Key Insights

The Europe Data Center Power market is forecast to reach $123.85 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 29.7% from the base year 2025. This significant expansion is driven by pervasive digital transformation, leading to exponential data growth and processing demands. The widespread adoption of cloud computing services necessitates robust and scalable data center power infrastructure. Furthermore, the burgeoning Internet of Things (IoT) ecosystem, with its vast array of connected devices, contributes substantially to market growth. The increasing prevalence of computationally intensive Big Data analytics and Artificial Intelligence (AI) applications also drives demand for highly reliable and efficient power solutions. Investments in new data center construction and expansion, particularly in hyperscale and colocation facilities across Europe, further bolster market growth.

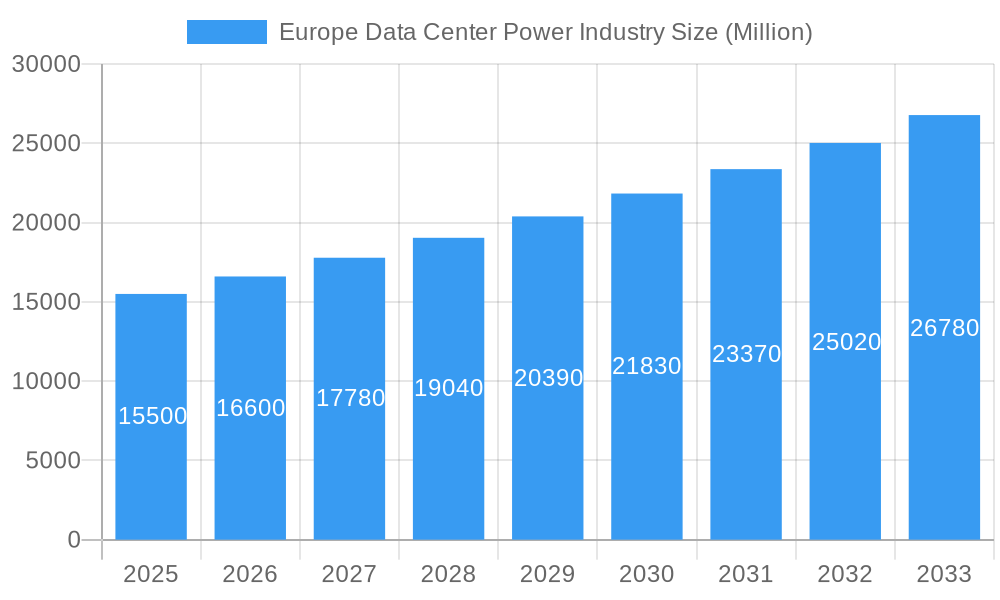

Europe Data Center Power Industry Market Size (In Billion)

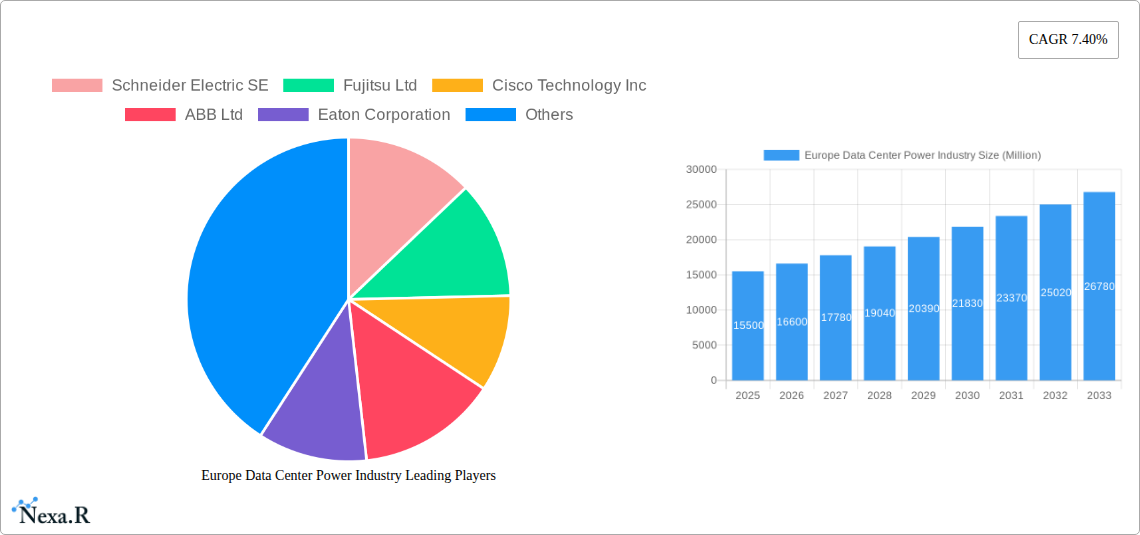

Key industry trends include a strong emphasis on energy efficiency and sustainability, with a growing focus on Power Distribution Units (PDUs) and Uninterruptible Power Supply (UPS) systems designed to minimize energy consumption and carbon footprint. System integration and professional services are becoming increasingly vital as data center operators seek comprehensive power management solutions. The market is also observing a significant uptake in advanced busway systems, valued for their flexibility and ease of deployment in high-density environments. Despite strong growth prospects, challenges remain. High initial investment costs for advanced power infrastructure can be a barrier for smaller enterprises. Additionally, evolving regulatory landscapes concerning data privacy and environmental impact, while driving innovation, can also present compliance challenges. The competitive landscape is dynamic, featuring established leaders such as Schneider Electric SE, ABB Ltd, and Eaton Corporation, alongside innovative companies specializing in niche solutions.

Europe Data Center Power Industry Company Market Share

Europe Data Center Power Industry: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Europe Data Center Power Industry, offering critical insights into market dynamics, growth trends, dominant segments, and key players. Focusing on the intricate landscape of power solutions, services, and end-user applications, this study covers a comprehensive historical period (2019-2024) and forecasts future market evolution through 2033, with a base and estimated year of 2025. With a deep dive into parent and child market segments, this report is essential for understanding the strategic opportunities and challenges within this rapidly expanding sector. All values are presented in Million units for clarity.

Europe Data Center Power Industry Market Dynamics & Structure

The Europe Data Center Power Industry is characterized by a dynamic and evolving market structure, driven by increasing data demands and the proliferation of digital services. Market concentration is moderate, with significant players investing heavily in innovation and strategic acquisitions to solidify their positions. Technological innovation is a primary driver, with advancements in UPS efficiency, power distribution units, and busway systems enabling greater energy savings and operational resilience. Regulatory frameworks, particularly concerning energy efficiency and carbon emissions, are increasingly shaping market strategies and product development. Competitive product substitutes, while present, often struggle to match the integrated solutions offered by established providers. End-user demographics are shifting, with hyperscale cloud providers and colocation facilities becoming increasingly dominant. Mergers and acquisitions (M&A) trends are prevalent as companies seek to expand their service portfolios and geographic reach.

- Market Concentration: Moderate, with a few key players holding substantial market share, but ample room for specialized providers.

- Technological Innovation Drivers: Growing need for energy efficiency, enhanced reliability, modularity, and the integration of renewable energy sources.

- Regulatory Frameworks: Stringent energy efficiency standards (e.g., EU directives), sustainability mandates, and data privacy regulations influencing infrastructure choices.

- Competitive Product Substitutes: While basic components exist, integrated power management solutions with advanced monitoring and control offer significant differentiation.

- End-user Demographics: Dominance of hyperscalers and colocation providers, with growing demand from AI/ML, IoT, and edge computing deployments.

- M&A Trends: Frequent consolidation to acquire new technologies, expand market access, and achieve economies of scale.

Europe Data Center Power Industry Growth Trends & Insights

The Europe Data Center Power Industry is poised for substantial growth over the forecast period, driven by an insatiable demand for digital infrastructure and advanced computing capabilities. The market size evolution is a direct reflection of the escalating data generation from cloud computing, big data analytics, Artificial Intelligence (AI), and the Internet of Things (IoT). Adoption rates of advanced power solutions, such as high-efficiency Uninterruptible Power Supplies (UPSs) and intelligent Power Distribution Units (PDUs), are accelerating as data center operators prioritize operational expenditure reduction and enhanced uptime. Technological disruptions, including the integration of lithium-ion battery technology in UPS systems for improved performance and lifespan, and the development of more efficient busway solutions, are fundamentally reshaping the industry. Consumer behavior shifts are also playing a crucial role; the increasing reliance on digital services for work, entertainment, and critical operations necessitates robust and reliable data center power infrastructure. The market penetration of advanced power management systems is expected to rise significantly as data centers strive for greater sustainability and reduced environmental impact.

The CAGR for the Europe Data Center Power Industry is projected to be robust, reflecting the ongoing digital transformation across various sectors. This growth is underpinned by significant investments in new data center construction and the modernization of existing facilities across the continent. The trend towards higher power densities per rack is also a key factor, demanding more sophisticated and efficient power distribution and backup solutions. Furthermore, the growing emphasis on edge computing, with its distributed architecture, presents a unique set of power challenges and opportunities, driving the need for localized and resilient power systems. The integration of smart grid technologies and renewable energy sources into data center power strategies is another emerging trend that will contribute to sustained growth and market evolution. The forecast period will witness a continued emphasis on modularity and scalability in power solutions to accommodate rapid changes in IT workloads and capacity requirements.

Dominant Regions, Countries, or Segments in Europe Data Center Power Industry

The Europe Data Center Power Industry's dominance is a multifaceted phenomenon, influenced by a confluence of economic, technological, and infrastructural factors. Within the Type segment, UPS (Uninterruptible Power Supply) solutions consistently emerge as a critical driver of market growth. The ever-increasing demand for uninterrupted power to safeguard sensitive IT equipment against outages is paramount for data center reliability. This segment's dominance is further amplified by the continuous innovation in UPS technology, including higher efficiencies, advanced battery chemistries like lithium-ion, and enhanced monitoring capabilities, directly addressing the need for greater energy efficiency and reduced operational costs.

Across End-user Applications, the Information Technology sector, encompassing cloud providers, colocation facilities, and enterprise data centers, stands out as the primary consumer of data center power solutions. The exponential growth of cloud services, AI/ML workloads, and big data analytics fuels an unquenchable thirst for computing power, thereby driving the expansion of IT infrastructure and, consequently, its power requirements. Within this, the hyperscale data center segment, characterized by massive scale and high power demands, is a particularly significant contributor to the overall market.

Geographically, Germany has historically been a powerhouse in the European data center landscape, driven by its robust economy, strong industrial base, and a growing concentration of hyperscale and enterprise data centers. The country's commitment to digital transformation and its strategic location within Europe make it a hub for data center development and, by extension, power solutions. Furthermore, Germany's stringent environmental regulations often push for the adoption of the most energy-efficient power technologies, thereby accelerating the market for advanced UPS and PDU solutions. The country's significant manufacturing sector also contributes to the demand for reliable power infrastructure in industrial data centers.

- Dominant Segment (Type): Uninterruptible Power Supply (UPS) - Driven by critical uptime requirements and continuous technological advancements.

- Dominant Segment (End-user Application): Information Technology - Fueling demand through cloud computing, AI/ML, and big data analytics.

- Dominant Country: Germany - Benefiting from a strong economy, extensive digital infrastructure, and stringent energy efficiency mandates.

- Key Drivers for Dominance:

- Economic Policies: Government support for digital infrastructure development and investment incentives.

- Infrastructure: Availability of reliable power grids and fiber optic networks.

- Technological Adoption: Early and widespread adoption of advanced data center power technologies.

- Data Center Growth: High concentration of hyperscale, colocation, and enterprise data centers.

- Environmental Regulations: Mandates promoting energy efficiency and sustainability in data center operations.

Europe Data Center Power Industry Product Landscape

The Europe Data Center Power Industry is characterized by a dynamic product landscape driven by innovation focused on efficiency, reliability, and sustainability. Advanced Uninterruptible Power Supplies (UPSs), particularly those employing lithium-ion battery technology, are gaining traction due to their longer lifespan, higher energy density, and improved thermal performance compared to traditional lead-acid batteries. Modular Power Distribution Units (PDUs) offer scalable power delivery, enabling data center operators to precisely match power capacity to evolving IT loads, thus optimizing energy consumption. Busway systems are increasingly favored for their flexibility, ease of installation, and ability to support high power densities, particularly in hyperscale environments. The product portfolio also includes intelligent monitoring and management software that provides real-time insights into power usage, system health, and potential anomalies, allowing for proactive maintenance and improved operational efficiency.

Key Drivers, Barriers & Challenges in Europe Data Center Power Industry

The Europe Data Center Power Industry is propelled by several key drivers, foremost among them being the relentless surge in data consumption and the subsequent expansion of digital infrastructure. The growing adoption of cloud computing, AI, and IoT technologies mandates an ever-increasing demand for reliable and efficient data center power. Furthermore, stringent government regulations mandating energy efficiency and sustainability are a significant catalyst, pushing for the adoption of advanced power solutions that minimize environmental impact and operational costs. Technological advancements in UPS efficiency, power distribution, and battery technology also play a crucial role in driving market growth.

Conversely, the industry faces notable barriers and challenges. High initial capital expenditure for advanced power infrastructure can be a restraint, particularly for smaller enterprises. Supply chain disruptions, exacerbated by geopolitical events and material shortages, pose a significant challenge, impacting project timelines and cost predictability. The complex and evolving regulatory landscape across different European nations can also create compliance hurdles. Moreover, intense competition among established players and emerging technology providers puts pressure on pricing and profit margins. The skilled workforce required for the installation and maintenance of sophisticated power systems also presents a challenge.

Emerging Opportunities in Europe Data Center Power Industry

Emerging opportunities in the Europe Data Center Power Industry are primarily centered around the burgeoning demand for edge computing infrastructure. As organizations push computing power closer to data sources, the need for compact, resilient, and energy-efficient power solutions for edge data centers will escalate. The increasing integration of renewable energy sources, such as solar and wind power, into data center power strategies presents a significant opportunity for providers offering solutions that facilitate grid independence and optimize energy mix. Furthermore, the circular economy trend is driving demand for power equipment with enhanced recyclability and reduced environmental footprint throughout their lifecycle. The development of advanced predictive maintenance solutions, leveraging AI and IoT, to minimize downtime and optimize power system performance also represents a lucrative avenue.

Growth Accelerators in the Europe Data Center Power Industry Industry

Several catalysts are accelerating long-term growth in the Europe Data Center Power Industry. The continuous evolution of Artificial Intelligence and Machine Learning workloads, which require massive processing power and, therefore, substantial and reliable energy, is a primary growth accelerator. Strategic partnerships between power solution providers, data center developers, and technology firms are fostering innovation and expanding market reach. The ongoing expansion of 5G networks across Europe necessitates a denser deployment of data processing capabilities, driving demand for localized power solutions. Furthermore, significant government and private sector investments in digital transformation initiatives and the development of smart cities are creating a sustained demand for robust data center infrastructure and its power backbone.

Key Players Shaping the Europe Data Center Power Industry Market

- Schneider Electric SE

- Fujitsu Ltd

- Cisco Technology Inc

- ABB Ltd

- Eaton Corporation

- Tripp Lite

- Rittal GmbH & Co KG

- Schleifenbauer

- Vertiv Co

- Legrand SA

- Black Box Corporation

Notable Milestones in Europe Data Center Power Industry Sector

- December 2022: Delta announced the opening of its Customer Experience Centre for Data Center and Uninterruptible Power Supply (UPS) technology in Soest, Germany. The 500m² center supports multiple megawatt power and testing to meet the test and qualification requirements from enterprise data centers to megawatt colocation data centers.

- August 2022: Panduit launched its lithium-ion-based SmartZone UPS products in Europe. The rack-mounted SmartZone uninterruptible power supplies (UPSs) now have a lithium-ion version, benefiting from lithium's capability of 97% efficiency and compliance with standards, including Energy Star 2.0, EMC, and safety specifications.

In-Depth Europe Data Center Power Industry Market Outlook

The future market outlook for the Europe Data Center Power Industry is exceptionally promising, driven by sustained digital transformation and evolving technological demands. Growth accelerators such as the increasing complexity of AI/ML workloads and the expansion of 5G infrastructure will continue to fuel the need for advanced power solutions. Strategic partnerships and collaborative innovation will be crucial for addressing emerging challenges like the integration of renewable energy and the demand for edge computing power. The market is poised for significant expansion as data center operators prioritize energy efficiency, operational resilience, and sustainability, creating substantial opportunities for companies offering cutting-edge power technologies and services.

Europe Data Center Power Industry Segmentation

-

1. Type

-

1.1. Solutions

- 1.1.1. Power Distribution Unit

- 1.1.2. UPS

- 1.1.3. Busway

- 1.1.4. Other Solutions

-

1.2. Services

- 1.2.1. Consulting

- 1.2.2. System Integration

- 1.2.3. Professional Service

-

1.1. Solutions

-

2. End-user Application

- 2.1. Information Technology

- 2.2. Manufacturing

- 2.3. BFSI

- 2.4. Government

- 2.5. Telecom

- 2.6. Other End-user Applications

Europe Data Center Power Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

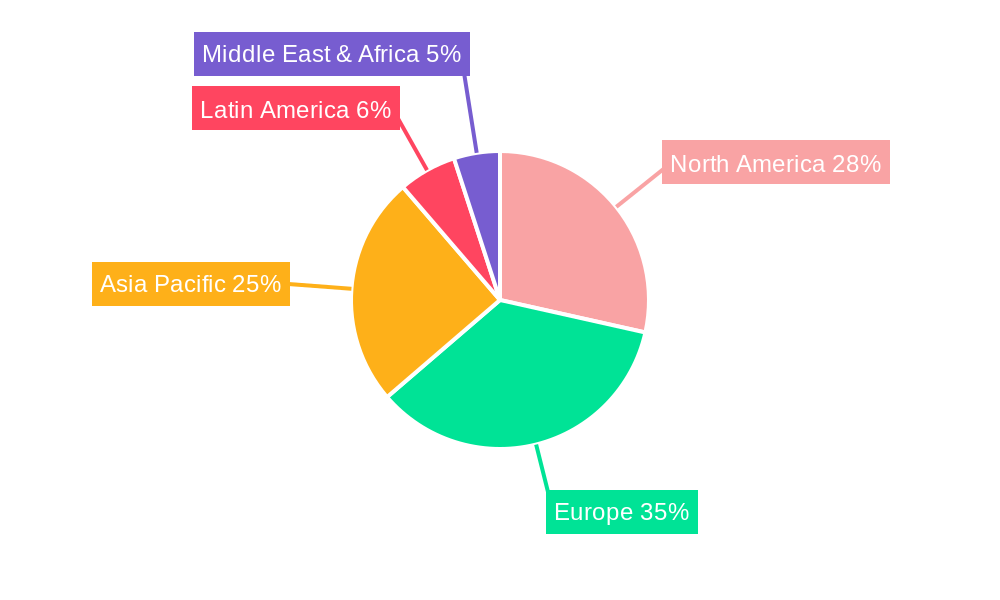

Europe Data Center Power Industry Regional Market Share

Geographic Coverage of Europe Data Center Power Industry

Europe Data Center Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 29.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Mega Data Centers and Cloud Computing is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Data Center Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.1.1. Power Distribution Unit

- 5.1.1.2. UPS

- 5.1.1.3. Busway

- 5.1.1.4. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Consulting

- 5.1.2.2. System Integration

- 5.1.2.3. Professional Service

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Information Technology

- 5.2.2. Manufacturing

- 5.2.3. BFSI

- 5.2.4. Government

- 5.2.5. Telecom

- 5.2.6. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schneider Electric SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fujitsu Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cisco Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ABB Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eaton Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tripp Lite

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rittal GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schleifenbauer

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vertiv Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Legrand SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Black Box Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Schneider Electric SE

List of Figures

- Figure 1: Europe Data Center Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Data Center Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Data Center Power Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Data Center Power Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 3: Europe Data Center Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Data Center Power Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Data Center Power Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 6: Europe Data Center Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Data Center Power Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Data Center Power Industry?

The projected CAGR is approximately 29.7%.

2. Which companies are prominent players in the Europe Data Center Power Industry?

Key companies in the market include Schneider Electric SE, Fujitsu Ltd, Cisco Technology Inc, ABB Ltd, Eaton Corporation, Tripp Lite, Rittal GmbH & Co KG, Schleifenbauer, Vertiv Co, Legrand SA, Black Box Corporatio.

3. What are the main segments of the Europe Data Center Power Industry?

The market segments include Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

Rising Adoption of Mega Data Centers and Cloud Computing is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

8. Can you provide examples of recent developments in the market?

December 2022: Delta announced opening a Customer Experience Centre for its Data Center and Uninterruptible Power Supply (UPS) technology in Soest, Germany. The 500m² center supports multiple megawatt power and testing to meet the test and qualification requirements from enterprise data centers to megawatt colocation data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Data Center Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Data Center Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Data Center Power Industry?

To stay informed about further developments, trends, and reports in the Europe Data Center Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence