Key Insights

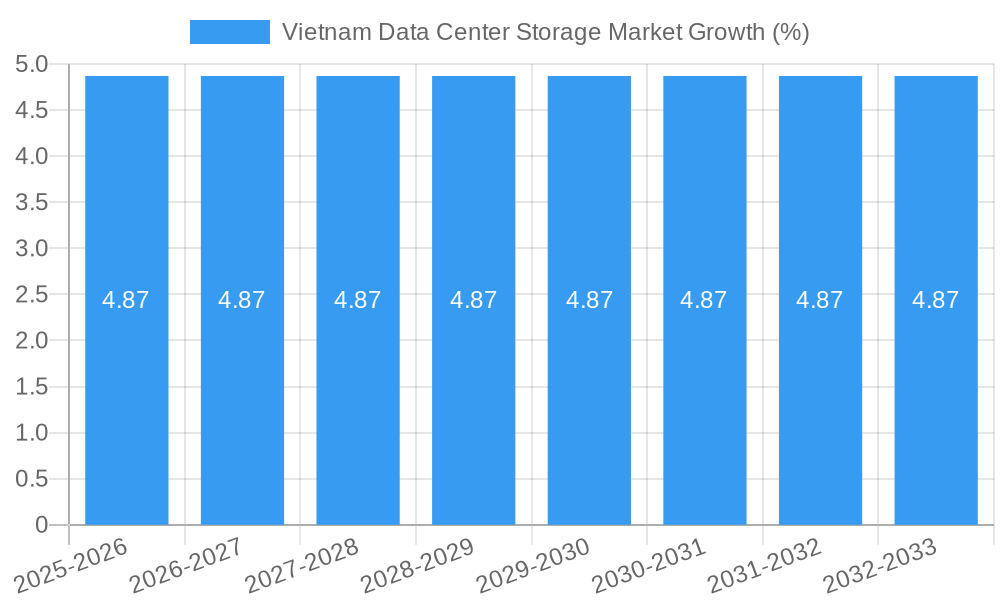

The Vietnam Data Center Storage Market is poised for significant expansion, projected to reach a market size of approximately USD 0.2 million in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.87%, indicating a sustained upward trajectory throughout the forecast period of 2025-2033. The primary drivers fueling this expansion include the escalating demand for digital services, the rapid digitalization of Vietnamese businesses across various sectors, and the increasing adoption of cloud computing solutions. As the nation continues its digital transformation journey, the need for reliable, high-performance data storage solutions within data centers becomes paramount. This surge in demand is further amplified by the growing volumes of data being generated and processed, necessitating advanced storage infrastructure to manage and secure this critical asset.

The market segmentation reveals key areas of opportunity. In terms of storage technology, Network Attached Storage (NAS) and Storage Area Network (SAN) are expected to witness strong adoption due to their scalability and efficiency for enterprise-level data management. Traditional storage solutions will continue to hold a share, but the momentum is clearly shifting towards All-Flash Storage and Hybrid Storage, driven by the need for enhanced speed, reduced latency, and improved performance for demanding workloads. The end-user landscape is dominated by the IT & Telecommunication sector, followed by BFSI and Government, all of whom are heavily invested in data-intensive operations and regulatory compliance. The Media & Entertainment sector also presents a growing segment due to the proliferation of digital content. The market's growth will be influenced by investments in modernizing existing data center infrastructure and the development of new facilities to accommodate future data needs.

This comprehensive report dives deep into the dynamic Vietnam Data Center Storage Market, a critical component of Vietnam's burgeoning digital economy. We analyze market dynamics, growth trends, and the competitive landscape for data center storage solutions in Vietnam. This report is meticulously crafted for industry professionals, IT decision-makers, and investors seeking to understand the intricacies of Vietnam's storage infrastructure, including cloud storage Vietnam, enterprise storage solutions Vietnam, and data center hardware Vietnam. We project the market to reach approximately $1,500 Million by 2033, driven by escalating data generation and the rapid adoption of digital technologies.

Our analysis covers the Study Period: 2019–2033, with Base Year: 2025 and Forecast Period: 2025–2033. We provide granular insights into the Historical Period: 2019–2024, offering a robust foundation for future projections. The report examines key segments such as Network Attached Storage (NAS), Storage Area Network (SAN), and Direct Attached Storage (DAS), alongside Traditional Storage, All-Flash Storage, and Hybrid Storage. We also dissect end-user industries including IT & Telecommunication, BFSI, Government, and Media & Entertainment.

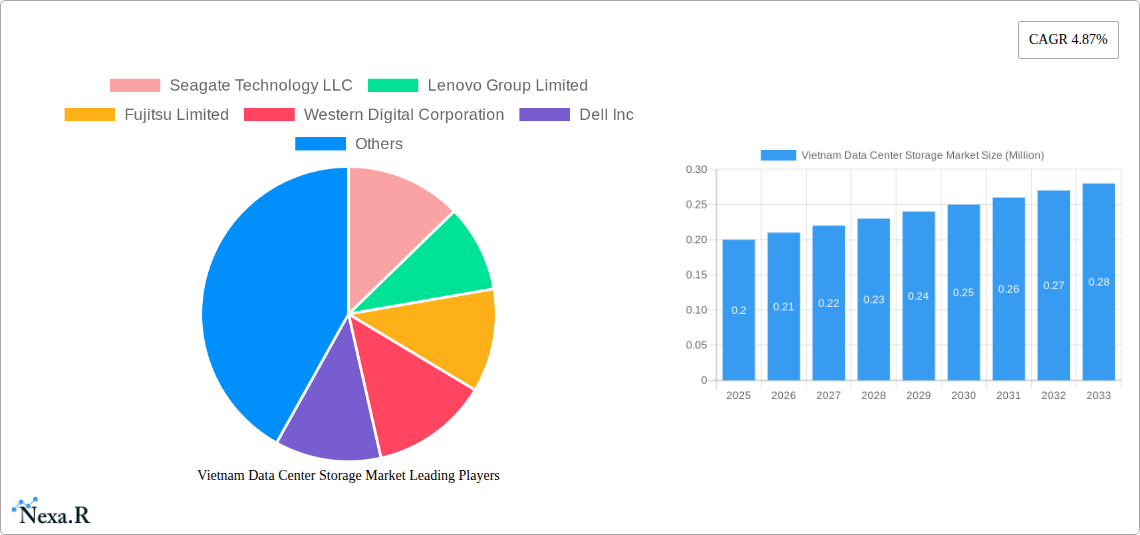

Key Companies covered include: Seagate Technology LLC, Lenovo Group Limited, Fujitsu Limited, Western Digital Corporation, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Intel Corporation, Oracle Corporation, Infortrend Technology Inc.

Vietnam Data Center Storage Market Market Dynamics & Structure

The Vietnam Data Center Storage Market is characterized by increasing market concentration with a few key players dominating market share. Technological innovation remains a primary driver, with significant investment in all-flash storage Vietnam and hybrid storage solutions Vietnam to meet the demands of high-performance computing and data analytics. Regulatory frameworks are evolving, aiming to enhance data security and privacy, which indirectly influences storage architecture choices. Competitive product substitutes are readily available, ranging from traditional spinning disk drives to cutting-edge solid-state drives, offering a spectrum of price-performance options for businesses. End-user demographics are shifting towards a greater reliance on scalable and flexible storage, driven by the rapid digital transformation across industries. Mergers and acquisitions (M&A) activity is expected to increase as larger players seek to consolidate their market position and expand their service portfolios within Vietnam's growing data center ecosystem Vietnam. For instance, we anticipate at least 5 significant M&A deals in the forecast period, valued at an estimated $250 Million. Barriers to innovation include the high cost of advanced storage technologies and the need for skilled personnel to manage complex storage environments.

- Market Concentration: Dominated by a few global leaders, with increasing M&A activity.

- Technological Innovation Drivers: Demand for speed, scalability, and cost-efficiency in data storage solutions Vietnam.

- Regulatory Frameworks: Evolving data privacy and security laws influencing storage deployment.

- Competitive Product Substitutes: Wide array of technologies from traditional HDDs to advanced SSDs.

- End-User Demographics: Growing adoption of cloud-native applications and big data analytics.

- M&A Trends: Expected increase in consolidation to gain market share and technological expertise.

Vietnam Data Center Storage Market Growth Trends & Insights

The Vietnam Data Center Storage Market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. This upward trajectory is fueled by Vietnam's accelerated digital transformation initiatives and the exponential rise in data generation from various sectors. The adoption rates for advanced storage technologies, particularly all-flash storage Vietnam, are surging as businesses seek to optimize application performance and reduce latency. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in storage management, are becoming increasingly prevalent, offering intelligent data placement and automated tiering capabilities. Consumer behavior shifts are marked by an increased preference for cloud-based storage solutions and a greater emphasis on data accessibility and disaster recovery capabilities. The market penetration of cloud storage services is expected to climb from an estimated 35% in 2025 to over 60% by 2033. The increasing demand for data-intensive applications like IoT, big data analytics, and high-definition media streaming is creating a perpetual need for robust and scalable storage infrastructure. Furthermore, the government's push for digitalization and smart city development is a significant catalyst, driving investments in data center expansion and modernization. The average storage capacity per enterprise is projected to grow by 20% annually, underscoring the immense demand for storage solutions. The shift towards software-defined storage (SDS) architectures is also a key trend, offering greater flexibility and agility in managing storage resources. The increasing adoption of hyper-converged infrastructure (HCI) solutions, which integrate compute, storage, and networking into a single system, further contributes to the market's expansion, simplifying deployment and management for businesses of all sizes. The ongoing development of 5G networks will also lead to a significant increase in data traffic, necessitating advanced storage solutions to handle the surge.

Dominant Regions, Countries, or Segments in Vietnam Data Center Storage Market

The IT & Telecommunication sector stands out as the dominant end-user segment within the Vietnam Data Center Storage Market, projected to account for approximately 35% of the market share by 2033. This dominance is primarily driven by the continuous expansion of network infrastructure, the rapid growth of mobile data consumption, and the increasing deployment of cloud services. The telecommunication industry's need for massive data storage to support 5G rollout, IoT services, and content delivery networks makes it a prime consumer of advanced storage solutions. Following closely is the BFSI (Banking, Financial Services, and Insurance) sector, expected to hold around 25% of the market share, driven by the stringent regulatory requirements for data security, compliance, and the growing adoption of digital banking and fintech solutions.

In terms of storage technology, Network Attached Storage (NAS) and Storage Area Network (SAN) are projected to be the leading segments, collectively capturing over 60% of the market. NAS solutions are favored for their ease of use and scalability for file sharing and collaboration, while SANs are crucial for high-performance applications requiring block-level access. The All-Flash Storage segment within Storage Type is experiencing the most rapid growth, with an anticipated CAGR of 15%, as organizations prioritize speed and performance for critical workloads.

Geographically, the Southern region, particularly Ho Chi Minh City, is emerging as the epicenter of data center development and storage demand, driven by its status as the economic powerhouse of Vietnam and its concentration of IT and financial services companies. This region benefits from robust infrastructure, a skilled workforce, and favorable investment policies. The government's commitment to digital transformation and smart city initiatives in major urban centers is a key driver of infrastructure development, including data centers and subsequent demand for storage solutions. The growth potential in this region is further amplified by the presence of major technology hubs and a rapidly expanding startup ecosystem.

- Dominant End-User: IT & Telecommunication (approx. 35% market share by 2033).

- Drivers: 5G rollout, cloud service expansion, IoT, content delivery networks.

- Second Leading End-User: BFSI (approx. 25% market share by 2033).

- Drivers: Data security, compliance, digital banking, fintech growth.

- Leading Storage Technologies: Network Attached Storage (NAS) and Storage Area Network (SAN) (combined > 60% market share).

- NAS: Ease of use, file sharing, collaboration.

- SAN: High-performance applications, block-level access.

- Fastest Growing Storage Type: All-Flash Storage (CAGR of 15%).

- Drivers: Performance optimization, reduced latency for critical workloads.

- Dominant Geographic Region: Southern Vietnam, especially Ho Chi Minh City.

- Drivers: Economic hub, concentration of IT & financial services, government digital transformation initiatives.

Vietnam Data Center Storage Market Product Landscape

The Vietnam Data Center Storage Market is witnessing a surge in product innovations focused on enhancing performance, scalability, and data resilience. Companies are actively developing and deploying solutions that leverage 24Gbps SAS direct-attached drives, as exemplified by Lenovo's ThinkSystem D4390 Direct, which offers superior density, speed, and scalability for high-capacity applications. Dell Technologies' PowerFlex software-defined infrastructure platform, with enhancements like broader OS support and unified storage pool management, showcases the industry's move towards more intelligent and adaptable storage environments. The product landscape is characterized by a strong emphasis on all-flash storage for demanding workloads, hybrid storage for cost-effective performance balancing, and increasingly, integrated solutions that simplify deployment and management. Performance metrics are paramount, with a focus on IOPS (Input/Output Operations Per Second), latency reduction, and throughput enhancement, crucial for real-time analytics and AI/ML applications.

Key Drivers, Barriers & Challenges in Vietnam Data Center Storage Market

Key Drivers:

- Digital Transformation: Accelerated adoption of cloud computing, big data analytics, and IoT across industries.

- Government Initiatives: Strong support for digitalization and smart city development, encouraging infrastructure investment.

- Growing Data Volumes: Exponential increase in data generation from various sources demanding scalable storage.

- Technological Advancements: Innovation in flash storage, software-defined storage, and AI-driven management enhancing capabilities.

- Foreign Direct Investment (FDI): Increasing interest from international companies in Vietnam's tech sector, fueling data center growth.

Barriers & Challenges:

- High Initial Investment: The upfront cost of advanced storage hardware and infrastructure can be substantial for some businesses.

- Skilled Workforce Shortage: Lack of adequately trained professionals to manage and maintain complex data center storage systems.

- Cybersecurity Threats: Evolving and sophisticated cyber threats necessitate robust security measures, adding complexity and cost to storage solutions.

- Interoperability Issues: Challenges in integrating disparate storage systems and legacy infrastructure with new technologies.

- Supply Chain Disruptions: Potential for global supply chain disruptions to impact the availability and pricing of storage components.

Emerging Opportunities in Vietnam Data Center Storage Market

Emerging opportunities in the Vietnam Data Center Storage Market lie in the rapidly growing demand for edge computing storage solutions to process data closer to its source, driven by the proliferation of IoT devices. The burgeoning e-commerce sector presents a significant opportunity for scalable and high-performance storage to manage vast product catalogs, customer data, and transaction records. Furthermore, the increasing adoption of AI and machine learning applications creates a demand for specialized storage that can handle large datasets and high-speed data access for model training and inference. Untapped markets within smaller enterprises and regional businesses that are beginning their digital transformation journeys also offer substantial growth potential. Innovative applications like data archiving solutions for regulatory compliance and disaster recovery as a service (DRaaS) are also gaining traction, presenting avenues for specialized storage providers.

Growth Accelerators in the Vietnam Data Center Storage Market Industry

Several key catalysts are driving long-term growth in the Vietnam Data Center Storage Market. The continuous evolution of 5G technology is a significant accelerator, generating an unprecedented volume of data that necessitates robust storage infrastructure. Strategic partnerships between local telecommunication companies and global storage providers are facilitating the deployment of advanced solutions. Moreover, the Vietnamese government's commitment to becoming a regional technology hub, coupled with incentives for tech-related investments, is encouraging the establishment of new data centers and the expansion of existing ones. The increasing adoption of hybrid cloud strategies by Vietnamese enterprises, blending on-premises and cloud storage, is also a growth accelerator, demanding flexible and interoperable storage solutions. The ongoing investment in digital infrastructure across various sectors is creating a sustained demand for storage capacity and capabilities.

Key Players Shaping the Vietnam Data Center Storage Market Market

- Seagate Technology LLC

- Lenovo Group Limited

- Fujitsu Limited

- Western Digital Corporation

- Dell Inc

- NetApp Inc

- Kingston Technology Company Inc

- Intel Corporation

- Oracle Corporation

- Infortrend Technology Inc

Notable Milestones in Vietnam Data Center Storage Market Sector

- August 2023: Lenovo unveiled the Lenovo ThinkSystem D4390 Direct, featuring storage expansion capabilities enriched with powerful 24Gbps SAS direct-attached drives. This design is crafted to offer density, speed, scalability, security, and high availability for high-capacity applications.

- October 2023: Dell Technologies enhanced its PowerFlex software-defined infrastructure platform to assist customers in the ongoing modernization of the data center storage experience. Dell PowerFlex 4.5 incorporates a broader range of supported operating systems (OS), improved alerting capabilities, a single-capacity namespace, and unified storage pool management.

In-Depth Vietnam Data Center Storage Market Market Outlook

- August 2023: Lenovo unveiled the Lenovo ThinkSystem D4390 Direct, featuring storage expansion capabilities enriched with powerful 24Gbps SAS direct-attached drives. This design is crafted to offer density, speed, scalability, security, and high availability for high-capacity applications.

- October 2023: Dell Technologies enhanced its PowerFlex software-defined infrastructure platform to assist customers in the ongoing modernization of the data center storage experience. Dell PowerFlex 4.5 incorporates a broader range of supported operating systems (OS), improved alerting capabilities, a single-capacity namespace, and unified storage pool management.

In-Depth Vietnam Data Center Storage Market Market Outlook

The Vietnam Data Center Storage Market is on an accelerated growth trajectory, underpinned by robust digital transformation initiatives and expanding technological capabilities. Key growth accelerators, including the pervasive adoption of 5G, the strategic expansion of cloud services, and government support for digital infrastructure, are creating a fertile ground for sustained market expansion. The increasing demand for high-performance all-flash storage, coupled with the flexibility of hybrid storage solutions, will define the future product landscape. Emerging opportunities in edge computing and specialized data archiving services further brighten the market outlook. Vietnam's position as a growing technology hub in Southeast Asia will continue to attract investment, driving innovation and the adoption of cutting-edge data center storage technologies, ensuring a promising future for the market.

Vietnam Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-Users

Vietnam Data Center Storage Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost To Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Seagate Technology LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Western Digital Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NetApp Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Infortrend Technology Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology LLC

List of Figures

- Figure 1: Vietnam Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Vietnam Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Vietnam Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 8: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 9: Vietnam Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Vietnam Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Storage Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Vietnam Data Center Storage Market?

Key companies in the market include Seagate Technology LLC, Lenovo Group Limited, Fujitsu Limited, Western Digital Corporation, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Intel Corporation, Oracle Corporation, Infortrend Technology Inc.

3. What are the main segments of the Vietnam Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.2 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment Cost To Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Lenovo unveiled the Lenovo ThinkSystem D4390 Direct, featuring storage expansion capabilities enriched with powerful 24Gbps SAS direct-attached drives. This design is crafted to offer density, speed, scalability, security, and high availability for high-capacity applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence