Key Insights

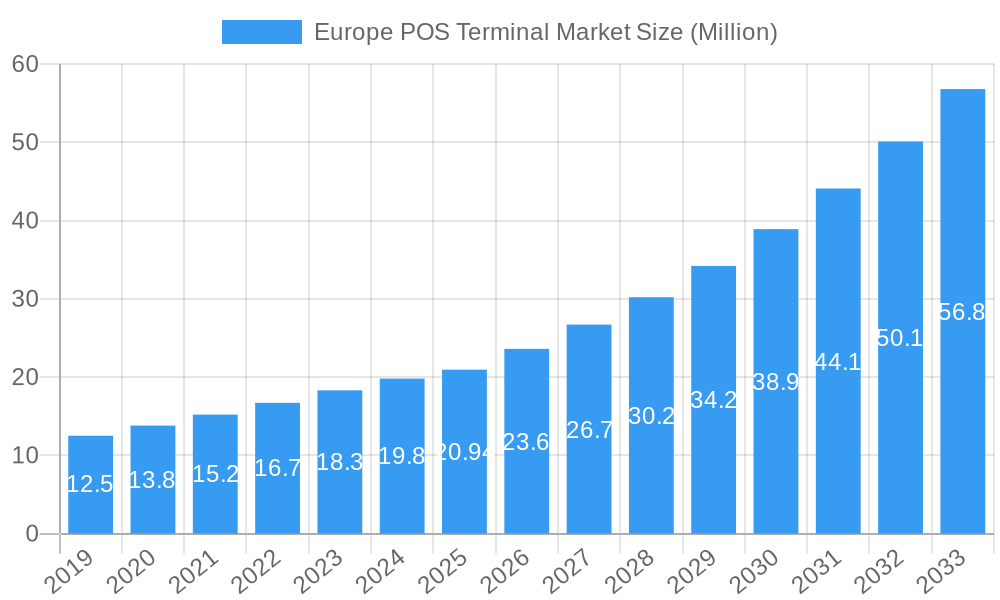

The European Point-of-Sale (POS) Terminal Market is poised for substantial expansion, projected to reach a valuation of $20.94 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.80% anticipated throughout the forecast period of 2025-2033. This significant growth is primarily propelled by the escalating adoption of digital payment solutions across various industries, driven by evolving consumer preferences for convenience and speed. The retail sector, in particular, is a key beneficiary, witnessing a surge in demand for advanced POS systems that streamline transactions, enhance inventory management, and offer personalized customer experiences. Furthermore, the hospitality and entertainment sectors are increasingly investing in mobile and portable POS solutions to improve service efficiency and guest satisfaction, especially in dynamic environments. The increasing prevalence of small and medium-sized businesses (SMBs) adopting cloud-based POS systems, offering cost-effectiveness and scalability, also acts as a significant growth stimulant.

Europe POS Terminal Market Market Size (In Million)

Despite the overall positive outlook, certain factors may moderate growth. High initial investment costs for sophisticated POS hardware and software can be a barrier for some businesses, especially in emerging markets within Europe. The evolving landscape of data security and privacy regulations, while essential, adds complexity and compliance costs for POS providers and end-users. However, technological advancements, such as the integration of AI for data analytics, NFC contactless payments, and EMV chip technology, are continuously driving innovation and creating new opportunities. The market is witnessing a growing emphasis on versatile POS systems that can handle diverse payment methods and offer integrated business management functionalities, thereby ensuring continued market dynamism and expansion across key European economies like the United Kingdom, Germany, France, and Spain.

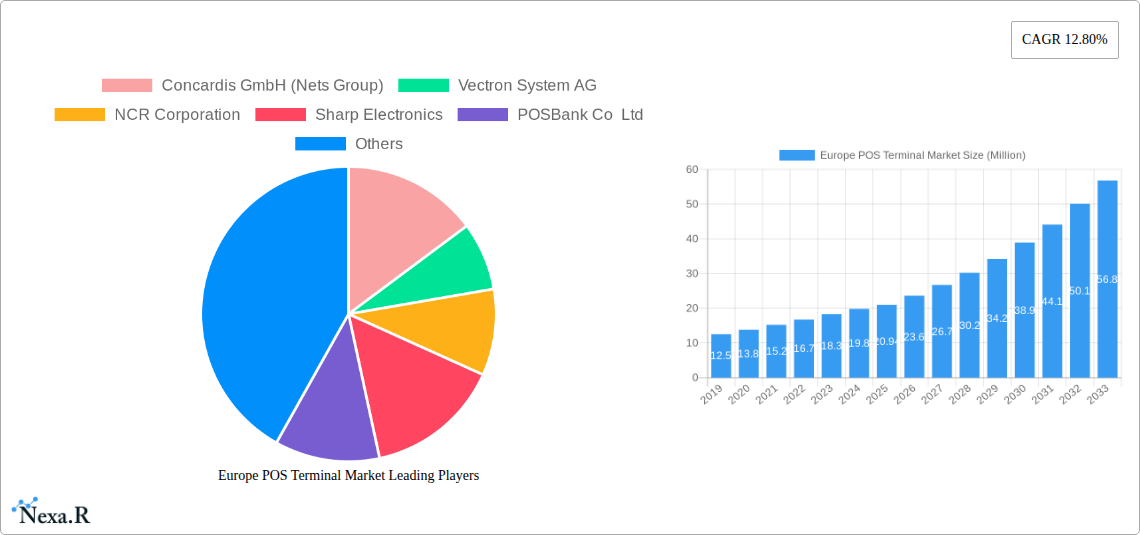

Europe POS Terminal Market Company Market Share

Here's a compelling, SEO-optimized report description for the Europe POS Terminal Market:

Europe POS Terminal Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the Europe POS Terminal Market, offering critical insights into fixed POS systems, mobile POS devices, and key end-user industries such as retail POS solutions, hospitality POS systems, healthcare POS technology, and entertainment POS terminals. Covering a detailed study period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for understanding market dynamics, growth trends, and the competitive landscape. Navigate the complex payment terminal market with data-driven projections and strategic outlooks.

Key Segments Covered:

Market Insights & Key Players: Explore the strategies of leading companies including Concardis GmbH (Nets Group), Vectron System AG, NCR Corporation, Sharp Electronics, POSBANK Co Ltd, Asseco South Eastern Europe SA, Sumup Inc, Aures Technologies SA, NEC Corporation, myPOS World Ltd, PAX Technology Ltd, Ingenico Group (Worldline), Izettle UK (Paypal), and Verifone Inc. Discover pivotal industry developments and forecast future market trajectories.

- POS Terminal Type:

- Fixed Point-of-Sale Systems

- Mobile/Portable Point-of-Sale Systems

- End-User Industry:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Other End-User Industry

Europe POS Terminal Market Market Dynamics & Structure

The Europe POS Terminal Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demands. Market concentration varies across sub-segments, with some areas dominated by a few large players offering comprehensive solutions, while others exhibit a more fragmented competitive environment driven by specialized mobile POS providers. Technological innovation is a primary driver, fueled by advancements in contactless payments, integrated software solutions, and the increasing demand for secure and user-friendly transaction processing. Regulatory frameworks, particularly those related to data privacy (GDPR) and payment security standards (PCI DSS), significantly influence product development and market entry. Competitive product substitutes, ranging from traditional card machines to comprehensive tablet-based POS systems and mobile payment apps, continuously challenge existing market players. End-user demographics are also evolving, with a growing preference for seamless, omnichannel purchasing experiences across all industries. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion, allowing companies to acquire new technologies, expand their geographic reach, and broaden their customer base.

- Market Concentration: A moderate to high concentration in fixed POS systems, with increasing fragmentation in the mobile POS segment.

- Technological Innovation Drivers: Contactless payment adoption, cloud-based POS software, AI for data analytics, and enhanced security features.

- Regulatory Frameworks: GDPR compliance, PCI DSS adherence, and evolving PSD2 regulations shaping transaction security and data handling.

- Competitive Product Substitutes: Mobile wallets, QR code payments, BNPL (Buy Now, Pay Later) integrations, and cloud-based inventory management systems.

- End-User Demographics: Increasing demand for personalization, loyalty programs, and integrated customer management features within POS solutions.

- M&A Trends: Strategic acquisitions focused on expanding software capabilities, gaining market share in specific verticals, and entering new geographic regions.

Europe POS Terminal Market Growth Trends & Insights

The Europe POS Terminal Market is experiencing robust growth, driven by the increasing digital transformation across various industries and the persistent shift towards cashless transactions. Market size is projected to expand significantly throughout the forecast period, fueled by higher adoption rates of sophisticated POS devices in small and medium-sized businesses (SMBs) seeking to enhance operational efficiency and customer experience. Technological disruptions, such as the widespread adoption of EMV chip technology and the ongoing surge in contactless payments, continue to redefine the market landscape. Consumer behavior shifts, including a growing preference for speed, convenience, and secure payment options, are directly influencing the demand for advanced POS terminals that can support these expectations. The integration of POS systems with broader business management software, including inventory, customer relationship management (CRM), and e-commerce platforms, is also a key growth trend. This integration allows businesses to gain a holistic view of their operations, optimize sales strategies, and provide a more cohesive customer journey. The increasing penetration of smartphones and tablets has also been instrumental in driving the adoption of mobile POS (mPOS) solutions, offering flexibility and affordability, especially for businesses with mobile sales operations or those in the hospitality and retail sectors seeking to serve customers anywhere on their premises. Furthermore, the growing acceptance of alternative payment methods like digital wallets and cryptocurrencies is pushing POS terminal manufacturers to develop devices capable of supporting a wider array of payment options, thereby expanding their market appeal. The ongoing modernization of retail infrastructure, coupled with government initiatives promoting digital payments and financial inclusion, are further accelerating market growth.

Dominant Regions, Countries, or Segments in Europe POS Terminal Market

The Retail end-user industry stands as a dominant segment within the Europe POS Terminal Market, significantly driving overall growth. Retailers, ranging from large hypermarkets and department stores to independent boutiques and e-commerce outlets, rely heavily on POS systems for efficient sales transactions, inventory management, customer loyalty programs, and data analytics. The inherent need for high transaction volumes, coupled with the increasing adoption of omnichannel retail strategies, necessitates robust and versatile POS solutions. Fixed POS systems continue to hold a substantial market share in established retail environments due to their reliability and comprehensive features for checkout counters. However, mobile/portable POS systems are rapidly gaining traction, enabling retailers to offer flexible checkout options on the sales floor, at pop-up shops, or during special events, thereby enhancing customer convenience and reducing wait times.

Key drivers for the retail segment's dominance include:

- High Transaction Volumes: Retail is characterized by a continuous flow of customer transactions, demanding reliable and fast POS processing.

- Omnichannel Retail Integration: The convergence of online and offline sales channels requires POS systems that can seamlessly integrate with e-commerce platforms, manage inventory across all touchpoints, and offer unified customer data.

- Customer Experience Enhancement: Retailers are investing in POS systems that support personalized offers, loyalty programs, and quick, frictionless checkouts to improve customer satisfaction and encourage repeat business.

- Inventory and Sales Management: Advanced POS features for real-time inventory tracking, sales reporting, and performance analytics are crucial for retail operational efficiency and decision-making.

- Growth of SMB Retailers: The increasing number of small and medium-sized retailers adopting modern POS solutions to compete with larger players further bolsters market expansion.

While fixed point-of-sale systems remain foundational, the rapid adoption of mobile/portable point-of-sale systems within retail signifies a crucial growth accelerator. This shift allows retailers to be more agile and responsive to customer needs, particularly in sectors like fashion, electronics, and grocery, where flexibility in service delivery is increasingly valued. The market share within the retail segment is substantial, estimated at over 35% of the total Europe POS Terminal Market. Growth potential remains high as retailers continue to upgrade their systems to support emerging payment technologies and evolving consumer expectations.

Europe POS Terminal Market Product Landscape

The Europe POS Terminal Market is defined by a diverse and rapidly evolving product landscape. Manufacturers are focusing on developing sleek, user-friendly devices that integrate advanced functionalities. Innovations include Android-based POS terminals offering greater flexibility and app integration, as well as enhanced security features like biometric authentication and robust encryption to combat fraud. Performance metrics are increasingly being evaluated on transaction speed, reliability, battery life for mobile units, and seamless integration with cloud-based software for real-time data synchronization. Unique selling propositions often lie in the ability to support a wide range of payment methods, from traditional chip and PIN and contactless cards to mobile wallets and QR code-based payments. Technological advancements are also prioritizing durability, mobility, and the integration of printers, scanners, and card readers into compact, all-in-one solutions.

Key Drivers, Barriers & Challenges in Europe POS Terminal Market

The Europe POS Terminal Market is propelled by several key drivers: the accelerating shift towards cashless economies, demanding more efficient payment solutions; rapid technological advancements in contactless and mobile payment technologies; the growing need for SMBs to adopt modern, integrated POS systems to improve operational efficiency; and supportive government initiatives promoting digital transactions and financial inclusion. These factors collectively stimulate demand for advanced POS hardware and software.

Conversely, the market faces significant barriers and challenges. High upfront costs for sophisticated POS systems can be a restraint for smaller businesses. Intense competition among numerous hardware and software providers leads to price pressures. Evolving cybersecurity threats and the need for continuous compliance with stringent data protection regulations (like GDPR) add complexity and cost. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of essential components. Furthermore, ensuring seamless integration with legacy systems in established businesses presents a technical hurdle.

Emerging Opportunities in Europe POS Terminal Market

Emerging opportunities in the Europe POS Terminal Market are largely centered around the expansion of unattended retail solutions, such as self-checkout kiosks in supermarkets and vending machines equipped with payment terminals. The growing demand for integrated payment and loyalty solutions within a single device presents a lucrative avenue for providers. Furthermore, the increasing adoption of POS systems in emerging sectors like mobile healthcare services, telemedicine, and remote diagnostics offers untapped market potential. The development of specialized POS terminals for micro-merchants and gig economy workers, offering affordable and feature-rich solutions, is another significant growth area. The ongoing development of the digital euro by the European Central Bank could also spur innovation in POS terminal capabilities to support its functionalities.

Growth Accelerators in the Europe POS Terminal Market Industry

Several catalysts are accelerating long-term growth in the Europe POS Terminal Market. The relentless drive towards digital transformation across all business verticals, from small cafes to large enterprises, necessitates continuous upgrades and adoption of advanced POS technology. Strategic partnerships between POS hardware manufacturers, software developers, and payment processors are creating more comprehensive and integrated solutions, enhancing value for end-users. Market expansion strategies, particularly by major players seeking to tap into underserved regions or industry-specific niches, are also contributing significantly to sustained growth. The increasing focus on providing value-added services through POS, such as customer analytics, marketing tools, and employee management features, is further driving adoption and customer loyalty.

Key Players Shaping the Europe POS Terminal Market Market

- Concardis GmbH (Nets Group)

- Vectron System AG

- NCR Corporation

- Sharp Electronics

- POSBANK Co Ltd

- Asseco South Eastern Europe SA

- Sumup Inc

- Aures Technologies SA

- NEC Corporation

- myPOS World Ltd

- PAX Technology Ltd

- Ingenico Group (Worldline)

- Izettle UK (Paypal)

- Verifone Inc

Notable Milestones in Europe POS Terminal Market Sector

- September 2022: The European Central Bank (ECB) chose Worldline to prototype the front-end user experience for the digital euro. This collaboration highlights Worldline's strategic positioning to influence and benefit from transformative payment initiatives, underscoring its commitment to the evolving payment industry.

- March 2022: PayXpert launched "PayXpress" and partnered with NetPay to sell Android POS devices to merchants in France, Spain, and Taiwan. The PayXpress solution's ability to accept multiple global payment methods on a single device makes it ideal for travel, hospitality, and retail sectors, indicating a trend towards unified payment acceptance.

In-Depth Europe POS Terminal Market Market Outlook

The Europe POS Terminal Market is poised for sustained and significant growth, driven by accelerating digital payment adoption and evolving business needs. Key growth accelerators include the ongoing digital transformation across all sectors, the strategic expansion efforts of leading players into new markets and verticals, and the continuous innovation in integrated software solutions that offer more than just transaction processing. The market's future potential lies in the development of AI-powered analytics integrated into POS systems, enabling businesses to gain deeper customer insights and optimize operations. Strategic opportunities abound in catering to the specific needs of growing segments like hospitality tech and healthcare patient payment solutions, as well as in providing more accessible and feature-rich POS options for micro-merchants. The increasing focus on security, user experience, and omnichannel integration will continue to shape product development and market strategies, ensuring a dynamic and expanding landscape for POS terminals in Europe.

Europe POS Terminal Market Segmentation

-

1. Type

- 1.1. Fixed Point-of -Sale Systems

- 1.2. Mobile/Portable Point-of-Sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-User Industry

Europe POS Terminal Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

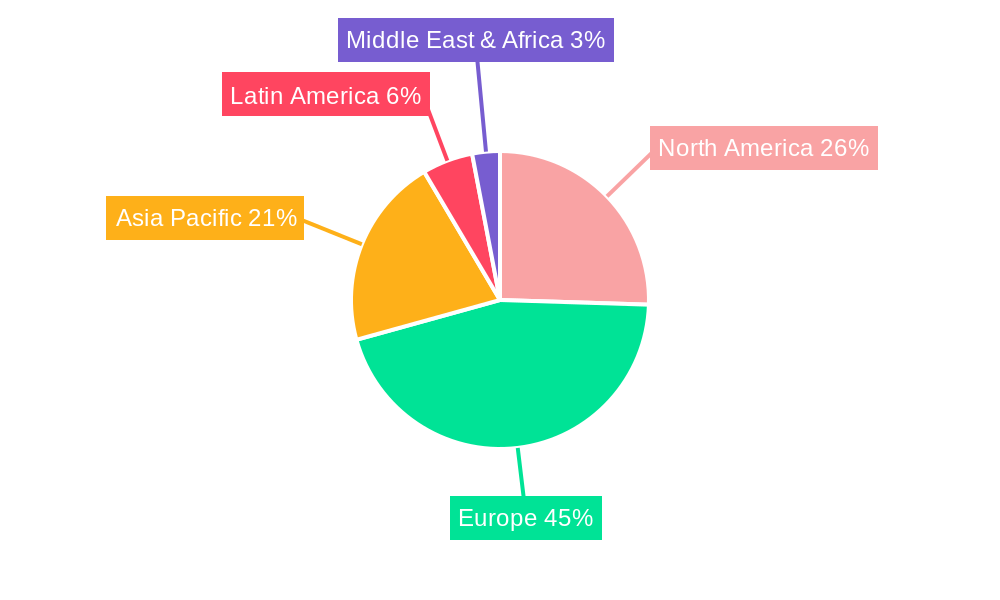

Europe POS Terminal Market Regional Market Share

Geographic Coverage of Europe POS Terminal Market

Europe POS Terminal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Contactless Payments Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of -Sale Systems

- 5.1.2. Mobile/Portable Point-of-Sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-User Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Concardis GmbH (Nets Group)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vectron System AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NCR Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sharp Electronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 POSBank Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Asseco South Eastern Europe SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sumup Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aures Technologies SA*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NEC Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 myPOS World Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PAX Technology Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ingenico Group (Worldline)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Izettle UK (Paypal)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Verifone Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Concardis GmbH (Nets Group)

List of Figures

- Figure 1: Europe POS Terminal Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe POS Terminal Market Share (%) by Company 2025

List of Tables

- Table 1: Europe POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe POS Terminal Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Europe POS Terminal Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe POS Terminal Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe POS Terminal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe POS Terminal Market?

The projected CAGR is approximately 12.80%.

2. Which companies are prominent players in the Europe POS Terminal Market?

Key companies in the market include Concardis GmbH (Nets Group), Vectron System AG, NCR Corporation, Sharp Electronics, POSBank Co Ltd, Asseco South Eastern Europe SA, Sumup Inc, Aures Technologies SA*List Not Exhaustive, NEC Corporation, myPOS World Ltd, PAX Technology Ltd, Ingenico Group (Worldline), Izettle UK (Paypal), Verifone Inc.

3. What are the main segments of the Europe POS Terminal Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Increasing Adoption of Contactless Payments Driving the Market.

7. Are there any restraints impacting market growth?

Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas.

8. Can you provide examples of recent developments in the market?

September 2022: The European Central Bank (ECB) chose Worldline to prototype the front-end user experience for the digital euro. By supporting key and possibly transformative projects like the digital euro, Worldline intends to actively participate in the growth of the payment industry and hence shares the common goal of the ECB and its partners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe POS Terminal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe POS Terminal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe POS Terminal Market?

To stay informed about further developments, trends, and reports in the Europe POS Terminal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence