Key Insights

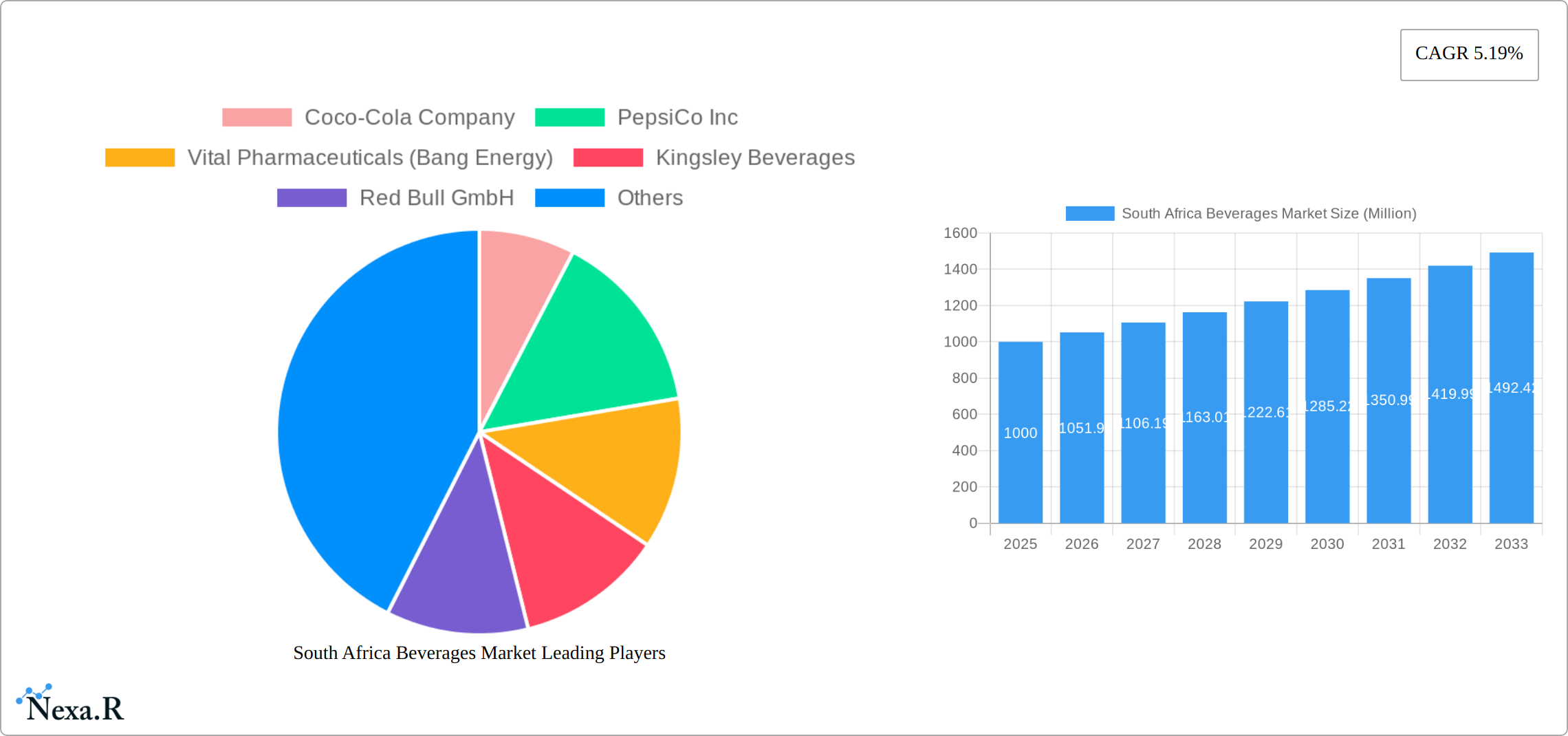

The South African beverage market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.19% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning population, particularly within the younger demographics, coupled with rising disposable incomes, is driving increased consumption of both alcoholic and non-alcoholic beverages. The increasing popularity of health and wellness trends is simultaneously boosting the demand for functional beverages and healthier alternatives, such as non-alcoholic spirits and enhanced water. Furthermore, the vibrant and diverse South African culture contributes to a dynamic market with a strong preference for local brands and unique flavor profiles. The market is segmented by product type (alcoholic and non-alcoholic beverages, including spirits) and distribution channel (on-trade and off-trade), with significant competition among major players like Coca-Cola, PepsiCo, Red Bull, and local brands like Twizza.

However, challenges exist. Economic fluctuations, particularly periods of high unemployment and inflation, can impact consumer spending on discretionary items like beverages. Additionally, stringent regulations surrounding alcohol consumption and health concerns regarding sugar content in certain beverages pose potential restraints to market growth. The competitive landscape is intense, demanding continuous innovation and effective marketing strategies to capture market share. The regional distribution within South Africa itself, with variations in consumer preferences and purchasing power across different provinces, presents further complexities for manufacturers. Future growth will likely depend on adapting to evolving consumer demands, effectively addressing health concerns, and strategically navigating the competitive landscape. Expanding into new product categories, such as plant-based beverages and functional drinks tailored to specific health needs, will be critical for sustained success.

South Africa Beverages Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa beverages market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, key players, and future opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report uses 2025 as the base year and provides forecasts until 2033. All values are presented in million units.

South Africa Beverages Market Dynamics & Structure

This section analyzes the South African beverage market's competitive landscape, focusing on market concentration, technological advancements, regulatory influences, and the impact of mergers and acquisitions (M&A). The market is characterized by a mix of multinational giants and local players, resulting in a moderately concentrated structure. The report quantifies market share held by key players and assesses the intensity of competition within each segment (alcoholic and non-alcoholic beverages).

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Key drivers include advancements in packaging, flavor development, and production efficiency, with a notable focus on sustainable practices. Barriers to innovation include high R&D costs and regulatory compliance.

- Regulatory Framework: South Africa's beverage industry is subject to various regulations concerning alcohol content, labeling, and marketing, impacting both production and distribution. Changes to these regulations can significantly impact market dynamics.

- Competitive Product Substitutes: The market faces competition from substitute products like juices, bottled water, and functional drinks, impacting growth within specific segments.

- End-User Demographics: Consumer preferences are diverse, with significant variations based on age, income, and lifestyle, influencing product demand across different beverage categories.

- M&A Trends: The report analyzes recent M&A activity in the South African beverage industry, providing a quantitative overview of deal volumes and qualitative insights into strategic rationale and implications. xx M&A deals were recorded between 2019 and 2024.

South Africa Beverages Market Growth Trends & Insights

The South African beverage market presents a dynamic landscape shaped by evolving consumer preferences, economic shifts, and technological advancements. This analysis delves into the market's growth trajectory, utilizing comprehensive data to illuminate its evolution from 2019 to 2024 and project its expansion from 2025 to 2033. We examine key growth drivers, including the increasing demand for healthier options, the impact of digital marketing and e-commerce, and the influence of fluctuating economic conditions. The projected compound annual growth rate (CAGR) for the total market during the forecast period is estimated at [Insert Projected CAGR]% – a figure influenced by [mention specific factors impacting CAGR, e.g., growing middle class, increased urbanization]. Furthermore, a detailed analysis of market penetration rates across key segments provides a granular understanding of market dynamics.

Specific segment analyses will highlight the adoption rates and driving forces behind various beverage types, including the performance of carbonated soft drinks, juices, energy drinks, alcoholic beverages (beer, wine, spirits), and emerging categories like functional and plant-based beverages. Detailed charts and graphs illustrating these trends will be included in the full report [link to full report if available].

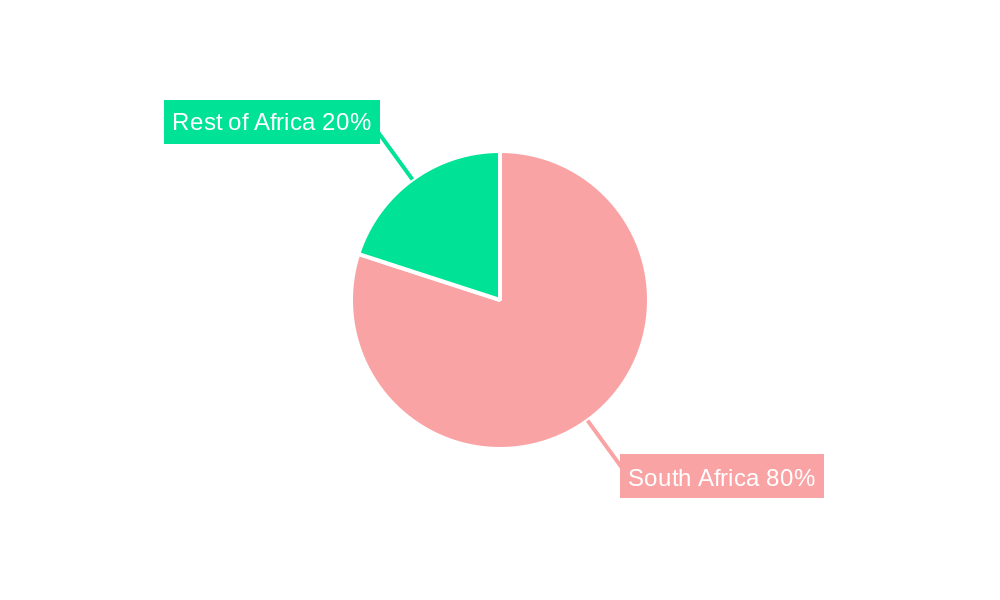

Dominant Regions, Countries, or Segments in South Africa Beverages Market

While South Africa is a single country, regional nuances in consumption patterns necessitate a geographically segmented analysis. This section identifies the leading regions, and segments within the South African beverage market based on Product Type (Alcoholic Beverages, Spirits, Non-Alcoholic Beverages, including carbonated soft drinks, juices, and energy drinks) and Distribution Channel (On-Trade, Off-Trade). The analysis will highlight the key growth drivers and competitive dynamics within each dominant segment.

- Product Type: The non-alcoholic beverage segment is anticipated to maintain its market dominance in 2025, commanding approximately [Insert Projected Market Share]% market share. This growth is primarily fueled by [mention specific drivers, e.g., rising health consciousness leading to increased demand for healthier alternatives, successful marketing campaigns targeting specific demographics]. Conversely, the alcoholic beverage segment, encompassing beer, wine, and spirits, is projected to hold a [Insert Projected Market Share]% market share, influenced by factors such as [mention specific factors, e.g., changing social trends, pricing strategies, government regulations].

- Distribution Channel: The off-trade channel (retail stores, supermarkets, online platforms) is poised to continue its dominance, capturing approximately [Insert Projected Market Share]% of the market share due to increased accessibility, convenience, and the rise of e-commerce. The on-trade channel (restaurants, bars, pubs), while maintaining a significant presence with a projected [Insert Projected Market Share]% market share, will experience growth influenced by factors such as [mention specific factors, e.g., tourism trends, government regulations on alcohol consumption, changing consumer habits].

South Africa Beverages Market Product Landscape

This section offers an overview of the product landscape, including innovations, applications, and performance metrics of beverages in the South African market. The focus is on identifying unique selling propositions and technological advancements driving innovation, such as sustainable packaging, healthier formulations, and functional beverages.

Key Drivers, Barriers & Challenges in South Africa Beverages Market

This section provides a comprehensive overview of the factors propelling growth and the obstacles hindering progress within the South African beverage market.

Key Drivers: The market's expansion is fueled by several key factors, including a growing middle class with increased disposable incomes, rapid urbanization leading to evolving lifestyles and consumption patterns, and a shifting preference towards healthier, functional beverages. Government policies supporting local production and investment in the industry also play a significant role. Furthermore, innovative product launches and effective marketing campaigns targeting specific consumer segments will impact the market positively.

Key Barriers & Challenges: The market faces significant headwinds, including volatile raw material costs, stringent regulatory frameworks governing production and labeling, intense competition among established players and new entrants, and potential supply chain disruptions that could impact production and distribution. These challenges could potentially reduce market growth by [Insert Projected Percentage]% by 2033. Addressing these challenges effectively will be crucial for sustained growth.

Emerging Opportunities in South Africa Beverages Market

Despite the challenges, the South African beverage market presents promising opportunities for growth. This section highlights key areas ripe for expansion, including untapped market segments in rural areas, the burgeoning demand for innovative product categories (such as functional beverages, plant-based drinks, and premium artisanal products), and the increasing consumer preference for sustainable and ethically sourced products. Furthermore, focusing on niche health and wellness needs, tailoring products to specific demographic preferences, and leveraging digital platforms for targeted marketing offer strong potential for growth.

Growth Accelerators in the South Africa Beverages Market Industry

Technological advancements, strategic partnerships, and market expansion initiatives are projected to drive long-term growth in the South African beverage market. Focus on innovation, sustainability, and strategic alliances will be crucial for success.

Key Players Shaping the South Africa Beverages Market Market

- Coca-Cola Company

- PepsiCo Inc

- Vital Pharmaceuticals (Bang Energy)

- Kingsley Beverages

- Red Bull GmbH

- Anheuser-Busch InBev NV

- The Beverage Company

- Carlsberg Group

- Ekhamanzi Springs (Pty) Ltd

- Twizza Soft Drinks (Pty) Ltd

- Diageo PLC (List Not Exhaustive)

Notable Milestones in South Africa Beverages Market Sector

- June 2022: Bang Energy partnered with SG Gateway Services to expand in South Africa.

- July 2022: Red Bull launched a Summer Edition Apricot energy drink.

- September 2022: Coca-Cola introduced its new Cappy juice brand.

In-Depth South Africa Beverages Market Market Outlook

The South African beverage market exhibits significant growth potential, driven by continued economic expansion, evolving consumer preferences, and the entry of new players. Strategic opportunities exist for companies focusing on innovation, sustainability, and catering to specific consumer needs. The market is expected to witness considerable expansion in the coming years, presenting lucrative prospects for both established and emerging players.

South Africa Beverages Market Segmentation

-

1. Product Type

-

1.1. Alcoholic Beverages

- 1.1.1. Beer

- 1.1.2. Wine

- 1.1.3. Spirits

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Energy & Sport Drinks

- 1.2.2. Carbonated Soft Drinks

- 1.2.3. Tea & Coffee

- 1.2.4. Other Non-alcoholic Beverages

-

1.1. Alcoholic Beverages

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Distribution Channels

South Africa Beverages Market Segmentation By Geography

- 1. South Africa

South Africa Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for flavored beverages in food and beverage industries

- 3.3. Market Restrains

- 3.3.1. Increasing concerns regarding obesity and health awareness

- 3.4. Market Trends

- 3.4.1. Increased Consumption of Alcoholic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcoholic Beverages

- 5.1.1.1. Beer

- 5.1.1.2. Wine

- 5.1.1.3. Spirits

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Energy & Sport Drinks

- 5.1.2.2. Carbonated Soft Drinks

- 5.1.2.3. Tea & Coffee

- 5.1.2.4. Other Non-alcoholic Beverages

- 5.1.1. Alcoholic Beverages

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Coco-Cola Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PepsiCo Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vital Pharmaceuticals (Bang Energy)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kingsley Beverages

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Red Bull GmbH

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Anheuser-Busch InBev NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Beverage Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Carlsberg Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ekhamanzi Springs (Pty) Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Twizza Soft Drinks (Pty) Ltd*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Diageo PLC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Coco-Cola Company

List of Figures

- Figure 1: South Africa Beverages Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Beverages Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Africa Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Africa Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: South Africa Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: South Africa Beverages Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Beverages Market?

The projected CAGR is approximately 5.19%.

2. Which companies are prominent players in the South Africa Beverages Market?

Key companies in the market include Coco-Cola Company, PepsiCo Inc, Vital Pharmaceuticals (Bang Energy), Kingsley Beverages, Red Bull GmbH, Anheuser-Busch InBev NV, The Beverage Company, Carlsberg Group, Ekhamanzi Springs (Pty) Ltd, Twizza Soft Drinks (Pty) Ltd*List Not Exhaustive, Diageo PLC.

3. What are the main segments of the South Africa Beverages Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for flavored beverages in food and beverage industries.

6. What are the notable trends driving market growth?

Increased Consumption of Alcoholic Beverages.

7. Are there any restraints impacting market growth?

Increasing concerns regarding obesity and health awareness.

8. Can you provide examples of recent developments in the market?

September 2022: Coca-Cola introduced a new juice brand in South Africa, Cappy, a 100% fruit juice in various flavors, including Tropical, Orange Mango, Apple, Orange, and Grape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Beverages Market?

To stay informed about further developments, trends, and reports in the South Africa Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence