Key Insights

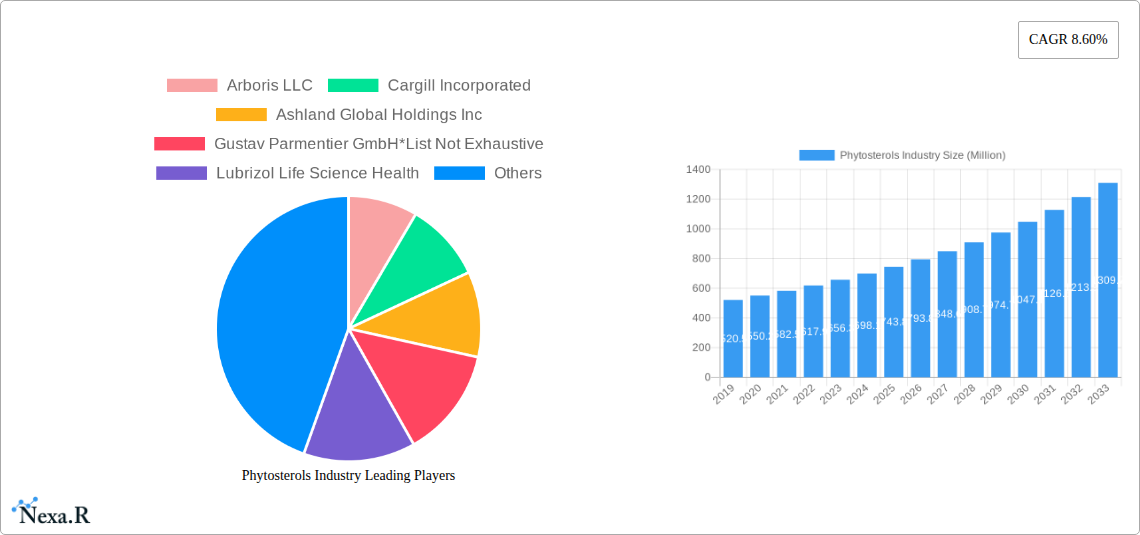

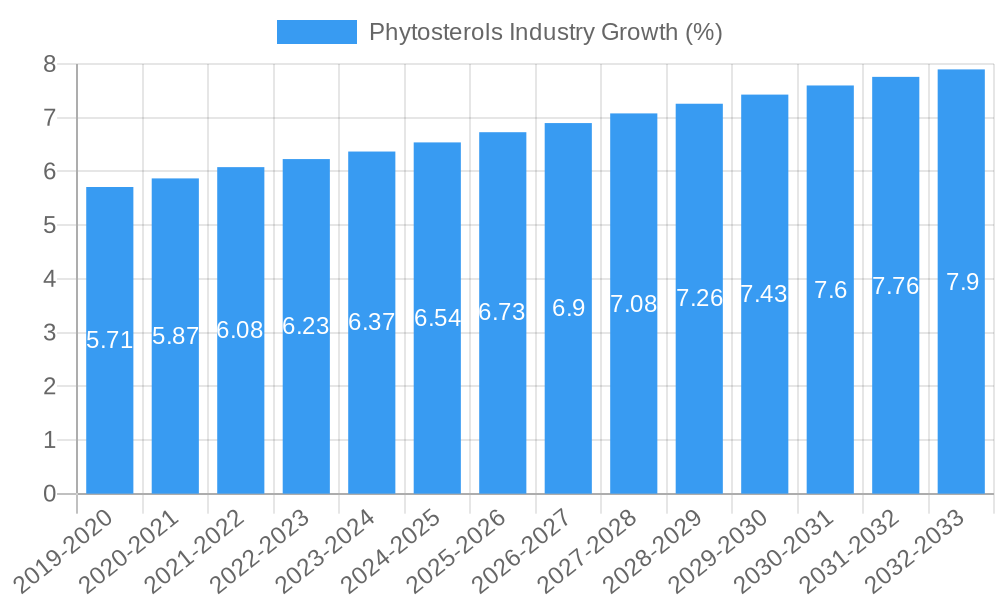

The global Phytosterols market is poised for substantial expansion, projected to reach a market size of USD 890.2 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.60% expected to continue through 2033. This impressive growth is primarily fueled by an increasing consumer awareness of the health benefits associated with phytosterols, particularly their ability to lower cholesterol levels. This heightened health consciousness is a significant driver, leading to a surge in demand across various applications. The food and beverage sector, especially dairy products, bakery and confectionery, and sauces and condiments, is a major consumer, incorporating phytosterols to enhance the nutritional profile of everyday products. Furthermore, the pharmaceutical and dietary supplement industries are leveraging phytosterols for their therapeutic properties, further propelling market growth. Emerging trends also include the development of novel delivery systems and the increasing use of phytosterols in cosmetic formulations for their skin-conditioning properties, contributing to a dynamic and evolving market landscape.

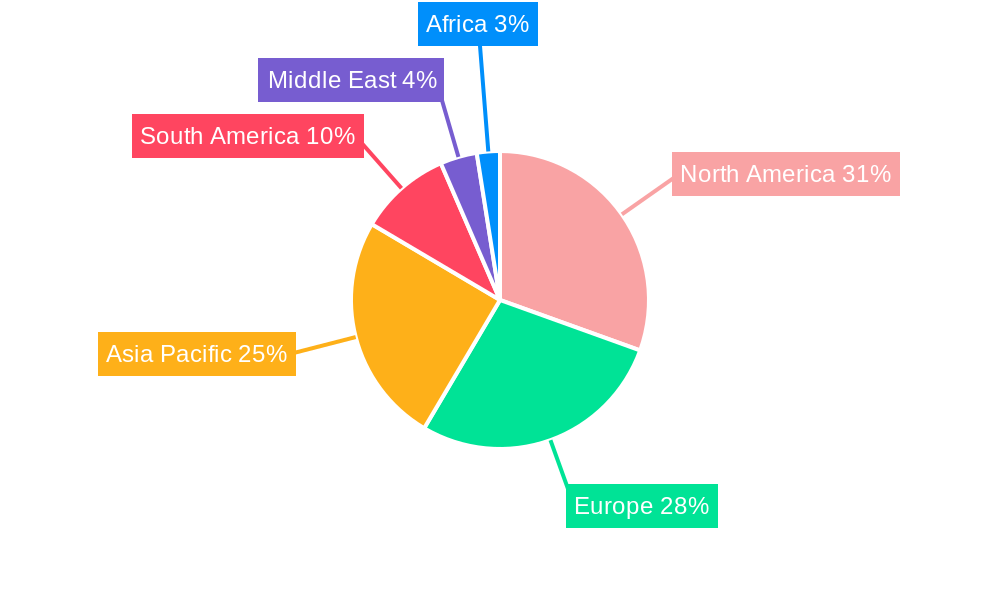

Despite the strong growth trajectory, the phytosterols market faces certain restraints, including the relatively high cost of production and processing, which can impact product affordability and adoption rates in price-sensitive markets. Additionally, regulatory hurdles and varying approval processes across different regions can pose challenges for market penetration. However, ongoing research and technological advancements are continuously addressing these issues, aiming to optimize production efficiency and reduce costs. The market is segmented into key product types such as Beta-Sitosterol, Campesterol, and Stigmasterol, each with its unique applications and market share. Geographically, North America and Europe currently dominate the market, driven by established healthcare systems and a strong consumer focus on wellness. However, the Asia Pacific region is anticipated to witness the fastest growth, spurred by rising disposable incomes, increasing health consciousness, and a growing food processing industry. Key players like Cargill Incorporated, DuPont de Nemours Inc., and BASF SE are actively investing in research and development, strategic collaborations, and market expansion to capitalize on these opportunities.

Unleash the Power of Phytosterols: A Comprehensive Market Intelligence Report (2019-2033)

This in-depth Phytosterols Industry report delivers a meticulously researched analysis of the global market, spanning from 2019 to 2033, with a base year of 2025. Covering parent and child market dynamics, this report offers unparalleled insights into growth trajectories, key drivers, and competitive landscapes. Optimized with high-traffic keywords, it is designed to equip industry professionals, investors, and stakeholders with actionable intelligence to navigate the evolving plant sterols market, cholesterol-lowering ingredients market, and phytosterol esters market. All monetary values are presented in Million USD.

Phytosterols Industry Market Dynamics & Structure

The phytosterols industry is characterized by a moderately concentrated market structure, driven by a blend of established multinational corporations and specialized ingredient manufacturers. Technological innovation is a significant catalyst, particularly in extraction and purification processes, alongside the development of novel phytosterols applications in health and wellness sectors. Regulatory frameworks, such as those from the FDA and EFSA, play a crucial role in dictating product claims and market access for cholesterol-lowering and heart health benefits. Competitive product substitutes, while present, often lack the scientifically validated efficacy of phytosterols, especially in dietary supplements and functional foods. End-user demographics are increasingly health-conscious, seeking natural solutions for cardiovascular health management. Mergers and acquisitions (M&A) are a notable trend, with companies aiming to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by a few key players, with significant market share held by leading ingredient providers in the beta-sitosterol, campesterol, and stigmasterol segments.

- Technological Innovation: Focus on enhancing bioavailability, developing new delivery systems, and exploring novel applications beyond cholesterol management.

- Regulatory Frameworks: Strict adherence to health claims substantiation and ingredient safety standards, impacting product development and marketing strategies.

- Competitive Substitutes: Primarily other functional ingredients and lifestyle changes, but with limited direct efficacy in cholesterol reduction compared to phytosterols.

- End-User Demographics: Growing demand from aging populations and health-conscious consumers in developed and emerging economies.

- M&A Trends: Strategic acquisitions to consolidate market position, gain access to new technologies, and broaden product offerings.

Phytosterols Industry Growth Trends & Insights

The phytosterols industry is poised for robust growth, driven by escalating global health awareness and the increasing prevalence of cardiovascular diseases. The market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033. Adoption rates for phytosterols are on an upward trajectory across various applications, particularly in food and beverages and dietary supplements. Technological disruptions are contributing to improved extraction efficiencies and the development of more palatable and effective phytosterol formulations. Consumer behavior shifts are a key influencer, with a growing preference for natural, plant-derived ingredients that offer tangible health benefits. The demand for cholesterol-lowering foods and beverages is particularly strong, fueling the integration of phytosterols into everyday consumables.

- Market Size Evolution: From an estimated USD 2,100 Million in 2025, the market is projected to reach USD 3,800 Million by 2033.

- Adoption Rates: Steady increase in the integration of phytosterols into fortified food products, dairy alternatives, and pharmaceutical formulations.

- Technological Disruptions: Advancements in microencapsulation and esterification techniques are enhancing phytosterol stability and absorption.

- Consumer Behavior Shifts: A pronounced trend towards preventive healthcare and the consumption of functional foods for heart health support.

- Market Penetration: Expanding beyond traditional markets to include emerging economies with rising disposable incomes and increasing health consciousness.

- Drivers of Growth: Increasing prevalence of hypercholesterolemia, growing demand for natural health ingredients, and government initiatives promoting healthy eating habits.

Dominant Regions, Countries, or Segments in Phytosterols Industry

North America, particularly the United States, is currently a dominant region in the phytosterols industry, driven by a mature market for dietary supplements and a strong consumer base focused on cardiovascular health. Europe, with its robust regulatory support for health claims and a well-established functional food sector, also holds a significant market share. Asia Pacific is emerging as a high-growth region, fueled by rising disposable incomes, increasing awareness of health and wellness, and the expanding food and beverage industry.

Within Product Types, Beta-Sitosterol continues to lead due to its widespread recognition and extensive research supporting its cholesterol-lowering properties. Campesterol and Stigmasterol are also gaining traction, often utilized in synergistic blends.

The Application segment of Food and Beverages is the largest market driver, with Dairy Products (yogurts, milk) and Bakery and Confectionery (margarines, spreads, baked goods) being key sub-segments. The Dietary Supplements sector also represents a substantial and growing market.

- Leading Region: North America, with a market share estimated at 35% in 2025.

- Key Drivers: High consumer awareness of heart health, strong demand for fortified foods, and established regulatory pathways for health claims.

- Growth Potential: Continued expansion in the functional foods and dietary supplements segments.

- Dominant Product Type: Beta-Sitosterol, estimated to capture 45% of the product type market share in 2025.

- Key Drivers: Extensive clinical evidence, wide availability, and established use in various product formulations.

- Growth Potential: Ongoing research into new applications and improved delivery systems.

- Dominant Application: Food and Beverages, projected to account for 55% of the total application market share in 2025.

- Sub-Segment Dominance: Dairy Products and Bakery & Confectionery segments are particularly strong.

- Growth Potential: Increasing innovation in product development for mainstream consumption.

- Emerging Markets: Asia Pacific, with an anticipated CAGR of 8.5% during the forecast period.

- Key Drivers: Growing middle class, urbanization, and increased adoption of Western dietary patterns and health consciousness.

Phytosterols Industry Product Landscape

The phytosterols industry is witnessing a dynamic product landscape characterized by continuous innovation. Companies are focusing on enhancing the efficacy and palatability of beta-sitosterol, campesterol, and stigmasterol through advanced esterification and microencapsulation techniques. Unique selling propositions often revolve around high purity, natural sourcing, and scientifically validated health benefits for cholesterol management and immune support. Technological advancements are leading to the development of phytosterols with improved solubility and bioavailability, enabling their seamless integration into a wider array of food and beverages, dietary supplements, and even cosmetics.

Key Drivers, Barriers & Challenges in Phytosterols Industry

The phytosterols industry is propelled by several key drivers. The escalating global burden of cardiovascular diseases and the rising consumer demand for natural, health-promoting ingredients are paramount. Technological advancements in extraction and formulation are enhancing product efficacy and appeal. Furthermore, increasing regulatory approvals for health claims related to cholesterol reduction are a significant growth accelerator.

- Key Drivers:

- Growing prevalence of hypercholesterolemia.

- Increasing consumer preference for natural and plant-based health solutions.

- Advancements in food fortification and dietary supplement formulations.

- Positive regulatory landscape for cholesterol-lowering claims.

However, the industry faces certain barriers and challenges. The cost of raw material sourcing and production can impact price competitiveness. Consumer awareness, while growing, still requires further education regarding the benefits and optimal dosage of phytosterols. Supply chain complexities and the need for stringent quality control also present hurdles.

- Key Barriers & Challenges:

- Fluctuations in raw material prices.

- Need for enhanced consumer education and awareness.

- Complex global supply chains and stringent quality control requirements.

- Competition from other functional ingredients and lifestyle interventions.

Emerging Opportunities in Phytosterols Industry

Emerging opportunities in the phytosterols industry lie in exploring novel applications beyond cholesterol management, such as immune system support and anti-inflammatory properties. The untapped potential in emerging economies, with their rapidly growing middle class and increasing health consciousness, presents a significant growth avenue. Furthermore, the demand for clean-label and plant-based products is creating opportunities for phytosterols derived from sustainable sources. The integration of phytosterols into pet food for animal health is another burgeoning niche.

Growth Accelerators in the Phytosterols Industry Industry

Long-term growth in the phytosterols industry is being accelerated by continuous technological breakthroughs in enhancing bioavailability and developing novel delivery systems. Strategic partnerships between ingredient manufacturers and food and beverage companies are crucial for product innovation and market penetration. Furthermore, market expansion strategies targeting emerging economies, coupled with increasing investment in research and development to uncover new health benefits, are pivotal in driving sustained growth and market dominance.

Key Players Shaping the Phytosterols Industry Market

- Arboris LLC

- Cargill Incorporated

- Ashland Global Holdings Inc

- Gustav Parmentier GmbH

- Lubrizol Life Science Health

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- BASF SE

- Berkshire Hathaway Inc

- Merck Group

Notable Milestones in Phytosterols Industry Sector

- June 2022: Kensing LLC acquired Vitae Naturals, a manufacturer of plant sterol esters and non-GMO vitamin E derivatives, expanding its reach into skincare, food, and nutrition end-use industries. This strategic acquisition bolsters Kensing's portfolio of naturally derived ingredients.

- February 2022: Elicit Plant, an AGtech company focused on crop water resistance and phytosterol-based solutions, successfully raised USD 17.26 million in a series funding round. These funds are earmarked for international growth and R&D to advance its innovative phytosterol-based solutions aimed at addressing water stress in agriculture, thus aiding farmers in climate change adaptation.

In-Depth Phytosterols Industry Market Outlook

The phytosterols industry is on a trajectory of significant expansion, fueled by a confluence of factors. Emerging opportunities in areas like enhanced immune support and novel cosmetic applications, coupled with the expanding reach into emerging economies, will act as key growth accelerators. Strategic collaborations and sustained investment in research and development to uncover further health benefits will solidify market leadership. The increasing consumer demand for natural, plant-derived ingredients with proven efficacy for cardiovascular health will continue to drive market penetration across food, beverage, pharmaceutical, and dietary supplement sectors, promising substantial future market potential and strategic advantages for industry participants.

Phytosterols Industry Segmentation

-

1. Product Type

- 1.1. Beta-Sitosterol

- 1.2. Campesterol

- 1.3. Stigmasterol

- 1.4. Other Product Types

-

2. Application

-

2.1. Food and Beverages

- 2.1.1. Dairy Products

- 2.1.2. Sauces and Condiments

- 2.1.3. Bakery and Confectionery

- 2.2. Pharmaceuticals

- 2.3. Cosmetics

- 2.4. Dietary Supplements

- 2.5. Animal Feed

-

2.1. Food and Beverages

Phytosterols Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Phytosterols Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Prevalence of allergen intolerance among the consumers

- 3.4. Market Trends

- 3.4.1. Increasing Prevalence of Cardiovascular Disease

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beta-Sitosterol

- 5.1.2. Campesterol

- 5.1.3. Stigmasterol

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.1.1. Dairy Products

- 5.2.1.2. Sauces and Condiments

- 5.2.1.3. Bakery and Confectionery

- 5.2.2. Pharmaceuticals

- 5.2.3. Cosmetics

- 5.2.4. Dietary Supplements

- 5.2.5. Animal Feed

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beta-Sitosterol

- 6.1.2. Campesterol

- 6.1.3. Stigmasterol

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.1.1. Dairy Products

- 6.2.1.2. Sauces and Condiments

- 6.2.1.3. Bakery and Confectionery

- 6.2.2. Pharmaceuticals

- 6.2.3. Cosmetics

- 6.2.4. Dietary Supplements

- 6.2.5. Animal Feed

- 6.2.1. Food and Beverages

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beta-Sitosterol

- 7.1.2. Campesterol

- 7.1.3. Stigmasterol

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.1.1. Dairy Products

- 7.2.1.2. Sauces and Condiments

- 7.2.1.3. Bakery and Confectionery

- 7.2.2. Pharmaceuticals

- 7.2.3. Cosmetics

- 7.2.4. Dietary Supplements

- 7.2.5. Animal Feed

- 7.2.1. Food and Beverages

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beta-Sitosterol

- 8.1.2. Campesterol

- 8.1.3. Stigmasterol

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.1.1. Dairy Products

- 8.2.1.2. Sauces and Condiments

- 8.2.1.3. Bakery and Confectionery

- 8.2.2. Pharmaceuticals

- 8.2.3. Cosmetics

- 8.2.4. Dietary Supplements

- 8.2.5. Animal Feed

- 8.2.1. Food and Beverages

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beta-Sitosterol

- 9.1.2. Campesterol

- 9.1.3. Stigmasterol

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.1.1. Dairy Products

- 9.2.1.2. Sauces and Condiments

- 9.2.1.3. Bakery and Confectionery

- 9.2.2. Pharmaceuticals

- 9.2.3. Cosmetics

- 9.2.4. Dietary Supplements

- 9.2.5. Animal Feed

- 9.2.1. Food and Beverages

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Beta-Sitosterol

- 10.1.2. Campesterol

- 10.1.3. Stigmasterol

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.1.1. Dairy Products

- 10.2.1.2. Sauces and Condiments

- 10.2.1.3. Bakery and Confectionery

- 10.2.2. Pharmaceuticals

- 10.2.3. Cosmetics

- 10.2.4. Dietary Supplements

- 10.2.5. Animal Feed

- 10.2.1. Food and Beverages

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Beta-Sitosterol

- 11.1.2. Campesterol

- 11.1.3. Stigmasterol

- 11.1.4. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Food and Beverages

- 11.2.1.1. Dairy Products

- 11.2.1.2. Sauces and Condiments

- 11.2.1.3. Bakery and Confectionery

- 11.2.2. Pharmaceuticals

- 11.2.3. Cosmetics

- 11.2.4. Dietary Supplements

- 11.2.5. Animal Feed

- 11.2.1. Food and Beverages

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. North America Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 12.1.4 Rest of North America

- 13. Europe Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Russia

- 13.1.5 Spain

- 13.1.6 Italy

- 13.1.7 Rest of Europe

- 14. Asia Pacific Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 India

- 14.1.2 China

- 14.1.3 Japan

- 14.1.4 Australia

- 14.1.5 Rest of Asia Pacific

- 15. South America Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Middle East Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Middle East

- 16.1.2 Africa

- 17. Saudi Arabia Phytosterols Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 South Africa

- 17.1.2 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Arboris LLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Cargill Incorporated

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Ashland Global Holdings Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Gustav Parmentier GmbH*List Not Exhaustive

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Lubrizol Life Science Health

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 DuPont de Nemours Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Archer Daniels Midland Company

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 BASF SE

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Berkshire Hathaway Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Merck Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Arboris LLC

List of Figures

- Figure 1: Global Phytosterols Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Phytosterols Industry Volume Breakdown (K Tons, %) by Region 2024 & 2032

- Figure 3: North America Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 5: North America Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 9: Europe Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 13: Asia Pacific Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 17: South America Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: Middle East Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: Middle East Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 21: Middle East Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: Saudi Arabia Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: Saudi Arabia Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 25: Saudi Arabia Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Saudi Arabia Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Phytosterols Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 28: North America Phytosterols Industry Volume (K Tons), by Product Type 2024 & 2032

- Figure 29: North America Phytosterols Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: North America Phytosterols Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 31: North America Phytosterols Industry Revenue (Million), by Application 2024 & 2032

- Figure 32: North America Phytosterols Industry Volume (K Tons), by Application 2024 & 2032

- Figure 33: North America Phytosterols Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: North America Phytosterols Industry Volume Share (%), by Application 2024 & 2032

- Figure 35: North America Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 37: North America Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Phytosterols Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 40: Europe Phytosterols Industry Volume (K Tons), by Product Type 2024 & 2032

- Figure 41: Europe Phytosterols Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 42: Europe Phytosterols Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 43: Europe Phytosterols Industry Revenue (Million), by Application 2024 & 2032

- Figure 44: Europe Phytosterols Industry Volume (K Tons), by Application 2024 & 2032

- Figure 45: Europe Phytosterols Industry Revenue Share (%), by Application 2024 & 2032

- Figure 46: Europe Phytosterols Industry Volume Share (%), by Application 2024 & 2032

- Figure 47: Europe Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Europe Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 49: Europe Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Europe Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Phytosterols Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 52: Asia Pacific Phytosterols Industry Volume (K Tons), by Product Type 2024 & 2032

- Figure 53: Asia Pacific Phytosterols Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: Asia Pacific Phytosterols Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 55: Asia Pacific Phytosterols Industry Revenue (Million), by Application 2024 & 2032

- Figure 56: Asia Pacific Phytosterols Industry Volume (K Tons), by Application 2024 & 2032

- Figure 57: Asia Pacific Phytosterols Industry Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Phytosterols Industry Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Pacific Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 61: Asia Pacific Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 63: South America Phytosterols Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 64: South America Phytosterols Industry Volume (K Tons), by Product Type 2024 & 2032

- Figure 65: South America Phytosterols Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 66: South America Phytosterols Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 67: South America Phytosterols Industry Revenue (Million), by Application 2024 & 2032

- Figure 68: South America Phytosterols Industry Volume (K Tons), by Application 2024 & 2032

- Figure 69: South America Phytosterols Industry Revenue Share (%), by Application 2024 & 2032

- Figure 70: South America Phytosterols Industry Volume Share (%), by Application 2024 & 2032

- Figure 71: South America Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 72: South America Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 73: South America Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: South America Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 75: Middle East Phytosterols Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 76: Middle East Phytosterols Industry Volume (K Tons), by Product Type 2024 & 2032

- Figure 77: Middle East Phytosterols Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 78: Middle East Phytosterols Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 79: Middle East Phytosterols Industry Revenue (Million), by Application 2024 & 2032

- Figure 80: Middle East Phytosterols Industry Volume (K Tons), by Application 2024 & 2032

- Figure 81: Middle East Phytosterols Industry Revenue Share (%), by Application 2024 & 2032

- Figure 82: Middle East Phytosterols Industry Volume Share (%), by Application 2024 & 2032

- Figure 83: Middle East Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 85: Middle East Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East Phytosterols Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: Saudi Arabia Phytosterols Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 88: Saudi Arabia Phytosterols Industry Volume (K Tons), by Product Type 2024 & 2032

- Figure 89: Saudi Arabia Phytosterols Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 90: Saudi Arabia Phytosterols Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 91: Saudi Arabia Phytosterols Industry Revenue (Million), by Application 2024 & 2032

- Figure 92: Saudi Arabia Phytosterols Industry Volume (K Tons), by Application 2024 & 2032

- Figure 93: Saudi Arabia Phytosterols Industry Revenue Share (%), by Application 2024 & 2032

- Figure 94: Saudi Arabia Phytosterols Industry Volume Share (%), by Application 2024 & 2032

- Figure 95: Saudi Arabia Phytosterols Industry Revenue (Million), by Country 2024 & 2032

- Figure 96: Saudi Arabia Phytosterols Industry Volume (K Tons), by Country 2024 & 2032

- Figure 97: Saudi Arabia Phytosterols Industry Revenue Share (%), by Country 2024 & 2032

- Figure 98: Saudi Arabia Phytosterols Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Phytosterols Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Phytosterols Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Global Phytosterols Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Phytosterols Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: United States Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Canada Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Mexico Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 21: Germany Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: France Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Russia Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Russia Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Spain Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Italy Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: India Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: China Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: China Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Japan Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Australia Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Australia Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Rest of Asia Pacific Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 49: Brazil Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Brazil Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Argentina Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Argentina Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Rest of South America Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of South America Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 55: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 57: Middle East Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Middle East Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 59: Africa Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Africa Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 61: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 63: South Africa Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Middle East Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 67: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 68: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 69: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 70: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 71: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 73: United States Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: United States Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 75: Canada Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Canada Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 77: Mexico Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Mexico Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 79: Rest of North America Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of North America Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 81: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 82: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 83: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 84: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 85: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 86: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 87: Germany Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Germany Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 89: United Kingdom Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: United Kingdom Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 91: France Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: France Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 93: Russia Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Russia Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 95: Spain Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Spain Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 97: Italy Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Italy Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 99: Rest of Europe Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Rest of Europe Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 101: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 102: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 103: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 104: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 105: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 106: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 107: India Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: India Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 109: China Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: China Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 111: Japan Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: Japan Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 113: Australia Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: Australia Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 115: Rest of Asia Pacific Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Rest of Asia Pacific Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 117: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 118: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 119: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 120: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 121: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 122: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 123: Brazil Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 124: Brazil Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 125: Argentina Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 126: Argentina Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 127: Rest of South America Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: Rest of South America Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 129: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 130: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 131: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 132: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 133: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 134: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 135: Global Phytosterols Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 136: Global Phytosterols Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 137: Global Phytosterols Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 138: Global Phytosterols Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 139: Global Phytosterols Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 140: Global Phytosterols Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 141: South Africa Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 142: South Africa Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 143: Rest of Middle East Phytosterols Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 144: Rest of Middle East Phytosterols Industry Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phytosterols Industry?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Phytosterols Industry?

Key companies in the market include Arboris LLC, Cargill Incorporated, Ashland Global Holdings Inc, Gustav Parmentier GmbH*List Not Exhaustive, Lubrizol Life Science Health, DuPont de Nemours Inc, Archer Daniels Midland Company, BASF SE, Berkshire Hathaway Inc, Merck Group.

3. What are the main segments of the Phytosterols Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 890.2 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Increasing Prevalence of Cardiovascular Disease.

7. Are there any restraints impacting market growth?

Prevalence of allergen intolerance among the consumers.

8. Can you provide examples of recent developments in the market?

June 2022: Kensing LLC, a manufacturer of plant sterols, natural vitamin E, and high-purity surfactants, announced the acquisition of Vitae Naturals, a manufacturer of plant sterol esters and non-GMO vitamin E derivatives which have their applications in skincare, food, and nutrition end-use industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phytosterols Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phytosterols Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phytosterols Industry?

To stay informed about further developments, trends, and reports in the Phytosterols Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence