Key Insights

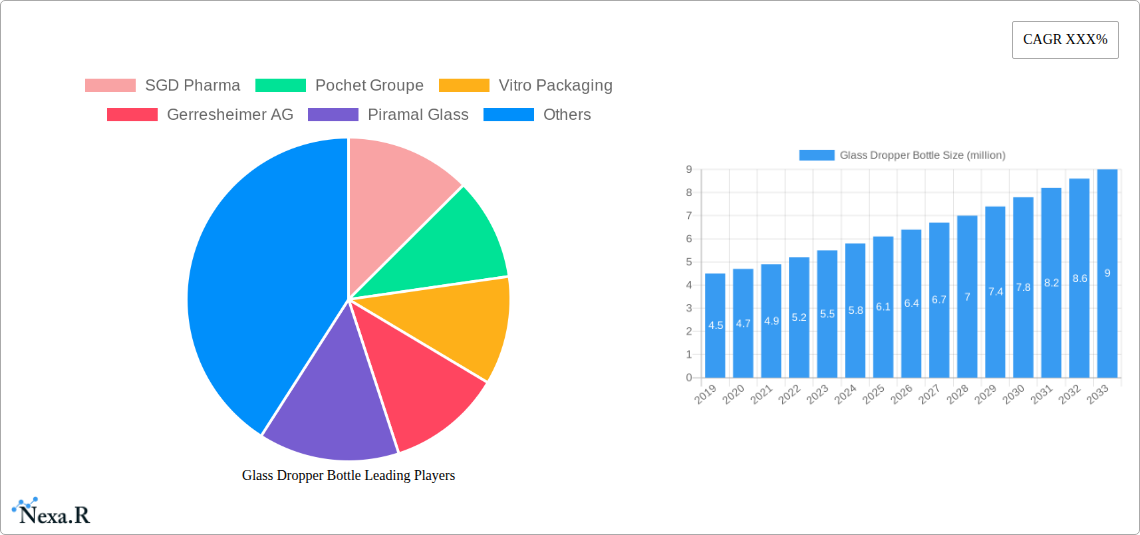

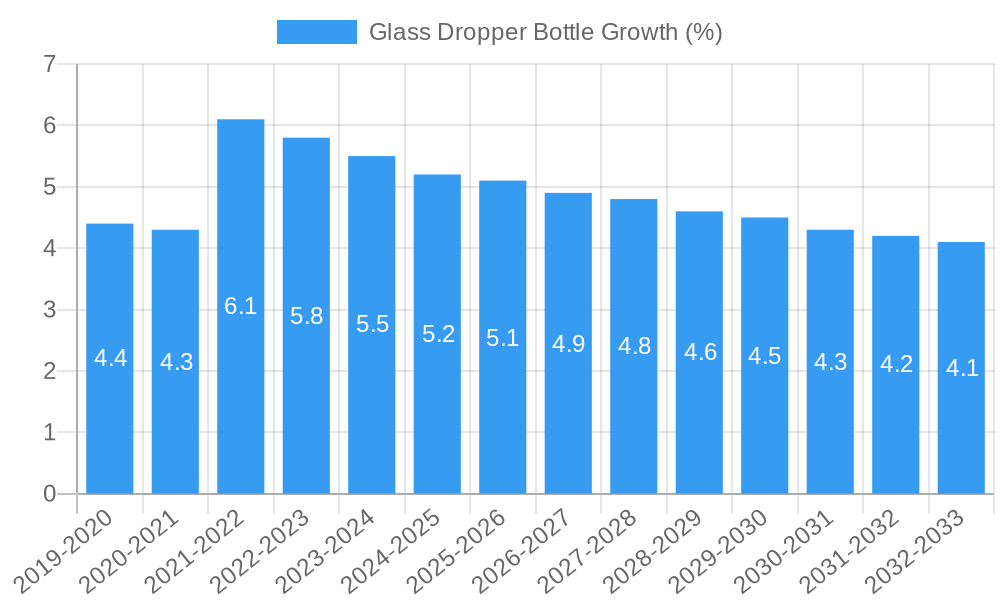

The global glass dropper bottle market is experiencing robust growth, projected to reach an estimated USD 6.5 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% through 2033. This expansion is primarily fueled by the increasing demand from the pharmaceutical industry, which relies on glass dropper bottles for precise dispensing of medications, serums, and specialized drug formulations. The cosmetic sector also significantly contributes to market growth, driven by the rising popularity of high-end skincare products, essential oils, and premium cosmetic formulations that often utilize dropper packaging for controlled application and a sophisticated user experience. Furthermore, the growing consumer preference for natural and organic products, particularly in the food and beverage sector for supplements and tinctures, is creating new avenues for market development.

The market is characterized by key drivers such as the inherent advantages of glass as a packaging material, including its inertness, non-reactivity, and premium aesthetic appeal. Its ability to protect sensitive contents from light and external contamination makes it an ideal choice for a wide range of applications. Emerging trends include a growing demand for amber and blue glass dropper bottles due to their UV-protective properties, which are crucial for preserving the efficacy of light-sensitive formulations. The convenience and precise dosing offered by dropper mechanisms are also appealing to consumers across various segments. However, certain restraints, such as the higher cost of glass compared to plastic alternatives and potential fragility, could temper growth in price-sensitive markets. Despite these challenges, the overall outlook for the glass dropper bottle market remains highly positive, with continuous innovation in design and material science expected to further propel its trajectory.

Glass Dropper Bottle Market Analysis: Dynamics, Growth, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Glass Dropper Bottle market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and strategic insights for industry stakeholders. The study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033.

Glass Dropper Bottle Market Dynamics & Structure

The global glass dropper bottle market is characterized by a moderately concentrated structure, with a few key players holding significant market share, alongside a larger number of smaller, specialized manufacturers. Technological innovation is a primary driver, with advancements in glass manufacturing techniques, decorative options, and specialized coatings enhancing product appeal and functionality. Regulatory frameworks, particularly in the pharmaceutical and cosmetic sectors, play a crucial role, mandating stringent quality, safety, and material standards for packaging solutions. Competitive product substitutes, such as plastic dropper bottles and other specialized dispensing systems, exert pressure, yet glass retains its premium appeal and inertness, especially for sensitive formulations.

- Market Concentration: Top players like SGD Pharma, Pochet Groupe, and Gerresheimer AG are prominent, while niche players cater to specific applications.

- Technological Innovation: Focus on enhanced barrier properties, tamper-evident features, and sustainable manufacturing processes.

- Regulatory Frameworks: FDA, EMA, and other regional bodies dictate material composition, leak-proof designs, and child-resistant closures, impacting market entry and product development.

- Competitive Product Substitutes: While plastic offers cost advantages, glass remains preferred for its perceived quality, chemical inertness, and aesthetic appeal.

- End-User Demographics: Growing demand from the pharmaceutical (essential oils, medications), cosmetic (serums, tinctures), and food (flavorings, supplements) industries.

- M&A Trends: Strategic acquisitions and partnerships are observed to expand product portfolios, geographical reach, and technological capabilities. For instance, recent M&A activity in the parent market has focused on consolidating supply chains and acquiring specialized glass manufacturing expertise, with approximately 5-7 significant deals in the past three years, impacting child market segments like premium cosmetic packaging.

Glass Dropper Bottle Growth Trends & Insights

The global glass dropper bottle market is poised for robust growth, driven by escalating demand across its primary application segments, particularly pharmaceuticals and cosmetics. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching an estimated value of USD 6.2 billion in 2025. This expansion is fueled by several interconnected trends.

The increasing consumer preference for premium and natural products in the cosmetic industry directly translates to a higher demand for glass packaging, renowned for its aesthetic appeal, perceived purity, and recyclability. This is particularly evident in the skincare and makeup segments, where glass dropper bottles are the preferred choice for high-value serums, oils, and foundations. In the pharmaceutical sector, the growing incidence of chronic diseases and the rising demand for specialized medications, including critical care drugs and advanced biologics, necessitate reliable and inert packaging solutions that glass dropper bottles consistently provide. Stringent regulatory requirements in this sector further reinforce the adoption of glass due to its proven compatibility with a wide range of active pharmaceutical ingredients (APIs) and its ability to maintain product integrity.

Technological disruptions are also playing a significant role. Innovations in glass manufacturing, such as the development of specialized coatings that enhance UV protection and barrier properties, are extending the shelf life and efficacy of packaged products. Furthermore, advancements in precision dispensing mechanisms incorporated into dropper bottles are improving user experience and accuracy, especially crucial for highly potent or precisely dosed formulations. The growing emphasis on sustainability and the circular economy is also a considerable growth catalyst. Glass is infinitely recyclable, and manufacturers are increasingly investing in eco-friendly production processes and exploring the use of recycled glass content, aligning with evolving consumer and corporate environmental consciousness. The shift towards direct-to-consumer (DTC) models in various industries is also contributing, as brands seek sophisticated and appealing packaging to enhance their online presence and customer unboxing experience. The adoption rate of glass dropper bottles in niche applications like e-liquids and specialized food extracts is also witnessing a steady increase, reflecting the versatility of this packaging format.

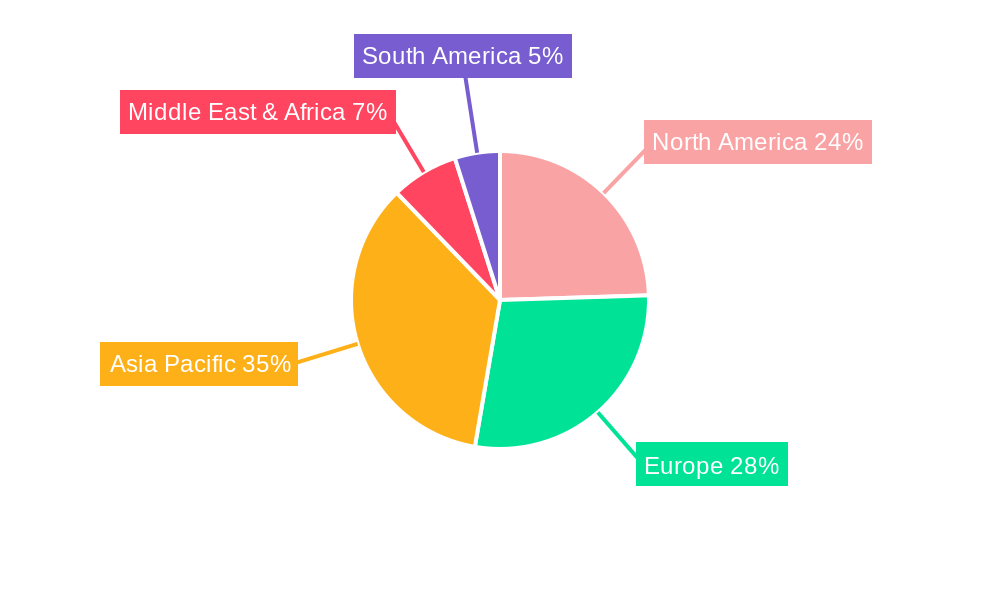

Dominant Regions, Countries, or Segments in Glass Dropper Bottle

The global glass dropper bottle market exhibits a clear dominance driven by the pharmaceutical and cosmetic segments, with a significant contribution from transparent and brown glass types. These segments collectively represent over 75% of the global market share in the base year of 2025. The application-wise dominance is primarily attributed to the stringent requirements for inertness, chemical compatibility, and product preservation inherent in pharmaceutical formulations and the premium aesthetic and perceived purity associated with cosmetic products.

In the pharmaceutical sector, glass dropper bottles are indispensable for packaging a vast array of products, including ophthalmic solutions, nasal sprays, oral medications, essential oils for therapeutic purposes, and complex biologics. The non-reactive nature of glass ensures that it does not leach chemicals into sensitive drug formulations, preserving their efficacy and safety. Regulatory mandates from bodies like the FDA and EMA further solidify glass's position as the preferred material for these critical applications. The pharmaceutical segment is estimated to account for approximately 45% of the total glass dropper bottle market.

The cosmetic industry follows closely, driven by the rising global demand for skincare, haircare, and personal care products that emphasize natural ingredients and luxury. Glass dropper bottles are the packaging of choice for high-value serums, facial oils, essential oils, tinctures, and perfumes, offering a premium look and feel that resonates with discerning consumers. The perceived eco-friendliness and recyclability of glass also align with the growing consumer consciousness regarding sustainable beauty practices. The cosmetic segment is projected to hold around 30% of the market share.

Geographically, North America and Europe currently lead the market, largely due to the well-established pharmaceutical and cosmetic industries, advanced manufacturing capabilities, and stringent quality standards. These regions benefit from significant R&D investments and a strong consumer base willing to pay a premium for quality and innovative products. The market in Asia-Pacific is experiencing the fastest growth, fueled by the expanding middle class, increasing disposable incomes, and a burgeoning pharmaceutical and cosmetic manufacturing sector in countries like China and India. Economic policies promoting domestic manufacturing and increasing healthcare expenditure are key drivers in these emerging economies.

Regarding glass types, transparent glass offers excellent product visibility, allowing consumers to gauge the quantity and appearance of the liquid, which is particularly advantageous for showcasing visually appealing cosmetic products. Brown glass, on the other hand, provides superior UV protection, crucial for light-sensitive pharmaceutical ingredients and certain natural oils, thereby extending product shelf life and maintaining potency. These two types collectively account for an estimated 60% and 15% of the market respectively, with blue glass and other specialized colors catering to specific branding needs and niche applications.

Glass Dropper Bottle Product Landscape

The glass dropper bottle product landscape is characterized by continuous innovation aimed at enhancing functionality, aesthetics, and sustainability. Manufacturers are focusing on developing bottles with improved barrier properties to protect sensitive contents from light, oxygen, and moisture. Advancements in dropper mechanisms include features like precise dosage control, tamper-evident seals, and child-resistant closures, particularly crucial for pharmaceutical and hazardous substance applications. The aesthetic appeal is being elevated through sophisticated printing techniques, frosting, and custom color variations, catering to the premium positioning of many cosmetic and specialty food products. Furthermore, the incorporation of recycled glass content and the adoption of energy-efficient manufacturing processes are key technological advancements driving product development.

Key Drivers, Barriers & Challenges in Glass Dropper Bottle

Key Drivers: The primary forces propelling the glass dropper bottle market include the escalating demand from the pharmaceutical industry for safe and inert packaging, coupled with the growing premiumization trend in the cosmetic sector, where glass conveys quality and luxury. The increasing consumer preference for natural and organic products, which often require protective packaging, also acts as a significant driver. Furthermore, the inherent recyclability and perceived environmental friendliness of glass align with global sustainability initiatives. Technological advancements in glass manufacturing and dropper assembly, leading to improved product integrity and user experience, are also key growth accelerators.

Barriers & Challenges: Key challenges include the relatively higher cost of glass packaging compared to plastic alternatives, which can impact price-sensitive markets. The fragility of glass presents a significant barrier, necessitating careful handling and robust secondary packaging throughout the supply chain. Supply chain disruptions, raw material price volatility, and energy costs associated with glass production can also pose considerable challenges. Moreover, evolving environmental regulations and the demand for lightweight packaging solutions for transportation efficiency present ongoing hurdles that manufacturers must address. The competitive pressure from alternative packaging materials and the capital-intensive nature of glass manufacturing require continuous investment in modernization and innovation.

Emerging Opportunities in Glass Dropper Bottle

Emerging opportunities in the glass dropper bottle industry lie in the expanding applications within the nutraceutical sector, particularly for specialized vitamins, supplements, and functional beverages that benefit from precise dispensing and premium packaging. The growing market for artisanal and craft food products, such as premium oils, vinegars, and extracts, also presents an avenue for growth, where glass dropper bottles enhance perceived value and product differentiation. Furthermore, the increasing demand for personalized medicine and targeted drug delivery systems will necessitate highly specialized and precisely engineered glass dropper solutions. The development of innovative tamper-evident and child-resistant features, tailored for emerging markets and specific product categories, also represents a significant growth area.

Growth Accelerators in the Glass Dropper Bottle Industry

Several catalysts are driving the long-term growth of the glass dropper bottle industry. Technological breakthroughs in lightweighting glass while maintaining strength, coupled with advancements in automated manufacturing processes, are enhancing cost-effectiveness and production efficiency. Strategic partnerships between glass manufacturers and pharmaceutical or cosmetic brands are crucial for co-developing bespoke packaging solutions that meet specific product needs and market demands. Market expansion into rapidly growing economies in Asia and Latin America, driven by increasing disposable incomes and healthcare spending, offers significant growth potential. The ongoing emphasis on eco-friendly packaging solutions, including the increased use of recycled glass and sustainable production methods, will further solidify glass dropper bottles' market position.

Key Players Shaping the Glass Dropper Bottle Market

- SGD Pharma

- Pochet Groupe

- Vitro Packaging

- Gerresheimer AG

- Piramal Glass

- Zignago Vetro

- Bormioli Luigi

- Stoelzle Glass Group

- Pragati Glass

- Ampulla LTD

- Miron Violetglass

- Richmond Containers CTP Limited

- Xuzhou Hanhua Glass Products

- Jiangyin Eu-Beauty Packing Industry

- Xuzhou Daxin Glass Products

Notable Milestones in Glass Dropper Bottle Sector

- 2021: Increased investment in R&D for eco-friendly glass formulations and manufacturing processes.

- 2022: Introduction of advanced child-resistant dropper mechanisms for pharmaceutical applications.

- 2023: Rise in demand for specialized glass dropper bottles for the booming skincare and serum market.

- 2024: Major glass manufacturers announce significant capacity expansions to meet growing global demand.

- 2025 (Estimated): Further integration of IoT and smart manufacturing technologies in glass production facilities.

- 2026 (Forecast): Expected emergence of bio-based coatings and finishes for enhanced product protection.

- 2028 (Forecast): Potential for wider adoption of recycled glass content exceeding 50% in mainstream products.

- 2030 (Forecast): Increased focus on circular economy models, including take-back and refill programs for glass dropper bottles.

- 2033 (Forecast): Continued innovation in specialized glass types for advanced pharmaceutical and cosmetic formulations.

In-Depth Glass Dropper Bottle Market Outlook

The future outlook for the glass dropper bottle market is exceptionally positive, driven by the sustained demand for premium, safe, and sustainable packaging. Growth accelerators, including technological advancements in lightweighting and eco-friendly production, coupled with strategic collaborations between manufacturers and end-users, will continue to fuel market expansion. The increasing emphasis on circular economy principles and the inherent recyclability of glass position it favorably against less sustainable alternatives. Emerging applications in nutraceuticals and artisanal food products, along with the persistent need for reliable pharmaceutical packaging, ensure robust long-term market potential. Strategic opportunities lie in expanding into high-growth geographical regions and catering to the evolving demands for innovative, customized, and environmentally conscious packaging solutions.

Glass Dropper Bottle Segmentation

-

1. Application

- 1.1. Pharma

- 1.2. Cosmetic

- 1.3. Food

- 1.4. Ink

- 1.5. Others

-

2. Type

- 2.1. Transparent

- 2.2. Blue

- 2.3. Brown

- 2.4. Others

Glass Dropper Bottle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Glass Dropper Bottle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glass Dropper Bottle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharma

- 5.1.2. Cosmetic

- 5.1.3. Food

- 5.1.4. Ink

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Transparent

- 5.2.2. Blue

- 5.2.3. Brown

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Glass Dropper Bottle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharma

- 6.1.2. Cosmetic

- 6.1.3. Food

- 6.1.4. Ink

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Transparent

- 6.2.2. Blue

- 6.2.3. Brown

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Glass Dropper Bottle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharma

- 7.1.2. Cosmetic

- 7.1.3. Food

- 7.1.4. Ink

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Transparent

- 7.2.2. Blue

- 7.2.3. Brown

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Glass Dropper Bottle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharma

- 8.1.2. Cosmetic

- 8.1.3. Food

- 8.1.4. Ink

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Transparent

- 8.2.2. Blue

- 8.2.3. Brown

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Glass Dropper Bottle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharma

- 9.1.2. Cosmetic

- 9.1.3. Food

- 9.1.4. Ink

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Transparent

- 9.2.2. Blue

- 9.2.3. Brown

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Glass Dropper Bottle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharma

- 10.1.2. Cosmetic

- 10.1.3. Food

- 10.1.4. Ink

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Transparent

- 10.2.2. Blue

- 10.2.3. Brown

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SGD Pharma

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pochet Groupe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vitro Packaging

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gerresheimer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Piramal Glass

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zignago Vetro

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bormioli Luigi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stoelzle Glass Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pragati Glass

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ampulla LTD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Miron Violetglass

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Richmond Containers CTP Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Xuzhou Hanhua Glass Products

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Jiangyin Eu-Beauty Packing Industry

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Xuzhou Daxin Glass Products

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 SGD Pharma

List of Figures

- Figure 1: Global Glass Dropper Bottle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Glass Dropper Bottle Revenue (million), by Application 2024 & 2032

- Figure 3: North America Glass Dropper Bottle Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Glass Dropper Bottle Revenue (million), by Type 2024 & 2032

- Figure 5: North America Glass Dropper Bottle Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Glass Dropper Bottle Revenue (million), by Country 2024 & 2032

- Figure 7: North America Glass Dropper Bottle Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Glass Dropper Bottle Revenue (million), by Application 2024 & 2032

- Figure 9: South America Glass Dropper Bottle Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Glass Dropper Bottle Revenue (million), by Type 2024 & 2032

- Figure 11: South America Glass Dropper Bottle Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Glass Dropper Bottle Revenue (million), by Country 2024 & 2032

- Figure 13: South America Glass Dropper Bottle Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Glass Dropper Bottle Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Glass Dropper Bottle Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Glass Dropper Bottle Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Glass Dropper Bottle Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Glass Dropper Bottle Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Glass Dropper Bottle Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Glass Dropper Bottle Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Glass Dropper Bottle Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Glass Dropper Bottle Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Glass Dropper Bottle Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Glass Dropper Bottle Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Glass Dropper Bottle Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Glass Dropper Bottle Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Glass Dropper Bottle Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Glass Dropper Bottle Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Glass Dropper Bottle Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Glass Dropper Bottle Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Glass Dropper Bottle Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Glass Dropper Bottle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Glass Dropper Bottle Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Glass Dropper Bottle Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Glass Dropper Bottle Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Glass Dropper Bottle Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Glass Dropper Bottle Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Glass Dropper Bottle Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Glass Dropper Bottle Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Glass Dropper Bottle Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Glass Dropper Bottle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Glass Dropper Bottle Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Glass Dropper Bottle Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Glass Dropper Bottle Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Glass Dropper Bottle Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Glass Dropper Bottle Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Glass Dropper Bottle Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Glass Dropper Bottle Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Glass Dropper Bottle Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Glass Dropper Bottle Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Glass Dropper Bottle Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Dropper Bottle?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Glass Dropper Bottle?

Key companies in the market include SGD Pharma, Pochet Groupe, Vitro Packaging, Gerresheimer AG, Piramal Glass, Zignago Vetro, Bormioli Luigi, Stoelzle Glass Group, Pragati Glass, Ampulla LTD, Miron Violetglass, Richmond Containers CTP Limited, Xuzhou Hanhua Glass Products, Jiangyin Eu-Beauty Packing Industry, Xuzhou Daxin Glass Products.

3. What are the main segments of the Glass Dropper Bottle?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glass Dropper Bottle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glass Dropper Bottle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glass Dropper Bottle?

To stay informed about further developments, trends, and reports in the Glass Dropper Bottle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence