Key Insights

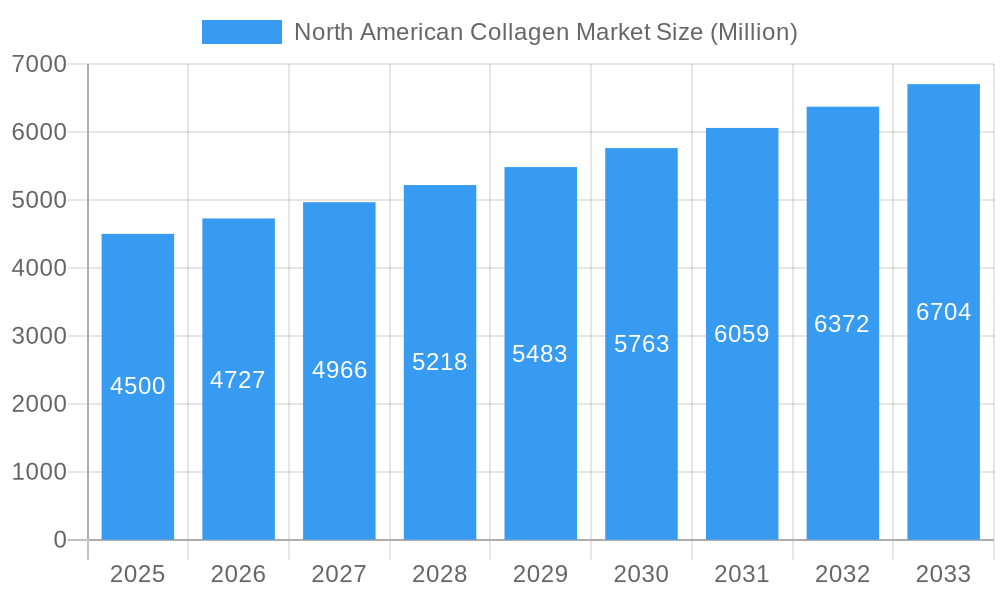

The North American collagen market is poised for robust growth, projected to reach a substantial market size of approximately USD 4,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.03% expected to propel it forward through 2033. This expansion is primarily fueled by the escalating consumer demand for healthier lifestyles and a growing awareness of collagen's multifaceted benefits. Dietary supplements represent a significant segment, driven by individuals seeking to improve joint health, skin elasticity, and overall well-being. The burgeoning demand for anti-aging products in the cosmetics and personal care sector also plays a pivotal role, as consumers actively seek out ingredients that promote youthful and radiant skin. Furthermore, the meat processing industry is increasingly incorporating collagen for its functional properties, contributing to product innovation and enhanced texture.

North American Collagen Market Market Size (In Billion)

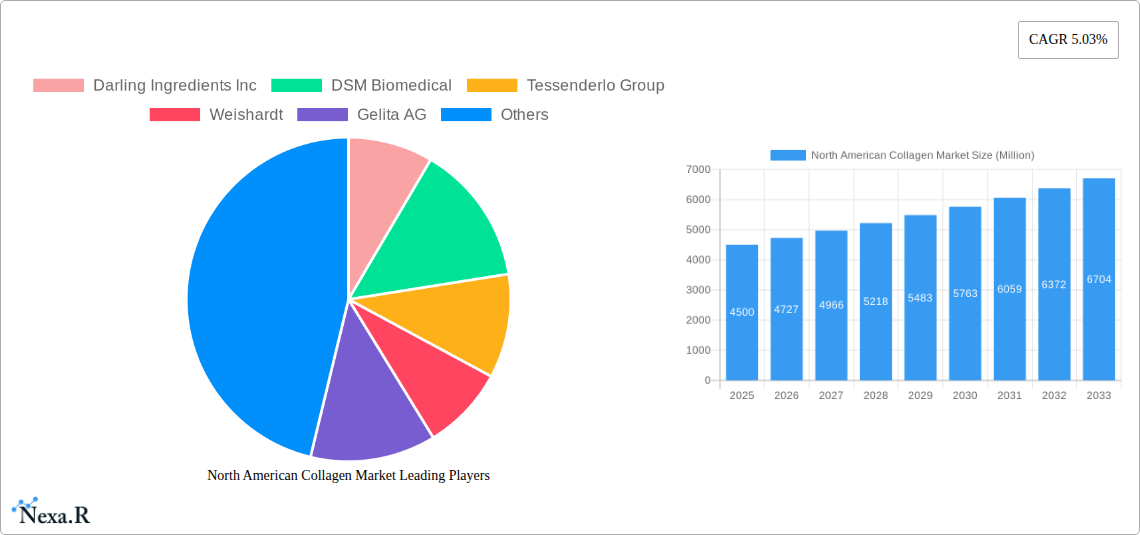

Navigating this dynamic market are key players like Darling Ingredients Inc., DSM Biomedical, Tessenderlo Group, Weishardt, Gelita AG, and Nitta Gelatin NA Inc., who are continuously innovating to meet evolving consumer preferences and stringent regulatory standards. While the market is characterized by strong growth drivers, potential restraints may include fluctuating raw material costs and increasing competition. However, the sustained focus on product development, coupled with strategic collaborations and investments in research and development, are expected to mitigate these challenges. The North American region, encompassing the United States, Canada, and Mexico, is a dominant force, benefiting from advanced healthcare infrastructure, high disposable incomes, and a proactive consumer base that readily adopts health and wellness trends, further solidifying its position as a leading market for collagen products.

North American Collagen Market Company Market Share

This comprehensive report delves into the dynamic North American Collagen Market, offering a detailed analysis of market size, growth drivers, segmentation, competitive landscape, and future outlook. Leveraging extensive primary and secondary research, this report provides actionable insights for stakeholders aiming to capitalize on the expanding opportunities within this vital industry. We cover parent and child market dynamics to provide a holistic view of the collagen ecosystem.

North American Collagen Market Market Dynamics & Structure

The North American collagen market is characterized by a moderately concentrated structure, with key players like Darling Ingredients Inc., DSM Biomedical, Tessenderlo Group, Weishardt, Gelita AG, and Nitta Gelatin NA Inc. actively shaping its trajectory. Technological innovation remains a primary driver, with advancements in collagen extraction, purification, and application development fueling new product offerings across diverse sectors. Regulatory frameworks, particularly concerning food safety and cosmetic ingredients, are evolving, necessitating strict adherence from market participants. The competitive landscape features a mix of established global entities and emerging regional players, with continuous efforts to differentiate through product quality, sustainability, and cost-effectiveness.

- Market Concentration: Dominated by a few key manufacturers, but with increasing entry of specialized suppliers.

- Technological Innovation Drivers: Enhanced bioavailability of collagen peptides, development of novel collagen delivery systems (e.g., injectables, topical formulations), and advancements in sustainable sourcing.

- Regulatory Frameworks: FDA regulations for food and supplements, Health Canada guidelines, and evolving cosmetic ingredient standards significantly influence product development and market access.

- Competitive Product Substitutes: While collagen offers unique benefits, alternatives like hyaluronic acid and synthetic peptides in certain cosmetic applications and plant-based protein supplements in the dietary sector present indirect competition.

- End-User Demographics: A growing consumer base driven by health and wellness trends, aging populations seeking joint health and skin rejuvenation, and a rising demand for clean-label, natural ingredients.

- M&A Trends: Strategic acquisitions and collaborations are observed, aimed at expanding product portfolios, enhancing manufacturing capabilities, and gaining market share. For instance, recent years have seen XX significant M&A deals valued at an estimated $XXX million, reflecting consolidation and strategic growth initiatives.

North American Collagen Market Growth Trends & Insights

The North American collagen market is experiencing robust growth, propelled by an escalating demand for health, wellness, and anti-aging solutions. The market size, valued at $XXXX million in 2024, is projected to reach $XXXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025-2033. This expansion is underpinned by increasing consumer awareness regarding the benefits of collagen for skin elasticity, joint health, and gut well-being. The rising popularity of dietary supplements, particularly hydrolyzed collagen and collagen peptides, is a significant growth driver. Furthermore, the food industry is increasingly incorporating collagen into products like beverages, functional foods, and snacks to enhance their nutritional profile and appeal to health-conscious consumers.

Technological advancements in processing and extraction methods are improving the efficacy and bioavailability of collagen, making it more attractive for a wider range of applications. The adoption rates for collagen-based products are on an upward trajectory, especially within the dietary supplement and cosmetics segments. Consumer behavior shifts towards preventative healthcare and natural ingredients are further fueling this trend. The market penetration of collagen in its various forms is steadily increasing, demonstrating its transition from niche products to mainstream wellness staples. The ongoing research into novel applications, such as wound healing and tissue regeneration, also presents substantial long-term growth potential. The estimated market size in the base year of 2025 is $XXXX million, with a projected CAGR of XX.X% from 2025 to 2033.

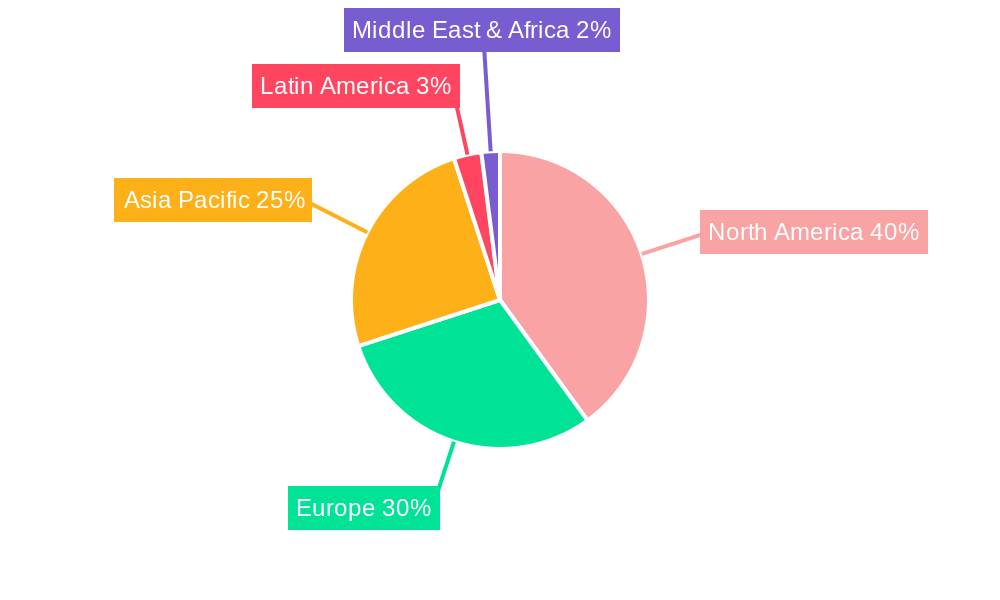

Dominant Regions, Countries, or Segments in North American Collagen Market

The North American collagen market is predominantly driven by the United States of America, which holds a significant share of the overall market value and volume. This dominance is attributable to several interconnected factors, including a large and health-conscious consumer base, a well-established healthcare and pharmaceutical industry, high disposable incomes, and a proactive approach to embracing new wellness trends. The U.S. market's robust demand for dietary supplements, coupled with advanced research and development capabilities in the nutraceutical and cosmeceutical sectors, solidifies its leading position.

Within the broader market segmentation, Animal-based Collagen is currently the dominant source due to its widespread availability from bovine and porcine sources, and its established history of use in various applications. However, Marine-based Collagen is rapidly gaining traction, driven by consumer preference for allergen-free and sustainable options, particularly for individuals with religious restrictions or seafood allergies.

In terms of applications, Dietary Supplements stand out as the leading segment, fueled by the global surge in health and wellness consciousness and the perceived benefits of collagen for joint health, skin rejuvenation, and overall well-being. The convenience and targeted benefits offered by collagen powders, capsules, and shots have resonated strongly with consumers. The Cosmetics and Personal Care segment also represents a significant and growing application, with increasing incorporation of collagen in anti-aging creams, serums, and other skincare products.

- Leading Geography: United States of America, accounting for an estimated XX% of the North American market value in 2025.

- Key Drivers in USA: High consumer expenditure on health and wellness products, strong presence of major collagen manufacturers and research institutions, and extensive distribution networks.

- Dominant Source: Animal-based Collagen, with an estimated market share of XX% in 2025, owing to its cost-effectiveness and established supply chains.

- Fastest Growing Source: Marine-based Collagen, projected to grow at a CAGR of XX.X% during the forecast period, driven by increasing demand for sustainable and clean-label products.

- Leading Application: Dietary Supplements, holding an estimated XX% of the market share in 2025, driven by the growing nutraceutical industry and rising consumer awareness of collagen's health benefits.

- Emerging Application: Meat Processing, showing promising growth due to its functional properties in improving texture and moisture retention.

North American Collagen Market Product Landscape

The North American collagen market boasts a diverse product landscape, featuring innovative formulations and applications. Key product developments include highly bioavailable collagen peptides, which are easily absorbed and utilized by the body, catering to the demand for efficacy in dietary supplements and functional foods. Advanced extraction techniques are yielding collagen with improved purity and reduced odor, enhancing consumer acceptance. In the cosmetics sector, collagen is being integrated into sophisticated anti-aging formulations, serums, and masks, promising enhanced skin elasticity and reduced wrinkle depth. Unique selling propositions often revolve around source purity, sustainability, and specialized benefits for joint, skin, and gut health.

Key Drivers, Barriers & Challenges in North American Collagen Market

Key Drivers:

- Rising Health and Wellness Consciousness: Growing consumer awareness of collagen's benefits for skin, joint, and gut health fuels demand for dietary supplements and functional foods.

- Aging Population: The increasing proportion of older adults seeking to maintain mobility and mitigate age-related skin changes drives demand for collagen products.

- Technological Advancements: Improved extraction, purification, and delivery systems enhance collagen's efficacy and appeal, leading to wider adoption.

- Clean Label and Natural Ingredients Trend: Consumer preference for natural, minimally processed ingredients favors collagen over synthetic alternatives.

Barriers & Challenges:

- Supply Chain Volatility: Dependence on animal sources can lead to price fluctuations and availability issues due to disease outbreaks or ethical concerns.

- Regulatory Hurdles: Stringent regulations for food and supplement ingredients, particularly in the U.S., can impact product development timelines and market entry.

- Competition from Substitutes: While collagen offers unique benefits, certain applications face competition from alternatives like hyaluronic acid, peptides, and plant-based proteins.

- Consumer Education: Despite growing awareness, a segment of the population may still lack comprehensive understanding of collagen's benefits and forms, impacting market penetration.

- Cost of Production: Premium sourcing and advanced processing can lead to higher product costs, potentially limiting accessibility for some consumer segments. The estimated cost of raw material sourcing and processing can impact profit margins by XX-XX%.

Emerging Opportunities in North American Collagen Market

Emerging opportunities in the North American collagen market are primarily centered around the expansion of marine-based collagen, catering to the growing demand for allergen-free and sustainable ingredients. Untapped markets within the functional food and beverage sector, such as specialized sports nutrition and fortified pet food, present significant growth potential. The development of innovative applications in medical fields, including wound healing, tissue engineering, and regenerative medicine, is poised to open new revenue streams. Evolving consumer preferences for personalized nutrition and customized wellness solutions also offer opportunities for specialized collagen formulations. Furthermore, the focus on sustainability throughout the supply chain, from sourcing to packaging, presents an avenue for companies to build brand loyalty and differentiate themselves.

Growth Accelerators in the North American Collagen Market Industry

Several key catalysts are accelerating long-term growth in the North American collagen market. Technological breakthroughs in bioavailability and delivery systems are enhancing product efficacy, driving consumer satisfaction and repeat purchases. Strategic partnerships between collagen manufacturers, supplement brands, and food & beverage companies are expanding product reach and innovation. Market expansion strategies, including exploring new geographical pockets and underserved consumer segments, are contributing to overall market penetration. The increasing investment in research and development for novel collagen applications, particularly in the medical and pharmaceutical sectors, promises to unlock significant future growth.

Key Players Shaping the North American Collagen Market Market

- Darling Ingredients Inc.

- DSM Biomedical

- Tessenderlo Group

- Weishardt

- Gelita AG

- Nitta Gelatin NA Inc

Notable Milestones in North American Collagen Market Sector

- 2023: Launch of a new line of marine collagen peptides with enhanced skin anti-aging properties.

- 2022: Strategic acquisition of a leading collagen peptide manufacturer by a major ingredient supplier, expanding its product portfolio and market reach.

- 2021: Development of novel collagen-based wound dressing technology showing promising clinical trial results.

- 2020: Increased investment in sustainable sourcing practices for bovine collagen, addressing growing ethical consumer concerns.

- 2019: Introduction of plant-based collagen alternatives leveraging innovative fermentation technologies.

In-Depth North American Collagen Market Market Outlook

The North American collagen market is poised for sustained and robust growth, driven by a confluence of favorable factors. The increasing emphasis on preventative healthcare, coupled with an aging demographic, will continue to propel demand for collagen’s joint and skin health benefits. Technological advancements in bioavailability and the development of novel delivery mechanisms will further enhance product efficacy and consumer acceptance, solidifying collagen's position as a staple in the wellness industry. Strategic collaborations and market expansion initiatives will unlock new avenues for growth, particularly in emerging applications like functional foods and medical treatments. The ongoing shift towards clean-label, sustainable ingredients will also favor companies prioritizing ethical sourcing and environmentally conscious production. The outlook suggests continued innovation and market penetration, making it a highly attractive sector for investment and development.

North American Collagen Market Segmentation

-

1. Source

- 1.1. Animal-based Collagen

- 1.2. Marine-based Collagen

-

2. Application

- 2.1. Dietary Supplements

- 2.2. Meat Processing

- 2.3. Food

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States of America

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

North American Collagen Market Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North American Collagen Market Regional Market Share

Geographic Coverage of North American Collagen Market

North American Collagen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Collagen is gaining popularity in the sports nutrition sector due to its role in supporting muscle recovery

- 3.2.2 joint health

- 3.2.3 and overall physical performance. Athletes and fitness enthusiasts are increasingly incorporating collagen into their diets.

- 3.3. Market Restrains

- 3.3.1 Collagen products

- 3.3.2 particularly those derived from marine sources

- 3.3.3 can be expensive. This higher cost can limit accessibility for some consumers and affect market penetration

- 3.4. Market Trends

- 3.4.1 There is a growing trend of incorporating collagen into beverages

- 3.4.2 including coffees

- 3.4.3 teas

- 3.4.4 smoothies

- 3.4.5 and flavored waters. These products target consumers looking for convenient ways to integrate collagen into their daily routines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Collagen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal-based Collagen

- 5.1.2. Marine-based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dietary Supplements

- 5.2.2. Meat Processing

- 5.2.3. Food

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States of America

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DSM Biomedical

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tessenderlo Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Weishardt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gelita AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nitta Gelatin NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: North American Collagen Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North American Collagen Market Share (%) by Company 2025

List of Tables

- Table 1: North American Collagen Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: North American Collagen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North American Collagen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North American Collagen Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North American Collagen Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 6: North American Collagen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: North American Collagen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North American Collagen Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States of America North American Collagen Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada North American Collagen Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico North American Collagen Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North American Collagen Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Collagen Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the North American Collagen Market?

Key companies in the market include Darling Ingredients Inc, DSM Biomedical, Tessenderlo Group, Weishardt, Gelita AG, Nitta Gelatin NA Inc.

3. What are the main segments of the North American Collagen Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Collagen is gaining popularity in the sports nutrition sector due to its role in supporting muscle recovery. joint health. and overall physical performance. Athletes and fitness enthusiasts are increasingly incorporating collagen into their diets..

6. What are the notable trends driving market growth?

There is a growing trend of incorporating collagen into beverages. including coffees. teas. smoothies. and flavored waters. These products target consumers looking for convenient ways to integrate collagen into their daily routines.

7. Are there any restraints impacting market growth?

Collagen products. particularly those derived from marine sources. can be expensive. This higher cost can limit accessibility for some consumers and affect market penetration.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Collagen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Collagen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Collagen Market?

To stay informed about further developments, trends, and reports in the North American Collagen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence