Key Insights

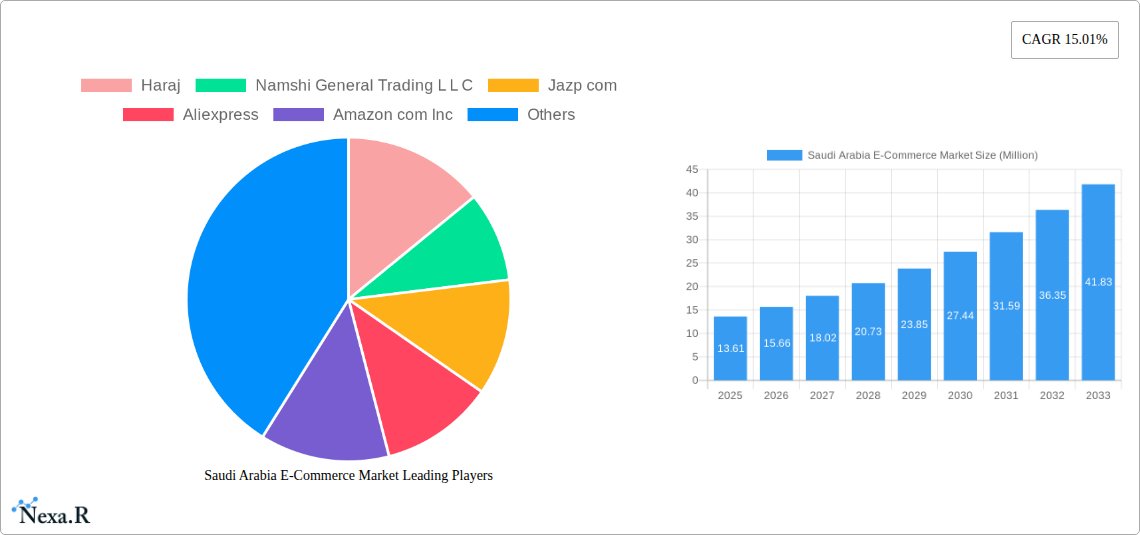

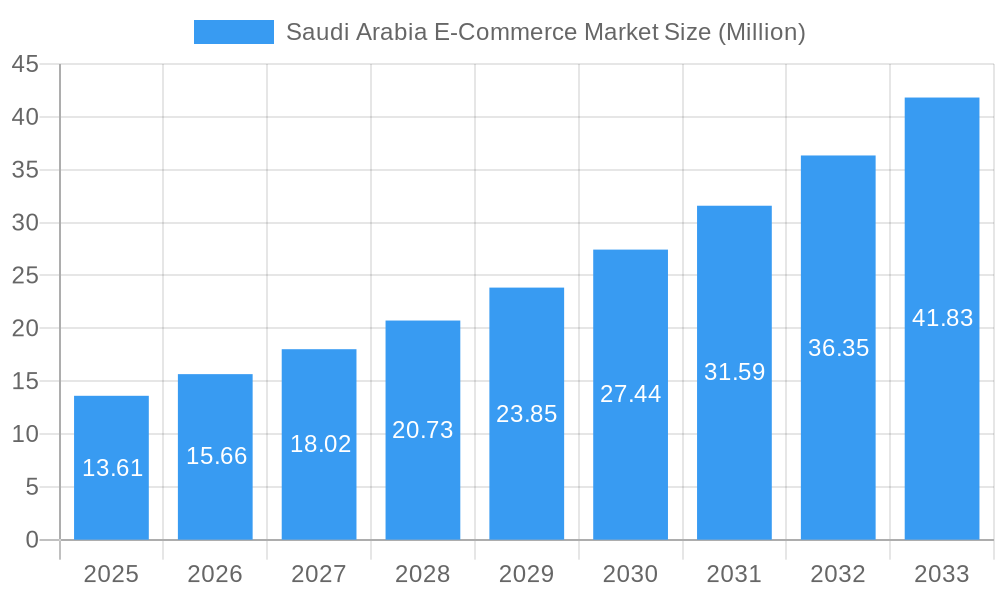

The Saudi Arabian e-commerce market is poised for significant expansion, projected to reach an estimated \$13.61 million in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 15.01% anticipated over the forecast period of 2025-2033. This surge is primarily driven by increasing internet penetration, a young and tech-savvy population, and a growing disposable income that fuels online purchasing. Government initiatives aimed at digital transformation and economic diversification, such as Vision 2030, are further catalyzing this e-commerce boom by fostering a more conducive environment for online businesses and digital payments. The widespread adoption of smartphones and the convenience offered by online platforms are making e-commerce an increasingly integral part of daily life for Saudi consumers.

Saudi Arabia E-Commerce Market Market Size (In Million)

The market is characterized by a diverse range of product segments, with Fashion & Apparel, Electronics, and Grocery emerging as dominant categories, reflecting evolving consumer preferences for convenience and variety. The rise of online grocery shopping, in particular, has been accelerated by changing lifestyles and the demand for quick and efficient delivery services. While individual consumers represent the largest end-user segment, businesses (B2B) and government institutions are also increasingly leveraging e-commerce for procurement and service delivery, adding another layer of growth potential. Key players like Amazon.com Inc., Noon E-Commerce, and AliExpress are intensely competing, driving innovation in logistics, customer experience, and payment solutions. Emerging local players like Haraj and Namshi are also carving out significant market share, catering to specific consumer needs and preferences within the region. The market's momentum is further propelled by ongoing investments in logistics infrastructure and payment gateways, ensuring a seamless and secure online shopping experience.

Saudi Arabia E-Commerce Market Company Market Share

Saudi Arabia E-Commerce Market: Comprehensive Report 2019–2033

This in-depth report provides a definitive analysis of the Saudi Arabia E-Commerce Market, covering market dynamics, growth trends, dominant segments, competitive landscape, and future outlook from 2019 to 2033. With a base year of 2025, this report offers critical insights for industry professionals seeking to understand and capitalize on the Kingdom's rapidly expanding digital commerce ecosystem. Explore parent and child market dynamics, key drivers, emerging opportunities, and strategic initiatives shaping the future of online retail in Saudi Arabia.

Saudi Arabia E-Commerce Market Market Dynamics & Structure

The Saudi Arabia E-Commerce Market is characterized by a dynamic and evolving structure, driven by increasing internet penetration, a young and digitally savvy population, and supportive government initiatives. Market concentration is observed among leading players like Amazon.com Inc., Noon Ad Holdings Ltd (Noon E-Commerce), and Aliexpress, who dominate significant market share through extensive product portfolios and robust logistics networks. Technological innovation is a key driver, with advancements in AI-powered personalization, blockchain for secure transactions, and augmented reality for enhanced shopping experiences continuously reshaping the landscape.

- Market Concentration: Dominated by a few key players, with a growing presence of specialized niche platforms.

- Technological Innovation Drivers: AI for personalization, AR for virtual try-ons, efficient payment gateways, and advanced logistics technology.

- Regulatory Frameworks: Government initiatives like Vision 2030 are fostering a conducive environment for e-commerce growth, with ongoing efforts to streamline regulations and promote digital transformation.

- Competitive Product Substitutes: Traditional retail remains a significant substitute, but its market share is gradually eroding due to the convenience and wider selection offered by online channels.

- End-User Demographics: Predominantly driven by individual consumers, with a nascent but growing B2B segment and limited government and institutional adoption currently.

- M&A Trends: The market has witnessed strategic acquisitions, such as Noon's acquisition of Namshi, to consolidate market position and expand offerings. Deal volumes are expected to increase as established players seek to acquire innovative startups and niche businesses.

Saudi Arabia E-Commerce Market Growth Trends & Insights

The Saudi Arabia E-commerce market is on an upward trajectory, fueled by a confluence of economic prosperity, technological adoption, and shifting consumer preferences. The market size is projected to witness robust growth, with an estimated Compound Annual Growth Rate (CAGR) that underscores its significant potential. This expansion is directly correlated with the increasing adoption rates of online shopping across various demographics, particularly the youth segment, who are early adopters of digital platforms and modern shopping paradigms. Technological disruptions are playing a pivotal role in shaping this growth. Innovations in payment gateways, such as the widespread acceptance of digital wallets and contactless payments, have streamlined the transaction process, making it more convenient and secure for consumers. Furthermore, the proliferation of smartphones and affordable internet access has democratized e-commerce, bringing it within reach of a larger portion of the population.

Consumer behavior shifts are profoundly impacting the market. There's a discernible move towards hyper-personalization, with consumers expecting tailored product recommendations and customized shopping experiences. This has led e-commerce platforms to invest heavily in data analytics and AI to understand individual preferences and purchasing patterns. The demand for fast and reliable delivery services is also a critical factor, driving investments in logistics and supply chain optimization. Platforms are increasingly offering same-day or next-day delivery options, enhancing customer satisfaction and loyalty. The COVID-19 pandemic further accelerated these trends, normalizing online shopping for essential goods like groceries and pharmaceuticals, a behavior that has largely persisted. The growing influence of social commerce, where purchasing decisions are swayed by social media influencers and peer recommendations, is another significant trend. This creates new avenues for marketing and customer engagement. As the digital infrastructure continues to mature and consumer trust in online transactions solidifies, the Saudi Arabia e-commerce market is poised for sustained and accelerated growth, attracting both local and international investment.

Dominant Regions, Countries, or Segments in Saudi Arabia E-Commerce Market

The Saudi Arabia E-Commerce Market's dominance is significantly influenced by a few key segments and a concentrated consumer base, primarily within major urban centers. Among the product types, Fashion & Apparel stands out as the leading segment, driven by a youthful population with a keen interest in global fashion trends and a high disposable income. This segment benefits from the presence of major online fashion retailers like Namshi (now part of Noon) and Noon itself, offering a vast array of brands and styles. The accessibility of online platforms has democratized fashion shopping, allowing consumers to explore a wider selection than traditional brick-and-mortar stores can offer.

- Fashion & Apparel: This segment enjoys the highest market share due to strong consumer interest, availability of international and local brands, and effective online marketing strategies. The rapid adoption of social media further fuels fashion-related online purchases.

- Electronics: Following closely, the Electronics segment thrives on the demand for the latest gadgets, home appliances, and computing devices. Major players like Amazon and Aliexpress offer competitive pricing and a wide selection, making them go-to destinations for tech-savvy consumers.

- Beauty & Personal Care: This segment is experiencing substantial growth, propelled by a growing emphasis on wellness and personal grooming. Online retailers are catering to this demand with specialized product offerings and personalized recommendations.

- Grocery: While historically slower to adopt, the Grocery segment is rapidly gaining traction, accelerated by the convenience and safety offered by online delivery services, especially post-pandemic. Platforms are investing heavily in cold chain logistics and wider product ranges to capture this market.

- Home Décor & Furniture: This segment is also witnessing a steady rise, as consumers seek to enhance their living spaces with modern and diverse furniture and décor options available online.

The Individual Consumers end-user segment is overwhelmingly the dominant driver of the Saudi Arabia E-Commerce Market. This is attributed to the Kingdom's demographics, with a large proportion of the population being young, digitally connected, and with a rising disposable income. They are actively engaged in online shopping for a wide range of products, from daily necessities to luxury goods.

- Individual Consumers: This segment represents the vast majority of e-commerce transactions, driven by convenience, variety, competitive pricing, and the increasing accessibility of online platforms.

- Businesses (B2B): While still in its nascent stages, the B2B segment is showing promising growth potential, particularly for procurement of office supplies, IT equipment, and specialized industrial goods.

- Government & Institutions: This segment is the smallest but holds potential for future growth, especially as government entities increasingly adopt digital procurement processes and invest in digital transformation initiatives.

The geographic concentration of e-commerce activity is highest in major cities like Riyadh, Jeddah, and Dammam, owing to higher population density, better infrastructure, and greater digital literacy. However, efforts to expand reach into secondary cities and remote areas are ongoing.

Saudi Arabia E-Commerce Market Product Landscape

The Saudi Arabia E-Commerce Market's product landscape is characterized by a diverse and expanding array of offerings designed to meet the evolving demands of consumers. The Fashion & Apparel segment continues to lead, showcasing a wide spectrum from fast fashion to high-end designer wear, with a notable surge in demand for modest fashion and activewear. Electronics remains a robust category, featuring the latest smartphones, laptops, gaming consoles, and home entertainment systems, often with exclusive online deals and early releases. The Beauty & Personal Care segment is vibrant, offering a curated selection of skincare, cosmetics, fragrances, and personal grooming tools, with a growing emphasis on natural and organic products. Grocery is rapidly digitalizing, with platforms expanding their offerings to include fresh produce, pantry staples, and household essentials, focusing on convenience and rapid delivery. Home Décor & Furniture presents a growing opportunity, with consumers seeking unique and aesthetically pleasing items to personalize their living spaces, often facilitated by visual search and augmented reality features. Beyond these core categories, the "Others" segment encompasses a wide range of niche products, including books, toys, automotive parts, and health & wellness items, demonstrating the market's capacity to cater to specialized interests. Technological advancements, such as AI-powered product recommendations and personalized shopping experiences, are enhancing the appeal and performance of these product categories.

Key Drivers, Barriers & Challenges in Saudi Arabia E-Commerce Market

Key Drivers:

The Saudi Arabia E-Commerce Market is propelled by a robust set of drivers. A significant catalyst is the Vision 2030 initiative, which actively promotes digital transformation and economic diversification, creating a favorable regulatory and investment climate for e-commerce. The young and tech-savvy population, with high smartphone penetration and internet access, forms a substantial consumer base eager to embrace online shopping. Increasing disposable incomes further fuel consumer spending power. Technological advancements, including the widespread adoption of mobile payments and the development of sophisticated logistics and delivery infrastructure, are enhancing convenience and efficiency. Furthermore, the growing acceptance and trust in online payment methods are crucial for sustained growth.

Barriers & Challenges:

Despite its growth, the market faces several barriers. Logistical complexities, particularly in last-mile delivery to remote areas, can impact delivery times and costs. Consumer trust and concerns about online security still pose a challenge, although this is diminishing with increased digital literacy. Intense competition among established players and the emergence of new entrants necessitate continuous innovation and competitive pricing strategies. Regulatory hurdles related to cross-border e-commerce and data privacy, though improving, can sometimes create complexities. Supply chain disruptions, as witnessed globally, can affect product availability and lead times. The digital skills gap among some segments of the population can also present a challenge for broader adoption.

Emerging Opportunities in Saudi Arabia E-Commerce Market

Emerging opportunities in the Saudi Arabia E-Commerce Market are abundant, driven by unmet consumer needs and evolving market trends. The B2B e-commerce segment presents a significant untapped market, with businesses increasingly seeking digital solutions for procurement. Specialized platforms catering to specific industries, such as healthcare supplies or construction materials, are poised for growth. The rise of social commerce, leveraging social media platforms for direct sales, offers new avenues for engagement and customer acquisition. The increasing demand for sustainable and ethically sourced products presents an opportunity for niche e-commerce players focusing on eco-friendly and socially responsible brands. Furthermore, the expansion of e-commerce into less developed regions and cities within the Kingdom offers substantial growth potential, provided that logistical challenges are effectively addressed. The integration of Artificial Intelligence (AI) for hyper-personalized shopping experiences and augmented reality (AR) for virtual product try-ons will continue to be key differentiators.

Growth Accelerators in the Saudi Arabia E-Commerce Market Industry

Several catalysts are accelerating long-term growth within the Saudi Arabia E-Commerce Market. The continued government support through Vision 2030, with its emphasis on digital infrastructure development and fostering a pro-business environment, remains a cornerstone. Strategic partnerships between e-commerce platforms and logistics providers are crucial for optimizing delivery networks and expanding reach. Investments in last-mile delivery solutions, including drone technology and smart lockers, are set to improve efficiency and customer satisfaction. The increasing adoption of fintech solutions and the development of innovative payment gateways are further simplifying transactions. Furthermore, the focus on building robust digital payment ecosystems and promoting financial inclusion will drive wider consumer participation. The continuous evolution of customer-centric strategies, including personalized marketing and loyalty programs, will foster customer retention and repeat purchases.

Key Players Shaping the Saudi Arabia E-Commerce Market Market

- Haraj

- Namshi General Trading L L C

- Jazp com

- Aliexpress

- Amazon com Inc

- Carrefou

- eBay Inc

- Noon Ad Holdings Ltd (Noon E-Commerce)

Notable Milestones in Saudi Arabia E-Commerce Market Sector

- February 2023: The online fashion retailer Namshi, which operated primarily in Saudi Arabia, was acquired by the e-commerce company Noon for a total cash consideration of USD 335.2 million, significantly consolidating Noon's position in the fashion and lifestyle segment within the country.

- December 2022: Sideup, an e-commerce platform developer, received USD 1.2 million in funding from local and international investors. The business was to use its investment funds to expand its operations in Saudi Arabia and shift its headquarters to Riyadh as part of its plans for Saudi Arabia, signaling continued investment in e-commerce infrastructure and development.

In-Depth Saudi Arabia E-Commerce Market Market Outlook

The Saudi Arabia E-Commerce Market outlook remains exceptionally positive, fueled by sustained economic growth, ongoing digital transformation initiatives, and an increasingly digitally-native consumer base. Growth accelerators such as enhanced logistics networks, evolving payment infrastructures, and strategic M&A activities will continue to shape the market. The expansion of B2B e-commerce and the increasing adoption of social commerce present significant untapped potential. Investments in AI and AR are expected to further enhance customer engagement and personalization. As the Kingdom continues to diversify its economy and foster innovation, the e-commerce sector is poised to play a pivotal role in its economic future, offering substantial strategic opportunities for both domestic and international stakeholders.

Saudi Arabia E-Commerce Market Segmentation

-

1. Product Type

- 1.1. Fashion & Apparel

- 1.2. Electronics

- 1.3. Grocery

- 1.4. Beauty & Personal Care

- 1.5. Home Décor & Furniture

- 1.6. Others

-

2. End-User

- 2.1. Individual Consumers

- 2.2. Businesses (B2B)

- 2.3. Government & Institutions

Saudi Arabia E-Commerce Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-Commerce Market Regional Market Share

Geographic Coverage of Saudi Arabia E-Commerce Market

Saudi Arabia E-Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector

- 3.2.2 including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel Segment is Expected to Grow Exponentially

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion & Apparel

- 5.1.2. Electronics

- 5.1.3. Grocery

- 5.1.4. Beauty & Personal Care

- 5.1.5. Home Décor & Furniture

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Individual Consumers

- 5.2.2. Businesses (B2B)

- 5.2.3. Government & Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Haraj

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Namshi General Trading L L C

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jazp com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aliexpress

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon com Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carrefou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 eBay Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Noon Ad Holdings Ltd (Noon E-Commerce)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Haraj

List of Figures

- Figure 1: Saudi Arabia E-Commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-Commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-Commerce Market?

The projected CAGR is approximately 15.01%.

2. Which companies are prominent players in the Saudi Arabia E-Commerce Market?

Key companies in the market include Haraj, Namshi General Trading L L C, Jazp com, Aliexpress, Amazon com Inc, Carrefou, eBay Inc, Noon Ad Holdings Ltd (Noon E-Commerce).

3. What are the main segments of the Saudi Arabia E-Commerce Market?

The market segments include Product Type , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 13.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector. including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers.

6. What are the notable trends driving market growth?

Fashion and Apparel Segment is Expected to Grow Exponentially.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2023: The online fashion retailer Namshi, which operated primarily in Saudi Arabia, was acquired by the e-commerce company Noon for a total cash consideration of USD 335.2 million, and this addition of more fashion and lifestyle brands to Noon's digital offering of goods and services in the country

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-Commerce Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence