Key Insights

Turkmenistan's Oil & Gas Upstream Industry is projected for robust expansion, underpinned by extensive hydrocarbon reserves and strategic production enhancement investments. The market, valued at $11.44 billion in the base year 2024, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 4.8%. This dynamic growth is driven by substantial upstream investments aimed at maximizing recovery from existing fields and exploring new discoveries. Government-led initiatives, including infrastructure modernization, advanced extraction technology adoption, and international collaboration, are pivotal to this market's trajectory. The exploration and production (E&P) segment will remain the primary growth engine, with a strong focus on both onshore and offshore ventures. The nation's commitment to leveraging natural resources for economic development solidifies the positive outlook for the oil and gas upstream sector.

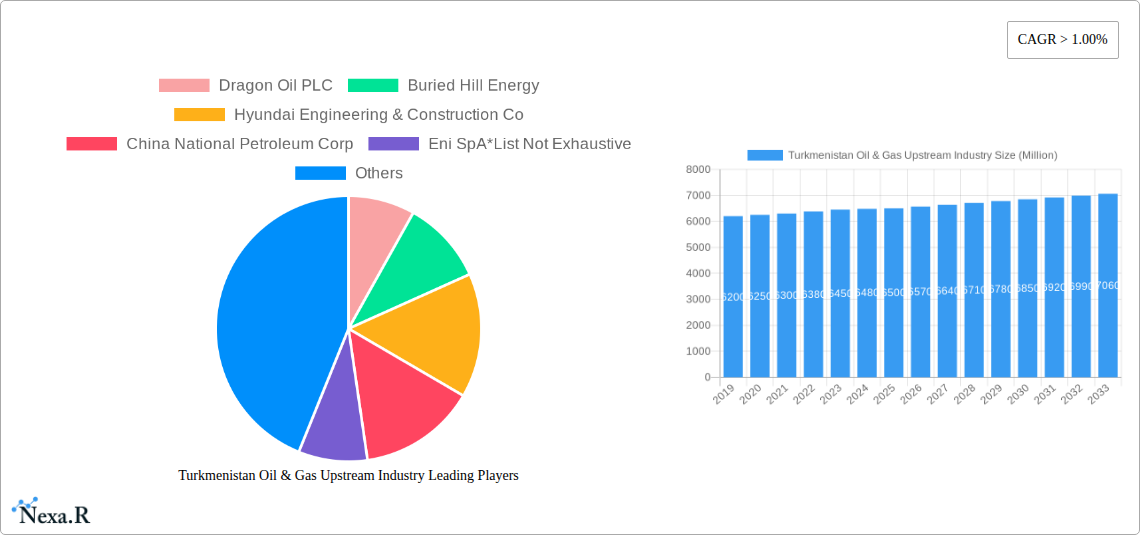

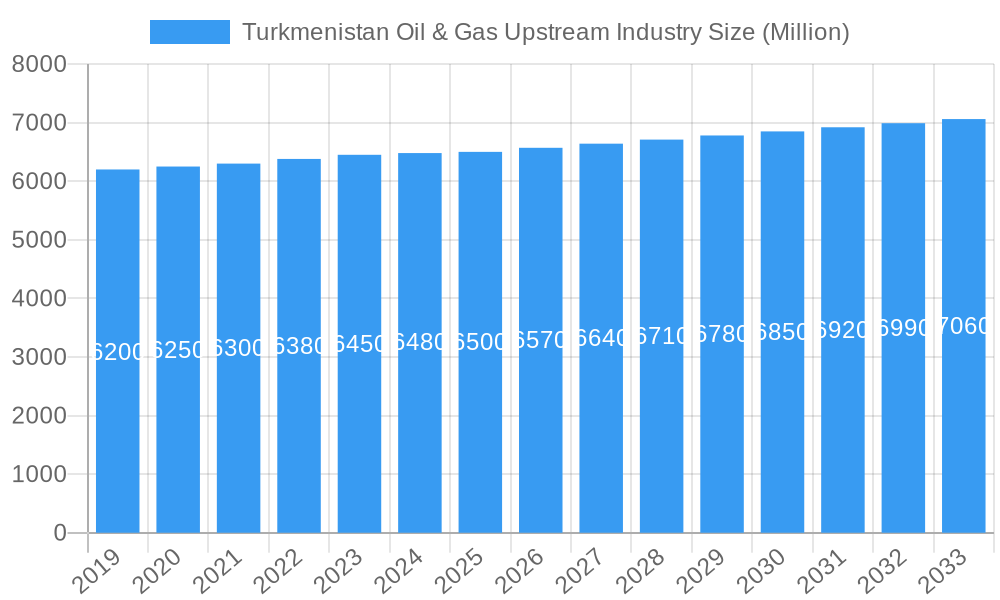

Turkmenistan Oil & Gas Upstream Industry Market Size (In Billion)

Key influences on Turkmenistan's oil and gas upstream industry include the active participation of major players such as Dragon Oil PLC, Buried Hill Energy, Hyundai Engineering & Construction Co, China National Petroleum Corp, and Eni SpA in E&P activities. While onshore operations are dominant, the Caspian Sea presents significant offshore exploration and development potential, attracting global expertise and capital. Drivers for growth include escalating global energy demand, particularly from Asian markets, and the government's strategic aim to diversify export routes. Challenges such as evolving environmental regulations, the necessity for technological advancements to address declining production from mature fields, and regional geopolitical factors demand strategic management. Nevertheless, the industry's inherent resource base and ongoing strategic initiatives point to a resilient and expanding Turkmenistan Oil & Gas Upstream Industry.

Turkmenistan Oil & Gas Upstream Industry Company Market Share

Turkmenistan Oil & Gas Upstream Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Turkmenistan oil and gas upstream industry, meticulously examining market dynamics, growth trends, regional dominance, product landscape, and key influencing factors. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report offers actionable insights for industry professionals, investors, and stakeholders. We delve into both the parent and child market segments, providing a holistic view of this vital sector.

Turkmenistan Oil & Gas Upstream Industry Market Dynamics & Structure

The Turkmenistan oil and gas upstream industry is characterized by a moderately concentrated market, driven by significant state-owned enterprises and a growing presence of international players. Technological innovation is primarily focused on enhancing recovery rates from mature fields and exploring new deep-water and onshore reserves, with significant investment in advanced seismic imaging and drilling technologies. The regulatory framework, largely dictated by the state, prioritizes foreign investment through Production Sharing Agreements (PSAs) and aims to attract capital for large-scale projects. Competitive product substitutes are limited in the upstream sector, with the primary competition revolving around efficiency, cost-effectiveness, and successful exploration. End-user demographics are primarily industrial, with the output feeding into national and international energy markets. Mergers and Acquisitions (M&A) trends are currently subdued but are anticipated to rise as companies seek to consolidate assets and expand their operational footprint.

- Market Concentration: Moderately concentrated, with a few dominant state-owned entities and a growing number of international participants.

- Technological Innovation Drivers: Enhanced oil recovery (EOR) techniques, deep-water exploration technology, digital oilfield solutions, and advanced drilling capabilities.

- Regulatory Frameworks: Production Sharing Agreements (PSAs), favorable investment terms for foreign entities, and national energy strategies.

- Competitive Product Substitutes: Limited in the upstream segment, with focus on operational efficiency and resource discovery.

- End-User Demographics: Primarily industrial consumers of crude oil and natural gas for refining and power generation.

- M&A Trends: Expected to increase as companies seek strategic partnerships and asset consolidation.

Turkmenistan Oil & Gas Upstream Industry Growth Trends & Insights

The Turkmenistan oil and gas upstream industry is poised for significant growth, driven by the country's vast hydrocarbon reserves and increasing global energy demand. Market size evolution is expected to witness a steady upward trajectory, with substantial investments in both onshore and offshore exploration and production activities. Adoption rates of advanced technologies, such as artificial intelligence for reservoir management and automation in drilling operations, are projected to accelerate, enhancing efficiency and reducing operational costs. Technological disruptions, particularly in seismic data interpretation and hydraulic fracturing techniques, will play a crucial role in unlocking previously inaccessible reserves. Consumer behavior shifts, influenced by the global transition towards cleaner energy, are also subtly impacting the upstream sector, with a greater emphasis on reducing emissions during production and exploring gas as a transitional fuel. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated at 6.5%, with market penetration expected to deepen as new discoveries are commercialized.

The market size of the Turkmenistan oil and gas upstream industry is anticipated to grow from an estimated $5,500 Million in 2025 to approximately $8,500 Million by 2033. This expansion will be fueled by a series of large-scale development projects and the successful exploitation of new reserves. The adoption rate of advanced digital technologies is expected to see a significant surge, moving from an estimated 15% in 2025 to over 40% by 2033, significantly improving operational efficiencies. Technological disruptions, such as the application of machine learning for predictive maintenance of drilling equipment and enhanced seismic imaging techniques, are projected to contribute an additional $1,200 Million in production value by the end of the forecast period. Consumer behavior, while globally shifting, currently sees a strong demand for natural gas and oil from industrial nations, with Turkmenistan strategically positioned to meet this demand. The market penetration of Turkmenistan's upstream products in key international markets is expected to increase by 10% over the forecast period, driven by strategic export initiatives and favorable pricing.

Dominant Regions, Countries, or Segments in Turkmenistan Oil & Gas Upstream Industry

The Onshore segment is currently the dominant region within the Turkmenistan oil and gas upstream industry, driving a significant portion of current production and future exploration efforts. This dominance is underpinned by the extensive and well-established onshore hydrocarbon fields, which have been the bedrock of Turkmenistan's energy sector for decades. The vast natural gas reserves, particularly in regions like the Galkynysh field, one of the world's largest, contribute immensely to the onshore segment's output. Economic policies implemented by the Turkmen government have consistently favored the development of these terrestrial resources, attracting substantial foreign direct investment for exploration and enhanced recovery operations. Infrastructure development, including pipelines and processing facilities, is more mature onshore, further facilitating efficient extraction and transportation. The market share for onshore production is estimated to be around 70% of the total upstream output in 2025, with a projected growth potential of 5.8% CAGR during the forecast period.

- Key Onshore Drivers:

- Vast proven reserves of natural gas and oil, particularly in the Galkynysh, Dovletabad, and Bagtiyarlyk fields.

- Established and robust infrastructure for extraction, processing, and transportation.

- Government focus on maximizing production from existing and newly discovered onshore fields.

- Lower exploration and development costs compared to offshore ventures.

The Offshore segment, while currently smaller in terms of production volume, represents a crucial growth frontier with significant untapped potential, particularly in the Caspian Sea. As onshore fields mature, the strategic imperative to explore and develop offshore reserves becomes increasingly prominent. Government initiatives aimed at attracting specialized offshore expertise and technology are expected to accelerate growth in this segment. Infrastructure development in the offshore region, although in its nascent stages compared to onshore, is receiving targeted investment to support complex drilling operations and subsea infrastructure. The market share for offshore production is currently estimated at 30% in 2025, but it is projected to grow at a higher CAGR of 7.5% during the forecast period, driven by the allure of vast undiscovered reserves and advancements in offshore exploration technology. The strategic importance of offshore exploration is further amplified by its potential to diversify export routes and tap into new international markets.

- Key Offshore Growth Potential:

- Significant unexplored hydrocarbon reserves in the Caspian Sea.

- Technological advancements in deep-water exploration and production.

- Government incentives and partnership opportunities for international offshore specialists.

- Strategic importance for diversifying energy exports and access to new markets.

Turkmenistan Oil & Gas Upstream Industry Product Landscape

The Turkmenistan oil and gas upstream industry primarily focuses on the extraction and initial processing of crude oil and natural gas. Product innovations in this sector are largely geared towards improving recovery efficiency and operational safety. Advanced seismic acquisition and processing techniques are enabling more precise identification of hydrocarbon reservoirs, while enhanced oil recovery (EOR) methods are being implemented to maximize output from mature fields. The performance metrics are measured by production volumes, reserve replacement ratios, and operational cost per barrel. Unique selling propositions lie in the sheer scale of Turkmenistan's hydrocarbon reserves, particularly its abundant natural gas, positioning it as a significant player in regional and global energy supply chains. Technological advancements are continually enhancing the cost-effectiveness and environmental performance of extraction processes.

Key Drivers, Barriers & Challenges in Turkmenistan Oil & Gas Upstream Industry

Key Drivers: The primary forces propelling the Turkmenistan oil and gas upstream industry include its vast, largely untapped hydrocarbon reserves, particularly natural gas, which is in high global demand. Favorable government policies aimed at attracting foreign direct investment through attractive Production Sharing Agreements (PSAs) are crucial. Technological advancements in exploration and production, such as seismic imaging and enhanced oil recovery, are unlocking new potential. Strategic export initiatives, like the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline project, also serve as significant growth catalysts.

Barriers & Challenges: Significant challenges include the capital-intensive nature of upstream operations, requiring substantial foreign investment and sophisticated technology. Geopolitical considerations and the need for stable international relations for export infrastructure development pose a barrier. Infrastructure limitations, especially in remote or offshore areas, can impede efficient operations. Regulatory complexities and the reliance on state-owned entities can sometimes lead to bureaucratic hurdles. Furthermore, fluctuating global energy prices and the increasing global focus on decarbonization present long-term challenges for the continued reliance on fossil fuels. Supply chain disruptions, though not a primary issue currently, could impact the timely delivery of specialized equipment and services.

Emerging Opportunities in Turkmenistan Oil & Gas Upstream Industry

Emerging opportunities in the Turkmenistan oil and gas upstream industry lie in further unlocking the potential of its deep offshore reserves in the Caspian Sea, which requires advanced exploration and extraction technologies. There is also a significant opportunity in the development and monetization of associated gas from oil fields, contributing to both domestic energy security and export revenues. The increasing global demand for cleaner energy sources also presents an opportunity for Turkmenistan to position its natural gas as a transitional fuel. Furthermore, collaborations with international technology providers for digital oilfield solutions, including AI-driven reservoir management and predictive maintenance, offer avenues for enhanced efficiency and cost reduction. Untapped markets for gas exports, particularly in South Asia, present substantial growth potential.

Growth Accelerators in the Turkmenistan Oil & Gas Upstream Industry Industry

Growth accelerators in the Turkmenistan oil and gas upstream industry are primarily driven by strategic international partnerships that bring in much-needed capital, technology, and expertise. The successful development and operationalization of major pipeline projects, such as the TAPI pipeline, will significantly expand export capacity and market reach. Continued government commitment to creating an attractive investment climate through transparent and favorable PSA terms is vital. Technological breakthroughs in unconventional resource extraction and enhanced recovery techniques will unlock further reserves. Market expansion strategies, focusing on diversifying export destinations beyond traditional markets, will also be crucial for sustained long-term growth.

Key Players Shaping the Turkmenistan Oil & Gas Upstream Industry Market

- Dragon Oil PLC

- Buried Hill Energy

- Hyundai Engineering & Construction Co

- China National Petroleum Corp

- Eni SpA

Notable Milestones in Turkmenistan Oil & Gas Upstream Industry Sector

- 2019: Dragon Oil PLC announces successful drilling of new production wells, boosting output from its Cheleken contract area.

- 2020: China National Petroleum Corporation (CNPC) continues exploration and development activities in the Bagtiyarlyk contract area, contributing to gas production.

- 2021: Eni SpA secures new exploration licenses in the Caspian Sea, signaling increased international interest in offshore potential.

- 2022: Hyundai Engineering & Construction Co. involved in the development of critical gas processing infrastructure, enhancing export capabilities.

- 2023: Buried Hill Energy continues its exploration and appraisal activities in onshore blocks, aiming to identify new reserves.

- 2024: Turkmenistan announces plans to boost gas production, indicating continued investment and focus on upstream development.

In-Depth Turkmenistan Oil & Gas Upstream Industry Market Outlook

The outlook for the Turkmenistan oil and gas upstream industry remains robust, driven by its substantial hydrocarbon reserves and ongoing strategic initiatives. Growth accelerators, including the expansion of export infrastructure and the cultivation of strategic international partnerships, are expected to fuel sustained expansion. The industry is well-positioned to leverage technological advancements to enhance production efficiency and explore untapped reserves, particularly in the offshore Caspian Sea. Future market potential hinges on the successful execution of large-scale projects and the ability to adapt to evolving global energy dynamics, with natural gas expected to play a pivotal role in its export portfolio. Strategic opportunities lie in diversifying its export markets and attracting further specialized expertise for complex offshore developments.

Turkmenistan Oil & Gas Upstream Industry Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

Turkmenistan Oil & Gas Upstream Industry Segmentation By Geography

- 1. Turkmenistan

Turkmenistan Oil & Gas Upstream Industry Regional Market Share

Geographic Coverage of Turkmenistan Oil & Gas Upstream Industry

Turkmenistan Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Technology in the Industrial Sector for Large-scale Heating and Cooling Applications4.; Risising Demand for Energy Storage Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Alternative Energy Storage Systems

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkmenistan Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Turkmenistan

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dragon Oil PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Buried Hill Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Engineering & Construction Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China National Petroleum Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Dragon Oil PLC

List of Figures

- Figure 1: Turkmenistan Oil & Gas Upstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkmenistan Oil & Gas Upstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkmenistan Oil & Gas Upstream Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 2: Turkmenistan Oil & Gas Upstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Turkmenistan Oil & Gas Upstream Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 4: Turkmenistan Oil & Gas Upstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkmenistan Oil & Gas Upstream Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Turkmenistan Oil & Gas Upstream Industry?

Key companies in the market include Dragon Oil PLC, Buried Hill Energy, Hyundai Engineering & Construction Co, China National Petroleum Corp, Eni SpA*List Not Exhaustive.

3. What are the main segments of the Turkmenistan Oil & Gas Upstream Industry?

The market segments include Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.44 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Technology in the Industrial Sector for Large-scale Heating and Cooling Applications4.; Risising Demand for Energy Storage Systems.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Alternative Energy Storage Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkmenistan Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkmenistan Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkmenistan Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Turkmenistan Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence