Key Insights

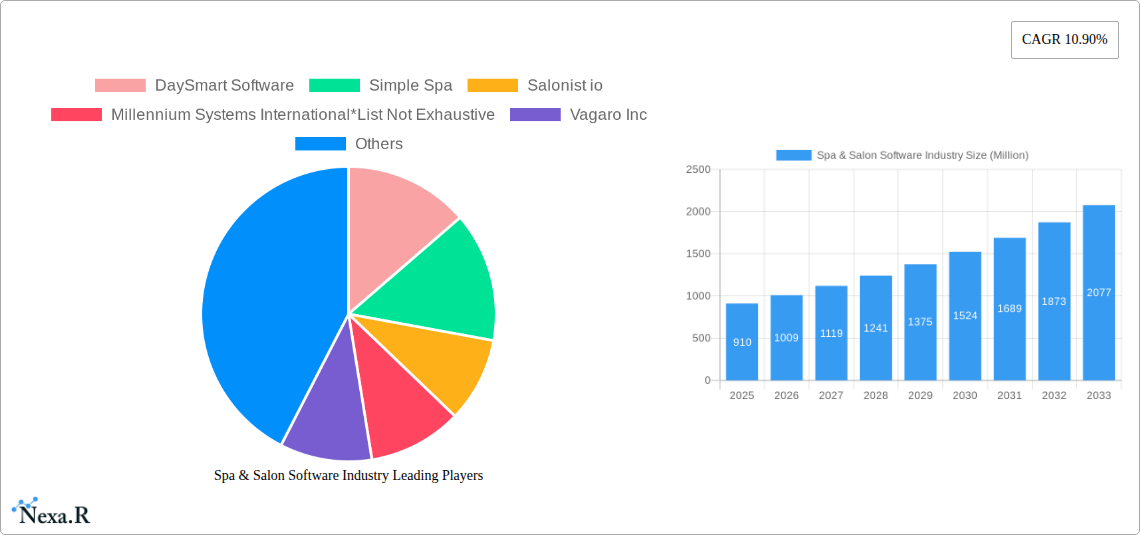

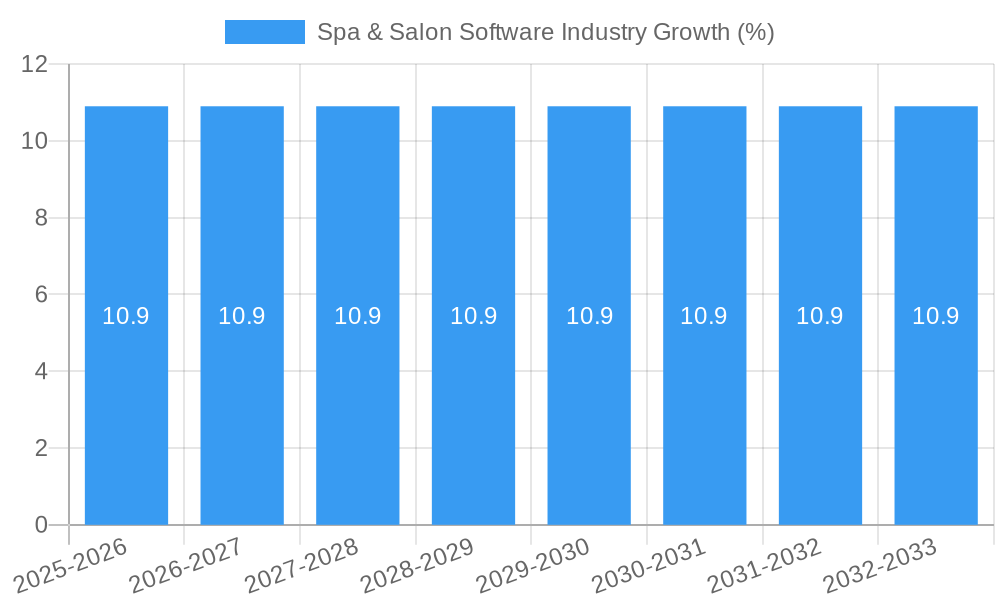

The global Spa & Salon Software market is poised for robust expansion, projecting a substantial market size valued at approximately $910 million in 2025. This growth is underpinned by an impressive Compound Annual Growth Rate (CAGR) of 10.90% throughout the forecast period of 2025-2033. This upward trajectory is significantly driven by the increasing demand for streamlined appointment booking, client management, and billing processes within the beauty and wellness sector. Key drivers include the rising adoption of cloud-based solutions, offering enhanced accessibility and scalability for businesses of all sizes, and the growing consumer preference for online booking platforms. Furthermore, the industry is witnessing a surge in demand for integrated marketing tools and customer loyalty programs that enhance client retention and business revenue.

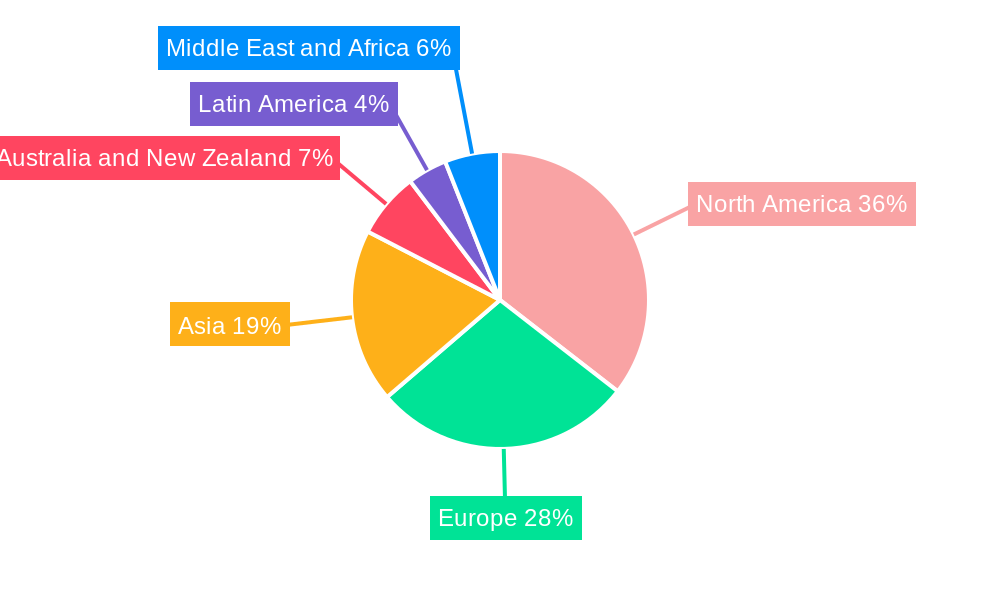

The market is segmenting effectively to cater to diverse operational needs. Small and individual professionals are increasingly adopting cost-effective and user-friendly solutions, while medium and large enterprises are investing in comprehensive software packages that offer advanced features like inventory management, employee scheduling, and detailed reporting. The deployment landscape is dominated by cloud-based solutions due to their flexibility and lower upfront costs, though on-premise solutions retain a niche for businesses with specific security or customization requirements. Geographically, North America, led by the United States and Canada, is expected to maintain a leading position, followed by Europe, with significant contributions from Germany, France, and the United Kingdom. The Asia Pacific region, particularly India and China, is demonstrating rapid growth, driven by an expanding middle class and a burgeoning beauty and wellness industry.

This comprehensive spa and salon software industry report provides an in-depth analysis of the global market, offering critical insights for stakeholders including salon management software, spa booking systems, hair salon software, beauty salon software, and appointment scheduling software. The study covers the historical period from 2019 to 2024, with a base and estimated year of 2025, and forecasts market trends up to 2033. Gain a competitive edge with detailed market segmentation, regional analysis, and strategic recommendations.

Spa & Salon Software Industry Market Dynamics & Structure

The spa and salon software market is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and a moderately fragmented competitive landscape. Market concentration is influenced by the presence of both established players and agile startups, each vying for market share in a sector ripe for digital transformation. Key drivers include the increasing demand for streamlined operations, enhanced customer experience, and efficient appointment management. Regulatory frameworks, while not overtly restrictive, emphasize data privacy and security, influencing software development and deployment strategies. Competitive product substitutes, such as manual booking or less sophisticated digital tools, are gradually being phased out as businesses recognize the superior benefits of integrated spa and salon management solutions. The end-user demographics span from individual beauty professionals and small independent salons to large enterprise chains, each with distinct software needs and adoption capabilities. Mergers and acquisitions (M&A) are becoming increasingly prevalent as larger entities seek to expand their service portfolios and market reach, and smaller innovative companies are acquired for their unique technologies. The barrier to entry for new players is moderate, primarily due to the need for robust feature sets, intuitive user interfaces, and reliable customer support.

- Market Concentration: Mixed, with a blend of large established vendors and numerous smaller, specialized providers.

- Technological Innovation Drivers: Demand for AI-powered scheduling, CRM capabilities, loyalty programs, and mobile accessibility.

- Regulatory Frameworks: Focus on data privacy (e.g., GDPR, CCPA) and compliance with payment processing standards.

- Competitive Product Substitutes: Traditional paper-based systems, basic calendar applications, and standalone booking websites.

- End-User Demographics: Individual professionals, small to medium-sized enterprises (SMEs), and large salon and spa chains.

- M&A Trends: Increasing consolidation driven by the acquisition of niche technologies and expansion into new geographical markets.

Spa & Salon Software Industry Growth Trends & Insights

The global spa and salon software market is poised for substantial growth, driven by the accelerating digital transformation within the beauty and wellness industries. With an estimated market size of $XX million in 2025, the industry is projected to witness a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This expansion is fueled by a significant increase in adoption rates, particularly among small and medium-sized enterprises (SMEs) that are recognizing the imperative to enhance operational efficiency and customer engagement through specialized software solutions. Technological disruptions are continuously reshaping the market, with advancements in cloud computing, artificial intelligence (AI), and mobile accessibility playing pivotal roles. AI is increasingly being integrated for intelligent appointment scheduling, personalized marketing campaigns, and predictive customer behavior analysis, thereby optimizing resource allocation and enhancing client satisfaction.

Consumer behavior shifts are also paramount to this growth trajectory. Modern consumers expect seamless online booking experiences, personalized service recommendations, and immediate digital communication. This demand is compelling spa and salon businesses to invest in user-friendly platforms that offer mobile booking apps, automated appointment reminders, and integrated payment systems. The market penetration of advanced spa and salon software is steadily rising as businesses move away from manual processes towards sophisticated, integrated solutions that streamline everything from client management and inventory tracking to staff scheduling and performance reporting. The adoption of Software-as-a-Service (SaaS) models has further democratized access to these powerful tools, reducing upfront investment costs and offering scalable solutions that adapt to business growth. The increasing emphasis on customer retention and personalized experiences, further amplified by social media and online reviews, necessitates the robust CRM functionalities offered by these software platforms.

Furthermore, the growing health and wellness consciousness globally has led to an expansion of the spa and salon industry itself, creating a larger addressable market for specialized software. Businesses are looking for solutions that not only manage appointments but also facilitate loyalty programs, manage memberships, and integrate with POS systems, providing a holistic view of their operations. The ability of these software solutions to offer valuable data analytics and business intelligence is also a key growth driver, enabling owners to make informed decisions based on performance metrics, client preferences, and market trends. The market penetration for cloud-based solutions is particularly high, offering flexibility, accessibility, and reduced IT overheads for businesses of all sizes.

Dominant Regions, Countries, or Segments in Spa & Salon Software Industry

The global spa and salon software industry exhibits distinct regional strengths and segment dominance, significantly shaping market growth and adoption patterns. In terms of deployment, the Cloud segment is emerging as the dominant force, projected to capture a market share of over XX% by 2025. This dominance is driven by the inherent advantages of cloud-based solutions: scalability, flexibility, remote accessibility, and lower upfront infrastructure costs. Businesses, particularly SMEs, find cloud deployment ideal for managing their operations efficiently without substantial IT investments. On-premise solutions, while still present, are gradually declining in market share as organizations prioritize agile and accessible software.

When considering the Size of Enterprise, the Medium Enterprises segment is a significant growth engine, projected to contribute XX% to the overall market revenue by 2025. These businesses often possess the financial resources and operational complexity to benefit most from comprehensive spa and salon software, seeking solutions that can manage multiple locations, larger staff rosters, and intricate service menus. While Small and Individual Professionals represent a vast user base, their adoption rates, though growing, are often tied to more budget-friendly and feature-specific solutions. Large Enterprises, though fewer in number, contribute substantially to market value due to their demand for highly customizable, integrated, and enterprise-grade platforms, often involving complex integrations with existing systems.

Geographically, North America is anticipated to retain its position as the leading region in the spa and salon software market, accounting for approximately XX% of the global market share in 2025. This dominance is attributed to several factors: a mature beauty and wellness industry, high adoption rates of technology, a strong presence of key market players, and favorable economic policies supporting small business growth. The United States, in particular, boasts a robust market for salon and spa services, with a significant number of establishments actively seeking digital solutions to enhance competitiveness and customer experience.

Europe follows closely as the second-largest market, driven by countries like the UK, Germany, and France, where there's a growing emphasis on digital services and personalized customer experiences within the beauty and wellness sectors. The increasing disposable income and a strong consumer inclination towards self-care contribute to the expansion of the spa and salon industry, thereby fueling the demand for sophisticated management software. Emerging economies in Asia-Pacific, particularly China and India, present substantial growth opportunities. Rapid urbanization, a burgeoning middle class, and increasing awareness of global beauty trends are driving the adoption of advanced technologies, including spa and salon software. Countries like Australia and New Zealand also show significant potential due to their established wellness culture and technological advancements.

Spa & Salon Software Industry Product Landscape

The product landscape of the spa and salon software industry is characterized by an increasing array of innovative features and sophisticated functionalities designed to optimize business operations and enhance customer engagement. Core offerings typically include robust appointment scheduling with real-time availability, client relationship management (CRM) for personalized communication and loyalty programs, and integrated payment processing. Unique selling propositions often revolve around specialized modules for inventory management, staff scheduling and payroll, marketing automation, and performance analytics. Technological advancements are pushing the boundaries with the integration of AI for intelligent recommendations and predictive scheduling, advanced reporting tools providing actionable business insights, and seamless mobile application development for both clients and staff. The emphasis is on delivering an all-in-one solution that simplifies complex workflows, improves operational efficiency, and ultimately drives revenue growth for spa and salon businesses.

Key Drivers, Barriers & Challenges in Spa & Salon Software Industry

Key Drivers:

- Growing Demand for Digitalization: Increasing adoption of technology by SMEs to streamline operations and enhance customer experience.

- Enhanced Customer Convenience: Need for seamless online booking, appointment reminders, and personalized services, driven by consumer expectations.

- Operational Efficiency: Software solutions that automate tasks like scheduling, inventory management, and payroll, reducing manual effort and errors.

- Data Analytics & Business Intelligence: Demand for insights into customer behavior, service popularity, and staff performance to drive informed decision-making.

- Competitive Advantage: Businesses utilizing advanced software gain a competitive edge through superior customer service and operational excellence.

Barriers & Challenges:

- Initial Investment Costs: While cloud solutions reduce upfront expenses, some businesses perceive the overall cost of comprehensive software as a barrier.

- Resistance to Change: Some long-standing businesses may be hesitant to adopt new technologies and retrain staff.

- Integration Complexities: Integrating new software with existing legacy systems can be challenging for some enterprises.

- Data Security Concerns: Ensuring the robust security and privacy of sensitive client data is a paramount concern.

- Intense Competition: A crowded market with numerous vendors can make it difficult for businesses to choose the right solution and for new entrants to establish a foothold.

Emerging Opportunities in Spa & Salon Software Industry

Emerging opportunities in the spa and salon software industry lie in leveraging artificial intelligence for hyper-personalized customer experiences, including AI-driven service recommendations and predictive client retention strategies. The expansion of integrated telehealth and virtual consultation features for beauty and wellness advice presents a significant untapped market. Furthermore, opportunities exist in developing specialized software modules for niche wellness services, such as holistic healing centers or advanced aesthetic clinics. The growing demand for sustainability and eco-friendly practices within the industry also opens avenues for software that can track and manage sustainable product usage and waste reduction. The development of robust, multi-lingual, and culturally adaptable solutions for global markets also represents a key growth avenue.

Growth Accelerators in the Spa & Salon Software Industry Industry

Key growth accelerators for the spa and salon software industry include the widespread adoption of cloud-based SaaS models, which lower entry barriers and provide scalability for businesses of all sizes. Strategic partnerships between software providers and complementary service providers, such as POS systems or marketing platforms, are creating more integrated and valuable ecosystems. Technological breakthroughs, particularly in AI and machine learning, are enabling more sophisticated features like personalized recommendations and predictive analytics, enhancing both customer satisfaction and operational efficiency. Furthermore, market expansion strategies by leading companies into emerging geographical regions with a growing demand for beauty and wellness services are significant growth catalysts. The increasing focus on customer loyalty programs and subscription-based service models, facilitated by specialized software functionalities, also fuels sustained revenue streams and user engagement.

Key Players Shaping the Spa & Salon Software Industry Market

- DaySmart Software

- Simple Spa

- Salonist io

- Millennium Systems International

- Vagaro Inc

- MindBody Inc

- Springer-Miller Systems

- Zenoti (Soham Inc)

- Waffor Inc

- Phorest Salon Software

Notable Milestones in Spa & Salon Software Industry Sector

- Apr 2022: Tippy announced that it has an embedded workforce payments platform Branch to launch an all-in-one solution for acquiring and disbursing cashless tips. Tippy and Branch's integrated solution aims to optimize the entire tipping experience, from the customer's wallet to the service professional's wallet.

- Jan 2022: Salon management software startup, Glamplus, raised USD 700,000 in a Pre-Series A round from Blume Ventures, Ramakant Sharma (COO- Livspace), and participation from existing investors IPV. The company clarified that the funds raised would be utilized in vertical tech SAAS capabilities and expand the B2B marketplace business to 10,000 partners.

In-Depth Spa & Salon Software Industry Market Outlook

The spa and salon software industry is set for continued robust expansion, propelled by several key growth accelerators. The increasing sophistication of cloud-based SaaS solutions will democratize access to advanced functionalities, enabling even the smallest businesses to compete effectively. Strategic collaborations and partnerships will foster integrated ecosystems, offering a holistic suite of services that enhance value for both businesses and consumers. Ongoing technological innovation, particularly in AI and data analytics, will unlock new levels of personalization and operational intelligence, driving greater efficiency and customer satisfaction. The push towards global market penetration, coupled with an increasing demand for beauty and wellness services worldwide, presents significant long-term growth potential. Embracing these advancements will be crucial for stakeholders to capitalize on the evolving landscape and secure a competitive advantage in this dynamic sector.

Spa & Salon Software Industry Segmentation

-

1. Size of the Enterprise

- 1.1. Small and Individual Professionals

- 1.2. Medium Enterprises

- 1.3. Large Enterprise

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

Spa & Salon Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

-

3. Asia

- 3.1. India

- 3.2. China

- 3.3. Japan

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Spa & Salon Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Healthy and Standard Lifestyle; Automation in Business Processes

- 3.3. Market Restrains

- 3.3.1. Requirement of Frequent Maintenance; Growing Customization Demands (Frequent Modification in Design Required according to Fluid Properties)

- 3.4. Market Trends

- 3.4.1. Cloud-based Software to Gain Maximum Market Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 5.1.1. Small and Individual Professionals

- 5.1.2. Medium Enterprises

- 5.1.3. Large Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 6. North America Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 6.1.1. Small and Individual Professionals

- 6.1.2. Medium Enterprises

- 6.1.3. Large Enterprise

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 7. Europe Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 7.1.1. Small and Individual Professionals

- 7.1.2. Medium Enterprises

- 7.1.3. Large Enterprise

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 8. Asia Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 8.1.1. Small and Individual Professionals

- 8.1.2. Medium Enterprises

- 8.1.3. Large Enterprise

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 9. Australia and New Zealand Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 9.1.1. Small and Individual Professionals

- 9.1.2. Medium Enterprises

- 9.1.3. Large Enterprise

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 10. Latin America Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 10.1.1. Small and Individual Professionals

- 10.1.2. Medium Enterprises

- 10.1.3. Large Enterprise

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 11. Middle East and Africa Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 11.1.1. Small and Individual Professionals

- 11.1.2. Medium Enterprises

- 11.1.3. Large Enterprise

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 12. North America Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 France

- 13.1.3 United Kingdom

- 13.1.4 Rest of Europe

- 14. Asia Pacific Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 India

- 14.1.2 China

- 14.1.3 Japan

- 14.1.4 Rest of Asia Pacific

- 15. Rest of the World Spa & Salon Software Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 DaySmart Software

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Simple Spa

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Salonist io

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Millennium Systems International*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Vagaro Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 MindBody Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Springer-Miller Systems

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Zenoti (Soham Inc )

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Waffor Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Phorest Salon Software

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 DaySmart Software

List of Figures

- Figure 1: Spa & Salon Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spa & Salon Software Industry Share (%) by Company 2024

List of Tables

- Table 1: Spa & Salon Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 3: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Spa & Salon Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 21: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 22: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United States Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 26: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 27: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Germany Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Kingdom Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 32: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 33: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: India Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: China Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 38: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 39: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 41: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 42: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2019 & 2032

- Table 44: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 45: Spa & Salon Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spa & Salon Software Industry?

The projected CAGR is approximately 10.90%.

2. Which companies are prominent players in the Spa & Salon Software Industry?

Key companies in the market include DaySmart Software, Simple Spa, Salonist io, Millennium Systems International*List Not Exhaustive, Vagaro Inc, MindBody Inc, Springer-Miller Systems, Zenoti (Soham Inc ), Waffor Inc, Phorest Salon Software.

3. What are the main segments of the Spa & Salon Software Industry?

The market segments include Size of the Enterprise, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Healthy and Standard Lifestyle; Automation in Business Processes.

6. What are the notable trends driving market growth?

Cloud-based Software to Gain Maximum Market Traction.

7. Are there any restraints impacting market growth?

Requirement of Frequent Maintenance; Growing Customization Demands (Frequent Modification in Design Required according to Fluid Properties).

8. Can you provide examples of recent developments in the market?

Apr 2022: Tippy announced that it has an embedded workforce payments platform Branch to launch an all-in-one solution for acquiring and disbursing cashless tips. Tippy and Branch's integrated solution aims to optimize the entire tipping experience, from the customer's wallet to the service professional's wallet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spa & Salon Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spa & Salon Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spa & Salon Software Industry?

To stay informed about further developments, trends, and reports in the Spa & Salon Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence