Key Insights

The Lithuania e-commerce market is projected to reach USD 3.18 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 15.46%. This growth is driven by increasing internet and mobile penetration, coupled with evolving consumer purchasing habits favoring online convenience, diverse product selection, and competitive pricing. Advancements in logistics and payment infrastructure further enhance the online shopping experience, fostering consumer trust and repeat business.

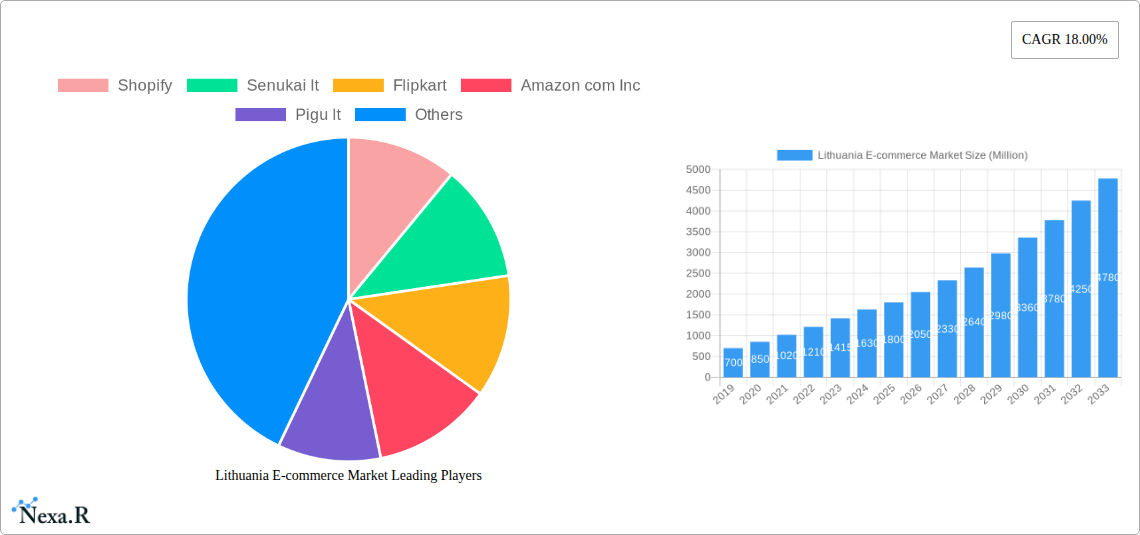

Lithuania E-commerce Market Market Size (In Billion)

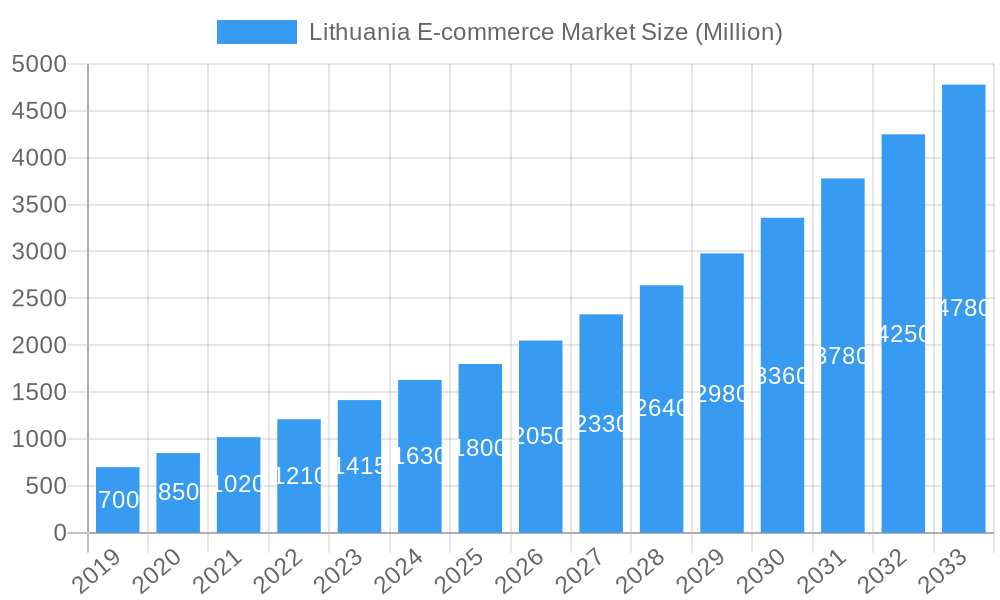

Both Business-to-Consumer (B2C) and Business-to-Business (B2B) segments are contributing to market expansion. B2C consumers are increasingly purchasing everyday goods, fashion, electronics, and home items online. Simultaneously, B2B e-commerce is streamlining procurement and sales for businesses. Key global players such as Amazon.com Inc., Shopify, and BigCommerce, alongside prominent local entities like Pigu.lt and Senukai.lt, are instrumental in shaping the market by providing essential platforms and services for businesses to establish and scale their online operations within Lithuania.

Lithuania E-commerce Market Company Market Share

This comprehensive report analyzes the Lithuania E-commerce Market, detailing market dynamics, growth trends, regional influence, product segmentation, key drivers, challenges, emerging opportunities, and the impact of leading players. The analysis covers the 2019-2033 period, with a focus on the 2025 base year, offering insights into the market's evolution and future trajectory across B2C and B2B segments, and the technological innovations driving digital commerce.

Lithuania E-commerce Market Market Dynamics & Structure

The Lithuania E-commerce Market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is gradually increasing as established players consolidate their positions, while new entrants strive to capture niche segments. Technological innovation serves as a primary driver, with advancements in artificial intelligence, machine learning, and blockchain technology paving the way for more personalized customer experiences and secure transactions. The regulatory framework, while evolving, aims to foster a secure and transparent online environment, encouraging both consumer and business participation. Competitive product substitutes are numerous, ranging from traditional retail to alternative online platforms, each vying for consumer attention and loyalty. End-user demographics are increasingly tech-savvy, with a growing preference for convenience, speed, and a wide product selection, driving the adoption of e-commerce solutions. Mergers and acquisitions (M&A) trends are observed as larger entities seek to expand their market reach and acquire innovative technologies or customer bases.

- Market Concentration: Moderate, with a growing trend towards consolidation by key players.

- Technological Innovation Drivers: AI-powered personalization, blockchain for secure payments, advanced logistics software.

- Regulatory Frameworks: Focus on data protection (GDPR), consumer rights, and digital security.

- Competitive Product Substitutes: Brick-and-mortar retail, social commerce platforms, direct-to-consumer (DTC) brand websites.

- End-User Demographics: Young to middle-aged population, high internet penetration, increasing disposable income.

- M&A Trends: Strategic acquisitions to enhance service offerings or expand market share.

Lithuania E-commerce Market Growth Trends & Insights

The Lithuania E-commerce Market has witnessed robust growth over the historical period (2019-2024) and is projected for continued expansion throughout the forecast period (2025-2033). This growth is fueled by a significant increase in internet penetration and smartphone adoption, making online shopping an accessible and convenient option for a wider population. The market size has evolved from an estimated $1,500 million in 2019 to $2,800 million in 2024, with a projected surge to $6,500 million by 2033. Adoption rates for e-commerce services are consistently rising, particularly within urban centers, as consumers become more comfortable with online transactions and delivery services. Technological disruptions, such as the proliferation of mobile commerce (m-commerce) and the integration of augmented reality (AR) for product visualization, are transforming the shopping experience, making it more interactive and engaging.

Consumer behavior shifts are a critical factor, with a growing emphasis on personalized recommendations, seamless checkout processes, and sustainable product options. The demand for fast and reliable delivery services continues to escalate, pushing e-commerce businesses to optimize their logistics and supply chains. Cross-border e-commerce is also gaining traction, driven by greater accessibility to international marketplaces and improved international shipping solutions. The COVID-19 pandemic acted as a significant accelerator, compelling many businesses to establish or enhance their online presence and permanently shifting consumer shopping habits towards digital channels. The average transaction value is expected to see a steady increase as consumers become more confident in purchasing higher-value items online, from electronics to furniture. The market penetration of e-commerce relative to total retail sales is projected to grow from approximately 15% in 2024 to over 30% by 2033, indicating a substantial shift in consumer spending patterns.

The CAGR for the forecast period (2025-2033) is estimated to be around 9.5%, underscoring the sustained growth momentum of the Lithuanian e-commerce sector. This consistent expansion is attributed to ongoing investments in digital infrastructure, supportive government initiatives, and the continuous innovation within the e-commerce ecosystem. The market's ability to adapt to emerging technologies and evolving consumer preferences will be paramount in realizing its full potential.

Dominant Regions, Countries, or Segments in Lithuania E-commerce Market

The B2C E-commerce segment is unequivocally the dominant force driving growth and shaping the landscape of the Lithuania E-commerce Market. This segment consistently outpaces its B2B counterpart in terms of market share and consumer engagement, reflecting broader global e-commerce trends. In 2025, B2C e-commerce is estimated to account for approximately 80% of the total market value, with a projected valuation of $4,800 million, while B2B e-commerce is estimated at $1,200 million. The primary drivers behind the dominance of B2C e-commerce include the rapidly expanding base of tech-savvy Lithuanian consumers, increasing disposable incomes, and a growing preference for the convenience, variety, and competitive pricing offered by online retailers.

Key drivers fueling the B2C segment's ascendancy include:

- High Internet and Smartphone Penetration: With over 90% internet penetration and widespread smartphone ownership, Lithuanians have readily embraced online shopping as a primary retail channel.

- Evolving Consumer Lifestyles: The demand for convenience, time-saving solutions, and access to a wider array of products than available in physical stores fuels continuous growth in online B2C transactions.

- Growth of Key Online Retailers: Major players like Pigu.lt, Senukai.lt, and Kosmada.lt have significantly invested in user experience, logistics, and marketing, solidifying their market positions and attracting a large customer base.

- Cross-Border E-commerce Appeal: Lithuanian consumers actively engage with international B2C platforms, seeking niche products and better deals, further boosting the overall B2C market volume.

- Digital Marketing Effectiveness: Sophisticated digital marketing strategies employed by e-commerce businesses effectively reach and convert target audiences, driving purchasing decisions.

While the B2B e-commerce segment is also experiencing growth, its penetration is slower due to longer sales cycles, established procurement processes, and the specific needs of businesses. However, the recent partnership between RippleNet's On-Demand Liquidity (ODL) and FINCI for B2B payments highlights the increasing focus on streamlining business transactions, which is expected to catalyze B2B e-commerce growth in the coming years.

The market share of B2C e-commerce is projected to remain dominant, potentially reaching over 85% by 2033, with an estimated market value of $5,525 million. The growth potential in the B2C segment is immense, driven by continuous innovation in online retail, personalized customer experiences, and the increasing adoption of m-commerce.

Lithuania E-commerce Market Product Landscape

The Lithuania E-commerce Market product landscape is characterized by a wide array of offerings across diverse categories. Dominant product categories include electronics, fashion and apparel, home and garden, health and beauty, and toys and baby products. Companies are increasingly focusing on providing a seamless online shopping experience for these goods. Product innovations are driven by the desire to replicate or enhance the in-store experience online. This includes the implementation of high-quality product imagery, detailed descriptions, customer reviews, and virtual try-on features for apparel. Furthermore, the integration of personalized recommendations powered by AI ensures that consumers are presented with products aligned with their preferences and purchase history. The performance metrics that matter most to consumers include product quality, price competitiveness, delivery speed, and ease of returns. Companies like Apple Inc. continue to see strong direct-to-consumer sales online for their devices, while specialized e-tailers like Senukai.lt cater to home improvement needs, and Pigu.lt offers a vast general merchandise selection.

Key Drivers, Barriers & Challenges in Lithuania E-commerce Market

The Lithuania E-commerce Market is propelled by several key drivers, including the increasing internet and smartphone penetration, which provides a foundational user base. Growing consumer comfort with online transactions and a preference for convenience further fuel adoption. Government initiatives promoting digital transformation and a supportive regulatory environment also play a crucial role. Technological advancements, such as sophisticated logistics and payment solutions, enhance the overall e-commerce experience.

However, the market faces notable barriers and challenges. Logistics and last-mile delivery complexities, particularly in less urbanized areas, can impact delivery times and costs. Consumer trust and security concerns remain, especially regarding data privacy and fraudulent activities, although this is steadily diminishing. Intense competition from both domestic and international players necessitates continuous innovation and competitive pricing strategies. Limited digital literacy among certain demographics can hinder widespread adoption. Supply chain disruptions, as witnessed in recent global events, can impact product availability and lead times. Regulatory hurdles, though generally supportive, can sometimes pose complexities for cross-border trade and evolving digital services.

Emerging Opportunities in Lithuania E-commerce Market

Emerging opportunities within the Lithuania E-commerce Market lie in several key areas. The growth of niche e-commerce segments such as sustainable products, artisanal goods, and personalized health and wellness items presents significant potential. The increasing demand for live shopping experiences and social commerce integration offers new avenues for customer engagement and sales. Furthermore, the expansion of B2B e-commerce solutions, particularly for small and medium-sized enterprises (SMEs), driven by the need for efficient procurement and operational streamlining, represents a largely untapped market. Innovations in personalized marketing through AI and data analytics will allow businesses to connect with consumers on a deeper level. The development of more sophisticated augmented and virtual reality applications for product visualization can further enhance the online shopping experience and reduce return rates, particularly in fashion and home goods.

Growth Accelerators in the Lithuania E-commerce Market Industry

Several catalysts are accelerating the growth of the Lithuania E-commerce Market. Continuous advancements in payment technologies, including the adoption of digital wallets and Buy Now, Pay Later (BNPL) options, are simplifying transactions and boosting conversion rates. Strategic partnerships between e-commerce platforms and logistics providers are optimizing delivery networks, leading to faster and more reliable fulfillment. Increased investment in digital marketing and customer relationship management (CRM) tools by businesses are enhancing customer acquisition and retention. The ongoing digital transformation of traditional businesses, compelling them to establish or enhance their online presence, is a significant growth driver. Finally, supportive government policies aimed at fostering the digital economy and e-commerce innovation are creating a favorable environment for sustained expansion.

Key Players Shaping the Lithuania E-commerce Market Market

- Shopify

- Senukai lt

- Flipkart

- Amazon com Inc

- Pigu lt

- Flatlogic

- Kosmada lt

- BigCommerce

- Parduotuvevaikams lt

- Apple Inc

Notable Milestones in Lithuania E-commerce Market Sector

- May 2022: RippleNet's On-Demand Liquidity (ODL), leveraging XRP for crypto-enabled cross-border payments, partners with FINCI, a Lithuanian online international money transfer provider. This collaboration aims to deliver instant and cost-effective retail remittances and business-to-business (B2B) payments via RippleNet's ODL, signaling a significant step towards faster and more efficient cross-border financial transactions within the Lithuanian e-commerce ecosystem.

In-Depth Lithuania E-commerce Market Market Outlook

The Lithuania E-commerce Market is poised for continued robust growth, driven by a confluence of technological advancements, evolving consumer behaviors, and strategic market initiatives. The integration of AI for hyper-personalization, alongside the expansion of secure and diverse payment options, will further enhance customer convenience and trust. Growth accelerators, such as optimized logistics networks and targeted digital marketing campaigns, will solidify market penetration across various segments, including the burgeoning B2B sector. The ongoing commitment to digital infrastructure development and supportive regulatory frameworks will create a fertile ground for innovation and investment. As e-commerce becomes increasingly intertwined with daily life, the Lithuanian market is set to experience substantial expansion in market size and sophistication, offering significant opportunities for both domestic and international players.

Lithuania E-commerce Market Segmentation

-

1. Type

- 1.1. B2C E-commerce

- 1.2. B2B E-commerce

Lithuania E-commerce Market Segmentation By Geography

- 1. Lithuania

Lithuania E-commerce Market Regional Market Share

Geographic Coverage of Lithuania E-commerce Market

Lithuania E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase developments of 5G Technology; Increased Adoption of Smartphones

- 3.3. Market Restrains

- 3.3.1. Growing Threat of Video Content Piracy

- 3.4. Market Trends

- 3.4.1. 5G Services May Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Lithuania E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2C E-commerce

- 5.1.2. B2B E-commerce

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Lithuania

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shopify

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Senukai lt

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flipkart

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon com Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pigu lt

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flatlogic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kosmada lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BigCommerce

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Parduotuvevaikams lt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shopify

List of Figures

- Figure 1: Lithuania E-commerce Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Lithuania E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Lithuania E-commerce Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Lithuania E-commerce Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Lithuania E-commerce Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Lithuania E-commerce Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Lithuania E-commerce Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Lithuania E-commerce Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Lithuania E-commerce Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Lithuania E-commerce Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithuania E-commerce Market?

The projected CAGR is approximately 15.46%.

2. Which companies are prominent players in the Lithuania E-commerce Market?

Key companies in the market include Shopify, Senukai lt, Flipkart, Amazon com Inc, Pigu lt, Flatlogic, Kosmada lt, BigCommerce, Parduotuvevaikams lt, Apple Inc.

3. What are the main segments of the Lithuania E-commerce Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 3.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase developments of 5G Technology; Increased Adoption of Smartphones.

6. What are the notable trends driving market growth?

5G Services May Drive the Market.

7. Are there any restraints impacting market growth?

Growing Threat of Video Content Piracy.

8. Can you provide examples of recent developments in the market?

May 2022 - RippleNet's On-Demand Liquidity (ODL), which leverages XRP for crypto-enabled cross border payments, has announced a partnership with FINCI, the Lithuanian online international money transfer provider, to deliver instant and cost-effective retail remittances and business to business (B2B) payments via RippleNet's On-Demand Liquidity (ODL).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lithuania E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lithuania E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lithuania E-commerce Market?

To stay informed about further developments, trends, and reports in the Lithuania E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence