Key Insights

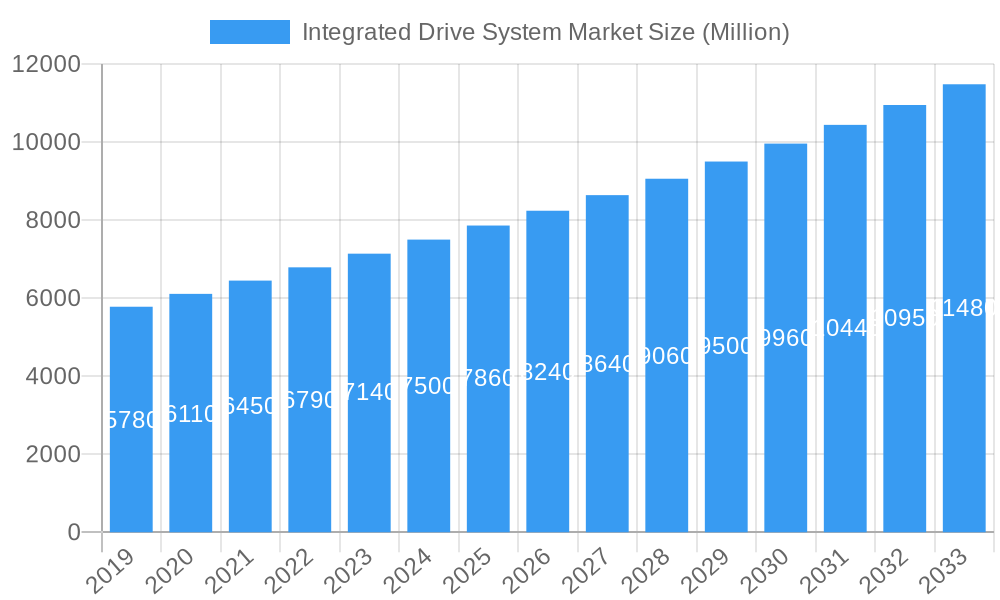

The global Integrated Drive System (IDS) market is poised for robust growth, projected to reach an estimated market size of approximately \$7,860 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.88% through 2033. This expansion is fueled by the escalating demand for automation and sophisticated control solutions across a multitude of industrial sectors. Key drivers include the increasing need for energy efficiency, enhanced productivity, and precision in manufacturing processes. As industries strive to optimize operational costs and improve product quality, the adoption of integrated drive systems, which combine motor, drive, and control functionalities into a single, optimized unit, becomes paramount. This trend is particularly pronounced in sectors like automotive, where advanced manufacturing lines demand high levels of automation, and in the oil and gas industry, where reliable and efficient operation in challenging environments is critical. The pharmaceutical and chemical industries are also significant contributors, leveraging IDS for precise process control and compliance with stringent regulatory standards.

Integrated Drive System Market Market Size (In Billion)

The market is characterized by several influential trends, including the growing adoption of smart factory concepts and Industry 4.0 initiatives, which necessitate interconnected and intelligent automation solutions. The miniaturization of components and the development of more compact, energy-efficient IDS are also shaping the market landscape. Furthermore, advancements in software integration and predictive maintenance capabilities are enhancing the value proposition of these systems, allowing for proactive issue resolution and minimizing downtime. However, certain restraints, such as the high initial investment cost for some integrated drive systems and the need for skilled personnel for installation and maintenance, could temper growth in specific segments or regions. Despite these challenges, the long-term outlook for the Integrated Drive System market remains exceptionally positive, as its benefits in terms of efficiency, performance, and operational flexibility continue to outweigh the perceived hurdles for a wide array of end-user industries. The market's segmentation by type, with both hardware and software components playing crucial roles, and its diverse application across industries like mining, food and beverage, and other specialized sectors, further underscores its broad market penetration and future potential.

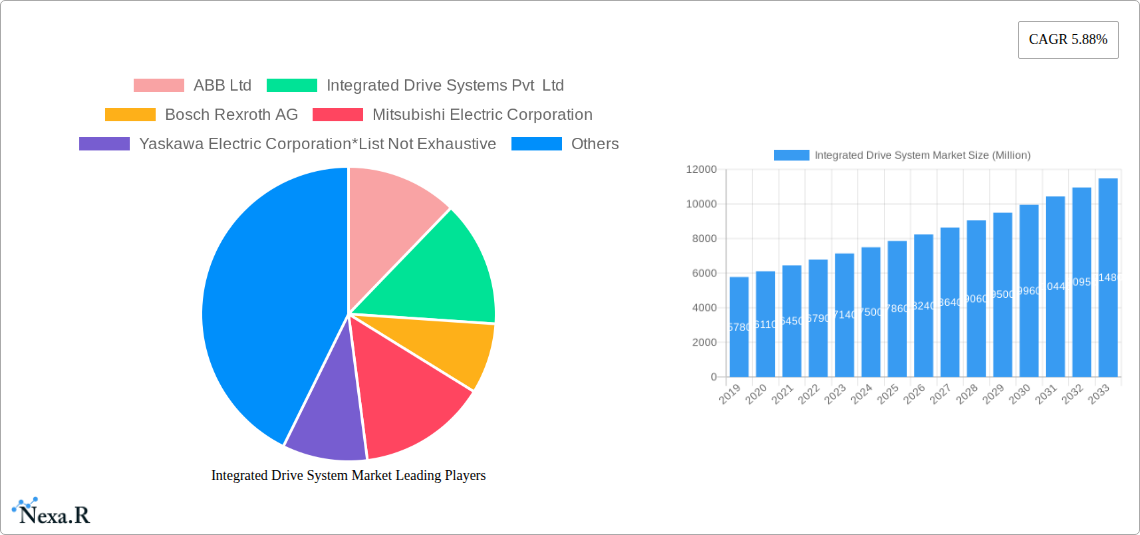

Integrated Drive System Market Company Market Share

Here is a compelling and SEO-optimized report description for the Integrated Drive System Market, incorporating your specified details and structure:

Report Title: Global Integrated Drive System Market: Growth, Trends, and Forecast 2025-2033

Report Description:

Dive deep into the expansive global integrated drive system market with this comprehensive report. Explore the intricate dynamics, robust growth trajectory, and future outlook of integrated drive systems, critical components for automation and efficiency across industries. This study, covering the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, provides unparalleled insights into the market's evolution and opportunities. We meticulously analyze the parent market and its child markets, offering a granular view of this essential industrial segment. Our analysis leverages extensive data, including market size evolution in million units, adoption rates, and technological disruptions, to guide strategic decision-making.

The report meticulously dissects the integrated drive system market, focusing on its segments: Hardware and Software. Furthermore, it examines the impact of these systems across key end-user industries, including Automotive, Oil and Gas, Food and Beverage, Mining, Pharmaceutical, and Chemical, alongside "Other End-user Industry." Understand the key players, emerging opportunities, and the forces shaping the future of industrial automation. This report is an indispensable resource for manufacturers, suppliers, investors, and decision-makers navigating the complexities of the integrated drive system landscape.

Integrated Drive System Market Market Dynamics & Structure

The integrated drive system market is characterized by a moderately consolidated structure, with leading players like Siemens AG, ABB Ltd, and Rockwell Automation Inc. holding significant market shares. Technological innovation remains a primary driver, fueled by the escalating demand for enhanced energy efficiency, precision control, and predictive maintenance in industrial automation. The integration of Industry 4.0 technologies, including IoT, AI, and cloud computing, is revolutionizing drive system capabilities, enabling smarter manufacturing processes. Regulatory frameworks, particularly those focused on energy conservation and environmental standards, are indirectly pushing the adoption of advanced integrated drive systems. Competitive product substitutes, such as standalone drives and conventional motor control systems, are gradually being phased out as the benefits of integrated solutions become more apparent. End-user demographics are shifting towards industries with higher automation needs, such as automotive manufacturing and food and beverage processing, driving increased demand. Merger and acquisition (M&A) trends are notable, with companies acquiring smaller specialized firms to expand their product portfolios and technological expertise.

- Market Concentration: Moderate, with a few dominant global players.

- Technological Innovation Drivers: Energy efficiency mandates, Industry 4.0 adoption, AI integration, IoT connectivity.

- Regulatory Frameworks: Energy conservation standards, emissions reduction targets.

- Competitive Product Substitutes: Traditional motor starters, individual frequency drives.

- End-user Demographics: Growing adoption in automotive, F&B, and pharmaceutical sectors.

- M&A Trends: Strategic acquisitions for technology enhancement and market reach.

Integrated Drive System Market Growth Trends & Insights

The global integrated drive system market is poised for robust expansion, projected to witness a substantial CAGR from 2025 to 2033. This growth is underpinned by the continuous evolution of industrial automation and the increasing necessity for sophisticated control and monitoring solutions. The market size, estimated to reach XXX million units in 2025, is expected to surge significantly by 2033, driven by widespread adoption across diverse industrial sectors. Adoption rates of integrated drive systems are accelerating, particularly in emerging economies where industrialization is rapidly progressing. Technological disruptions are at the forefront of this evolution; advancements in power electronics, embedded software, and communication protocols are enabling more compact, efficient, and intelligent drive systems. The trend towards digitalization and smart manufacturing is compelling industries to invest in solutions that offer real-time data analytics and remote monitoring capabilities. Consumer behavior shifts, within industrial procurement, are increasingly prioritizing total cost of ownership, reliability, and energy savings, all areas where integrated drive systems excel. Furthermore, the increasing focus on sustainability and the reduction of carbon footprints across global industries are acting as powerful catalysts for the adoption of energy-efficient integrated drive solutions. The ability of these systems to optimize energy consumption during operation directly contributes to achieving environmental goals, making them an attractive investment for forward-thinking businesses.

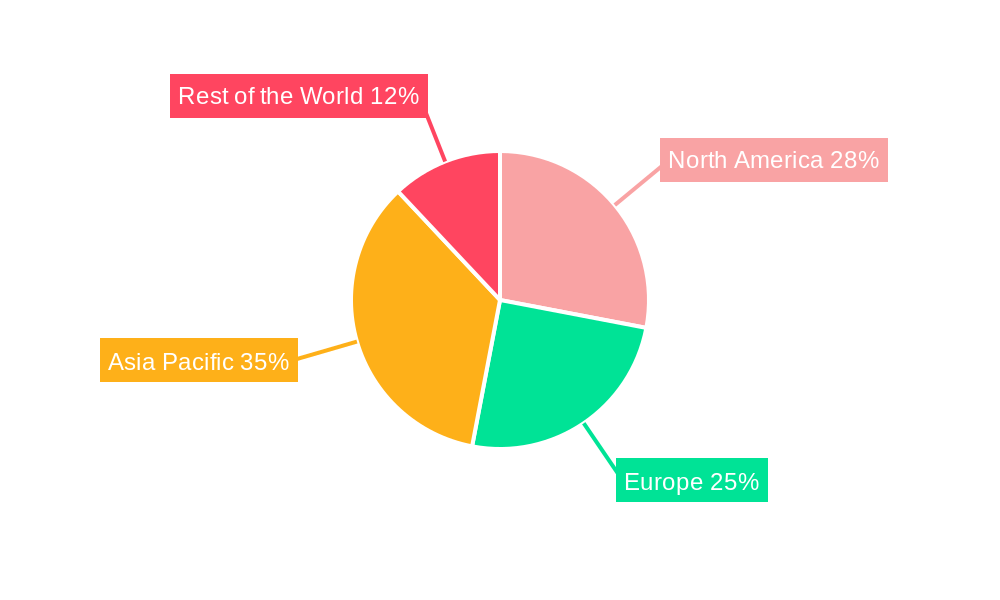

Dominant Regions, Countries, or Segments in Integrated Drive System Market

The Hardware segment is currently the dominant force within the integrated drive system market, driven by the fundamental need for robust and reliable physical components in industrial automation. This dominance is further amplified by the increasing demand for high-performance motors, variable frequency drives (VFDs), and sophisticated control units across various manufacturing processes. The Automotive industry stands out as a key end-user industry propelling market growth. This is attributed to the automotive sector's continuous drive for enhanced production efficiency, precision assembly, and the adoption of electric vehicle (EV) technologies, which heavily rely on advanced motor control and energy management systems. Countries within North America and Europe are leading the charge due to their mature industrial bases, strong emphasis on technological innovation, and stringent regulatory frameworks promoting energy efficiency and automation. For instance, the United States' robust manufacturing sector and Germany's prowess in engineering and automation contribute significantly to the dominance of these regions. Economic policies that support manufacturing upgrades and infrastructure development in these regions further bolster the adoption of integrated drive systems. The market share within these dominant regions is substantial, with a continuous inflow of investments into research and development for more advanced and intelligent drive solutions. The growth potential in these areas remains high as industries continue to embrace Industry 4.0 principles and seek competitive advantages through optimized operational performance.

- Dominant Segment (Type): Hardware, owing to its integral role in automation infrastructure.

- Dominant Segment (End-user Industry): Automotive, driven by precision manufacturing and EV adoption.

- Leading Regions: North America and Europe, due to established industrial ecosystems and technological adoption.

- Key Countries: United States, Germany, China (emerging prominence).

- Drivers of Dominance: Economic policies favoring industrial automation, stringent energy efficiency standards, advanced manufacturing capabilities.

Integrated Drive System Market Product Landscape

The integrated drive system market is witnessing a surge in product innovations focused on enhanced connectivity, intelligent diagnostics, and superior energy efficiency. Key advancements include the development of compact, modular drive units that simplify installation and maintenance. Furthermore, the integration of advanced software functionalities, such as predictive maintenance algorithms and self-optimizing control loops, is becoming a significant unique selling proposition. These software enhancements allow for real-time performance monitoring, early detection of potential failures, and optimized operational parameters, leading to reduced downtime and increased productivity. Performance metrics are consistently improving, with manufacturers achieving higher power density, wider operating temperature ranges, and enhanced torque control accuracy.

Key Drivers, Barriers & Challenges in Integrated Drive System Market

Key Drivers:

- Industry 4.0 Adoption: The pervasive integration of smart technologies, IoT, and AI in manufacturing necessitates advanced control systems.

- Energy Efficiency Mandates: Growing global focus on sustainability and energy conservation drives demand for efficient drive solutions.

- Automation Demand: Escalating need for increased productivity, precision, and reduced operational costs across industries.

- Technological Advancements: Continuous innovation in power electronics, software, and communication protocols.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of implementing integrated drive systems can be a deterrent for some small and medium-sized enterprises.

- Complex Integration: Integrating these systems with existing legacy infrastructure can be challenging and time-consuming.

- Skilled Workforce Requirement: Operation and maintenance require personnel with specialized technical expertise.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of critical components, leading to price volatility. (Estimated impact: 5-10% potential cost increase during disruptions).

Emerging Opportunities in Integrated Drive System Market

Emerging opportunities in the integrated drive system market are centered around the growing demand for specialized solutions in niche applications and the increasing adoption of sustainable technologies. The expansion of the electric vehicle (EV) charging infrastructure presents a significant opportunity for compact and high-performance integrated drives. Furthermore, the application of AI and machine learning for predictive maintenance within drive systems is a rapidly growing area, offering enhanced reliability and reduced operational expenses for end-users. The development of eco-friendly and energy-harvesting integrated drives is also gaining traction, aligning with global sustainability initiatives and appealing to environmentally conscious industries.

Growth Accelerators in the Integrated Drive System Market Industry

Long-term growth in the integrated drive system market is being accelerated by significant technological breakthroughs in power semiconductor technology, leading to smaller, more efficient, and cost-effective drive units. Strategic partnerships between drive manufacturers and automation solution providers are creating integrated ecosystems that offer comprehensive solutions to end-users, simplifying adoption and enhancing functionality. Market expansion strategies, particularly targeting developing economies undergoing rapid industrialization, are opening up new avenues for growth. The continuous evolution of software capabilities, enabling greater autonomy and intelligence in drive systems, is also a key accelerator.

Key Players Shaping the Integrated Drive System Market Market

- ABB Ltd

- Integrated Drive Systems Pvt Ltd

- Bosch Rexroth AG

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc

- Emerson Electric Company

Notable Milestones in Integrated Drive System Market Sector

- 2023 (Q4): Siemens AG launches next-generation Sinamics V20 compact drive, focusing on enhanced energy savings and ease of integration for general-purpose applications.

- 2024 (Q1): Rockwell Automation Inc. acquires a leading provider of industrial IoT analytics, strengthening its integrated drive system offerings with advanced predictive maintenance capabilities.

- 2024 (Q2): ABB Ltd. announces significant advancements in its ACS series drives, incorporating novel power electronics for improved thermal management and extended lifespan.

- 2024 (Q3): Mitsubishi Electric Corporation unveils a new range of integrated servo drives designed for high-precision motion control in robotic and automation applications.

- 2024 (Q4): Yaskawa Electric Corporation expands its global manufacturing capacity for integrated drive systems to meet rising demand from the automotive and logistics sectors.

In-Depth Integrated Drive System Market Market Outlook

The future outlook for the integrated drive system market is exceptionally promising, driven by the relentless pursuit of industrial efficiency, sustainability, and digitalization. Growth accelerators such as the continued integration of AI for smarter control, the development of highly efficient power electronics, and the expansion into emerging markets will significantly shape the market's trajectory. Strategic partnerships and a focus on developing comprehensive solutions that address the evolving needs of end-user industries will be crucial for success. The increasing adoption of electric mobility and the growing emphasis on smart manufacturing environments will create sustained demand for advanced integrated drive systems, positioning the market for substantial and enduring growth.

Integrated Drive System Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Oil and Gas

- 2.3. Food and Beverage

- 2.4. Mining

- 2.5. Pharmaceutical

- 2.6. Chemical

- 2.7. Other End-user Industry

Integrated Drive System Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Integrated Drive System Market Regional Market Share

Geographic Coverage of Integrated Drive System Market

Integrated Drive System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Focus on Efficiency and Lowering Production Cost; Increased Deployment of Integrated Systems in Industrial Automation

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to be One of the Major Sectors of Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Integrated Drive System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Oil and Gas

- 5.2.3. Food and Beverage

- 5.2.4. Mining

- 5.2.5. Pharmaceutical

- 5.2.6. Chemical

- 5.2.7. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Integrated Drive System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Oil and Gas

- 6.2.3. Food and Beverage

- 6.2.4. Mining

- 6.2.5. Pharmaceutical

- 6.2.6. Chemical

- 6.2.7. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Integrated Drive System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Oil and Gas

- 7.2.3. Food and Beverage

- 7.2.4. Mining

- 7.2.5. Pharmaceutical

- 7.2.6. Chemical

- 7.2.7. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Integrated Drive System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Oil and Gas

- 8.2.3. Food and Beverage

- 8.2.4. Mining

- 8.2.5. Pharmaceutical

- 8.2.6. Chemical

- 8.2.7. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Integrated Drive System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Oil and Gas

- 9.2.3. Food and Beverage

- 9.2.4. Mining

- 9.2.5. Pharmaceutical

- 9.2.6. Chemical

- 9.2.7. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Integrated Drive Systems Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bosch Rexroth AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mitsubishi Electric Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yaskawa Electric Corporation*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rockwell Automation Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Emerson Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Global Integrated Drive System Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Integrated Drive System Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Integrated Drive System Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Integrated Drive System Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Integrated Drive System Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Integrated Drive System Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Integrated Drive System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Integrated Drive System Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Integrated Drive System Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Integrated Drive System Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Integrated Drive System Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Integrated Drive System Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Integrated Drive System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Integrated Drive System Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Integrated Drive System Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Integrated Drive System Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Integrated Drive System Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Integrated Drive System Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Integrated Drive System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Integrated Drive System Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World Integrated Drive System Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Integrated Drive System Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Integrated Drive System Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Integrated Drive System Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Integrated Drive System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Integrated Drive System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Integrated Drive System Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Integrated Drive System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Integrated Drive System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Integrated Drive System Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Integrated Drive System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Integrated Drive System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Integrated Drive System Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Integrated Drive System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Integrated Drive System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Integrated Drive System Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Integrated Drive System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Integrated Drive System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Integrated Drive System Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Integrated Drive System Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Drive System Market?

The projected CAGR is approximately 13.72%.

2. Which companies are prominent players in the Integrated Drive System Market?

Key companies in the market include ABB Ltd, Integrated Drive Systems Pvt Ltd, Bosch Rexroth AG, Mitsubishi Electric Corporation, Yaskawa Electric Corporation*List Not Exhaustive, Siemens AG, Schneider Electric SE, Rockwell Automation Inc, Emerson Electric Company.

3. What are the main segments of the Integrated Drive System Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Focus on Efficiency and Lowering Production Cost; Increased Deployment of Integrated Systems in Industrial Automation.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to be One of the Major Sectors of Application.

7. Are there any restraints impacting market growth?

; High Initial Investment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Integrated Drive System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Integrated Drive System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Integrated Drive System Market?

To stay informed about further developments, trends, and reports in the Integrated Drive System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence