Key Insights

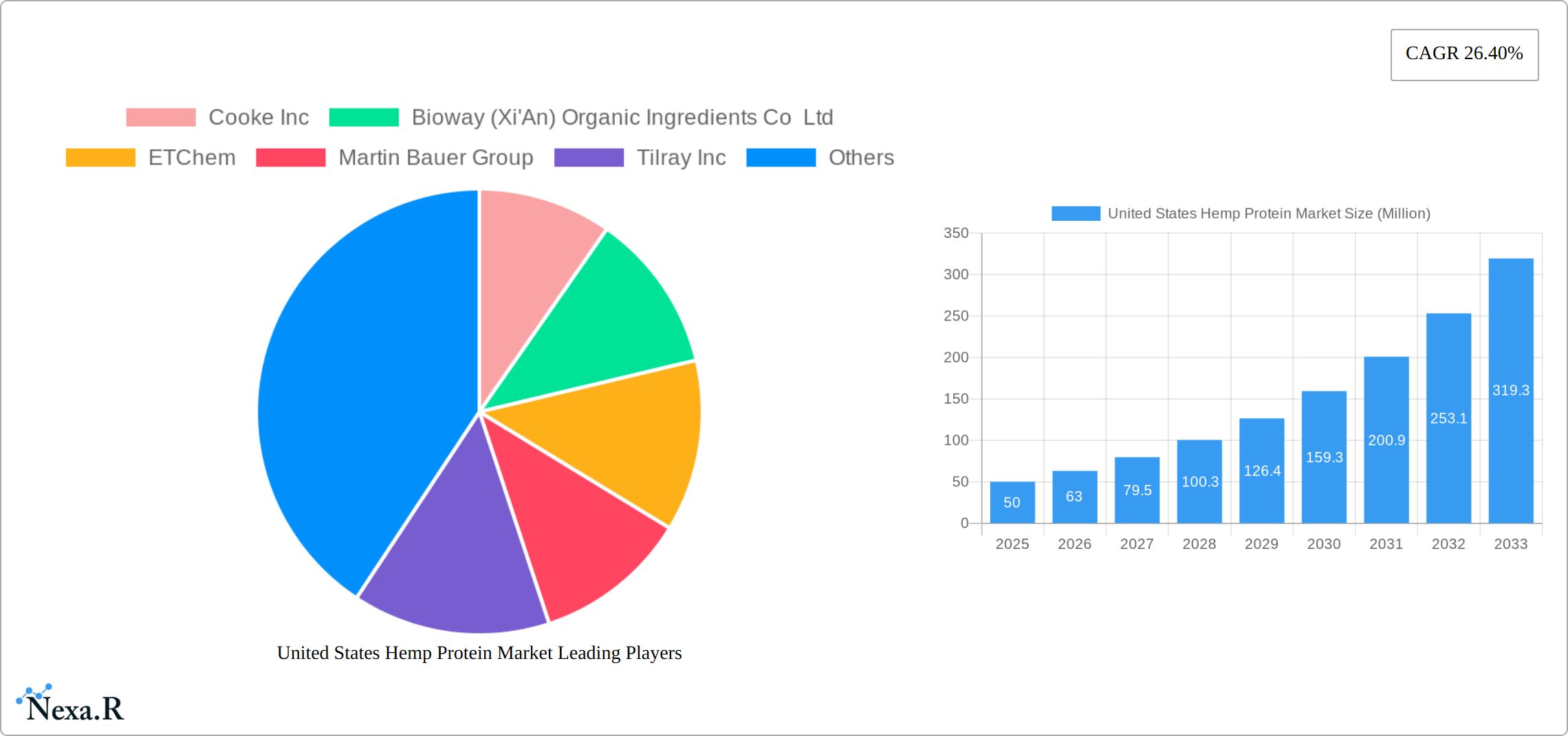

The United States Hemp Protein Market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 26.40% from 2025 to 2033. This robust growth trajectory is driven by increasing consumer demand for plant-based protein alternatives, particularly within the food and beverage sector. Key segments such as meat alternatives, dairy alternatives, and protein bars are witnessing heightened interest, reflecting a broader trend towards health-conscious and sustainable eating habits. Companies like Cooke Inc and Axiom Foods Inc are at the forefront, innovating to meet the evolving preferences of American consumers. The market's value, reaching an estimated $XX million by 2025, underscores its burgeoning potential and the strategic focus of major players to capitalize on this trend.

Regionally, North America, with the United States at its core, dominates the hemp protein market due to a supportive regulatory environment and heightened consumer awareness about the benefits of hemp-based products. The market's growth is further fueled by trends such as the increasing prevalence of vegan diets and a shift towards clean-label products. Despite challenges such as fluctuating raw material prices and stringent regulations, the market is expected to continue its upward trajectory. The focus on sports and performance nutrition, evidenced by the popularity of protein shakes and energy drinks, also contributes significantly to market expansion. As the market evolves, stakeholders are likely to witness continued innovation and product diversification, catering to the nuanced needs of health-focused consumers.

United States Hemp Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States hemp protein market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and stakeholders. The market is segmented by end-user (Food & Beverages, Sport/Performance Nutrition) and further categorized into various applications (Meat alternatives, dairy alternatives, baked goods, protein bars, snacks, protein shakes, powders, supplements, energy drinks). The total market size is projected to reach xx Million by 2033.

United States Hemp Protein Market Dynamics & Structure

The US hemp protein market exhibits a moderately consolidated structure with key players vying for market share. Technological innovation, primarily focused on improving protein extraction methods and enhancing product quality, is a significant driver. Favorable regulatory changes surrounding hemp cultivation and processing are fueling market growth, while the presence of competitive protein substitutes (soy, whey) poses a challenge. The end-user demographic is expanding, driven by growing health consciousness and demand for plant-based protein sources. M&A activity, as evidenced by Tilray's acquisition of Manitoba Harvest, demonstrates the strategic importance of consolidating market share and leveraging existing distribution networks.

- Market Concentration: Moderately consolidated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on efficient extraction, improved texture, and enhanced bioavailability.

- Regulatory Framework: Favorable regulations are promoting market expansion, though variations across states exist.

- Competitive Substitutes: Soy, whey, and pea protein present competitive pressures.

- End-User Demographics: Health-conscious consumers and vegans/vegetarians drive demand.

- M&A Trends: Strategic acquisitions are consolidating market leadership and expanding distribution channels. xx M&A deals observed between 2019 and 2024.

United States Hemp Protein Market Growth Trends & Insights

The US hemp protein market experienced significant growth during the historical period (2019-2024), driven by increasing consumer awareness of the health benefits of hemp protein and the rise of plant-based diets. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), fueled by technological advancements leading to improved product quality and affordability, coupled with the expansion of distribution channels into mainstream retail outlets. Market penetration remains relatively low, offering significant untapped potential for growth. Shifts in consumer behavior, favoring sustainable and ethically sourced products, further contribute to the positive market outlook.

- Market Size Evolution: From xx Million in 2019 to xx Million in 2024, projected to reach xx Million by 2033.

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, with significant growth potential.

- Technological Disruptions: Innovations in protein extraction and formulation enhance product quality and appeal.

- Consumer Behavior Shifts: Increased preference for plant-based and sustainable protein sources.

Dominant Regions, Countries, or Segments in United States Hemp Protein Market

The western region of the United States currently dominates the hemp protein market, driven by early adoption of hemp cultivation and a high concentration of health-conscious consumers. California and Oregon are leading states in terms of production and consumption. Within the end-user segments, the Food & Beverages sector holds a significant market share, with applications in meat alternatives, dairy alternatives, and protein bars experiencing rapid growth. The Sport/Performance Nutrition segment also exhibits strong growth potential due to the increasing popularity of hemp protein as a performance-enhancing supplement.

- Key Drivers (Western US): Established hemp cultivation infrastructure, high consumer demand for health foods, favorable regulatory environment.

- Dominant Segment: Food & Beverages (xx% market share in 2024), followed by Sport/Performance Nutrition (xx% market share in 2024).

- High-Growth Applications: Meat alternatives, dairy alternatives, protein bars, and protein shakes.

- Growth Potential: Untapped markets in the eastern and southern regions offer significant expansion opportunities.

United States Hemp Protein Market Product Landscape

The United States hemp protein market showcases a diverse range of products, extending beyond simple raw hemp protein powder. Manufacturers are increasingly incorporating hemp protein into a wide array of food and beverage applications, including protein bars, smoothies, baked goods, and plant-based meat alternatives. A significant focus lies in enhancing the organoleptic properties – improving texture, taste, and solubility – to broaden consumer appeal and overcome past challenges associated with hemp's earthy flavor profile. Advancements in extraction methods are resulting in higher protein yields and improved nutritional profiles, maximizing the value proposition. Key selling points consistently emphasize the high protein content, abundant fiber, complete amino acid profile, and the growing consumer interest in plant-based and sustainable protein sources.

Key Drivers, Barriers & Challenges in United States Hemp Protein Market

Key Drivers:

- Growing demand for plant-based protein sources.

- Increasing consumer awareness of hemp's health benefits.

- Favorable regulatory changes in hemp cultivation and processing.

- Technological advancements leading to higher yields and better product quality.

Key Challenges & Restraints:

- Competition from established protein sources (soy, whey).

- Price volatility of raw hemp material.

- Supply chain limitations and inconsistent product quality.

- Consumer perception regarding hemp's association with cannabis. This leads to reduced market penetration by an estimated xx% in 2024.

Emerging Opportunities in United States Hemp Protein Market

- Expansion into Novel Food and Beverage Applications: Beyond established uses, opportunities exist in innovative product formats like ready-to-drink protein shakes, protein-enriched snacks, and functional foods targeting specific health needs.

- Development of Functional Hemp Protein Products: Formulating hemp protein with added functional ingredients, such as probiotics, prebiotics, adaptogens, or other beneficial nutrients, creates value-added products catering to specific health goals.

- Targeted Consumer Segmentation: Focusing marketing efforts on specific demographics, such as athletes seeking plant-based protein, vegans looking for complete protein sources, and health-conscious individuals prioritizing sustainable and nutritious options, is vital for maximizing market penetration.

- International Market Expansion: Leveraging the growing global demand for plant-based proteins, exploring export opportunities can unlock significant growth potential for US hemp protein producers.

- Ingredient Branding and Transparency: Highlighting the origin and sustainability of hemp ingredients, emphasizing ethical sourcing, and promoting transparency throughout the supply chain can build consumer trust and loyalty.

Growth Accelerators in the United States Hemp Protein Market Industry

Several factors are crucial for accelerating the growth of the US hemp protein market. These include ongoing technological advancements in hemp processing and formulation, resulting in cost-effective and high-quality products. Strategic partnerships between hemp producers, ingredient suppliers, and food manufacturers are vital for efficient scaling and distribution. Expanding distribution networks into mainstream retail channels, including grocery stores, health food stores, and online retailers, ensures broad market accessibility. Finally, comprehensive marketing campaigns effectively communicating the health benefits, sustainability aspects, and versatility of hemp protein are essential for driving consumer adoption.

Key Players Shaping the United States Hemp Protein Market Market

- Cooke Inc

- Bioway (Xi'An) Organic Ingredients Co Ltd

- ETChem

- Martin Bauer Group

- Tilray Inc

- Axiom Foods Inc

- A Costantino & C SpA

- Green Source Organics

- Foodcom SA

Notable Milestones in United States Hemp Protein Market Sector

- February 2019: Tilray's acquisition of Manitoba Harvest significantly expanded its presence and market share in the hemp food sector.

- December 2019: The merger of Privateer Holdings Inc. and Tilray Brands Inc. further consolidated Tilray's position in the broader cannabis and hemp industries, providing resources and scale for hemp protein development and marketing.

- July 2021: Manitoba Harvest's research partnership focused on enhancing hemp and pea protein varieties signifies a commitment to ongoing innovation and product improvement within the market.

- Ongoing Regulatory Developments: The evolving regulatory landscape surrounding hemp cultivation and product manufacturing continues to shape market dynamics and presents both challenges and opportunities for industry players.

In-Depth United States Hemp Protein Market Market Outlook

The US hemp protein market is poised for substantial growth over the forecast period, driven by continued consumer demand for plant-based protein, ongoing technological advancements, and increased market penetration. Strategic partnerships, product diversification, and effective marketing strategies will be key to capitalizing on the significant opportunities presented by this dynamic market. The market is expected to reach xx Million by 2033.

United States Hemp Protein Market Segmentation

-

1. End User

-

1.1. Food and Beverages

-

1.1.1. By Sub End User

- 1.1.1.1. Bakery

- 1.1.1.2. Snacks

-

1.1.1. By Sub End User

-

1.2. Supplements

- 1.2.1. Elderly Nutrition and Medical Nutrition

- 1.2.2. Sport/Performance Nutrition

-

1.1. Food and Beverages

United States Hemp Protein Market Segmentation By Geography

- 1. United States

United States Hemp Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Food and Beverages

- 5.1.1.1. By Sub End User

- 5.1.1.1.1. Bakery

- 5.1.1.1.2. Snacks

- 5.1.1.1. By Sub End User

- 5.1.2. Supplements

- 5.1.2.1. Elderly Nutrition and Medical Nutrition

- 5.1.2.2. Sport/Performance Nutrition

- 5.1.1. Food and Beverages

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. United States United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Cooke Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bioway (Xi'An) Organic Ingredients Co Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ETChem

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Martin Bauer Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tilray Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Axiom Foods Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 A Costantino & C SpA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Green Source Organics

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Foodcom SA

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Cooke Inc

List of Figures

- Figure 1: United States Hemp Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Hemp Protein Market Share (%) by Company 2024

List of Tables

- Table 1: United States Hemp Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Hemp Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: United States Hemp Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Hemp Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States United States Hemp Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada United States Hemp Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico United States Hemp Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Hemp Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 9: United States Hemp Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hemp Protein Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the United States Hemp Protein Market?

Key companies in the market include Cooke Inc, Bioway (Xi'An) Organic Ingredients Co Ltd, ETChem, Martin Bauer Group, Tilray Inc, Axiom Foods Inc, A Costantino & C SpA, Green Source Organics, Foodcom SA.

3. What are the main segments of the United States Hemp Protein Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2021: Tilray Brands Inc.'s subsidiary Manitoba Harvest announced a new research partnership to drive innovation in hemp and pea protein with a consortium of industry leaders through Protein Industries Canada to develop new hemp and pea varieties with increased protein content, differential starch content, and improved texture.December 2019: Privateer Holdings Inc. merged with Tilray Brands Inc., a global pioneer in cannabis research, cultivation, production, and distribution.February 2019: Tilray acquired Manitoba Harvest from Compass Group Diversified Holdings LLC. Manitoba Harvest is one of the largest hemp food manufacturers and distributes a broad-based portfolio of hemp-based products. It is the parent company of Hemp Oil Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hemp Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hemp Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hemp Protein Market?

To stay informed about further developments, trends, and reports in the United States Hemp Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence