Key Insights

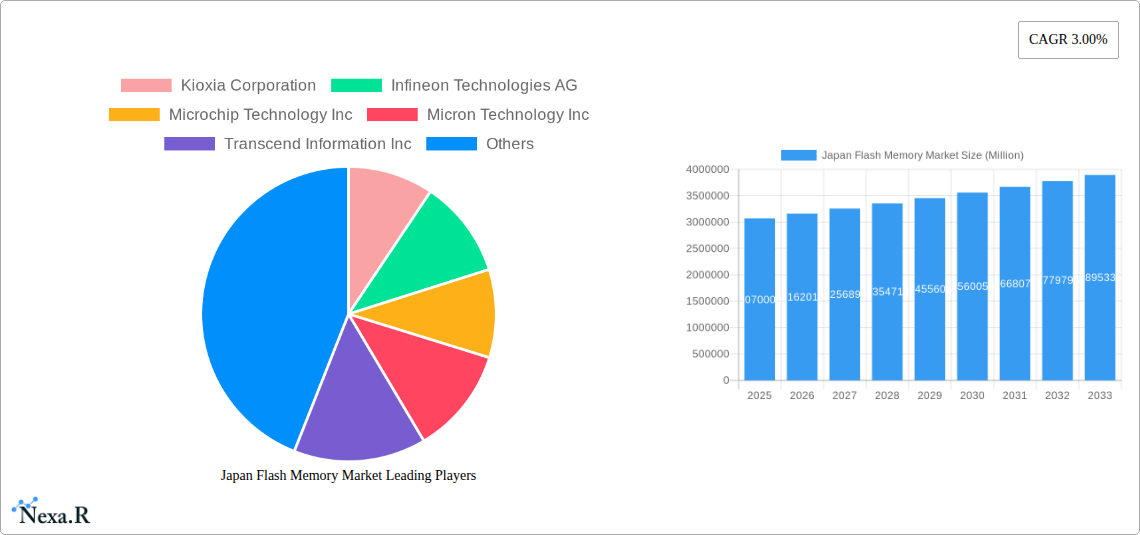

The Japan Flash Memory Market is poised for steady growth, projected to reach an estimated market size of approximately 3.07 million units by 2025, with a Compound Annual Growth Rate (CAGR) of 3.00% anticipated over the forecast period of 2025-2033. This sustained expansion is primarily driven by the increasing demand for high-density storage solutions across various sectors, particularly within data centers and the rapidly evolving automotive industry. The proliferation of advanced driver-assistance systems (ADAS), in-vehicle infotainment, and the growing adoption of electric vehicles (EVs) are significant contributors to this demand. Furthermore, the relentless innovation in consumer electronics, including smartphones, tablets, and personal computers, necessitates continuous upgrades in flash memory technology to support enhanced performance and larger data capacities.

Japan Flash Memory Market Market Size (In Million)

The market's segmentation reveals a dynamic landscape. Within NAND flash memory, the demand for higher densities, such as 2 GIGABIT & LESS (greater than 1GB) and 4 GIGABIT & LESS (greater than 2GB), is expected to dominate, reflecting the need for more sophisticated storage in complex applications. Similarly, NOR flash memory will witness growth, particularly in the 16 MEGABIT & LESS (greater than 8MB) and 32 MEGABIT & LESS (greater than 16MB) segments, catering to embedded systems and critical applications requiring reliable and fast data access. Key end-user segments like Data Centers (Enterprise and Servers) and Mobile & Tablets are expected to remain primary growth engines. While the market benefits from technological advancements and rising device penetration, it faces potential restraints such as fluctuating raw material costs and intense price competition among major players like Kioxia Corporation, Micron Technology Inc., and Western Digital Corporation.

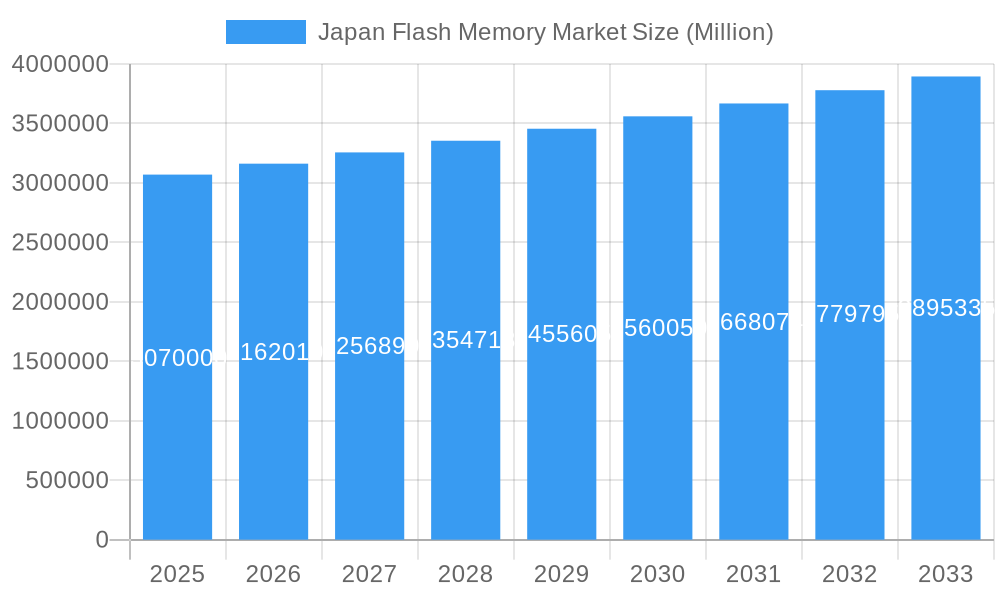

Japan Flash Memory Market Company Market Share

Here's the SEO-optimized report description for the Japan Flash Memory Market, designed for maximum visibility and engagement:

Japan Flash Memory Market: Comprehensive Analysis 2019-2033 | Trends, Growth, Key Players & Opportunities

Gain unparalleled insights into the dynamic Japan Flash Memory Market with this in-depth research report. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this report provides a granular understanding of market evolution, technological advancements, and strategic imperatives. Explore key segments like NAND Flash Memory (by density: 128 MB & LESS, 512 MB & LESS, 2 GIGABIT & LESS (greater than 1GB), 256 MB & LESS, 1 GIGABIT & LESS, 4 GIGABIT & LESS (greater than 2GB)) and NOR Flash Memory (2 MEGABIT & LESS, 4 MEGABIT & LESS (greater than 2MB), 8 MEGABIT & LESS (greater than 4MB), 16 MEGABIT & LESS (greater than 8MB), 32 MEGABIT & LESS (greater than 16MB), 64 MEGABIT & LESS (greater than 32MB)), alongside critical end-user verticals including Data Center (Enterprise and Servers), Automotive, Mobile & Tablets, Client (PC, Client SSD), and Other End-user Applications. Discover the strategic moves of industry giants such as Kioxia Corporation, Infineon Technologies AG, Microchip Technology Inc., Micron Technology Inc., Transcend Information Inc., Western Digital Corporation, Renesas Electronics Corporation, Gigadevice Semiconductor Inc., and Winbond Electronics Corporation. This report is essential for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within Japan's advanced semiconductor landscape. All values are presented in Million Units.

Japan Flash Memory Market Market Dynamics & Structure

The Japan Flash Memory Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, fostering intense competition and driving innovation. Technological innovation is a primary catalyst, fueled by the relentless demand for higher density, faster speeds, and lower power consumption across various applications. Regulatory frameworks, particularly those promoting domestic semiconductor manufacturing and R&D, play a crucial role in shaping market entry and expansion strategies. Competitive product substitutes, while limited in the core flash memory space, emerge through advancements in alternative storage technologies. End-user demographics are rapidly evolving, with a strong shift towards data-intensive applications in data centers, the growing complexity of automotive electronics, and the ever-increasing storage needs of mobile devices. Mergers and acquisitions (M&A) trends are indicative of strategic consolidation, aimed at enhancing technological capabilities, expanding product portfolios, and securing market dominance.

- Market Concentration: Dominated by key players like Kioxia Corporation and Micron Technology Inc., with significant contributions from others like Infineon Technologies AG and Western Digital Corporation.

- Technological Innovation Drivers: Miniaturization, increased storage density, improved read/write speeds, and enhanced power efficiency are paramount.

- Regulatory Frameworks: Government initiatives and subsidies supporting semiconductor development and manufacturing are key influencing factors.

- End-User Demographics: Rapid growth in demand from Data Centers, Automotive, and Mobile & Tablets sectors.

- M&A Trends: Strategic alliances and acquisitions are focused on strengthening R&D, expanding manufacturing capabilities, and securing supply chains.

Japan Flash Memory Market Growth Trends & Insights

The Japan Flash Memory Market is poised for significant expansion, driven by a confluence of technological advancements and burgeoning end-user demand. Market size evolution is directly linked to the increasing sophistication of digital infrastructure and the proliferation of data-generating devices. Adoption rates for advanced flash memory solutions are accelerating, particularly in high-performance computing, artificial intelligence, and the Internet of Things (IoT) ecosystems. Technological disruptions, such as the development of new memory architectures and advanced packaging techniques, are continuously reshaping the competitive landscape. Consumer behavior shifts towards greater reliance on cloud services, portable entertainment, and connected automotive features are directly translating into a higher demand for reliable and high-capacity flash memory. The market is witnessing a robust Compound Annual Growth Rate (CAGR) as industries integrate flash memory into their core operations and product offerings. Market penetration is deepening across traditional sectors while expanding into emerging applications, reflecting the pervasive nature of digital transformation. The continuous pursuit of faster data access, seamless multitasking, and robust data storage solutions underscores the fundamental role of flash memory in the modern economy. Furthermore, the strategic investments in domestic semiconductor production, exemplified by government subsidies for critical players like Micron Technology Inc., are set to bolster the market's growth trajectory, ensuring a stable and innovative supply chain. The increasing complexity of embedded systems in automotive and industrial applications also necessitates advanced flash memory solutions, further contributing to the sustained growth momentum. The push towards edge computing and distributed data processing will also demand more specialized and efficient flash memory, creating new avenues for market expansion and product development.

Dominant Regions, Countries, or Segments in Japan Flash Memory Market

The NAND Flash Memory segment, particularly its 4 GIGABIT & LESS (greater than 2GB) and 2 GIGABIT & LESS (greater than 1GB) sub-segments, is a dominant force driving growth in the Japan Flash Memory Market. This dominance is propelled by the insatiable demand from the Data Center (Enterprise and Servers) and Mobile & Tablets end-user segments. The ever-increasing volume of data generated by cloud computing, big data analytics, and the proliferation of smartphones and tablets necessitates high-density, cost-effective NAND flash solutions. The Automotive sector is also emerging as a significant growth driver, with the increasing adoption of advanced driver-assistance systems (ADAS), infotainment, and in-car connectivity demanding substantial and reliable flash memory storage.

- NAND Flash Memory (4 GIGABIT & LESS (greater than 2GB)): This segment caters to the core storage needs of servers, enterprise SSDs, and high-end mobile devices, directly benefiting from the digital transformation across industries.

- Key Drivers: Exponential data growth, cloud infrastructure expansion, enterprise mobility solutions, and the development of 5G networks requiring faster data access.

- Data Center (Enterprise and Servers): The backbone of digital infrastructure, data centers continuously upgrade their storage capacity and performance, making them a prime consumer of high-density NAND flash.

- Dominance Factors: Critical role in cloud services, big data processing, AI/ML workloads, and the need for high IOPS (Input/Output Operations Per Second) and low latency.

- Mobile & Tablets: The relentless pursuit of larger storage capacities and faster performance in smartphones and tablets directly fuels the demand for advanced NAND flash.

- Growth Potential: Continued innovation in mobile device features, increasing demand for high-resolution content, and the growing popularity of gaming and multimedia consumption on portable devices.

- Automotive: The increasing sophistication of in-vehicle electronics, from autonomous driving systems to advanced infotainment, presents a substantial growth opportunity for NOR and NAND flash memory.

- Key Drivers: Proliferation of ADAS, connected car technologies, infotainment systems, and the transition towards electric vehicles with complex electronic architectures.

Japan Flash Memory Market Product Landscape

The Japan Flash Memory Market is characterized by a diverse and rapidly evolving product landscape. Kioxia Corporation and Micron Technology Inc. are at the forefront of developing high-density NAND flash memory, essential for Solid State Drives (SSDs) in data centers and client PCs, as well as for consumer electronics. Infineon Technologies AG and Renesas Electronics Corporation are significant players in the NOR flash memory space, offering solutions crucial for embedded systems in automotive and industrial applications, emphasizing reliability and long-term data retention. Product innovations are consistently focused on increasing storage capacities, enhancing read/write speeds, improving power efficiency, and ensuring data integrity. Applications range from mission-critical data storage in enterprise environments to robust firmware storage in automotive ECUs and high-performance gaming devices. The introduction of technologies like 3D NAND and advanced NOR architectures underscores the industry's commitment to pushing the boundaries of memory performance and density.

Key Drivers, Barriers & Challenges in Japan Flash Memory Market

Key Drivers: The primary drivers propelling the Japan Flash Memory Market include the relentless global demand for data storage, the rapid advancement of digital technologies like AI and 5G, and the increasing adoption of IoT devices. Government initiatives and substantial investments in domestic semiconductor manufacturing, as seen with the subsidy for Micron Technology Inc., are also significant growth accelerators. The expanding automotive sector's need for sophisticated electronics and the continuous evolution of mobile devices further bolster market expansion.

Barriers & Challenges: Key challenges include the highly competitive global landscape, which exerts pressure on pricing and profit margins. Supply chain disruptions, exacerbated by geopolitical factors and the reliance on complex manufacturing processes, pose a significant risk. High research and development costs associated with developing next-generation memory technologies represent another substantial barrier. Regulatory hurdles and the need for stringent quality control in critical applications like automotive also add complexity.

Emerging Opportunities in Japan Flash Memory Market

Emerging opportunities in the Japan Flash Memory Market lie in the burgeoning field of edge computing, where localized data processing requires compact and efficient flash memory solutions. The growing demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies in the automotive sector presents a significant avenue for growth, particularly for high-reliability NOR flash. Furthermore, the increasing prevalence of AI-powered applications across various industries will necessitate specialized flash memory for machine learning model storage and inference. The expansion of the Industrial Internet of Things (IIoT) and smart manufacturing environments also offers untapped potential for embedded flash memory solutions designed for ruggedness and long-term operation.

Growth Accelerators in the Japan Flash Memory Market Industry

Long-term growth in the Japan Flash Memory Market is being significantly accelerated by breakthroughs in material science and manufacturing techniques, leading to higher storage densities and improved performance. Strategic partnerships between memory manufacturers and end-product developers, such as those between semiconductor firms and automotive OEMs, are crucial for co-developing tailored solutions that meet specific application requirements. Market expansion strategies, including the exploration of new geographical markets and the development of specialized flash memory for niche applications, are also contributing to sustained growth. The ongoing digital transformation across all sectors, from healthcare to entertainment, continues to create a fundamental and ever-increasing demand for advanced memory solutions.

Key Players Shaping the Japan Flash Memory Market Market

- Kioxia Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Micron Technology Inc.

- Transcend Information Inc.

- Western Digital Corporation

- Renesas Electronics Corporation

- Gigadevice Semiconductor Inc.

- Winbond Electronics Corporation

Notable Milestones in Japan Flash Memory Market Sector

- February 2023: Infineon Technologies AG launched the SEMPER Nano NOR Flash memory, targeting small-form-factor, battery-powered electronic devices. This innovation addresses the increasing demand for high density and low power consumption, offering robust engineering and design support.

- September 2022: The Japan government announced a subsidy of USD 320 million to Micron Technology Inc. to develop advanced memory chips at their Hiroshima-based manufacturing plant. This initiative aims to foster stronger cooperation between the U.S. and Japan amidst geopolitical tensions and technology conflicts.

In-Depth Japan Flash Memory Market Market Outlook

The future outlook for the Japan Flash Memory Market is exceptionally bright, underpinned by robust growth accelerators. The ongoing digital transformation across all industries, coupled with the rapid evolution of emerging technologies like AI, 5G, and the IIoT, will continue to drive demand for advanced flash memory solutions. Strategic investments in domestic semiconductor manufacturing are expected to enhance supply chain resilience and foster innovation, positioning Japan as a key player in the global memory market. The increasing complexity and data-intensiveness of automotive electronics present a particularly significant opportunity, as does the sustained demand from data centers and mobile device manufacturers. Opportunities for market expansion also lie in developing specialized, high-performance flash memory for niche applications, ensuring continued market growth and technological leadership.

Japan Flash Memory Market Segmentation

-

1. Type

-

1.1. NAND Flash Memory

-

1.1.1. By Density

- 1.1.1.1. 128 MB & LESS

- 1.1.1.2. 512 MB & LESS

- 1.1.1.3. 2 GIGABIT & LESS (greater than 1GB)

- 1.1.1.4. 256 MB & LESS

- 1.1.1.5. 1 GIGABIT & LESS

- 1.1.1.6. 4 GIGABIT & LESS (greater than 2GB)

-

1.1.1. By Density

-

1.2. NOR Flash Memory

- 1.2.1. 2 MEGABIT & LESS

- 1.2.2. 4 MEGABIT & LESS (greater than 2MB)

- 1.2.3. 8 MEGABIT & LESS (greater than 4MB)

- 1.2.4. 16 MEGABIT & LESS (greater than 8MB)

- 1.2.5. 32 MEGABIT & LESS (greater than 16MB)

- 1.2.6. 64 MEGABIT & LESS (greater than 32MB)

-

1.1. NAND Flash Memory

-

2. End User

- 2.1. Data Center (Enterprise and Servers)

- 2.2. Automotive

- 2.3. Mobile & Tablets

- 2.4. Client (PC, Client SSD)

- 2.5. Other End-user Applications

Japan Flash Memory Market Segmentation By Geography

- 1. Japan

Japan Flash Memory Market Regional Market Share

Geographic Coverage of Japan Flash Memory Market

Japan Flash Memory Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Electric Vehicles and Smartphones; Growing Applications of IoT

- 3.3. Market Restrains

- 3.3.1. Reliability Issues

- 3.4. Market Trends

- 3.4.1. Automotive to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Flash Memory Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. NAND Flash Memory

- 5.1.1.1. By Density

- 5.1.1.1.1. 128 MB & LESS

- 5.1.1.1.2. 512 MB & LESS

- 5.1.1.1.3. 2 GIGABIT & LESS (greater than 1GB)

- 5.1.1.1.4. 256 MB & LESS

- 5.1.1.1.5. 1 GIGABIT & LESS

- 5.1.1.1.6. 4 GIGABIT & LESS (greater than 2GB)

- 5.1.1.1. By Density

- 5.1.2. NOR Flash Memory

- 5.1.2.1. 2 MEGABIT & LESS

- 5.1.2.2. 4 MEGABIT & LESS (greater than 2MB)

- 5.1.2.3. 8 MEGABIT & LESS (greater than 4MB)

- 5.1.2.4. 16 MEGABIT & LESS (greater than 8MB)

- 5.1.2.5. 32 MEGABIT & LESS (greater than 16MB)

- 5.1.2.6. 64 MEGABIT & LESS (greater than 32MB)

- 5.1.1. NAND Flash Memory

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Data Center (Enterprise and Servers)

- 5.2.2. Automotive

- 5.2.3. Mobile & Tablets

- 5.2.4. Client (PC, Client SSD)

- 5.2.5. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kioxia Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microchip Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Micron Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transcend Information Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Western Digital Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renesas Electronics Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gigadevice Semiconductor Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Winbond Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kioxia Corporation

List of Figures

- Figure 1: Japan Flash Memory Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Flash Memory Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Flash Memory Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Flash Memory Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Japan Flash Memory Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Flash Memory Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Japan Flash Memory Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Japan Flash Memory Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Flash Memory Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Japan Flash Memory Market?

Key companies in the market include Kioxia Corporation, Infineon Technologies AG, Microchip Technology Inc, Micron Technology Inc, Transcend Information Inc, Western Digital Corporation, Renesas Electronics Corporation, Gigadevice Semiconductor Inc, Winbond Electronics Corporation.

3. What are the main segments of the Japan Flash Memory Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Electric Vehicles and Smartphones; Growing Applications of IoT.

6. What are the notable trends driving market growth?

Automotive to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Reliability Issues.

8. Can you provide examples of recent developments in the market?

February 2023: Infineon Technologies AG launched the SEMPER Nano NOR Flash memory for small-form-factor, battery-powered electronic devices. With the increasing demand for more memory, the company introduced new flash memory to deliver a solution comprising both high density and low power, design support, and robust engineering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Flash Memory Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Flash Memory Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Flash Memory Market?

To stay informed about further developments, trends, and reports in the Japan Flash Memory Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence