Key Insights

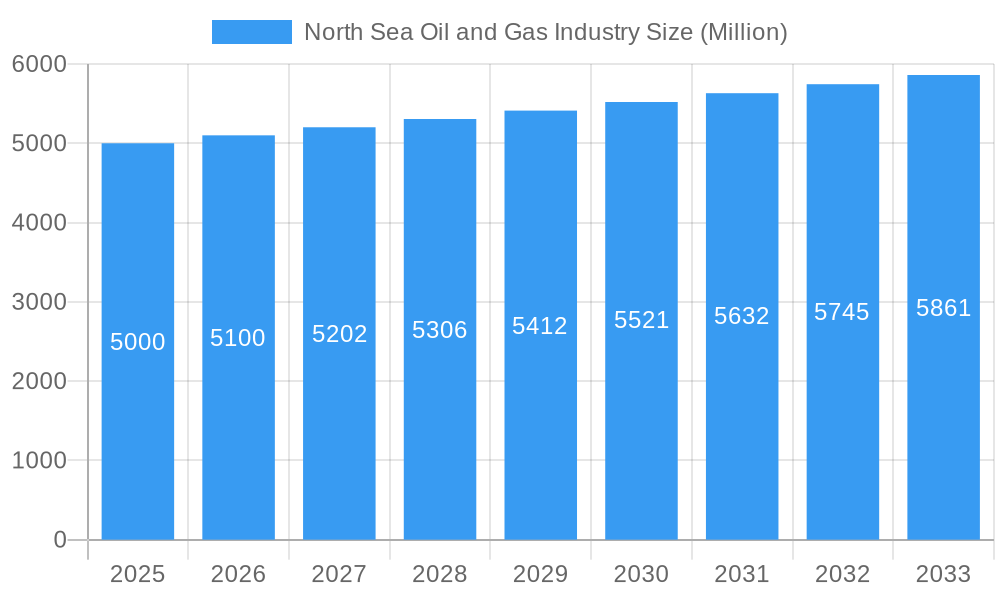

The North Sea oil and gas industry, while facing headwinds, remains a significant player in the global energy market. Driven by persistent global energy demand and a gradual increase in oil and gas prices, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 2.00%, with a market size exceeding several billion dollars in 2025 (the precise figure cannot be provided without the missing market size "XX" value). Key drivers include the ongoing need for energy security, particularly in Europe, and strategic investments in enhancing existing infrastructure and exploring new reserves, especially in the face of energy transition challenges. Technological advancements in exploration (like advanced seismic surveys and drilling techniques) and production (including optimized platform operations and subsea technologies) are also contributing to growth. However, the industry faces constraints, including stricter environmental regulations aimed at reducing carbon emissions, fluctuating oil and gas prices, and the increasing focus on renewable energy sources. Market segmentation reveals strong activity across exploration (seismic surveys, exploratory drilling), production (offshore and fixed platforms), transportation (subsea pipelines, tankers), and services (supply vessels, maintenance & repair). Major players like Equinor ASA, Shell Plc, and BP Plc are actively navigating these challenges through diversification, strategic partnerships, and technological innovation.

North Sea Oil and Gas Industry Market Size (In Billion)

The regional distribution of activity is diverse. While the North Sea itself remains a core area, significant activity also extends to surrounding regions. North America (especially the United States and Canada) benefits from its proximity to the North Sea and technological expertise, influencing the supply chain. European countries are major consumers of the extracted resources, heavily influencing the demand side. Asia-Pacific's growth is primarily linked to its increasing energy demand, which creates import opportunities. South America and the Middle East and Africa (MEA) regions play less significant roles, but strategic partnerships and investment opportunities still exist, particularly in technological and service provision. The forecast period (2025-2033) suggests continued growth, albeit at a pace influenced by geopolitical factors, technological disruptions, and the overall trajectory of the global energy transition. Despite the challenges, the industry’s adaptability and innovative capacity suggest a continued role in meeting global energy needs.

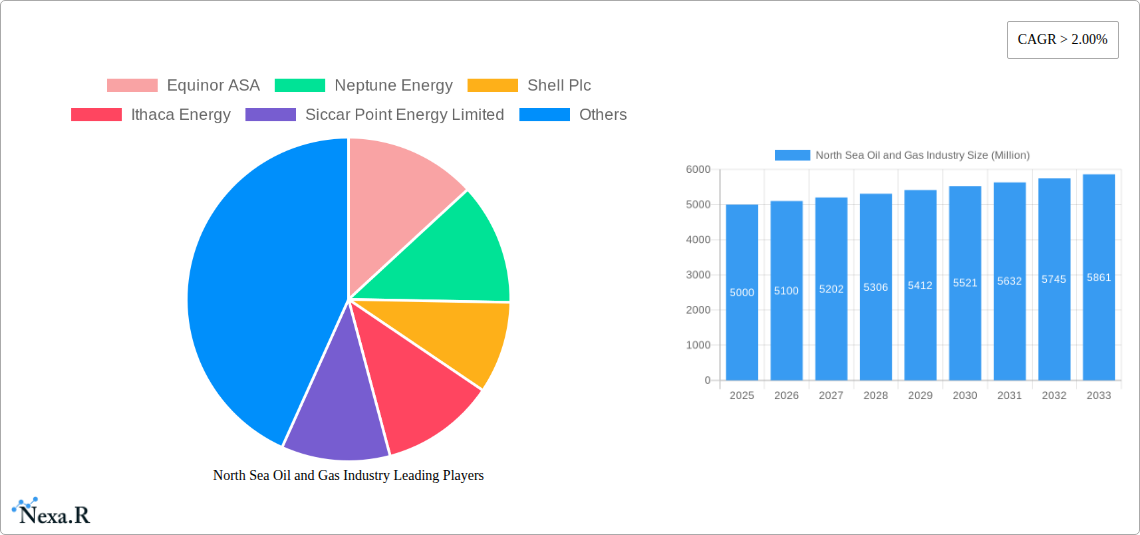

North Sea Oil and Gas Industry Company Market Share

North Sea Oil and Gas Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North Sea oil and gas industry, encompassing market dynamics, growth trends, dominant segments, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and policymakers seeking insights into this dynamic sector. The report's quantitative analysis uses Million units as its value metric.

North Sea Oil and Gas Industry Market Dynamics & Structure

The North Sea oil and gas market is characterized by a moderate level of concentration, with major players like Equinor ASA, Shell Plc, and BP Plc holding significant market share. Technological innovation, driven by the need for enhanced oil recovery (EOR) techniques and environmental regulations, is a key driver. The regulatory landscape, encompassing licensing processes and environmental permits, significantly influences operational costs and investment decisions. The market faces competition from renewable energy sources, particularly offshore wind, and increasing pressure to decarbonize. Mergers and acquisitions (M&A) activity has been substantial, with xx deals valued at approximately xx million recorded between 2019 and 2024. This consolidation reflects the industry's ongoing adaptation to evolving market conditions and the pursuit of operational efficiencies.

- Market Concentration: Highly concentrated with top 5 players holding approximately 60% market share in 2024.

- Technological Innovation: Focus on EOR, digitalization, and automation to improve efficiency and reduce costs.

- Regulatory Framework: Stringent environmental regulations and licensing processes impacting investment decisions.

- Competitive Substitutes: Growing competition from renewable energy sources, particularly offshore wind power.

- M&A Activity: Significant consolidation through mergers and acquisitions, averaging xx deals per year (2019-2024).

- Innovation Barriers: High capital expenditures, technological complexity, and regulatory uncertainty.

North Sea Oil and Gas Industry Growth Trends & Insights

The North Sea oil and gas market experienced a period of decline in the early 2020s, primarily due to the impact of the COVID-19 pandemic and fluctuating global oil prices. However, a recovery is underway, driven by increasing global energy demand and sustained investment in new exploration and production projects. The market is expected to witness a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million by 2033. Technological advancements, such as improved seismic imaging and advanced drilling techniques, are enhancing exploration success rates. The shift towards more sustainable practices, including carbon capture, utilization, and storage (CCUS) technologies, is shaping future investment decisions.

Dominant Regions, Countries, or Segments in North Sea Oil and Gas Industry

The UK and Norway are the dominant countries in the North Sea oil and gas market, accounting for the majority of production and exploration activities. The production segment (offshore platforms, fixed platforms) contributes significantly to the market value, owing to the established infrastructure and ongoing production from mature fields. The services segment is experiencing robust growth, driven by the need for maintenance, repair, and decommissioning services for aging infrastructure.

- UK: Strong government support for the energy transition and significant existing infrastructure.

- Norway: Large reserves, favorable regulatory environment, and high production efficiency.

- Production Segment: Largest contributor to market value, with offshore platforms holding the majority of market share.

- Services Segment: High growth potential driven by decommissioning activities and maintenance requirements.

North Sea Oil and Gas Industry Product Landscape

The North Sea oil and gas industry product landscape encompasses a range of advanced technologies and services. This includes sophisticated seismic survey equipment for enhanced exploration accuracy, advanced drilling rigs for efficient well construction, and innovative offshore platforms designed for optimal production and safety. Subsea pipelines and tankers are critical for transportation, while supply vessels and maintenance services are essential for operational efficiency and longevity of the assets. The industry is increasingly focusing on CCUS technologies, to enhance sustainability and mitigate the environmental impact of operations.

Key Drivers, Barriers & Challenges in North Sea Oil and Gas Industry

Key Drivers: Increasing global energy demand, technological advancements in exploration and production, government support for energy transition (e.g., UK's commitment to support the transition to clean energy), and the ongoing need for robust energy infrastructure.

Key Challenges: Declining reserves in mature fields, stringent environmental regulations (leading to higher operational costs), volatile oil prices, and the increasing competition from renewable energy sources. Supply chain disruptions can cause significant delays and cost overruns, while regulatory hurdles can hinder investment and innovation. Competitive pressure from both established and emerging players further complicates the market dynamics, impacting profitability and investment returns.

Emerging Opportunities in North Sea Oil and Gas Industry

Significant opportunities exist in the development of CCUS technologies, expansion of offshore wind energy, and the exploration of new hydrocarbon reserves. The decommissioning of aging infrastructure represents a substantial market for specialized services and technologies. Furthermore, the development of hydrogen production from natural gas and the optimization of existing infrastructure to support emerging energy sources offer exciting new avenues for market expansion.

Growth Accelerators in the North Sea Oil and Gas Industry Industry

The North Sea oil and gas industry's long-term growth is fueled by technological advancements such as improved EOR techniques, digitalization of operations, and adoption of CCUS technologies. Strategic partnerships between energy companies and technology providers are further accelerating innovation and market expansion. Focused investment in new exploration and development projects coupled with a commitment to decarbonization will drive future growth.

Key Players Shaping the North Sea Oil and Gas Industry Market

- Equinor ASA

- Neptune Energy

- Shell Plc

- Ithaca Energy

- Siccar Point Energy Limited

- INEOS Group

- Vår Energi

- BP Plc

Notable Milestones in North Sea Oil and Gas Industry Sector

- March 2021: UK government announces a deal to support the oil and gas industry's transition to clean energy, safeguarding 40,000 jobs.

- January 2021: Norwegian Petroleum Directorate awards 61 production licenses to 30 companies in the APA 2020 licensing round.

In-Depth North Sea Oil and Gas Industry Market Outlook

The future of the North Sea oil and gas industry is characterized by a transition towards a lower-carbon energy system. While oil and gas will continue to play a crucial role in meeting energy demands in the near term, the long-term outlook hinges on successful decarbonization strategies. The focus on CCUS technologies, offshore wind integration, and hydrogen production offers significant growth opportunities. Strategic partnerships, technological innovation, and a supportive regulatory environment will be key to ensuring a sustainable and prosperous future for the North Sea oil and gas industry.

North Sea Oil and Gas Industry Segmentation

-

1. Geography

- 1.1. United Kingdom

- 1.2. Norway

- 1.3. Denmark

- 1.4. Rest of the Other Countries

North Sea Oil and Gas Industry Segmentation By Geography

- 1. United Kingdom

- 2. Norway

- 3. Denmark

- 4. Rest of the Other Countries

North Sea Oil and Gas Industry Regional Market Share

Geographic Coverage of North Sea Oil and Gas Industry

North Sea Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Gas Sector Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North Sea Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. United Kingdom

- 5.1.2. Norway

- 5.1.3. Denmark

- 5.1.4. Rest of the Other Countries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Norway

- 5.2.3. Denmark

- 5.2.4. Rest of the Other Countries

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. United Kingdom North Sea Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. United Kingdom

- 6.1.2. Norway

- 6.1.3. Denmark

- 6.1.4. Rest of the Other Countries

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Norway North Sea Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. United Kingdom

- 7.1.2. Norway

- 7.1.3. Denmark

- 7.1.4. Rest of the Other Countries

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Denmark North Sea Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. United Kingdom

- 8.1.2. Norway

- 8.1.3. Denmark

- 8.1.4. Rest of the Other Countries

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Rest of the Other Countries North Sea Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. United Kingdom

- 9.1.2. Norway

- 9.1.3. Denmark

- 9.1.4. Rest of the Other Countries

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Equinor ASA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Neptune Energy

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Shell Plc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ithaca Energy

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siccar Point Energy Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 INEOS Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Vår Energi

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BP Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Equinor ASA

List of Figures

- Figure 1: Global North Sea Oil and Gas Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North Sea Oil and Gas Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: United Kingdom North Sea Oil and Gas Industry Revenue (Million), by Geography 2025 & 2033

- Figure 4: United Kingdom North Sea Oil and Gas Industry Volume (K Tons), by Geography 2025 & 2033

- Figure 5: United Kingdom North Sea Oil and Gas Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: United Kingdom North Sea Oil and Gas Industry Volume Share (%), by Geography 2025 & 2033

- Figure 7: United Kingdom North Sea Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 8: United Kingdom North Sea Oil and Gas Industry Volume (K Tons), by Country 2025 & 2033

- Figure 9: United Kingdom North Sea Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Kingdom North Sea Oil and Gas Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Norway North Sea Oil and Gas Industry Revenue (Million), by Geography 2025 & 2033

- Figure 12: Norway North Sea Oil and Gas Industry Volume (K Tons), by Geography 2025 & 2033

- Figure 13: Norway North Sea Oil and Gas Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Norway North Sea Oil and Gas Industry Volume Share (%), by Geography 2025 & 2033

- Figure 15: Norway North Sea Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Norway North Sea Oil and Gas Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: Norway North Sea Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Norway North Sea Oil and Gas Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Denmark North Sea Oil and Gas Industry Revenue (Million), by Geography 2025 & 2033

- Figure 20: Denmark North Sea Oil and Gas Industry Volume (K Tons), by Geography 2025 & 2033

- Figure 21: Denmark North Sea Oil and Gas Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Denmark North Sea Oil and Gas Industry Volume Share (%), by Geography 2025 & 2033

- Figure 23: Denmark North Sea Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Denmark North Sea Oil and Gas Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: Denmark North Sea Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Denmark North Sea Oil and Gas Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the Other Countries North Sea Oil and Gas Industry Revenue (Million), by Geography 2025 & 2033

- Figure 28: Rest of the Other Countries North Sea Oil and Gas Industry Volume (K Tons), by Geography 2025 & 2033

- Figure 29: Rest of the Other Countries North Sea Oil and Gas Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Rest of the Other Countries North Sea Oil and Gas Industry Volume Share (%), by Geography 2025 & 2033

- Figure 31: Rest of the Other Countries North Sea Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Rest of the Other Countries North Sea Oil and Gas Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: Rest of the Other Countries North Sea Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the Other Countries North Sea Oil and Gas Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 2: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 3: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 19: Global North Sea Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global North Sea Oil and Gas Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North Sea Oil and Gas Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the North Sea Oil and Gas Industry?

Key companies in the market include Equinor ASA, Neptune Energy, Shell Plc, Ithaca Energy, Siccar Point Energy Limited, INEOS Group, Vår Energi, BP Plc.

3. What are the main segments of the North Sea Oil and Gas Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Increasing Investments in Gas Sector Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

In March 2021, United Kingdom became the first G7 country to be agreed on the deal to support the oil and gas industry's transition to clean, green energy, while supporting 40,000 jobs in the North Sea region. The deal between the government of the United Kingdom and the oil and gas sector industry is expected to support workers, businesses, and the supply chain through this transition by harnessing the industry's existing capabilities, infrastructure, and private investment potential to exploit new and emerging technologies such as hydrogen production, Carbon Capture Usage and Storage, offshore wind and decommissioning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North Sea Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North Sea Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North Sea Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the North Sea Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence