Key Insights

The Reusable Plastic Returnable Transport Packaging (RTP) market in the United States and Europe is poised for steady growth, projected to reach a significant market size by 2025. This expansion is primarily fueled by an increasing emphasis on sustainability and the circular economy across major industries. Businesses are actively seeking cost-effective and environmentally responsible alternatives to single-use packaging, driving the adoption of durable and recyclable plastic RTP solutions. The food and beverage sector, with its high volume of product distribution and stringent hygiene requirements, is a key beneficiary and adopter of these solutions. Similarly, the automotive and industrial sectors are recognizing the long-term economic benefits and operational efficiencies offered by RTP, from streamlined logistics to reduced waste disposal costs. The inherent durability and reusability of plastic containers, pallets, IBCs, and crates contribute to lower total cost of ownership compared to traditional packaging, further bolstering market demand. Regulatory pressures encouraging waste reduction and responsible packaging also act as significant catalysts for this market's upward trajectory.

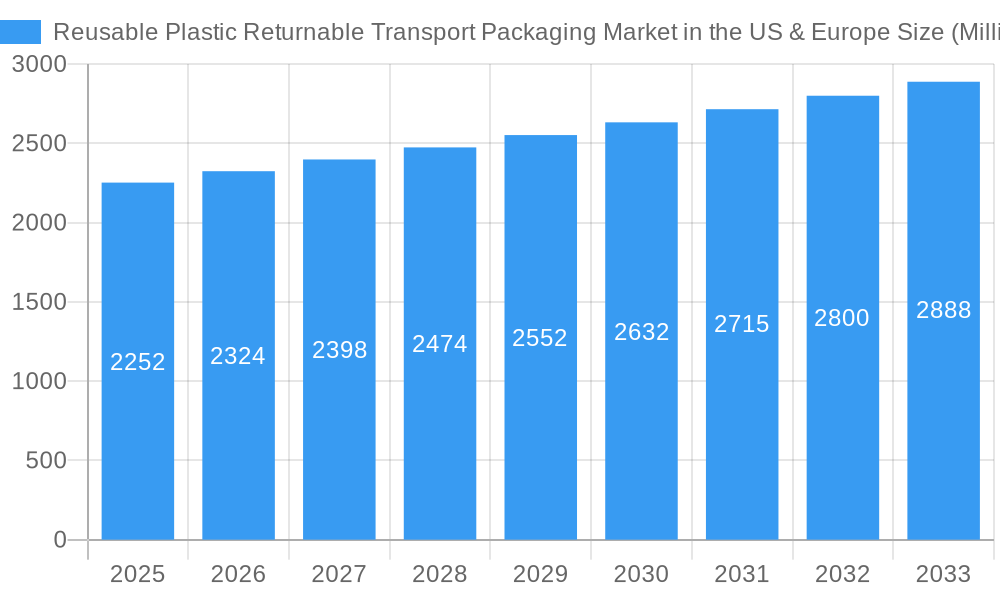

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Size (In Billion)

The market's Compound Annual Growth Rate (CAGR) of 3.25% over the forecast period from 2025 to 2033 underscores a consistent and robust expansion. This growth is supported by ongoing innovations in material science and packaging design, leading to lighter, stronger, and more versatile RTP products. The development of smart packaging solutions, incorporating features like RFID tracking and temperature monitoring, is also expected to enhance the value proposition for end-users, particularly in sensitive supply chains. While the market is largely driven by these positive trends, certain restraints, such as the initial investment cost for some businesses and the need for robust reverse logistics infrastructure, may present challenges. However, the long-term savings and environmental benefits are increasingly outweighing these initial hurdles. The competitive landscape features established players like Orbis Corporation, Schaefer Systems International Inc., and IFCO Systems, alongside emerging companies, all vying to capture market share by offering tailored solutions and expanding their service offerings across key European nations like the UK, Germany, and France, and throughout the United States.

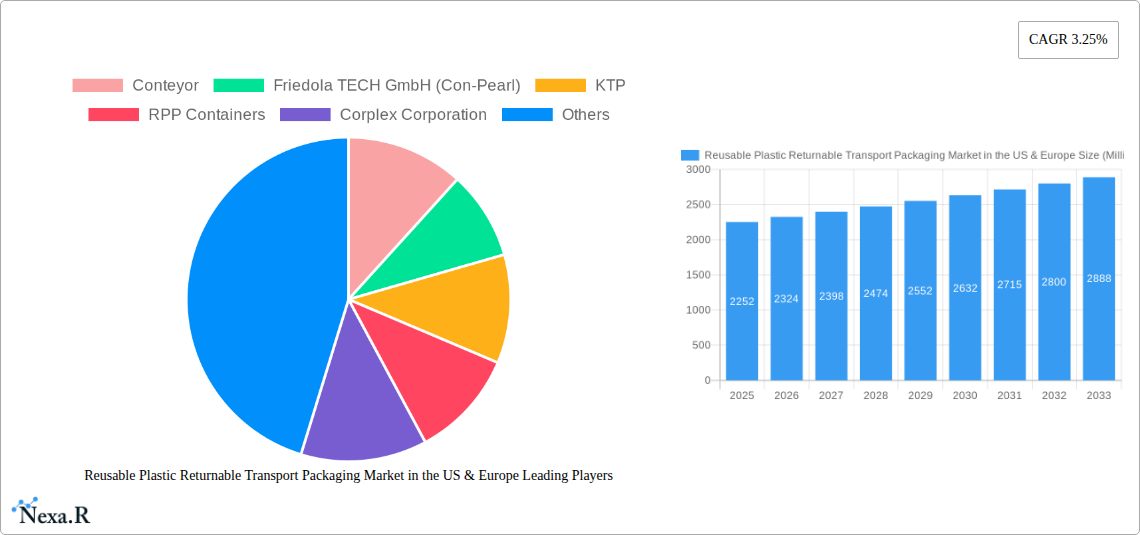

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Company Market Share

Sure, here is a compelling, SEO-optimized report description for the Reusable Plastic Returnable Transport Packaging Market in the US & Europe, integrating high-traffic keywords and structured as requested.

Report Title: US & Europe Reusable Plastic Returnable Transport Packaging Market: Size, Trends, Opportunities & Forecast 2025-2033

Report Description:

Gain unparalleled insights into the dynamic Reusable Plastic Returnable Transport Packaging Market in the US & Europe, a critical sector for supply chain efficiency and sustainability. This comprehensive market research report delves deep into the parent market dynamics and analyzes key child market segments, providing actionable intelligence for industry stakeholders. From reusable plastic containers and pallets to corrugated boxes, IBCs, and crates, understand the product landscape and its evolving applications. Explore the dominant end-user verticals, including Food and Beverage, Automotive, Consumer Durables, and Industrial (including Chemicals), and their impact on packaging demand.

With a detailed study period of 2019–2033, a base and estimated year of 2025, and a robust forecast period of 2025–2033, this report offers a forward-looking perspective. Analyze market concentration, technological innovation drivers, stringent regulatory frameworks, and the competitive threat of product substitutes. Understand the influence of end-user demographics and crucial M&A trends, featuring key players like Conteyor, Orbis Corporation (Menasha Corporation), Schaefer Systems International Inc, IFCO Systems, and Tosca Ltd.

This report is indispensable for manufacturers, suppliers, distributors, investors, and logistics professionals seeking to capitalize on the growing adoption of sustainable packaging solutions, eco-friendly transport packaging, and closed-loop supply chain management in the US and Europe.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Dynamics & Structure

The Reusable Plastic Returnable Transport Packaging Market in the US & Europe is characterized by moderate market concentration, with a mix of large established players and smaller specialized manufacturers. Technological innovation is a significant driver, with companies continuously developing lighter, more durable, and smarter packaging solutions. Regulatory frameworks, particularly those promoting circular economy principles and reducing single-use plastics, are increasingly shaping market dynamics. Competitive product substitutes, primarily cardboard and metal, still hold a presence but are gradually being outcompeted by the long-term cost-effectiveness and sustainability of reusable plastics. End-user demographics are shifting towards businesses prioritizing supply chain resilience and environmental responsibility, fueling demand. Merger and acquisition (M&A) trends are evident as larger entities seek to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by approximately 25-35% by top 5-10 players, with a fragmented landscape for niche products.

- Technological Innovation Drivers: Focus on advanced material science for enhanced durability, integrated RFID/IoT for tracking, and optimized designs for improved space utilization.

- Regulatory Frameworks: Increasing mandates for waste reduction and carbon footprint management are significant policy drivers.

- Competitive Product Substitutes: While present, their total cost of ownership is often higher than reusable plastic alternatives over the long term.

- End-User Demographics: Growing preference for sustainable and circular economy-aligned solutions across all major verticals.

- M&A Trends: A consistent trend of consolidation as companies aim for economies of scale and broader service offerings. Estimated 5-8 significant M&A activities annually across the region.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Growth Trends & Insights

The Reusable Plastic Returnable Transport Packaging Market in the US & Europe is poised for robust growth, driven by a confluence of economic, environmental, and operational factors. The market size is expected to witness a significant evolution from approximately $15,000 million units in 2025 to an estimated $25,000 million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 6.5%. Adoption rates for these sustainable packaging solutions are accelerating across diverse industries, spurred by increasing awareness of the environmental impact of single-use packaging and the long-term cost savings associated with reusable systems. Technological disruptions, such as advancements in plastic recycling technologies and the integration of smart tracking systems within packaging, are enhancing the value proposition of returnable transport packaging. Consumer behavior shifts towards brands demonstrating environmental responsibility are also indirectly influencing businesses to adopt more sustainable supply chain practices. The increasing emphasis on circular economy models further amplifies the demand for reusable plastic packaging as businesses aim to minimize waste and optimize resource utilization. The shift from linear "take-make-dispose" models to circular "reuse-recycle-recover" systems is a fundamental driver. The adoption of these packaging solutions is not merely a trend but a strategic imperative for businesses seeking operational efficiency and a stronger brand image. Furthermore, evolving logistics and warehousing practices that leverage the standardized dimensions and stacking capabilities of reusable plastic packaging are contributing to increased market penetration. The investment in closed-loop systems, where packaging is returned, cleaned, and reused, is becoming a cornerstone of modern supply chain management. The market's growth is also supported by initiatives aimed at standardizing packaging formats, which simplifies inter-company logistics and enhances overall supply chain fluidity. The inherent durability and longevity of plastic packaging, compared to traditional alternatives, contribute to a lower total cost of ownership, a critical factor for businesses operating on tight margins. The demand for hygienic and safe packaging in sectors like food and beverage and pharmaceuticals further propels the market.

Dominant Regions, Countries, or Segments in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

The Food and Beverage end-user vertical is a dominant force propelling the Reusable Plastic Returnable Transport Packaging Market in the US & Europe. This sector's stringent requirements for hygiene, temperature control, and product integrity, coupled with the high volume of shipments, make reusable plastic packaging an ideal solution. The demand for Reusable Plastic Containers and Crates and Totes within this segment is particularly strong. The US market, owing to its larger economic scale and advanced logistics infrastructure, often leads in terms of overall market value and adoption rates, followed closely by key European economies like Germany, France, and the UK.

- Dominant End-User Vertical: Food and Beverage

- Drivers: High demand for hygiene, temperature-controlled logistics, product protection, and reducing food waste through efficient handling.

- Market Share: Estimated to account for over 30% of the total market revenue.

- Growth Potential: Continual innovation in specialized food-grade plastics and integrated cooling solutions will sustain high growth.

- Dominant Product Segment: Reusable Plastic Containers and Crates and Totes

- Drivers: Versatility, ease of handling, stackability for space optimization, and washability for repeated use in demanding environments.

- Market Share: These categories collectively represent over 45% of the product segment market.

- Growth Potential: Increasing adoption in e-commerce fulfillment and last-mile delivery further boosts demand for these products.

- Leading Geographic Markets:

- United States: Significant market size, strong adoption in agriculture, CPG, and automotive sectors, robust logistics network.

- Germany: High emphasis on sustainability, strong manufacturing base, and advanced recycling infrastructure.

- United Kingdom: Growing adoption in retail and food service, driven by environmental regulations and corporate sustainability goals.

- France: Increasing focus on circular economy initiatives and reduction of plastic waste.

- Key Growth Drivers by Country/Region:

- Economic Policies: Government incentives for adopting sustainable packaging and waste reduction mandates.

- Infrastructure: Well-developed logistics and transportation networks facilitating efficient return loops.

- Industry-Specific Needs: Tailored solutions for industries like automotive (parts distribution) and retail (grocery replenishment).

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Product Landscape

The product landscape of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe is diverse and continuously evolving. Reusable Plastic Containers, available in various sizes and configurations, are highly sought after for their durability and stackability. Pallets, including innovative designs like Orbis Corporation's new p3 Pallet, are crucial for efficient material handling and offer significant advantages over traditional wooden pallets in terms of hygiene and longevity. Corrugated Boxes and Panels made from durable plastic offer a sustainable alternative to paper-based corrugated products, providing enhanced moisture resistance and reusability. IBCs (Intermediate Bulk Containers) are essential for bulk liquid and semi-solid transport, offering improved safety and handling. Crates and Totes are ubiquitous, serving a wide range of applications from retail distribution to industrial parts handling. These products are designed for optimal performance in specific applications, featuring UV resistance, chemical inertness, and load-bearing capacities tailored to their intended use.

Key Drivers, Barriers & Challenges in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Key Drivers:

- Sustainability Mandates & Corporate Social Responsibility (CSR): Growing pressure from consumers, regulators, and investors to reduce environmental impact drives adoption.

- Cost-Effectiveness: Long-term savings through reduced packaging waste, lower handling costs, and extended product lifespan compared to single-use alternatives.

- Operational Efficiency: Improved handling, stacking, and transportation space utilization, leading to optimized logistics.

- Hygiene and Product Protection: Superior protection against contamination and damage, especially critical in the food and beverage and pharmaceutical sectors.

- Technological Advancements: Innovations in plastic materials, design, and tracking technologies enhance performance and value.

Barriers & Challenges:

- Initial Capital Investment: Higher upfront costs compared to disposable packaging can be a deterrent for some businesses.

- Reverse Logistics Complexity: Establishing efficient and cost-effective return and cleaning systems requires significant planning and infrastructure.

- Cleaning and Maintenance Costs: While reusable, the ongoing costs of washing and maintaining containers need to be factored in.

- Availability of Infrastructure: Lack of standardized collection and washing facilities in certain regions can hinder widespread adoption.

- Competition from Low-Cost Single-Use Packaging: In price-sensitive markets, cheaper disposable options can still pose a challenge.

- Recycling Infrastructure Limitations: While durable, end-of-life recycling of certain plastic types can be a challenge. Estimated 60% of plastic packaging is recycled, with significant regional variations.

Emerging Opportunities in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Emerging opportunities lie in the expansion of smart packaging solutions integrated with IoT and RFID for real-time tracking and condition monitoring, enhancing supply chain visibility and reducing loss. The growing demand for customized packaging solutions tailored to specific industry needs, such as temperature-controlled reusable containers for specialized food products or impact-resistant packaging for sensitive electronics, presents a significant growth area. Furthermore, the increasing focus on e-commerce logistics and the need for durable, easily handled packaging for last-mile delivery opens up new avenues. Untapped markets within smaller businesses and specific niche industries are also ripe for penetration. The development of more biodegradable or compostable reusable plastics could also address some environmental concerns and open new market segments.

Growth Accelerators in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Industry

Long-term growth in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe will be significantly accelerated by strategic partnerships between packaging manufacturers and logistics providers to optimize reverse logistics. Technological breakthroughs in material science, leading to lighter, stronger, and more sustainable plastic formulations, will be crucial. Market expansion strategies focused on educating smaller businesses about the total cost of ownership benefits and providing flexible leasing or pooling models will drive adoption. The increasing integration of circular economy principles into national and regional economic policies will create a more favorable regulatory environment, further stimulating investment and innovation.

Key Players Shaping the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

- Conteyor

- Friedola TECH GmbH (Con-Pearl)

- KTP

- RPP Containers

- Corplex Corporation

- Schaefer Systems International Inc

- Kiga

- Tosca Ltd

- CABKA

- Sohner Plastics LLC

- IFCO Systems

- Wellplast

- Soehner

- Sustainable Transport Packaging (Reusable Transport Packaging)

- WI Sales

- Wisechemann

- Orbis Corporation (Menasha Corporation)

- Duro-Therm

- Auer

Notable Milestones in Reusable Plastic Returnable Transport Packaging Market in the US & Europe Sector

- June 2022: Orbis Corporation introduced the new p3 Pallet to its suite of reusable plastic pallet offerings to improve sustainable handling in primary packaging, food and beverage, and CPG applications. The size of the Pallet is 40.48 inches, a durable, lightweight, stackable, hygienic packaging solution that integrates seamlessly with both automatic and manual material handling equipment.

In-Depth Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Outlook

The future outlook for the Reusable Plastic Returnable Transport Packaging Market in the US & Europe is exceptionally strong, driven by an irreversible shift towards sustainability and operational efficiency. The market is expected to continue its upward trajectory, fueled by ongoing technological advancements, supportive regulatory landscapes, and growing corporate commitment to environmental stewardship. Strategic investments in infrastructure for reverse logistics and cleaning, coupled with innovative product designs, will unlock new opportunities and expand market reach. The increasing integration of smart technologies will further enhance the value proposition, making reusable plastic packaging an indispensable component of resilient and sustainable supply chains across the US and Europe.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation

-

1. Product

- 1.1. Reusable Plastic Containers

- 1.2. Pallets

- 1.3. Corrugated Boxes and Panels

- 1.4. IBCs

- 1.5. Crates and Totes

- 1.6. Other Product Types

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Automotive

- 2.3. Consumer Durables

- 2.4. Industrial (including Chemicals)

- 2.5. Other End-user verticals

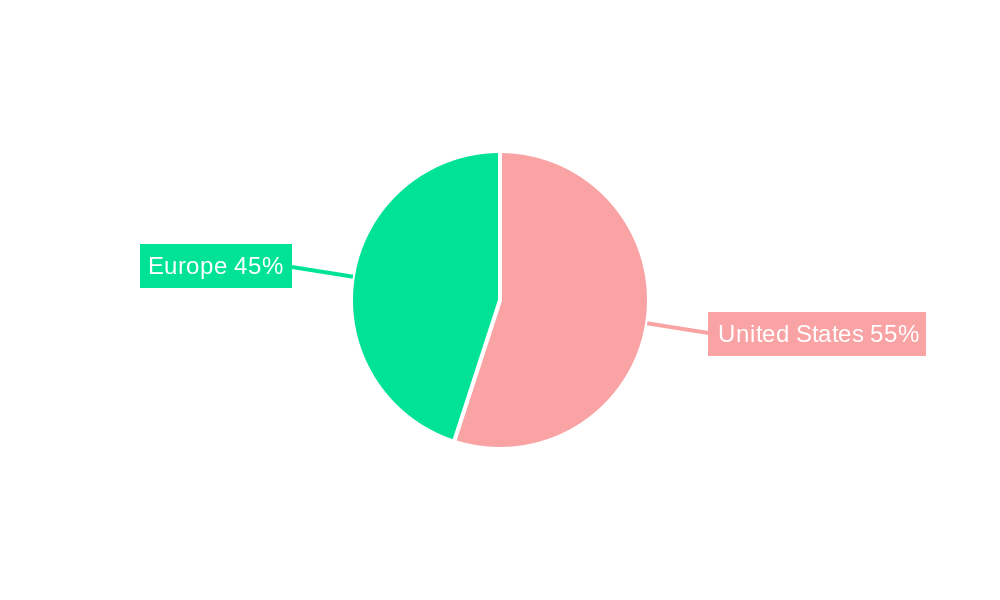

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation By Geography

- 1. United States

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Regional Market Share

Geographic Coverage of Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Reusable Plastic Returnable Transport Packaging Market in the US & Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP

- 3.3. Market Restrains

- 3.3.1. Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials

- 3.4. Market Trends

- 3.4.1. Pallets to Account for Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Reusable Plastic Containers

- 5.1.2. Pallets

- 5.1.3. Corrugated Boxes and Panels

- 5.1.4. IBCs

- 5.1.5. Crates and Totes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Automotive

- 5.2.3. Consumer Durables

- 5.2.4. Industrial (including Chemicals)

- 5.2.5. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Reusable Plastic Containers

- 6.1.2. Pallets

- 6.1.3. Corrugated Boxes and Panels

- 6.1.4. IBCs

- 6.1.5. Crates and Totes

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Food and Beverage

- 6.2.2. Automotive

- 6.2.3. Consumer Durables

- 6.2.4. Industrial (including Chemicals)

- 6.2.5. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Reusable Plastic Containers

- 7.1.2. Pallets

- 7.1.3. Corrugated Boxes and Panels

- 7.1.4. IBCs

- 7.1.5. Crates and Totes

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Food and Beverage

- 7.2.2. Automotive

- 7.2.3. Consumer Durables

- 7.2.4. Industrial (including Chemicals)

- 7.2.5. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Conteyor

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Friedola TECH GmbH (Con-Pearl)

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 KTP

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 RPP Containers

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Corplex Corporation

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Schaefer Systems International Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Kiga

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Tosca Ltd

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 CABKA

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Sohner Plastics LLC

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 IFCO Systems

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Wellplast

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Soehner

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 Sustainable Transport Packaging (Reusable Transport Packaging)

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.15 WI Sales*List Not Exhaustive

- 8.2.15.1. Overview

- 8.2.15.2. Products

- 8.2.15.3. SWOT Analysis

- 8.2.15.4. Recent Developments

- 8.2.15.5. Financials (Based on Availability)

- 8.2.16 Wisechemann

- 8.2.16.1. Overview

- 8.2.16.2. Products

- 8.2.16.3. SWOT Analysis

- 8.2.16.4. Recent Developments

- 8.2.16.5. Financials (Based on Availability)

- 8.2.17 Orbis Corporation (Menasha Corporation)

- 8.2.17.1. Overview

- 8.2.17.2. Products

- 8.2.17.3. SWOT Analysis

- 8.2.17.4. Recent Developments

- 8.2.17.5. Financials (Based on Availability)

- 8.2.18 Duro-Therm

- 8.2.18.1. Overview

- 8.2.18.2. Products

- 8.2.18.3. SWOT Analysis

- 8.2.18.4. Recent Developments

- 8.2.18.5. Financials (Based on Availability)

- 8.2.19 Auer

- 8.2.19.1. Overview

- 8.2.19.2. Products

- 8.2.19.3. SWOT Analysis

- 8.2.19.4. Recent Developments

- 8.2.19.5. Financials (Based on Availability)

- 8.2.1 Conteyor

List of Figures

- Figure 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Share (%) by Company 2025

List of Tables

- Table 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

Key companies in the market include Conteyor, Friedola TECH GmbH (Con-Pearl), KTP, RPP Containers, Corplex Corporation, Schaefer Systems International Inc, Kiga, Tosca Ltd, CABKA, Sohner Plastics LLC, IFCO Systems, Wellplast, Soehner, Sustainable Transport Packaging (Reusable Transport Packaging), WI Sales*List Not Exhaustive, Wisechemann, Orbis Corporation (Menasha Corporation), Duro-Therm, Auer.

3. What are the main segments of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The market segments include Product, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP.

6. What are the notable trends driving market growth?

Pallets to Account for Major Market Share.

7. Are there any restraints impacting market growth?

Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials.

8. Can you provide examples of recent developments in the market?

June 2022 - Orbis corporation has introduced the new p3 Pallet to its suite of reusable plastic pallet offerings to improve sustainable handling in primary packaging, food and beverage, and CPG applications. The size of the Pallet is 40,48 inches, a durable, lightweight, stackable, hygienic packaging solution that integrates seamlessly with both automatic and manual material handling equipment

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Reusable Plastic Returnable Transport Packaging Market in the US & Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

To stay informed about further developments, trends, and reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence