Key Insights

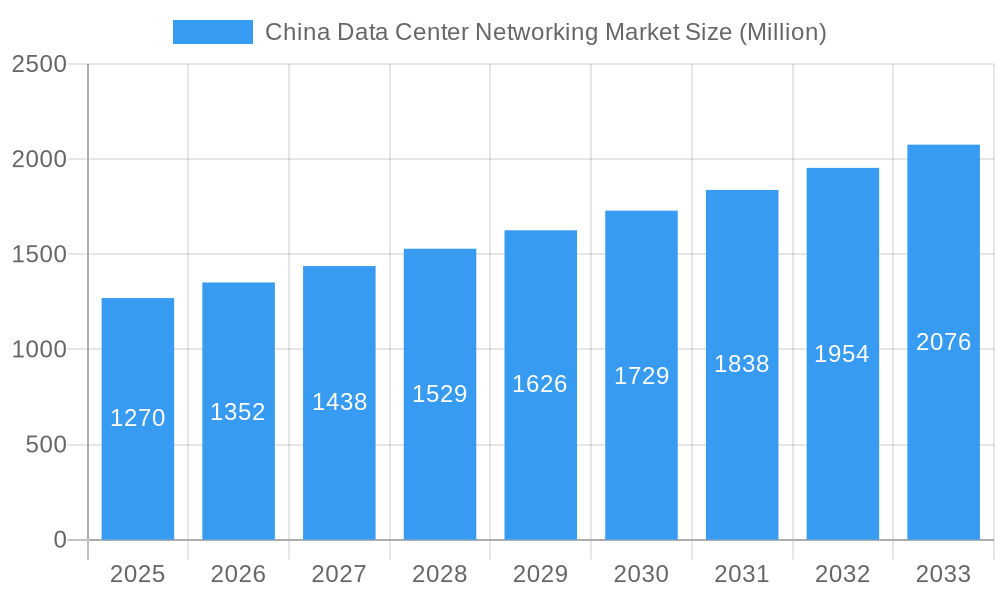

The China Data Center Networking Market is poised for significant expansion, driven by the nation's relentless digital transformation and burgeoning demand for high-performance network infrastructure. With a current market size estimated at approximately $1.27 billion in the base year of 2025, the market is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.56% throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by escalating investments in cloud computing, big data analytics, artificial intelligence, and the rapid adoption of 5G technology, all of which necessitate advanced and scalable data center networking solutions. Key market drivers include government initiatives promoting digital infrastructure development, the increasing complexity of data center architectures, and the growing need for enhanced network security and efficiency to manage vast amounts of data.

China Data Center Networking Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape with Ethernet Switches and Routers dominating the component segment, reflecting the foundational role these products play in building efficient data center networks. The services segment, particularly Installation & Integration and Support & Maintenance, is expected to witness considerable growth as organizations seek specialized expertise to deploy and manage sophisticated networking solutions. End-user segments like IT & Telecommunication and BFSI are leading the charge in adopting advanced data center networking technologies, driven by the need for superior performance, reliability, and scalability. Emerging trends such as the rise of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) are further shaping the market, offering greater flexibility and automation. While growth is strong, potential restraints may include the high initial investment costs for cutting-edge networking equipment and evolving regulatory landscapes, which companies must navigate to fully capitalize on the market's potential.

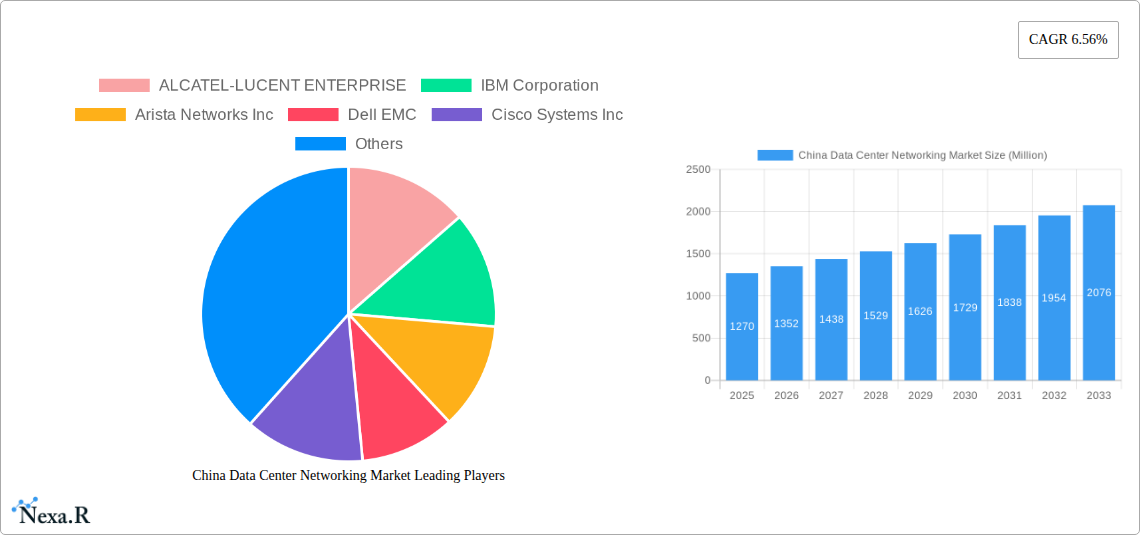

China Data Center Networking Market Company Market Share

Gain unparalleled insights into the dynamic China Data Center Networking Market, a critical sector powering the nation's digital transformation. This comprehensive report, spanning 2019–2033 with a base and estimated year of 2025, provides an in-depth analysis of market dynamics, growth trajectories, and key player strategies. Dive deep into the evolution of essential data center network hardware, data center network services, and the burgeoning demand across key end-user industries such as IT & Telecommunication, BFSI, Government, and Media & Entertainment. With a forecast period from 2025–2033, this report is your definitive guide to navigating this rapidly expanding landscape and capitalizing on future opportunities.

China Data Center Networking Market Market Dynamics & Structure

The China Data Center Networking Market is characterized by a moderately concentrated structure, with a few dominant players like Cisco Systems Inc, Arista Networks Inc, and Juniper Networks Inc holding significant market share. However, the landscape is continuously shaped by relentless technological innovation, particularly in areas like high-speed Ethernet switches, advanced routers, and software-defined networking (SDN) solutions. Regulatory frameworks, increasingly focused on data security and national infrastructure development, play a pivotal role in shaping market entry and product compliance. Competitive product substitutes are emerging from local players and specialized vendors, particularly in the Storage Area Network (SAN) and Application Delivery Controller (ADC) segments. End-user demographics reveal a strong preference for scalable, secure, and efficient networking solutions to support the exponential growth of data. Mergers & Acquisitions (M&A) activity, while not pervasive, has historically focused on acquiring innovative technologies and expanding market reach.

- Market Concentration: Moderate, with leading global and emerging local vendors.

- Technological Innovation Drivers: AI/ML integration, 5G network demands, cloud computing expansion, and edge computing adoption.

- Regulatory Frameworks: Evolving policies on data localization, cybersecurity standards, and infrastructure investment.

- Competitive Product Substitutes: Increasing competition from vendors offering open networking solutions and specialized hardware.

- End-User Demographics: Driven by digital transformation initiatives across all sectors.

- M&A Trends: Strategic acquisitions targeting niche technologies and market penetration.

China Data Center Networking Market Growth Trends & Insights

The China Data Center Networking Market is poised for substantial expansion, driven by the nation's robust digital economy and aggressive investments in advanced infrastructure. Throughout the historical period of 2019–2024, the market witnessed steady growth, fueled by increasing internet penetration, the proliferation of cloud services, and the ongoing digital transformation of enterprises across various sectors. The base year of 2025 signifies a pivotal point, with significant investments anticipated in upgrading existing data center networks and building new, state-of-the-art facilities. The forecast period from 2025–2033 is expected to be characterized by a Compound Annual Growth Rate (CAGR) of approximately 12-15%, a testament to the sustained demand for high-performance, scalable, and secure networking solutions.

Technological disruptions are a key theme, with the increasing adoption of 100GbE, 200GbE, and 400GbE Ethernet switches becoming standard for high-performance computing and AI workloads. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in network management and optimization is also gaining traction, promising enhanced efficiency and predictive maintenance. Consumer behavior shifts are evident in the growing demand for low-latency, high-bandwidth connectivity to support cloud gaming, virtual reality, and augmented reality applications. Furthermore, the expansion of 5G networks is creating a ripple effect, necessitating the development of more sophisticated and distributed data center networking architectures to support edge computing deployments. The market penetration of advanced networking solutions, particularly within the IT & Telecommunication and BFSI sectors, is already high and expected to increase further. Emerging applications like the Internet of Things (IoT) and smart city initiatives will continue to drive the need for ubiquitous and intelligent data center networking.

The market's trajectory is also influenced by government initiatives promoting technological self-reliance and the development of domestic cloud infrastructure. This, in turn, creates opportunities for both established global players and rising Chinese vendors to contribute to the nation's digital backbone. The adoption rate of cutting-edge networking technologies, such as intent-based networking and network function virtualization (NFV), is accelerating as organizations seek to streamline operations and improve agility. Overall, the China Data Center Networking Market presents a compelling growth narrative, underpinned by strong economic fundamentals, rapid technological advancements, and evolving digital demands.

Dominant Regions, Countries, or Segments in China Data Center Networking Market

The IT & Telecommunication segment is overwhelmingly dominant within the China Data Center Networking Market, acting as the primary driver of growth and innovation. This sector's insatiable demand for bandwidth, low latency, and scalability to support cloud services, mobile networks (including 5G), and a vast array of digital applications directly translates into substantial investments in advanced networking equipment and services. The market size within this segment is projected to exceed $15,000 Million by 2025, with a consistent CAGR of over 14% during the forecast period.

Within the IT & Telecommunication sector, Ethernet Switches represent the largest and most critical product category, experiencing robust demand for high-density, high-speed solutions. The migration from 10GbE and 40GbE to 100GbE, 200GbE, and even 400GbE is a key trend, driven by the computational demands of AI, big data analytics, and large-scale cloud deployments. Routers also play a crucial role in interconnecting these high-performance switches and facilitating traffic management across complex network architectures.

Geographically, the Eastern China region, particularly metropolitan hubs like Shanghai, Beijing, and Shenzhen, commands the largest share of the data center networking market. These regions are epicenters of technological development, home to major cloud providers, IT enterprises, and financial institutions, all of which require extensive and sophisticated data center infrastructure. Government initiatives encouraging the development of digital infrastructure and technological innovation further bolster the demand in these key areas. The BFSI sector, while smaller than IT & Telecommunication, is a significant and high-value segment, demanding extremely high levels of security, reliability, and low latency for trading platforms, core banking systems, and risk management.

- Dominant End-User Segment: IT & Telecommunication (Market Size in 2025: Approx. $15,000 Million)

- Key Drivers: Cloud computing, 5G network expansion, data analytics, AI/ML workloads.

- Growth Potential: Continual upgrades and expansion of hyperscale and enterprise data centers.

- Dominant Product Category: Ethernet Switches (Market Size in 2025: Approx. $8,000 Million)

- Key Drivers: Increasing port speeds (100GbE, 200GbE, 400GbE), demand for high density and performance.

- Market Share: Estimated at over 40% of the total product market.

- Dominant Geographic Region: Eastern China (Market Size in 2025: Approx. $12,000 Million)

- Key Drivers: Concentration of major tech companies, financial institutions, and government cloud initiatives.

- Infrastructure: Presence of leading hyperscale data centers and enterprise facilities.

- Significant Growing Segment: Government

- Key Drivers: Smart city initiatives, e-governance, national cybersecurity efforts.

- Investment Trends: Increased spending on secure and reliable networking for public services.

China Data Center Networking Market Product Landscape

The product landscape of the China Data Center Networking Market is marked by rapid innovation and a focus on delivering higher speeds, greater density, and enhanced intelligence. Ethernet Switches are at the forefront, with vendors continuously launching models supporting 100GbE, 200GbE, and 400GbE speeds, designed to handle the massive data flows generated by AI, big data, and cloud computing. Routers are evolving to manage increasingly complex network topologies and provide advanced traffic engineering capabilities. Storage Area Network (SAN) solutions are being optimized for faster data access and improved storage efficiency. Application Delivery Controllers (ADCs) are becoming more sophisticated, offering advanced load balancing, security, and performance optimization for critical applications. The "Other Networking Equipment" category encompasses emerging solutions like network function virtualization (NFV) infrastructure and specialized hardware for edge computing. Performance metrics are continuously improving, with reduced latency, increased throughput, and greater energy efficiency being key selling points across all product categories.

Key Drivers, Barriers & Challenges in China Data Center Networking Market

Key Drivers:

The China Data Center Networking Market is propelled by several potent drivers. The relentless expansion of cloud computing and the burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) create an insatiable demand for high-performance, scalable networking infrastructure. The ongoing digital transformation across all industries, coupled with the nationwide rollout of 5G networks, necessitates robust data center connectivity to support the massive data generated and consumed. Government initiatives promoting digital infrastructure development and technological self-sufficiency further accelerate market growth. The increasing popularity of edge computing also requires localized, high-speed networking capabilities.

Barriers & Challenges:

Despite its robust growth, the market faces several challenges. Intense price competition among vendors, particularly for standard networking components like Ethernet switches, can impact profit margins. Evolving and complex regulatory landscapes concerning data security and localization can pose compliance hurdles for international players. Supply chain disruptions, as evidenced by global chip shortages, can lead to extended lead times and increased costs for critical components. Furthermore, the need for highly skilled professionals to design, deploy, and manage advanced data center networks presents a talent acquisition challenge. The rapid pace of technological change also requires continuous investment in R&D and product upgrades, creating a barrier for smaller players.

Emerging Opportunities in China Data Center Networking Market

Emerging opportunities within the China Data Center Networking Market are diverse and ripe for exploration. The rapid growth of the Internet of Things (IoT) is creating a demand for specialized networking solutions to manage and process data from billions of connected devices, especially at the edge. The increasing adoption of Smart City initiatives across numerous Chinese municipalities presents a significant opportunity for networking vendors to contribute to intelligent infrastructure. Furthermore, the burgeoning demand for high-performance computing (HPC) for scientific research, simulations, and AI training necessitates the deployment of advanced, high-bandwidth networking solutions. The development of next-generation wireless technologies beyond 5G will also require significant upgrades to data center networking capabilities. Finally, the drive towards sustainability and energy efficiency in data centers opens avenues for innovative, low-power networking equipment and intelligent management software.

Growth Accelerators in the China Data Center Networking Market Industry

Several key catalysts are accelerating the long-term growth of the China Data Center Networking Market. Technological breakthroughs in areas like silicon photonics, AI-driven network automation, and composable infrastructure are enabling faster, more efficient, and more adaptable networks. Strategic partnerships between networking hardware vendors, cloud service providers, and software developers are fostering integrated solutions that address complex customer needs. The ongoing market expansion strategies of both domestic and international players, through increased investment in R&D, localized manufacturing, and expanded sales and support networks, are further driving market penetration. Government support for digitalization initiatives and the development of advanced technological ecosystems continues to provide a favorable environment for growth.

Key Players Shaping the China Data Center Networking Market Market

- ALCATEL-LUCENT ENTERPRISE

- IBM Corporation

- Arista Networks Inc

- Dell EMC

- Cisco Systems Inc

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- Schneider Electric

- VMware Inc

Notable Milestones in China Data Center Networking Market Sector

- March 2023: Huawei's CloudEngine 16800, 8800, and 6800 series data center switches passed the security evaluation by SGS Brightsight and earned Common Criteria (CC) Evaluation Assurance Level 4 Augmented (EAL4+) for its products. This milestone underscores a commitment to enhanced security and international standards for critical network infrastructure.

- June 2023: Huawei launched CloudEngine 16800-X, a data center switch specifically designed for diversified computing power. This launch signifies a strategic move to address the evolving demands of modern data centers that increasingly handle a variety of processing workloads.

In-Depth China Data Center Networking Market Market Outlook

The outlook for the China Data Center Networking Market is exceptionally bright, driven by sustained investment in digital infrastructure and the accelerating adoption of advanced technologies. Growth accelerators such as the ongoing development of AI and big data capabilities, coupled with the expansive rollout of 5G and the emergence of edge computing, will continue to fuel demand for high-performance networking solutions. Strategic opportunities lie in providing increasingly intelligent and automated networking capabilities that reduce operational complexity and enhance agility. The market's trajectory is firmly set on a path of significant expansion, promising substantial returns for stakeholders who can align their offerings with the evolving needs of China's dynamic digital economy.

China Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

China Data Center Networking Market Segmentation By Geography

- 1. China

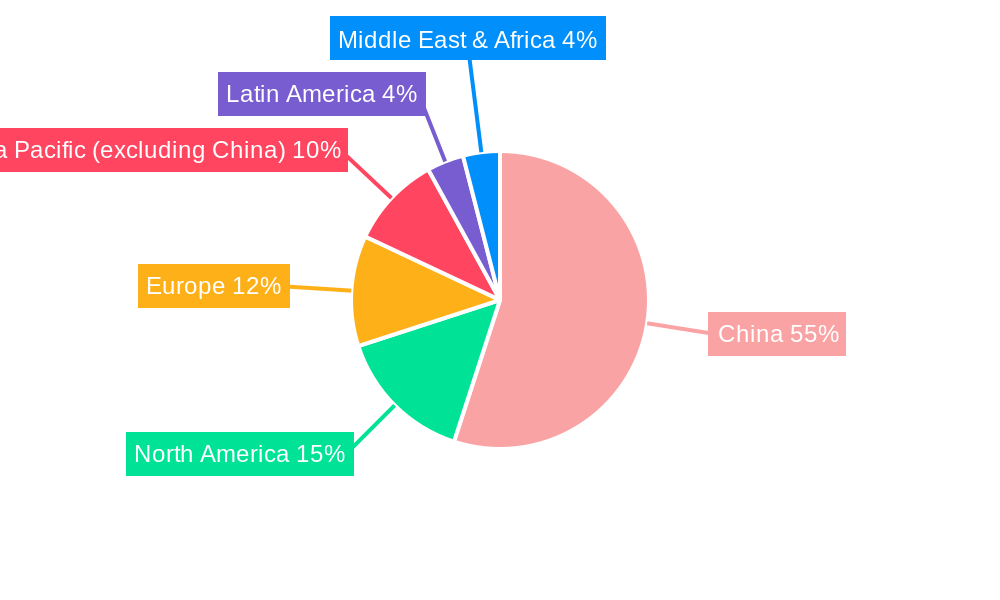

China Data Center Networking Market Regional Market Share

Geographic Coverage of China Data Center Networking Market

China Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals is Hindering the Market Demand

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ALCATEL-LUCENT ENTERPRISE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ALCATEL-LUCENT ENTERPRISE

List of Figures

- Figure 1: China Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: China Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: China Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: China Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: China Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: China Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Data Center Networking Market?

The projected CAGR is approximately 6.56%.

2. Which companies are prominent players in the China Data Center Networking Market?

Key companies in the market include ALCATEL-LUCENT ENTERPRISE, IBM Corporation, Arista Networks Inc, Dell EMC, Cisco Systems Inc, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, Schneider Electric, VMware Inc.

3. What are the main segments of the China Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals is Hindering the Market Demand.

8. Can you provide examples of recent developments in the market?

March 2023: Huawei's CloudEngine 16800, 8800, and 6800 series data center switches passed the security evaluation by SGS Brightsight and earned Common Criteria (CC) Evaluation Assurance Level 4 Augmented (EAL4+) for its products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Data Center Networking Market?

To stay informed about further developments, trends, and reports in the China Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence