Key Insights

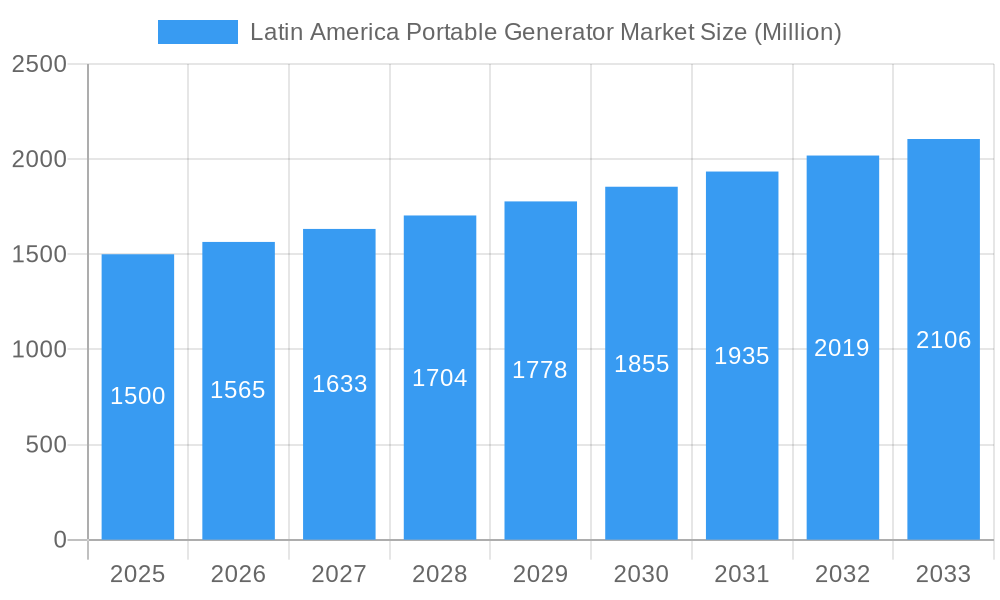

The Latin America Portable Generator Market is projected for significant expansion, driven by escalating demand for dependable power solutions across diverse industries. With a projected Compound Annual Growth Rate (CAGR) of 6%, the market size, currently valued at 5.11 billion in the base year 2025, is anticipated to experience substantial growth through the forecast period of 2025-2033. Key growth factors include the persistent need for backup power in areas with unstable grids, rapid urbanization, and the expansion of industrial and commercial operations necessitating uninterrupted power. The "Power Rating: Below 5 kW" segment is expected to dominate due to its affordability and broad application in residential and small commercial settings. Additionally, the increasing preference for gas-powered generators, attributed to their superior fuel efficiency and reduced emissions compared to diesel models, will further fuel market growth.

Latin America Portable Generator Market Market Size (In Billion)

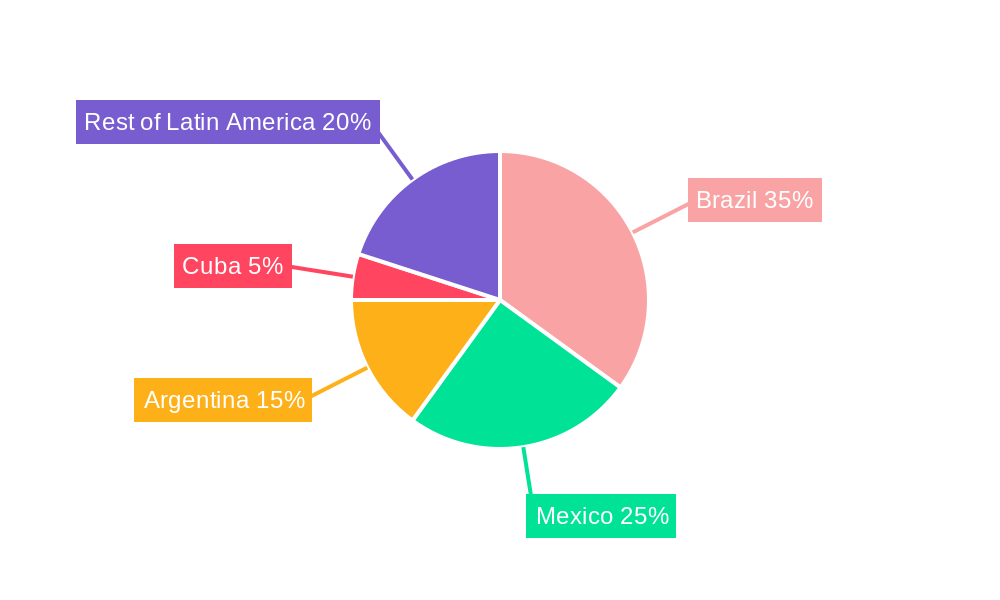

The market's growth is further accelerated by the rising adoption of portable generators in the commercial sector for events, construction, and temporary power requirements, and in the industrial sector for critical applications. While the residential segment also shows expansion, driven by heightened awareness of power outage consequences and the need for home energy resilience, the industrial and commercial sectors represent the larger market share. Brazil is anticipated to lead market growth due to its robust industrial base and ongoing infrastructure development. However, potential restraints include the initial investment cost of generators, volatile fuel prices, and the increasing availability of renewable energy alternatives. Nevertheless, technological innovations, such as the development of more fuel-efficient and environmentally friendly portable generator models, are expected to offset these challenges and maintain strong market momentum in the ensuing years.

Latin America Portable Generator Market Company Market Share

Unlocking the Power: Latin America Portable Generator Market Analysis (2019-2033)

This comprehensive report delivers an in-depth analysis of the Latin America portable generator market, meticulously segmented by power rating, fuel type, end-user, and geography. Explore critical market dynamics, growth trends, and the competitive landscape from 2019 to 2033, with a focus on the base year 2025 and a robust forecast period. Gain actionable insights into this dynamic sector, crucial for strategizing your business in Mexico, Brazil, Argentina, Cuba, and the wider Rest of Latin America.

Latin America Portable Generator Market Market Dynamics & Structure

The Latin America portable generator market is characterized by a moderate to high level of concentration, with key players like Briggs & Stratton Corporation, Atlas Copco AB, Caterpillar Inc., Kohler Power Systems, and Generac Holdings Inc. actively shaping its trajectory. Technological innovation is a significant driver, fueled by the increasing demand for reliable backup power solutions in the face of grid instability and growing adoption in off-grid applications. Regulatory frameworks, while evolving, play a role in dictating emissions standards and safety certifications, influencing product development and market entry. Competitive product substitutes, such as solar power solutions and uninterruptible power supplies (UPS), are present but the inherent portability and cost-effectiveness of generators continue to make them a preferred choice for many. End-user demographics span a wide spectrum, from residential consumers seeking preparedness for natural disasters and power outages to commercial businesses and industrial operations reliant on uninterrupted power for productivity. Mergers and acquisitions (M&A) trends, though not as pronounced as in some mature markets, are indicative of strategic consolidation and market expansion efforts by leading entities.

- Market Concentration: Dominated by a few key global manufacturers, with increasing regional player emergence.

- Technological Innovation: Focus on fuel efficiency, noise reduction, smart features, and dual-fuel capabilities.

- Regulatory Frameworks: Increasing emphasis on emission standards and energy efficiency mandates.

- Competitive Landscape: Generators compete with alternative power sources but maintain a strong niche.

- End-User Demographics: Diversified demand from residential, commercial, and industrial sectors.

- M&A Trends: Strategic acquisitions for market share expansion and technology integration.

Latin America Portable Generator Market Growth Trends & Insights

The Latin America portable generator market is poised for significant expansion, driven by a confluence of factors that underscore the growing need for reliable and accessible power solutions across the region. The market size evolution reflects a steady increase, fueled by increasing industrialization, urbanization, and a persistent concern regarding the stability of existing power grids. Adoption rates are particularly strong in areas prone to natural disasters, such as hurricanes and earthquakes, where portable generators are essential for maintaining critical operations and ensuring public safety. Furthermore, the growing trend towards decentralized power generation and the increasing accessibility of portable power in remote and off-grid communities are contributing to a broader market penetration.

Technological disruptions are continuously reshaping the landscape. The introduction of inverter generators, offering cleaner power output suitable for sensitive electronics, and the growing prevalence of dual-fuel models, providing flexibility in fuel choices (gasoline and propane), are key innovations enhancing user convenience and cost-effectiveness. These advancements address evolving consumer behavior shifts, with a heightened awareness of the importance of preparedness and the demand for portable power solutions that offer both performance and environmental considerations. The overall CAGR for the forecast period is expected to reflect a robust growth trajectory, as the region continues to grapple with infrastructure challenges and a rising demand for dependable energy backup.

- Market Size Evolution: Projecting substantial growth in value and volume across the forecast period.

- Adoption Rates: Steadily increasing due to grid unreliability and disaster preparedness needs.

- Technological Disruptions: Inverter technology and dual-fuel models are key innovation areas.

- Consumer Behavior Shifts: Growing emphasis on preparedness, convenience, and fuel flexibility.

- Market Penetration: Expanding into new geographic areas and end-user segments.

- CAGR: Expected to remain strong, reflecting sustained demand and market expansion.

Dominant Regions, Countries, or Segments in Latin America Portable Generator Market

The Latin America portable generator market's dominance is intricately linked to the economic and infrastructural realities of its constituent nations and specific product segments. Within the geography segment, Brazil stands out as a primary growth engine, owing to its large industrial base, significant agricultural sector, and ongoing infrastructure development projects that necessitate reliable power. Mexico also presents substantial opportunities, driven by its robust manufacturing sector and its own set of energy infrastructure challenges.

In terms of fuel type, Gas portable generators currently hold a dominant market share due to their widespread availability, relatively lower upfront cost, and established refueling infrastructure. However, Diesel generators remain critical for heavy-duty industrial and commercial applications where longer run times and higher power output are paramount. The “Other Fuel Types” segment, while smaller, is expected to see growth driven by the exploration of cleaner fuel alternatives and specialized applications.

Examining power rating, the Below 5 kW segment consistently leads in volume, catering to the broad residential and small commercial demand for basic power needs, emergency backup, and outdoor activities. The 5-10 kW segment is experiencing significant traction, bridging the gap for larger homes and small to medium-sized businesses requiring more substantial power. The Above 10 kW segment, though smaller in unit volume, is crucial for large industrial operations and critical infrastructure, demonstrating high value.

For end-users, the Residential segment is a significant contributor, driven by increasing awareness of home backup power needs and a growing middle class. The Commercial segment, encompassing retail, hospitality, and small businesses, relies heavily on portable generators to mitigate revenue losses during power outages. The Industrial segment, while less frequent in its purchase of portable units, demands robust, high-capacity generators for critical applications and remote operations.

- Dominant Geography: Brazil and Mexico are key markets due to industrialization and infrastructure needs.

- Leading Fuel Type: Gas generators lead due to availability and cost, with Diesel significant for industrial use.

- Power Rating Dominance: Below 5 kW for widespread residential use, 5-10 kW for growing SME demand.

- End-User Segments: Residential and Commercial sectors are major volume drivers, Industrial for high-capacity needs.

- Key Drivers: Economic policies, urbanization, grid instability, disaster preparedness, and infrastructure development.

- Market Share: Brazil and Mexico hold significant shares, with dominant segments reflecting essential power needs.

Latin America Portable Generator Market Product Landscape

The Latin America portable generator market is defined by a landscape of increasingly sophisticated and versatile products. Innovations are centered on enhancing reliability, portability, and user convenience. Manufacturers are focusing on developing models with improved fuel efficiency, reduced noise levels, and enhanced safety features to meet stringent environmental and consumer expectations. The integration of smart technology, allowing for remote monitoring and control, is a growing trend, particularly for higher-end models. Applications range from essential backup power for homes and businesses during outages to powering remote construction sites, outdoor events, and recreational activities. Performance metrics such as wattage output, run time, fuel consumption, and durability are key differentiators. Unique selling propositions often revolve around robust build quality for demanding environments, user-friendly interfaces, and extended warranty periods. Technological advancements are pushing towards cleaner emissions and greater fuel flexibility, with dual-fuel and tri-fuel options becoming more prevalent to cater to diverse fuel availability and cost considerations.

Key Drivers, Barriers & Challenges in Latin America Portable Generator Market

The Latin America portable generator market is propelled by several key drivers. Economic development and industrial growth in countries like Brazil and Mexico necessitate reliable power for businesses to maintain operations and productivity, significantly boosting demand for generators. Grid instability and frequent power outages across the region are a primary catalyst, compelling both residential and commercial users to invest in backup power solutions for preparedness and business continuity. Furthermore, the increasing frequency of natural disasters like hurricanes and earthquakes amplifies the need for portable generators as essential emergency equipment. The growing demand for off-grid power solutions in remote agricultural and mining regions also contributes to market growth.

However, several barriers and challenges temper this growth. High upfront costs of advanced portable generators can be a significant deterrent for a segment of the population, especially in economically sensitive regions. Limited access to financing and credit facilities can further restrict purchasing power. Fluctuating fuel prices can impact the long-term operational costs, making it challenging for users to budget effectively. Regulatory hurdles and import duties in some countries can increase the cost of bringing products into the market and slow down adoption. Logistical complexities in vast and sometimes underdeveloped territories can also pose challenges for distribution and after-sales service. Intense competition and price wars among manufacturers and distributors can also put pressure on profit margins.

- Drivers: Economic growth, grid instability, natural disasters, off-grid power demand, urbanization.

- Barriers: High upfront costs, limited financing, fuel price volatility, regulatory complexities, logistical challenges, intense competition.

Emerging Opportunities in Latin America Portable Generator Market

Emerging opportunities in the Latin America portable generator market lie in the increasing adoption of smart and connected generators offering remote monitoring, diagnostics, and load management capabilities, catering to tech-savvy consumers and sophisticated commercial operations. The development of eco-friendly portable generators that utilize cleaner fuels or offer hybrid power solutions presents a significant opportunity as environmental consciousness grows. Expansion into underserved rural and remote areas with tailored, rugged, and cost-effective generator solutions can unlock new customer bases. The growing popularity of outdoor recreational activities and a rise in demand for portable power at events and festivals also presents a niche but expanding market. Furthermore, partnerships with local distributors and service providers can enhance market penetration and customer support in diverse geographies.

Growth Accelerators in the Latin America Portable Generator Market Industry

Several growth accelerators are poised to fuel the Latin America portable generator market. Technological breakthroughs leading to more efficient, quieter, and sustainable generator designs will drive adoption. Strategic partnerships and collaborations between manufacturers and local distributors are crucial for expanding reach and improving market access. Government initiatives promoting energy security and disaster preparedness can incentivize purchases and create supportive regulatory environments. The increasing urbanization and the expansion of the middle class in key Latin American economies will continue to bolster demand for residential backup power solutions. Lastly, a focus on innovative business models, such as rental services and power-as-a-service, could unlock new revenue streams and customer segments.

Key Players Shaping the Latin America Portable Generator Market Market

- Briggs & Stratton Corporation

- Atlas Copco AB

- Caterpillar Inc.

- Kohler Power Systems

- Generac Holdings Inc.

Notable Milestones in Latin America Portable Generator Market Sector

- May 2022: Generac Power Systems Inc. launched two portable dual fuel gas generators, the Powermate 7500 Watt Duel Fuel Portable Generator and the Powermate 4500 Watt Duel Fuel Portable Generator, designed to operate on gasoline or LP gas, enhancing fuel flexibility for users in the region.

In-Depth Latin America Portable Generator Market Market Outlook

The outlook for the Latin America portable generator market remains exceptionally strong, driven by persistent demand for reliable power solutions and continuous innovation. Growth accelerators such as technological advancements in fuel efficiency and smart features, coupled with strategic market expansion by key players, will continue to propel the industry forward. The increasing focus on energy resilience in the face of climate change and evolving grid infrastructures presents a significant long-term opportunity. Untapped markets within rural and less developed regions offer substantial potential for tailored product offerings. Strategic partnerships and a keen understanding of evolving consumer preferences for sustainable and convenient power will be crucial for capitalizing on future growth prospects and solidifying market leadership in this dynamic sector.

Latin America Portable Generator Market Segmentation

-

1. Power Rating

- 1.1. Below 5 kW

- 1.2. 5-10 kW

- 1.3. Above 10 kW

-

2. Fuel Type

- 2.1. Gas

- 2.2. Diesel

- 2.3. Other Fuel Types

-

3. End-user

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

-

4. Geography

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Cuba

- 4.5. Rest of Latin America

Latin America Portable Generator Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Argentina

- 4. Cuba

- 5. Rest of Latin America

Latin America Portable Generator Market Regional Market Share

Geographic Coverage of Latin America Portable Generator Market

Latin America Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Power

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power

- 3.4. Market Trends

- 3.4.1. Residential Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Below 5 kW

- 5.1.2. 5-10 kW

- 5.1.3. Above 10 kW

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gas

- 5.2.2. Diesel

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Argentina

- 5.4.4. Cuba

- 5.4.5. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Mexico

- 5.5.3. Argentina

- 5.5.4. Cuba

- 5.5.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. Brazil Latin America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Below 5 kW

- 6.1.2. 5-10 kW

- 6.1.3. Above 10 kW

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gas

- 6.2.2. Diesel

- 6.2.3. Other Fuel Types

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Industrial

- 6.3.2. Commercial

- 6.3.3. Residential

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Mexico

- 6.4.3. Argentina

- 6.4.4. Cuba

- 6.4.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. Mexico Latin America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Below 5 kW

- 7.1.2. 5-10 kW

- 7.1.3. Above 10 kW

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gas

- 7.2.2. Diesel

- 7.2.3. Other Fuel Types

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Industrial

- 7.3.2. Commercial

- 7.3.3. Residential

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Mexico

- 7.4.3. Argentina

- 7.4.4. Cuba

- 7.4.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. Argentina Latin America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Below 5 kW

- 8.1.2. 5-10 kW

- 8.1.3. Above 10 kW

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gas

- 8.2.2. Diesel

- 8.2.3. Other Fuel Types

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Industrial

- 8.3.2. Commercial

- 8.3.3. Residential

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Mexico

- 8.4.3. Argentina

- 8.4.4. Cuba

- 8.4.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. Cuba Latin America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 9.1.1. Below 5 kW

- 9.1.2. 5-10 kW

- 9.1.3. Above 10 kW

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gas

- 9.2.2. Diesel

- 9.2.3. Other Fuel Types

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Industrial

- 9.3.2. Commercial

- 9.3.3. Residential

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.4.3. Argentina

- 9.4.4. Cuba

- 9.4.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 10. Rest of Latin America Latin America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Power Rating

- 10.1.1. Below 5 kW

- 10.1.2. 5-10 kW

- 10.1.3. Above 10 kW

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Gas

- 10.2.2. Diesel

- 10.2.3. Other Fuel Types

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Industrial

- 10.3.2. Commercial

- 10.3.3. Residential

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Brazil

- 10.4.2. Mexico

- 10.4.3. Argentina

- 10.4.4. Cuba

- 10.4.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Power Rating

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Briggs & Stratton Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Atlas Copco AB*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Caterpillar Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kohler Power Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Generac Holdings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Briggs & Stratton Corporation

List of Figures

- Figure 1: Latin America Portable Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Portable Generator Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 2: Latin America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 3: Latin America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Latin America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 5: Latin America Portable Generator Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Latin America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 7: Latin America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Latin America Portable Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Latin America Portable Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Latin America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 12: Latin America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 13: Latin America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Latin America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 15: Latin America Portable Generator Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 16: Latin America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 17: Latin America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Latin America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Latin America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Latin America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Latin America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 22: Latin America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 23: Latin America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 24: Latin America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 25: Latin America Portable Generator Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 26: Latin America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 27: Latin America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Latin America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Latin America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Latin America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Latin America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 32: Latin America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 33: Latin America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 34: Latin America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 35: Latin America Portable Generator Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 36: Latin America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 37: Latin America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Latin America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Latin America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Latin America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Latin America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 42: Latin America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 43: Latin America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 44: Latin America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 45: Latin America Portable Generator Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 46: Latin America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 47: Latin America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Latin America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Latin America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Latin America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Latin America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 52: Latin America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 53: Latin America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 54: Latin America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 55: Latin America Portable Generator Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 56: Latin America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 57: Latin America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Latin America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Latin America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Latin America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Portable Generator Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Latin America Portable Generator Market?

Key companies in the market include Briggs & Stratton Corporation, Atlas Copco AB*List Not Exhaustive, Caterpillar Inc, Kohler Power Systems, Generac Holdings Inc.

3. What are the main segments of the Latin America Portable Generator Market?

The market segments include Power Rating, Fuel Type, End-user, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Power.

6. What are the notable trends driving market growth?

Residential Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power.

8. Can you provide examples of recent developments in the market?

May 2022: Generac Power Systems Inc., one of the industry leaders in the region, launched two portable dual fuel gas generators named the Powermate 7500 Watt Duel Fuel Portable Generator and the Powermate 4500 Watt Duel Fuel Portable Generator. Both models are designed to operate on gasoline or LP gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Portable Generator Market?

To stay informed about further developments, trends, and reports in the Latin America Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence