Key Insights

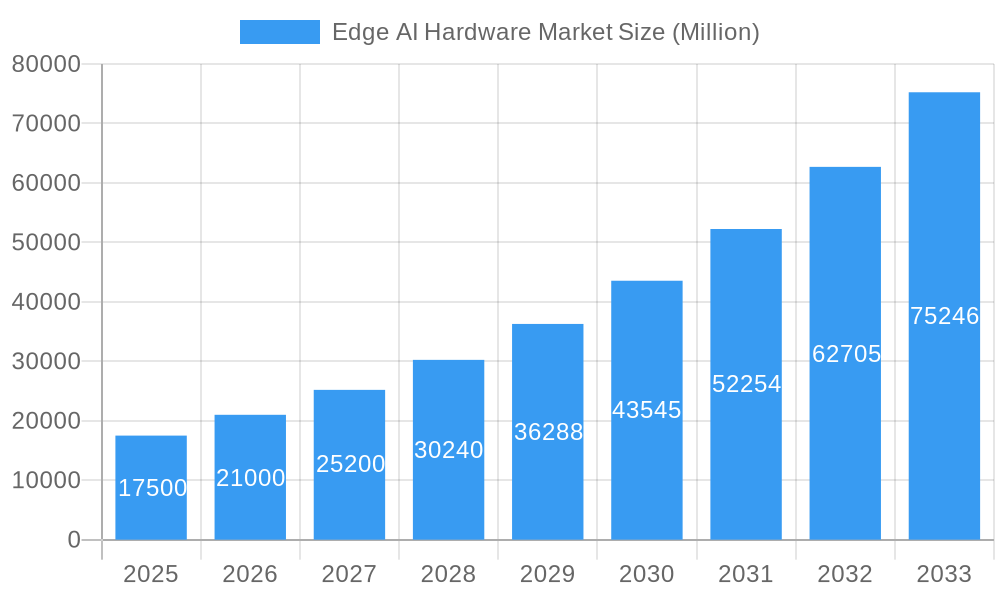

The global Edge AI Hardware Market is poised for explosive growth, projected to reach an estimated market size of $17,500 million by 2025, driven by a remarkable Compound Annual Growth Rate (CAGR) of 19.85%. This significant expansion is fueled by the escalating demand for real-time data processing and intelligent decision-making at the point of data generation. Key growth drivers include the proliferation of IoT devices, the increasing adoption of AI in autonomous systems such as vehicles and robots, and the need for enhanced consumer electronics with advanced functionalities. The market's trajectory is also significantly influenced by the continuous innovation in processor technologies, with CPUs, GPUs, FPGAs, and ASICs all playing crucial roles in enabling efficient AI computations at the edge. Consumer demand for smarter, more responsive devices like smartphones, wearables, and smart speakers directly translates into a robust need for powerful edge AI hardware. Furthermore, the integration of AI in critical sectors like healthcare for remote diagnostics and manufacturing for predictive maintenance underscores the transformative potential of this technology.

Edge AI Hardware Market Market Size (In Billion)

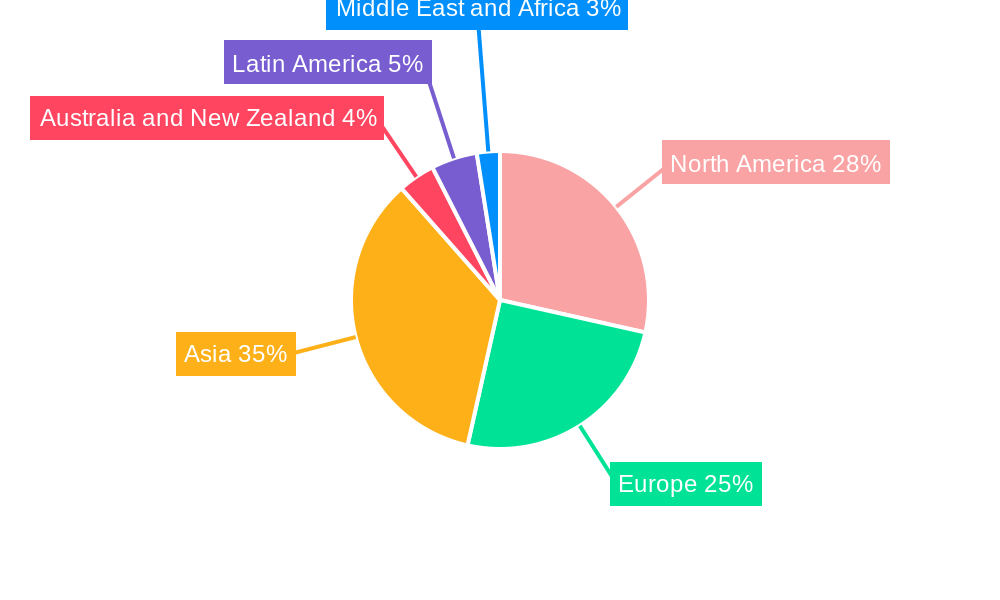

The market's robust growth is further supported by evolving industry trends, including the development of specialized AI chips optimized for low power consumption and high performance, and the increasing deployment of edge AI solutions in areas where latency is a critical concern, such as industrial automation and smart city infrastructure. However, certain restraints, such as the initial high cost of specialized edge AI hardware and the complexity of managing distributed AI systems, need to be addressed to fully unlock the market's potential. Geographically, the market is expected to witness significant contributions from North America and Asia, driven by strong technological innovation and high adoption rates in both consumer and industrial sectors. The diverse range of end-user industries, from government and automotive to healthcare and consumer electronics, highlights the pervasive and essential nature of edge AI hardware in shaping the future of technology and intelligent systems.

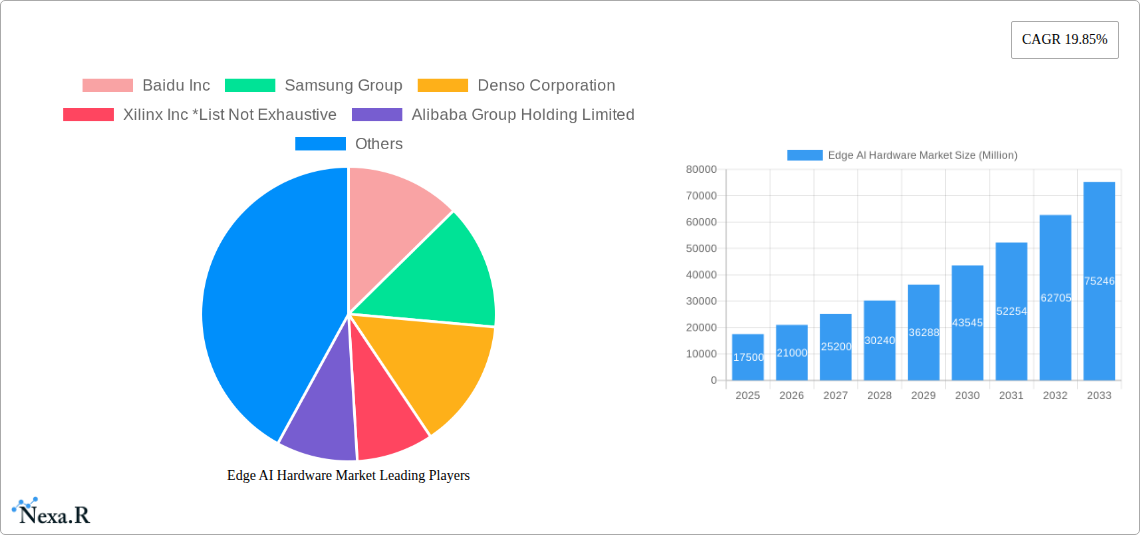

Edge AI Hardware Market Company Market Share

Edge AI Hardware Market: Unlocking Intelligent Edge Processing for Enhanced Performance and Scalability

This comprehensive report delves into the dynamic Edge AI Hardware Market, forecasting significant growth driven by the increasing demand for real-time data processing, reduced latency, and enhanced privacy at the edge. We analyze the market's evolution from 2019 to 2033, with a base year of 2025, providing in-depth insights into edge AI chipsets, edge AI processors, and edge AI solutions. This report covers key segments including CPUs, GPUs, FPGAs, and ASICs for processors, and smartphones, cameras, robots, wearables, smart speakers, and other devices for hardware. Furthermore, we examine the impact across diverse end-user industries such as government, real estate, consumer electronics, automotive, transportation, healthcare, manufacturing, and others. The study will present all values in Million units.

Edge AI Hardware Market Dynamics & Structure

The Edge AI Hardware Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and intense competition. Market concentration is influenced by the significant R&D investments required for advanced silicon development, leading to dominance by a few key players, but also fostering innovation through specialized chip designers. Technological innovation is the primary driver, with continuous advancements in processor architectures, power efficiency, and miniaturization enabling the deployment of AI capabilities on increasingly diverse edge devices. Regulatory frameworks, particularly concerning data privacy and security, indirectly shape the market by encouraging localized processing, thus bolstering demand for edge AI hardware. Competitive product substitutes include cloud-based AI processing and traditional embedded systems that lack sophisticated AI capabilities, highlighting the need for edge AI hardware to offer superior performance and cost-effectiveness. End-user demographics are shifting towards greater adoption across various sectors, from connected vehicles demanding low-latency decision-making to smart factories requiring real-time anomaly detection. Mergers and acquisitions (M&A) trends are active, with larger technology firms acquiring specialized AI hardware startups to bolster their portfolios and secure competitive advantages in the rapidly expanding edge computing hardware space.

- Market Concentration: Dominated by a few global semiconductor giants with substantial R&D budgets, but with growing opportunities for niche players.

- Technological Innovation Drivers: Demand for real-time AI inference, low latency, power efficiency, and miniaturization.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR, CCPA) drive decentralized processing, boosting edge AI.

- Competitive Product Substitutes: Cloud AI, traditional embedded systems.

- End-User Demographics: Rapid adoption in automotive, healthcare, manufacturing, and consumer electronics.

- M&A Trends: Strategic acquisitions of AI chip startups by larger tech companies.

Edge AI Hardware Market Growth Trends & Insights

The Edge AI Hardware Market is poised for remarkable expansion, driven by a confluence of technological advancements and escalating demand for decentralized intelligence. The market size evolution is projected to witness a substantial Compound Annual Growth Rate (CAGR) during the forecast period of 2025–2033, fueled by the increasing integration of AI into everyday devices and industrial applications. Adoption rates are accelerating as businesses and consumers recognize the tangible benefits of real-time processing at the edge, including enhanced responsiveness, improved security, and reduced operational costs. Technological disruptions are continuously reshaping the landscape, with the development of more powerful yet power-efficient processors like specialized ASICs and advanced GPUs specifically designed for AI inference at the edge. Consumer behavior shifts are also playing a crucial role; for instance, the demand for personalized experiences in smart homes and the need for proactive safety features in autonomous vehicles are directly translating into increased deployment of edge AI hardware. The market penetration of edge AI capabilities is expected to surge as costs decrease and performance benchmarks are continuously raised. For example, the burgeoning AI camera market and the expanding robotics industry are significant contributors to this growth trajectory. Furthermore, the increasing adoption of edge AI in healthcare for diagnostics and remote patient monitoring, and in automotive AI hardware for advanced driver-assistance systems (ADAS) and infotainment, underscores the pervasive influence of edge AI across critical sectors. The analysis will leverage detailed market sizing data, including projected unit shipments in Million units for various edge AI chip types and edge AI device categories, to provide a granular understanding of market dynamics. The historical period (2019–2024) provides a baseline for understanding the nascent stages of edge AI adoption, while the forecast period (2025–2033) illuminates the exponential growth phase driven by ongoing innovation and wider market acceptance of edge computing solutions. The report will also explore the impact of specific edge AI processor architectures and the growing importance of AI accelerators in maximizing efficiency and performance for a wide array of edge applications, from smart city infrastructure to industrial IoT.

Dominant Regions, Countries, or Segments in Edge AI Hardware Market

The Edge AI Hardware Market's dominance is multifaceted, with significant growth drivers emanating from specific regions, countries, and product segments. North America, particularly the United States, is a leading region owing to its robust technological infrastructure, substantial investment in AI research and development, and the early adoption of advanced technologies in sectors like automotive and consumer electronics. The country’s proactive approach to innovation and supportive regulatory environment for emerging technologies further solidify its position. Within the processor segment, ASICs (Application-Specific Integrated Circuits) are emerging as a dominant force. Their tailored design for specific AI tasks offers unparalleled efficiency and performance, making them ideal for power-constrained edge devices. This is closely followed by GPUs (Graphics Processing Units), which continue to leverage their parallel processing capabilities for complex AI workloads at the edge, particularly in applications like advanced computer vision and machine learning inference. The Automotive end-user industry stands out as a primary growth engine. The relentless pursuit of autonomous driving, connected car features, and advanced driver-assistance systems (ADAS) necessitates on-device AI processing for real-time decision-making, low latency, and enhanced safety. This translates into substantial demand for specialized automotive AI hardware. The Consumer Electronics sector also plays a pivotal role, with the proliferation of AI-powered smartphones, wearables, and smart speakers driving the adoption of compact and efficient edge AI processors. The increasing sophistication of features like voice recognition, facial recognition, and predictive analytics directly fuels the demand for edge AI hardware solutions. Furthermore, the Manufacturing sector is increasingly leveraging edge AI for predictive maintenance, quality control, and robotics automation, creating a significant market for industrial-grade edge AI hardware. The Cameras segment, particularly smart surveillance cameras with on-board AI capabilities for object detection and analysis, represents another strong contributor. Robots equipped with AI for navigation, interaction, and task execution are also significant adopters of edge AI hardware. The report will provide granular market share data for each processor type, device category, and end-user industry, along with projected growth rates, to offer a comprehensive understanding of the market's dominant forces.

- Dominant Regions: North America (especially the USA), Europe, and Asia-Pacific (driven by China and South Korea).

- Dominant Countries: United States, China, Germany, Japan, South Korea.

- Dominant Processor Segment: ASICs and GPUs, followed by FPGAs for specialized applications.

- Dominant Device Segment: Smartphones, Automotive Systems, Cameras, and Industrial Robots.

- Dominant End-User Industry: Automotive, Consumer Electronics, Manufacturing, and Healthcare.

- Key Drivers: Autonomous driving, IoT proliferation, smart city initiatives, industrial automation, demand for real-time analytics.

Edge AI Hardware Market Product Landscape

The Edge AI Hardware Market is characterized by a rapid evolution of product innovations focused on delivering high performance, low power consumption, and compact form factors. Product differentiation hinges on specialized architectures tailored for AI inference at the edge. This includes the development of highly efficient ASICs designed for specific neural network models, offering significant power savings and speed advantages. GPUs, while more general-purpose, are also being optimized for edge AI with reduced power envelopes and enhanced inference capabilities. FPGAs offer flexibility and reconfigurability for rapidly evolving AI algorithms, making them suitable for research and development as well as niche applications. The performance metrics that define competitive products include inference speed (e.g., TOPS - Tera Operations Per Second), power efficiency (e.g., TOPS/Watt), latency, and memory bandwidth. Applications span from real-time object detection in smart cameras and facial recognition in security systems to predictive diagnostics in healthcare devices and advanced driver-assistance systems in vehicles. Unique selling propositions often revolve around integrated AI processing capabilities that eliminate the need for constant cloud connectivity, thereby enhancing privacy and enabling offline functionality. Technological advancements such as novel memory architectures and specialized instruction sets are continuously improving the efficiency of edge AI inference.

Key Drivers, Barriers & Challenges in Edge AI Hardware Market

Key Drivers:

The Edge AI Hardware Market is propelled by several powerful forces. The relentless demand for real-time data processing and reduced latency in applications like autonomous vehicles, industrial automation, and real-time analytics is a primary driver. The proliferation of IoT devices, generating vast amounts of data at the edge, necessitates local processing capabilities. Growing concerns over data privacy and security further incentivize decentralized processing, keeping sensitive information on-device. Significant investments in AI research and development by leading technology companies are leading to continuous innovation in more powerful and efficient edge AI chips.

- Real-time data processing needs: Critical for autonomous systems and time-sensitive applications.

- IoT device expansion: Generating massive data volumes requiring local analysis.

- Data privacy and security concerns: Driving on-device processing to protect sensitive information.

- Technological advancements: Continuous innovation in AI chip design and efficiency.

Barriers & Challenges:

Despite its promising outlook, the Edge AI Hardware Market faces significant hurdles. The high cost of developing and manufacturing cutting-edge AI silicon can be a barrier to entry for smaller companies and can lead to higher initial costs for end-users. Power consumption remains a critical challenge, especially for battery-operated edge devices, requiring ongoing innovation in energy-efficient architectures. The rapid pace of technological change means that hardware can become obsolete quickly, posing a challenge for long-term investments. Furthermore, the lack of standardized development tools and frameworks can complicate the deployment of AI models across different edge hardware platforms. Supply chain disruptions can also impact the availability and cost of essential components.

- High development and manufacturing costs: Leading to increased hardware prices.

- Power consumption limitations: Especially for battery-powered edge devices.

- Rapid technological obsolescence: Requiring frequent hardware upgrades.

- Fragmentation in development tools and standards: Complicating deployment.

- Supply chain vulnerabilities: Potential for component shortages and price volatility.

Emerging Opportunities in Edge AI Hardware Market

Emerging opportunities in the Edge AI Hardware Market are vast and span across numerous innovative applications and untapped markets. The expansion of smart cities, with their interconnected infrastructure for traffic management, public safety, and environmental monitoring, presents a significant growth avenue for edge AI hardware in sensors and intelligent devices. The healthcare sector is witnessing a surge in demand for edge AI in remote patient monitoring devices, portable diagnostic tools, and AI-assisted medical imaging, all requiring specialized, low-power hardware. The industrial IoT (IIoT) landscape continues to evolve, with edge AI offering predictive maintenance, quality control, and worker safety solutions in manufacturing and logistics. The metaverse and extended reality (XR) applications are also creating new demands for low-latency, high-performance edge AI hardware capable of real-time rendering and interactive experiences. Furthermore, the increasing focus on sustainability and energy efficiency is driving the development of specialized edge AI chips optimized for minimal power consumption, opening up opportunities in battery-powered devices and remote deployments.

Growth Accelerators in the Edge AI Hardware Market Industry

Several key factors are acting as significant growth accelerators for the Edge AI Hardware Market. Continuous technological breakthroughs in semiconductor design, such as novel AI-specific architectures and advanced packaging techniques, are enabling the creation of more powerful and efficient edge AI processors. Strategic partnerships between semiconductor manufacturers, AI software developers, and system integrators are crucial for fostering ecosystem development and accelerating product adoption. Market expansion strategies, including increased focus on specific verticals like automotive, healthcare, and industrial automation, are driving tailored solutions and boosting demand. The growing trend towards edge-native AI models, optimized for deployment directly on edge hardware, further solidifies the market's growth trajectory. Moreover, the increasing availability of open-source AI frameworks and development tools is lowering the barrier to entry for developers, leading to a wider range of innovative edge AI applications.

Key Players Shaping the Edge AI Hardware Market Market

- Baidu Inc

- Samsung Group

- Denso Corporation

- Xilinx Inc

- Alibaba Group Holding Limited

- Alphabet Inc

- Continental AG

- Qualcomm Incorporated

- Advanced Micro Devices Inc

- Amazon com Inc

- Robert Bosch GmbH

- KALRAY Corporation

- Huawei Technologies Co Ltd

- MediaTek Inc

- Nvidia Corporation

- Apple Inc

- Intel Corporation

Notable Milestones in Edge AI Hardware Market Sector

- November 2022: Lumen Technologies began expanding its portfolio of Edge Computing Solutions into the Asia-Pacific Region, including its Edge Bare Metal pay-as-you-go hardware solution for servers, taking advantage of sites in Singapore and Japan.

- October 2022: Kneron bagged USD 50 million in funding for next-gen AI hardware solutions. The company plans to use the funds to accelerate its research and development to produce next-gen AI inference modules. Kneron anticipates increased adoption of on-device edge AI technology in the future. This involves placing AI computing power onto devices that include hardware rather than within cloud software.

- August 2022: Stanford University engineers created a more efficient and flexible AI chip suited to power AI in tiny edge devices. The engineers' chip, called NeuRRAM, is a novel resistive random-access memory (RRAM) chip that innovates how current chips process and store data.

In-Depth Edge AI Hardware Market Market Outlook

The future outlook for the Edge AI Hardware Market is exceptionally promising, driven by sustained innovation and broadening adoption across critical industries. Growth accelerators, including the relentless pursuit of autonomous systems, the pervasive expansion of IoT, and the imperative for enhanced data privacy, will continue to fuel demand for sophisticated edge AI solutions. Strategic partnerships between leading technology firms and specialized hardware developers will be instrumental in creating integrated ecosystems that simplify development and deployment. Market expansion into emerging economies and untapped verticals will unlock new revenue streams. The ongoing miniaturization and power efficiency advancements in AI processors will enable a new generation of intelligent, interconnected devices, further solidifying the indispensable role of edge AI hardware in shaping our technological future. The market is on a trajectory of exponential growth, promising transformative capabilities across consumer, industrial, and enterprise sectors.

Edge AI Hardware Market Segmentation

-

1. Processor

- 1.1. CPU

- 1.2. GPU

- 1.3. FPGA

- 1.4. ASICs

-

2. Device

- 2.1. Smartphones

- 2.2. Cameras

- 2.3. Robots

- 2.4. Wearables

- 2.5. Smart Speaker

- 2.6. Other Devices

-

3. End-User Industry

- 3.1. Government

- 3.2. Real Estate

- 3.3. Consumer Electronics

- 3.4. Automotive

- 3.5. Transportation

- 3.6. Healthcare

- 3.7. Manufacturing

- 3.8. Others

Edge AI Hardware Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Edge AI Hardware Market Regional Market Share

Geographic Coverage of Edge AI Hardware Market

Edge AI Hardware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of AI in Edge Devices; Increasing Demand for Smart Homes and Smart Cities

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Edge AI Devices

- 3.4. Market Trends

- 3.4.1. Increase Demand for Smart Homes and Smart Cities is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Processor

- 5.1.1. CPU

- 5.1.2. GPU

- 5.1.3. FPGA

- 5.1.4. ASICs

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Smartphones

- 5.2.2. Cameras

- 5.2.3. Robots

- 5.2.4. Wearables

- 5.2.5. Smart Speaker

- 5.2.6. Other Devices

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Government

- 5.3.2. Real Estate

- 5.3.3. Consumer Electronics

- 5.3.4. Automotive

- 5.3.5. Transportation

- 5.3.6. Healthcare

- 5.3.7. Manufacturing

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Processor

- 6. North America Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Processor

- 6.1.1. CPU

- 6.1.2. GPU

- 6.1.3. FPGA

- 6.1.4. ASICs

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Smartphones

- 6.2.2. Cameras

- 6.2.3. Robots

- 6.2.4. Wearables

- 6.2.5. Smart Speaker

- 6.2.6. Other Devices

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Government

- 6.3.2. Real Estate

- 6.3.3. Consumer Electronics

- 6.3.4. Automotive

- 6.3.5. Transportation

- 6.3.6. Healthcare

- 6.3.7. Manufacturing

- 6.3.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Processor

- 7. Europe Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Processor

- 7.1.1. CPU

- 7.1.2. GPU

- 7.1.3. FPGA

- 7.1.4. ASICs

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Smartphones

- 7.2.2. Cameras

- 7.2.3. Robots

- 7.2.4. Wearables

- 7.2.5. Smart Speaker

- 7.2.6. Other Devices

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Government

- 7.3.2. Real Estate

- 7.3.3. Consumer Electronics

- 7.3.4. Automotive

- 7.3.5. Transportation

- 7.3.6. Healthcare

- 7.3.7. Manufacturing

- 7.3.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Processor

- 8. Asia Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Processor

- 8.1.1. CPU

- 8.1.2. GPU

- 8.1.3. FPGA

- 8.1.4. ASICs

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Smartphones

- 8.2.2. Cameras

- 8.2.3. Robots

- 8.2.4. Wearables

- 8.2.5. Smart Speaker

- 8.2.6. Other Devices

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Government

- 8.3.2. Real Estate

- 8.3.3. Consumer Electronics

- 8.3.4. Automotive

- 8.3.5. Transportation

- 8.3.6. Healthcare

- 8.3.7. Manufacturing

- 8.3.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Processor

- 9. Australia and New Zealand Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Processor

- 9.1.1. CPU

- 9.1.2. GPU

- 9.1.3. FPGA

- 9.1.4. ASICs

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Smartphones

- 9.2.2. Cameras

- 9.2.3. Robots

- 9.2.4. Wearables

- 9.2.5. Smart Speaker

- 9.2.6. Other Devices

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Government

- 9.3.2. Real Estate

- 9.3.3. Consumer Electronics

- 9.3.4. Automotive

- 9.3.5. Transportation

- 9.3.6. Healthcare

- 9.3.7. Manufacturing

- 9.3.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Processor

- 10. Latin America Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Processor

- 10.1.1. CPU

- 10.1.2. GPU

- 10.1.3. FPGA

- 10.1.4. ASICs

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Smartphones

- 10.2.2. Cameras

- 10.2.3. Robots

- 10.2.4. Wearables

- 10.2.5. Smart Speaker

- 10.2.6. Other Devices

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Government

- 10.3.2. Real Estate

- 10.3.3. Consumer Electronics

- 10.3.4. Automotive

- 10.3.5. Transportation

- 10.3.6. Healthcare

- 10.3.7. Manufacturing

- 10.3.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Processor

- 11. Middle East and Africa Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Processor

- 11.1.1. CPU

- 11.1.2. GPU

- 11.1.3. FPGA

- 11.1.4. ASICs

- 11.2. Market Analysis, Insights and Forecast - by Device

- 11.2.1. Smartphones

- 11.2.2. Cameras

- 11.2.3. Robots

- 11.2.4. Wearables

- 11.2.5. Smart Speaker

- 11.2.6. Other Devices

- 11.3. Market Analysis, Insights and Forecast - by End-User Industry

- 11.3.1. Government

- 11.3.2. Real Estate

- 11.3.3. Consumer Electronics

- 11.3.4. Automotive

- 11.3.5. Transportation

- 11.3.6. Healthcare

- 11.3.7. Manufacturing

- 11.3.8. Others

- 11.1. Market Analysis, Insights and Forecast - by Processor

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Baidu Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Samsung Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Denso Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Xilinx Inc *List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alibaba Group Holding Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alphabet Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Continental AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Qualcomm Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Advanced Micro Devices Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Amazon com Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Robert Bosch GmbH

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 KALRAY Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Huawei Technologies Co Ltd

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 MediaTek Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Nvidia Corporation

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Apple Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Intel Corporation

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.1 Baidu Inc

List of Figures

- Figure 1: Global Edge AI Hardware Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 3: North America Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 4: North America Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 5: North America Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 6: North America Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 7: North America Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 11: Europe Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 12: Europe Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 13: Europe Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 14: Europe Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 15: Europe Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 19: Asia Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 20: Asia Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 21: Asia Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 22: Asia Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 23: Asia Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 27: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 28: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 29: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 30: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 31: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 35: Latin America Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 36: Latin America Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 37: Latin America Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 38: Latin America Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 39: Latin America Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Latin America Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Latin America Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 43: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 44: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 45: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 46: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 47: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 48: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 2: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 3: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Edge AI Hardware Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 6: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 7: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 10: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 11: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 14: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 15: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 18: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 19: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 22: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 23: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 26: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 27: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Edge AI Hardware Market?

The projected CAGR is approximately 17.6%.

2. Which companies are prominent players in the Edge AI Hardware Market?

Key companies in the market include Baidu Inc, Samsung Group, Denso Corporation, Xilinx Inc *List Not Exhaustive, Alibaba Group Holding Limited, Alphabet Inc, Continental AG, Qualcomm Incorporated, Advanced Micro Devices Inc, Amazon com Inc, Robert Bosch GmbH, KALRAY Corporation, Huawei Technologies Co Ltd, MediaTek Inc, Nvidia Corporation, Apple Inc, Intel Corporation.

3. What are the main segments of the Edge AI Hardware Market?

The market segments include Processor, Device, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of AI in Edge Devices; Increasing Demand for Smart Homes and Smart Cities.

6. What are the notable trends driving market growth?

Increase Demand for Smart Homes and Smart Cities is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Security Concerns Related to Edge AI Devices.

8. Can you provide examples of recent developments in the market?

November 2022 - Network solutions provider Lumen Technologies began expanding its portfolio of Edge Computing Solutions into the Asia-Pacific Region, including its Edge Bare Metal pay-as-you-go hardware solution for servers, taking advantage of sites in Singapore and Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Edge AI Hardware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Edge AI Hardware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Edge AI Hardware Market?

To stay informed about further developments, trends, and reports in the Edge AI Hardware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence