Key Insights

The Africa Outdoor Small Cell Market is projected for substantial growth, anticipating a market size of $3.3 billion by 2025, with a robust CAGR of 36.2% through 2033. This expansion is driven by increasing demand for advanced mobile broadband and the widespread rollout of 4G and 5G networks. Key factors include a growing mobile subscriber base, higher smartphone adoption, and the rise of data-intensive applications like streaming, online gaming, and IoT. Government and telecommunication investments are crucial for improving connectivity, especially in urban and suburban areas, and addressing increased data traffic from connected devices.

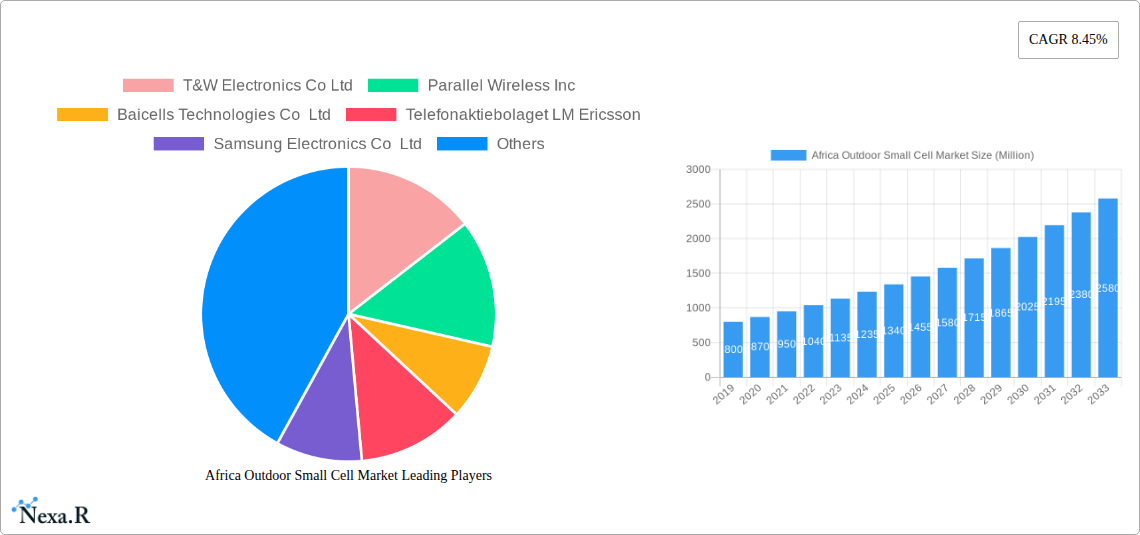

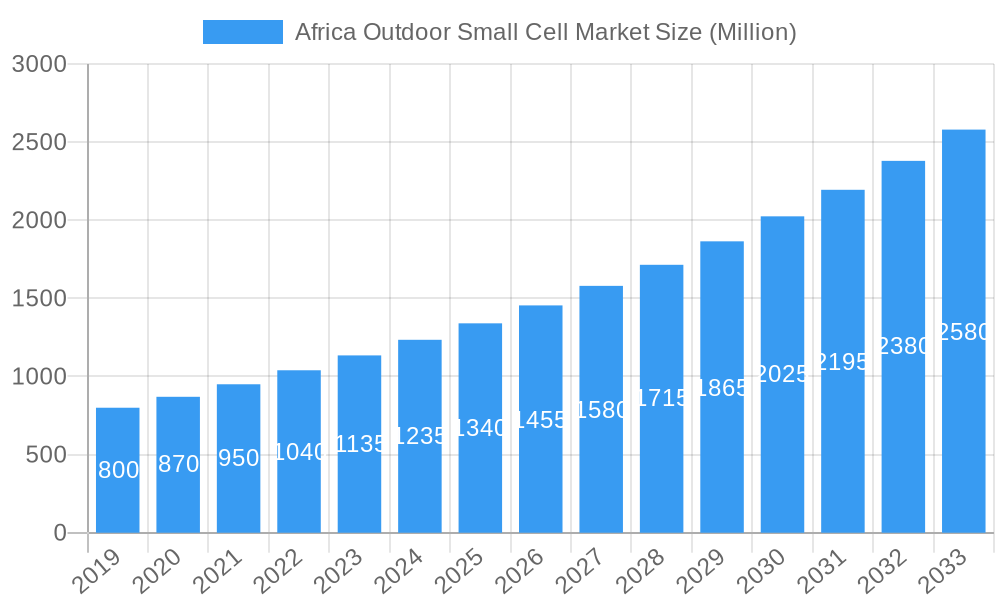

Africa Outdoor Small Cell Market Market Size (In Billion)

Market dynamics are influenced by evolving technology and strategic industry initiatives. Outdoor small cells are vital for achieving comprehensive network coverage and enhancing indoor signal strength in densely populated areas and public venues. While growth is strong, high initial deployment costs and complexities in site acquisition and regulatory approvals present challenges. Technological advancements, such as more affordable and energy-efficient small cell solutions, alongside supportive government policies, are expected to overcome these hurdles. The competitive arena includes major global and regional players like Huawei, Ericsson, Nokia, and Samsung, who are focused on R&D and strategic partnerships to foster innovation in Africa's telecommunications sector.

Africa Outdoor Small Cell Market Company Market Share

This comprehensive report offers in-depth analysis of the Africa Outdoor Small Cell Market, providing critical insights into market dynamics, growth trends, regional performance, product offerings, and key stakeholders. It highlights the role of outdoor small cells in bridging the digital divide, increasing mobile network capacity, and fostering economic development across the continent. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this report provides a forward-looking view of wireless infrastructure evolution. It examines key areas including outdoor small cell deployments, rural connectivity solutions, urban densification strategies, and the growing demand for 5G small cells in Africa.

Africa Outdoor Small Cell Market Market Dynamics & Structure

The Africa Outdoor Small Cell Market is characterized by a moderately fragmented structure, with key players actively investing in expanding network coverage and capacity. Technological innovation, particularly in areas like Open RAN and advanced antenna systems, is a significant driver, aiming to reduce deployment costs and improve efficiency. Regulatory frameworks, while evolving, present both opportunities and challenges, with governments increasingly focusing on policies that promote digital inclusion and affordable access to telecommunications services. Competitive product substitutes include traditional macro cells, though the cost-effectiveness and targeted coverage of small cells make them increasingly attractive for specific deployment scenarios. End-user demographics are diverse, ranging from urban centers requiring capacity upgrades to rural and suburban areas demanding basic mobile connectivity. Mergers and acquisitions (M&A) activity, though not extensively documented in this nascent market, is anticipated to increase as larger telecommunications infrastructure providers seek to consolidate their market positions and expand their portfolios. Barriers to innovation include the significant upfront investment required for research and development, coupled with the complex regulatory approval processes across different African nations.

- Market Concentration: Moderately fragmented with a mix of global and regional players.

- Technological Innovation Drivers: Open RAN, AI-driven network management, advanced antenna technologies (Massive MIMO).

- Regulatory Frameworks: Focus on digital inclusion, spectrum allocation, and infrastructure sharing initiatives.

- Competitive Product Substitutes: Macro cells, Wi-Fi offloading solutions.

- End-User Demographics: Urban population density, rural connectivity gaps, enterprise-specific needs.

- M&A Trends: Expected to rise with market maturity and consolidation efforts.

- Innovation Barriers: High capital expenditure, complex regulatory landscapes, spectrum availability.

Africa Outdoor Small Cell Market Growth Trends & Insights

The Africa Outdoor Small Cell Market is poised for significant growth, driven by the relentless demand for increased mobile data consumption, the expanding internet penetration across the continent, and the ongoing rollout of 4G and emerging 5G networks. This market's expansion is intrinsically linked to the need for improved network capacity in densely populated urban areas and the critical requirement to extend connectivity to underserved rural and remote regions. The adoption rate of outdoor small cell technology is escalating as operators recognize its cost-effectiveness and flexibility in addressing specific coverage and capacity challenges compared to traditional macro cell deployments. Technological disruptions, such as the maturation of Open RAN architectures and advancements in software-defined networking (SDN), are further accelerating adoption by offering greater vendor interoperability and reducing operational expenditures. Consumer behavior shifts, including a surge in mobile video streaming, cloud-based services, and the proliferation of IoT devices, necessitate robust and reliable wireless infrastructure, positioning outdoor small cells as a key enabler. The projected Compound Annual Growth Rate (CAGR) for the Africa Outdoor Small Cell Market is estimated at XX% during the forecast period of 2025–2033, with market penetration expected to rise from XX% in 2025 to XX% by 2033. This growth trajectory is underpinned by substantial investments in digital transformation initiatives across various African economies, aiming to bridge the digital divide and foster economic opportunities. The market size evolution is anticipated to witness a substantial increase, moving from an estimated XX Million units in 2025 to XX Million units by 2033, reflecting the increasing deployment of these crucial network components.

Dominant Regions, Countries, or Segments in Africa Outdoor Small Cell Market

The Outdoor segment, within the broader Application category, is projected to be the dominant force driving growth in the Africa Outdoor Small Cell Market. This dominance is fueled by the pressing need to enhance mobile network capacity in high-traffic urban centers, where population density and data consumption are rapidly increasing. Furthermore, outdoor small cells play a pivotal role in extending cellular coverage to suburban and peri-urban areas, bridging the gap between fully connected city centers and less developed regions. Countries such as South Africa, Nigeria, and Egypt are anticipated to lead the market due to their comparatively advanced telecommunications infrastructure, significant population bases, and proactive government policies aimed at promoting digital inclusion and investment in broadband networks. Economic policies that incentivize infrastructure development, coupled with a growing middle class with increasing disposable income for mobile services, are key drivers. The market share within the Outdoor segment is expected to be significant, driven by substantial network densification projects undertaken by major Mobile Network Operators (MNOs) across the continent. Growth potential in these leading countries is further bolstered by the increasing demand for mobile broadband services, the rollout of 4G LTE and the nascent stages of 5G deployments, all of which benefit immensely from the strategic placement of outdoor small cells. Infrastructure development initiatives, including public-private partnerships and universal service fund programs, are also contributing to the accelerated deployment of outdoor small cells in areas previously lacking adequate coverage. The combination of high demand for connectivity, supportive regulatory environments, and substantial investment makes the outdoor segment, and these leading countries, the primary growth engines of the Africa Outdoor Small Cell Market.

Africa Outdoor Small Cell Market Product Landscape

The Africa Outdoor Small Cell Market product landscape is characterized by continuous innovation aimed at enhancing performance, reducing form factors, and increasing cost-effectiveness. Key product developments focus on multi-band and multi-technology support, allowing a single small cell unit to operate across different cellular generations (2G, 4G, and nascent 5G). Enhanced antenna designs, including beamforming and massive MIMO capabilities, are being integrated to optimize signal strength and user experience, particularly in densely populated areas. Power efficiency and ruggedized designs for harsh environmental conditions are also critical product attributes. Unique selling propositions often revolve around ease of deployment, lower power consumption, and seamless integration with existing network infrastructure. Technological advancements are leading to smaller, more aesthetically pleasing units that can be discreetly deployed on street furniture, lampposts, and building facades, minimizing visual impact. The performance metrics of these outdoor small cells are continuously improving, with advancements in throughput, latency reduction, and capacity enhancement becoming standard features.

Key Drivers, Barriers & Challenges in Africa Outdoor Small Cell Market

Key Drivers:

- Growing Demand for Mobile Data: Increasing smartphone penetration and data-intensive applications are driving the need for enhanced network capacity.

- Network Densification Initiatives: Operators are deploying small cells to augment macro networks in urban and suburban areas, improving coverage and capacity.

- Rural Connectivity Expansion: Government initiatives and operator efforts to bridge the digital divide are leading to outdoor small cell deployments in underserved regions.

- 5G Rollout: The gradual deployment of 5G networks requires denser infrastructure, making small cells a crucial component.

- Cost-Effectiveness: Outdoor small cells offer a more economical solution for targeted capacity upgrades and coverage extensions compared to macro cells.

Barriers & Challenges:

- Spectrum Availability and Harmonization: Inconsistent spectrum allocation policies across African nations can hinder deployment.

- Infrastructure Sharing Regulations: Complexities in negotiating infrastructure sharing agreements can slow down deployments.

- Power Availability and Reliability: Ensuring consistent power supply to outdoor small cell sites, especially in rural areas, remains a challenge.

- Skilled Workforce Shortage: A lack of trained personnel for installation, maintenance, and operation of small cell networks.

- Security Concerns: Protecting outdoor small cell units from vandalism and theft.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of critical components and devices.

- Affordability of Services: Ensuring that increased network capacity translates into affordable data services for consumers.

Emerging Opportunities in Africa Outdoor Small Cell Market

Emerging opportunities in the Africa Outdoor Small Cell Market lie in the untapped potential of connecting vast rural populations and developing smart city infrastructure. The increasing adoption of IoT devices across sectors like agriculture, logistics, and smart grids presents a significant demand for localized, high-capacity wireless connectivity, which outdoor small cells are ideally positioned to provide. Furthermore, the growing trend of neutral host deployments, where infrastructure is shared among multiple operators, is opening new avenues for revenue generation and accelerated network build-out. Innovative applications such as enhanced public safety communications, real-time traffic management systems, and augmented reality experiences in public spaces will further drive the demand for dense and reliable outdoor wireless networks. The ongoing digital transformation initiatives across various African countries are creating a fertile ground for the deployment of advanced small cell solutions that support emerging technologies and services.

Growth Accelerators in the Africa Outdoor Small Cell Market Industry

Growth accelerators in the Africa Outdoor Small Cell Market industry are primarily driven by substantial technological breakthroughs, strategic partnerships, and aggressive market expansion strategies undertaken by key stakeholders. The maturation of Open RAN technologies is a significant catalyst, promising reduced vendor lock-in and increased deployment flexibility, thereby lowering overall infrastructure costs. Strategic partnerships between telecommunications operators, infrastructure vendors, and local enterprises are crucial for navigating the complex African market landscape and accelerating deployment timelines. Furthermore, government initiatives focused on digital inclusion and the development of broadband infrastructure, often supported by international funding, act as powerful growth accelerators. The increasing demand for reliable connectivity to support e-commerce, digital education, and telemedicine services is also propelling market expansion.

Key Players Shaping the Africa Outdoor Small Cell Market Market

- T&W Electronics Co Ltd

- Parallel Wireless Inc

- Baicells Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co Ltd

- Nokia Corporation

- NEC Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Airspan Networks Inc

Notable Milestones in Africa Outdoor Small Cell Market Sector

- November 2023: Parallel Wireless announced the deployment of 2G and 4G networks for a large national operator, focusing on rural and suburban areas in East Africa under the Universal Communications Service Access Fund (UCSAF). This initiative aims to deliver greater cellular connectivity to all residents, highlighting a commitment to bridging the digital divide.

- September 2023: InfiniG introduced its First True Neutral Host Service using Shared Spectrum for Enhanced In-Building Mobile Coverage. This service integrates optimized shared infrastructure linked to InfiniG’s cloud-driven platform, overseeing essential operations for mobile operator coverage, including agreements, spectrum access, software upgrades, and data analytics. Crucially, NHaaS connects buildings to mobile operator networks with zero manual intervention.

In-Depth Africa Outdoor Small Cell Market Market Outlook

The Africa Outdoor Small Cell Market outlook is exceptionally promising, fueled by a confluence of factors poised to transform connectivity across the continent. The continuous drive for digital inclusion, coupled with substantial investments in telecommunications infrastructure, will solidify the market's growth trajectory. Emerging opportunities in smart city development, IoT enablement, and the expansion of 5G services will create sustained demand for advanced outdoor small cell solutions. Strategic collaborations between global technology providers and local African entities will be instrumental in overcoming regional challenges and accelerating deployment. The market's future will be shaped by innovative business models, including infrastructure sharing and neutral host deployments, further democratizing access to high-quality wireless services and unlocking immense socio-economic potential.

Africa Outdoor Small Cell Market Segmentation

-

1. Application

- 1.1. Outdoor

- 1.2. Indoor

Africa Outdoor Small Cell Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Outdoor Small Cell Market Regional Market Share

Geographic Coverage of Africa Outdoor Small Cell Market

Africa Outdoor Small Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 36.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents

- 3.3. Market Restrains

- 3.3.1. Various Regulations and Policies Coupled with Storage Issues

- 3.4. Market Trends

- 3.4.1. Outdoor to Have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 T&W Electronics Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Parallel Wireless Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baicells Technologies Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telefonaktiebolaget LM Ericsson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nokia Corporation*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NEC Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZTE Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Airspan Networks Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 T&W Electronics Co Ltd

List of Figures

- Figure 1: Africa Outdoor Small Cell Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Outdoor Small Cell Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Outdoor Small Cell Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 3: Africa Outdoor Small Cell Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 5: Africa Outdoor Small Cell Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 7: Africa Outdoor Small Cell Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Nigeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 11: South Africa Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 13: Egypt Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Egypt Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 15: Kenya Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Ethiopia Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 19: Morocco Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Morocco Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 21: Ghana Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Ghana Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 23: Algeria Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Algeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 25: Tanzania Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Tanzania Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 27: Ivory Coast Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Ivory Coast Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Outdoor Small Cell Market?

The projected CAGR is approximately 36.2%.

2. Which companies are prominent players in the Africa Outdoor Small Cell Market?

Key companies in the market include T&W Electronics Co Ltd, Parallel Wireless Inc, Baicells Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd, Nokia Corporation*List Not Exhaustive, NEC Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Airspan Networks Inc.

3. What are the main segments of the Africa Outdoor Small Cell Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents.

6. What are the notable trends driving market growth?

Outdoor to Have Significant Share.

7. Are there any restraints impacting market growth?

Various Regulations and Policies Coupled with Storage Issues.

8. Can you provide examples of recent developments in the market?

November 2023 - Parallel Wireless has announced that it will be deploying 2G and 4G networks for a for a large national operator, Where It will focus on rural and suburban areas, deploying and delivering cellular connectivity under the Universal Communications Service Access Fund (UCSAF) in East Africa which is a government initiative aimed to deliver greater coverage to all residents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Outdoor Small Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Outdoor Small Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Outdoor Small Cell Market?

To stay informed about further developments, trends, and reports in the Africa Outdoor Small Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence