Key Insights

The European Safety Instrumented Systems (SIS) market is projected to achieve a market size of 4784.1 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.4% from 2025 to 2033. This expansion is driven by stringent industrial safety regulations and the widespread adoption of advanced automation technologies in vital sectors. Key growth factors include the necessity for operational integrity in hazardous environments, accident prevention, and the increasing complexity of industrial processes requiring sophisticated safety measures. The chemicals, petrochemicals, power generation, and oil & gas industries are leading SIS investment to mitigate operational risks. Digitalization and the Industrial Internet of Things (IIoT) are further accelerating market growth through predictive maintenance and real-time safety system monitoring.

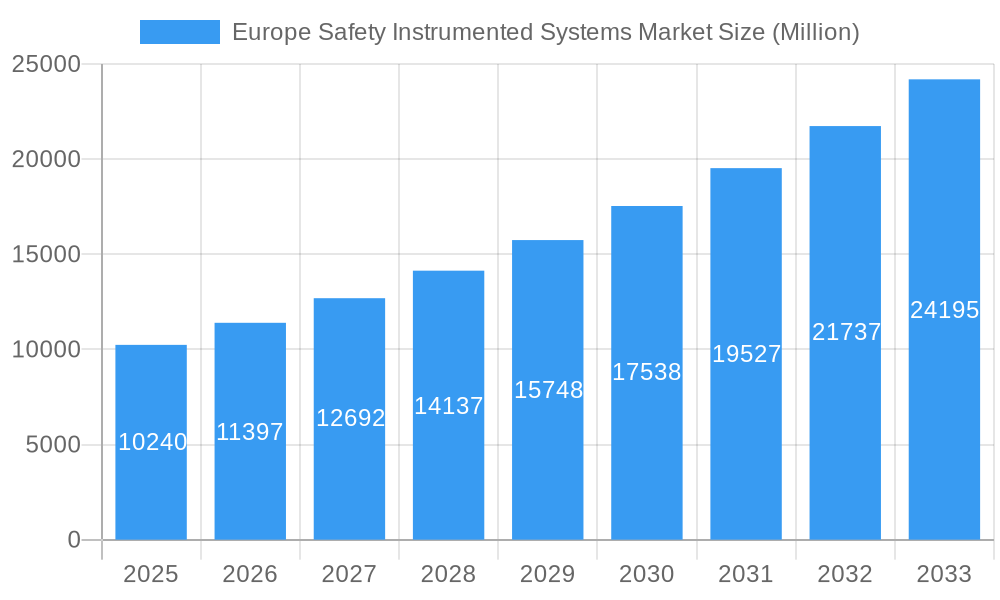

Europe Safety Instrumented Systems Market Market Size (In Billion)

Challenges to market growth include the significant upfront investment for advanced SIS implementation and maintenance, alongside a scarcity of qualified professionals for system design, installation, and management. The dynamic regulatory environment also demands continuous compliance updates. Nevertheless, the crucial benefits of SIS in preventing accidents, minimizing downtime, and safeguarding lives and the environment are expected to overcome these hurdles. Key markets within Europe include the United Kingdom, Germany, and France, owing to their robust industrial infrastructure and rigorous safety standards. The market is segmented by components, with programmable devices and sensors being pivotal, and by applications like Emergency Shutdown Systems (ESD) and Fire and Gas Monitoring and Control (F&GC), which are essential for industrial safety.

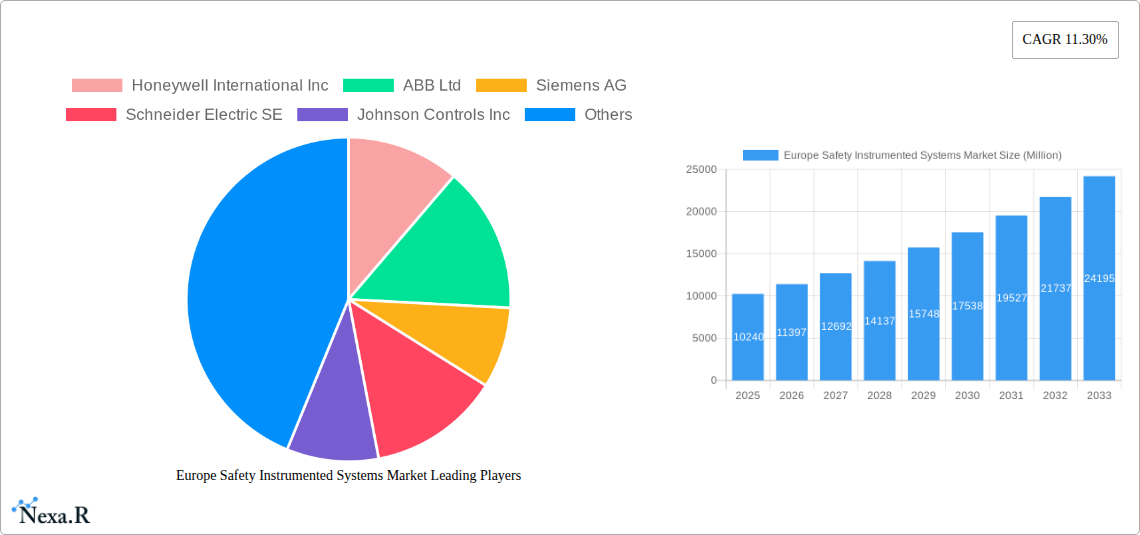

Europe Safety Instrumented Systems Market Company Market Share

This comprehensive report offers a definitive analysis of the European Safety Instrumented Systems (SIS) market from 2025 to 2033, based on 2025 data. It examines market dynamics, growth drivers, key segments, product offerings, opportunities, challenges, and the competitive landscape, providing valuable insights for industry stakeholders. The analysis covers parent and child markets, presenting all data in millions.

Europe Safety Instrumented Systems Market Market Dynamics & Structure

The European Safety Instrumented Systems (SIS) market is characterized by a moderate to high level of market concentration, driven by the presence of established global players and the stringent regulatory landscape. Technological innovation remains a paramount driver, with continuous advancements in sensor accuracy, programmable logic controllers (PLCs), and advanced diagnostic capabilities shaping the market's evolution. Regulatory frameworks, such as IEC 61511 and ATEX directives, are pivotal, dictating safety integrity levels (SIL) and mandating robust SIS implementation across critical industries.

- Technological Innovation Drivers: Increasing demand for higher SIL ratings, predictive maintenance capabilities, cybersecurity enhancements within SIS, and integration with Industrial Internet of Things (IIoT) platforms.

- Regulatory Frameworks: Strict adherence to international and regional safety standards (e.g., IEC 61508, IEC 61511, ATEX) is non-negotiable, influencing product development and system design.

- Competitive Product Substitutes: While direct substitutes for fundamental SIS functions are limited, advancements in digital safety solutions and integrated control systems present indirect competition.

- End-User Demographics: A strong reliance on SIS in high-risk industries like Oil & Gas, Chemicals, and Power Generation, with growing adoption in Pharmaceuticals and Food & Beverage.

- M&A Trends: Consolidation is observed as larger players acquire niche technology providers to broaden their SIS portfolios and expand market reach. The volume of M&A deals in the historical period (2019-2024) reached approximately xx million units.

- Innovation Barriers: High R&D costs, lengthy certification processes, and the need for specialized engineering expertise pose significant barriers to entry for new participants.

Europe Safety Instrumented Systems Market Growth Trends & Insights

The European Safety Instrumented Systems (SIS) market is poised for significant expansion, driven by an escalating emphasis on industrial safety, stringent regulatory mandates, and the continuous pursuit of operational excellence across various sectors. Market size is projected to grow from approximately $xx,xxx million in 2019 to $xx,xxx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around x.x% during the forecast period (2025–2033). This growth trajectory is underpinned by increasing investments in upgrading legacy safety systems and implementing advanced SIS solutions to mitigate risks associated with complex industrial processes.

The adoption rates of SIS are steadily increasing, particularly in industries with inherently high safety requirements. The digital transformation wave is profoundly influencing the market, with the integration of SIS with IIoT platforms, artificial intelligence (AI), and machine learning (ML) enabling predictive maintenance, real-time monitoring, and enhanced diagnostic capabilities. This technological disruption allows for proactive identification of potential failures, thereby minimizing downtime and preventing catastrophic accidents.

Consumer behavior shifts are also playing a crucial role. End-users are increasingly prioritizing safety and reliability, demanding SIS solutions that not only comply with regulations but also offer superior performance, ease of integration, and lifecycle support. The growing awareness of the financial and reputational consequences of safety incidents further fuels the demand for robust and dependable SIS. Market penetration of advanced SIS solutions is expected to deepen, especially within the Chemicals and Petrochemicals, and Oil & Gas sectors, where the potential for severe accidents necessitates comprehensive safety measures.

Furthermore, the evolving landscape of industrial automation, including the rise of smart manufacturing and Industry 4.0 initiatives, necessitates intrinsically safe environments. SIS plays a foundational role in achieving these safety objectives. The market is also witnessing a gradual but consistent rise in the demand for SIS in sectors such as Pharmaceutical and Food & Beverage, where product integrity and human safety are paramount. The overall trend indicates a sustained upward movement in market size, propelled by technological advancements, evolving regulatory demands, and a heightened focus on safety as a core business imperative across Europe.

Dominant Regions, Countries, or Segments in Europe Safety Instrumented Systems Market

The European Safety Instrumented Systems (SIS) market is experiencing robust growth, with several regions, countries, and segments exhibiting particular strength. Among the Components, Programmable Devices are expected to dominate due to their versatility and increasing integration with advanced diagnostic and communication capabilities, essential for meeting higher Safety Integrity Levels (SIL). In the Application segment, Emergency Shutdown Systems (ESD) are a primary driver, reflecting the critical need for rapid and reliable shutdown mechanisms in high-risk industrial processes. For End-Users, the Chemicals and Petrochemicals sector consistently leads the market, driven by inherent process hazards and stringent regulatory compliance requirements.

Dominant Component Segment: Programmable Devices: These include Programmable Logic Controllers (PLCs) and Safety PLCs that form the brain of SIS. Their dominance stems from their ability to handle complex logic, integrate with various sensors and actuators, and facilitate advanced diagnostics. The market share for programmable devices is estimated to be around xx% of the total components market in 2025. Key drivers include the demand for higher SIL ratings and the need for flexible system configurations.

Dominant Application Segment: Emergency Shutdown Systems (ESD): ESDs are fundamental to preventing catastrophic failures in industries like Oil & Gas and Chemicals. Their widespread adoption is driven by regulatory mandates and the severe consequences of uncontrolled incidents. The market share for ESDs is projected to be approximately xx% of the total applications market in 2025. Growth is fueled by the ongoing modernization of existing plants and the construction of new facilities.

Dominant End-User Segment: Chemicals and Petrochemicals: This sector has the highest concentration of high-hazard processes, necessitating robust SIS. Strict adherence to safety standards like IEC 61511 is a significant growth accelerator. The market share for the Chemicals and Petrochemicals segment is estimated at xx% of the total end-user market in 2025. Factors contributing to this dominance include the scale of operations, the complexity of chemical reactions, and the significant financial and environmental risks associated with incidents.

Key Country Drivers: Germany and the United Kingdom are significant contributors to the European SIS market. Germany's strong industrial base, particularly in chemical manufacturing and automotive production, along with stringent environmental and safety regulations, fuels demand. The UK's substantial Oil & Gas sector, coupled with ongoing investments in renewable energy infrastructure, further bolsters the SIS market.

Emerging Growth Drivers: The Power Generation sector is witnessing increasing adoption of SIS, especially with the transition towards cleaner energy sources and the integration of advanced control systems in nuclear and renewable energy facilities. The Oil & Gas sector continues to be a major consumer, with ongoing offshore projects and upgrades to existing onshore infrastructure driving demand for advanced SIS solutions.

Europe Safety Instrumented Systems Market Product Landscape

The European Safety Instrumented Systems (SIS) market is characterized by a continuous stream of innovative products designed to enhance safety, reliability, and efficiency. Leading manufacturers are focusing on developing SIS components with higher diagnostic coverage, increased processing power, and enhanced cybersecurity features. Advanced sensors offering greater accuracy and faster response times, alongside robust programmable devices capable of executing complex safety logic, are key product developments. Actuators and valves are being designed for fail-safe operation and improved durability in harsh environments. These product innovations aim to meet the escalating demand for higher Safety Integrity Levels (SIL) and streamline the implementation and maintenance of SIS across various industrial applications, ultimately reducing operational risks and ensuring compliance with stringent safety standards.

Key Drivers, Barriers & Challenges in Europe Safety Instrumented Systems Market

Key Drivers: The European SIS market is primarily propelled by stringent regulatory frameworks such as IEC 61511, which mandates the implementation of SIS for critical operations. Growing awareness of industrial safety and risk mitigation among end-users, coupled with the increasing complexity of industrial processes, further drives demand. Technological advancements in sensors, programmable devices, and diagnostic capabilities, enabling higher SIL ratings and predictive maintenance, are also significant growth catalysts. Investments in new industrial infrastructure and the modernization of legacy systems across key sectors like Oil & Gas, Chemicals, and Power Generation are substantial drivers.

Barriers & Challenges: High initial investment costs for advanced SIS solutions can be a barrier, particularly for small and medium-sized enterprises. The shortage of skilled personnel for installation, configuration, and maintenance of complex SIS poses a significant challenge. Cybersecurity threats to interconnected SIS, requiring robust protection measures, add complexity and cost. Integration complexities with existing plant systems and the need for lengthy certification processes can also slow down adoption. Furthermore, economic uncertainties and fluctuating commodity prices in sectors like Oil & Gas can impact investment decisions.

Emerging Opportunities in Europe Safety Instrumented Systems Market

Emerging opportunities in the European SIS market lie in the increasing demand for integrated safety and automation solutions, particularly those incorporating IIoT capabilities for enhanced data analytics and predictive maintenance. The growing focus on energy transition and the expansion of renewable energy infrastructure (e.g., offshore wind farms, hydrogen production facilities) presents a significant untapped market for specialized SIS solutions. Furthermore, the adoption of SIS in non-traditional industries such as advanced manufacturing, food processing, and pharmaceutical production, driven by evolving quality and safety standards, offers considerable growth potential. The development of cloud-based SIS management platforms and AI-driven safety diagnostics also represents a promising avenue for market expansion.

Growth Accelerators in the Europe Safety Instrumented Systems Market Industry

Long-term growth in the European SIS market is being significantly accelerated by continuous technological breakthroughs, such as advancements in artificial intelligence for predictive safety analytics and the development of more robust and resilient hardware components. Strategic partnerships and collaborations between SIS providers, automation vendors, and end-users are crucial for developing tailored solutions and expanding market reach. Furthermore, increasing government initiatives and incentives focused on industrial safety and environmental protection are creating a favorable ecosystem for market expansion. The ongoing digitalization of industrial operations, including the adoption of Industry 4.0 principles, necessitates the integration of advanced SIS to ensure safe and efficient operations, acting as a major growth accelerator.

Key Players Shaping the Europe Safety Instrumented Systems Market Market

- Honeywell International Inc

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- Johnson Controls Inc

- HIMA Paul Hildebrandt GmbH

- OMRON Corporation

- Yokogawa Electric Corporation

- General Electric Company

- Emerson Process Management

- Tyco International Plc

Notable Milestones in Europe Safety Instrumented Systems Market Sector

- February 2021: Yokogawa Electric Corporation announced the addition of new turbidity detectors, chlorine sensor units, and liquid analyzers lineup in its product portfolio for water treatment facilities, enhancing monitoring capabilities.

- November 2020: Siemens Energy partnered with Houston-based ProFlex Technologies to provide spontaneous leak detection services for pipeline operators. As part of the agreement, Siemens Energy gains exclusive access to ProFlex Technologies' digital Pipe-Safe advanced leak detection technology. The technology, combined with Siemens Energy's Internet of Things (IoT) system, will enable operators to reduce the environmental risk associated with operating their infrastructure by minimizing unplanned releases of products into the ecosystem.

In-Depth Europe Safety Instrumented Systems Market Market Outlook

The future outlook for the European Safety Instrumented Systems (SIS) market is exceptionally positive, driven by persistent trends towards heightened industrial safety and regulatory compliance. Growth accelerators such as the relentless pace of technological innovation, particularly in areas like AI-powered predictive analytics and enhanced cybersecurity, will continue to shape the market. Strategic alliances and collaborations will foster the development of integrated, smart safety solutions. Furthermore, the global push for sustainable and safe industrial operations, coupled with supportive government policies, will create a fertile ground for market expansion. The ongoing digital transformation across industries ensures that SIS will remain a cornerstone for ensuring operational integrity and mitigating risks, solidifying its position as a critical component of modern industrial infrastructure.

Europe Safety Instrumented Systems Market Segmentation

-

1. Components

- 1.1. Sensors

- 1.2. Switches

- 1.3. Programable Devices

- 1.4. Actuators and Valves

-

2. Application

- 2.1. Emergency Shutdown Systems (ESD)

- 2.2. Fire and Gas Monitoring and Control (F&GC)

- 2.3. High Integrity Pressure Protection Systems (HIPPS)

- 2.4. Burner Management Systems (BMS)

- 2.5. Turbo Machinery Control

-

3. End-User

- 3.1. Chemicals and Petrochemicals

- 3.2. Power Generation

- 3.3. Pharmaceutical

- 3.4. Food and Beverage

- 3.5. Oil and Gas

Europe Safety Instrumented Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

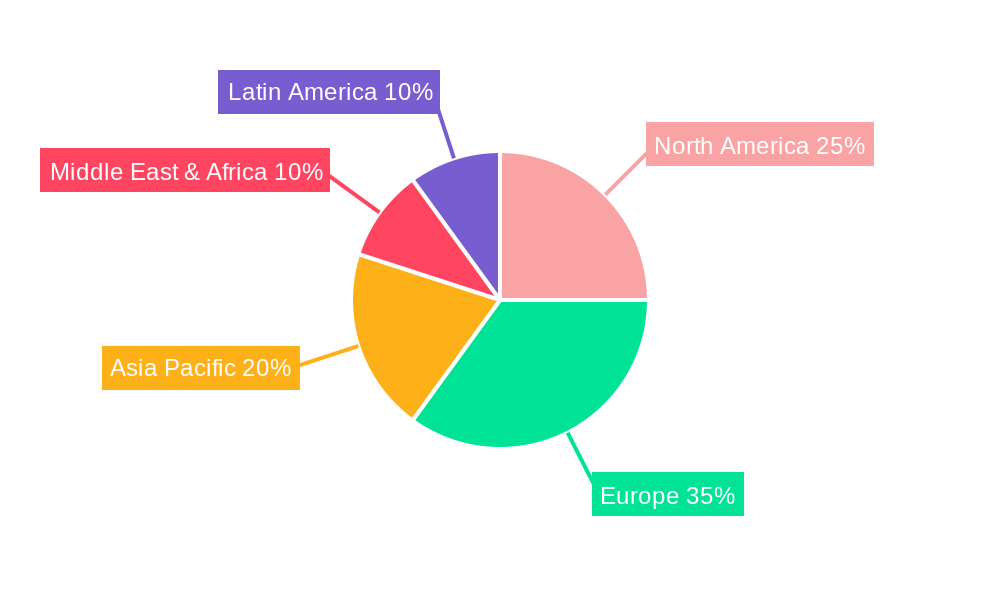

Europe Safety Instrumented Systems Market Regional Market Share

Geographic Coverage of Europe Safety Instrumented Systems Market

Europe Safety Instrumented Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industry Safety Standards; Rise in Automotive Manufacturing

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness and Complexity of Standards; Low Response Rate; High Operational Costs

- 3.4. Market Trends

- 3.4.1. The Emergency Shutdown Systems are Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Sensors

- 5.1.2. Switches

- 5.1.3. Programable Devices

- 5.1.4. Actuators and Valves

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Emergency Shutdown Systems (ESD)

- 5.2.2. Fire and Gas Monitoring and Control (F&GC)

- 5.2.3. High Integrity Pressure Protection Systems (HIPPS)

- 5.2.4. Burner Management Systems (BMS)

- 5.2.5. Turbo Machinery Control

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Chemicals and Petrochemicals

- 5.3.2. Power Generation

- 5.3.3. Pharmaceutical

- 5.3.4. Food and Beverage

- 5.3.5. Oil and Gas

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Controls Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HIMA Paul Hildebrandt GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OMRON Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yokogawa Electric Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Emerson Process Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tyco International Plc*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Safety Instrumented Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Safety Instrumented Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Safety Instrumented Systems Market Revenue million Forecast, by Components 2020 & 2033

- Table 2: Europe Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Safety Instrumented Systems Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Europe Safety Instrumented Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Safety Instrumented Systems Market Revenue million Forecast, by Components 2020 & 2033

- Table 6: Europe Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Europe Safety Instrumented Systems Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Europe Safety Instrumented Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Safety Instrumented Systems Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Europe Safety Instrumented Systems Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Siemens AG, Schneider Electric SE, Johnson Controls Inc, HIMA Paul Hildebrandt GmbH, OMRON Corporation, Yokogawa Electric Corporation, General Electric Company, Emerson Process Management, Tyco International Plc*List Not Exhaustive.

3. What are the main segments of the Europe Safety Instrumented Systems Market?

The market segments include Components, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4784.1 million as of 2022.

5. What are some drivers contributing to market growth?

Industry Safety Standards; Rise in Automotive Manufacturing.

6. What are the notable trends driving market growth?

The Emergency Shutdown Systems are Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness and Complexity of Standards; Low Response Rate; High Operational Costs.

8. Can you provide examples of recent developments in the market?

February 2021 - Yokogawa Electric Corporation announced the addition of new turbidity detectors, chlorine sensor units, and liquid analyzers lineup in its product portfolio for water treatment facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Safety Instrumented Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Safety Instrumented Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Safety Instrumented Systems Market?

To stay informed about further developments, trends, and reports in the Europe Safety Instrumented Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence