Key Insights

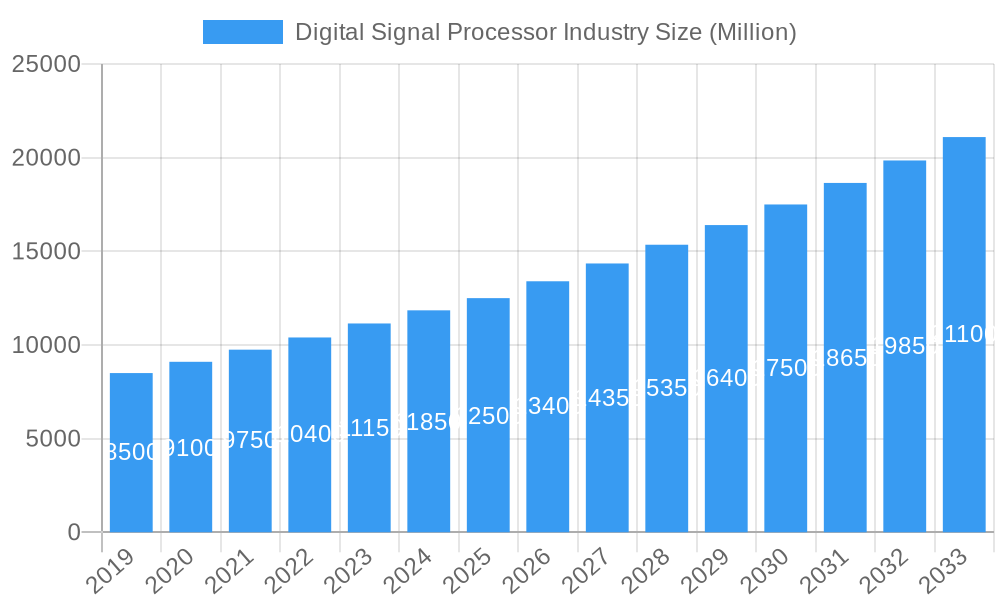

The Digital Signal Processor (DSP) market is poised for robust expansion, driven by an estimated market size of USD 12,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 7.28% through 2033. This impressive growth is fueled by the relentless demand for sophisticated signal processing capabilities across a multitude of burgeoning industries. The increasing complexity of data and the proliferation of connected devices necessitate advanced processing power, making DSPs indispensable. Key drivers include the escalating adoption of AI and machine learning, which heavily rely on efficient data manipulation, and the burgeoning IoT ecosystem, where real-time data analysis is paramount. Furthermore, the continuous evolution of consumer electronics, with devices becoming smarter and more feature-rich, alongside the critical role of DSPs in next-generation communication networks like 5G and beyond, are substantial contributors to market momentum. The automotive sector's transformation towards autonomous driving and advanced driver-assistance systems (ADAS), as well as the critical applications in healthcare for medical imaging and diagnostics, further underscore the pervasive influence and growing importance of DSP technology.

Digital Signal Processor Industry Market Size (In Billion)

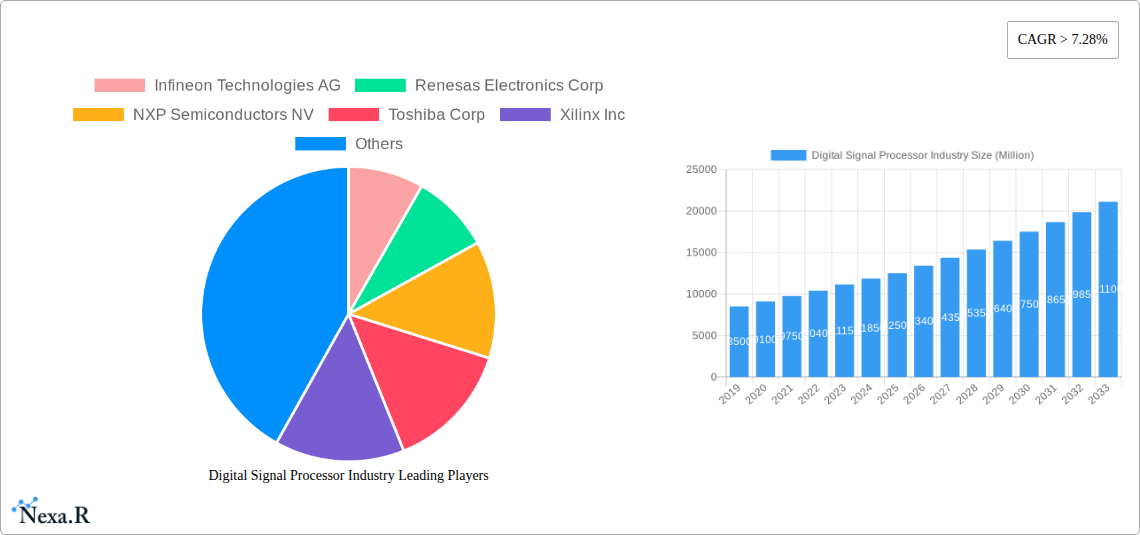

The DSP market's trajectory is shaped by significant trends, including the rise of specialized DSP architectures optimized for specific tasks, such as artificial intelligence inference and edge computing. Multi-core processors are increasingly dominating the landscape, offering enhanced parallel processing power crucial for handling the massive data volumes generated by modern applications. While the market enjoys strong tailwinds, certain restraints warrant consideration. The intense competition among established players and the emergence of new entrants can lead to price pressures. Additionally, the rapid pace of technological innovation necessitates continuous investment in research and development, posing a challenge for smaller companies. However, the strategic focus on developing energy-efficient DSP solutions, particularly for battery-powered devices and IoT applications, is mitigating some of these concerns. Major industry players like Infineon Technologies AG, Renesas Electronics Corp, NXP Semiconductors NV, Texas Instruments Inc, and Intel Corporation are at the forefront of innovation, driving the market's advancement through strategic partnerships and product development, ensuring the continued evolution and widespread adoption of DSP technology.

Digital Signal Processor Industry Company Market Share

Digital Signal Processor (DSP) Industry Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Gain critical insights into the dynamic Digital Signal Processor (DSP) market, a cornerstone of modern electronics driving innovation across diverse sectors. This report offers an in-depth analysis of market dynamics, growth trajectories, regional dominance, product landscapes, and key players. Delve into the crucial role of DSPs in communication, automotive, consumer electronics, industrial, aerospace & defense, and healthcare applications. Understand the strategic moves of industry giants like Texas Instruments, Analog Devices, Infineon Technologies, NXP Semiconductors, and Intel Corporation. This comprehensive report, covering the study period 2019–2033, with base year 2025 and forecast period 2025–2033, provides actionable intelligence for stakeholders seeking to capitalize on the burgeoning DSP industry. With a focus on parent and child market segments, this report is indispensable for anyone involved in the embedded systems, AI chip, and semiconductor market.

Digital Signal Processor Industry Market Dynamics & Structure

The Digital Signal Processor (DSP) market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, yet offering ample opportunities for niche players and emerging technologies. Technological innovation remains the primary driver, fueled by the relentless demand for higher processing power, lower energy consumption, and advanced functionalities like artificial intelligence (AI) at the edge. The increasing integration of DSPs into complex systems, particularly for real-time data processing in communication networks, automotive ADAS (Advanced Driver-Assistance Systems), and advanced consumer electronics, underscores their indispensability. Regulatory frameworks, while generally supportive of technological advancement, can influence product development cycles, particularly concerning power efficiency and environmental standards. Competitive product substitutes, such as general-purpose processors (GPPs) with specialized instruction sets or Application-Specific Integrated Circuits (ASICs), pose a threat but often lack the dedicated architecture and power efficiency of purpose-built DSPs for specific signal processing tasks. End-user demographics are shifting towards sophisticated applications requiring real-time analytics and machine learning capabilities, driving demand for multi-core DSP solutions. Mergers and acquisitions (M&A) are significant, as companies seek to consolidate intellectual property, expand their product portfolios, and gain a stronger foothold in rapidly evolving markets. For instance, the acquisition of Lion Semiconductor by Cirrus Logic highlights the strategic consolidation aimed at bolstering mixed-signal capabilities for consumer and mobile applications.

- Market Concentration: Moderate, with key players like Texas Instruments, Analog Devices, and Infineon Technologies leading.

- Technological Innovation Drivers: Demand for AI, 5G, IoT, advanced audio/video processing, and edge computing.

- Regulatory Frameworks: Focus on power efficiency, security, and standardization in communication protocols.

- Competitive Product Substitutes: GPPs with DSP extensions, FPGAs, and ASICs for highly specialized tasks.

- End-User Demographics: Growing demand from sophisticated applications in communication, automotive, and industrial automation.

- M&A Trends: Strategic acquisitions to enhance product offerings, expand market reach, and acquire specialized IP.

Digital Signal Processor Industry Growth Trends & Insights

The Digital Signal Processor (DSP) market is poised for robust growth, driven by an accelerating adoption of advanced technologies across a multitude of end-user industries. The market size evolution is characterized by consistent expansion, projected to witness significant upward trajectory from its historical period of 2019–2024 to the forecast period of 2025–2033. Key adoption rates are soaring, particularly in sectors demanding high-performance, low-power processing capabilities for real-time data manipulation. Technological disruptions, such as the burgeoning field of AI and the widespread implementation of 5G networks, are not merely influencing but fundamentally redefining the utility and demand for DSPs. These advancements necessitate more powerful and efficient signal processing to handle the massive influx of data generated and processed at the edge. Consumer behavior shifts are also playing a pivotal role; users expect increasingly intelligent and responsive devices, from smart home appliances to advanced automotive infotainment systems, all powered by sophisticated DSPs. The market penetration of DSPs is expanding beyond traditional strongholds into new and emerging application areas. The compound annual growth rate (CAGR) is expected to remain strong, reflecting the integral nature of DSPs in enabling next-generation technologies. Innovations in chip architecture, such as the development of highly parallel multi-core DSPs and specialized AI accelerators integrated within DSPs, are further fueling this growth by offering enhanced performance and power efficiency. The transition from single-core to multi-core architectures is a testament to the increasing complexity of signal processing tasks, where parallel processing is crucial for achieving desired outcomes in areas like advanced sensor fusion, complex audio encoding/decoding, and sophisticated image and video analysis. This sustained growth is underpinned by continuous research and development efforts by industry leaders, focusing on miniaturization, reduced power consumption, and increased processing speeds to meet the ever-growing demands of the digital world. The integration of DSPs with other processing units, like CPUs and GPUs, on a single System-on-Chip (SoC) further amplifies their market appeal, enabling highly integrated and efficient solutions for a wide array of electronic devices. The market is also witnessing a push towards embedded AI capabilities within DSPs, allowing for more localized data processing and decision-making, which is critical for latency-sensitive applications.

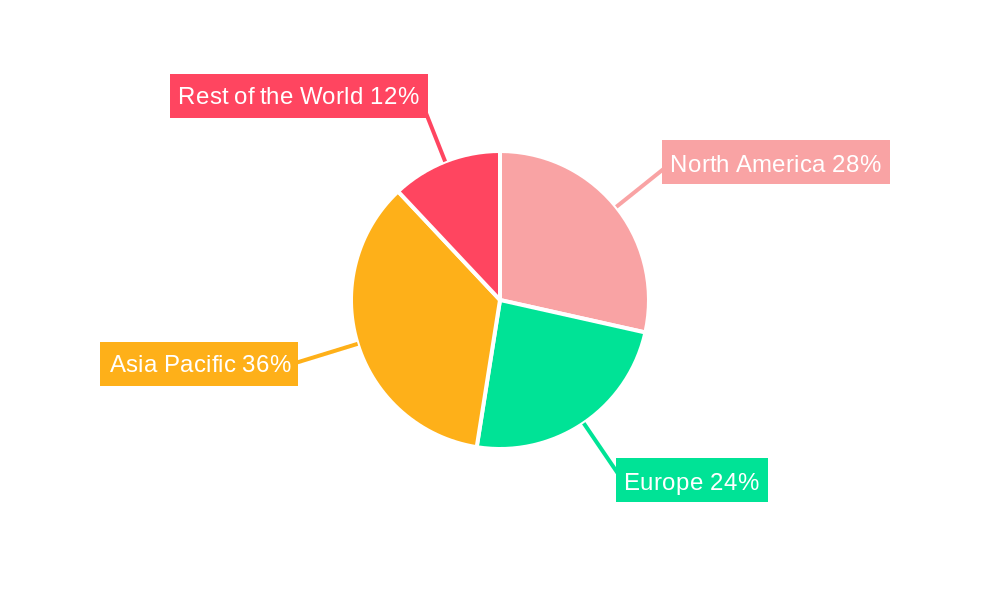

Dominant Regions, Countries, or Segments in Digital Signal Processor Industry

The Digital Signal Processor (DSP) industry is experiencing significant growth, with particular dominance observed in regions and segments that are at the forefront of technological adoption and manufacturing. Among the core segments, Multi-core DSPs are increasingly driving market growth, overtaking single-core processors in applications demanding higher computational power and parallelism. This shift is directly linked to the burgeoning needs of advanced communication technologies, such as 5G, and the exponential growth in data analytics and artificial intelligence processing. In terms of end-user industries, the Communication sector stands out as a primary growth engine, fueled by the global rollout of 5G infrastructure, the proliferation of connected devices in the Internet of Things (IoT), and the continuous demand for enhanced audio and video streaming capabilities. The Automotive sector is another critical segment, with the increasing sophistication of Advanced Driver-Assistance Systems (ADAS), in-car infotainment, and the nascent stages of autonomous driving heavily relying on high-performance DSPs for sensor fusion, signal processing, and real-time decision-making.

Geographically, Asia Pacific emerges as a dominant region, largely due to its status as a global manufacturing hub for electronics and the significant investments in 5G infrastructure and smart city initiatives across countries like China, South Korea, and Japan. The presence of major semiconductor manufacturers and a vast consumer base further solidifies its leading position. North America, particularly the United States, remains a crucial market due to its leadership in technological innovation, significant R&D investments, and the presence of major players in the semiconductor and software development landscape. Europe follows closely, driven by its strong automotive industry, advancements in industrial automation, and growing demand for consumer electronics.

- Dominant Core Segment: Multi-core DSPs, driven by AI, 5G, and complex data processing.

- Dominant End-User Industry: Communication (5G, IoT, advanced media) and Automotive (ADAS, infotainment).

- Dominant Region: Asia Pacific, owing to its manufacturing prowess and rapid adoption of new technologies.

- Key Growth Drivers in Dominant Segments/Regions:

- Communication: 5G deployment, IoT expansion, increased data traffic, and demand for real-time connectivity.

- Automotive: Development of autonomous driving features, advanced safety systems, and sophisticated in-car experiences.

- Asia Pacific: Government initiatives promoting digitalization, strong electronics manufacturing ecosystem, and a large consumer market.

- Market Share & Growth Potential: Multi-core DSPs are capturing increasing market share from single-core variants. The communication and automotive segments are projected to exhibit the highest growth rates in the forecast period, with Asia Pacific expected to maintain its lead in market size and growth.

Digital Signal Processor Industry Product Landscape

The product landscape of the Digital Signal Processor (DSP) industry is characterized by continuous innovation focused on enhancing processing power, reducing power consumption, and integrating advanced functionalities. Key product advancements include the development of highly specialized DSPs optimized for specific tasks, such as audio and voice processing, image and video signal processing, and motor control. The trend towards System-on-Chip (SoC) integration is prominent, with DSP cores being embedded alongside CPUs, GPUs, and AI accelerators to create highly compact and efficient solutions for edge computing and IoT devices. Notable innovations include the introduction of DSPs with dedicated hardware blocks for machine learning inference, enabling on-device AI capabilities for applications like speech recognition, anomaly detection, and predictive maintenance. Furthermore, advancements in fabrication processes are enabling smaller, more power-efficient DSPs, crucial for battery-powered devices and increasingly stringent power consumption regulations.

Key Drivers, Barriers & Challenges in Digital Signal Processor Industry

The Digital Signal Processor (DSP) market is propelled by several key drivers. The relentless evolution of 5G technology, demanding significantly more complex signal processing for higher data rates and lower latency, is a major catalyst. The pervasive growth of the Internet of Things (IoT) ecosystem, with its vast network of sensors generating immense data, necessitates efficient on-device processing. Advancements in Artificial Intelligence (AI) and Machine Learning (ML), particularly at the edge, require specialized DSP capabilities for real-time inference. Furthermore, the automotive industry's push towards electrification and autonomous driving relies heavily on DSPs for sensor fusion, control systems, and advanced driver-assistance features.

However, several barriers and challenges temper this growth. Intense price competition among semiconductor manufacturers, particularly for high-volume consumer applications, can squeeze profit margins. The complexity of software development and integration for advanced DSP applications requires specialized expertise, creating a talent bottleneck. Supply chain disruptions and semiconductor shortages, as witnessed in recent years, pose significant risks to production and delivery timelines. The increasing power efficiency demands from both end-users and regulatory bodies present an ongoing engineering challenge, requiring continuous innovation in architecture and manufacturing.

Emerging Opportunities in Digital Signal Processor Industry

Emerging opportunities in the Digital Signal Processor (DSP) industry are largely concentrated in areas where advanced signal processing is critical for enabling next-generation technologies. The exponential growth of Edge AI presents a significant avenue, with the demand for DSPs capable of performing complex AI inferencing directly on devices, reducing reliance on cloud connectivity and improving response times. The Industrial IoT (IIoT) revolution, encompassing smart manufacturing, predictive maintenance, and industrial automation, requires robust DSP solutions for real-time sensor data analysis and control. The healthcare sector is increasingly leveraging DSPs for advanced medical imaging, wearable health monitoring devices, and sophisticated diagnostic equipment. Furthermore, the expanding market for augmented and virtual reality (AR/VR) devices necessitates powerful DSPs for processing spatial audio, real-time rendering, and immersive sensory experiences.

Growth Accelerators in the Digital Signal Processor Industry Industry

Several factors are accelerating the long-term growth of the Digital Signal Processor (DSP) industry. Continuous technological breakthroughs in semiconductor fabrication, leading to smaller, faster, and more power-efficient chips, are fundamental. Strategic partnerships and collaborations between DSP manufacturers and application developers, particularly in areas like AI, automotive, and telecommunications, foster ecosystem growth and accelerate product development. The increasing adoption of multi-core architectures and heterogeneous computing within DSPs allows for greater parallel processing capabilities, essential for handling complex workloads. Furthermore, market expansion strategies by key players, including acquisitions and geographical diversification, are opening up new revenue streams and customer bases, solidifying the industry's upward trajectory.

Key Players Shaping the Digital Signal Processor Industry Market

- Infineon Technologies AG

- Renesas Electronics Corp

- NXP Semiconductors NV

- Toshiba Corp

- Xilinx Inc

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- Cirrus Logic Inc

- STMicroelectronics N V

- Broadcom Inc

- Analog Devices Inc

- Intel Corporation

Notable Milestones in Digital Signal Processor Industry Sector

- February 2022: STMicroelectronics launched Intelligent Sensor Processing Unit (ISPU), integrating a DSP for AI algorithms and MEMS sensors on a single silicon, significantly reducing size and power consumption by up to 80%, enabling edge decision-making.

- July 2021: Cirrus Logic announced its plan to acquire Lion Semiconductor for USD 335 million to expand its mixed-signal business, gain a product portfolio and IP for consumer and mobile applications, and enter new markets.

In-Depth Digital Signal Processor Industry Market Outlook

The Digital Signal Processor (DSP) industry is on an impressive growth trajectory, driven by the insatiable demand for intelligent processing power across burgeoning technological frontiers. Future market potential is deeply intertwined with the expansion of AI at the edge, the ubiquitous deployment of 5G networks, and the increasing sophistication of connected devices in the automotive and industrial sectors. Strategic opportunities lie in developing highly specialized DSP solutions for emerging applications like advanced driver-assistance systems, industrial automation, and next-generation communication infrastructure. The continuous innovation in chip architecture, focusing on enhanced performance, reduced power consumption, and seamless integration with other processing units, will be paramount. Companies that can effectively navigate the complexities of the semiconductor supply chain and cater to the growing demand for embedded AI capabilities are well-positioned for sustained success.

Digital Signal Processor Industry Segmentation

-

1. Core

- 1.1. Single-core

- 1.2. Multi-core

-

2. End-user Industry

- 2.1. Communication

- 2.2. Automotive

- 2.3. Consumer Electronics

- 2.4. Industrial

- 2.5. Aerospace & Defense

- 2.6. Healthcare

Digital Signal Processor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Digital Signal Processor Industry Regional Market Share

Geographic Coverage of Digital Signal Processor Industry

Digital Signal Processor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant developments in wireless infrastructure; Growing demand for VoIP and IP video; Rise in adoption of connected devices

- 3.3. Market Restrains

- 3.3.1 High complexity and initial development costs; Trade-off between performance

- 3.3.2 power consumption

- 3.3.3 and price

- 3.4. Market Trends

- 3.4.1. Growing Applications in Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core

- 5.1.1. Single-core

- 5.1.2. Multi-core

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Communication

- 5.2.2. Automotive

- 5.2.3. Consumer Electronics

- 5.2.4. Industrial

- 5.2.5. Aerospace & Defense

- 5.2.6. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Core

- 6. North America Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core

- 6.1.1. Single-core

- 6.1.2. Multi-core

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Communication

- 6.2.2. Automotive

- 6.2.3. Consumer Electronics

- 6.2.4. Industrial

- 6.2.5. Aerospace & Defense

- 6.2.6. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Core

- 7. Europe Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core

- 7.1.1. Single-core

- 7.1.2. Multi-core

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Communication

- 7.2.2. Automotive

- 7.2.3. Consumer Electronics

- 7.2.4. Industrial

- 7.2.5. Aerospace & Defense

- 7.2.6. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Core

- 8. Asia Pacific Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core

- 8.1.1. Single-core

- 8.1.2. Multi-core

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Communication

- 8.2.2. Automotive

- 8.2.3. Consumer Electronics

- 8.2.4. Industrial

- 8.2.5. Aerospace & Defense

- 8.2.6. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Core

- 9. Rest of the World Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core

- 9.1.1. Single-core

- 9.1.2. Multi-core

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Communication

- 9.2.2. Automotive

- 9.2.3. Consumer Electronics

- 9.2.4. Industrial

- 9.2.5. Aerospace & Defense

- 9.2.6. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Core

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Renesas Electronics Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors NV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toshiba Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Xilinx Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Texas Instruments Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cirrus Logic Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 STMicroelectronics N V

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Broadcom Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Analog Devices Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Digital Signal Processor Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 3: North America Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 4: North America Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 9: Europe Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 10: Europe Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 15: Asia Pacific Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 16: Asia Pacific Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 21: Rest of the World Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 22: Rest of the World Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 2: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Digital Signal Processor Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 5: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 8: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 11: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 14: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Signal Processor Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Digital Signal Processor Industry?

Key companies in the market include Infineon Technologies AG, Renesas Electronics Corp, NXP Semiconductors NV, Toshiba Corp, Xilinx Inc, Texas Instruments Inc, Samsung Electronics Co Ltd, Cirrus Logic Inc *List Not Exhaustive, STMicroelectronics N V, Broadcom Inc, Analog Devices Inc, Intel Corporation.

3. What are the main segments of the Digital Signal Processor Industry?

The market segments include Core, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Significant developments in wireless infrastructure; Growing demand for VoIP and IP video; Rise in adoption of connected devices.

6. What are the notable trends driving market growth?

Growing Applications in Automotive Industry.

7. Are there any restraints impacting market growth?

High complexity and initial development costs; Trade-off between performance. power consumption. and price.

8. Can you provide examples of recent developments in the market?

In February 2022, STMicroelectronics launched Intelligent Sensor Processing Unit (ISPU), which combines a DSP suitable for running AI algorithms and MEMS sensor on the same silicon. Apart from reducing the size of system-in-package devices and power consumption by up to 80%, merging sensors and AI poses electronic decision-making in the application Edge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Signal Processor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Signal Processor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Signal Processor Industry?

To stay informed about further developments, trends, and reports in the Digital Signal Processor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence