Key Insights

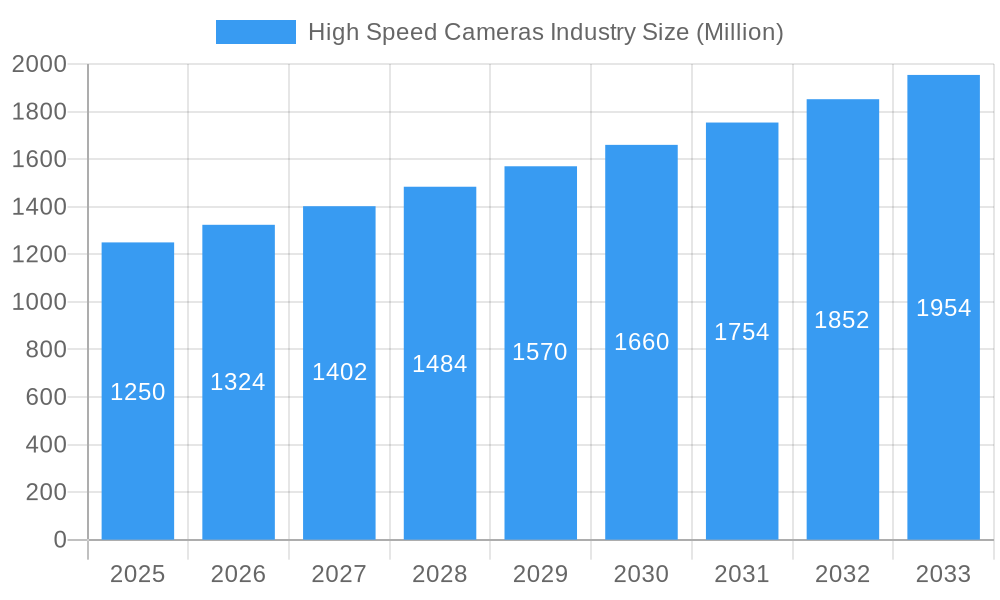

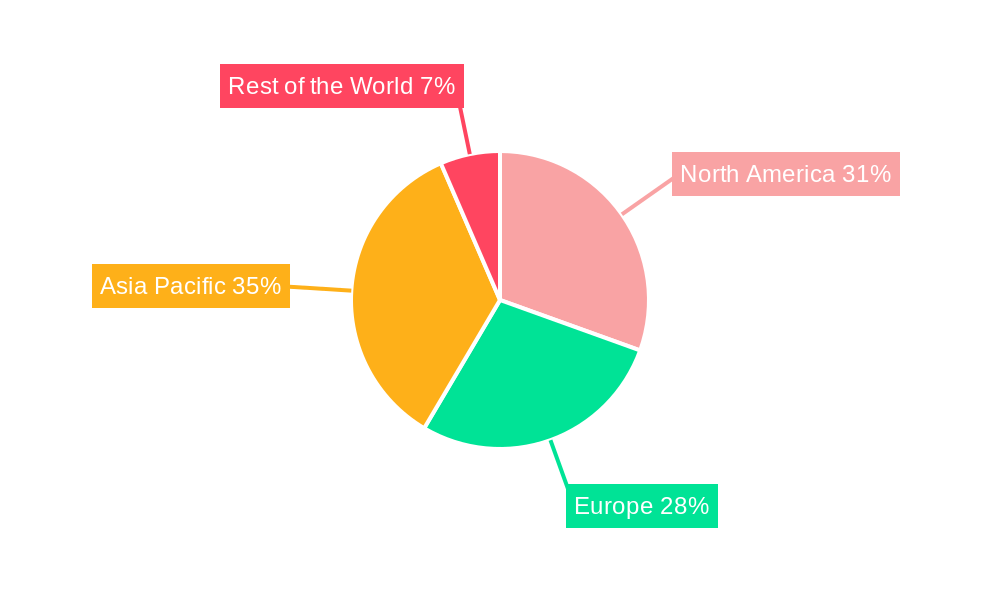

The global High Speed Cameras market is projected to achieve significant growth, reaching $565.14 million by 2033, with a Compound Annual Growth Rate (CAGR) of 6.41% from its base year of 2024. This expansion is driven by increasing demand across industrial manufacturing, aerospace, entertainment, and defense sectors. Innovations in high-speed imaging technology, advanced image sensors, and lenses are key catalysts, enhancing camera performance and adoption. The need for precise quality control, accident reconstruction, and scientific research further fuels market penetration. The Asia Pacific region is expected to be a substantial growth contributor, mirroring advancements in its industrial and technological sectors. The integration of AI and machine learning for automated analysis and data interpretation is a pivotal trend.

High Speed Cameras Industry Market Size (In Million)

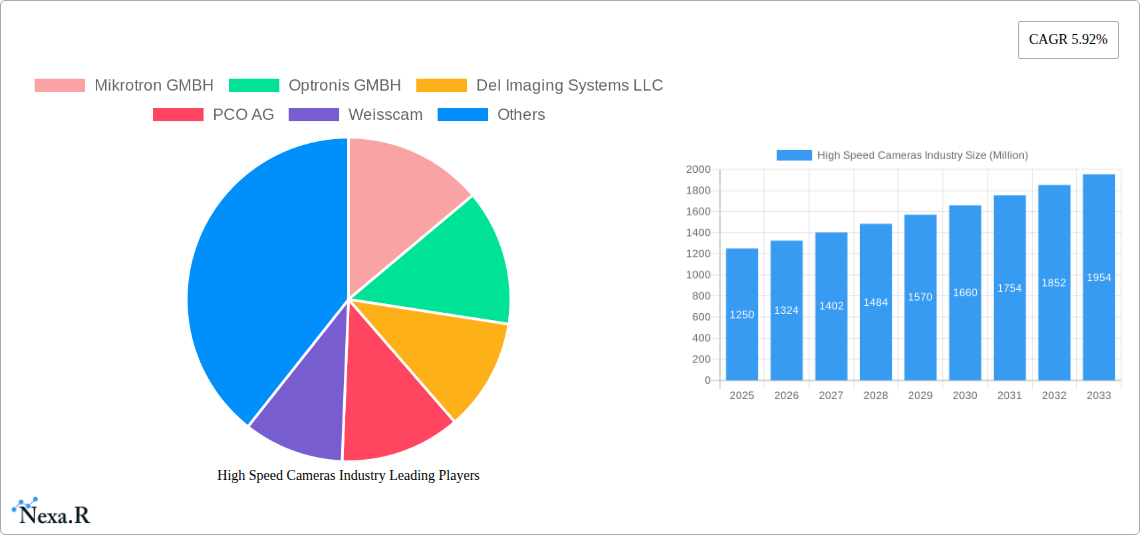

Technological advancements and expanding frame rate capabilities, particularly in the 5,001-20,000 and 20,001-100,000 frames per second segments, are supporting market expansion. While high initial costs and the need for specialized expertise present restraints, these are being offset by the increasing return on investment in critical applications. Leading companies such as Vision Research Inc., NAC Image Technology, and Mikrotron GMBH are introducing innovative solutions. Growing adoption in sports analytics and automotive crash testing highlights the indispensable nature of high-speed cameras in modern research, development, and operations. Strategic focus on R&D and increased investment by key players will continue to drive product development.

High Speed Cameras Industry Company Market Share

Gain unparalleled insights into the global High Speed Cameras market, a dynamic sector revolutionizing industries from aerospace to entertainment. This comprehensive report, covering a historical period and a robust forecast to 2033, provides critical data on market dynamics, growth trends, regional dominance, product innovations, and key players. With a base year of 2024, we deliver actionable intelligence for stakeholders seeking to navigate and capitalize on the accelerating demand for ultra-fast imaging solutions. Discover market opportunities, explore technological advancements driving adoption, and understand the competitive landscape shaping the future of high-speed cinematography and industrial analysis.

High Speed Cameras Industry Market Dynamics & Structure

The high-speed camera market is characterized by moderate concentration, driven by significant technological innovation and substantial R&D investments. Companies are continuously pushing the boundaries of frame rates and resolution, creating a competitive environment where product differentiation is key. Regulatory frameworks primarily focus on export controls for advanced imaging technologies, particularly in military and defense applications, while also promoting standards for industrial safety and quality control. The threat of substitute products, such as advanced conventional cameras with higher frame rate capabilities or specialized imaging techniques, is present but generally limited in high-end applications requiring extreme temporal resolution. End-user demographics are diverse, ranging from academic researchers and industrial engineers to filmmakers and athletes, each with specific performance and budget requirements. Merger and acquisition (M&A) activity, while not rampant, is strategic, with larger players acquiring niche technology providers or companies with established market presence in specific applications.

- Market Concentration: Moderate, with key players holding significant but not dominant market shares.

- Technological Innovation Drivers: Demand for higher frame rates (exceeding 100,000 fps), improved image quality in low light, miniaturization, and advanced data processing capabilities.

- Regulatory Frameworks: Primarily focused on export controls and industry-specific safety standards.

- Competitive Product Substitutes: Limited in extreme high-speed applications, but advanced conventional cameras pose a threat in mid-range frame rate segments.

- End-User Demographics: Broad, spanning scientific research, industrial automation, entertainment, defense, and consumer electronics.

- M&A Trends: Strategic acquisitions of specialized technology firms and companies with established application-specific market reach.

High Speed Cameras Industry Growth Trends & Insights

The global High Speed Cameras market is projected for substantial expansion, fueled by relentless technological advancements and an increasing adoption across a multitude of sectors. Market size evolution is being driven by the insatiable demand for capturing fleeting moments with unprecedented detail. Adoption rates are steadily climbing as industries recognize the critical role of high-speed imaging in optimizing processes, ensuring safety, and creating compelling visual content. Technological disruptions, particularly in image sensor technology and data storage, are continuously lowering barriers to entry and expanding the capabilities of high-speed cameras. Consumer behavior shifts are also playing a role, with a growing appreciation for high-fidelity visual content in entertainment and sports, driving demand for advanced cameras.

The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. By 2025, the global market size is estimated to reach an impressive $xx Million units. This growth is underpinned by the increasing penetration of high-speed cameras in industrial automation, where they are used for quality control, anomaly detection, and process optimization, contributing an estimated $xx Million units to the market in the same year. In the research and design segment, scientific discoveries and product development are heavily reliant on the ability to visualize rapid events, further bolstering market demand. The entertainment and media industry continues to be a significant consumer, leveraging these cameras for cinematic effects and broadcast applications, with a market contribution of approximately $xx Million units by 2025. The increasing sophistication of these cameras, offering higher resolutions and frame rates, is enabling new applications and driving the overall market expansion.

Dominant Regions, Countries, or Segments in High Speed Cameras Industry

The high-speed cameras industry's dominance is notably concentrated within North America, driven by its robust technological ecosystem, substantial government investments in defense and aerospace, and a thriving industrial manufacturing sector. The United States, in particular, stands out as a key market due to the presence of leading research institutions, advanced manufacturing capabilities, and significant military expenditure, which fuels the demand for high-performance surveillance and testing equipment. Economic policies supporting innovation and advanced manufacturing, coupled with well-developed infrastructure for research and development, further solidify North America's leading position.

Within the industry segments, Frame Rate: Greater Than 100,000 is emerging as a significant growth driver, catering to highly specialized applications in scientific research, ballistics, and advanced materials testing where capturing extremely rapid phenomena is paramount. The development of cutting-edge image sensors and processing capabilities is enabling manufacturers to deliver cameras that surpass previously unimaginable frame rate thresholds, opening up new frontiers for scientific inquiry and industrial problem-solving. This segment is projected to contribute significantly to the overall market value, with an estimated XX% market share by 2025.

In terms of Application, Industrial Manufacturing represents a cornerstone of the high-speed camera market. The relentless pursuit of efficiency, quality control, and automation in manufacturing processes necessitates precise visual analysis of high-speed operations, from assembly line checks and material deformation studies to fluid dynamics and impact testing. The growing adoption of Industry 4.0 principles further amplifies this demand, as manufacturers seek to leverage data-driven insights for process optimization and predictive maintenance. This sector is estimated to command a market share of approximately XX% by 2025, valued at $XX Million units.

- Dominant Region: North America (driven by US market strength).

- Key Country: United States (strong R&D, defense, and manufacturing sectors).

- Dominant Frame Rate Segment: Greater Than 100,000 fps (enabling cutting-edge scientific and industrial applications).

- Dominant Application Segment: Industrial Manufacturing (crucial for automation, quality control, and process optimization).

- Key Drivers in North America: Government funding, strong R&D infrastructure, advanced manufacturing base, defense expenditure.

- Growth Potential in "Greater Than 100,000 fps" segment: Driven by scientific discovery and advanced material science.

- Market Share in Industrial Manufacturing: Estimated at XX% by 2025, valued at $XX Million units.

High Speed Cameras Industry Product Landscape

The high-speed camera product landscape is defined by continuous innovation, offering enhanced performance metrics and expanded application capabilities. Manufacturers are increasingly focusing on developing cameras with higher frame rates, reaching well beyond 100,000 frames per second, coupled with significant improvements in image sensor technology for superior low-light sensitivity and dynamic range. Innovations in lens design are also critical, enabling sharper imagery at extreme speeds. Products are now integrating advanced memory systems and on-board processing to handle massive data streams efficiently.

Notable advancements include the integration of CMOS sensors for greater speed and lower power consumption, and the development of compact, ruggedized designs for challenging environments. Unique selling propositions often lie in the combination of ultra-high frame rates, exceptional image quality, and specialized features like global shutter technology for distortion-free capture of rapid motion.

Key Drivers, Barriers & Challenges in High Speed Cameras Industry

Key Drivers:

- Technological Advancements: Continuous improvements in image sensor technology (e.g., higher resolution, sensitivity), processing power, and data storage are driving demand for higher performance.

- Growing Industrial Automation: The need for precise monitoring, quality control, and process optimization in manufacturing is a significant growth accelerator.

- Scientific Research Expansion: Breakthroughs in fields like physics, materials science, and biomechanics rely on high-speed imaging to understand fleeting phenomena.

- Demand in Entertainment & Media: The pursuit of captivating visual effects and detailed sports analysis fuels the adoption of high-speed cameras.

- Military & Defense Applications: Surveillance, testing of munitions, and aerospace research contribute to sustained demand.

Barriers & Challenges:

- High Initial Investment Cost: Advanced high-speed cameras can be prohibitively expensive for smaller businesses or academic departments, limiting widespread adoption.

- Complex Data Management: The sheer volume of data generated by high-speed cameras requires significant storage and processing infrastructure, posing a challenge for users.

- Technical Expertise Requirement: Operating and analyzing data from high-speed cameras often requires specialized technical knowledge, creating a skills gap.

- Supply Chain Disruptions: Global events can impact the availability of critical components, leading to production delays and increased costs.

- Competition from Emerging Technologies: While niche, some advanced conventional cameras or other imaging techniques may offer a more cost-effective solution for less demanding applications.

Emerging Opportunities in High Speed Cameras Industry

Emerging opportunities lie in the development of more affordable, user-friendly high-speed camera solutions tailored for specific niche markets, such as educational institutions or smaller R&D labs. The integration of artificial intelligence (AI) and machine learning for real-time data analysis and anomaly detection within the camera itself presents a significant avenue for growth. Furthermore, the expansion into emerging markets with rapidly developing industrial and research sectors offers untapped potential. The increasing demand for high-speed imaging in fields like autonomous vehicle testing, advanced robotics, and immersive virtual reality content creation also represents fertile ground for innovation and market penetration.

Growth Accelerators in the High Speed Cameras Industry Industry

Long-term growth in the high-speed cameras industry is significantly propelled by ongoing technological breakthroughs, particularly in semiconductor manufacturing that enables smaller, faster, and more efficient image sensors. Strategic partnerships between camera manufacturers and software developers are creating integrated solutions that streamline data acquisition and analysis, making these powerful tools more accessible. Market expansion strategies, such as focusing on emerging economies and developing specialized camera models for niche applications like medical diagnostics or environmental monitoring, are also critical growth accelerators. The continuous drive for scientific discovery and industrial efficiency will ensure a sustained demand for these precision imaging instruments.

Key Players Shaping the High Speed Cameras Industry Market

- Mikrotron GMBH

- Optronis GMBH

- Del Imaging Systems LLC

- PCO AG

- Weisscam

- Photron LTD

- NAC Image Technology

- Ix-Cameras Inc

- Vision Research Inc

- Olympus Corporation

- Motion Capture Technologies

Notable Milestones in High Speed Cameras Industry Sector

- April 2022: Vision Research introduces the Phantom VEO 610, an "entry-level" high-speed camera with a maximum refresh speed of 218,970 fps at 320x12 resolution and HD 720p recording at 7,420 fps.

- March 2022: Photron USA unveils three innovative high-speed camera solutions, including the Fastcam Nova R5-4K, touted as the world's fastest 4K UHD camera, featuring advanced CMOS sensor technology for superior light sensitivity and large internal memory.

- February 2022: OM Digital Solutions (formerly Olympus) launches the OM System OM-1, a premium Micro Four Thirds camera equipped with a 20.4 million pixel Stacking BSI Live MOS sensor, capable of recording at 50fps in C-AF mode and 120 fps in S-AF, demonstrating advancements in consumer-grade high-speed capture.

In-Depth High Speed Cameras Industry Market Outlook

The high-speed cameras industry is poised for remarkable future growth, driven by a confluence of technological innovation and expanding application horizons. The relentless pursuit of capturing faster, more intricate events will continue to fuel advancements in sensor technology and processing power. Strategic market expansion, particularly into rapidly industrializing regions and nascent scientific fields, will unlock new revenue streams. The increasing integration of AI for intelligent data analysis within high-speed imaging systems represents a significant opportunity, transforming raw data into actionable insights and enhancing the value proposition of these cameras. Furthermore, the growing demand for immersive content in entertainment and the critical need for precision in advanced manufacturing and research will ensure a sustained and robust market outlook.

High Speed Cameras Industry Segmentation

-

1. Component

- 1.1. Image Sensors

- 1.2. Lens

- 1.3. Battery

- 1.4. Memory Systems

-

2. Frame Rate

- 2.1. 1,000-5,000

- 2.2. 5,001-20,000

- 2.3. 20,001-100,000

- 2.4. Greater Than 100,000

-

3. Application

- 3.1. Entertainment & Media

- 3.2. Sports

- 3.3. Consumer Electronics

- 3.4. Research & Design

- 3.5. Industrial Manufacturing

- 3.6. Military & Defense

- 3.7. Aerospace

- 3.8. Other Applications

High Speed Cameras Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

High Speed Cameras Industry Regional Market Share

Geographic Coverage of High Speed Cameras Industry

High Speed Cameras Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of High Speed Camera in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of High Speed Cameras

- 3.4. Market Trends

- 3.4.1. Intelligent Transportation Systems Initiative to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Speed Cameras Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Image Sensors

- 5.1.2. Lens

- 5.1.3. Battery

- 5.1.4. Memory Systems

- 5.2. Market Analysis, Insights and Forecast - by Frame Rate

- 5.2.1. 1,000-5,000

- 5.2.2. 5,001-20,000

- 5.2.3. 20,001-100,000

- 5.2.4. Greater Than 100,000

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Entertainment & Media

- 5.3.2. Sports

- 5.3.3. Consumer Electronics

- 5.3.4. Research & Design

- 5.3.5. Industrial Manufacturing

- 5.3.6. Military & Defense

- 5.3.7. Aerospace

- 5.3.8. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America High Speed Cameras Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Image Sensors

- 6.1.2. Lens

- 6.1.3. Battery

- 6.1.4. Memory Systems

- 6.2. Market Analysis, Insights and Forecast - by Frame Rate

- 6.2.1. 1,000-5,000

- 6.2.2. 5,001-20,000

- 6.2.3. 20,001-100,000

- 6.2.4. Greater Than 100,000

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Entertainment & Media

- 6.3.2. Sports

- 6.3.3. Consumer Electronics

- 6.3.4. Research & Design

- 6.3.5. Industrial Manufacturing

- 6.3.6. Military & Defense

- 6.3.7. Aerospace

- 6.3.8. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe High Speed Cameras Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Image Sensors

- 7.1.2. Lens

- 7.1.3. Battery

- 7.1.4. Memory Systems

- 7.2. Market Analysis, Insights and Forecast - by Frame Rate

- 7.2.1. 1,000-5,000

- 7.2.2. 5,001-20,000

- 7.2.3. 20,001-100,000

- 7.2.4. Greater Than 100,000

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Entertainment & Media

- 7.3.2. Sports

- 7.3.3. Consumer Electronics

- 7.3.4. Research & Design

- 7.3.5. Industrial Manufacturing

- 7.3.6. Military & Defense

- 7.3.7. Aerospace

- 7.3.8. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific High Speed Cameras Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Image Sensors

- 8.1.2. Lens

- 8.1.3. Battery

- 8.1.4. Memory Systems

- 8.2. Market Analysis, Insights and Forecast - by Frame Rate

- 8.2.1. 1,000-5,000

- 8.2.2. 5,001-20,000

- 8.2.3. 20,001-100,000

- 8.2.4. Greater Than 100,000

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Entertainment & Media

- 8.3.2. Sports

- 8.3.3. Consumer Electronics

- 8.3.4. Research & Design

- 8.3.5. Industrial Manufacturing

- 8.3.6. Military & Defense

- 8.3.7. Aerospace

- 8.3.8. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World High Speed Cameras Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Image Sensors

- 9.1.2. Lens

- 9.1.3. Battery

- 9.1.4. Memory Systems

- 9.2. Market Analysis, Insights and Forecast - by Frame Rate

- 9.2.1. 1,000-5,000

- 9.2.2. 5,001-20,000

- 9.2.3. 20,001-100,000

- 9.2.4. Greater Than 100,000

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Entertainment & Media

- 9.3.2. Sports

- 9.3.3. Consumer Electronics

- 9.3.4. Research & Design

- 9.3.5. Industrial Manufacturing

- 9.3.6. Military & Defense

- 9.3.7. Aerospace

- 9.3.8. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mikrotron GMBH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Optronis GMBH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Del Imaging Systems LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PCO AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Weisscam

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Photron LTD

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 NAC Image Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ix-Cameras Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vision Research Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Olympus Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Motion Capture Technologies

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Mikrotron GMBH

List of Figures

- Figure 1: Global High Speed Cameras Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America High Speed Cameras Industry Revenue (million), by Component 2025 & 2033

- Figure 3: North America High Speed Cameras Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America High Speed Cameras Industry Revenue (million), by Frame Rate 2025 & 2033

- Figure 5: North America High Speed Cameras Industry Revenue Share (%), by Frame Rate 2025 & 2033

- Figure 6: North America High Speed Cameras Industry Revenue (million), by Application 2025 & 2033

- Figure 7: North America High Speed Cameras Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America High Speed Cameras Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America High Speed Cameras Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe High Speed Cameras Industry Revenue (million), by Component 2025 & 2033

- Figure 11: Europe High Speed Cameras Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe High Speed Cameras Industry Revenue (million), by Frame Rate 2025 & 2033

- Figure 13: Europe High Speed Cameras Industry Revenue Share (%), by Frame Rate 2025 & 2033

- Figure 14: Europe High Speed Cameras Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Europe High Speed Cameras Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe High Speed Cameras Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Europe High Speed Cameras Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific High Speed Cameras Industry Revenue (million), by Component 2025 & 2033

- Figure 19: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific High Speed Cameras Industry Revenue (million), by Frame Rate 2025 & 2033

- Figure 21: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Frame Rate 2025 & 2033

- Figure 22: Asia Pacific High Speed Cameras Industry Revenue (million), by Application 2025 & 2033

- Figure 23: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific High Speed Cameras Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World High Speed Cameras Industry Revenue (million), by Component 2025 & 2033

- Figure 27: Rest of the World High Speed Cameras Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Rest of the World High Speed Cameras Industry Revenue (million), by Frame Rate 2025 & 2033

- Figure 29: Rest of the World High Speed Cameras Industry Revenue Share (%), by Frame Rate 2025 & 2033

- Figure 30: Rest of the World High Speed Cameras Industry Revenue (million), by Application 2025 & 2033

- Figure 31: Rest of the World High Speed Cameras Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World High Speed Cameras Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World High Speed Cameras Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Speed Cameras Industry Revenue million Forecast, by Component 2020 & 2033

- Table 2: Global High Speed Cameras Industry Revenue million Forecast, by Frame Rate 2020 & 2033

- Table 3: Global High Speed Cameras Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global High Speed Cameras Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global High Speed Cameras Industry Revenue million Forecast, by Component 2020 & 2033

- Table 6: Global High Speed Cameras Industry Revenue million Forecast, by Frame Rate 2020 & 2033

- Table 7: Global High Speed Cameras Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global High Speed Cameras Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global High Speed Cameras Industry Revenue million Forecast, by Component 2020 & 2033

- Table 12: Global High Speed Cameras Industry Revenue million Forecast, by Frame Rate 2020 & 2033

- Table 13: Global High Speed Cameras Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global High Speed Cameras Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global High Speed Cameras Industry Revenue million Forecast, by Component 2020 & 2033

- Table 20: Global High Speed Cameras Industry Revenue million Forecast, by Frame Rate 2020 & 2033

- Table 21: Global High Speed Cameras Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: Global High Speed Cameras Industry Revenue million Forecast, by Country 2020 & 2033

- Table 23: China High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Japan High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: India High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global High Speed Cameras Industry Revenue million Forecast, by Component 2020 & 2033

- Table 28: Global High Speed Cameras Industry Revenue million Forecast, by Frame Rate 2020 & 2033

- Table 29: Global High Speed Cameras Industry Revenue million Forecast, by Application 2020 & 2033

- Table 30: Global High Speed Cameras Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Latin America High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Middle East High Speed Cameras Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Speed Cameras Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the High Speed Cameras Industry?

Key companies in the market include Mikrotron GMBH, Optronis GMBH, Del Imaging Systems LLC, PCO AG, Weisscam, Photron LTD, NAC Image Technology, Ix-Cameras Inc *List Not Exhaustive, Vision Research Inc, Olympus Corporation, Motion Capture Technologies.

3. What are the main segments of the High Speed Cameras Industry?

The market segments include Component, Frame Rate, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 565.14 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of High Speed Camera in Manufacturing Sector.

6. What are the notable trends driving market growth?

Intelligent Transportation Systems Initiative to Drive the Market.

7. Are there any restraints impacting market growth?

High Cost of High Speed Cameras.

8. Can you provide examples of recent developments in the market?

April 2022: The Phantom VEO 610 is Vision Study's latest "entry-level" high-speed camera. The camera has a maximum refresh speed of 218.970 fps in 320 x 12 and can record in HD 720p at 7420 pictures per second.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Speed Cameras Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Speed Cameras Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Speed Cameras Industry?

To stay informed about further developments, trends, and reports in the High Speed Cameras Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence