Key Insights

The South American botanical supplements market, valued at approximately $60.02 billion in 2025, is projected for significant expansion with a compound annual growth rate (CAGR) of 10.24% from 2025 to 2033. Key growth drivers include heightened consumer awareness of natural product benefits and the rising incidence of chronic diseases, increasing demand for botanical solutions. The region's growing adoption of holistic health practices and a shift towards healthier lifestyles, supported by increased disposable income and digital information access, further fuel this market surge. While regulatory challenges and quality standardization concerns exist, market resilience and the increasing availability of certified, high-quality products are mitigating these factors. The market is segmented by form (powder, capsules, tablets, etc.) and distribution channel (supermarkets, pharmacies, online, etc.), presenting diverse growth avenues. Brazil and Argentina lead the market, driven by robust consumer spending and established distribution networks.

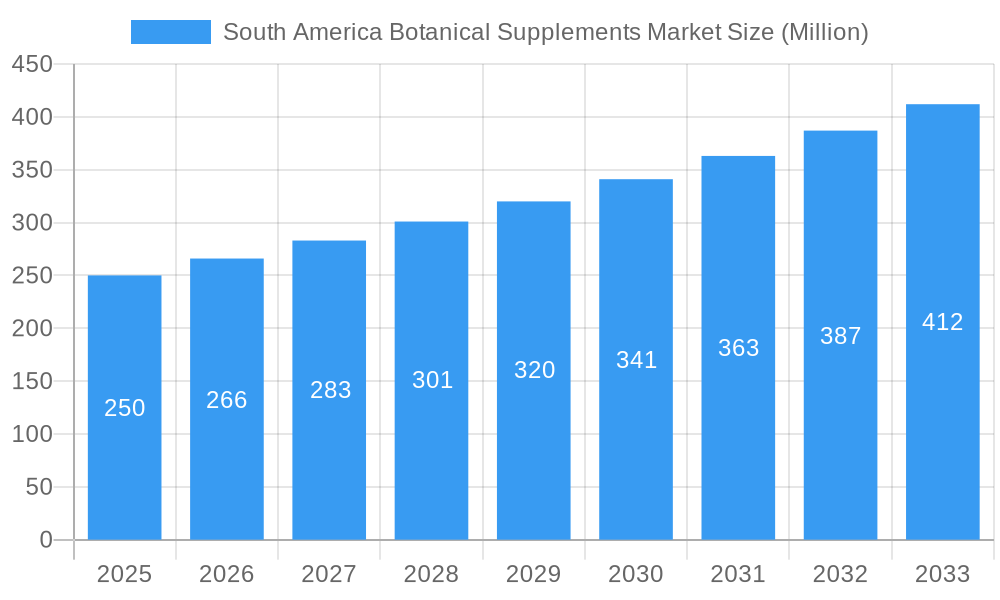

South America Botanical Supplements Market Market Size (In Billion)

The competitive landscape features multinational corporations and regional players, fostering innovation and product development. Future success depends on adapting to evolving consumer preferences, investing in R&D for product efficacy, and building strong distribution channels. Niche segments focusing on specific health concerns, personalized nutrition, and functional foods offer significant growth potential. The expanding adoption of e-commerce platforms provides a vital opportunity to broaden market reach and customer accessibility.

South America Botanical Supplements Market Company Market Share

South America Botanical Supplements Market Analysis: Trends, Opportunities, and Forecast 2025-2033

This comprehensive report offers an in-depth analysis of the South America Botanical Supplements Market, detailing market dynamics, growth trajectories, key stakeholders, and future prospects. Covering the period from 2025 to 2033, with 2025 as the base year, this report serves as a critical resource for industry professionals, investors, and strategic decision-makers. Market segmentation includes product form (powder, capsules, tablets, etc.) and distribution channel (supermarkets, pharmacies, online, etc.).

South America Botanical Supplements Market Dynamics & Structure

The South American botanical supplements market is characterized by a moderately fragmented structure, with several large multinational companies and a significant number of smaller regional players competing for market share. Market concentration is relatively low, indicating ample opportunities for both established and emerging players. Technological innovation, particularly in extraction methods and product formulation, is a key driver, enhancing product efficacy and consumer appeal. Regulatory frameworks vary across South American countries, impacting product registration and labeling requirements. The market faces competition from synthetic supplements, but the growing consumer preference for natural and organic products provides a significant advantage to botanical supplements. End-user demographics show increasing demand from health-conscious consumers across various age groups, particularly millennials and Gen Z. M&A activity in the sector has been moderate, with strategic acquisitions aimed at expanding product portfolios and geographic reach.

- Market Concentration: Moderately fragmented (xx% market share held by top 5 players in 2024).

- Technological Innovation: Focus on standardized extracts, enhanced bioavailability, and sustainable sourcing.

- Regulatory Landscape: Varies significantly across countries, creating compliance challenges.

- Competitive Substitutes: Synthetic vitamins and supplements represent the primary competition.

- End-User Demographics: Growing demand from health-conscious millennials and Gen Z.

- M&A Activity: Moderate activity, primarily focusing on expansion and product diversification (xx deals in 2019-2024).

South America Botanical Supplements Market Growth Trends & Insights

The South American botanical supplements market has witnessed robust growth in recent years, driven by increasing health awareness, rising disposable incomes, and changing consumer preferences towards natural health solutions. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%. This growth is further fueled by the expanding e-commerce sector, which provides increased accessibility to a wider range of products. Technological advancements are improving product quality, efficacy, and safety, bolstering consumer confidence. Furthermore, the rising prevalence of chronic diseases is contributing to the increased demand for preventative and supportive healthcare solutions, further driving market expansion. Market penetration remains relatively low compared to developed markets, presenting significant untapped potential for growth.

Dominant Regions, Countries, or Segments in South America Botanical Supplements Market

Brazil dominates the South American botanical supplements market, accounting for the largest market share, driven by its large population, relatively high disposable incomes, and established health and wellness sector. Other key markets include Argentina, Colombia, and Mexico, though their market shares are significantly smaller than Brazil's. In terms of product segments, capsules and tablets hold the largest market share due to their convenience and ease of consumption. The online distribution channel is experiencing rapid growth, propelled by increasing internet penetration and the convenience of online shopping.

- Key Drivers in Brazil: Strong consumer spending on health and wellness, well-developed retail infrastructure.

- Key Drivers in Argentina: Rising health awareness and adoption of natural remedies.

- Dominant Product Segment: Capsules (xx% market share) due to consumer preference for convenience.

- Fastest-Growing Distribution Channel: Online stores (xx% CAGR).

South America Botanical Supplements Market Product Landscape

Product innovation is a significant aspect of the South American botanical supplements market. Companies are focusing on developing novel formulations with enhanced bioavailability, improved efficacy, and targeted health benefits. Many products are now incorporating functional ingredients and blends to address specific health needs. The market also sees a strong emphasis on organic and sustainably sourced ingredients to cater to environmentally conscious consumers. Standardized extracts are becoming increasingly popular as they guarantee consistent quality and potency.

Key Drivers, Barriers & Challenges in South America Botanical Supplements Market

Key Drivers:

- Growing health consciousness and preventative healthcare practices.

- Rising disposable incomes and increased spending on wellness products.

- Expanding e-commerce penetration and online retail channels.

- Increasing prevalence of chronic diseases.

Challenges:

- Varying regulatory frameworks across South American countries create compliance challenges (estimated xx% of companies face compliance issues).

- Counterfeit and substandard products represent a significant threat to market integrity (estimated xx Million units of counterfeit products seized annually).

- Supply chain disruptions and logistical challenges impact product availability and costs (average delay of xx days reported in 2024).

Emerging Opportunities in South America Botanical Supplements Market

- Expansion into niche markets, such as sports nutrition and specialized health conditions.

- Development of personalized botanical supplement formulations based on individual genetic profiles.

- Increased adoption of sustainable sourcing and eco-friendly packaging practices.

- Growing demand for products with clinically proven efficacy.

Growth Accelerators in the South America Botanical Supplements Market Industry

Strategic partnerships and collaborations between botanical supplement manufacturers and health and wellness companies are accelerating market growth. The ongoing development and improvement of extraction and production technologies are enhancing the quality and efficacy of products, and greater emphasis on research and clinical studies are increasing consumer confidence. Furthermore, the expansion of distribution networks into previously underserved areas is broadening market access and driving penetration.

Key Players Shaping the South America Botanical Supplements Market Market

- GNC Holdings Inc.

- Dr. Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC)

- Amway Corporation

- Herbalife Nutrition Limited

- MusclePharm

- Nature's Bounty Co

- NOW Foods

- Blackmores Limited

- Arizona Natural Products

- Gaia Herbs

Notable Milestones in South America Botanical Supplements Market Sector

- October 2021: GNC Holdings Inc. partners with GLAXON to expand its sports nutrition product line.

- March 2021: Gaia Herbs launches a new line of mushroom capsules targeting various health benefits.

- January 2021: Herbalife Nutrition repurchases USD 600 Million of its shares.

In-Depth South America Botanical Supplements Market Market Outlook

The South American botanical supplements market is poised for continued expansion, driven by several factors, including increasing health awareness, rising disposable incomes, and technological advancements. Strategic partnerships, product innovation, and targeted marketing initiatives will play a crucial role in shaping the market landscape. The increasing focus on sustainable sourcing and eco-friendly practices will appeal to environmentally conscious consumers. Untapped market segments, including personalized nutrition and specific health conditions, offer significant growth potential. The market is expected to experience strong growth over the forecast period, with significant opportunities for both established players and new entrants.

South America Botanical Supplements Market Segmentation

-

1. Form

- 1.1. Powdered

- 1.2. Capsules

- 1.3. Tablets

- 1.4. Other Forms

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Pharmacies/Drug Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Argentina

- 3.2. Brazil

- 3.3. Rest of South America

South America Botanical Supplements Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Botanical Supplements Market Regional Market Share

Geographic Coverage of South America Botanical Supplements Market

South America Botanical Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Increased Focus on Preventive Healthcare

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powdered

- 5.1.2. Capsules

- 5.1.3. Tablets

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Pharmacies/Drug Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Argentina

- 5.3.2. Brazil

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Argentina South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powdered

- 6.1.2. Capsules

- 6.1.3. Tablets

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Pharmacies/Drug Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Argentina

- 6.3.2. Brazil

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Brazil South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powdered

- 7.1.2. Capsules

- 7.1.3. Tablets

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Pharmacies/Drug Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Argentina

- 7.3.2. Brazil

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Rest of South America South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powdered

- 8.1.2. Capsules

- 8.1.3. Tablets

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Pharmacies/Drug Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Argentina

- 8.3.2. Brazil

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GNC Holdings Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Amway Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Herbalife Nutrition Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 MusclePharm

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nature's Bounty Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 NOW Foods

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Blackmores Limited*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Arizona Natural Products

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Gaia Herbs

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 GNC Holdings Inc

List of Figures

- Figure 1: South America Botanical Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Botanical Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Botanical Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 6: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 10: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Botanical Supplements Market?

The projected CAGR is approximately 10.24%.

2. Which companies are prominent players in the South America Botanical Supplements Market?

Key companies in the market include GNC Holdings Inc, Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC ), Amway Corporation, Herbalife Nutrition Limited, MusclePharm, Nature's Bounty Co, NOW Foods, Blackmores Limited*List Not Exhaustive, Arizona Natural Products, Gaia Herbs.

3. What are the main segments of the South America Botanical Supplements Market?

The market segments include Form, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Increased Focus on Preventive Healthcare.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

In October 2021, GNC Holdings Inc. and GLAXON have established a strategic product partnership. GLAXON supplies nutrition supplements for athletes. The collaboration with GNC is the first to emerge from GNC Ventures, the subsidiary that fosters innovation and technology and is connected to GNC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Botanical Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Botanical Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Botanical Supplements Market?

To stay informed about further developments, trends, and reports in the South America Botanical Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence