Key Insights

The Subscriber Data Analysis Market is projected for substantial growth, with an estimated market size of $557.8 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 13.3%. This expansion is driven by the escalating volume and complexity of subscriber data across telecommunications, media, and digital services. Key growth factors include the demand for personalized customer experiences, the need for improved network performance and optimization, and the increasing importance of robust security and fraud prevention. As service providers focus on customer engagement and operational efficiency, leveraging subscriber data for actionable insights is critical. The proliferation of 5G, IoT, and a hyper-connected consumer base generates vast amounts of data, necessitating sophisticated analytical solutions.

Subscriber Data Analysis Market Market Size (In Billion)

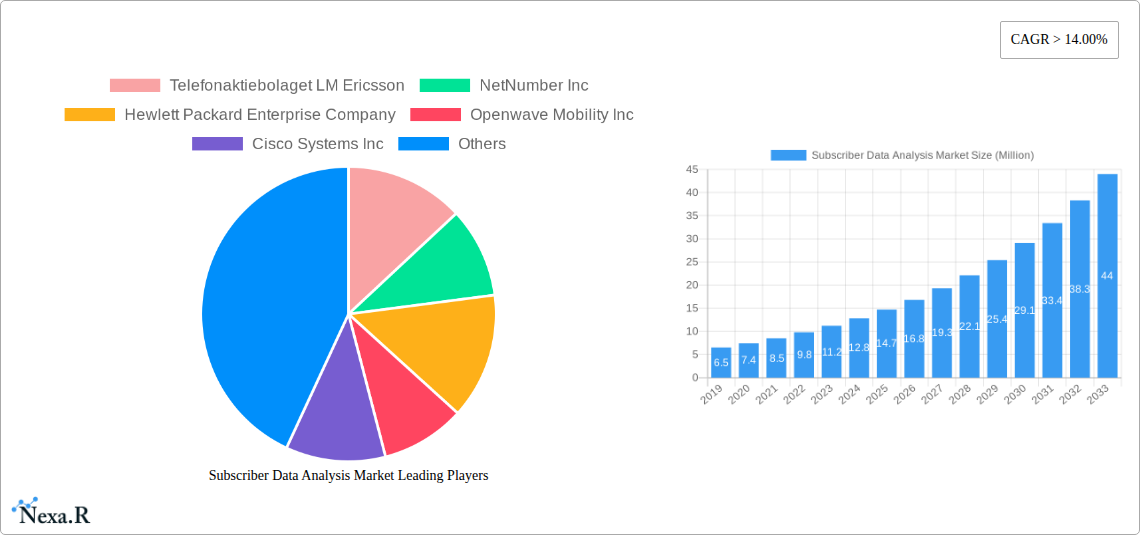

The market is segmented by deployment models, with cloud-based solutions gaining traction due to scalability and cost-effectiveness, while on-premise remains relevant for data sovereignty. Large enterprises are key adopters for strategic decision-making, and SMEs are increasingly utilizing it for customer acquisition and retention. Core solutions include Subscriber Data Repositories, Subscriber Policy Management, and Subscriber Identity Management. Leading players include Ericsson, NetNumber, HPE, Openwave Mobility, Cisco, Huawei, ZTE, Computaris, and Nokia. The Asia Pacific region is expected to be a significant growth driver due to rapid digital transformation and expanding mobile penetration.

Subscriber Data Analysis Market Company Market Share

This report offers a comprehensive analysis of the global Subscriber Data Analysis Market, covering its dynamics, growth, key players, and future outlook. It provides data-driven forecasts and actionable insights for stakeholders in this evolving sector.

Subscriber Data Analysis Market Market Dynamics & Structure

The Subscriber Data Analysis Market is characterized by a moderately concentrated landscape, with leading players like Telefonaktiebolaget LM Ericsson, NetNumber Inc, Hewlett Packard Enterprise Company, Openwave Mobility Inc, Cisco Systems Inc, Huawei Technologies Co Ltd, ZTE Corporation, Computaris International Ltd, and Nokia Corporation holding significant influence. Technological innovation is a primary driver, fueled by the increasing demand for personalized customer experiences, enhanced network efficiency, and proactive threat detection. The integration of AI and machine learning algorithms is revolutionizing how subscriber data is processed and analyzed, enabling predictive insights and automated decision-making. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), are shaping market development, necessitating robust compliance measures and transparent data handling practices. Competitive product substitutes are emerging, ranging from advanced analytics platforms to specialized customer data platforms (CDPs), pushing vendors to differentiate through superior functionality and integration capabilities. End-user demographics are diverse, encompassing telecommunications operators, media and entertainment companies, and other digital service providers, each with unique data analysis needs. Mergers and acquisitions (M&A) remain a strategic trend, with larger entities acquiring innovative startups to expand their technological portfolios and market reach. For instance, the past few years have witnessed several significant M&A deals aimed at consolidating market share and acquiring specialized data analytics expertise. Innovation barriers include the complexity of data integration from disparate sources and the high cost of advanced analytical tools, alongside the continuous need for skilled data scientists and analysts.

- Market Concentration: Moderately concentrated, with a few key players dominating the market.

- Technological Innovation Drivers: AI/ML integration, real-time analytics, predictive modeling, personalized customer journeys.

- Regulatory Frameworks: Stringent data privacy and security regulations are paramount.

- Competitive Product Substitutes: Advanced analytics platforms, Customer Data Platforms (CDPs).

- End-User Demographics: Telecom operators, media, entertainment, digital service providers.

- M&A Trends: Consolidation of market share and acquisition of specialized technology.

- Innovation Barriers: Data integration complexity, cost of advanced tools, talent scarcity.

Subscriber Data Analysis Market Growth Trends & Insights

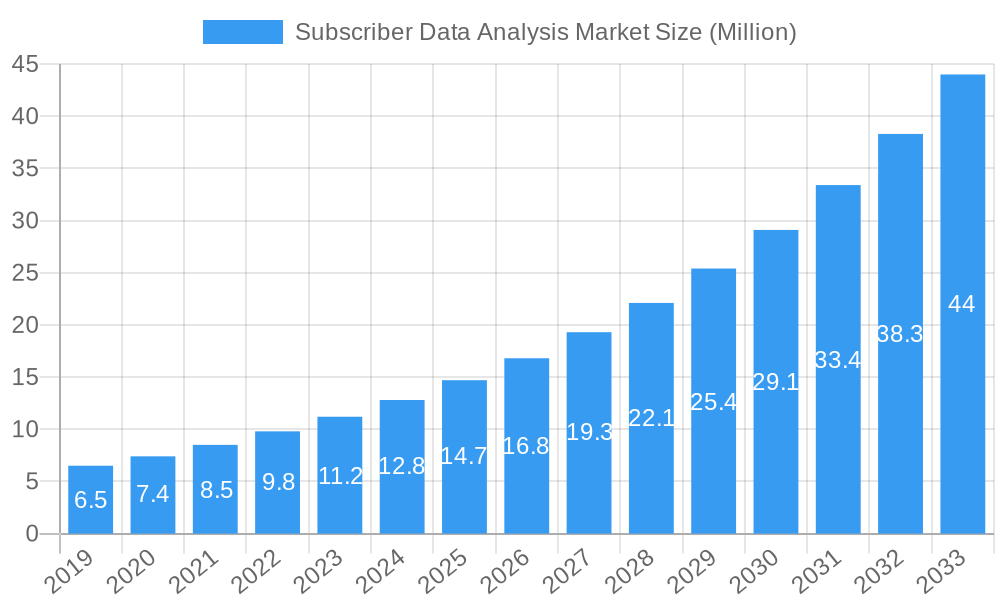

The Subscriber Data Analysis Market is projected for robust expansion, driven by the escalating volume of digital interactions and the consequent explosion of subscriber data. The market size, valued at $5,120.5 Million in 2025, is anticipated to grow at a compound annual growth rate (CAGR) of 18.6% during the forecast period of 2025–2033, reaching an estimated $19,545.7 Million by 2033. This impressive growth is propelled by the increasing adoption of cloud-based solutions, offering scalability, flexibility, and cost-efficiency for data storage and processing. On-premise deployments, while still relevant for organizations with stringent data control requirements, are gradually ceding ground to cloud alternatives.

Technological disruptions, particularly the advancement of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, are fundamentally reshaping the subscriber data analysis landscape. These technologies enable sophisticated pattern recognition, predictive analytics, and personalized service delivery, moving beyond basic data aggregation. Consumer behavior shifts towards hyper-personalized experiences are forcing businesses to leverage subscriber data for targeted marketing, customized product offerings, and proactive customer support. The adoption rate of advanced analytics tools is accelerating across various industries, as organizations recognize the competitive advantage derived from actionable data insights. For instance, telecommunication providers are increasingly utilizing subscriber data to optimize network performance, reduce churn, and develop new revenue streams through value-added services. The penetration of mobile devices and the proliferation of IoT devices are generating unprecedented volumes of real-time data, further fueling the demand for efficient subscriber data analysis solutions. The historical period (2019–2024) witnessed steady growth, laying the groundwork for the accelerated expansion expected in the coming decade. Key metrics such as market penetration, average revenue per user (ARPU) analysis, and churn prediction models are becoming critical components of any successful subscriber data strategy.

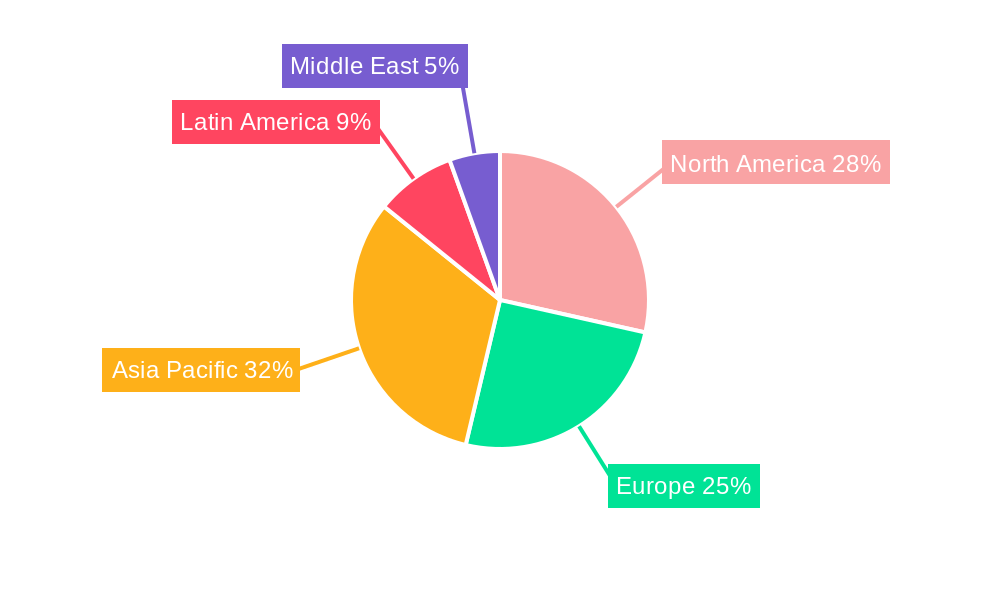

Dominant Regions, Countries, or Segments in Subscriber Data Analysis Market

North America currently holds a dominant position in the Subscriber Data Analysis Market, driven by its advanced technological infrastructure, a high concentration of large enterprises, and a strong emphasis on data-driven decision-making. The United States, in particular, is a key contributor, with its leading telecommunications companies and technology giants heavily investing in sophisticated subscriber data analysis solutions. The prevalence of cloud deployments in this region, accounting for a significant market share of 65% of total deployments in 2025, facilitates the rapid processing and analysis of vast datasets.

- Regional Dominance: North America leads due to technological advancements and enterprise adoption.

- Country-Specific Strength: The United States is a major market driver.

- Deployment Dominance: Cloud deployments are favored for scalability and flexibility, representing an estimated $3,328.3 Million market share in 2025. On-premise deployments are estimated at $1,792.2 Million in the same year.

- Organization Size Focus: Large Enterprises constitute the primary customer base, contributing an estimated $3,584.4 Million to the market in 2025, owing to their extensive subscriber bases and complex analytical needs. Small & Medium Enterprises (SMEs) represent a growing segment, estimated at $1,536.1 Million in 2025, as cloud solutions become more accessible.

- Solution Dominance: Subscriber Data Repository solutions are foundational, estimated at $1,638.6 Million in 2025, enabling centralized data storage. Subscriber Policy Management follows closely, estimated at $1,510.4 Million in 2025, crucial for governing data access and usage. Subscriber Identity Management is also a significant segment, valued at $1,219.5 Million in 2025, and the "Subscriber" segment (encompassing broader subscriber analytics) contributes an estimated $752.0 Million.

Economic policies supporting digital transformation, coupled with robust investments in 5G infrastructure, are further accelerating market growth in North America. The region's early adoption of AI and ML technologies in subscriber data analysis provides a significant competitive edge. While other regions like Europe and Asia-Pacific are experiencing substantial growth, North America's established ecosystem and proactive approach to leveraging data insights position it as the leading market for the foreseeable future.

Subscriber Data Analysis Market Product Landscape

The Subscriber Data Analysis Market is characterized by a dynamic product landscape focused on delivering actionable insights from diverse subscriber data streams. Innovations are centered around enhancing the accuracy, speed, and depth of analysis. Key product categories include sophisticated Subscriber Data Repositories for secure and scalable data storage, advanced Subscriber Policy Management tools for granular control over data access and compliance, and robust Subscriber Identity Management solutions ensuring data integrity and user authentication. Emerging solutions are integrating real-time processing capabilities and predictive analytics engines, allowing businesses to anticipate customer behavior, optimize service delivery, and personalize engagement. The unique selling propositions often lie in the ability to unify disparate data sources, provide intuitive visualization dashboards, and offer seamless integration with existing enterprise systems. Technological advancements in areas like natural language processing (NLP) for sentiment analysis of customer feedback and graph databases for understanding complex relationship networks are enhancing the performance metrics of these solutions.

Key Drivers, Barriers & Challenges in Subscriber Data Analysis Market

Key Drivers: The subscriber data analysis market is primarily driven by the insatiable demand for personalized customer experiences, necessitating deeper insights into user behavior and preferences. The escalating volume of digital data generated by mobile devices and IoT gadgets provides a rich source for analysis. Advancements in AI and Machine Learning are enabling more sophisticated analytical capabilities, leading to predictive insights and automated decision-making. Furthermore, the drive for operational efficiency and cost optimization within telecom and digital service providers compels them to leverage data for network performance enhancement and resource allocation.

Key Barriers & Challenges: A significant challenge lies in ensuring data privacy and compliance with evolving regulatory frameworks like GDPR and CCPA. The complexity of integrating data from disparate sources and legacy systems poses a considerable hurdle, often requiring substantial IT investment. The scarcity of skilled data scientists and analysts capable of extracting meaningful insights from raw data is another restraint. Moreover, the high cost of advanced analytics software and infrastructure can be prohibitive for smaller organizations. Security concerns surrounding the storage and processing of sensitive subscriber data remain paramount, demanding robust cybersecurity measures.

Emerging Opportunities in Subscriber Data Analysis Market

Emerging opportunities in the Subscriber Data Analysis Market are largely shaped by the pervasive expansion of the Internet of Things (IoT) and the growing demand for real-time, context-aware services. Untapped markets include the development of specialized analytics for emerging technologies like augmented reality (AR) and virtual reality (VR) user behavior. Innovative applications are arising in predictive maintenance for consumer electronics and personalized healthcare based on wearable device data. Evolving consumer preferences for proactive and seamless customer support present opportunities for AI-powered chatbots and self-service analytics platforms. The increasing focus on sustainability and ethical data usage is also opening avenues for privacy-preserving analytics and transparent data governance solutions.

Growth Accelerators in the Subscriber Data Analysis Market Industry

Several catalysts are accelerating the long-term growth of the Subscriber Data Analysis Market. Technological breakthroughs in areas such as edge computing, enabling data processing closer to the source, are crucial for real-time analytics. Strategic partnerships between cloud providers, data analytics software vendors, and telecommunications companies are fostering innovation and expanding market reach. The continuous evolution of 5G technology is creating a vastly more connected ecosystem, generating unprecedented data volumes that require advanced analytical capabilities. Market expansion strategies, including the penetration into new industry verticals beyond traditional telecom and media, such as retail and finance, are also significant growth drivers. The development of more user-friendly, low-code/no-code analytics platforms is democratizing access to data insights, further fueling adoption.

Key Players Shaping the Subscriber Data Analysis Market Market

- Telefonaktiebolaget LM Ericsson

- NetNumber Inc

- Hewlett Packard Enterprise Company

- Openwave Mobility Inc

- Cisco Systems Inc

- Huawei Technologies Co Ltd

- ZTE Corporation

- Computaris International Ltd

- Nokia Corporation

Notable Milestones in Subscriber Data Analysis Market Sector

- 2020 - Q1: Introduction of advanced AI-driven churn prediction models by leading telecom analytics providers, significantly reducing customer attrition rates.

- 2021 - Q3: Major cloud providers enhance their data analytics platforms with integrated machine learning capabilities, simplifying subscriber data processing for enterprises.

- 2022 - Q2: Significant advancements in real-time data streaming and processing technologies enabling instant insights for dynamic customer engagement strategies.

- 2023 - Q4: Increased focus on data governance and privacy compliance features within subscriber data analysis solutions, driven by stricter regulations.

- 2024 - Q1: Emergence of specialized analytics for 5G network optimization and enhanced customer experience management.

In-Depth Subscriber Data Analysis Market Market Outlook

The future outlook for the Subscriber Data Analysis Market is exceptionally promising, driven by a confluence of technological advancements and evolving market demands. Growth accelerators, including the widespread adoption of AI and ML, the expansion of 5G networks, and the increasing sophistication of edge computing, will continue to fuel market expansion. Strategic partnerships and a growing emphasis on data-driven innovation will unlock new revenue streams and enhance competitive advantages for businesses. The market's ability to provide personalized customer experiences, optimize operational efficiencies, and ensure robust data security will remain paramount. As organizations increasingly recognize the strategic imperative of leveraging subscriber data, the market is poised for sustained and substantial growth, offering significant opportunities for stakeholders across the ecosystem.

Subscriber Data Analysis Market Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium Enterprises

-

3. Solution**

- 3.1. Subscriber Data Repository

- 3.2. Subscriber Policy Management

- 3.3. Subscriber Identity Management

- 3.4. Subscrib

Subscriber Data Analysis Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Subscriber Data Analysis Market Regional Market Share

Geographic Coverage of Subscriber Data Analysis Market

Subscriber Data Analysis Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Growing Need to Reduce Opex and Enable Cross Network Consolidation; Increasing Subscriber Demand for LTE

- 3.2.2 VoLTE and 5G Networks

- 3.3. Market Restrains

- 3.3.1. ; Complexity and Privacy Issues of the SDM Solution

- 3.4. Market Trends

- 3.4.1. Subscriber Identity Management to Witness Considerable Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Subscriber Data Analysis Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Solution**

- 5.3.1. Subscriber Data Repository

- 5.3.2. Subscriber Policy Management

- 5.3.3. Subscriber Identity Management

- 5.3.4. Subscrib

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Subscriber Data Analysis Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small & Medium Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Solution**

- 6.3.1. Subscriber Data Repository

- 6.3.2. Subscriber Policy Management

- 6.3.3. Subscriber Identity Management

- 6.3.4. Subscrib

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Subscriber Data Analysis Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small & Medium Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Solution**

- 7.3.1. Subscriber Data Repository

- 7.3.2. Subscriber Policy Management

- 7.3.3. Subscriber Identity Management

- 7.3.4. Subscrib

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Subscriber Data Analysis Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small & Medium Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Solution**

- 8.3.1. Subscriber Data Repository

- 8.3.2. Subscriber Policy Management

- 8.3.3. Subscriber Identity Management

- 8.3.4. Subscrib

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Subscriber Data Analysis Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small & Medium Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Solution**

- 9.3.1. Subscriber Data Repository

- 9.3.2. Subscriber Policy Management

- 9.3.3. Subscriber Identity Management

- 9.3.4. Subscrib

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Subscriber Data Analysis Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small & Medium Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Solution**

- 10.3.1. Subscriber Data Repository

- 10.3.2. Subscriber Policy Management

- 10.3.3. Subscriber Identity Management

- 10.3.4. Subscrib

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Telefonaktiebolaget LM Ericsson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NetNumber Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hewlett Packard Enterprise Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Openwave Mobility Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huawei Technologies Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZTE Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Computaris International Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nokia Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Telefonaktiebolaget LM Ericsson

List of Figures

- Figure 1: Global Subscriber Data Analysis Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Subscriber Data Analysis Market Revenue (billion), by Deployment 2025 & 2033

- Figure 3: North America Subscriber Data Analysis Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Subscriber Data Analysis Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 5: North America Subscriber Data Analysis Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Subscriber Data Analysis Market Revenue (billion), by Solution** 2025 & 2033

- Figure 7: North America Subscriber Data Analysis Market Revenue Share (%), by Solution** 2025 & 2033

- Figure 8: North America Subscriber Data Analysis Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Subscriber Data Analysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Subscriber Data Analysis Market Revenue (billion), by Deployment 2025 & 2033

- Figure 11: Europe Subscriber Data Analysis Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Subscriber Data Analysis Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 13: Europe Subscriber Data Analysis Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Subscriber Data Analysis Market Revenue (billion), by Solution** 2025 & 2033

- Figure 15: Europe Subscriber Data Analysis Market Revenue Share (%), by Solution** 2025 & 2033

- Figure 16: Europe Subscriber Data Analysis Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Subscriber Data Analysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Subscriber Data Analysis Market Revenue (billion), by Deployment 2025 & 2033

- Figure 19: Asia Pacific Subscriber Data Analysis Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific Subscriber Data Analysis Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Subscriber Data Analysis Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Subscriber Data Analysis Market Revenue (billion), by Solution** 2025 & 2033

- Figure 23: Asia Pacific Subscriber Data Analysis Market Revenue Share (%), by Solution** 2025 & 2033

- Figure 24: Asia Pacific Subscriber Data Analysis Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Subscriber Data Analysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Subscriber Data Analysis Market Revenue (billion), by Deployment 2025 & 2033

- Figure 27: Latin America Subscriber Data Analysis Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Subscriber Data Analysis Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 29: Latin America Subscriber Data Analysis Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Latin America Subscriber Data Analysis Market Revenue (billion), by Solution** 2025 & 2033

- Figure 31: Latin America Subscriber Data Analysis Market Revenue Share (%), by Solution** 2025 & 2033

- Figure 32: Latin America Subscriber Data Analysis Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Subscriber Data Analysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Subscriber Data Analysis Market Revenue (billion), by Deployment 2025 & 2033

- Figure 35: Middle East Subscriber Data Analysis Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East Subscriber Data Analysis Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 37: Middle East Subscriber Data Analysis Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Middle East Subscriber Data Analysis Market Revenue (billion), by Solution** 2025 & 2033

- Figure 39: Middle East Subscriber Data Analysis Market Revenue Share (%), by Solution** 2025 & 2033

- Figure 40: Middle East Subscriber Data Analysis Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Subscriber Data Analysis Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Subscriber Data Analysis Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global Subscriber Data Analysis Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Global Subscriber Data Analysis Market Revenue billion Forecast, by Solution** 2020 & 2033

- Table 4: Global Subscriber Data Analysis Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Subscriber Data Analysis Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 6: Global Subscriber Data Analysis Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Global Subscriber Data Analysis Market Revenue billion Forecast, by Solution** 2020 & 2033

- Table 8: Global Subscriber Data Analysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Subscriber Data Analysis Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 10: Global Subscriber Data Analysis Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 11: Global Subscriber Data Analysis Market Revenue billion Forecast, by Solution** 2020 & 2033

- Table 12: Global Subscriber Data Analysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Subscriber Data Analysis Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: Global Subscriber Data Analysis Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 15: Global Subscriber Data Analysis Market Revenue billion Forecast, by Solution** 2020 & 2033

- Table 16: Global Subscriber Data Analysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Subscriber Data Analysis Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 18: Global Subscriber Data Analysis Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 19: Global Subscriber Data Analysis Market Revenue billion Forecast, by Solution** 2020 & 2033

- Table 20: Global Subscriber Data Analysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Subscriber Data Analysis Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 22: Global Subscriber Data Analysis Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 23: Global Subscriber Data Analysis Market Revenue billion Forecast, by Solution** 2020 & 2033

- Table 24: Global Subscriber Data Analysis Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Subscriber Data Analysis Market?

The projected CAGR is approximately 13.3%.

2. Which companies are prominent players in the Subscriber Data Analysis Market?

Key companies in the market include Telefonaktiebolaget LM Ericsson, NetNumber Inc, Hewlett Packard Enterprise Company, Openwave Mobility Inc, Cisco Systems Inc, Huawei Technologies Co Ltd, ZTE Corporation, Computaris International Ltd, Nokia Corporation.

3. What are the main segments of the Subscriber Data Analysis Market?

The market segments include Deployment, Organization Size, Solution**.

4. Can you provide details about the market size?

The market size is estimated to be USD 557.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Need to Reduce Opex and Enable Cross Network Consolidation; Increasing Subscriber Demand for LTE. VoLTE and 5G Networks.

6. What are the notable trends driving market growth?

Subscriber Identity Management to Witness Considerable Share.

7. Are there any restraints impacting market growth?

; Complexity and Privacy Issues of the SDM Solution.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Subscriber Data Analysis Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Subscriber Data Analysis Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Subscriber Data Analysis Market?

To stay informed about further developments, trends, and reports in the Subscriber Data Analysis Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence