Key Insights

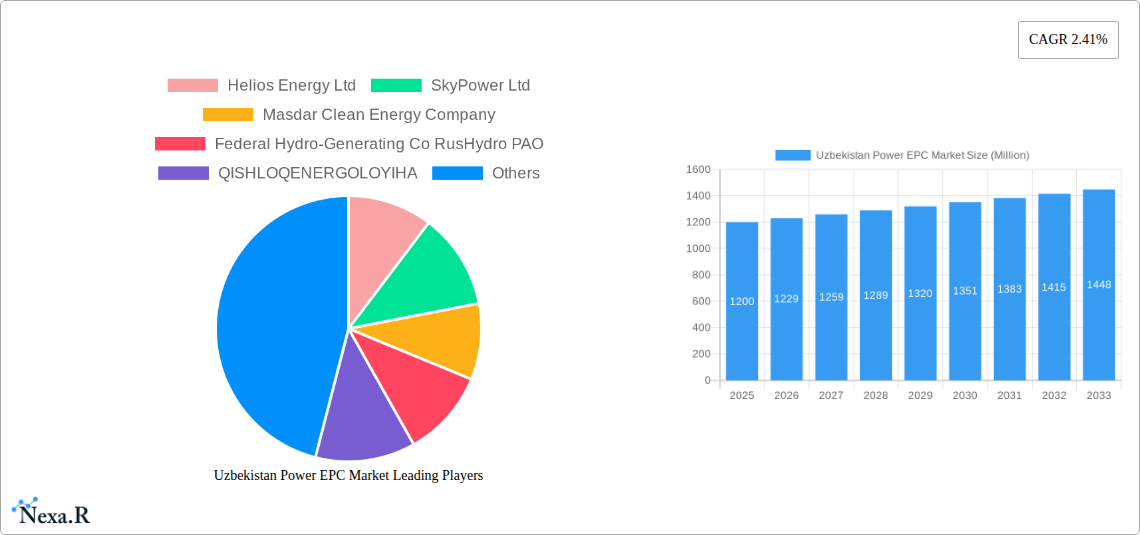

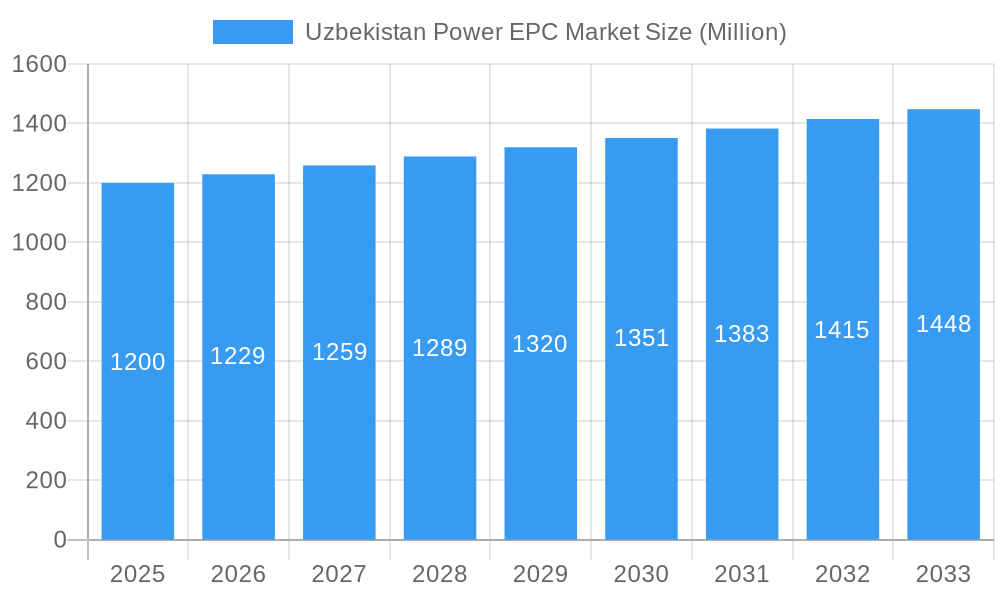

The Uzbekistan Power EPC market is experiencing robust growth, driven by escalating electricity demand to support economic expansion and infrastructure modernization. With a projected CAGR of 2.41% from the base year 2025, the market size is expected to grow from $145.81 billion to reach approximately $1.5 billion by the end of the forecast period. This upward trajectory is underpinned by the government's strategic energy initiatives, emphasizing power generation diversification, enhanced transmission and distribution networks, and foreign investment attraction. Key growth drivers include the imperative for reliable power to bolster industrial development, modernize agriculture, and cater to a growing urban populace. Uzbekistan's strategic regional positioning and its ambition to become an energy hub are attracting significant investment in new power projects, with a notable focus on renewable energy sources such as solar and wind, complementing the continued significance of thermal power.

Uzbekistan Power EPC Market Market Size (In Billion)

The Uzbekistan power EPC services market is characterized by a strategic focus on both conventional and advanced energy infrastructure development. While thermal power generation, a cornerstone of current capacity, remains vital, there is a pronounced pivot towards renewables, alongside planned expansions in hydropower and nuclear capabilities. Numerous significant projects are actively underway or in development stages across power generation, transmission, and distribution, aimed at upgrading aged infrastructure and meeting escalating energy requirements. The government's proactive stance in cultivating an conducive environment for private sector engagement, including international EPC firms, is a prominent trend. However, potential restraints may arise from the necessity for technological upgrades, regulatory streamlining, and the effective integration of diverse energy sources. Prominent companies such as Helios Energy Ltd, SkyPower Ltd, Masdar Clean Energy Company, Federal Hydro-Generating Co RusHydro PAO, QISHLOQENERGOLOYIHA, Rosatom Corp, and Mitsubishi Heavy Industries Ltd are instrumental in shaping Uzbekistan's future power sector through their specialized EPC expertise.

Uzbekistan Power EPC Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Uzbekistan Power Engineering, Procurement, and Construction (EPC) market, offering a 15-year outlook from 2019 to 2033. Focusing on market dynamics, growth trajectories, dominant segments, product offerings, key industry players, and future opportunities, this report serves as an indispensable resource for industry professionals aiming to understand and leverage the evolving energy infrastructure landscape in Uzbekistan. The report includes a detailed segmentation of the Power Generation Scenario (Thermal, Hydropower, Renewables, Nuclear) and the Power Transmission and Distribution Scenario. All financial figures are presented in Million USD.

Uzbekistan Power EPC Market Market Dynamics & Structure

The Uzbekistan Power EPC market is characterized by a dynamic interplay of state-led development initiatives and increasing private sector participation. While market concentration has historically been influenced by state-owned enterprises, recent reforms are fostering a more competitive environment. Technological innovation is primarily driven by the adoption of advanced renewable energy technologies and the modernization of existing thermal power plants. Regulatory frameworks are steadily evolving to attract foreign investment and streamline project execution. Competitive product substitutes are emerging, particularly in the renewable energy sector, challenging traditional thermal power solutions. End-user demographics are shifting with a growing demand for reliable and cleaner energy sources across industrial, commercial, and residential sectors. Mergers and acquisitions (M&A) trends are anticipated to accelerate as larger international players seek to establish a stronger foothold and local companies consolidate their capabilities. For instance, the recent acquisition of a significant stake in a new solar project by a consortium of international investors highlights this trend, valued at approximately $250 Million. Barriers to innovation include the upfront capital required for advanced technologies and the need for skilled local labor to operate and maintain sophisticated power infrastructure.

- Market Concentration: Moderate to High, with increasing fragmentation due to new entrants.

- Technological Innovation Drivers: Renewable energy integration, smart grid technologies, efficient thermal power plant upgrades.

- Regulatory Frameworks: Evolving policies to encourage FDI and private participation, with ongoing reforms in energy sector liberalization.

- Competitive Product Substitutes: Solar PV, Wind Turbines, Battery Energy Storage Systems (BESS) vs. Conventional Thermal Power.

- End-User Demographics: Growing industrial demand, increasing urbanization, and government focus on rural electrification.

- M&A Trends: Increasing strategic partnerships and acquisitions by international EPC firms.

Uzbekistan Power EPC Market Growth Trends & Insights

The Uzbekistan Power EPC market is projected for robust growth, driven by the nation's ambitious energy diversification and modernization agenda. The market size is expected to expand significantly from an estimated $1,500 Million in the base year 2025 to over $4,000 Million by the forecast year 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 13.5%. Adoption rates for renewable energy sources, particularly solar and wind power, are accelerating as Uzbekistan aims to reduce its reliance on fossil fuels and meet its growing energy demand. Technological disruptions are evident with the increasing deployment of utility-scale solar farms and the integration of advanced grid management systems. Consumer behavior shifts are observed with a growing preference for sustainable and cost-effective energy solutions. The government's commitment to renewable energy targets, coupled with international financing mechanisms, further fuels this growth trajectory. The development of new transmission and distribution infrastructure to support these new power sources will also be a major growth catalyst. Market penetration of renewable energy projects is on an upward trend, projected to reach over 30% of the total installed capacity by 2033. Investments in energy efficiency technologies within existing thermal power plants are also contributing to market expansion. The adoption of smart grid technologies will improve grid reliability and reduce transmission losses, creating further opportunities for EPC providers.

Dominant Regions, Countries, or Segments in Uzbekistan Power EPC Market

The Power Generation Scenario, with a particular emphasis on Renewables, is emerging as the dominant segment driving growth in the Uzbekistan Power EPC market. This dominance is underpinned by a confluence of strategic government policies, favorable environmental conditions, and significant international investment interest. Uzbekistan possesses vast untapped potential for solar and wind energy, making these renewable sources a cornerstone of its energy security strategy.

Renewables (Solar and Wind): This sub-segment is experiencing unprecedented expansion. Government targets to increase the share of renewables in the energy mix, coupled with ambitious auction programs for solar and wind projects, are creating a sustained demand for EPC services. For instance, the successful commissioning of the $600 Million Nur-Navoi solar project is a testament to this trend. The availability of substantial land for development and declining global costs of solar PV and wind turbine technologies further bolster its appeal.

Thermal Power (Modernization and Efficiency): While renewables are the growth engine, the modernization and efficiency improvements of existing thermal power plants remain a crucial aspect of the market. Significant investments are being made to upgrade older units, reduce emissions, and improve fuel efficiency, ensuring a stable baseload power supply. The planned upgrades for the $400 Million Tashkent Thermal Power Plant exemplify this ongoing commitment.

Hydropower: Uzbekistan has a well-established hydropower sector, and while new large-scale projects are less frequent, upgrades and maintenance of existing facilities continue to offer EPC opportunities. The potential for small-scale hydropower development in mountainous regions also presents niche opportunities.

Nuclear (Planned Projects): The planned development of Uzbekistan's first nuclear power plant, in collaboration with Rosatom Corp, represents a significant future prospect, albeit with a longer gestation period. This multi-billion-dollar project will necessitate extensive EPC expertise.

The Power Transmission and Distribution Scenario also plays a vital role, acting as an enabler for the expanding generation capacity. Investments in upgrading and expanding the grid network are crucial to integrate new power sources, reduce transmission losses, and ensure reliable power delivery across the country. The development of smart grids and substations to accommodate the intermittency of renewables is a key focus.

Uzbekistan Power EPC Market Product Landscape

The Uzbekistan Power EPC market's product landscape is characterized by a growing demand for advanced and sustainable energy solutions. Innovations in solar photovoltaic (PV) technology, including higher efficiency panels and bifacial modules, are being widely adopted in utility-scale projects. Wind turbine technology is also evolving, with larger capacity turbines being deployed to maximize energy generation. For thermal power, the focus is on upgrading existing plants with more efficient boilers, advanced emission control systems, and integrated gasification combined cycle (IGCC) technologies. In power transmission and distribution, smart grid technologies, including advanced metering infrastructure (AMI), supervisory control and data acquisition (SCADA) systems, and digital substations, are gaining prominence for enhanced grid management and reliability. The unique selling proposition for EPC providers lies in their ability to offer integrated solutions that combine cutting-edge technology with efficient project management and adherence to international standards.

Key Drivers, Barriers & Challenges in Uzbekistan Power EPC Market

Key Drivers:

- Government Support and Renewable Energy Targets: Ambitious national goals for renewable energy adoption, aiming to diversify the energy mix and reduce carbon emissions.

- Growing Energy Demand: Rapid industrialization and urbanization are increasing the demand for reliable and expanded power supply.

- Foreign Direct Investment (FDI) Incentives: Favorable investment climate and government initiatives to attract international players and capital.

- Technological Advancements: Availability of cost-effective and efficient renewable energy technologies.

- Infrastructure Modernization: Need to upgrade and expand aging transmission and distribution networks.

Barriers & Challenges:

- Financing and Capital Availability: High upfront costs for large-scale projects, especially for renewable energy and nuclear power.

- Skilled Workforce Shortages: Limited availability of experienced engineers and technicians for specialized EPC roles.

- Regulatory and Permitting Complexities: Navigating bureaucratic processes and obtaining necessary approvals can be time-consuming.

- Supply Chain Disruptions: Potential challenges in procuring specialized equipment and materials due to global logistics.

- Grid Integration Issues: Integrating variable renewable energy sources into the existing grid requires significant investment in grid modernization.

Emerging Opportunities in Uzbekistan Power EPC Market

Emerging opportunities in the Uzbekistan Power EPC market lie in the untapped potential of distributed renewable energy generation, including rooftop solar for commercial and industrial consumers. The development of energy storage solutions to complement renewable energy integration presents another significant avenue. Furthermore, the growing interest in green hydrogen production, leveraging Uzbekistan's renewable energy resources, opens up new frontiers for EPC contractors. The modernization of existing industrial facilities to improve energy efficiency and reduce their carbon footprint also offers substantial project potential. The expansion of charging infrastructure for electric vehicles (EVs) driven by government initiatives will also create niche EPC opportunities.

Growth Accelerators in the Uzbekistan Power EPC Market Industry

Several key factors are poised to act as growth accelerators for the Uzbekistan Power EPC market. The continued commitment from the government to achieve ambitious renewable energy targets, supported by international financial institutions, will drive consistent project pipelines. Strategic partnerships between international EPC giants and local Uzbek companies will foster knowledge transfer and enhance local capacity building, accelerating project execution. The increasing adoption of digital technologies and smart grid solutions will not only improve efficiency but also unlock new revenue streams for EPC providers offering integrated solutions. Furthermore, the potential development of cross-border energy transmission projects with neighboring countries could significantly expand the scope of EPC activities.

Key Players Shaping the Uzbekistan Power EPC Market Market

- Helios Energy Ltd

- SkyPower Ltd

- Masdar Clean Energy Company

- Federal Hydro-Generating Co RusHydro PAO

- QISHLOQENERGOLOYIHA

- Rosatom Corp

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Uzbekistan Power EPC Market Sector

- 2019: Launch of ambitious renewable energy targets by the government, signaling a shift towards green energy.

- 2020: Signing of key agreements for the development of large-scale solar projects with international developers.

- 2021: Successful commissioning of initial phases of utility-scale solar farms, demonstrating growing EPC capabilities.

- 2022: Increased focus on modernization of existing thermal power plants to improve efficiency and reduce emissions.

- 2023: Announcement of plans for the first nuclear power plant project, marking a significant long-term opportunity.

- 2024: Continued expansion of transmission and distribution infrastructure to support the integration of new power sources.

In-Depth Uzbekistan Power EPC Market Market Outlook

The Uzbekistan Power EPC market is on a trajectory of strong and sustainable growth, driven by a clear national vision for energy security and sustainability. The market outlook is exceptionally positive, fueled by substantial government investments, attractive incentives for foreign direct investment, and the inherent potential for renewable energy development. The ongoing modernization of thermal power plants and the strategic introduction of nuclear energy will ensure a diversified and reliable energy mix, while the expansion of transmission and distribution infrastructure will be critical enablers. EPC companies that can offer innovative, cost-effective, and integrated solutions, coupled with a strong understanding of the local regulatory landscape and a commitment to sustainable practices, are well-positioned to thrive in this dynamic market. The strategic opportunities presented by this evolving energy landscape promise significant returns for stakeholders.

Uzbekistan Power EPC Market Segmentation

-

1. Power Generation Scenario Fuel Type

-

1.1. Thermal

- 1.1.1. Market Overview

-

1.1.2. Key Project Information

- 1.1.2.1. Existing Projects

- 1.1.2.2. Planned and Upcoming Projects

- 1.2. Hydropower

- 1.3. Renewables

-

1.4. Nuclear

- 1.4.1. Planned Projects

-

1.1. Thermal

-

2. Power Transmission and Distribution Scenario

- 2.1. Market Overview

- 2.2. Projects

- 2.3. Planned and Upcoming Projects

Uzbekistan Power EPC Market Segmentation By Geography

- 1. Uzbekistan

Uzbekistan Power EPC Market Regional Market Share

Geographic Coverage of Uzbekistan Power EPC Market

Uzbekistan Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uzbekistan Power EPC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario Fuel Type

- 5.1.1. Thermal

- 5.1.1.1. Market Overview

- 5.1.1.2. Key Project Information

- 5.1.1.2.1. Existing Projects

- 5.1.1.2.2. Planned and Upcoming Projects

- 5.1.2. Hydropower

- 5.1.3. Renewables

- 5.1.4. Nuclear

- 5.1.4.1. Planned Projects

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution Scenario

- 5.2.1. Market Overview

- 5.2.2. Projects

- 5.2.3. Planned and Upcoming Projects

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uzbekistan

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Helios Energy Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SkyPower Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Masdar Clean Energy Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Federal Hydro-Generating Co RusHydro PAO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 QISHLOQENERGOLOYIHA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rosatom Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Helios Energy Ltd

List of Figures

- Figure 1: Uzbekistan Power EPC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Uzbekistan Power EPC Market Share (%) by Company 2025

List of Tables

- Table 1: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Generation Scenario Fuel Type 2020 & 2033

- Table 2: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Transmission and Distribution Scenario 2020 & 2033

- Table 3: Uzbekistan Power EPC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Generation Scenario Fuel Type 2020 & 2033

- Table 5: Uzbekistan Power EPC Market Revenue billion Forecast, by Power Transmission and Distribution Scenario 2020 & 2033

- Table 6: Uzbekistan Power EPC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uzbekistan Power EPC Market?

The projected CAGR is approximately 2.41%.

2. Which companies are prominent players in the Uzbekistan Power EPC Market?

Key companies in the market include Helios Energy Ltd, SkyPower Ltd, Masdar Clean Energy Company, Federal Hydro-Generating Co RusHydro PAO, QISHLOQENERGOLOYIHA, Rosatom Corp, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Uzbekistan Power EPC Market?

The market segments include Power Generation Scenario Fuel Type, Power Transmission and Distribution Scenario.

4. Can you provide details about the market size?

The market size is estimated to be USD 145.81 billion as of 2022.

5. What are some drivers contributing to market growth?

; Drivers; Restraints.

6. What are the notable trends driving market growth?

Thermal Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uzbekistan Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uzbekistan Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uzbekistan Power EPC Market?

To stay informed about further developments, trends, and reports in the Uzbekistan Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence