Key Insights

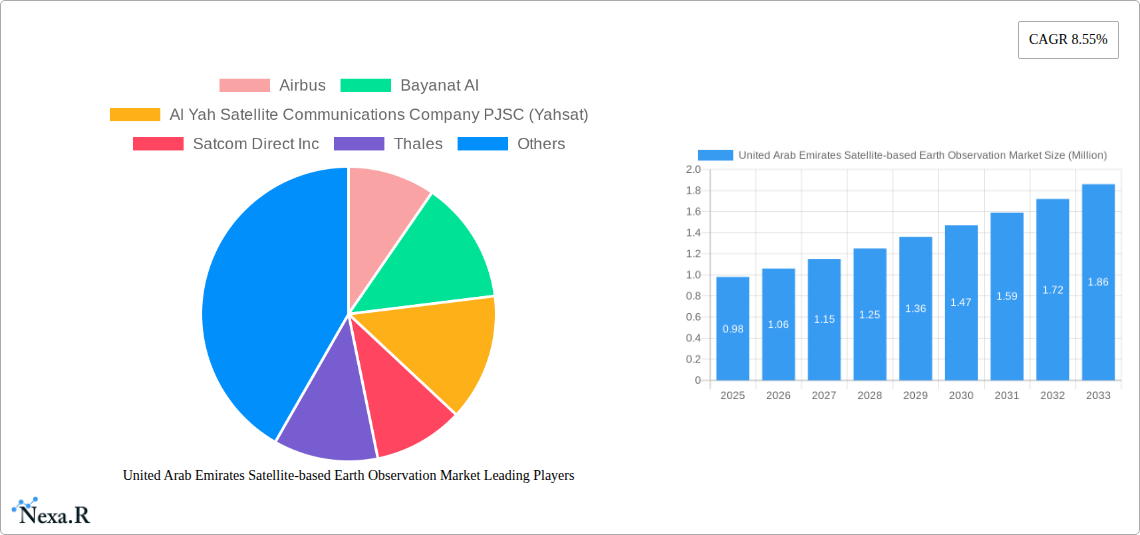

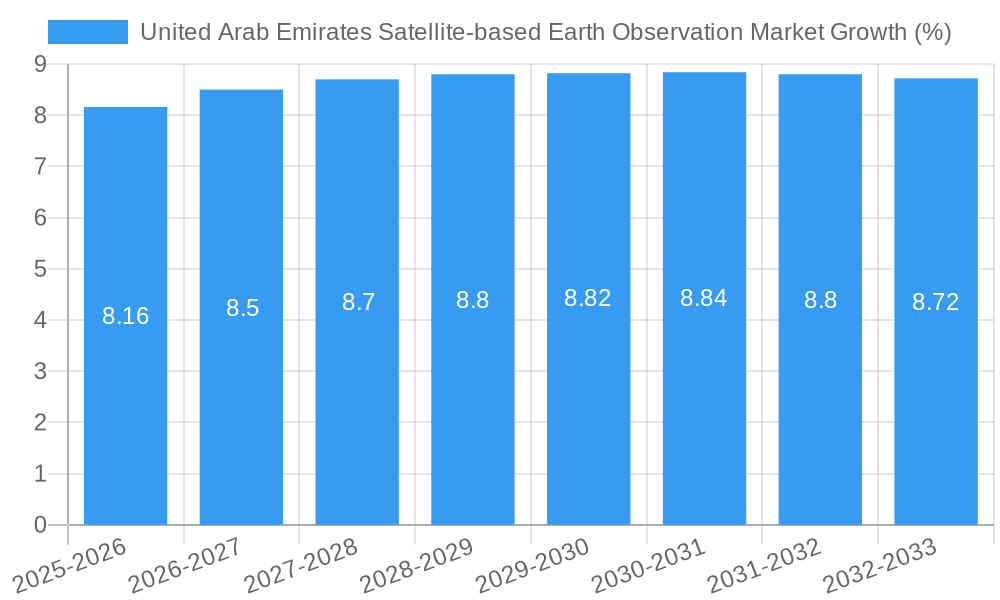

The United Arab Emirates (UAE) is poised for substantial growth in its satellite-based Earth observation market, driven by an expanding focus on smart city initiatives, environmental monitoring, and resource management. With a current market size of approximately USD 0.98 million, the sector is projected to experience a robust Compound Annual Growth Rate (CAGR) of 8.55% over the forecast period of 2025-2033. This expansion is underpinned by increasing investments in advanced satellite technologies and value-added services, crucial for sectors like urban development and cultural heritage preservation, agriculture, climate services, and the burgeoning energy and raw materials sector. The UAE's strategic vision for technological advancement and sustainability aligns perfectly with the capabilities offered by Earth observation, making it a key enabler for national development goals.

The market's growth is further propelled by the increasing adoption of Earth observation data for infrastructure development and monitoring, alongside a rising demand for climate services and accurate agricultural analytics. While the market is still in its nascent stages, the presence of major global players like Airbus and Thales, alongside emerging regional specialists such as Bayanat AI and Al Yah Satellite Communications Company PJSC (Yahsat), indicates a competitive landscape fostering innovation. The UAE's commitment to becoming a global hub for space technology, coupled with its significant geographical and environmental considerations, will continue to fuel demand for sophisticated satellite-based solutions. The primary drivers include government support for space exploration and applications, the need for improved disaster management capabilities, and the exploitation of satellite data for enhanced decision-making across various industries.

Unlock critical insights into the rapidly evolving United Arab Emirates (UAE) Satellite-based Earth Observation Market. This in-depth report offers a holistic view of market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033, with a base year of 2025. Dive deep into the segmentation of Earth Observation Data and Value Added Services, analyze the impact of various Satellite Orbits (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit), and understand the driving forces behind key End-use sectors including Urban Development and Cultural Heritage, Agriculture, Climate Services, Energy and Raw Materials, and Infrastructure. With a focus on high-traffic keywords such as "UAE satellite imagery," "geospatial solutions UAE," "earth observation data market," and "satellite analytics," this report is optimized for maximum search engine visibility and designed to engage industry professionals.

United Arab Emirates Satellite-based Earth Observation Market Market Dynamics & Structure

The UAE Satellite-based Earth Observation Market is characterized by a dynamic interplay of government initiatives, private sector innovation, and growing end-user demand for actionable geospatial intelligence. Market concentration is influenced by a blend of established global players and emerging local champions, driven by significant investments in the nation's space sector. Technological innovation is a paramount driver, with advancements in Synthetic Aperture Radar (SAR) and high-resolution optical imagery capabilities shaping the competitive landscape. Regulatory frameworks are supportive, fostering a conducive environment for satellite data utilization and the development of value-added services. Competitive product substitutes are evolving, with increased data fusion and AI-driven analytics offering enhanced insights. End-user demographics are broadening, encompassing government agencies, commercial enterprises, and research institutions. Mergers and acquisitions (M&A) are anticipated to play a role as companies seek to consolidate capabilities and expand market reach, further shaping market concentration. The market is expected to see an increasing trend towards data-as-a-service models, enhancing accessibility and adoption across various sectors.

- Market Concentration: A hybrid landscape featuring multinational corporations and a growing presence of specialized UAE-based entities like Bayanat AI and Yahsat.

- Technological Innovation Drivers: Advancements in sensor technology, AI-powered image processing, cloud-based analytics platforms, and the increasing deployment of constellations in Low Earth Orbit (LEO).

- Regulatory Frameworks: Supportive government policies and the establishment of national space agencies are fostering growth and collaboration.

- Competitive Product Substitutes: Sophisticated analytics software, drone-based imagery (for localized applications), and alternative data sources are present, but satellite data offers unparalleled coverage and revisit capabilities.

- End-User Demographics: Diversified, from government entities focused on national security and urban planning to commercial sectors like agriculture, energy, and infrastructure.

- M&A Trends: Potential for consolidation to gain economies of scale, acquire specialized technologies, and expand service offerings in areas like satellite data processing and analytics.

United Arab Emirates Satellite-based Earth Observation Market Growth Trends & Insights

The United Arab Emirates Satellite-based Earth Observation Market is poised for substantial growth, fueled by strategic national vision and a burgeoning demand for advanced geospatial intelligence across diverse sectors. The market size is projected to witness a significant upward trajectory, driven by increasing adoption rates of satellite data and value-added services by both government and private entities. Technological disruptions, including the proliferation of smaller, more agile satellites in LEO, enhanced data resolution, and sophisticated artificial intelligence (AI) algorithms for image analysis, are fundamentally reshaping how Earth observation data is utilized. These advancements are enabling more precise and timely insights for critical applications. Consumer behavior shifts are evident as end-users move from simply acquiring raw satellite imagery to demanding integrated solutions and predictive analytics. This evolution necessitates a deeper understanding of market penetration and the factors influencing the adoption of these advanced services. The CAGR for the forecast period is expected to reflect robust expansion, indicating a healthy investment climate and increasing market maturity. The integration of Earth observation data with other data sources, such as IoT sensor data and ground-based surveys, is emerging as a key trend, creating synergistic value and driving demand for comprehensive geospatial platforms. The UAE's commitment to digital transformation and smart city initiatives further underpins the sustained growth of this market, as satellite-based intelligence becomes indispensable for planning, monitoring, and managing complex urban environments and critical infrastructure.

Dominant Regions, Countries, or Segments in United Arab Emirates Satellite-based Earth Observation Market

Within the United Arab Emirates Satellite-based Earth Observation Market, the Earth Observation Data segment stands out as a primary driver of growth, underpinning the development and widespread adoption of downstream Value Added Services. This dominance is fueled by the foundational importance of accurate, high-resolution, and timely satellite imagery and related geospatial products. The accessibility of data from various satellite orbits, particularly Low Earth Orbit (LEO) for its frequent revisit times and superior resolution, and Geostationary Orbit (GEO) for continuous monitoring, caters to a broad spectrum of end-user needs, from detailed mapping to large-scale environmental surveillance.

The End-use sector of Urban Development and Cultural Heritage is experiencing particularly strong demand, propelled by the UAE's ambitious urban expansion projects, smart city initiatives, and preservation efforts. Satellite imagery plays a crucial role in urban planning, infrastructure development monitoring, land use analysis, and the protection of historical sites. Similarly, Infrastructure development, including the construction of new cities, transportation networks, and energy facilities, relies heavily on precise geospatial data for site selection, progress tracking, and environmental impact assessments. The Energy and Raw Materials sector benefits from satellite-based monitoring for exploration, resource management, and the assessment of extraction impacts.

The increasing focus on Climate Services and Agriculture, driven by national sustainability goals and the need for precision farming, is also contributing significantly to market expansion. Satellite data provides critical inputs for climate modeling, disaster management, water resource monitoring, and optimizing agricultural yields. The dominance of these segments is further amplified by government policies and investments aimed at leveraging space technology for national development and economic diversification. The ongoing development of in-country capabilities, such as the strategic collaborations between Bayanat AI and Yahsat, are critical accelerators, ensuring localized expertise and tailored solutions that cater specifically to the UAE's unique environmental and developmental context. The inherent scalability and comprehensive coverage offered by satellite-based Earth Observation Data make it an indispensable tool for addressing the nation's evolving challenges and opportunities.

- Dominant Segment (Type): Earth Observation Data, forming the bedrock for all subsequent analyses and services.

- Key Satellite Orbits Driving Adoption: Low Earth Orbit (LEO) for high-resolution imagery and frequent revisits; Geostationary Orbit (GEO) for continuous monitoring.

- Leading End-use Sectors:

- Urban Development and Cultural Heritage: Essential for smart city initiatives, land use planning, and heritage site preservation.

- Infrastructure: Critical for monitoring construction, resource management, and transportation network development.

- Energy and Raw Materials: Supports exploration, resource management, and environmental impact monitoring.

- Climate Services: Aids in climate modeling, disaster response, and environmental monitoring.

- Agriculture: Enables precision farming, yield optimization, and water management.

United Arab Emirates Satellite-based Earth Observation Market Product Landscape

The UAE Satellite-based Earth Observation Market is rich with diverse product offerings, ranging from raw satellite imagery and processed geospatial datasets to sophisticated analytics platforms and tailored value-added services. Innovations in sensor technology are yielding higher spatial, spectral, and temporal resolutions, enabling unprecedented detail in captured data. Key products include high-definition optical imagery, Synthetic Aperture Radar (SAR) data for all-weather imaging, multispectral and hyperspectral data for detailed material analysis, and derived products like Digital Elevation Models (DEMs) and Land Cover Maps. Applications span across critical sectors, from monitoring urban sprawl and infrastructure development to assessing agricultural health, tracking environmental changes, and supporting disaster management. Performance metrics are continually improving, with shorter revisit times, enhanced data accuracy, and faster processing capabilities. Unique selling propositions often lie in the integration of AI and machine learning for automated feature extraction and predictive analysis, offering clients actionable insights rather than just raw data.

Key Drivers, Barriers & Challenges in United Arab Emirates Satellite-based Earth Observation Market

Key Drivers:

The growth of the UAE Satellite-based Earth Observation Market is propelled by strong governmental support for space exploration and technology, exemplified by national space programs and significant investments. The increasing demand for detailed geospatial data for urban planning, infrastructure development, and resource management, driven by the UAE's ambitious development agenda, is a primary catalyst. Technological advancements in satellite imaging, AI, and cloud computing are making data more accessible, accurate, and valuable. Furthermore, the growing awareness of climate change and the need for effective environmental monitoring and climate services are creating sustained demand.

Barriers & Challenges:

High upfront investment costs for satellite development and deployment pose a significant barrier. The technical expertise required for advanced data processing and analysis can be a limiting factor, necessitating skilled workforce development. Regulatory complexities and data sharing agreements between different entities and nations can sometimes hinder seamless operations. Furthermore, ensuring data security and privacy in a region with diverse geopolitical considerations presents ongoing challenges. Intense competition from established global players and the need to continuously innovate to stay ahead of rapidly evolving technologies also put pressure on market participants. Supply chain disruptions for critical satellite components can impact deployment timelines and costs.

Emerging Opportunities in United Arab Emirates Satellite-based Earth Observation Market

Emerging opportunities in the UAE Satellite-based Earth Observation Market lie in the expanding application of AI for predictive analytics, enabling forecasting in sectors like agriculture and infrastructure maintenance. The development of specialized value-added services tailored to niche markets, such as maritime surveillance and precision urban planning, presents significant potential. There is a growing demand for integrated solutions that fuse satellite data with other sources like IoT and social media data for comprehensive insights. The "new space" era, characterized by smaller, more cost-effective satellite constellations, opens avenues for more frequent data acquisition and broader coverage. Furthermore, the UAE's strategic geographical location and its ambition to become a regional hub for space technology offer opportunities for international partnerships and service export.

Growth Accelerators in the United Arab Emirates Satellite-based Earth Observation Market Industry

Growth in the UAE Satellite-based Earth Observation Market is significantly accelerated by strategic partnerships and collaborations aimed at developing in-country capabilities and fostering innovation. The UAE Space Agency's proactive role in promoting research and development, alongside public-private partnerships, acts as a crucial catalyst. Investments in advanced data processing infrastructure and the development of AI-driven analytical tools are enhancing the utility and accessibility of satellite data. The increasing adoption of Earth observation data in key economic sectors, such as sustainable agriculture, smart city development, and energy management, driven by national strategic objectives, further propels market expansion. The successful implementation of projects like the UAE's national space program and the establishment of geospatial data centers are critical growth accelerators, demonstrating commitment and fostering a robust ecosystem.

Key Players Shaping the United Arab Emirates Satellite-based Earth Observation Market Market

- Airbus

- Bayanat AI

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Satcom Direct Inc

- Thales

- SES S A

- EOMAP GmbH & Co KG

- 4 Earth Intelligence (4EI)

- Inmarsat Communications Company LLC

- ViaSat Inc

Notable Milestones in United Arab Emirates Satellite-based Earth Observation Market Sector

- February 2023: Bayanat, a leading provider of AI-powered geospatial solutions, signed an MOU with Al Yah Satellite Communications Company PJSC (Yahsat), the UAE's flagship satellite solutions provider, to develop an in-country space program. This strategic collaboration aims to establish and operate strategic earth observation partnerships within the UAE, including Synthetic Aperture Radar (SAR) and optical imagery satellite capabilities, significantly boosting local SAR and optical data provision.

- December 2022: The UAE Space Agency and Bayanat signed a collaboration agreement to create and operate a geospatial analytics platform for the Space Data Centre, a key program of the UAE government. Bayanat will establish an innovative environment for Earth observation apps by leveraging large-scale data management and processing capabilities, providing analytical reports based on Earth observation satellites, enhancing the nation's data analytics prowess.

In-Depth United Arab Emirates Satellite-based Earth Observation Market Market Outlook

- February 2023: Bayanat, a leading provider of AI-powered geospatial solutions, signed an MOU with Al Yah Satellite Communications Company PJSC (Yahsat), the UAE's flagship satellite solutions provider, to develop an in-country space program. This strategic collaboration aims to establish and operate strategic earth observation partnerships within the UAE, including Synthetic Aperture Radar (SAR) and optical imagery satellite capabilities, significantly boosting local SAR and optical data provision.

- December 2022: The UAE Space Agency and Bayanat signed a collaboration agreement to create and operate a geospatial analytics platform for the Space Data Centre, a key program of the UAE government. Bayanat will establish an innovative environment for Earth observation apps by leveraging large-scale data management and processing capabilities, providing analytical reports based on Earth observation satellites, enhancing the nation's data analytics prowess.

In-Depth United Arab Emirates Satellite-based Earth Observation Market Market Outlook

The United Arab Emirates Satellite-based Earth Observation Market is set for robust and sustained growth, driven by a confluence of visionary government initiatives, technological advancements, and increasing industry adoption. Future market potential is significantly amplified by the UAE's commitment to economic diversification and its ambition to become a global leader in space technology and geospatial services. Strategic opportunities lie in the continued development of sophisticated AI and machine learning applications for predictive modeling, enabling enhanced decision-making across various sectors. The expansion of value-added services, offering integrated solutions and tailored insights rather than just raw data, will be a key differentiator. Furthermore, the growing emphasis on sustainable development, climate action, and smart city infrastructure will continue to fuel demand for reliable and precise Earth observation data. The market is expected to witness further consolidation and strategic alliances as companies strive to capture market share and leverage synergistic capabilities, solidifying the UAE's position as a pivotal player in the global satellite-based Earth observation landscape.

United Arab Emirates Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

United Arab Emirates Satellite-based Earth Observation Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Several Initiatives and Investments by UAE Government in Space Sector; Growing demand for Environmental Monitoring is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Personnel

- 3.4. Market Trends

- 3.4.1. Growing demand for Environmental Monitoring is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United Arab Emirates Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United Arab Emirates Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United Arab Emirates Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United Arab Emirates Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa United Arab Emirates Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Airbus

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayanat AI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Yah Satellite Communications Company PJSC (Yahsat)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Satcom Direct Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SES S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EOMAP GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 4 Earth Intelligence (4EI)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inmarsat Communications Company LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ViaSat Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Airbus

List of Figures

- Figure 1: United Arab Emirates Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Satellite-based Earth Observation Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 4: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 5: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Arab Emirates Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United Arab Emirates Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United Arab Emirates Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 18: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 19: United Arab Emirates Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Satellite-based Earth Observation Market?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the United Arab Emirates Satellite-based Earth Observation Market?

Key companies in the market include Airbus, Bayanat AI, Al Yah Satellite Communications Company PJSC (Yahsat), Satcom Direct Inc, Thales, SES S A, EOMAP GmbH & Co KG, 4 Earth Intelligence (4EI), Inmarsat Communications Company LLC, ViaSat Inc.

3. What are the main segments of the United Arab Emirates Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Several Initiatives and Investments by UAE Government in Space Sector; Growing demand for Environmental Monitoring is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Growing demand for Environmental Monitoring is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Personnel.

8. Can you provide examples of recent developments in the market?

February 2023 - Bayanat, a leading provider of AI-powered geospatial solutions, signed an MOU with Al Yah Satellite Communications Company PJSC (Yahsat), the UAE's flagship satellite solutions provider, to develop an in-country space program. The strategic collaboration aims to establish and operate strategic earth observation partnerships within the UAE, including Synthetic Aperture Radar (SAR) and optical imagery satellite capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence