Key Insights

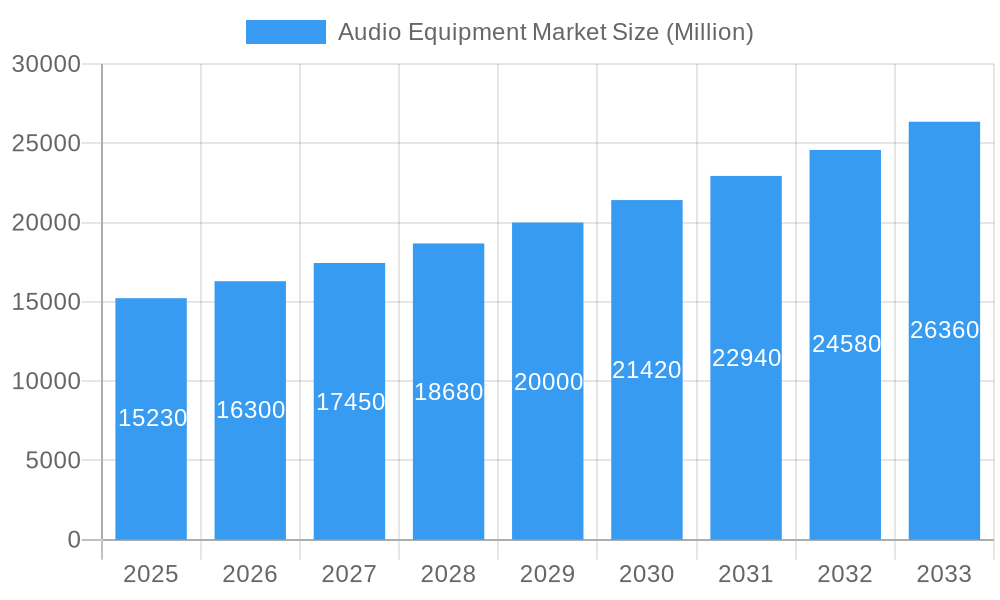

The global Audio Equipment Market is poised for significant expansion, currently valued at an estimated USD 15.23 billion in 2025, and is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.06% through 2033. This robust growth is fueled by a confluence of factors, including the increasing demand for high-fidelity audio experiences across various sectors, technological advancements in audio processing and connectivity, and the rising disposable incomes of consumers globally. The market is segmented into key product types such as Mixers, Amplifiers, Microphones, and Audio Monitors, each catering to distinct application needs. The Commercial sector, encompassing professional audio setups for events, studios, and public address systems, represents a substantial driver, alongside the burgeoning Automotive industry's integration of advanced in-car audio systems and the persistent strength of the Home Entertainment segment, driven by smart home adoption and the popularity of streaming services.

Audio Equipment Market Market Size (In Billion)

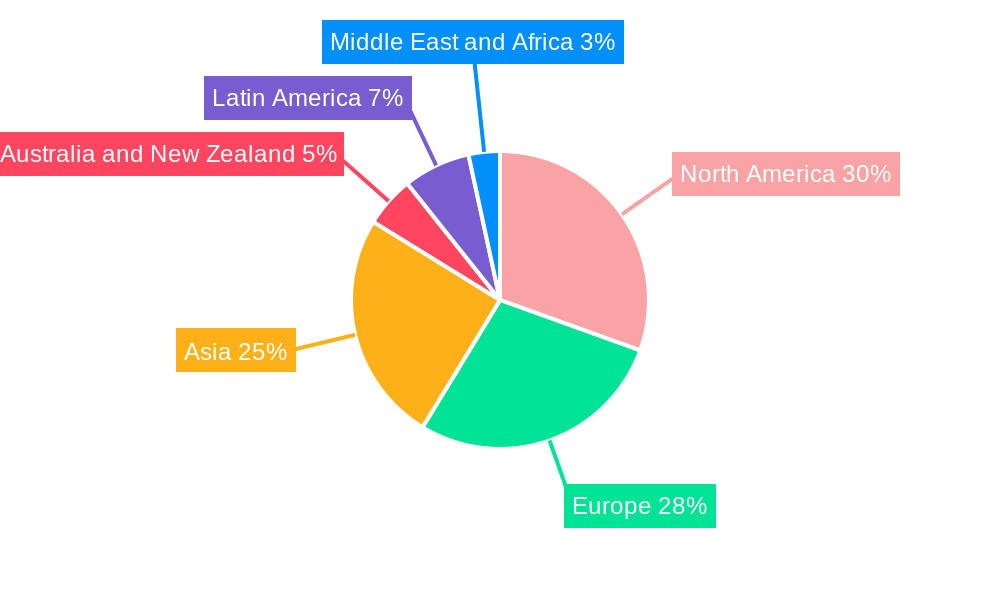

Further propelling this growth are emerging trends like the widespread adoption of wireless audio technologies, including Bluetooth and Wi-Fi, enhancing user convenience and mobility. The proliferation of AI-powered audio features, offering personalized listening experiences and intelligent noise cancellation, is also a significant trend. While the market benefits from these strong drivers and trends, it also faces certain restraints. The high cost associated with premium audio equipment and potential component shortages can pose challenges. Nonetheless, the overall outlook remains exceptionally positive, with significant opportunities in emerging markets and continuous innovation expected to drive market penetration and revenue growth. Regions such as North America and Europe are anticipated to lead in market share due to established consumer demand and technological adoption, while Asia is expected to exhibit the fastest growth trajectory.

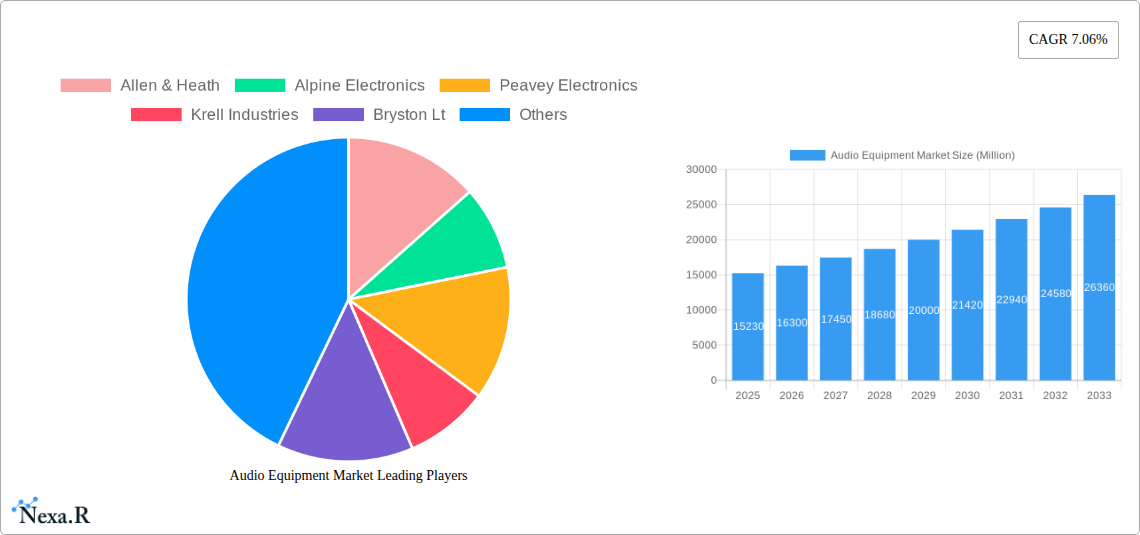

Audio Equipment Market Company Market Share

Unlocking the Future of Sound: A Comprehensive Audio Equipment Market Report (2019-2033)

This in-depth audio equipment market report provides a strategic roadmap for navigating the dynamic global landscape of audio technology. With a comprehensive market size analysis and detailed CAGR forecast from 2019 to 2033, this report leverages extensive data, including estimated market value for 2025, to empower industry stakeholders. We dissect key trends in professional audio equipment, consumer electronics audio, and home theater audio systems, offering critical insights into market penetration and technological disruptions. Explore detailed segmentation by product type (Mixers, Amplifiers, Microphones, Audio Monitors, Other Product Types) and end-user (Commercial, Automotive, Home Entertainment, Other End Users), with a specific focus on the burgeoning automotive audio systems market and the robust commercial audio solutions sector. Gain a competitive edge through an understanding of parent and child market dynamics, ensuring no aspect of this high-growth industry is overlooked.

Audio Equipment Market Market Dynamics & Structure

The global audio equipment market exhibits a moderately concentrated structure, characterized by the presence of established players alongside agile innovators. Technological innovation serves as a primary driver, with continuous advancements in digital signal processing, wireless audio, and noise-cancellation technologies shaping product development and consumer adoption. Key companies like Yamaha Corporation, NXP Semiconductors, and Harman International (AKG Acoustics) are at the forefront, investing heavily in R&D to enhance audio fidelity and user experience. Regulatory frameworks, primarily concerning sound emission standards and wireless communication protocols, are evolving, necessitating compliance from manufacturers. Competitive product substitutes, particularly the increasing integration of audio capabilities into smartphones and other smart devices, present a persistent challenge. End-user demographics are diversifying, with a growing demand for high-resolution audio in both commercial and consumer segments, driving innovation in applications ranging from professional studios to immersive home entertainment systems. Mergers and acquisitions (M&A) trends are significant, with larger corporations acquiring specialized technology firms to bolster their portfolios and expand market reach. For instance, the past few years have seen several strategic acquisitions in the professional audio and automotive audio segments, underscoring consolidation efforts and the pursuit of market dominance.

- Market Concentration: Moderately concentrated with key players.

- Technological Innovation: Driven by digital signal processing, wireless audio, and AI-powered audio enhancements.

- Regulatory Frameworks: Evolving standards for sound quality, wireless connectivity, and device safety.

- Competitive Substitutes: Increasing integration of audio into multi-functional consumer electronics.

- End-User Demographics: Growing demand for premium audio across commercial and consumer sectors.

- M&A Trends: Strategic acquisitions to expand product portfolios and market share, with an estimated XX deals in the historical period.

Audio Equipment Market Growth Trends & Insights

The audio equipment market is poised for substantial growth, driven by an ever-increasing consumer appetite for immersive and high-fidelity sound experiences across diverse applications. This growth is underpinned by significant technological advancements that are continually redefining audio capabilities. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period, reflecting a strong upward trajectory. A key trend is the accelerating adoption of wireless audio technologies, including Bluetooth and Wi-Fi, which have become standard features in a wide array of products, from headphones and portable speakers to complex sound systems. This shift towards wireless convenience is directly impacting consumer behavior, with users prioritizing seamless connectivity and portability.

Furthermore, the proliferation of streaming services has fueled demand for high-resolution audio playback, pushing manufacturers to develop equipment capable of delivering superior sound quality. This has led to increased investment in research and development of advanced audio codecs and processing technologies. The automotive audio equipment market, in particular, is experiencing significant growth as car manufacturers increasingly integrate premium sound systems as a key selling point. Consumers are now expecting a concert-hall like experience within their vehicles, driving innovation in speaker design, amplifier technology, and acoustic tuning.

In the commercial audio solutions sector, demand for sophisticated sound systems for venues such as concert halls, auditoriums, and corporate event spaces continues to rise, further contributing to market expansion. The integration of smart home technologies is another significant growth accelerator. As more households adopt smart speakers and connected audio devices, the market for compatible and high-quality audio peripherals expands. Consumer behavior is increasingly shifting towards personalized audio experiences, leading to a greater demand for customizable sound profiles and adaptive audio technologies. This evolving landscape presents substantial opportunities for companies that can deliver innovative, high-performance, and user-friendly audio solutions that cater to these diverse and sophisticated consumer preferences. The market penetration of advanced audio features is expected to rise significantly in the coming years, driven by both technological innovation and evolving consumer expectations for superior sonic experiences.

Dominant Regions, Countries, or Segments in Audio Equipment Market

The audio equipment market is experiencing dynamic growth across various regions and segments, with a clear dominance emerging in key areas. North America, particularly the United States, has historically been a powerhouse in the audio equipment industry, driven by a strong consumer base with a high disposable income and an early adoption rate for new technologies. The region's dominance is fueled by a significant presence of leading audio equipment manufacturers and a thriving entertainment industry that demands high-quality audio solutions for both professional and home use. The home entertainment audio systems segment in North America is exceptionally robust, with consumers investing heavily in advanced soundbars, home theater systems, and multi-room audio setups.

Asia-Pacific represents the fastest-growing region, propelled by a rapidly expanding middle class, increasing urbanization, and a burgeoning demand for consumer electronics, including sophisticated audio devices. Countries like China, Japan, and South Korea are key contributors, boasting a strong manufacturing base and a large domestic market. The commercial audio solutions segment in this region is also witnessing remarkable growth, driven by investments in public infrastructure, entertainment venues, and a growing corporate sector requiring advanced audio-visual equipment for presentations and events.

Within product types, Amplifiers and Microphones consistently demonstrate strong market share and growth potential. Amplifiers are the backbone of most audio systems, driving sound output, and advancements in digital amplification technology are making them more efficient and powerful, appealing to both professional and consumer markets. Microphones, crucial for content creation, broadcasting, and live performances, are experiencing increased demand due to the rise of the creator economy and the proliferation of podcasting and online streaming.

The Automotive Audio Equipment end-user segment is a significant growth driver globally. As vehicles become more technologically advanced, premium audio systems are no longer a luxury but an expected feature, leading manufacturers to integrate high-fidelity sound solutions. This segment is experiencing substantial investment from both automotive OEMs and specialized audio companies, with innovative features like spatial audio and active noise cancellation becoming increasingly common.

- Dominant Region: North America, with Asia-Pacific as the fastest-growing region.

- Key Countries: United States, China, Japan, South Korea.

- Dominant Product Type: Amplifiers and Microphones exhibit strong market share and growth potential.

- Dominant End User Segment: Automotive Audio Equipment is a significant global growth driver.

- Key Drivers: High disposable income, early technology adoption (North America); rapid economic growth, expanding middle class, manufacturing prowess (Asia-Pacific); rise of creator economy and streaming (Microphones); vehicle technology advancement (Automotive).

Audio Equipment Market Product Landscape

The audio equipment market product landscape is characterized by continuous innovation and a drive towards enhanced sonic performance and user convenience. From studio-grade microphones like those from AKG Acoustics to sophisticated mixers from Allen & Heath and powerful amplifiers by Peavey Electronics, professional audio solutions are at the cutting edge. Consumer audio is witnessing a surge in smart speakers, wireless earbuds with advanced noise cancellation, and soundbars offering immersive surround sound experiences. Key technological advancements include the integration of AI for personalized sound tuning, spatial audio technologies for three-dimensional soundscapes, and ultra-low latency wireless connectivity. Companies like Alpine Electronics and Kenwood Corporation are pushing boundaries in automotive audio, integrating advanced acoustic engineering with in-car entertainment systems. The focus remains on delivering pristine sound quality, robust build, and intuitive user interfaces across all product categories, from portable solutions to complex professional setups.

Key Drivers, Barriers & Challenges in Audio Equipment Market

The audio equipment market is propelled by several key drivers. Technological innovation, particularly in digital signal processing, wireless audio, and AI-driven sound enhancement, is a primary catalyst, leading to products with superior fidelity and enhanced user experiences. Growing consumer demand for immersive audio in home entertainment, automotive, and professional settings, fueled by the proliferation of streaming content and the creator economy, further fuels market expansion. Economic growth in emerging markets translates to increased disposable income and a higher propensity to invest in premium audio solutions.

However, the market faces significant barriers and challenges. Intense price competition from lower-cost manufacturers, particularly in the consumer electronics segment, can impact profit margins. The rapid pace of technological obsolescence necessitates continuous R&D investment and product updates, posing a financial challenge. Supply chain disruptions, as seen in recent global events, can impact production and lead times, affecting availability and cost. Stringent regulatory compliance, especially for wireless technologies and safety standards, adds complexity and development costs.

Key Drivers:

- Technological advancements (DSP, wireless, AI)

- Growing consumer demand for immersive audio

- Economic growth in emerging markets

- Rise of the creator economy and content streaming

Barriers & Challenges:

- Intense price competition

- Rapid technological obsolescence

- Supply chain vulnerabilities

- Regulatory compliance complexities

- High R&D investment requirements

Emerging Opportunities in Audio Equipment Market

Emerging opportunities in the audio equipment market are manifold. The continued expansion of the automotive audio systems market presents a significant avenue, with increasing demand for personalized in-car sound experiences and integration of advanced audio features. The burgeoning home entertainment audio systems sector, driven by the adoption of immersive technologies like Dolby Atmos and DTS:X, offers substantial growth potential for high-end soundbars, AV receivers, and smart speakers. The creator economy's relentless growth fuels demand for professional-grade microphones, audio interfaces, and monitoring equipment for content creators across various platforms. Furthermore, the integration of AI and machine learning into audio devices for adaptive sound, intelligent noise cancellation, and voice control represents a significant frontier. Untapped markets in developing regions, coupled with evolving consumer preferences for premium and personalized audio, provide fertile ground for innovation and market penetration.

Growth Accelerators in the Audio Equipment Market Industry

Long-term growth in the audio equipment market is significantly accelerated by ongoing technological breakthroughs. The continued miniaturization and enhancement of digital signal processors (DSPs) are enabling more sophisticated audio processing in smaller, more energy-efficient devices. Advancements in wireless audio transmission, such as improved codecs and reduced latency, are making cable-free solutions increasingly viable and appealing for a wider range of applications. Strategic partnerships between audio equipment manufacturers and consumer electronics companies, as well as automotive OEMs, are crucial for integrating cutting-edge audio solutions into mainstream products. Market expansion strategies, including targeting emerging markets and developing tailored product lines for specific user segments, are also vital growth catalysts. The increasing focus on sustainability and eco-friendly manufacturing processes is also becoming a growth driver as consumers become more environmentally conscious.

Key Players Shaping the Audio Equipment Market Market

- Allen & Heath

- Alpine Electronics

- Peavey Electronics

- Krell Industries

- Bryston Lt

- Behringer

- AKG Acoustics (Harman International)

- NXP Semiconductors

- Yamaha Corporation

- Kenwood Corporation

Notable Milestones in Audio Equipment Market Sector

- February 2023: Pioneer DJ announced the introduction of its new 4-channel mixer, the DJM-A9, featuring advanced functionalities like Center Lock for Sound Color FX, an improved layout, enhanced Beat FX section, and Bluetooth input connectivity. This release caters to both Rekordbox and Serato users, indicating a focus on professional DJ performance and versatility.

- February 2023: Cherry Americas announced the launch of a new product line of computer microphones and accessories, targeting a broad spectrum of users from home and office professionals to streaming studio experts. This expansion of their audio portfolio underscores a commitment to diversifying their offerings in the growing microphone market.

In-Depth Audio Equipment Market Market Outlook

The audio equipment market is set for a future characterized by intelligent, immersive, and personalized sound experiences. Growth accelerators, including advancements in AI for adaptive audio, spatial audio technologies for unparalleled realism, and ultra-low latency wireless connectivity, will continue to drive innovation and consumer adoption. The increasing integration of sophisticated audio solutions into automotive and smart home ecosystems presents a significant avenue for expansion. Strategic collaborations between technology providers and product manufacturers will be pivotal in bringing these innovations to market effectively. The market's outlook is bright, with a sustained demand for high-fidelity audio across all segments, positioning it as a dynamic and evolving industry ripe with opportunity for those who can anticipate and meet the ever-increasing demands of audiophiles and mainstream consumers alike.

Audio Equipment Market Segmentation

-

1. Product Type

- 1.1. Mixers

- 1.2. Amplifiers

- 1.3. Microphones

- 1.4. Audio Monitors

- 1.5. Other Product Types

-

2. End User

- 2.1. Commercial

- 2.2. Automotive

- 2.3. Home Entertainment

- 2.4. Other End Users

Audio Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Audio Equipment Market Regional Market Share

Geographic Coverage of Audio Equipment Market

Audio Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tendency of Increased Expenditures on Global Festivals and Music Concerts; Rise of Audio Equipment in Automobiles; Increasing Demand for HD and Ultra HD Sound Quality

- 3.3. Market Restrains

- 3.3.1. Design and Complexity Challenges for the Development of High-Efficiency Audio Equipment

- 3.4. Market Trends

- 3.4.1. Microphones Segment is Expected to Register the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Mixers

- 5.1.2. Amplifiers

- 5.1.3. Microphones

- 5.1.4. Audio Monitors

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Automotive

- 5.2.3. Home Entertainment

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Mixers

- 6.1.2. Amplifiers

- 6.1.3. Microphones

- 6.1.4. Audio Monitors

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Automotive

- 6.2.3. Home Entertainment

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Mixers

- 7.1.2. Amplifiers

- 7.1.3. Microphones

- 7.1.4. Audio Monitors

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Automotive

- 7.2.3. Home Entertainment

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Mixers

- 8.1.2. Amplifiers

- 8.1.3. Microphones

- 8.1.4. Audio Monitors

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Automotive

- 8.2.3. Home Entertainment

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Mixers

- 9.1.2. Amplifiers

- 9.1.3. Microphones

- 9.1.4. Audio Monitors

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Automotive

- 9.2.3. Home Entertainment

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Mixers

- 10.1.2. Amplifiers

- 10.1.3. Microphones

- 10.1.4. Audio Monitors

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Automotive

- 10.2.3. Home Entertainment

- 10.2.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Audio Equipment Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Mixers

- 11.1.2. Amplifiers

- 11.1.3. Microphones

- 11.1.4. Audio Monitors

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Commercial

- 11.2.2. Automotive

- 11.2.3. Home Entertainment

- 11.2.4. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Allen & Heath

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Alpine Electronics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Peavey Electronics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Krell Industries

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bryston Lt

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Behringer

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 AKG Acoustics (Harman International)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NXP Semiconductors

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Yamaha Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kenwood Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Allen & Heath

List of Figures

- Figure 1: Global Audio Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Audio Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Audio Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Audio Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Audio Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Audio Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Audio Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Audio Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Audio Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Audio Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Audio Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Audio Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Audio Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Audio Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Audio Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Audio Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Audio Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Audio Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Audio Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Audio Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Australia and New Zealand Audio Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Australia and New Zealand Audio Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Australia and New Zealand Audio Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Australia and New Zealand Audio Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Audio Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Audio Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Latin America Audio Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Latin America Audio Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Audio Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Audio Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Audio Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Audio Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 33: Middle East and Africa Audio Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Middle East and Africa Audio Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 35: Middle East and Africa Audio Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 36: Middle East and Africa Audio Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Audio Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Audio Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Audio Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Audio Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Audio Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Audio Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Audio Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Audio Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Audio Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Audio Equipment Market?

The projected CAGR is approximately 7.06%.

2. Which companies are prominent players in the Audio Equipment Market?

Key companies in the market include Allen & Heath, Alpine Electronics, Peavey Electronics, Krell Industries, Bryston Lt, Behringer, AKG Acoustics (Harman International), NXP Semiconductors, Yamaha Corporation, Kenwood Corporation.

3. What are the main segments of the Audio Equipment Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tendency of Increased Expenditures on Global Festivals and Music Concerts; Rise of Audio Equipment in Automobiles; Increasing Demand for HD and Ultra HD Sound Quality.

6. What are the notable trends driving market growth?

Microphones Segment is Expected to Register the Fastest Growth.

7. Are there any restraints impacting market growth?

Design and Complexity Challenges for the Development of High-Efficiency Audio Equipment.

8. Can you provide examples of recent developments in the market?

February 2023: Pioneer DJ announced introducing a new 4-channel mixer, the DJM-A9. The new unit has many features, including the Center Lock feature for Sound Color FX and a new layout with more space around the EQ controls. The Beat FX section and mic have also been improved and have Bluetooth input that can be routed to any channel. Compatible with both Rekordboxand Serato.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Audio Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Audio Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Audio Equipment Market?

To stay informed about further developments, trends, and reports in the Audio Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence