Key Insights

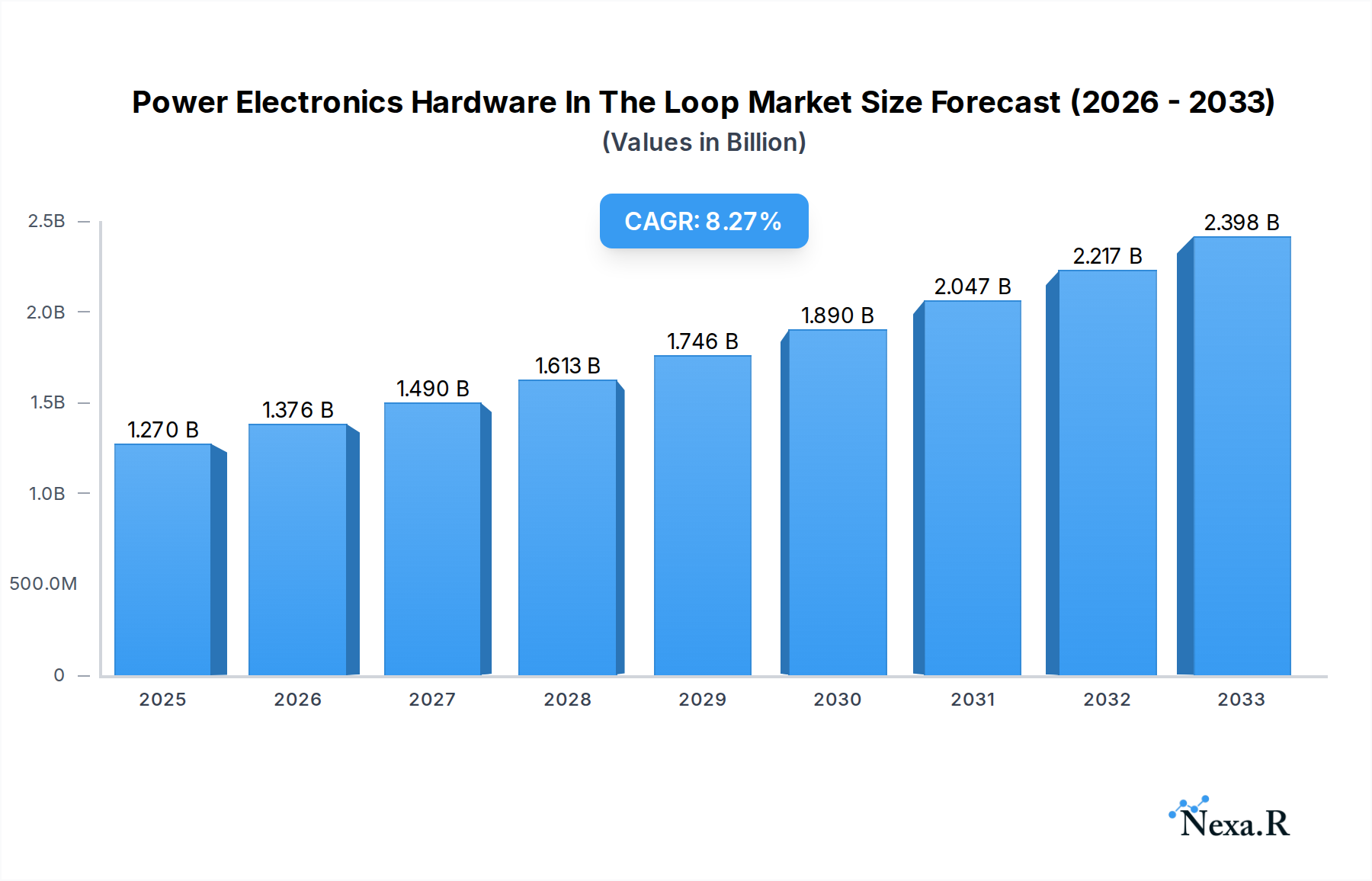

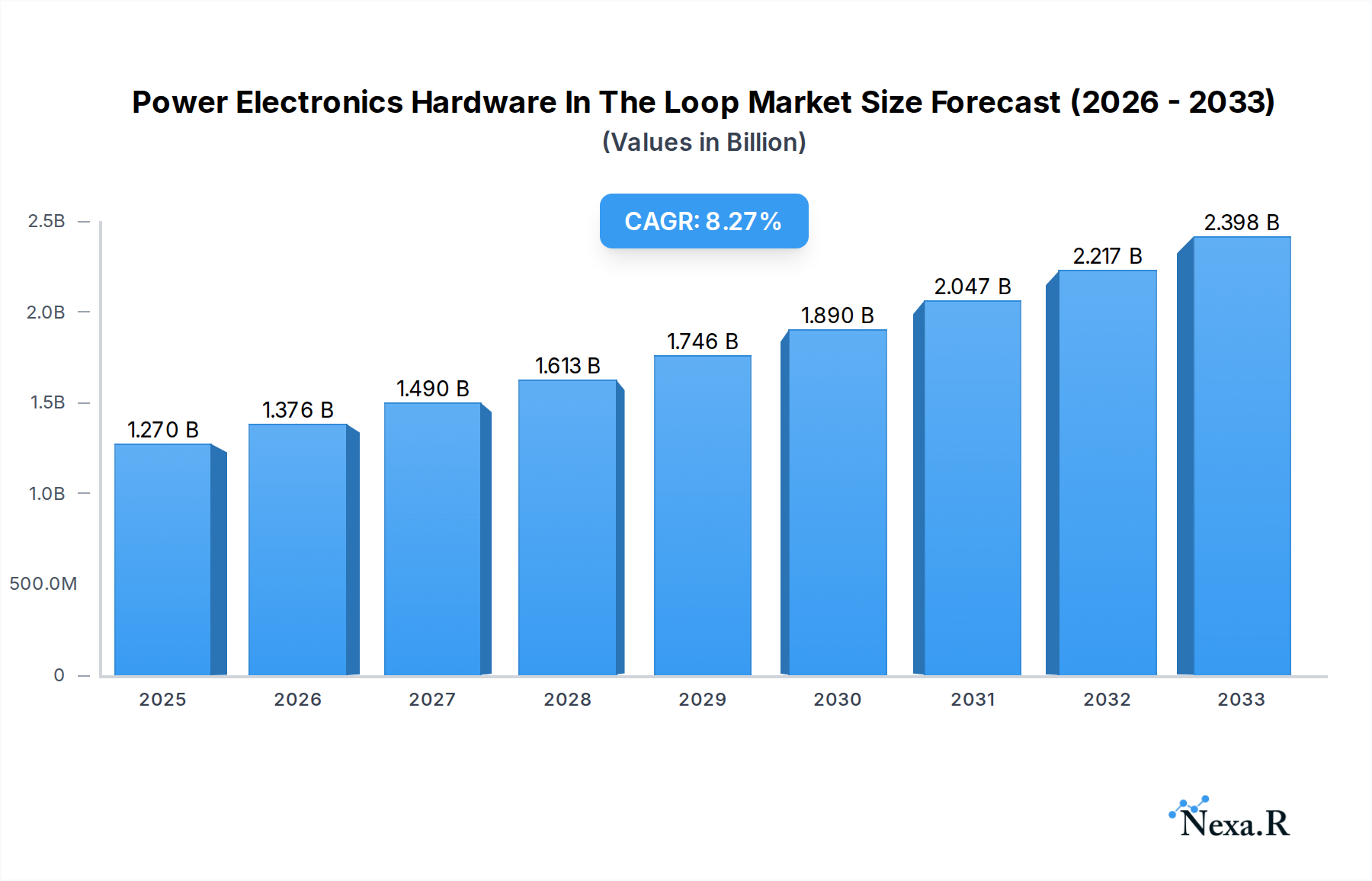

The global Power Electronics Hardware-in-the-Loop (HIL) market is poised for significant expansion, projected to reach approximately $1.27 billion by 2025. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 8.3% through 2033, underscoring the escalating demand for advanced simulation and testing solutions in the power electronics sector. The increasing complexity and stringent performance requirements of power electronic systems across various industries, including automotive, renewable energy, and industrial automation, are primary drivers. The automotive sector, with its rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), is a particularly strong contributor, demanding robust and reliable power electronics for battery management systems, motor controllers, and charging infrastructure. Similarly, the surge in renewable energy integration, such as solar and wind power, necessitates sophisticated HIL testing to ensure grid stability and efficient energy conversion. Emerging trends like the development of smart grids, advancements in high-voltage direct current (HVDC) transmission, and the miniaturization of power converters further amplify the need for accurate and efficient HIL testing platforms.

Power Electronics Hardware In The Loop Market Size (In Billion)

Despite the robust growth trajectory, certain factors may present challenges to the market. High initial investment costs for sophisticated HIL systems can be a barrier for smaller enterprises or research institutions. Furthermore, the need for specialized expertise to operate and maintain these complex testing environments can also influence adoption rates. However, the continuous innovation in HIL technology, leading to increased affordability, enhanced simulation capabilities, and user-friendly interfaces, is expected to mitigate these restraints. The market is segmented by application, with applications in electric vehicle testing, renewable energy grid integration, industrial motor drives, and aerospace & defense exhibiting distinct growth patterns. By type, real-time simulators, data acquisition systems, and power amplifiers form the core components of HIL solutions, with ongoing advancements in each area driving market evolution. Key players like DSpace GmbH, National Instruments, and Typhoon HIL are at the forefront of innovation, continuously introducing cutting-edge solutions to meet the evolving demands of the power electronics industry.

Power Electronics Hardware In The Loop Company Market Share

Power Electronics Hardware In The Loop (HIL) Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Power Electronics Hardware In The Loop (HIL) market, covering market dynamics, growth trends, regional dominance, product landscape, and key player strategies. Leveraging a robust study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report offers unparalleled insights for industry stakeholders. We delve into the parent market dynamics of Power Electronics and the child market segments within HIL, providing a holistic view of market evolution.

Power Electronics Hardware In The Loop Market Dynamics & Structure

The global Power Electronics Hardware In The Loop (HIL) market is characterized by a moderate to high concentration, driven by the increasing complexity of power electronic systems and the imperative for robust, real-time testing solutions. Key innovation drivers include the relentless demand for higher efficiency, greater power density, and enhanced reliability in electric vehicles (EVs), renewable energy integration, and industrial automation. Regulatory frameworks, particularly those promoting grid stability and emissions reduction, indirectly fuel HIL adoption by mandating stringent performance standards for power converters and inverters. Competitive product substitutes, such as purely software-based simulation, are increasingly being supplanted by HIL due to its ability to accurately model real-world hardware interactions, thereby mitigating risks associated with physical prototyping. End-user demographics are shifting towards advanced research and development departments in automotive OEMs, inverter manufacturers, and energy utility companies. Mergers and acquisition (M&A) trends are observed, with established players seeking to expand their technological portfolios and geographic reach. For instance, the volume of M&A deals in the broader power electronics sector has seen a XX% increase in the past three years, signaling consolidation and strategic investment.

- Market Concentration: Moderate to High, dominated by a few key HIL solution providers.

- Technological Innovation Drivers: Demand for EV powertrain testing, renewable energy grid integration, smart grid development, and advanced industrial control systems.

- Regulatory Frameworks: Environmental regulations (e.g., emissions standards), grid codes, and safety certifications for power electronic devices.

- Competitive Product Substitutes: Purely software-based simulation, physical prototyping.

- End-User Demographics: Automotive (EV/HEV), Renewable Energy (solar, wind), Industrial Automation, Aerospace & Defense, Research Institutions.

- M&A Trends: Strategic acquisitions to gain access to advanced HIL simulation technologies, expand product portfolios, and increase market share. The average deal size for HIL-specific acquisitions has been estimated at $XX billion.

Power Electronics Hardware In The Loop Growth Trends & Insights

The global Power Electronics Hardware In The Loop (HIL) market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust growth is underpinned by an escalating adoption rate of HIL technology across various industries, driven by its critical role in accelerating product development cycles and reducing testing costs for complex power electronic systems. By 2025, the market size is estimated to reach $XX billion, fueled by significant investments in electric mobility and renewable energy infrastructure. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) into HIL simulation platforms, are enhancing predictive capabilities and fault detection, further increasing their appeal. Consumer behavior shifts, particularly the growing demand for sustainable energy solutions and sophisticated automotive technologies, are indirectly driving the need for advanced HIL testing. Market penetration of HIL solutions is expected to rise from approximately XX% in 2025 to over XX% by 2033. The parent market, Power Electronics, is estimated to be valued at $XXX billion in 2025, with HIL representing a critical enabling technology. The child market segments within HIL, such as EV powertrain HIL and renewable energy grid simulation HIL, are showing particularly dynamic growth trajectories.

- Market Size Evolution: Projected to grow from an estimated $XX billion in 2025 to over $XXX billion by 2033.

- Adoption Rates: Increasing significantly across automotive, renewable energy, and industrial sectors, driven by cost-efficiency and risk mitigation.

- Technological Disruptions: Integration of AI/ML for predictive maintenance, advanced fault injection, and optimized control algorithms. Development of higher fidelity, real-time simulation models.

- Consumer Behavior Shifts: Demand for energy-efficient products, advanced automotive features, and reliable grid infrastructure.

- Market Penetration: Expected to expand from XX% in 2025 to over XX% by 2033.

- CAGR (2025-2033): XX%

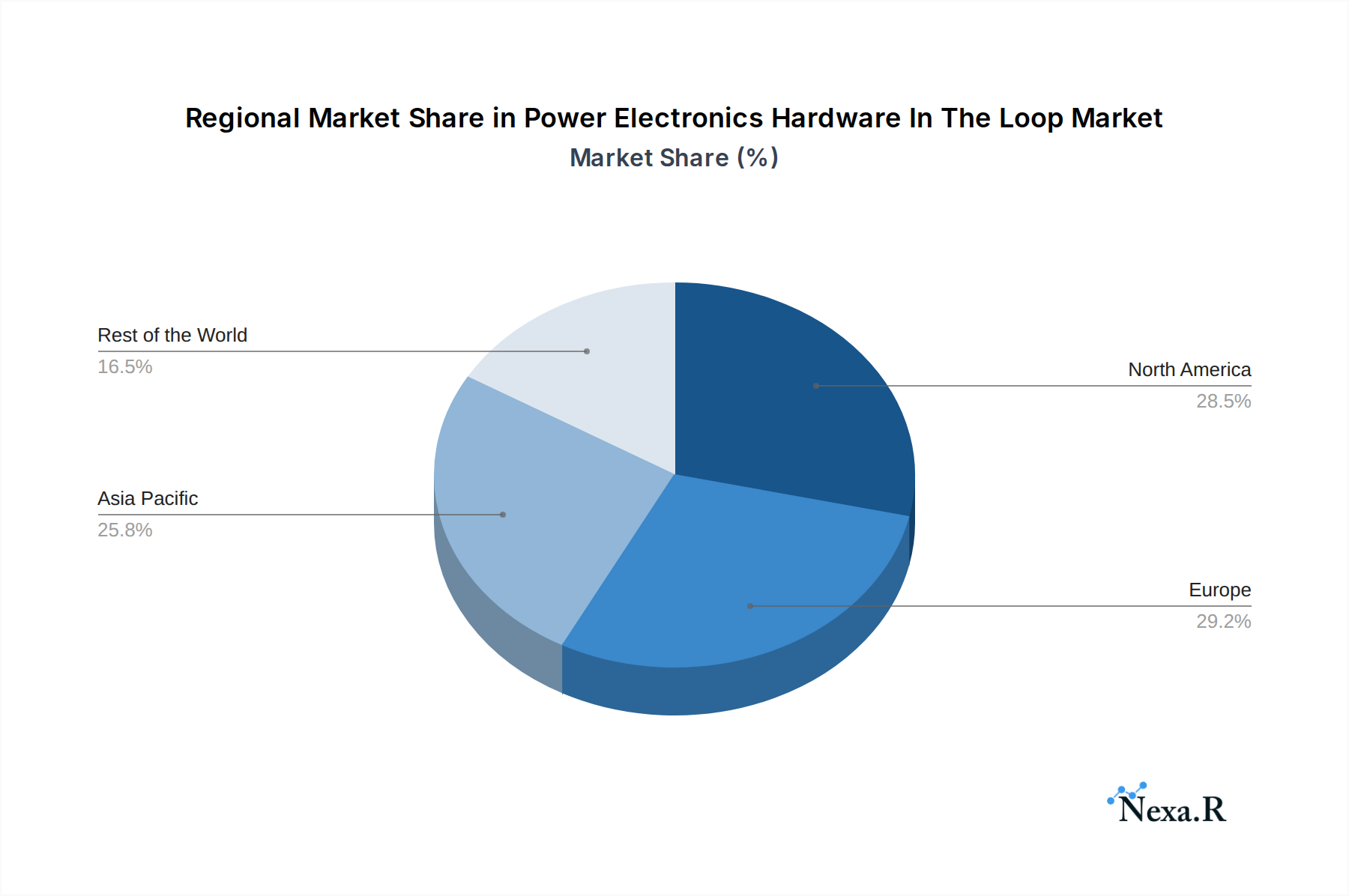

Dominant Regions, Countries, or Segments in Power Electronics Hardware In The Loop

The Application segment of Electric Vehicle (EV) Powertrain Testing is a primary driver of growth and dominance within the global Power Electronics Hardware In The Loop (HIL) market. The rapidly expanding electric vehicle industry, particularly in North America, Europe, and Asia Pacific, necessitates rigorous and efficient testing of complex EV powertrains, including inverters, converters, battery management systems (BMS), and electric motors. Consequently, the demand for specialized EV powertrain HIL systems is soaring. Countries like the United States, Germany, China, and South Korea are leading the charge due to substantial government investments in EV infrastructure, favorable regulatory policies, and the presence of major automotive manufacturers and their R&D centers. For instance, the United States is projected to hold a XX% market share in the EV HIL segment by 2028, driven by aggressive EV adoption targets and advancements in battery technology. Germany, with its strong automotive engineering heritage and leading EV manufacturers, is another key player, focusing on high-fidelity simulation for powertrain optimization and reliability. China, the world's largest EV market, presents immense growth potential with extensive manufacturing capabilities and government support for new energy vehicles. The Type segment of Real-Time HIL Simulators plays a crucial role in enabling this dominance by providing the necessary computational power and deterministic execution required for accurate emulation of dynamic power electronic systems. These simulators are vital for testing control algorithms and system responses under various operating conditions, a critical requirement for EV powertrain development. The market share for real-time HIL systems is estimated at XX% of the overall HIL market by 2025.

- Dominant Application Segment: Electric Vehicle (EV) Powertrain Testing

- Key Drivers: Rapid global EV adoption, increasing complexity of EV powertrains, stringent safety and performance standards, government incentives for EV manufacturing and adoption.

- Market Share: Estimated to account for over XX% of the total HIL market by 2028.

- Dominant Type Segment: Real-Time HIL Simulators

- Key Drivers: Need for deterministic, high-fidelity emulation of dynamic power electronic systems, capability to test control algorithms under realistic conditions.

- Market Share: Holding a significant XX% share of the HIL market in 2025.

- Leading Regions:

- North America (especially USA): Strong EV market, advanced R&D in automotive and renewable energy.

- Europe (especially Germany): Dominant automotive sector, focus on sustainable mobility and grid integration.

- Asia Pacific (especially China): Largest EV market, massive manufacturing base, and significant government support for new energy vehicles.

- Key Countries: United States, Germany, China, South Korea, Japan.

- Dominance Factors: Robust automotive industry, strong focus on renewable energy integration, supportive government policies, presence of leading power electronics and automotive manufacturers, extensive R&D investments.

- Growth Potential: High, driven by continued technological advancements and market expansion.

Power Electronics Hardware In The Loop Product Landscape

The Power Electronics Hardware In The Loop (HIL) market is witnessing a rapid evolution in its product landscape, characterized by increasingly sophisticated and specialized simulation platforms. Innovations are focused on enhancing real-time performance, accuracy, and scalability to meet the demands of complex power electronic systems. Key advancements include the integration of higher processing power for simulating more intricate system dynamics, improved I/O capabilities for seamless interfacing with external hardware, and enhanced software tools for model development and analysis. Applications of these HIL systems are diversifying, extending beyond traditional automotive and industrial sectors to areas like smart grid development, aerospace, and advanced scientific research. Unique selling propositions for leading products often lie in their modularity, user-friendly interfaces, and comprehensive model libraries covering a wide array of power electronic topologies and control strategies. Technological advancements are also emphasizing the development of cyber-physical systems and digital twins, allowing for more comprehensive testing and validation throughout the product lifecycle.

Key Drivers, Barriers & Challenges in Power Electronics Hardware In The Loop

The Power Electronics Hardware In The Loop (HIL) market is propelled by several key drivers. The increasing complexity and electrification of automotive powertrains, particularly in the Electric Vehicle (EV) sector, necessitate advanced testing solutions to ensure safety, efficiency, and reliability. Furthermore, the growing integration of renewable energy sources like solar and wind into existing power grids demands robust simulation of grid stability and control systems, a role HIL excels at. The push for industrial automation and the development of smart grids also contributes significantly to market growth.

However, several barriers and challenges temper this growth. The initial investment cost for high-performance HIL systems can be substantial, posing a challenge for smaller companies and research institutions. The complexity of setting up and maintaining these advanced simulation environments requires specialized expertise, leading to a talent gap. Supply chain disruptions for critical electronic components can also impact production timelines and costs for HIL vendors. Additionally, the continuous need for software updates and model compatibility with evolving hardware standards presents an ongoing challenge.

- Key Drivers:

- Rapid growth of the Electric Vehicle (EV) market.

- Increasing integration of renewable energy sources into power grids.

- Advancements in industrial automation and smart grid technologies.

- Need for faster product development cycles and reduced physical prototyping.

- Stringent safety and performance regulations for power electronic systems.

- Key Barriers & Challenges:

- High initial investment cost of advanced HIL systems.

- Requirement for specialized technical expertise and talent.

- Supply chain vulnerabilities for critical electronic components.

- Ongoing need for software updates and model compatibility.

- Competition from lower-cost, less comprehensive simulation solutions.

- Complexity in modeling highly dynamic and non-linear power electronic behaviors.

Emerging Opportunities in Power Electronics Hardware In The Loop

Emerging opportunities in the Power Electronics Hardware In The Loop (HIL) market are largely driven by the burgeoning fields of smart grids, advanced energy storage systems, and the increasing adoption of electric and autonomous vehicles. The development of microgrids and distributed energy resources presents a significant avenue for HIL solutions to test grid resilience and control strategies. Furthermore, the ongoing research into next-generation battery technologies and charging infrastructure will require advanced HIL platforms for validation. The aerospace and defense sectors are also showing increased interest in HIL for testing critical power systems. The rise of 5G technology and its impact on smart city infrastructure, which heavily relies on advanced power electronics, opens up new application areas for HIL.

- Smart Grid Development: Testing microgrid control, energy management systems, and grid stabilization under various fault conditions.

- Advanced Energy Storage: Validating battery management systems (BMS) for novel battery chemistries and large-scale energy storage solutions.

- Electric & Autonomous Vehicle Advancements: Testing advanced driver-assistance systems (ADAS) integration with EV powertrains, and the reliability of highly integrated power electronics in autonomous vehicles.

- Aerospace & Defense: Development and testing of advanced power conversion and distribution systems for aircraft and defense platforms.

- 5G Infrastructure: Testing power management solutions for 5G base stations and related smart city technologies.

Growth Accelerators in the Power Electronics Hardware In The Loop Industry

Several key factors are acting as growth accelerators for the Power Electronics Hardware In The Loop (HIL) industry. The relentless global push towards decarbonization and electrification, particularly in transportation and energy sectors, directly translates into increased demand for HIL solutions. Technological advancements in computing power and simulation algorithms are enabling higher fidelity and more complex system simulations, making HIL an indispensable tool. Strategic partnerships between HIL vendors and automotive manufacturers, as well as renewable energy companies, are fostering innovation and accelerating market penetration. The growing emphasis on product reliability and safety standards across industries is also a significant growth catalyst, as HIL provides a critical means to achieve these objectives without the risks and costs associated with extensive physical testing.

Key Players Shaping the Power Electronics Hardware In The Loop Market

- DSpace GmbH

- National Instruments

- Opal-RT Technologies

- Typhoon HIL

- Speedgoat GmbH

- Modeling Tech

Notable Milestones in Power Electronics Hardware In The Loop Sector

- 2019: Introduction of enhanced real-time simulation capabilities for electric vehicle component testing by leading HIL providers, enabling faster development cycles.

- 2020: Increased adoption of cloud-based HIL simulation platforms, offering greater accessibility and collaborative testing opportunities for global R&D teams.

- 2021: Significant advancements in AI-driven fault injection and predictive maintenance within HIL systems, enhancing test automation and system reliability assessment.

- 2022: Launch of new HIL platforms specifically designed for renewable energy grid integration, supporting the testing of complex inverter control strategies and grid codes.

- 2023: Growing interest and development of HIL solutions for testing advanced battery management systems (BMS) and electric propulsion systems for future mobility applications.

- 2024: Focus on increased modularity and scalability of HIL systems, allowing for customization and expansion based on specific project requirements and budgets.

In-Depth Power Electronics Hardware In The Loop Market Outlook

The future outlook for the Power Electronics Hardware In The Loop (HIL) market is exceptionally promising, driven by the foundational shift towards electrification and sustainable energy solutions. Continued technological breakthroughs in real-time simulation, AI integration for predictive diagnostics, and the expansion of HIL applications into novel sectors like aerospace and advanced mobility will act as significant growth accelerators. Strategic collaborations between technology providers and end-users will further propel market penetration and innovation. The market's ability to address the critical need for efficient, safe, and reliable power electronic system development positions it for sustained and robust growth, creating substantial opportunities for stakeholders invested in the future of energy and mobility.

Power Electronics Hardware In The Loop Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Power Electronics Hardware In The Loop Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Power Electronics Hardware In The Loop Regional Market Share

Geographic Coverage of Power Electronics Hardware In The Loop

Power Electronics Hardware In The Loop REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Electronics Hardware In The Loop Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Power Electronics Hardware In The Loop Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Power Electronics Hardware In The Loop Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Power Electronics Hardware In The Loop Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Power Electronics Hardware In The Loop Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Power Electronics Hardware In The Loop Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DSpace GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 National Instruments

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Opal-RT Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Typhoon HIL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Speedgoat GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Modeling Tech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 DSpace GmbH

List of Figures

- Figure 1: Global Power Electronics Hardware In The Loop Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Application 2025 & 2033

- Figure 3: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Application 2025 & 2033

- Figure 4: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Type 2025 & 2033

- Figure 5: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Type 2025 & 2033

- Figure 6: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Country 2025 & 2033

- Figure 7: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Country 2025 & 2033

- Figure 8: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Application 2025 & 2033

- Figure 9: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Application 2025 & 2033

- Figure 10: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Type 2025 & 2033

- Figure 11: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Type 2025 & 2033

- Figure 12: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Country 2025 & 2033

- Figure 13: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Country 2025 & 2033

- Figure 14: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Application 2025 & 2033

- Figure 15: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Application 2025 & 2033

- Figure 16: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Type 2025 & 2033

- Figure 17: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Type 2025 & 2033

- Figure 18: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Country 2025 & 2033

- Figure 19: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Country 2025 & 2033

- Figure 20: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Application 2025 & 2033

- Figure 21: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Application 2025 & 2033

- Figure 22: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Type 2025 & 2033

- Figure 23: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Type 2025 & 2033

- Figure 24: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Country 2025 & 2033

- Figure 25: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Country 2025 & 2033

- Figure 26: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Application 2025 & 2033

- Figure 27: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Application 2025 & 2033

- Figure 28: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Type 2025 & 2033

- Figure 29: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Type 2025 & 2033

- Figure 30: undefined Power Electronics Hardware In The Loop Revenue (undefined), by Country 2025 & 2033

- Figure 31: undefined Power Electronics Hardware In The Loop Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Power Electronics Hardware In The Loop Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Electronics Hardware In The Loop?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Power Electronics Hardware In The Loop?

Key companies in the market include DSpace GmbH, National Instruments, Opal-RT Technologies, Typhoon HIL, Speedgoat GmbH, Modeling Tech.

3. What are the main segments of the Power Electronics Hardware In The Loop?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Electronics Hardware In The Loop," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Electronics Hardware In The Loop report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Electronics Hardware In The Loop?

To stay informed about further developments, trends, and reports in the Power Electronics Hardware In The Loop, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence