Key Insights

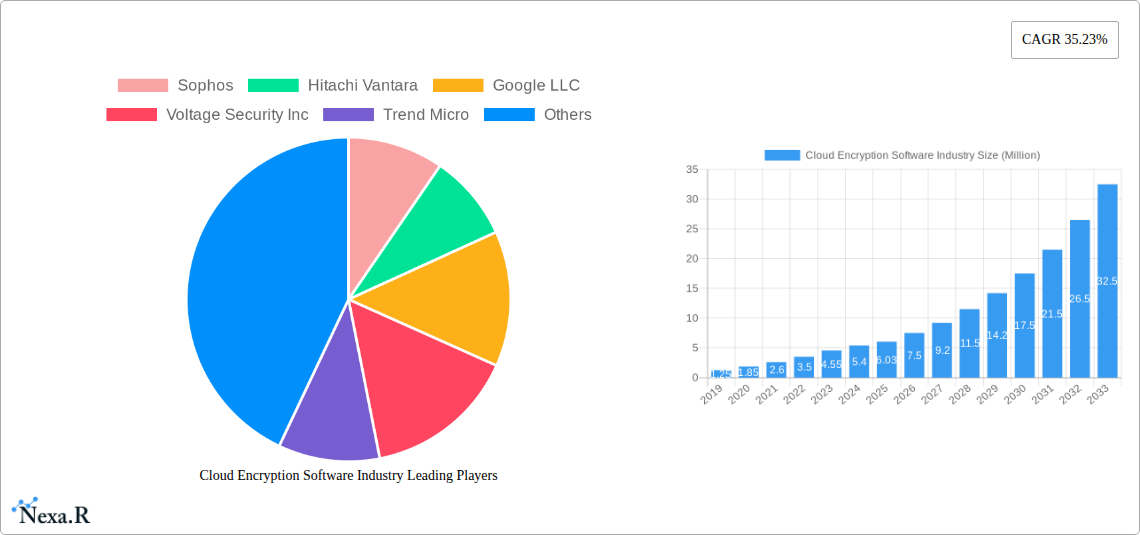

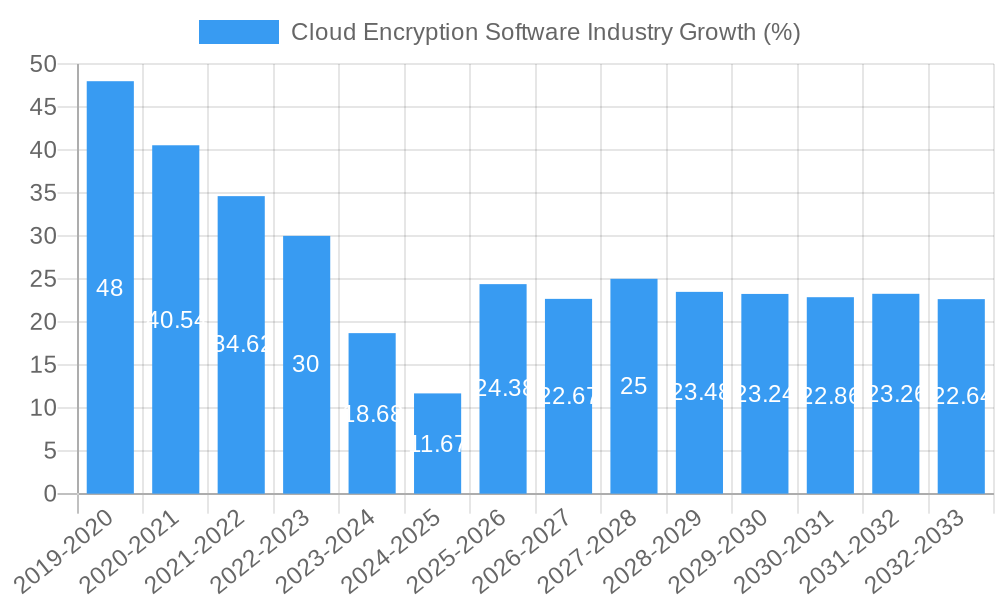

The Cloud Encryption Software market is experiencing an unprecedented surge, projected to reach $6.03 million by 2025 and demonstrating a remarkable Compound Annual Growth Rate (CAGR) of 35.23%. This robust expansion is fundamentally driven by the escalating adoption of cloud services across all organizational sizes, from agile SMEs to large enterprises. The inherent need to protect sensitive data stored and processed in the cloud, coupled with increasingly stringent data privacy regulations globally, forms the bedrock of this market's growth. Professional and Managed Services are emerging as key segments, reflecting a growing demand for expert implementation and ongoing management of cloud encryption solutions. The IT & Telecommunication, BFSI, Healthcare, and Retail sectors are at the forefront of this adoption, recognizing the critical importance of safeguarding customer data, intellectual property, and regulatory compliance. As businesses continue to migrate critical operations to the cloud, the demand for advanced encryption technologies that ensure data confidentiality, integrity, and availability will only intensify.

The market's upward trajectory is further fueled by several significant trends, including the rise of data-centric security, homomorphic encryption, and the integration of encryption solutions with broader cloud security platforms. These advancements offer more sophisticated ways to secure data both at rest and in transit, even while it is being processed. However, the market faces certain restraints, such as the complexity and cost associated with implementing and managing advanced encryption solutions, particularly for smaller organizations. There's also a lingering concern regarding key management complexities and the potential for vendor lock-in. Despite these challenges, the sheer volume of data being generated and stored in the cloud, coupled with a heightened awareness of cyber threats, ensures a sustained and dynamic growth phase for the Cloud Encryption Software industry. Prominent players like Sophos, Hitachi Vantara, Google LLC, Trend Micro, and Symantec Corporation are actively innovating to address these challenges and capitalize on the vast opportunities within this burgeoning market.

Cloud Encryption Software Industry: Comprehensive Market Report (2019-2033)

This in-depth report provides a meticulous analysis of the global Cloud Encryption Software market, projecting its trajectory from 2019 to 2033, with a base year of 2025. It dissects the market dynamics, growth trends, regional dominance, product landscape, and the intricate interplay of drivers, barriers, and emerging opportunities shaping this critical sector. Targeted at industry professionals, decision-makers, and investors, this report leverages high-traffic keywords and a structured format to deliver actionable insights and maximize visibility for "cloud encryption software," "data security solutions," "cybersecurity encryption," "SME encryption," and "enterprise data protection." We delve into parent and child market segments, offering a holistic view of market evolution.

Cloud Encryption Software Industry Market Dynamics & Structure

The cloud encryption software industry is characterized by a moderately concentrated market, driven by intense technological innovation and a growing imperative for robust data protection. Key drivers include the escalating threat landscape, stringent data privacy regulations (e.g., GDPR, CCPA), and the increasing adoption of cloud computing services by organizations of all sizes. Competitive product substitutes, such as on-premises encryption solutions and basic data masking techniques, are being increasingly overshadowed by the comprehensive security and flexibility offered by cloud-based encryption. End-user demographics are broadening, encompassing SMEs seeking cost-effective security solutions and large enterprises demanding sophisticated data governance. Mergers and acquisition (M&A) trends are on the rise as established players aim to consolidate their market position and acquire innovative technologies. Barriers to innovation include the complexity of integrating diverse cloud environments and the evolving nature of cyber threats. The market is projected to witness a significant growth in M&A activities, with an estimated xx deal volumes in the historical period, indicating consolidation and strategic expansion.

- Market Concentration: Moderately concentrated with key players vying for market share through advanced features and competitive pricing.

- Technological Innovation Drivers: AI-powered threat detection, zero-trust architecture integration, and post-quantum cryptography research are pivotal.

- Regulatory Frameworks: GDPR, CCPA, and industry-specific mandates are compelling organizations to adopt advanced cloud encryption.

- Competitive Product Substitutes: While on-premises solutions exist, their scalability and flexibility are limited compared to cloud encryption.

- End-User Demographics: Shifting from predominantly large enterprises to a significant inclusion of SMEs driven by cloud adoption.

- M&A Trends: Expected to increase as companies seek to expand their portfolios and gain competitive advantages, with an estimated xx% annual growth in deal volume during the forecast period.

Cloud Encryption Software Industry Growth Trends & Insights

The cloud encryption software market is poised for substantial expansion, driven by an unprecedented surge in cloud adoption and the escalating value of digital data. The market size is projected to evolve from approximately $xx million in 2019 to an estimated $xx million by 2033. Adoption rates for cloud encryption solutions are rapidly increasing across all organizational sizes, fueled by the inherent benefits of enhanced data security, compliance adherence, and operational efficiency. Technological disruptions, such as advancements in client-side encryption, homomorphic encryption, and the integration of AI for intelligent encryption management, are redefining the industry's capabilities. Consumer behavior shifts are evident, with a growing preference for cloud-native security solutions that offer seamless integration and centralized management. The CAGR for the cloud encryption software market is estimated at xx% during the forecast period (2025–2033), reflecting a robust growth trajectory. Market penetration for advanced cloud encryption solutions is expected to reach xx% by 2033, indicating widespread acceptance and integration within business operations.

The increasing volume of sensitive data being stored and processed in cloud environments necessitates robust protection mechanisms. This surge in data, coupled with the growing sophistication of cyber threats, compels organizations to invest in advanced cloud encryption software. From personal identifiable information (PII) in healthcare to financial records in BFSI, the need for secure data handling is paramount. The global shift towards remote work models further amplifies the demand for secure access to data from anywhere, anytime, making cloud encryption an indispensable tool.

Technological advancements are continuously enhancing the efficacy and usability of cloud encryption. Client-side encryption, as exemplified by Utimaco's u.trust LAN Crypt Cloud, ensures data remains protected before it even leaves the user's device, offering an unparalleled layer of security. Furthermore, the development of zero-trust security models is increasingly reliant on strong encryption to verify and protect data in transit and at rest across diverse cloud infrastructures. The ability of these solutions to integrate with existing IT ecosystems and provide comprehensive visibility into data security posture is a key adoption driver.

Consumer behavior is also adapting. Organizations are moving away from fragmented security approaches towards integrated, cloud-centric platforms that simplify management and reduce operational overhead. The demand for managed services in cloud encryption is also growing, as many SMEs and even larger enterprises lack the specialized expertise to manage complex encryption deployments effectively. This trend indicates a maturing market where ease of use and comprehensive support are becoming as critical as the underlying encryption technology itself.

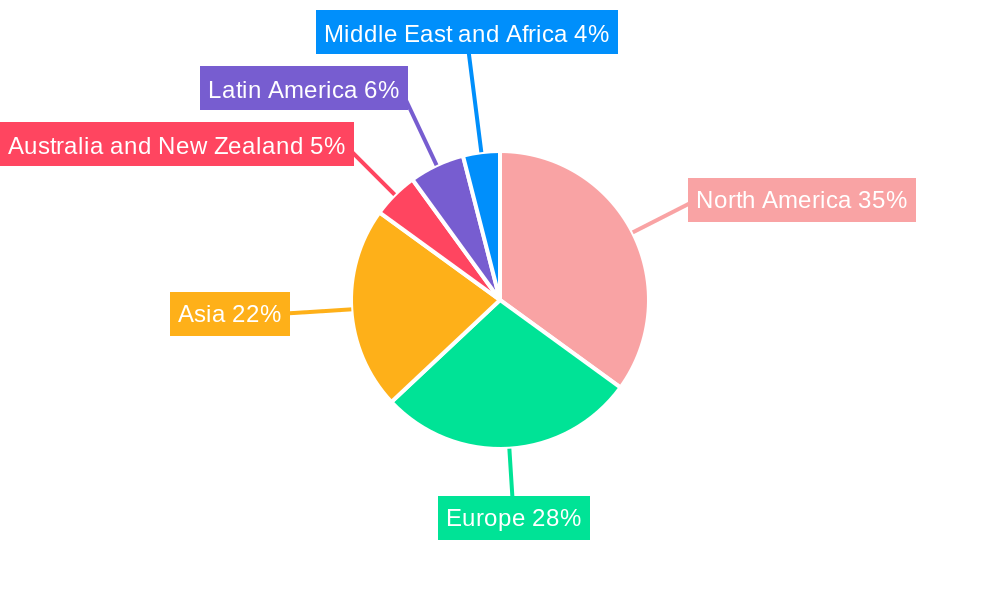

Dominant Regions, Countries, or Segments in Cloud Encryption Software Industry

The North America region is currently identified as the dominant force in the cloud encryption software industry, propelled by its robust technological infrastructure, high cloud adoption rates, and a stringent regulatory environment that mandates advanced data protection. Countries like the United States, with its significant concentration of technology giants and a strong emphasis on cybersecurity, are at the forefront of this dominance. The IT & Telecommunication and BFSI industry verticals within North America are key drivers of this growth, investing heavily in cloud encryption to safeguard critical customer data and intellectual property. The Large Enterprises segment is a primary adopter, allocating substantial budgets towards comprehensive security solutions, including advanced cloud encryption.

- Leading Region: North America, driven by high cloud adoption and a strong regulatory landscape.

- Key Countries: United States, Canada, leading innovation and market penetration.

- Dominant Segment (Organization Size): Large Enterprises, due to higher data volumes and compliance demands, representing an estimated xx% of the market share in this region.

- Dominant Segment (Industry Vertical): IT & Telecommunication and BFSI, investing significantly in securing sensitive data and meeting regulatory requirements.

- Growth Potential: Emerging economies in Asia-Pacific and Europe are exhibiting accelerated growth, driven by increasing cloud investments and evolving data privacy laws.

- Economic Policies: Favorable government initiatives supporting digital transformation and cybersecurity in North America contribute to market expansion.

- Infrastructure: Advanced cloud infrastructure and widespread internet penetration enable seamless deployment and utilization of cloud encryption solutions.

The emphasis on data sovereignty and compliance within the BFSI sector, for instance, necessitates sophisticated encryption that ensures data remains protected even when processed across multiple cloud environments. Similarly, the IT & Telecommunication sector, constantly at the forefront of technological innovation, adopts cloud encryption to secure its own vast data resources and offer secure services to its clientele. While SMEs are increasingly adopting cloud encryption, their current market share in terms of absolute spending is lower than that of large enterprises, though their growth rate is significant. The strategic importance of data security in these verticals makes them prime markets for advanced cloud encryption solutions, contributing an estimated xx% to regional revenue.

Cloud Encryption Software Industry Product Landscape

The cloud encryption software product landscape is defined by continuous innovation, focusing on delivering robust data protection across diverse cloud environments. Innovations include advanced client-side encryption, offering granular control over data before it enters the cloud, and homomorphic encryption, enabling data processing while it remains encrypted. Performance metrics emphasize low latency and minimal impact on application performance. Unique selling propositions often revolve around seamless integration with existing cloud platforms, comprehensive key management services, and compliance with evolving data privacy regulations. Technological advancements are pushing towards AI-driven threat detection and automated encryption policy management, enhancing both security and operational efficiency.

Key Drivers, Barriers & Challenges in Cloud Encryption Software Industry

Key Drivers: The primary forces propelling the cloud encryption software market include the escalating volume and sensitivity of data stored in cloud environments, increasing cyber threats and data breaches, and stringent data privacy regulations globally. The growing adoption of hybrid and multi-cloud strategies necessitates consistent encryption across disparate platforms. Technological advancements in encryption algorithms and key management solutions also act as significant growth accelerators.

Barriers & Challenges: Despite robust growth, the industry faces challenges such as the complexity of managing encryption keys across distributed cloud architectures, the potential for vendor lock-in, and the skills gap in cybersecurity expertise. High implementation costs can be a barrier for smaller organizations. Supply chain issues related to hardware security modules (HSMs) and the evolving nature of cyber-attacks require continuous adaptation, posing significant competitive pressures. Regulatory hurdles, while driving adoption, also introduce complexity in compliance management for global deployments.

Emerging Opportunities in Cloud Encryption Software Industry

Emerging opportunities lie in the development of post-quantum cryptography solutions to address future threats, and the expansion of encryption services for IoT devices and edge computing. Untapped markets in developing regions with increasing cloud penetration present significant growth potential. Innovative applications such as secure data sharing for collaborative research and enhanced privacy for AI/ML training datasets are also gaining traction. Evolving consumer preferences lean towards more user-friendly, integrated, and automated encryption management tools, creating a demand for smarter, more intuitive solutions.

Growth Accelerators in the Cloud Encryption Software Industry Industry

Long-term growth in the cloud encryption software industry will be catalyzed by breakthroughs in advanced encryption techniques like fully homomorphic encryption, enabling computation on encrypted data without decryption. Strategic partnerships between cloud providers and encryption software vendors will foster deeper integration and wider accessibility. Market expansion strategies targeting underserved verticals and regions, coupled with the development of specialized encryption solutions for emerging technologies like blockchain and quantum computing, will further accelerate growth. The increasing demand for data privacy and security as a core business function will continue to drive innovation and investment.

Key Players Shaping the Cloud Encryption Software Industry Market

- Sophos

- Hitachi Vantara

- Google LLC

- Voltage Security Inc

- Trend Micro

- Ciphercloud

- Hewlett Packard Enterprise

- Safenet

- Boxcryptor

- CyberArk

- Symantec Corporation

Notable Milestones in Cloud Encryption Software Industry Sector

- May 2024: HPE announced new solutions across the HPE GreenLake cloud to simplify how enterprises manage and optimize their storage, data and workloads across on-prem and public cloud environments. New or expanded offerings include HPE GreenLake Block Storage for Amazon Web Services (AWS), a new software-defined storage offering to seamlessly manage block storage across hybrid cloud environments.

- November 2023: Utimaco launch of its new easy-to-use file encryption as-a-service management solution, u.trust LAN Crypt Cloud, to protect sensitive and business-critical data against unauthorized access. Client-side encryption ensures that data remains protected, regardless of its storage location, whether on-premises or in the cloud.

In-Depth Cloud Encryption Software Industry Market Outlook

The future outlook for the cloud encryption software industry is exceptionally strong, driven by an unwavering demand for data security and privacy in an increasingly digital world. Growth accelerators such as the maturation of AI in enhancing encryption efficiency and threat detection, coupled with the strategic expansion of offerings by key players like HPE into hybrid cloud environments, will fuel market expansion. The continued push for regulatory compliance worldwide ensures a steady demand for robust encryption solutions. Emerging opportunities in securing data for nascent technologies and the increasing preference for integrated, managed encryption services will solidify the industry's trajectory towards substantial growth and innovation in the coming years, making it a critical component of global cybersecurity infrastructure.

Cloud Encryption Software Industry Segmentation

-

1. Organization Size

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Service

- 2.1. Professional Services

- 2.2. Managed Services

-

3. Industry Vertical

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Healthcare

- 3.4. Entertainment and Media

- 3.5. Retail

- 3.6. Education

- 3.7. Other Industry Verticals

Cloud Encryption Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Cloud Encryption Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 35.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Standards Related to Data Transfer and its Security; Growing Volume of Strength of Cyber Attacks and Mobile Theft

- 3.3. Market Restrains

- 3.3.1. Rise in Organizational Overhead Expenses

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Professional Services

- 5.2.2. Managed Services

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Healthcare

- 5.3.4. Entertainment and Media

- 5.3.5. Retail

- 5.3.6. Education

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Professional Services

- 6.2.2. Managed Services

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. IT & Telecommunication

- 6.3.2. BFSI

- 6.3.3. Healthcare

- 6.3.4. Entertainment and Media

- 6.3.5. Retail

- 6.3.6. Education

- 6.3.7. Other Industry Verticals

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Professional Services

- 7.2.2. Managed Services

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. IT & Telecommunication

- 7.3.2. BFSI

- 7.3.3. Healthcare

- 7.3.4. Entertainment and Media

- 7.3.5. Retail

- 7.3.6. Education

- 7.3.7. Other Industry Verticals

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Professional Services

- 8.2.2. Managed Services

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. IT & Telecommunication

- 8.3.2. BFSI

- 8.3.3. Healthcare

- 8.3.4. Entertainment and Media

- 8.3.5. Retail

- 8.3.6. Education

- 8.3.7. Other Industry Verticals

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Australia and New Zealand Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Professional Services

- 9.2.2. Managed Services

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. IT & Telecommunication

- 9.3.2. BFSI

- 9.3.3. Healthcare

- 9.3.4. Entertainment and Media

- 9.3.5. Retail

- 9.3.6. Education

- 9.3.7. Other Industry Verticals

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Latin America Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Professional Services

- 10.2.2. Managed Services

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. IT & Telecommunication

- 10.3.2. BFSI

- 10.3.3. Healthcare

- 10.3.4. Entertainment and Media

- 10.3.5. Retail

- 10.3.6. Education

- 10.3.7. Other Industry Verticals

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. Middle East and Africa Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Organization Size

- 11.1.1. SMEs

- 11.1.2. Large Enterprises

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Professional Services

- 11.2.2. Managed Services

- 11.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 11.3.1. IT & Telecommunication

- 11.3.2. BFSI

- 11.3.3. Healthcare

- 11.3.4. Entertainment and Media

- 11.3.5. Retail

- 11.3.6. Education

- 11.3.7. Other Industry Verticals

- 11.1. Market Analysis, Insights and Forecast - by Organization Size

- 12. North America Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Cloud Encryption Software Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Sophos

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Hitachi Vantara

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Google LLC

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Voltage Security Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Trend Micro

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Ciphercloud

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Hewlett Packard Enterprise

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Safenet

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Boxcryptor*List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 CyberArk

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Symantec Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Sophos

List of Figures

- Figure 1: Global Cloud Encryption Software Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cloud Encryption Software Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 15: North America Cloud Encryption Software Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 16: North America Cloud Encryption Software Industry Revenue (Million), by Service 2024 & 2032

- Figure 17: North America Cloud Encryption Software Industry Revenue Share (%), by Service 2024 & 2032

- Figure 18: North America Cloud Encryption Software Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 19: North America Cloud Encryption Software Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 20: North America Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Cloud Encryption Software Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 23: Europe Cloud Encryption Software Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 24: Europe Cloud Encryption Software Industry Revenue (Million), by Service 2024 & 2032

- Figure 25: Europe Cloud Encryption Software Industry Revenue Share (%), by Service 2024 & 2032

- Figure 26: Europe Cloud Encryption Software Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 27: Europe Cloud Encryption Software Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 28: Europe Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Cloud Encryption Software Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 31: Asia Cloud Encryption Software Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 32: Asia Cloud Encryption Software Industry Revenue (Million), by Service 2024 & 2032

- Figure 33: Asia Cloud Encryption Software Industry Revenue Share (%), by Service 2024 & 2032

- Figure 34: Asia Cloud Encryption Software Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 35: Asia Cloud Encryption Software Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 36: Asia Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Australia and New Zealand Cloud Encryption Software Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Australia and New Zealand Cloud Encryption Software Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Australia and New Zealand Cloud Encryption Software Industry Revenue (Million), by Service 2024 & 2032

- Figure 41: Australia and New Zealand Cloud Encryption Software Industry Revenue Share (%), by Service 2024 & 2032

- Figure 42: Australia and New Zealand Cloud Encryption Software Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 43: Australia and New Zealand Cloud Encryption Software Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 44: Australia and New Zealand Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Australia and New Zealand Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Latin America Cloud Encryption Software Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 47: Latin America Cloud Encryption Software Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 48: Latin America Cloud Encryption Software Industry Revenue (Million), by Service 2024 & 2032

- Figure 49: Latin America Cloud Encryption Software Industry Revenue Share (%), by Service 2024 & 2032

- Figure 50: Latin America Cloud Encryption Software Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 51: Latin America Cloud Encryption Software Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 52: Latin America Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Latin America Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East and Africa Cloud Encryption Software Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 55: Middle East and Africa Cloud Encryption Software Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 56: Middle East and Africa Cloud Encryption Software Industry Revenue (Million), by Service 2024 & 2032

- Figure 57: Middle East and Africa Cloud Encryption Software Industry Revenue Share (%), by Service 2024 & 2032

- Figure 58: Middle East and Africa Cloud Encryption Software Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 59: Middle East and Africa Cloud Encryption Software Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 60: Middle East and Africa Cloud Encryption Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Cloud Encryption Software Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Encryption Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Global Cloud Encryption Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Cloud Encryption Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Cloud Encryption Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Cloud Encryption Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Cloud Encryption Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Cloud Encryption Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Cloud Encryption Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 19: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 20: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 21: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 23: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 24: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 25: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 27: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 28: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 29: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 31: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 32: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 33: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 35: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 36: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 37: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Cloud Encryption Software Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 39: Global Cloud Encryption Software Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 40: Global Cloud Encryption Software Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 41: Global Cloud Encryption Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Encryption Software Industry?

The projected CAGR is approximately 35.23%.

2. Which companies are prominent players in the Cloud Encryption Software Industry?

Key companies in the market include Sophos, Hitachi Vantara, Google LLC, Voltage Security Inc, Trend Micro, Ciphercloud, Hewlett Packard Enterprise, Safenet, Boxcryptor*List Not Exhaustive, CyberArk, Symantec Corporation.

3. What are the main segments of the Cloud Encryption Software Industry?

The market segments include Organization Size, Service, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Standards Related to Data Transfer and its Security; Growing Volume of Strength of Cyber Attacks and Mobile Theft.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Witness High Growth.

7. Are there any restraints impacting market growth?

Rise in Organizational Overhead Expenses.

8. Can you provide examples of recent developments in the market?

May 2024 - HPE announced new solutions across the HPE GreenLake cloud to simplify how enterprises manage and optimize their storage, data and workloads across on-prem and public cloud environments. New or expanded offerings include HPE GreenLake Block Storage for Amazon Web Services (AWS), a new software-defined storage offering to seamlessly manage block storage across hybrid cloud environments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Encryption Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Encryption Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Encryption Software Industry?

To stay informed about further developments, trends, and reports in the Cloud Encryption Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence