Key Insights

The United Arab Emirates (UAE) fuel station market is poised for robust expansion, driven by a burgeoning automotive sector, escalating tourism, and a growing population. Government initiatives promoting sustainable transportation and ongoing infrastructure development further bolster market growth. Considering the UAE's dynamic economic landscape and its pivotal role as a global transit hub, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.5%. The market size is estimated at 453.8 million in the base year of 2024, with projections indicating significant future increases.

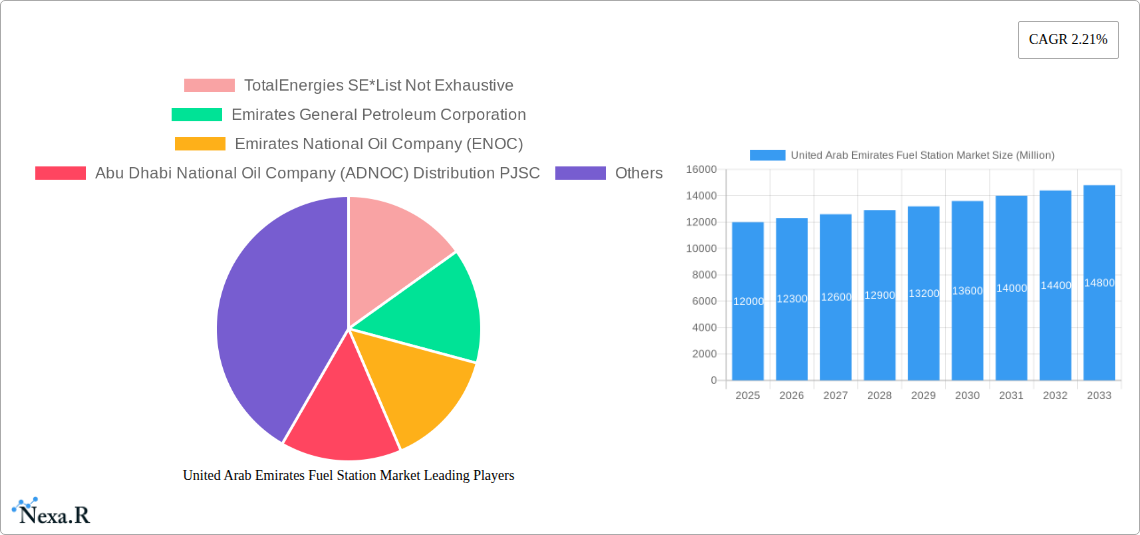

United Arab Emirates Fuel Station Market Market Size (In Million)

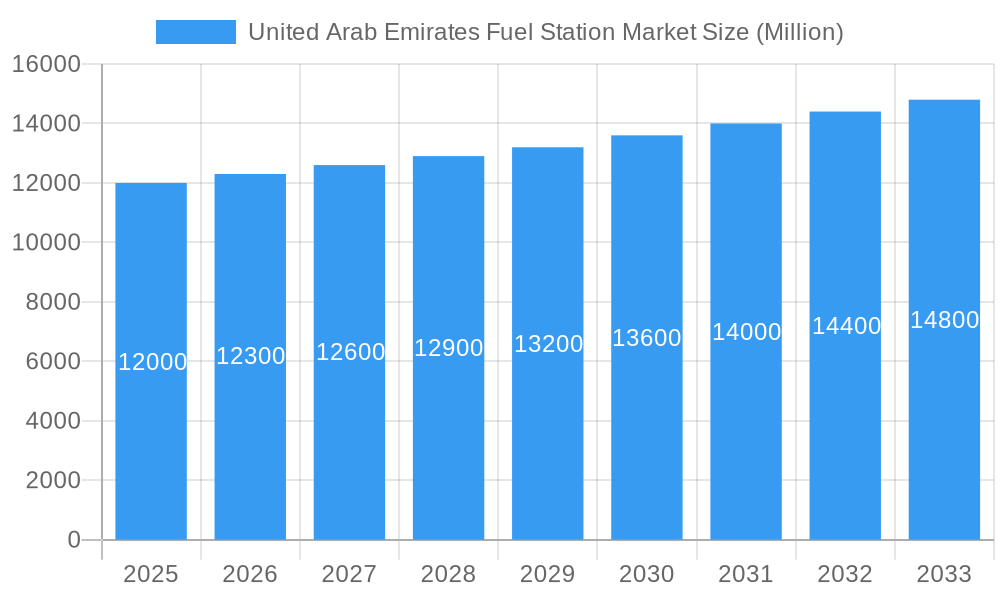

Market segmentation highlights a dominant demand for light distillates (gasoline) due to the high prevalence of passenger vehicles. However, the increasing adoption of heavy-duty vehicles in construction and logistics signals a rising demand for middle and heavy distillates. Key market players, including TotalEnergies, Emirates General Petroleum Corporation, ENOC, and ADNOC Distribution, exert substantial influence through competitive branding, pricing, and service innovation. While fluctuating global oil prices and evolving environmental regulations favoring electric vehicles and alternative fuels present challenges, the UAE's strong economic foundation, consistent governmental backing, and its strategic position in global energy distribution are expected to sustain a vigorous growth trajectory.

United Arab Emirates Fuel Station Market Company Market Share

United Arab Emirates Fuel Station Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Arab Emirates (UAE) fuel station market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by geography (including Morocco, Algeria, Egypt, and Rest of North Africa for comparative analysis) and fuel type (Light Distillates, Middle Distillates, Heavy Distillates). The total market size in 2025 is estimated at XX Million units.

United Arab Emirates Fuel Station Market Dynamics & Structure

The UAE fuel station market is characterized by a moderate level of concentration, with key players such as ADNOC Distribution PJSC, ENOC, Emirates General Petroleum Corporation, and TotalEnergies SE holding significant market share. The market is driven by technological innovations, such as the increasing adoption of AI-powered solutions for enhanced customer experience and the exploration of alternative fuels like hydrogen. Stringent regulatory frameworks governing fuel quality and safety standards significantly shape market operations. The emergence of electric vehicles presents a competitive threat, prompting fuel station operators to adapt their strategies. Recent M&A activity in the sector has been relatively low (xx deals in the last 5 years), suggesting a stable, though evolving, competitive landscape.

- Market Concentration: Moderately concentrated, with top 4 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on AI-powered solutions, alternative fuels (hydrogen), and improved efficiency.

- Regulatory Framework: Stringent regulations on fuel quality, safety, and environmental standards.

- Competitive Substitutes: Growth of electric vehicles and alternative fuel options posing a long-term competitive threat.

- End-User Demographics: Predominantly driven by personal vehicles and commercial transportation.

- M&A Trends: Low M&A activity in recent years (xx deals in the last 5 years).

United Arab Emirates Fuel Station Market Growth Trends & Insights

The UAE fuel station market has experienced steady growth over the past five years, with a CAGR of xx% during the period 2019-2024. This growth is primarily attributed to increasing vehicle ownership, robust economic growth, and expanding infrastructure. However, the market faces challenges from the growing adoption of electric vehicles and the rising focus on sustainability. Technological disruptions, such as the integration of AI and digital technologies, are transforming the customer experience and operational efficiency within the sector. Changing consumer preferences, driven by environmental concerns, are impacting fuel demand and market dynamics. The market penetration rate for AI-powered solutions at fuel stations is projected to reach xx% by 2033. Market size is predicted to reach XX Million units by 2033.

Dominant Regions, Countries, or Segments in United Arab Emirates Fuel Station Market

Within the UAE, the dominant segment is the Light Distillates segment, fueled by the high prevalence of gasoline-powered vehicles. This segment is projected to maintain its dominance throughout the forecast period, although its growth rate may be impacted by the gradual uptake of electric vehicles. Among the geographically compared markets (Morocco, Algeria, Egypt, and Rest of North Africa), the UAE's fuel station market shows significantly higher growth potential due to its larger economy, higher vehicle ownership, and better infrastructure.

- Key Drivers for Light Distillates Segment: High vehicle ownership, robust economic growth, and tourism.

- UAE Market Dominance: Larger economy, higher vehicle ownership, established infrastructure compared to other North African markets.

- Growth Potential: High growth potential, although potentially impacted by EV adoption and sustainability concerns.

United Arab Emirates Fuel Station Market Product Landscape

The UAE fuel station market is witnessing a shift towards providing enhanced customer experiences through integrated technologies. This includes the use of loyalty programs, mobile payment options, and AI-powered solutions for personalized fuel services, as exemplified by ADNOC Fill & Go’s AI-powered system. Fuel retailers are also exploring the incorporation of convenience stores and other amenities to attract more customers. A focus on improved operational efficiency and environmental sustainability, through technology implementation and greener fuels, is another key product development trend.

Key Drivers, Barriers & Challenges in United Arab Emirates Fuel Station Market

Key Drivers:

- Increasing vehicle ownership and transportation needs.

- Strong economic growth and tourism in the UAE.

- Government initiatives to improve infrastructure.

Key Challenges and Restraints:

- Growing adoption of electric vehicles and alternative fuel sources.

- Fluctuating crude oil prices affecting fuel costs and profitability.

- Environmental concerns and regulations impacting emissions.

Emerging Opportunities in United Arab Emirates Fuel Station Market

Emerging opportunities include expanding into the hydrogen fuel market, as evidenced by the DEWA and ENOC partnership. Furthermore, there is potential for growth in electric vehicle charging infrastructure at fuel stations, offering diversified services to a wider range of vehicles. The development of innovative loyalty programs and the integration of more convenient services (e.g., car washes, quick service restaurants) at fuel stations are other avenues for growth.

Growth Accelerators in the United Arab Emirates Fuel Station Market Industry

Long-term growth will be driven by strategic partnerships to explore alternative fuels and develop new technologies, such as the DEWA and ENOC collaboration. Government support for infrastructure development and the continuous improvement of customer experiences through advanced technologies like AI and digital solutions will also be vital growth accelerators. Expansion into ancillary services, such as car washes and convenience stores, will further enhance profitability.

Key Players Shaping the United Arab Emirates Fuel Station Market Market

- TotalEnergies SE

- Emirates General Petroleum Corporation

- Emirates National Oil Company (ENOC)

- Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

Notable Milestones in United Arab Emirates Fuel Station Market Sector

- February 2023: DEWA and ENOC announced a joint feasibility study for developing a hydrogen fueling station. This signifies a move towards alternative fuels and aligns with sustainability goals.

- February 2023: ADNOC Fill & Go launched AI technology at its stations, enhancing customer experience and operational efficiency. This marks a significant technological advancement in the sector.

In-Depth United Arab Emirates Fuel Station Market Market Outlook

The UAE fuel station market is poised for continued growth, albeit at a potentially moderated rate due to the adoption of electric vehicles. However, the strategic integration of alternative fuels (hydrogen) and the continued enhancement of customer experiences through technological innovation presents considerable opportunities for market expansion and profitability. The focus on efficiency and sustainability will play a crucial role in the sector's long-term success. Strategic partnerships and investments in advanced technologies will be key to unlocking the full potential of the market.

United Arab Emirates Fuel Station Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Arab Emirates Fuel Station Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Fuel Station Market Regional Market Share

Geographic Coverage of United Arab Emirates Fuel Station Market

United Arab Emirates Fuel Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand for Electric Vehicles in the Country

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TotalEnergies SE*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emirates General Petroleum Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emirates National Oil Company (ENOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 TotalEnergies SE*List Not Exhaustive

List of Figures

- Figure 1: United Arab Emirates Fuel Station Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Fuel Station Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Fuel Station Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 3: United Arab Emirates Fuel Station Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 5: United Arab Emirates Fuel Station Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: United Arab Emirates Fuel Station Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: United Arab Emirates Fuel Station Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: United Arab Emirates Fuel Station Market Revenue million Forecast, by Region 2020 & 2033

- Table 12: United Arab Emirates Fuel Station Market Volume Million Forecast, by Region 2020 & 2033

- Table 13: United Arab Emirates Fuel Station Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 14: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 15: United Arab Emirates Fuel Station Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: United Arab Emirates Fuel Station Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: United Arab Emirates Fuel Station Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: United Arab Emirates Fuel Station Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: United Arab Emirates Fuel Station Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Fuel Station Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the United Arab Emirates Fuel Station Market?

Key companies in the market include TotalEnergies SE*List Not Exhaustive, Emirates General Petroleum Corporation, Emirates National Oil Company (ENOC), Abu Dhabi National Oil Company (ADNOC) Distribution PJSC.

3. What are the main segments of the United Arab Emirates Fuel Station Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 453.8 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles to Drive the Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Demand for Electric Vehicles in the Country.

8. Can you provide examples of recent developments in the market?

February 2023: DEWA and ENOC announced joining hands to develop a hydrogen fuelling station for vehicles in the United Arab Emirates. Both firms will conduct a joint feasibility study for establishing, developing, and operating pilot projects which will be utilized to provide hydrogen for vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Fuel Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Fuel Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Fuel Station Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Fuel Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence