Key Insights

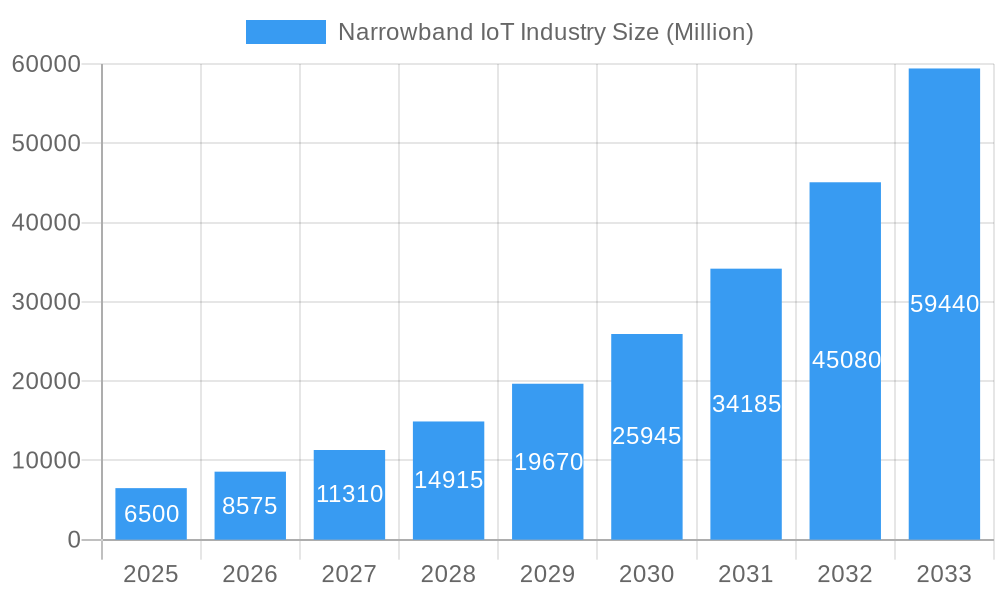

The Narrowband IoT (NB-IoT) market is poised for explosive growth, projected to reach a substantial market size of $30,500 million by 2033, fueled by a remarkable Compound Annual Growth Rate (CAGR) of 31.82% between 2025 and 2033. This surge is primarily driven by the escalating demand for low-power, wide-area network solutions that can efficiently connect a massive number of devices across diverse applications. The increasing adoption of smart technologies in smart cities, energy & utilities, and transportation & logistics are fundamental growth catalysts. Furthermore, the inherent benefits of NB-IoT, such as its ability to penetrate deep into buildings and underground, its enhanced security features, and its cost-effectiveness for mass deployments, are making it the technology of choice for many industrial and consumer IoT solutions. The trend towards miniaturization of devices and the growing ecosystem of NB-IoT chipsets and modules are also accelerating market penetration.

Narrowband IoT Industry Market Size (In Billion)

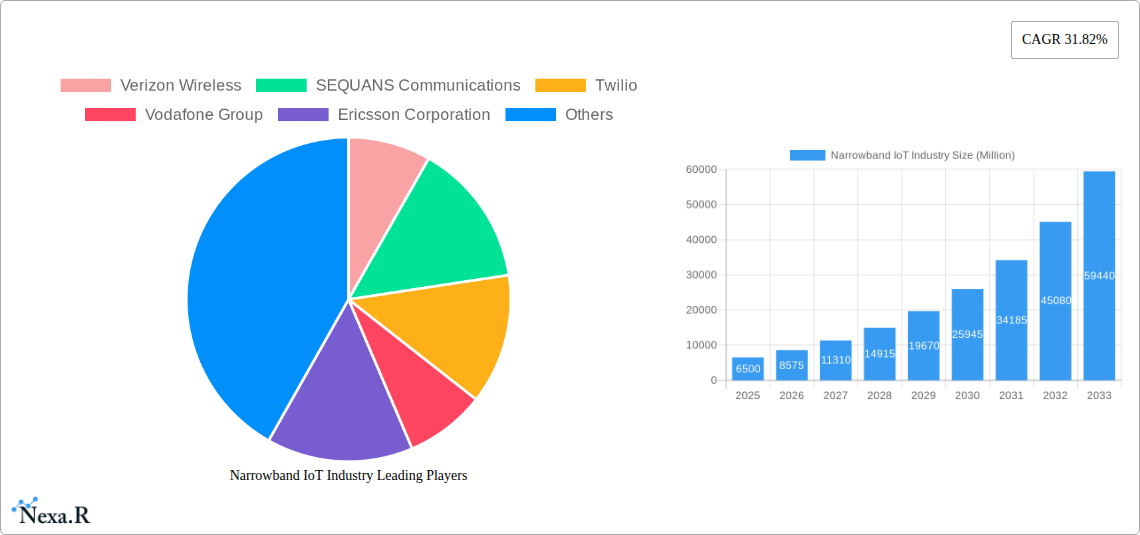

The market's trajectory is further bolstered by significant investments in 5G infrastructure, which provides a robust foundation for NB-IoT deployments. Key players like Verizon Wireless, Vodafone Group, Ericsson Corporation, Qualcomm Technologies, and Huawei Technologies Co Ltd are actively expanding their NB-IoT networks and product portfolios, fostering innovation and driving adoption. While the market is experiencing unprecedented growth, certain restrains like the need for widespread network coverage in remote areas and the initial investment costs for infrastructure development are being addressed through strategic partnerships and technological advancements. The market is segmented across crucial components such as networks and modules, deployment types including standalone, in-band, and guard-band, and a wide array of device types from wearables to smart meters and detectors. This comprehensive segmentation indicates a highly dynamic and evolving market landscape ready to support a vast array of future IoT applications.

Narrowband IoT Industry Company Market Share

Narrowband IoT Industry Report: Unlocking the Future of Low-Power Connectivity

This comprehensive report provides an in-depth analysis of the Narrowband IoT (NB-IoT) industry, a critical technology enabling the massive proliferation of low-power, wide-area connected devices. The study delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, opportunities, and the influential players shaping this rapidly evolving sector. With a focus on quantitative data and actionable insights, this report is an indispensable resource for industry professionals, investors, and strategists seeking to navigate and capitalize on the burgeoning NB-IoT ecosystem.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Narrowband IoT Industry Market Dynamics & Structure

The Narrowband IoT industry is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing end-user adoption. Market concentration varies across different segments, with chipset manufacturers and network infrastructure providers exhibiting higher levels of consolidation compared to module and device manufacturers. Technological innovation is primarily driven by the demand for enhanced power efficiency, extended range, and lower device costs, fostering a competitive environment among key players. Regulatory frameworks, while generally supportive of IoT deployment, can introduce complexities related to spectrum allocation and data security. Competitive product substitutes, such as LoRaWAN and Sigfox, present alternative low-power wide-area network (LPWAN) solutions, influencing market positioning and pricing strategies. End-user demographics are broadening, encompassing diverse industries seeking efficient connectivity for a wide array of applications. Mergers and acquisitions (M&A) trends reflect strategic moves to consolidate market share, acquire innovative technologies, and expand geographical reach. For instance, recent M&A activities have focused on integrating advanced chipset capabilities with comprehensive IoT platform solutions. Barriers to innovation include the high cost of R&D for new technologies, the need for extensive field testing, and the challenge of achieving widespread interoperability across diverse device ecosystems.

- Market Concentration: Moderate to high in chipsets and network infrastructure; moderate in module manufacturing.

- Technological Innovation Drivers: Power efficiency, range extension, reduced latency, lower cost of connectivity.

- Regulatory Frameworks: Spectrum allocation, data privacy, security standards, government incentives for IoT adoption.

- Competitive Product Substitutes: LoRaWAN, Sigfox, LTE-M.

- End-User Demographics: Increasing adoption across utilities, logistics, smart cities, agriculture, and healthcare.

- M&A Trends: Focus on platform integration, chipset advancements, and end-to-end IoT solutions.

- Innovation Barriers: High R&D investment, interoperability challenges, evolving security threats.

Narrowband IoT Industry Growth Trends & Insights

The Narrowband IoT industry is poised for significant expansion, driven by the relentless demand for connected devices in a hyper-connected world. The market size evolution indicates a robust growth trajectory, with projections showcasing a compound annual growth rate (CAGR) that will propel the industry to new heights within the forecast period. Adoption rates are accelerating across various sectors, fueled by the inherent advantages of NB-IoT technology, including its ability to provide deep indoor penetration, support a massive number of devices per cell, and deliver extended battery life for connected assets. Technological disruptions are continuously reshaping the landscape, with advancements in chipset design, network optimization, and data analytics enabling more sophisticated and cost-effective NB-IoT solutions. Consumer behavior shifts are also playing a crucial role, as individuals and businesses increasingly embrace smart technologies and data-driven decision-making. For example, the rise of smart home devices and the demand for efficient supply chain management are directly contributing to the increased adoption of NB-IoT. The market penetration of NB-IoT devices is expected to surge, moving from nascent stages in some applications to widespread deployment in others. Specific metrics such as market size in millions of units, adoption penetration percentages, and average revenue per user (ARPU) are projected to demonstrate substantial growth. Furthermore, the integration of NB-IoT with emerging technologies like artificial intelligence (AI) and edge computing is unlocking new possibilities and driving innovation. The increasing focus on sustainability and resource management also presents a significant growth avenue for NB-IoT solutions in areas such as smart metering and environmental monitoring. The future of NB-IoT is characterized by its ability to democratize connectivity, making it accessible and affordable for a wider range of applications and industries, thus solidifying its position as a cornerstone of the Internet of Things.

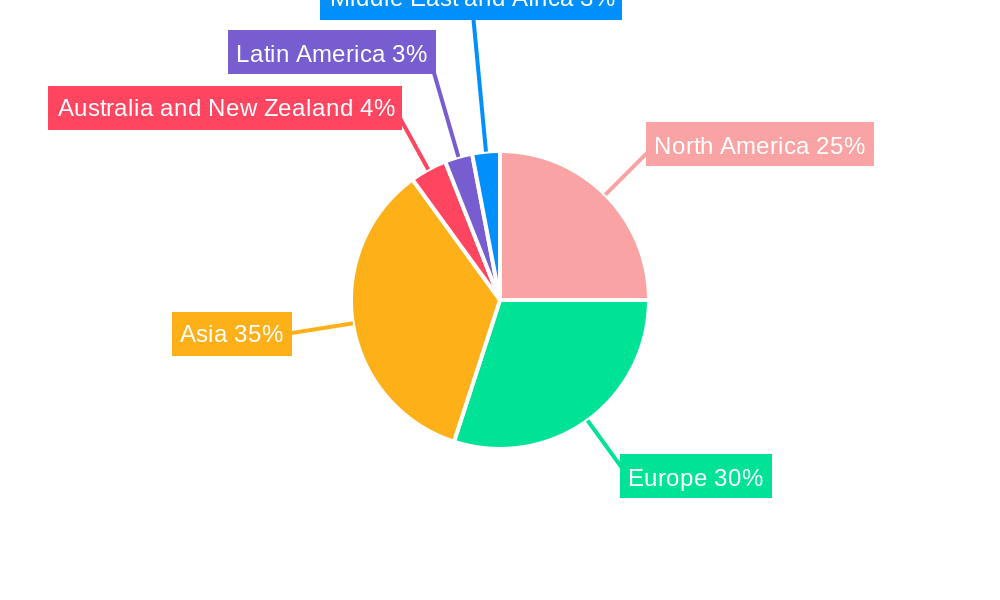

Dominant Regions, Countries, or Segments in Narrowband IoT Industry

The Narrowband IoT industry's dominance is geographically and segmentally diverse, with specific regions and applications emerging as key growth engines. In terms of Application, Smart Cities are emerging as a dominant force, leveraging NB-IoT for a multitude of urban services. This includes smart street lighting that optimizes energy consumption, intelligent traffic management systems, waste management optimization, and public safety monitoring. The economic policies promoting urban modernization and the substantial investments in smart city infrastructure within regions like North America and Europe are significant drivers of this dominance. Asia-Pacific, particularly China, is also a major contributor due to its rapid urbanization and government initiatives supporting IoT adoption.

Within the Component segment, Network infrastructure plays a pivotal role, with significant investments by telecommunication operators in expanding NB-IoT coverage. Companies like Verizon Wireless, Vodafone Group, AT&T Inc, and Deutsche Telekom are at the forefront of this expansion, ensuring ubiquitous connectivity. The Module segment is also critical, with manufacturers like SEQUANS Communications, Qualcomm Technologies, and Intel Corporation developing increasingly efficient and cost-effective NB-IoT modules.

The Device Type segment witnesses substantial growth in Trackers and Smart Meters. Trackers are crucial for supply chain visibility, asset management, and personal safety, while smart meters are transforming energy and utility management by enabling remote monitoring and dynamic pricing. The Energy & Utilities application sector is a significant beneficiary of NB-IoT technology, facilitating efficient resource management and reducing operational costs.

The Deployment strategy of Standalone NB-IoT networks offers greater control and optimization, making it a preferred choice for many large-scale deployments, especially in smart city initiatives. The ability to deploy independent NB-IoT networks allows for tailored performance characteristics and greater independence from existing LTE infrastructure.

- Dominant Application: Smart Cities, driven by smart lighting, traffic management, and waste monitoring.

- Dominant Region: North America and Europe for Smart City initiatives; Asia-Pacific for overall IoT device deployment.

- Key Component Drivers: Network infrastructure expansion by major telcos and advancements in NB-IoT modules.

- Leading Device Types: Trackers for logistics and asset management, Smart Meters for utility efficiency.

- Prominent Deployment: Standalone NB-IoT for optimized network performance.

- Growth Potential: Energy & Utilities sector, owing to efficiency and cost-saving benefits.

- Market Share: Specific countries like the USA, China, and Germany are expected to hold significant market share within their respective regions.

Narrowband IoT Industry Product Landscape

The Narrowband IoT industry product landscape is defined by continuous innovation aimed at enhancing device efficiency, connectivity robustness, and application-specific performance. Products range from ultra-low-power NB-IoT chipsets and modules designed for minimal energy consumption, enabling battery lives of up to 10-14 years in devices like trackers and alarm systems, to integrated sensors and gateways facilitating seamless data transmission. Key advancements include improved signal processing for better penetration in challenging environments, enhanced security features for data protection, and miniaturized form factors for discreet integration into devices such as wearables and smart lighting solutions. The performance metrics for NB-IoT products are characterized by low data rates (typically up to 250 kbps), extended range capabilities, and high device density support, making them ideal for applications that require infrequent, small data transmissions. Unique selling propositions often revolve around cost-effectiveness, power efficiency, and the ability to connect a massive number of devices reliably, thereby unlocking new business models and operational efficiencies across various sectors.

Key Drivers, Barriers & Challenges in Narrowband IoT Industry

The Narrowband IoT industry is propelled by several key drivers. The escalating demand for connected devices across diverse sectors, including smart cities, agriculture, and utilities, serves as a primary catalyst. The inherent advantages of NB-IoT, such as its low power consumption, extended range, and cost-effectiveness, are crucial for enabling large-scale IoT deployments. Furthermore, government initiatives and industry-wide standardization efforts are fostering an environment conducive to growth. The increasing availability of affordable NB-IoT modules and chipsets from players like Qualcomm Technologies and Intel Corporation further accelerates adoption.

However, the industry faces significant barriers and challenges. The limited bandwidth of NB-IoT restricts its applicability for high-data-rate applications, necessitating hybrid solutions in some scenarios. Regulatory hurdles related to spectrum allocation and data privacy can also impede deployment. Supply chain issues, including the availability of components and geopolitical uncertainties, can impact production timelines and costs. Intense competition from alternative LPWAN technologies, such as LTE-M and LoRaWAN, requires continuous innovation and differentiation. The need for robust security measures to protect connected devices and data remains a paramount challenge, requiring ongoing investment in advanced security protocols and threat mitigation strategies. The operational complexity of managing a vast network of connected devices and ensuring their long-term reliability also presents a considerable hurdle.

Emerging Opportunities in Narrowband IoT Industry

Emerging opportunities in the Narrowband IoT industry lie in the expansion of its application scope into new and underserved markets. The increasing global focus on environmental sustainability presents a significant avenue, with NB-IoT poised to play a crucial role in smart agriculture for precision farming, water management for efficient irrigation, and environmental monitoring for pollution control. The development of specialized NB-IoT chipsets and platforms tailored for specific industry needs, such as industrial automation and healthcare, will unlock new revenue streams. The integration of NB-IoT with 5G technology, particularly in non-standalone deployments, offers a pathway to leverage the enhanced capabilities of 5G while benefiting from the low-power characteristics of NB-IoT for specific use cases. Furthermore, the growing demand for asset tracking and management solutions in emerging economies, coupled with the decreasing cost of NB-IoT hardware, creates a substantial opportunity for market penetration in regions previously underserved by advanced connectivity solutions. The burgeoning market for smart wearables, particularly in healthcare and fitness, also presents a fertile ground for NB-IoT-enabled devices.

Growth Accelerators in the Narrowband IoT Industry Industry

The long-term growth of the Narrowband IoT industry is being significantly accelerated by several key catalysts. Technological breakthroughs in power management and antenna design are enabling even lower power consumption and enhanced signal integrity, extending device battery life and network reach. Strategic partnerships between telecommunication operators, chipset manufacturers, and application developers are crucial for creating end-to-end solutions and accelerating market adoption. For instance, collaborations aimed at simplifying NB-IoT device integration and management are vital. Market expansion strategies, including the development of specialized NB-IoT platforms for emerging economies and niche industrial applications, are driving penetration into new verticals. The continuous reduction in the cost of NB-IoT modules and the increasing availability of affordable SIM solutions are making the technology more accessible to a broader range of businesses, from small enterprises to large industrial players. Furthermore, the growing ecosystem of developers and solution providers is fostering innovation and creating a wider variety of compelling use cases, thereby driving demand and accelerating overall market growth.

Key Players Shaping the Narrowband IoT Industry Market

- Verizon Wireless

- SEQUANS Communications

- Twilio

- Vodafone Group

- Ericsson Corporation

- Qualcomm Technologies

- Huawei Technologies Co Ltd

- Nokia Corporation

- AT&T Inc

- Intel Corporation

- Deutsche Telekom

Notable Milestones in Narrowband IoT Industry Sector

- March 2023: Monogoto, a cloud-based cellular network provider, announced a new roaming agreement with Skylo Technologies, a Non-Terrestrial Network (NTN) service operator. This partnership aims to simplify satellite connectivity integration for asset monitoring solutions via Monogoto Cloud, offering an economical NB-IoT satellite connectivity solution. SODAQ is set to unveil a new asset-tracking trial kit leveraging this Monogoto connection.

- January 2023: Airgain, Inc., a provider of wireless connectivity solutions, partnered with Deutsche Telekom IoT. This collaboration connects Airgain's asset tracking devices with Deutsche Telekom's IoT network coverage in Europe, offering solutions with extended battery life (up to 14 years) utilizing NB-IoT and LTE-M technologies.

In-Depth Narrowband IoT Industry Market Outlook

The in-depth market outlook for the Narrowband IoT industry is exceptionally promising, driven by the sustained demand for efficient and cost-effective connectivity solutions. Growth accelerators, such as the ongoing miniaturization and power optimization of NB-IoT chipsets, are expected to further reduce device costs and expand deployment possibilities. Strategic partnerships, particularly those fostering interoperability and creating integrated end-to-end solutions, will be instrumental in driving market penetration. The expansion into emerging markets and the development of tailored solutions for niche industrial applications represent significant untapped potential. As regulatory bodies continue to streamline spectrum allocation and promote IoT adoption, the industry is poised for a robust growth trajectory, solidifying NB-IoT's position as a foundational technology for the massive Internet of Things.

Narrowband IoT Industry Segmentation

-

1. Component

- 1.1. Network

- 1.2. Module

-

2. Deployment

- 2.1. Standalone

- 2.2. In-band

- 2.3. Guard-band

-

3. Device Type

- 3.1. Wearables

- 3.2. Tracker

- 3.3. Smart Meter

- 3.4. Smart Lighting

- 3.5. Alarm & Detector

- 3.6. Others

-

4. Application

- 4.1. Smart Cities

- 4.2. Transportation & Logistics

- 4.3. Energy & Utilities

- 4.4. Retail

- 4.5. Agriculture

- 4.6. Others

Narrowband IoT Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

-

3. Asia

- 3.1. India

- 3.2. China

- 3.3. Japan

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

Narrowband IoT Industry Regional Market Share

Geographic Coverage of Narrowband IoT Industry

Narrowband IoT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need of Cloud Storage; Increasing Cyberattacks Among Enterprises

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Smart Cities is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Network

- 5.1.2. Module

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Standalone

- 5.2.2. In-band

- 5.2.3. Guard-band

- 5.3. Market Analysis, Insights and Forecast - by Device Type

- 5.3.1. Wearables

- 5.3.2. Tracker

- 5.3.3. Smart Meter

- 5.3.4. Smart Lighting

- 5.3.5. Alarm & Detector

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Smart Cities

- 5.4.2. Transportation & Logistics

- 5.4.3. Energy & Utilities

- 5.4.4. Retail

- 5.4.5. Agriculture

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Network

- 6.1.2. Module

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Standalone

- 6.2.2. In-band

- 6.2.3. Guard-band

- 6.3. Market Analysis, Insights and Forecast - by Device Type

- 6.3.1. Wearables

- 6.3.2. Tracker

- 6.3.3. Smart Meter

- 6.3.4. Smart Lighting

- 6.3.5. Alarm & Detector

- 6.3.6. Others

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Smart Cities

- 6.4.2. Transportation & Logistics

- 6.4.3. Energy & Utilities

- 6.4.4. Retail

- 6.4.5. Agriculture

- 6.4.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Network

- 7.1.2. Module

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Standalone

- 7.2.2. In-band

- 7.2.3. Guard-band

- 7.3. Market Analysis, Insights and Forecast - by Device Type

- 7.3.1. Wearables

- 7.3.2. Tracker

- 7.3.3. Smart Meter

- 7.3.4. Smart Lighting

- 7.3.5. Alarm & Detector

- 7.3.6. Others

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Smart Cities

- 7.4.2. Transportation & Logistics

- 7.4.3. Energy & Utilities

- 7.4.4. Retail

- 7.4.5. Agriculture

- 7.4.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Network

- 8.1.2. Module

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Standalone

- 8.2.2. In-band

- 8.2.3. Guard-band

- 8.3. Market Analysis, Insights and Forecast - by Device Type

- 8.3.1. Wearables

- 8.3.2. Tracker

- 8.3.3. Smart Meter

- 8.3.4. Smart Lighting

- 8.3.5. Alarm & Detector

- 8.3.6. Others

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Smart Cities

- 8.4.2. Transportation & Logistics

- 8.4.3. Energy & Utilities

- 8.4.4. Retail

- 8.4.5. Agriculture

- 8.4.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Network

- 9.1.2. Module

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Standalone

- 9.2.2. In-band

- 9.2.3. Guard-band

- 9.3. Market Analysis, Insights and Forecast - by Device Type

- 9.3.1. Wearables

- 9.3.2. Tracker

- 9.3.3. Smart Meter

- 9.3.4. Smart Lighting

- 9.3.5. Alarm & Detector

- 9.3.6. Others

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Smart Cities

- 9.4.2. Transportation & Logistics

- 9.4.3. Energy & Utilities

- 9.4.4. Retail

- 9.4.5. Agriculture

- 9.4.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Network

- 10.1.2. Module

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Standalone

- 10.2.2. In-band

- 10.2.3. Guard-band

- 10.3. Market Analysis, Insights and Forecast - by Device Type

- 10.3.1. Wearables

- 10.3.2. Tracker

- 10.3.3. Smart Meter

- 10.3.4. Smart Lighting

- 10.3.5. Alarm & Detector

- 10.3.6. Others

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Smart Cities

- 10.4.2. Transportation & Logistics

- 10.4.3. Energy & Utilities

- 10.4.4. Retail

- 10.4.5. Agriculture

- 10.4.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Narrowband IoT Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Network

- 11.1.2. Module

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. Standalone

- 11.2.2. In-band

- 11.2.3. Guard-band

- 11.3. Market Analysis, Insights and Forecast - by Device Type

- 11.3.1. Wearables

- 11.3.2. Tracker

- 11.3.3. Smart Meter

- 11.3.4. Smart Lighting

- 11.3.5. Alarm & Detector

- 11.3.6. Others

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Smart Cities

- 11.4.2. Transportation & Logistics

- 11.4.3. Energy & Utilities

- 11.4.4. Retail

- 11.4.5. Agriculture

- 11.4.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Verizon Wireless

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SEQUANS Communications

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Twilio

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Vodafone Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ericsson Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Qualcomm Technologies

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huawei Technologies Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nokia Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SEQUANS Communications*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AT&T Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Intel Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Deutsche Telekom

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Verizon Wireless

List of Figures

- Figure 1: Global Narrowband IoT Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Narrowband IoT Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Narrowband IoT Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Narrowband IoT Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 5: North America Narrowband IoT Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Narrowband IoT Industry Revenue (undefined), by Device Type 2025 & 2033

- Figure 7: North America Narrowband IoT Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 8: North America Narrowband IoT Industry Revenue (undefined), by Application 2025 & 2033

- Figure 9: North America Narrowband IoT Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Narrowband IoT Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Narrowband IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Narrowband IoT Industry Revenue (undefined), by Component 2025 & 2033

- Figure 13: Europe Narrowband IoT Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Narrowband IoT Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 15: Europe Narrowband IoT Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Narrowband IoT Industry Revenue (undefined), by Device Type 2025 & 2033

- Figure 17: Europe Narrowband IoT Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 18: Europe Narrowband IoT Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: Europe Narrowband IoT Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Narrowband IoT Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Europe Narrowband IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Narrowband IoT Industry Revenue (undefined), by Component 2025 & 2033

- Figure 23: Asia Narrowband IoT Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Narrowband IoT Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 25: Asia Narrowband IoT Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Narrowband IoT Industry Revenue (undefined), by Device Type 2025 & 2033

- Figure 27: Asia Narrowband IoT Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 28: Asia Narrowband IoT Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Asia Narrowband IoT Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Narrowband IoT Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Narrowband IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Narrowband IoT Industry Revenue (undefined), by Component 2025 & 2033

- Figure 33: Australia and New Zealand Narrowband IoT Industry Revenue Share (%), by Component 2025 & 2033

- Figure 34: Australia and New Zealand Narrowband IoT Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 35: Australia and New Zealand Narrowband IoT Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Australia and New Zealand Narrowband IoT Industry Revenue (undefined), by Device Type 2025 & 2033

- Figure 37: Australia and New Zealand Narrowband IoT Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: Australia and New Zealand Narrowband IoT Industry Revenue (undefined), by Application 2025 & 2033

- Figure 39: Australia and New Zealand Narrowband IoT Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Australia and New Zealand Narrowband IoT Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Australia and New Zealand Narrowband IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Narrowband IoT Industry Revenue (undefined), by Component 2025 & 2033

- Figure 43: Latin America Narrowband IoT Industry Revenue Share (%), by Component 2025 & 2033

- Figure 44: Latin America Narrowband IoT Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 45: Latin America Narrowband IoT Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 46: Latin America Narrowband IoT Industry Revenue (undefined), by Device Type 2025 & 2033

- Figure 47: Latin America Narrowband IoT Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 48: Latin America Narrowband IoT Industry Revenue (undefined), by Application 2025 & 2033

- Figure 49: Latin America Narrowband IoT Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Latin America Narrowband IoT Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Latin America Narrowband IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Middle East and Africa Narrowband IoT Industry Revenue (undefined), by Component 2025 & 2033

- Figure 53: Middle East and Africa Narrowband IoT Industry Revenue Share (%), by Component 2025 & 2033

- Figure 54: Middle East and Africa Narrowband IoT Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 55: Middle East and Africa Narrowband IoT Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 56: Middle East and Africa Narrowband IoT Industry Revenue (undefined), by Device Type 2025 & 2033

- Figure 57: Middle East and Africa Narrowband IoT Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 58: Middle East and Africa Narrowband IoT Industry Revenue (undefined), by Application 2025 & 2033

- Figure 59: Middle East and Africa Narrowband IoT Industry Revenue Share (%), by Application 2025 & 2033

- Figure 60: Middle East and Africa Narrowband IoT Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Middle East and Africa Narrowband IoT Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 3: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 4: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Narrowband IoT Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 7: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 8: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 9: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Narrowband IoT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 14: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 15: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 16: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Narrowband IoT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Germany Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 22: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 23: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 24: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Narrowband IoT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: India Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: China Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Japan Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 30: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 31: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 32: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Narrowband IoT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 35: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 36: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 37: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Narrowband IoT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: Brazil Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Argentina Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Global Narrowband IoT Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 42: Global Narrowband IoT Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 43: Global Narrowband IoT Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 44: Global Narrowband IoT Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 45: Global Narrowband IoT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: United Arab Emirates Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Saudi Arabia Narrowband IoT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Narrowband IoT Industry?

The projected CAGR is approximately 13.2%.

2. Which companies are prominent players in the Narrowband IoT Industry?

Key companies in the market include Verizon Wireless, SEQUANS Communications, Twilio, Vodafone Group, Ericsson Corporation, Qualcomm Technologies, Huawei Technologies Co Ltd, Nokia Corporation, SEQUANS Communications*List Not Exhaustive, AT&T Inc, Intel Corporation, Deutsche Telekom.

3. What are the main segments of the Narrowband IoT Industry?

The market segments include Component, Deployment, Device Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need of Cloud Storage; Increasing Cyberattacks Among Enterprises.

6. What are the notable trends driving market growth?

Smart Cities is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

March 2023 - Monogoto, a cloud-based cellular network provider, has announced a new roaming agreement with Skylo Technologies, a Non-Terrestrial Network (NTN) service operator. This new partnership lowers developers' barrier to adding satellite connectivity to existing public and/or private networks on Monogoto Cloud, giving the world's most economical and accessible solution for NB-IoT Satellite connectivity for asset monitoring solutions. Also, SODAQ, a low-power tracking and sensing system developer, will unveil a new asset-tracking trial kit using Monogoto connection and network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Narrowband IoT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Narrowband IoT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Narrowband IoT Industry?

To stay informed about further developments, trends, and reports in the Narrowband IoT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence