Key Insights

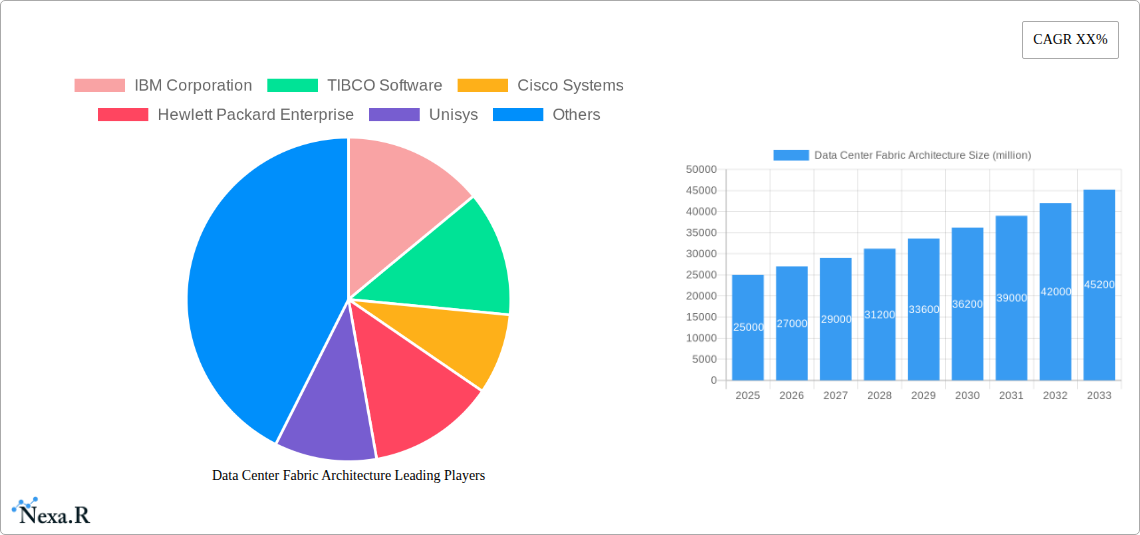

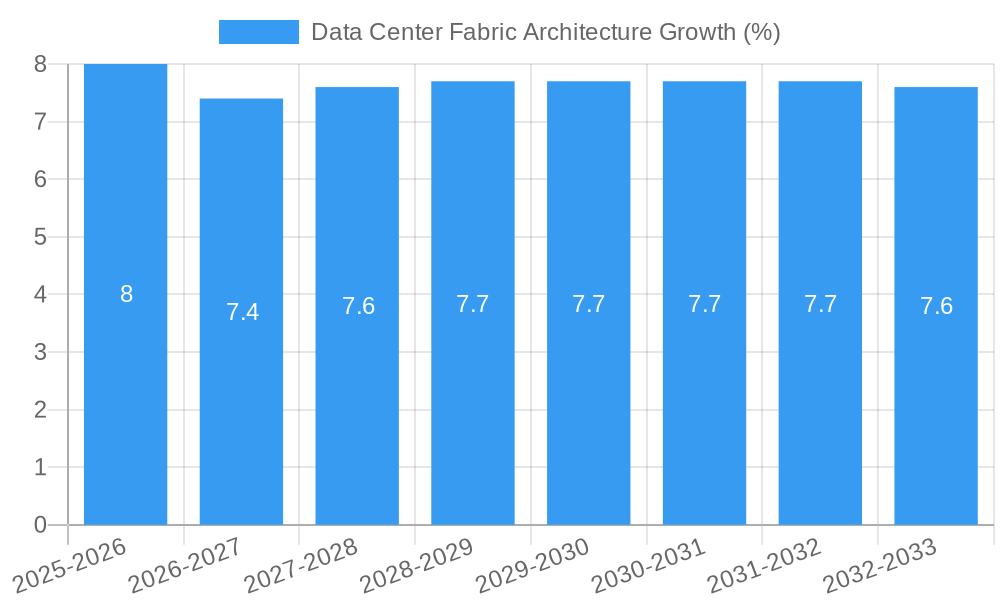

The Data Center Fabric Architecture market is projected to experience robust growth, with an estimated market size of USD 25,000 million in 2025, driven by a Compound Annual Growth Rate (CAGR) of XX%. This expansion is primarily fueled by the escalating demand for faster, more efficient, and scalable network infrastructures within data centers. Key drivers include the pervasive adoption of cloud computing, the exponential growth of big data analytics, and the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) workloads, all of which necessitate high-performance networking solutions. The IT & Telecommunications sector is anticipated to be the dominant application segment, followed closely by Automotive, as connected vehicles generate vast amounts of data requiring rapid processing. The shift towards cloud-based fabric architectures is evident, offering greater flexibility, scalability, and simplified management compared to traditional local-based solutions. However, the market faces certain restraints, including the substantial upfront investment required for implementing advanced fabric architectures and concerns around vendor lock-in. Despite these challenges, the continuous evolution of networking technologies and the growing need for enhanced data center agility and resilience are expected to propel market expansion throughout the forecast period of 2025-2033.

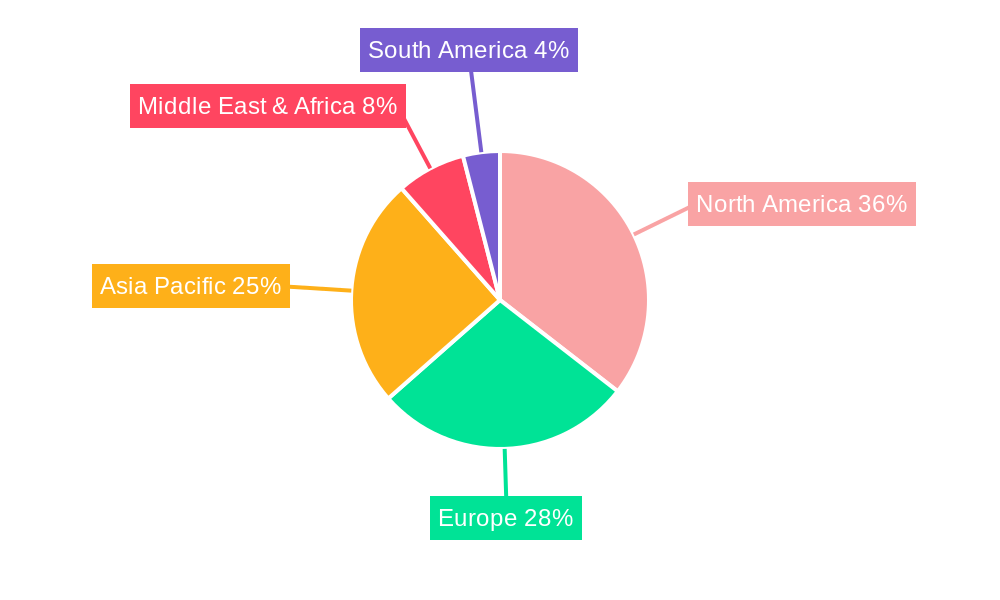

The strategic importance of data center fabric architecture is underscored by its critical role in enabling digital transformation initiatives across various industries. Companies like IBM Corporation, Cisco Systems, Hewlett Packard Enterprise, and Microsoft Corporation are at the forefront, offering innovative solutions that address the complexities of modern data center environments. North America, particularly the United States, is expected to lead the market in terms of revenue share, owing to its mature digital infrastructure and high concentration of cloud service providers and enterprises investing heavily in data center modernization. Asia Pacific, led by China and India, presents a significant growth opportunity, driven by rapid digitalization, increasing internet penetration, and the burgeoning demand for cloud services and AI-powered applications. The ongoing trends in network virtualization, software-defined networking (SDN), and network function virtualization (NFV) are further shaping the data center fabric landscape, paving the way for more intelligent, automated, and efficient data center operations. Addressing the evolving needs of the digital economy, the data center fabric architecture market is poised for sustained and significant advancement.

Here is a compelling, SEO-optimized report description for Data Center Fabric Architecture, integrating high-traffic keywords and industry specifics, with all values presented in millions.

Data Center Fabric Architecture Market Dynamics & Structure

The global Data Center Fabric Architecture market is characterized by a moderate concentration, with leading players like Cisco Systems, Dell, and Hewlett Packard Enterprise holding significant market shares. Technological innovation is a primary driver, fueled by the increasing demand for high-speed, low-latency networking solutions essential for cloud computing, AI, and big data analytics. The market is also shaped by evolving regulatory frameworks, particularly concerning data privacy and security, pushing organizations towards more robust and secure fabric architectures. Competitive product substitutes, while present, often fall short of the integrated performance and scalability offered by dedicated fabric solutions. End-user demographics are rapidly shifting towards enterprises and service providers prioritizing digital transformation, with a growing adoption by sectors beyond traditional IT and Telecommunications. Merger and Acquisition (M&A) trends are active, with an estimated 50+ M&A deals occurring within the historical period (2019-2024), driven by the desire for technology consolidation and market expansion.

- Market Concentration: Dominated by a few key players, but with increasing opportunities for niche solutions.

- Technological Innovation: Driven by demand for 5G, AI/ML, IoT, and edge computing.

- Regulatory Frameworks: Emphasis on data sovereignty, cybersecurity, and compliance standards.

- Competitive Substitutes: Traditional networking solutions versus specialized fabric architectures.

- End-User Demographics: Growing adoption by enterprises, cloud providers, and telecommunication companies.

- M&A Trends: Consolidation for technology acquisition and market reach.

Data Center Fabric Architecture Growth Trends & Insights

The global Data Center Fabric Architecture market is projected for substantial growth, driven by the insatiable demand for enhanced network performance and agility. Market size is estimated to reach $85,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025–2033). This robust expansion is underpinned by escalating adoption rates of cloud-based solutions and the increasing complexity of data center operations. Technological disruptions, such as the advent of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), are revolutionizing how data center fabrics are designed and managed, enabling greater automation and flexibility. Consumer behavior shifts are evident, with businesses prioritizing scalable, resilient, and cost-effective network infrastructure to support their digital transformation initiatives. The market penetration of advanced fabric architectures is anticipated to surpass 65% by the end of the forecast period, indicating a significant shift away from legacy networking models. Key performance indicators like reduced latency, increased bandwidth, and improved operational efficiency are compelling more organizations to invest in these cutting-edge solutions. The base year (2025) sees the market valued at an estimated $35,000 million, setting a strong foundation for the projected growth trajectory.

Dominant Regions, Countries, or Segments in Data Center Fabric Architecture

The IT & Telecommunications segment, with an estimated 45% market share in the Base Year (2025), is the dominant force driving growth in the Data Center Fabric Architecture market. This dominance is propelled by the inherent need within this sector for high-performance, scalable, and reliable networking to support cloud services, mobile data traffic, and a myriad of digital applications. North America, particularly the United States, holds a significant lead in market share, estimated at 30%, due to its advanced technological infrastructure, substantial investments in data centers, and the presence of major cloud service providers.

Key Drivers for Dominance:

- Technological Advancement: Early adoption and innovation in networking technologies.

- Cloud Infrastructure Growth: Proliferation of hyperscale and enterprise data centers.

- Digital Transformation Initiatives: Aggressive investment in network upgrades for competitive advantage.

- Economic Policies: Favorable government policies supporting technology infrastructure development.

- Skilled Workforce: Availability of specialized talent in network engineering and architecture.

Cloud Based architectures are experiencing accelerated adoption within this dominant segment, projected to account for 70% of the total market by 2033. This preference is driven by the inherent scalability, flexibility, and cost-efficiency of cloud models, allowing organizations to adapt quickly to changing demands. While the Automotive sector is showing promising growth, with an estimated market contribution of 15% by 2033, and the Retail sector following at 12%, their current adoption rates and market share are considerably lower than that of IT & Telecommunications. The "Others" segment, encompassing various industries like healthcare, finance, and manufacturing, collectively represents a growing opportunity, projected to reach 28% by 2033, driven by increasing digitization across all business verticals.

Data Center Fabric Architecture Product Landscape

The Data Center Fabric Architecture market is characterized by a landscape of highly sophisticated products focused on delivering unparalleled network performance and agility. Key innovations include advancements in Ethernet switching technology, offering multi-gigabit speeds and reduced latency for demanding workloads like AI and high-frequency trading. Software-defined networking (SDN) controllers and Network Functions Virtualization (NFV) platforms are integral, enabling automated provisioning, dynamic traffic management, and seamless integration of various network services. Performance metrics such as port density, throughput, power efficiency, and fabric resilience are crucial selling propositions, with vendors competing on delivering superior capabilities. Leading products often feature advanced telemetry for real-time network monitoring and analytics, enhancing operational visibility and troubleshooting.

Key Drivers, Barriers & Challenges in Data Center Fabric Architecture

Key Drivers:

- Exponential Data Growth: The relentless surge in data volume necessitates more efficient network architectures.

- Cloud Computing Expansion: Cloud providers and enterprises adopting cloud strategies demand scalable, high-performance fabrics.

- Emergence of AI & Machine Learning: These technologies require low-latency, high-bandwidth networks for efficient data processing.

- Edge Computing Adoption: Distributed computing requires resilient and agile network fabrics to connect edge devices.

- Digital Transformation Initiatives: Organizations investing in modernizing their IT infrastructure.

Barriers & Challenges:

- High Initial Investment: Implementing advanced fabric architectures can require significant upfront capital expenditure, estimated to be upwards of $5 million for large-scale deployments.

- Complexity of Integration: Integrating new fabric architectures with existing legacy systems can be a formidable task, potentially leading to operational disruptions.

- Skilled Workforce Shortage: A lack of adequately trained professionals to design, deploy, and manage complex fabric networks poses a significant hurdle.

- Security Concerns: Ensuring robust security across a distributed and dynamic fabric environment requires continuous vigilance and advanced solutions.

- Vendor Lock-in: Concerns about being tied to specific vendor ecosystems can deter some organizations from adopting certain solutions.

Emerging Opportunities in Data Center Fabric Architecture

Emerging opportunities in Data Center Fabric Architecture lie in the growing demand for hyper-converged infrastructure (HCI) integration, offering a unified approach to compute, storage, and networking. The expansion of 5G networks presents a significant opportunity for edge data center fabrics, enabling low-latency connectivity for a new wave of applications. Furthermore, the increasing adoption of AI-driven network automation and predictive analytics offers a pathway to optimize fabric performance and reduce operational overhead. The development of more energy-efficient fabric solutions is also gaining traction, aligning with sustainability goals and potentially unlocking cost savings for data center operators. Untapped markets in emerging economies are also poised for growth as these regions invest heavily in digital infrastructure.

Growth Accelerators in the Data Center Fabric Architecture Industry

The Data Center Fabric Architecture industry is experiencing accelerated growth primarily through technological breakthroughs in areas like photonic integrated circuits and next-generation Ethernet standards, enabling higher speeds and lower latencies. Strategic partnerships between hardware manufacturers, software providers, and cloud service providers are crucial catalysts, fostering ecosystem development and interoperability. Market expansion strategies focusing on specific industry verticals, such as finance and healthcare, are also driving adoption. The increasing emphasis on network programmability and orchestration, facilitated by open standards and APIs, is further accelerating the deployment and management of these complex architectures, making them more accessible and adaptable to diverse business needs.

Key Players Shaping the Data Center Fabric Architecture Market

- IBM Corporation

- TIBCO Software

- Cisco Systems

- Hewlett Packard Enterprise

- Unisys

- Avaya

- Atos

- CA Technologies

- Oracle Corporation

- Microsoft Corporation

- Dell

Notable Milestones in Data Center Fabric Architecture Sector

- 2019 Q1: Cisco launches Nexus 9000 series with enhanced ACI capabilities, pushing software-defined networking in enterprise data centers.

- 2020 Q3: Dell Technologies introduces new PowerSwitch platforms designed for cloud-native environments, emphasizing open networking.

- 2021 Q2: Hewlett Packard Enterprise announces advancements in its Aruba fabric solutions, focusing on campus and data center convergence.

- 2022 Q4: Industry-wide adoption of 400GbE and the exploration of 800GbE technologies become prominent trends.

- 2023 H1: Growing emphasis on AI/ML-specific network fabrics, designed for optimal performance in deep learning workloads.

- 2024 Q1: Increased M&A activity as larger players acquire specialized fabric technology companies to enhance their portfolios.

In-Depth Data Center Fabric Architecture Market Outlook

The future outlook for the Data Center Fabric Architecture market is exceptionally promising, driven by continuous technological innovation and the relentless expansion of digital services. Growth accelerators, including the widespread adoption of AI, the proliferation of IoT devices, and the increasing demand for edge computing, will fuel the need for more agile, scalable, and performant network infrastructures. Strategic opportunities lie in developing solutions that address the unique challenges of specific industry verticals and in fostering greater interoperability and standardization across different vendor offerings. The market is poised for significant expansion as organizations continue to invest in modernizing their data center operations to support the demands of the digital economy, with projected market value to reach $85,000 million by 2033.

Data Center Fabric Architecture Segmentation

-

1. Application

- 1.1. IT & Telecommunications

- 1.2. Automotive

- 1.3. Retail

- 1.4. Others

-

2. Types

- 2.1. Cloud Based

- 2.2. Local Based

Data Center Fabric Architecture Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Center Fabric Architecture REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Fabric Architecture Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. IT & Telecommunications

- 5.1.2. Automotive

- 5.1.3. Retail

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. Local Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Data Center Fabric Architecture Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. IT & Telecommunications

- 6.1.2. Automotive

- 6.1.3. Retail

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. Local Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Data Center Fabric Architecture Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. IT & Telecommunications

- 7.1.2. Automotive

- 7.1.3. Retail

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. Local Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Data Center Fabric Architecture Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. IT & Telecommunications

- 8.1.2. Automotive

- 8.1.3. Retail

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. Local Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Data Center Fabric Architecture Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. IT & Telecommunications

- 9.1.2. Automotive

- 9.1.3. Retail

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. Local Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Data Center Fabric Architecture Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. IT & Telecommunications

- 10.1.2. Automotive

- 10.1.3. Retail

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. Local Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TIBCO Software

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cisco Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hewlett Packard Enterprise

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unisys

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avaya

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Atos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CA Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Microsoft Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dell

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global Data Center Fabric Architecture Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Data Center Fabric Architecture Revenue (million), by Application 2024 & 2032

- Figure 3: North America Data Center Fabric Architecture Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Data Center Fabric Architecture Revenue (million), by Types 2024 & 2032

- Figure 5: North America Data Center Fabric Architecture Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Data Center Fabric Architecture Revenue (million), by Country 2024 & 2032

- Figure 7: North America Data Center Fabric Architecture Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Data Center Fabric Architecture Revenue (million), by Application 2024 & 2032

- Figure 9: South America Data Center Fabric Architecture Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Data Center Fabric Architecture Revenue (million), by Types 2024 & 2032

- Figure 11: South America Data Center Fabric Architecture Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Data Center Fabric Architecture Revenue (million), by Country 2024 & 2032

- Figure 13: South America Data Center Fabric Architecture Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Data Center Fabric Architecture Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Data Center Fabric Architecture Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Data Center Fabric Architecture Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Data Center Fabric Architecture Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Data Center Fabric Architecture Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Data Center Fabric Architecture Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Data Center Fabric Architecture Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Data Center Fabric Architecture Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Data Center Fabric Architecture Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Data Center Fabric Architecture Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Data Center Fabric Architecture Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Data Center Fabric Architecture Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Data Center Fabric Architecture Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Data Center Fabric Architecture Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Data Center Fabric Architecture Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Data Center Fabric Architecture Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Data Center Fabric Architecture Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Data Center Fabric Architecture Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center Fabric Architecture Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center Fabric Architecture Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Data Center Fabric Architecture Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Data Center Fabric Architecture Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Data Center Fabric Architecture Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Data Center Fabric Architecture Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Data Center Fabric Architecture Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Data Center Fabric Architecture Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Data Center Fabric Architecture Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Data Center Fabric Architecture Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Data Center Fabric Architecture Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Data Center Fabric Architecture Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Data Center Fabric Architecture Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Data Center Fabric Architecture Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Data Center Fabric Architecture Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Data Center Fabric Architecture Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Data Center Fabric Architecture Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Data Center Fabric Architecture Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Data Center Fabric Architecture Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Data Center Fabric Architecture Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Fabric Architecture?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Data Center Fabric Architecture?

Key companies in the market include IBM Corporation, TIBCO Software, Cisco Systems, Hewlett Packard Enterprise, Unisys, Avaya, Atos, CA Technologies, Oracle Corporation, Microsoft Corporation, Dell.

3. What are the main segments of the Data Center Fabric Architecture?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Fabric Architecture," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Fabric Architecture report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Fabric Architecture?

To stay informed about further developments, trends, and reports in the Data Center Fabric Architecture, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence