein

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Dairy Products

- 2.3. Nutritional Supplements

- 2.4. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Wheat Protein Ingredients Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Wheat Protein Ingredients Market Regional Market Share

Geographic Coverage of North America Wheat Protein Ingredients Market

North America Wheat Protein Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Preference for Plant-Based Protein; Improved Functional and Processing Benefits of Wheat Protein

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Protein Varieties

- 3.4. Market Trends

- 3.4.1. Rising Preference for Plant-Based Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wheat Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wheat Concentrate

- 5.1.2. Wheat Protein Isolate

- 5.1.3. Textured Wheat Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy Products

- 5.2.3. Nutritional Supplements

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Wheat Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wheat Concentrate

- 6.1.2. Wheat Protein Isolate

- 6.1.3. Textured Wheat Protein

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery and Confectionery

- 6.2.2. Dairy Products

- 6.2.3. Nutritional Supplements

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Wheat Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wheat Concentrate

- 7.1.2. Wheat Protein Isolate

- 7.1.3. Textured Wheat Protein

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery and Confectionery

- 7.2.2. Dairy Products

- 7.2.3. Nutritional Supplements

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Wheat Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wheat Concentrate

- 8.1.2. Wheat Protein Isolate

- 8.1.3. Textured Wheat Protein

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery and Confectionery

- 8.2.2. Dairy Products

- 8.2.3. Nutritional Supplements

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Wheat Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wheat Concentrate

- 9.1.2. Wheat Protein Isolate

- 9.1.3. Textured Wheat Protein

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery and Confectionery

- 9.2.2. Dairy Products

- 9.2.3. Nutritional Supplements

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sudzucker AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Manildra Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 AMCO Proteins

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MGP Ingredients Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Archer Daniels Midland Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cargill Incorporated*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Roquette Frères

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kerry Group PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 The Scoular Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 A Costantino & C SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sudzucker AG

List of Figures

- Figure 1: North America Wheat Protein Ingredients Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Wheat Protein Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Wheat Protein Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wheat Protein Ingredients Market?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the North America Wheat Protein Ingredients Market?

Key companies in the market include Sudzucker AG, Manildra Group, AMCO Proteins, MGP Ingredients Inc, Archer Daniels Midland Company, Cargill Incorporated*List Not Exhaustive, Roquette Frères, Kerry Group PLC, The Scoular Company, A Costantino & C SpA.

3. What are the main segments of the North America Wheat Protein Ingredients Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Preference for Plant-Based Protein; Improved Functional and Processing Benefits of Wheat Protein.

6. What are the notable trends driving market growth?

Rising Preference for Plant-Based Protein.

7. Are there any restraints impacting market growth?

Availability of Alternative Protein Varieties.

8. Can you provide examples of recent developments in the market?

February 2022: MGP Ingredients, Inc., a prominent provider of specialty proteins and starches, made an exciting announcement regarding the construction of a cutting-edge extrusion plant. This facility will be dedicated to producing its renowned ProTerra line of texturized proteins. The primary objective behind this move is to address the surging demand for ProTerra products while simultaneously enhancing their control over the entire manufacturing process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wheat Protein Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wheat Protein Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wheat Protein Ingredients Market?

To stay informed about further developments, trends, and reports in the North America Wheat Protein Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence