Key Insights

The Asia Pacific Internet of Vehicles (IoV) market is poised for remarkable expansion, projected to reach a substantial USD 42.24 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 24.41%. This robust growth is fueled by a confluence of transformative drivers, including the rapid advancement and widespread adoption of advanced automotive technologies, increasing consumer demand for connected car features, and supportive government initiatives promoting smart city infrastructure and vehicle connectivity. The integration of technologies like Wi-Fi, Bluetooth, NFC, and cellular connectivity is revolutionizing in-car experiences, enabling seamless communication between vehicles, infrastructure, and other entities. Key players such as Tesla Motors, Google LLC, and Toyota Connected Asia-Pacific Limited are actively investing in research and development, launching innovative IoV solutions that further accelerate market penetration. The growing prevalence of 5G networks across the region is a significant catalyst, promising higher speeds, lower latency, and greater reliability for IoV applications, thereby enhancing safety, infotainment, and operational efficiency.

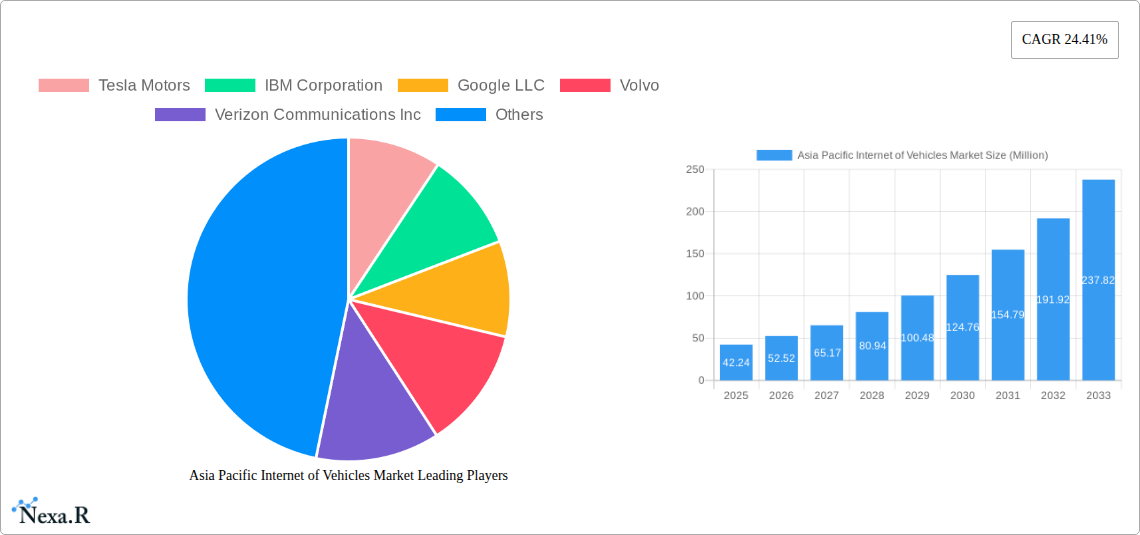

Asia Pacific Internet of Vehicles Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer expectations and the increasing sophistication of communication equipment, encompassing both Car-to-Car (C2C) and Car-to-Infrastructure (C2I) communication. While the market benefits from strong growth drivers, it also faces certain restraints. High initial investment costs for advanced connectivity hardware and infrastructure, coupled with concerns regarding data privacy and cybersecurity, present challenges that require strategic mitigation. Nonetheless, the overwhelming demand for enhanced safety features, real-time traffic information, predictive maintenance, and immersive in-car entertainment is expected to outweigh these restraints. The Asia Pacific region, particularly China, Japan, and South Korea, is at the forefront of this IoV revolution, driven by a tech-savvy population and a strong manufacturing base for automotive and electronics industries. Continuous innovation in software and services, alongside a focus on robust component hardware, will be crucial for sustained market leadership and fulfilling the immense potential of the Internet of Vehicles.

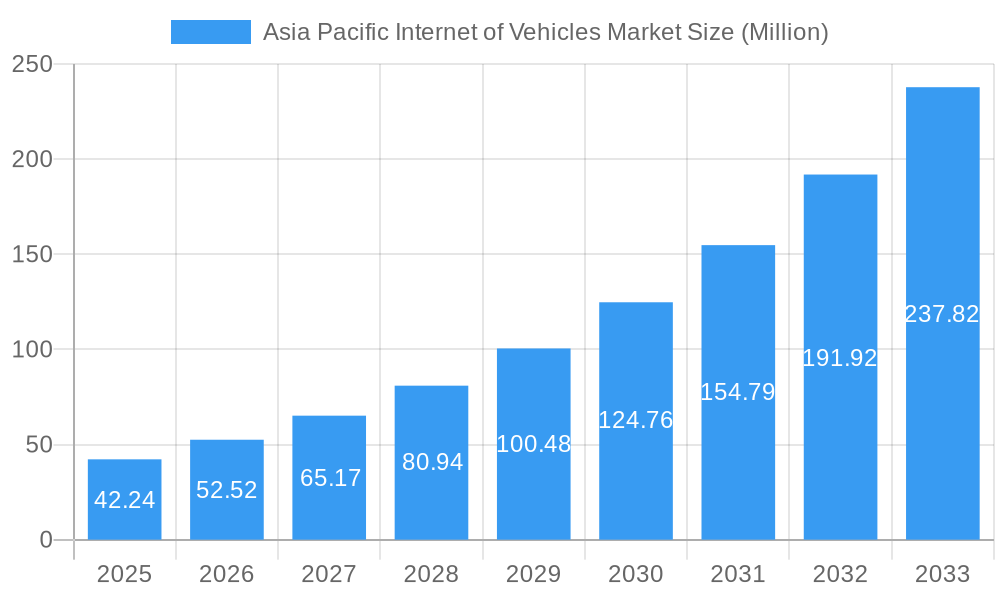

Asia Pacific Internet of Vehicles Market Company Market Share

This comprehensive report provides an in-depth analysis of the Asia Pacific Internet of Vehicles (IoV) market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this study delivers actionable intelligence for stakeholders navigating this rapidly evolving sector. The report explores key segments including Hardware, Software, and Service, alongside technologies like Wi-Fi, Bluetooth, NFC, and Cellular, and communication equipment such as Car-to-Car and Car-to-Infrastructure.

Asia Pacific Internet of Vehicles Market Market Dynamics & Structure

The Asia Pacific Internet of Vehicles market is characterized by a dynamic blend of increasing technological innovation and evolving regulatory landscapes. Market concentration is moderate, with key players vying for dominance through strategic investments in advanced IoV technologies. The primary drivers of innovation stem from the surging demand for connected and autonomous driving experiences, enhanced safety features, and the integration of in-car digital services. Regulatory frameworks across the region are progressively adapting to accommodate IoV technologies, focusing on data privacy, cybersecurity, and road safety standards, though inconsistencies can present challenges. Competitive product substitutes are emerging, particularly in telematics and infotainment systems, pushing established players to continuously innovate. End-user demographics are shifting, with a growing tech-savvy population in urban centers actively seeking advanced automotive solutions. Mergers and Acquisitions (M&A) are a significant trend, with companies consolidating to gain market share and acquire crucial technological capabilities. For instance, the past year has seen several strategic partnerships aimed at accelerating 5G integration for IoV applications.

- Market Concentration: Moderate, with a mix of established automotive giants and emerging tech players.

- Technological Innovation Drivers: Demand for autonomous driving, enhanced safety, in-car digital services, and 5G connectivity.

- Regulatory Frameworks: Evolving, with a focus on data privacy, cybersecurity, and safety standards, creating both opportunities and compliance hurdles.

- Competitive Product Substitutes: Telematics and advanced infotainment systems are key areas of competition.

- End-User Demographics: Growing adoption among tech-literate consumers in urban Asia Pacific regions.

- M&A Trends: Active M&A activity to secure technology and market position.

Asia Pacific Internet of Vehicles Market Growth Trends & Insights

The Asia Pacific Internet of Vehicles market is poised for substantial expansion, driven by a confluence of technological advancements and shifting consumer preferences. Over the forecast period of 2025–2033, the market size is projected to witness robust growth, underpinned by increasing vehicle connectivity rates and the widespread adoption of advanced automotive technologies. The CAGR for this period is estimated to be approximately xx%, reflecting the significant market penetration expected for IoV solutions. Technological disruptions, such as the widespread rollout of 5G networks and advancements in Artificial Intelligence (AI) for autonomous driving, are fundamentally reshaping the automotive landscape. These innovations are not only enhancing vehicle performance and safety but also creating new revenue streams through value-added services. Consumer behavior is increasingly shifting towards valuing integrated digital experiences within their vehicles, mirroring their expectations from smartphones and smart homes. This includes a demand for seamless connectivity, personalized infotainment, and proactive vehicle management services. The adoption of IoV technologies is also being fueled by government initiatives aimed at promoting smart cities and intelligent transportation systems across the region. For example, countries are investing heavily in smart infrastructure that can support vehicle-to-infrastructure (V2I) communication, further driving the demand for connected vehicles. The market penetration of connected car features is expected to rise from xx% in 2025 to an estimated xx% by 2033. The increasing complexity and sophistication of vehicle software and hardware components are also contributing to market growth, as manufacturers invest in creating more intelligent and responsive vehicles. Furthermore, the growing middle class in many Asia Pacific nations translates to a larger pool of potential buyers for premium vehicles equipped with advanced IoV features. The report also delves into the evolving landscape of automotive software, highlighting the growing importance of over-the-air (OTA) updates and in-car app ecosystems. These elements are crucial for delivering continuous improvements and new functionalities to consumers, thereby enhancing the overall ownership experience and driving repeat business for manufacturers and service providers. The integration of IoV with other emerging technologies like the Internet of Things (IoT) and blockchain for enhanced security and data management further amplifies the market's growth potential.

Dominant Regions, Countries, or Segments in Asia Pacific Internet of Vehicles Market

The Asia Pacific Internet of Vehicles market is experiencing significant growth across multiple segments, with certain regions and countries emerging as key growth engines. The Software segment is poised to dominate, driven by the increasing complexity of vehicle functionalities, the need for sophisticated data analytics, and the development of intelligent in-car applications. As vehicles evolve into mobile computing platforms, the value derived from software solutions—including operating systems, AI algorithms, and user interface platforms—is escalating. Countries like China, Japan, and South Korea are leading this charge due to their robust technological ecosystems, strong automotive manufacturing bases, and proactive government support for digital transformation in transportation. China, in particular, with its vast consumer market and aggressive push towards electrification and smart mobility, is a dominant force, accounting for an estimated xx% of the regional market share in 2025.

Key Drivers of Dominance:

China: Massive consumer base, government support for smart mobility, and rapid advancements in electric and connected vehicle technologies. Its market share is projected to reach xx% by 2033.

- Economic Policies: Favorable policies promoting R&D and adoption of IoV technologies.

- Infrastructure Development: Significant investments in 5G networks and smart city initiatives.

- Consumer Demand: High adoption rates for advanced digital features in vehicles.

Japan: Renowned for its automotive innovation and high-quality manufacturing, Japan is a significant player in the Hardware segment, particularly in advanced sensor technology and integrated electronic systems. Its focus on safety and efficiency drives the demand for sophisticated IoV components.

- Technological Expertise: Leading in automotive electronics and advanced driver-assistance systems (ADAS).

- Quality Standards: High demand for reliable and durable IoV hardware.

South Korea: A strong contender in both Hardware and Software, South Korea benefits from its leading technology companies and a government keen on fostering innovation in the automotive sector. The country is at the forefront of developing next-generation communication technologies for vehicles.

- Government Initiatives: Strong support for R&D in telecommunications and automotive technologies.

- Leading Technology Firms: Presence of major electronics and automotive component manufacturers.

Within the Technology segment, Cellular connectivity, particularly 5G, is emerging as the most crucial enabler, facilitating high-speed data transfer essential for advanced IoV applications like real-time navigation, autonomous driving, and seamless infotainment. The Communication Equipment segment is witnessing a surge in Car-to-Infrastructure solutions, as smart city projects and V2I communication become more prevalent, enabling vehicles to interact with traffic signals, road sensors, and other urban infrastructure. This synergy between hardware, software, and advanced communication technologies is creating a powerful ecosystem that is driving the overall growth and sophistication of the Asia Pacific Internet of Vehicles market.

Asia Pacific Internet of Vehicles Market Product Landscape

The Asia Pacific Internet of Vehicles product landscape is characterized by continuous innovation, with a focus on enhancing user experience, safety, and operational efficiency. Leading companies are introducing sophisticated software platforms that enable features like predictive maintenance, real-time traffic analysis, and personalized infotainment services. Hardware innovations include advanced sensor suites for autonomous driving, high-performance processing units for in-car AI, and robust telematics control units (TCUs). Applications span from enhanced navigation and remote vehicle diagnostics to in-car payments and immersive entertainment. Unique selling propositions often revolve around seamless integration with existing digital ecosystems and the provision of secure, over-the-air updates that continuously improve vehicle capabilities. For example, the integration of cloud-based services allows for real-time data processing and personalized user profiles, setting new benchmarks in automotive technology.

Key Drivers, Barriers & Challenges in Asia Pacific Internet of Vehicles Market

Key Drivers:

- Technological Advancements: The rapid evolution of 5G, AI, IoT, and advanced sensor technologies are fundamental drivers, enabling more sophisticated connected vehicle features.

- Consumer Demand: Growing consumer appetite for enhanced safety, convenience, personalized entertainment, and seamless digital experiences within their vehicles.

- Government Initiatives: Proactive government policies promoting smart cities, intelligent transportation systems, and electric vehicle adoption are accelerating IoV deployment.

- Automotive Industry Transformation: The shift towards software-defined vehicles and the increasing focus on data-driven services by automotive manufacturers.

Key Barriers & Challenges:

- Cybersecurity Threats: The interconnected nature of IoV systems makes them vulnerable to sophisticated cyberattacks, posing significant risks to data privacy and vehicle safety.

- Regulatory Hurdles: Inconsistent data privacy regulations, cybersecurity standards, and spectrum allocation across different Asia Pacific countries can hinder widespread adoption.

- Infrastructure Development Gaps: Uneven development of 5G networks and smart city infrastructure in certain regions limits the full potential of advanced IoV applications.

- High Implementation Costs: The initial investment required for developing and integrating IoV technologies can be substantial, impacting affordability for both manufacturers and consumers.

- Interoperability Issues: Ensuring seamless communication and data exchange between diverse vehicle systems, infrastructure, and third-party applications remains a challenge.

Emerging Opportunities in Asia Pacific Internet of Vehicles Market

Emerging opportunities lie in the development of comprehensive in-car ecosystems that integrate various digital services beyond traditional automotive functions. This includes partnerships with e-commerce platforms for seamless in-car purchasing, integration with smart home devices for remote control and monitoring, and the expansion of the Android Auto platform to include more specialized apps like IoT and weather services, as demonstrated by Google's recent initiatives. The growing demand for personalization presents opportunities for AI-driven services that adapt to individual driver preferences and habits. Furthermore, the nascent market for Vehicle-to-Everything (V2X) communication, including Car-to-Car (C2C) and Car-to-Infrastructure (C2I), offers significant potential for enhancing road safety and traffic efficiency. The increasing adoption of electric vehicles (EVs) also opens avenues for specialized IoV services related to charging infrastructure, battery management, and optimized route planning for EVs.

Growth Accelerators in the Asia Pacific Internet of Vehicles Market Industry

The Asia Pacific Internet of Vehicles market is experiencing significant acceleration driven by strategic alliances and technological breakthroughs. The ongoing integration of 5G technology is a paramount growth accelerator, enabling ultra-low latency and high-bandwidth communications critical for advanced IoV functions such as real-time data streaming for autonomous driving and immersive in-car experiences. Furthermore, the increasing adoption of AI and Machine Learning (ML) algorithms within vehicles is enhancing predictive capabilities for maintenance, improving safety features, and personalizing user experiences, thereby driving demand for sophisticated software solutions. Strategic partnerships between automotive manufacturers, technology providers, and telecommunication companies are crucial for fostering innovation and expanding market reach. For instance, collaborations like the one between Cisco and Audi to enhance mobile car collaboration experiences are indicative of how industry players are proactively addressing evolving consumer needs and creating new application spaces for IoV.

Key Players Shaping the Asia Pacific Internet of Vehicles Market Market

- Tesla Motors

- IBM Corporation

- Google LLC

- Volvo

- Verizon Communications Inc

- Telefonaktiebolaget LM Ericsson

- Cisco System Inc

- AT&T Inc

- Toyota Connected Asia-Pacific Limited

Notable Milestones in Asia Pacific Internet of Vehicles Market Sector

- June 2023: Cisco and Audi announced an initiative to enhance mobile car collaboration experiences, aiming to provide secure and user-friendly mobile collaboration for hybrid workers through the Webex automotive application available in the Audi Application Store.

- May 2023: Alphabet Inc., through its subsidiary Google, introduced new features and services for cars, including video conferencing, gaming, and YouTube, expanding Android Auto's app capabilities to include IoT and weather apps.

In-Depth Asia Pacific Internet of Vehicles Market Market Outlook

The future outlook for the Asia Pacific Internet of Vehicles market is exceptionally bright, driven by continuous technological advancements and evolving consumer expectations for integrated digital mobility. The expansion of 5G networks will further unlock the potential of real-time V2X communication, paving the way for enhanced traffic management, predictive safety, and seamless autonomous driving experiences. Strategic collaborations, such as those focusing on in-car app development and cloud-based services, will foster innovation and create new revenue streams. The increasing focus on data analytics and AI will lead to more personalized and efficient vehicle operations and user experiences. As governments continue to invest in smart city infrastructure and intelligent transportation systems, the demand for connected vehicles is set to surge, making the Asia Pacific IoV market a significant growth engine for the global automotive and technology sectors.

Asia Pacific Internet of Vehicles Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

-

2. Technology

- 2.1. Wi-FI

- 2.2. Bluetooth

- 2.3. NFC

- 2.4. Cellular

- 2.5. Other Technology Types

-

3. Communication Equipment

- 3.1. Car-to-Car

- 3.2. Car-to-Infrastructure

- 3.3. Other Communication Equipment

Asia Pacific Internet of Vehicles Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Internet of Vehicles Market Regional Market Share

Geographic Coverage of Asia Pacific Internet of Vehicles Market

Asia Pacific Internet of Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing number of people connected to internet; Growth in adoption of Big Data solutions; New Technologies like 5G

- 3.2.2 Big Data Solutions

- 3.2.3 and AI to Boost the Demand for Internet-Enabled Cars

- 3.3. Market Restrains

- 3.3.1. Technology yet to become fully functional; Initial Costs are high

- 3.4. Market Trends

- 3.4.1 New Technologies like 5G

- 3.4.2 Big Data Solutions

- 3.4.3 and AI to Boost the Demand for Internet-Enabled Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Internet of Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Wi-FI

- 5.2.2. Bluetooth

- 5.2.3. NFC

- 5.2.4. Cellular

- 5.2.5. Other Technology Types

- 5.3. Market Analysis, Insights and Forecast - by Communication Equipment

- 5.3.1. Car-to-Car

- 5.3.2. Car-to-Infrastructure

- 5.3.3. Other Communication Equipment

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tesla Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volvo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Verizon Communications Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telefonaktiebolaget LM Ericsson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco System Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AT&T Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Connected Asia-Pacific Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Tesla Motors

List of Figures

- Figure 1: Asia Pacific Internet of Vehicles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Internet of Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Communication Equipment 2020 & 2033

- Table 4: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Communication Equipment 2020 & 2033

- Table 8: Asia Pacific Internet of Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Internet of Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Internet of Vehicles Market?

The projected CAGR is approximately 24.41%.

2. Which companies are prominent players in the Asia Pacific Internet of Vehicles Market?

Key companies in the market include Tesla Motors, IBM Corporation, Google LLC, Volvo, Verizon Communications Inc, Telefonaktiebolaget LM Ericsson, Cisco System Inc, AT&T Inc, Toyota Connected Asia-Pacific Limited.

3. What are the main segments of the Asia Pacific Internet of Vehicles Market?

The market segments include Component, Technology, Communication Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of people connected to internet; Growth in adoption of Big Data solutions; New Technologies like 5G. Big Data Solutions. and AI to Boost the Demand for Internet-Enabled Cars.

6. What are the notable trends driving market growth?

New Technologies like 5G. Big Data Solutions. and AI to Boost the Demand for Internet-Enabled Cars.

7. Are there any restraints impacting market growth?

Technology yet to become fully functional; Initial Costs are high.

8. Can you provide examples of recent developments in the market?

June 2023, Cisco and Audi has announced to enhance mobile car collaboration experiences for hybrid workers in to order meet consumer demand and provide a safe, secure and easy-to-use secure mobile collaboration experience, the Webex automotive application will be available through the in-vehicle Audi Application Store.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Internet of Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Internet of Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Internet of Vehicles Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Internet of Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence