Key Insights

The North America compressor market is projected for robust expansion, with an estimated market size of $5.84 billion in 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.72% through 2033. This upward trajectory is significantly driven by substantial demand from core industrial sectors. The oil and gas industry remains a primary growth engine, fueling investment in exploration and production that necessitates dependable compression technologies. The power sector also contributes significantly, propelled by the increasing demand for compressed air in power generation facilities and the continuous development of renewable energy infrastructure. Furthermore, the manufacturing and chemical/petrochemical industries are experiencing renewed activity, with companies prioritizing operational efficiency and capacity expansion, thereby stimulating demand for diverse compressor types.

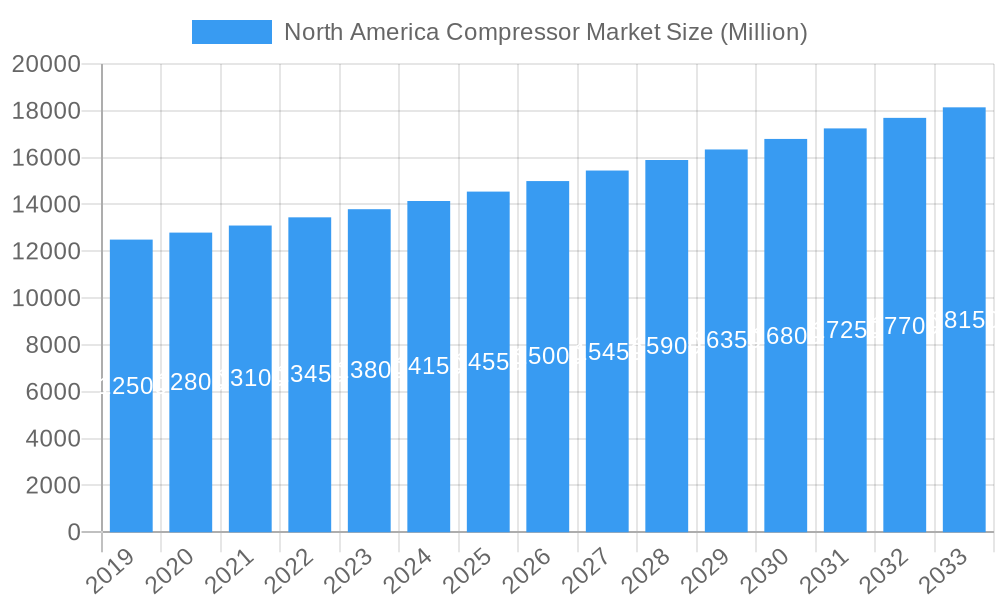

North America Compressor Market Market Size (In Billion)

This market is defined by a dynamic interplay of technological innovation and evolving industrial requirements. Positive displacement compressors, recognized for their high-pressure application reliability and efficiency, maintain a leading position, particularly in the oil and gas and petrochemical sectors. Concurrently, dynamic compressors are gaining prominence for their suitability in high-volume, low-pressure applications, witnessing increased adoption in large-scale manufacturing and power generation. While challenges such as fluctuating raw material costs and the substantial initial capital investment for advanced compressor technologies exist, emerging trends like enhanced energy efficiency, digitalization, and intelligent monitoring systems are poised to mitigate these restraints and foster sustained market growth across the United States, Canada, and broader North America. Key industry leaders, including Trane Technologies, Ebara Corporation, and Atlas Copco AB, are actively pursuing innovation to address these evolving market demands.

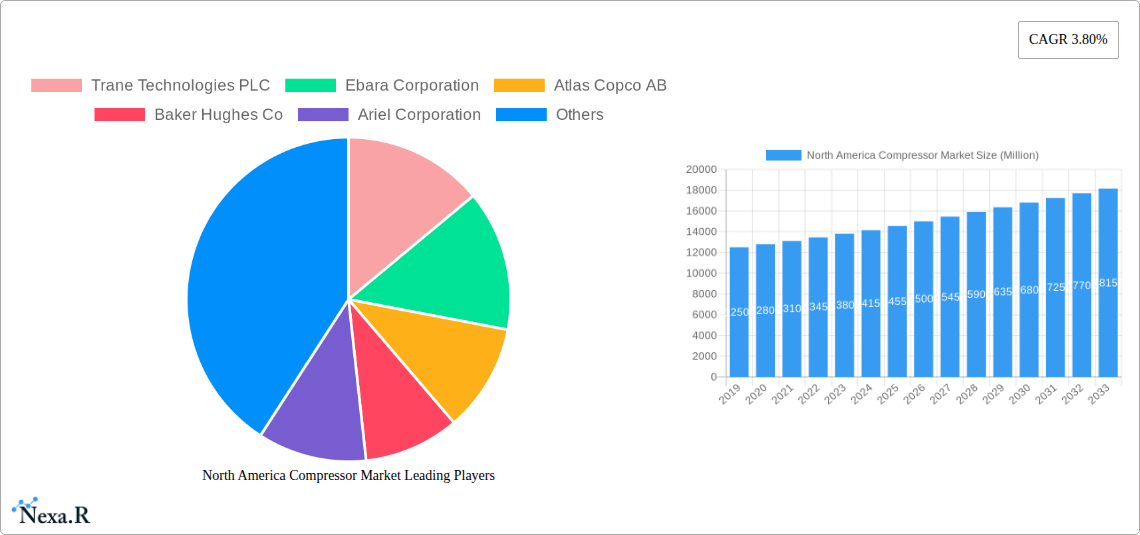

North America Compressor Market Company Market Share

Comprehensive North America Compressor Market Report: Insights, Trends, and Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the North America Compressor Market, encompassing historical trends, current dynamics, and future projections. We delve into market segmentation by type, end-user industry, and geography, offering critical insights for stakeholders navigating this complex landscape. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this report equips you with the data and strategic intelligence needed for informed decision-making. Quantified values are presented in Million units for clarity and actionable analysis.

North America Compressor Market Market Dynamics & Structure

The North America Compressor Market exhibits a moderately concentrated structure, with leading players like Trane Technologies PLC, Ebara Corporation, Atlas Copco AB, Baker Hughes Co, and Siemens AG dominating market share. Technological innovation is a significant driver, fueled by increasing demand for energy-efficient and smart compressor solutions across various industries. Regulatory frameworks, particularly those focused on emissions reduction and energy efficiency standards, are shaping product development and adoption. Competitive product substitutes, such as advanced pump technologies, also present a dynamic competitive landscape. End-user demographics are shifting, with a growing emphasis on operational reliability and reduced lifecycle costs. Mergers and acquisitions (M&A) trends are ongoing, with key players consolidating to expand their product portfolios and geographical reach. For instance, the historical period (2019-2024) saw an estimated X M&A deals, signifying industry consolidation efforts aimed at enhancing competitive positioning. Barriers to innovation include high research and development costs and the lengthy qualification processes for new technologies in critical sectors like oil and gas.

- Market Concentration: Moderately concentrated, with top 5 players holding an estimated 55-60% market share.

- Technological Innovation: Focus on energy efficiency, IoT integration for predictive maintenance, and advanced sealing technologies.

- Regulatory Frameworks: Stringent emissions standards and energy efficiency mandates from governmental bodies are crucial influencers.

- Competitive Substitutes: Advanced pump systems and alternative fluid handling technologies.

- End-User Demographics: Increasing demand for reliability, reduced operational expenditure, and integrated digital solutions.

- M&A Trends: Strategic acquisitions and partnerships for portfolio expansion and market penetration, with an estimated XX M&A deals in the historical period.

North America Compressor Market Growth Trends & Insights

The North America Compressor Market is poised for substantial growth, driven by a confluence of economic, technological, and industrial factors. The market size is projected to evolve from approximately 120 Million units in 2019 to an estimated 185 Million units by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of approximately 3.5% during the forecast period (2025-2033). Adoption rates are accelerating, particularly for variable speed drive (VSD) compressors and those equipped with advanced monitoring systems, which contribute to significant energy savings and operational efficiency. Technological disruptions, such as the integration of artificial intelligence (AI) for performance optimization and the development of more durable materials, are reshaping product offerings. Consumer behavior shifts are evident, with end-users prioritizing total cost of ownership and long-term sustainability over initial purchase price. The increasing adoption of smart factory initiatives and Industry 4.0 principles is further propelling the demand for intelligent and connected compressor solutions. Market penetration of advanced compressor technologies is expected to rise from an estimated 40% in 2025 to over 65% by 2033.

- Market Size Evolution: Projected to grow from 120 Million units (2019) to 185 Million units (2033).

- CAGR: Estimated at 3.5% for the forecast period 2025-2033.

- Adoption Rates: Increasing for VSD and IoT-enabled compressors, leading to enhanced energy efficiency.

- Technological Disruptions: AI integration, advanced material science, and digital twin technologies are transforming the market.

- Consumer Behavior Shifts: Focus on total cost of ownership, operational reliability, and sustainability.

- Market Penetration: Advanced compressor technologies expected to reach over 65% by 2033.

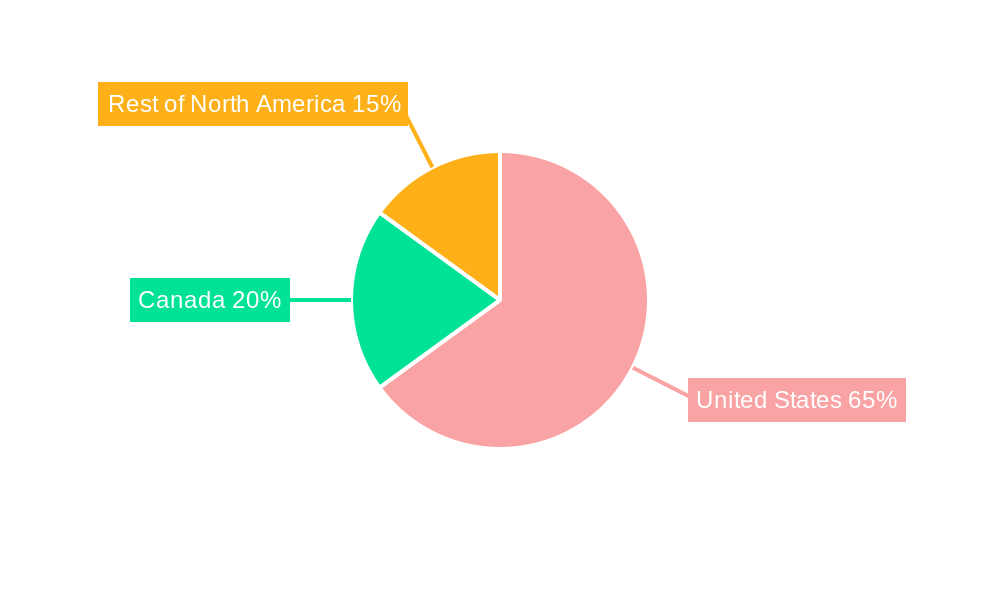

Dominant Regions, Countries, or Segments in North America Compressor Market

The United States stands as the dominant region in the North America Compressor Market, consistently exhibiting the highest demand and market share. This dominance is attributed to its robust industrial base, significant presence of key end-user industries such as oil and gas, power generation, and manufacturing, and substantial investments in infrastructure development. Economic policies favoring industrial growth and technological advancements further bolster the US market. Within segments, the Oil and Gas Industry is a primary growth driver, requiring high-performance compressors for exploration, extraction, processing, and transportation of hydrocarbons. The Power Sector also contributes significantly, with an increasing need for compressors in power generation facilities, including those utilizing renewable energy sources. The Manufacturing Sector’s demand is propelled by the need for compressed air in various production processes.

- Dominant Geography: United States, accounting for an estimated 70-75% of the North American market share.

- Key End User Segments:

- Oil and Gas Industry: Crucial for exploration, extraction, and processing operations.

- Power Sector: Essential for power generation and distribution.

- Manufacturing Sector: Widely used in diverse production processes.

- Dominance Factors in the US: Strong industrial infrastructure, significant investments in energy and manufacturing, favorable economic policies.

- Growth Potential in the US: Driven by energy transition projects, industrial modernization, and infrastructure upgrades.

North America Compressor Market Product Landscape

The North America Compressor Market's product landscape is characterized by a diverse range of innovations focused on enhanced efficiency, reliability, and smart capabilities. Positive Displacement compressors, including screw and reciprocating types, remain prevalent for applications requiring precise air delivery and high pressures, while Dynamic compressors, such as centrifugal and axial types, are favored for large-volume, continuous air supply in sectors like power generation and petrochemicals. Product innovations emphasize energy-saving features, such as variable speed drives, advanced lubrication systems, and optimized impeller/rotor designs. The integration of IoT sensors and predictive maintenance software is becoming a standard unique selling proposition, enabling remote monitoring, diagnostics, and proactive servicing. Performance metrics like specific power consumption (kW/100 cfm) and noise reduction are key areas of technological advancement.

Key Drivers, Barriers & Challenges in North America Compressor Market

Key Drivers:

- Growing Industrial Automation: The widespread adoption of Industry 4.0 and automation across manufacturing sectors is a primary driver.

- Energy Efficiency Mandates: Stringent regulations and corporate sustainability goals are pushing for energy-efficient compressor technologies.

- Oil and Gas Sector Expansion: Continued investments in exploration, production, and LNG projects in North America fuel demand.

- Infrastructure Development: Government initiatives and private sector investments in infrastructure projects require robust compressed air solutions.

Barriers & Challenges:

- High Initial Investment Costs: Advanced compressor systems often entail significant upfront capital expenditure, posing a challenge for some businesses.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and pricing of critical components, leading to production delays.

- Skilled Workforce Shortage: A lack of trained technicians for installation, maintenance, and repair of sophisticated compressor systems is a growing concern.

- Intense Competition: The market is characterized by fierce competition, putting pressure on profit margins and driving price wars.

Emerging Opportunities in North America Compressor Market

Emerging opportunities in the North America Compressor Market lie in the increasing demand for specialized compressors in emerging industries and the development of sustainable solutions. The hydrogen economy presents a significant untapped market, requiring high-pressure compressors for hydrogen production, storage, and transportation. The growing adoption of carbon capture, utilization, and storage (CCUS) technologies will also necessitate specialized compression systems. Furthermore, the decentralized energy generation trend and the expansion of electric vehicle (EV) charging infrastructure are creating new avenues for compressor applications. Innovative solutions focused on noise reduction and vibration control for urban environments are also gaining traction.

Growth Accelerators in the North America Compressor Market Industry

Long-term growth in the North America Compressor Market will be significantly accelerated by continuous technological breakthroughs, strategic partnerships, and proactive market expansion strategies. The ongoing development of more energy-efficient and environmentally friendly compressor designs, including those powered by renewable energy, will be a major catalyst. Strategic partnerships between compressor manufacturers and end-users, as well as collaborations with technology providers for AI and IoT integration, will foster innovation and accelerate product adoption. Furthermore, market expansion into underserved regions within North America and the development of customized solutions for niche applications will drive sustained growth.

Key Players Shaping the North America Compressor Market Market

- Trane Technologies PLC

- Ebara Corporation

- Atlas Copco AB

- Baker Hughes Co

- Ariel Corporation

- Aerzener Maschinenfabrik GmbH

- Siemens AG

- General Electric Company

- Sauer Compressors USA Inc

Notable Milestones in North America Compressor Market Sector

- January 2022: ASK Chemicals Group successfully opened its new manufacturing facility in El Carmen, Mexico, enhancing regional production capabilities.

- March 2022: Tellurian Inc. announced a limited notice to proceed to Bechtel Energy Inc. for the construction of phase one of the Driftwood LNG export terminal in Louisiana, signaling significant demand for large-scale compressors in the LNG sector.

In-Depth North America Compressor Market Market Outlook

The future outlook for the North America Compressor Market is exceptionally promising, driven by a sustained demand from core industries and the emergence of new growth avenues. Growth accelerators such as advancements in digitalization, the push towards decarbonization, and infrastructure investments will continue to shape the market's trajectory. Strategic opportunities exist in developing and marketing compressors for the burgeoning hydrogen and CCUS sectors, as well as catering to the evolving needs of the renewable energy landscape. The continued focus on energy efficiency and operational optimization will ensure robust demand for advanced and intelligent compressor solutions, positioning the market for sustained expansion and innovation.

North America Compressor Market Segmentation

-

1. Type

- 1.1. Positive Displacement

- 1.2. Dynamic

-

2. End User

- 2.1. Oil and Gas Industry

- 2.2. Power Sector

- 2.3. Manufacturing Sector

- 2.4. Chemicals and Petrochemical Industry

- 2.5. Other End User

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Compressor Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Compressor Market Regional Market Share

Geographic Coverage of North America Compressor Market

North America Compressor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Compressor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Positive Displacement

- 5.1.2. Dynamic

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas Industry

- 5.2.2. Power Sector

- 5.2.3. Manufacturing Sector

- 5.2.4. Chemicals and Petrochemical Industry

- 5.2.5. Other End User

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Compressor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Positive Displacement

- 6.1.2. Dynamic

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas Industry

- 6.2.2. Power Sector

- 6.2.3. Manufacturing Sector

- 6.2.4. Chemicals and Petrochemical Industry

- 6.2.5. Other End User

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Compressor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Positive Displacement

- 7.1.2. Dynamic

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas Industry

- 7.2.2. Power Sector

- 7.2.3. Manufacturing Sector

- 7.2.4. Chemicals and Petrochemical Industry

- 7.2.5. Other End User

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Compressor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Positive Displacement

- 8.1.2. Dynamic

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas Industry

- 8.2.2. Power Sector

- 8.2.3. Manufacturing Sector

- 8.2.4. Chemicals and Petrochemical Industry

- 8.2.5. Other End User

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Trane Technologies PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ebara Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Atlas Copco AB

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Baker Hughes Co

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Ariel Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Aerzener Maschinenfabrik GmbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Siemens AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 General Electric Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Sauer Compressors USA Inc*List Not Exhaustive

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Trane Technologies PLC

List of Figures

- Figure 1: North America Compressor Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Compressor Market Share (%) by Company 2025

List of Tables

- Table 1: North America Compressor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Compressor Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: North America Compressor Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: North America Compressor Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: North America Compressor Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Compressor Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America Compressor Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Compressor Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Compressor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Compressor Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: North America Compressor Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: North America Compressor Market Volume K Units Forecast, by End User 2020 & 2033

- Table 13: North America Compressor Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Compressor Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America Compressor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Compressor Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America Compressor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Compressor Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: North America Compressor Market Revenue billion Forecast, by End User 2020 & 2033

- Table 20: North America Compressor Market Volume K Units Forecast, by End User 2020 & 2033

- Table 21: North America Compressor Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Compressor Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Compressor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Compressor Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Compressor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: North America Compressor Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: North America Compressor Market Revenue billion Forecast, by End User 2020 & 2033

- Table 28: North America Compressor Market Volume K Units Forecast, by End User 2020 & 2033

- Table 29: North America Compressor Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Compressor Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America Compressor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Compressor Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Compressor Market?

The projected CAGR is approximately 4.72%.

2. Which companies are prominent players in the North America Compressor Market?

Key companies in the market include Trane Technologies PLC, Ebara Corporation, Atlas Copco AB, Baker Hughes Co, Ariel Corporation, Aerzener Maschinenfabrik GmbH, Siemens AG, General Electric Company, Sauer Compressors USA Inc*List Not Exhaustive.

3. What are the main segments of the North America Compressor Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.84 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

Oil and Gas Industry Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

January 2022: ASK Chemicals Group successfully opened its new manufacturing facility in El Carmen, Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Compressor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Compressor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Compressor Market?

To stay informed about further developments, trends, and reports in the North America Compressor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence