Key Insights

The Asia-Pacific Medium Voltage Switchgear Market is projected for substantial expansion, anticipated to reach

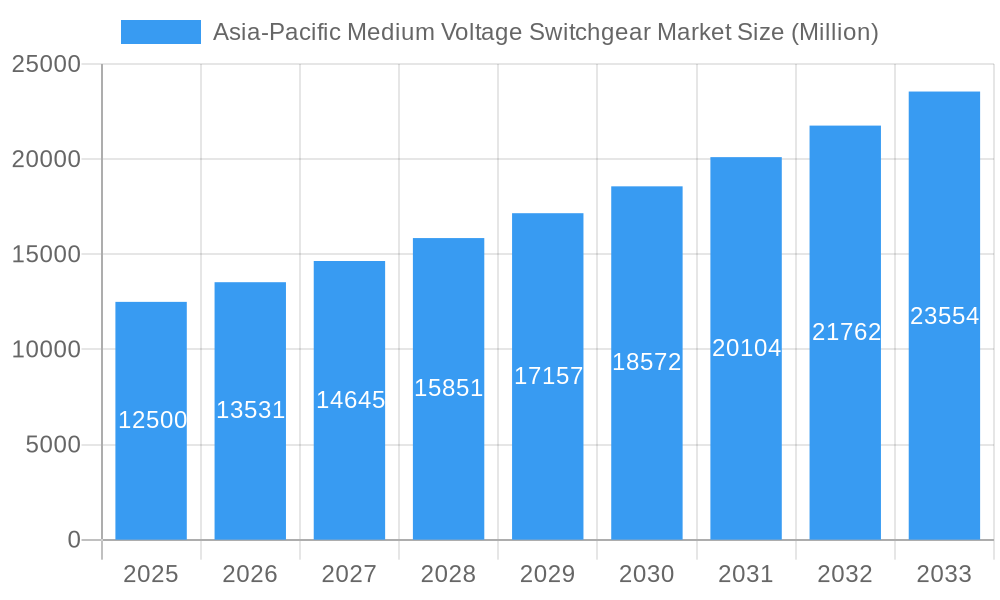

Asia-Pacific Medium Voltage Switchgear Market Market Size (In Billion)

Challenges include significant upfront capital investment for manufacturing and deployment, and a complex regulatory landscape. Stringent environmental regulations and the need for advanced technological integration necessitate continuous innovation. China and India are expected to lead market growth due to large populations, expanding economies, and ongoing infrastructure development. The market is segmented by voltage levels (3kV to 12kV, 12kV to 24kV, 24kV to 36kV), components (Circuit Breakers, Contactors, Switches & Disconnector, Fuses), insulation types (Air Insulation, Gas Insulation, Other Insulations), and end-users (Commercial & Residential, Power Utilities, Industrial Sector). Key players are prioritizing research and development and strategic collaborations to expand market presence and offer advanced solutions.

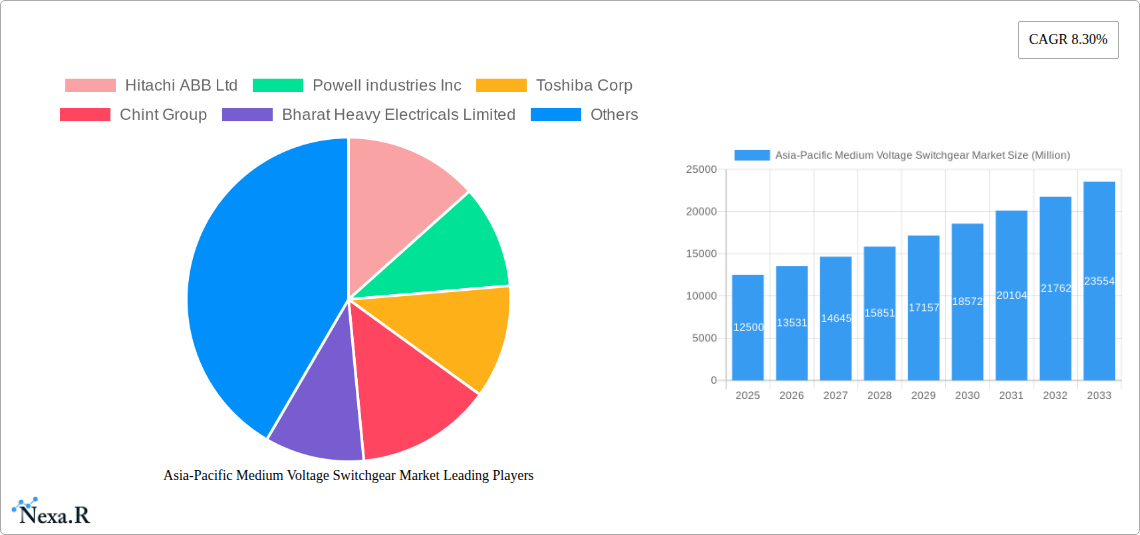

Asia-Pacific Medium Voltage Switchgear Market Company Market Share

Gain critical insights into the Asia-Pacific Medium Voltage Switchgear Market. This report details market dynamics, growth forecasts, regional analysis, product innovation, and strategic opportunities. Essential for stakeholders, this analysis offers a comprehensive understanding of a market driven by infrastructure development, renewable energy integration, and grid modernization. Explore market segments, key player strategies, and the future of power distribution in this dynamic economic region.

Asia-Pacific Medium Voltage Switchgear Market Dynamics & Structure

The Asia-Pacific medium voltage switchgear market is characterized by a moderately concentrated to fragmented structure, with leading global players and a growing number of regional manufacturers vying for market share. Technological innovation is a primary driver, fueled by the increasing demand for smart grid solutions, enhanced cybersecurity, and the integration of renewable energy sources, necessitating sophisticated switchgear with advanced monitoring and control capabilities. Regulatory frameworks are evolving across the region, with a growing emphasis on grid reliability, safety standards (e.g., IEC standards), and environmental regulations impacting product development and adoption. Competitive product substitutes include advancements in digital substations and increasingly integrated solutions. End-user demographics are shifting, with a substantial rise in demand from industrial sectors undergoing automation and digital transformation, alongside ongoing infrastructure projects in both developed and developing economies. Mergers and acquisitions (M&A) activity, though not consistently high, plays a crucial role in market consolidation and the acquisition of new technologies. For instance, the period witnessed xx notable M&A deals impacting key segments. Innovation barriers exist, primarily related to the high cost of R&D for advanced technologies and the need for significant capital investment in manufacturing facilities.

- Market Concentration: Moderately concentrated with a mix of global and regional players.

- Technological Innovation Drivers: Smart grid adoption, renewable energy integration, grid modernization, cybersecurity demands.

- Regulatory Frameworks: Evolving standards for reliability, safety, and environmental compliance; increasing push for digitalization.

- Competitive Product Substitutes: Digital substations, integrated control and protection systems.

- End-User Demographics: Strong growth from industrial automation, renewable energy projects, and expanding urban infrastructure.

- M&A Trends: Strategic acquisitions for technology and market access; estimated xx significant deals in the historical period.

- Innovation Barriers: High R&D costs, capital investment for advanced manufacturing, standardization challenges.

Asia-Pacific Medium Voltage Switchgear Market Growth Trends & Insights

The Asia-Pacific medium voltage switchgear market is experiencing robust growth, driven by a confluence of factors that are reshaping the region's power infrastructure. The projected market size evolution indicates a substantial upward trajectory, with a significant Compound Annual Growth Rate (CAGR) anticipated over the forecast period. This expansion is underpinned by increasing investments in electricity transmission and distribution (T&D) networks, particularly in emerging economies like India and Southeast Asian nations, where aging infrastructure is being replaced and new capacity is being added to meet rising energy demands. Adoption rates of advanced switchgear technologies are accelerating, propelled by the imperative to enhance grid stability, reduce transmission losses, and integrate intermittent renewable energy sources like solar and wind power more effectively. Technological disruptions are a key feature, with a growing emphasis on digitalization and automation. This includes the widespread adoption of gas insulation switchgear (GIS) due to its compact design, enhanced safety, and reduced maintenance requirements, especially in urbanized areas with limited space. Furthermore, the development of smart grid technologies, such as intelligent sensors, advanced metering infrastructure, and remote monitoring systems, is transforming traditional switchgear into more sophisticated, data-driven assets. Consumer behavior shifts are also playing a role, with end-users increasingly demanding reliable and uninterrupted power supply, pushing utilities to invest in more resilient and efficient grid components. The market penetration of medium voltage switchgear is expected to deepen across all end-user segments as industrialization continues and the demand for electricity grows. The historical period (2019-2024) laid the groundwork for this expansion, with key investments in infrastructure and a growing awareness of the need for advanced grid solutions. The base year (2025) signifies a strong starting point for the forecast period (2025-2033), which will witness the full impact of these growth accelerators, including government initiatives promoting renewable energy and smart grid deployment. The forecast period is estimated to reach a market value of USD xx billion by 2033, with a CAGR of xx% from 2025.

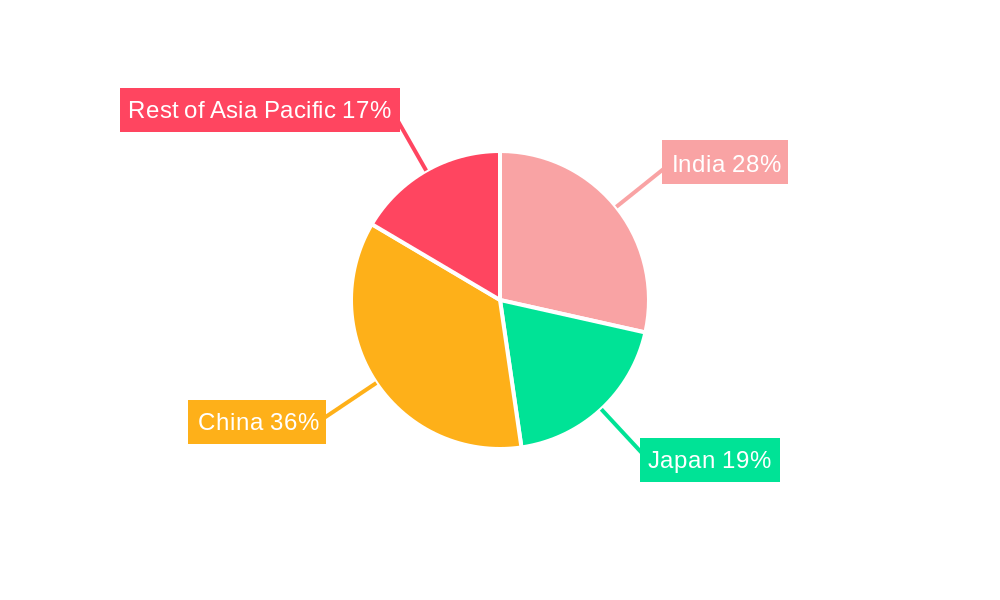

Dominant Regions, Countries, or Segments in Asia-Pacific Medium Voltage Switchgear Market

China stands as a dominant force in the Asia-Pacific medium voltage switchgear market, driven by its massive industrial base, extensive infrastructure development, and strong government support for energy modernization. The 24kV to 36kV voltage segment, crucial for industrial applications and sub-transmission networks, exhibits significant growth, directly correlating with China's industrial output and ongoing urban expansion. Within the components category, Circuit Breakers are paramount, reflecting the need for robust protection and control in high-demand scenarios. Gas Insulation Switchgear (GIS) is increasingly favored over traditional Air Insulation Switchgear due to its superior performance, safety, and space-saving attributes, particularly in densely populated urban centers where space is a premium. The Industrial sector emerges as a primary end-user, driven by the significant investments in manufacturing, mining, and heavy industries that require reliable and high-capacity power distribution solutions.

- Dominant Country: China, leading in terms of market size and growth potential.

- Dominant Voltage Segment: 24kV to 36kV, catering to extensive industrial and sub-transmission needs.

- Dominant Component: Circuit Breakers, essential for reliable grid protection and control.

- Dominant Insulation Type: Gas Insulation Switchgear (GIS), preferred for its safety, compactness, and performance in urban and industrial settings.

- Dominant End-User: Industrial Sector, fueled by massive manufacturing activities and infrastructure projects.

- Key Drivers in China: Government initiatives for grid modernization, massive industrial growth, urban development, and increasing adoption of renewables.

- Market Share: China accounts for approximately xx% of the Asia-Pacific medium voltage switchgear market.

- Growth Potential: High, driven by continued investment in T&D infrastructure and industrial expansion.

In India, the market is characterized by rapid expansion, driven by government initiatives like "Make in India" and the urgent need to upgrade its aging power infrastructure. The Power Utilities sector is the largest end-user, demanding reliable and efficient switchgear for the expansion and modernization of its vast transmission and distribution networks. The 12kV to 24kV segment is particularly active, supporting the growing demand in urban and semi-urban areas. Switches & Disconnectors play a critical role in ensuring operational flexibility and maintenance safety. The push for Air Insulation Switchgear continues due to its cost-effectiveness and widespread availability, though GIS adoption is steadily increasing. The "Rest of Asia-Pacific" region, encompassing countries like South Korea, Australia, and Southeast Asian nations, presents diverse growth opportunities driven by economic development, renewable energy mandates, and smart city projects. Japan, a mature market, focuses on advanced technological solutions and grid resilience.

- Key Country (Emerging): India, with significant growth driven by utility expansion and infrastructure development.

- Key Voltage Segment (India): 12kV to 24kV, supporting growing energy demands in urban and semi-urban areas.

- Key Component (India): Switches & Disconnectors, crucial for operational flexibility and maintenance.

- Key Insulation Type (India): Air Insulation Switchgear (AIS), favored for its cost-effectiveness and established presence, with growing GIS adoption.

- Key End-User (India): Power Utilities, for T&D network expansion and modernization.

- Rest of Asia-Pacific Dynamics: Diverse growth driven by economic development, renewable energy, and smart city initiatives. Japan focuses on advanced tech and resilience.

Asia-Pacific Medium Voltage Switchgear Market Product Landscape

The product landscape for Asia-Pacific medium voltage switchgear is dynamic, with manufacturers continuously innovating to meet the evolving demands of the power industry. Key product innovations include the development of smart switchgear solutions equipped with advanced digital sensors, communication modules, and integrated protection and control functionalities. These products offer enhanced real-time monitoring, predictive maintenance capabilities, and seamless integration into smart grids. Performance metrics are being elevated through the use of advanced insulation materials and improved arc quenching technologies, leading to higher dielectric strength, increased operational lifespan, and enhanced safety. The integration of vacuum interrupters in medium voltage circuit breakers is a prominent trend, offering reliable and eco-friendly switching solutions. Applications are expanding beyond traditional grid infrastructure to include specialized requirements in renewable energy substations, industrial automation facilities, and large-scale commercial complexes. The unique selling proposition of many new products lies in their ability to improve grid reliability, reduce operational costs, and facilitate the integration of renewable energy sources. Technological advancements are also focused on miniaturization, modular designs for easier installation and maintenance, and enhanced cybersecurity features to protect critical infrastructure from cyber threats.

Key Drivers, Barriers & Challenges in Asia-Pacific Medium Voltage Switchgear Market

Key Drivers:

- Robust Infrastructure Development: Significant investments in expanding and upgrading electricity transmission and distribution networks across the region, particularly in emerging economies, are a primary growth catalyst.

- Renewable Energy Integration: The escalating adoption of solar and wind power necessitates advanced switchgear solutions capable of handling the intermittency and bidirectional power flow associated with these sources.

- Smart Grid Initiatives: Government policies and utility investments in smart grid technologies, including automation, digitalization, and advanced metering, are driving demand for intelligent switchgear.

- Industrial Growth and Automation: The expansion of manufacturing, mining, and other industrial sectors, coupled with increasing automation, requires reliable and high-capacity medium voltage switchgear.

- Aging Infrastructure Replacement: Many countries in the Asia-Pacific region have aging power grids that require modernization, driving demand for new and efficient switchgear.

Barriers & Challenges:

- High Initial Investment Costs: Advanced switchgear, particularly GIS and smart solutions, involve substantial upfront costs, which can be a barrier for some utilities and developing economies.

- Skilled Workforce Shortage: The implementation and maintenance of advanced switchgear require a skilled workforce, and a shortage of such expertise can hinder adoption.

- Regulatory and Standardization Hurdles: Variations in regulatory frameworks and technical standards across different countries can create complexities for manufacturers and complicate market entry.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as witnessed in recent years, can impact the availability of raw materials and components, leading to production delays and cost fluctuations.

- Competition from Alternative Technologies: While not a direct substitute, advancements in low-voltage distribution and other grid management technologies could indirectly influence the demand for specific medium voltage switchgear applications.

Emerging Opportunities in Asia-Pacific Medium Voltage Switchgear Market

Emerging opportunities in the Asia-Pacific medium voltage switchgear market lie in the increasing demand for smart substations that offer advanced monitoring, control, and automation capabilities, enhancing grid efficiency and resilience. The rapid expansion of renewable energy projects, particularly in offshore wind and large-scale solar farms, presents a significant opportunity for specialized medium voltage switchgear solutions designed for these environments. Furthermore, the growing focus on energy storage systems integrated with renewable energy sources creates a demand for switchgear that can seamlessly manage the charging and discharging cycles of batteries. The development of microgrids for industrial campuses, remote communities, and critical infrastructure also offers a niche but growing market for tailored medium voltage switchgear solutions. Evolving consumer preferences for reliable and sustainable power are driving utilities to invest in greener and more efficient technologies, opening doors for manufacturers who can offer environmentally friendly switchgear options.

Growth Accelerators in the Asia-Pacific Medium Voltage Switchgear Market Industry

Several key catalysts are accelerating the growth of the Asia-Pacific medium voltage switchgear market. Technological breakthroughs in digitalization and IoT integration are enabling switchgear to become smarter, more connected, and capable of providing valuable data analytics for grid optimization. Strategic partnerships and collaborations between switchgear manufacturers, technology providers, and utilities are fostering innovation and accelerating the development and deployment of advanced solutions. Market expansion strategies, including entry into underserved geographies within the Asia-Pacific region and the development of cost-effective solutions tailored for specific market needs, are also significant growth drivers. Furthermore, increasing government incentives and policy support for grid modernization and renewable energy integration are creating a favorable environment for market expansion. The ongoing trend of electrification of transportation and industries also fuels the demand for robust and reliable medium voltage switchgear infrastructure.

Key Players Shaping the Asia-Pacific Medium Voltage Switchgear Market Market

- Hitachi ABB Ltd

- Powell Industries Inc

- Toshiba Corp

- Chint Group

- Bharat Heavy Electricals Limited

- Mitsubishi Electric Corporation

- Lucy Group Ltd

- Schneider Electric SE

- Eaton Corporation PLC

- Siemens Energy AG

- General Electric Company

- Hyosung Heavy Industries Corp

Notable Milestones in Asia-Pacific Medium Voltage Switchgear Market Sector

- 2023: Launch of advanced SF6-free gas insulated switchgear by Siemens Energy AG for enhanced environmental compliance.

- 2023: Eaton Corporation PLC secures a significant order for medium voltage switchgear for a major industrial complex in India.

- 2022: Schneider Electric SE unveils new digital substation solutions to enhance grid automation in Southeast Asia.

- 2022: Chint Group expands its manufacturing capacity for medium voltage switchgear to meet rising demand in China.

- 2021: Mitsubishi Electric Corporation announces a strategic partnership to develop smart grid technologies for the Japanese market.

- 2021: Hitachi ABB Ltd inaugurates a new R&D center focused on advanced switchgear solutions in the region.

- 2020: Toshiba Corp introduces a new range of vacuum circuit breakers with improved performance and longevity.

- 2019: Powell Industries Inc establishes a new regional presence to cater to the growing Australian market.

- 2019: Bharat Heavy Electricals Limited (BHEL) completes a major project for upgrading transmission infrastructure in India.

- 2019: General Electric Company (GE) partners with a regional utility for the deployment of digital switchgear.

In-Depth Asia-Pacific Medium Voltage Switchgear Market Market Outlook

The Asia-Pacific medium voltage switchgear market is poised for sustained and significant growth, propelled by a convergence of economic development, technological advancements, and strategic policy initiatives. The ongoing drive towards grid modernization and the integration of renewable energy sources will continue to be primary growth accelerators, creating demand for smarter, more resilient, and environmentally friendly switchgear solutions. Emerging opportunities in smart substations, microgrids, and energy storage systems offer substantial untapped market potential. Manufacturers focusing on innovation in digitalization, automation, and advanced insulation technologies will be well-positioned to capture market share. Strategic partnerships and a focus on developing cost-effective solutions for emerging economies will further fuel expansion. The market outlook remains highly optimistic, with a clear trajectory towards more intelligent and sustainable power distribution infrastructure across the Asia-Pacific region.

Asia-Pacific Medium Voltage Switchgear Market Segmentation

-

1. Voltage

- 1.1. 3kV to 12kV

- 1.2. 12kV to 24kV

- 1.3. 24kV to 36kV

-

2. Component

- 2.1. Circuit Breakers

- 2.2. Contactors

- 2.3. Switches & Disconnector

- 2.4. Fuses

-

3. Insulation

- 3.1. Air Insulation Switchgear

- 3.2. Gas Insulation Switchgear

- 3.3. Other Insulations

-

4. End-User

- 4.1. Commercial & Residential

- 4.2. Power utilities

- 4.3. Industrial sector

-

5. Geography

- 5.1. India

- 5.2. Japan

- 5.3. China

- 5.4. Rest of Asia-Pacific

Asia-Pacific Medium Voltage Switchgear Market Segmentation By Geography

- 1. India

- 2. Japan

- 3. China

- 4. Rest of Asia Pacific

Asia-Pacific Medium Voltage Switchgear Market Regional Market Share

Geographic Coverage of Asia-Pacific Medium Voltage Switchgear Market

Asia-Pacific Medium Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investments in transmission and distribution infrastructure.

- 3.3. Market Restrains

- 3.3.1. 4.; Utilization of SF6 gas in insulating switchgears.

- 3.4. Market Trends

- 3.4.1. Gas Insulated Switchgear Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Medium Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. 3kV to 12kV

- 5.1.2. 12kV to 24kV

- 5.1.3. 24kV to 36kV

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Circuit Breakers

- 5.2.2. Contactors

- 5.2.3. Switches & Disconnector

- 5.2.4. Fuses

- 5.3. Market Analysis, Insights and Forecast - by Insulation

- 5.3.1. Air Insulation Switchgear

- 5.3.2. Gas Insulation Switchgear

- 5.3.3. Other Insulations

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Commercial & Residential

- 5.4.2. Power utilities

- 5.4.3. Industrial sector

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. India

- 5.5.2. Japan

- 5.5.3. China

- 5.5.4. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.6.2. Japan

- 5.6.3. China

- 5.6.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. India Asia-Pacific Medium Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. 3kV to 12kV

- 6.1.2. 12kV to 24kV

- 6.1.3. 24kV to 36kV

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Circuit Breakers

- 6.2.2. Contactors

- 6.2.3. Switches & Disconnector

- 6.2.4. Fuses

- 6.3. Market Analysis, Insights and Forecast - by Insulation

- 6.3.1. Air Insulation Switchgear

- 6.3.2. Gas Insulation Switchgear

- 6.3.3. Other Insulations

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Commercial & Residential

- 6.4.2. Power utilities

- 6.4.3. Industrial sector

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. India

- 6.5.2. Japan

- 6.5.3. China

- 6.5.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. Japan Asia-Pacific Medium Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. 3kV to 12kV

- 7.1.2. 12kV to 24kV

- 7.1.3. 24kV to 36kV

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Circuit Breakers

- 7.2.2. Contactors

- 7.2.3. Switches & Disconnector

- 7.2.4. Fuses

- 7.3. Market Analysis, Insights and Forecast - by Insulation

- 7.3.1. Air Insulation Switchgear

- 7.3.2. Gas Insulation Switchgear

- 7.3.3. Other Insulations

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Commercial & Residential

- 7.4.2. Power utilities

- 7.4.3. Industrial sector

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. India

- 7.5.2. Japan

- 7.5.3. China

- 7.5.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. China Asia-Pacific Medium Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. 3kV to 12kV

- 8.1.2. 12kV to 24kV

- 8.1.3. 24kV to 36kV

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Circuit Breakers

- 8.2.2. Contactors

- 8.2.3. Switches & Disconnector

- 8.2.4. Fuses

- 8.3. Market Analysis, Insights and Forecast - by Insulation

- 8.3.1. Air Insulation Switchgear

- 8.3.2. Gas Insulation Switchgear

- 8.3.3. Other Insulations

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Commercial & Residential

- 8.4.2. Power utilities

- 8.4.3. Industrial sector

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. India

- 8.5.2. Japan

- 8.5.3. China

- 8.5.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Rest of Asia Pacific Asia-Pacific Medium Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 9.1.1. 3kV to 12kV

- 9.1.2. 12kV to 24kV

- 9.1.3. 24kV to 36kV

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Circuit Breakers

- 9.2.2. Contactors

- 9.2.3. Switches & Disconnector

- 9.2.4. Fuses

- 9.3. Market Analysis, Insights and Forecast - by Insulation

- 9.3.1. Air Insulation Switchgear

- 9.3.2. Gas Insulation Switchgear

- 9.3.3. Other Insulations

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Commercial & Residential

- 9.4.2. Power utilities

- 9.4.3. Industrial sector

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. India

- 9.5.2. Japan

- 9.5.3. China

- 9.5.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hitachi ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Powell industries Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Chint Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bharat Heavy Electricals Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Electric Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lucy Group Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Eaton Corporation PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Siemens Energy AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 General Electric Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hyosung Heavy Industries Corp

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Hitachi ABB Ltd

List of Figures

- Figure 1: Asia-Pacific Medium Voltage Switchgear Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Medium Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 3: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Component 2020 & 2033

- Table 4: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Component 2020 & 2033

- Table 5: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 6: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Insulation 2020 & 2033

- Table 7: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 9: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 13: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 14: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 15: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Component 2020 & 2033

- Table 16: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Component 2020 & 2033

- Table 17: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 18: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Insulation 2020 & 2033

- Table 19: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 21: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 26: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 27: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Component 2020 & 2033

- Table 28: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Component 2020 & 2033

- Table 29: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 30: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Insulation 2020 & 2033

- Table 31: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 32: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 33: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 35: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 37: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 38: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 39: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Component 2020 & 2033

- Table 40: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Component 2020 & 2033

- Table 41: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 42: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Insulation 2020 & 2033

- Table 43: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 45: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 50: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 51: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Component 2020 & 2033

- Table 52: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Component 2020 & 2033

- Table 53: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 54: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Insulation 2020 & 2033

- Table 55: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 56: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 57: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 59: Asia-Pacific Medium Voltage Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Asia-Pacific Medium Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Medium Voltage Switchgear Market?

The projected CAGR is approximately 7.71%.

2. Which companies are prominent players in the Asia-Pacific Medium Voltage Switchgear Market?

Key companies in the market include Hitachi ABB Ltd, Powell industries Inc, Toshiba Corp, Chint Group, Bharat Heavy Electricals Limited, Mitsubishi Electric Corporation, Lucy Group Ltd, Schneider Electric SE, Eaton Corporation PLC, Siemens Energy AG, General Electric Company, Hyosung Heavy Industries Corp.

3. What are the main segments of the Asia-Pacific Medium Voltage Switchgear Market?

The market segments include Voltage, Component, Insulation, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.83 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investments in transmission and distribution infrastructure..

6. What are the notable trends driving market growth?

Gas Insulated Switchgear Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; Utilization of SF6 gas in insulating switchgears..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Medium Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Medium Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Medium Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Medium Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence