Key Insights

The European Industrial Computed Tomography (ICT) market is poised for significant expansion, driven by its critical role in quality control and non-destructive testing (NDT) across key manufacturing sectors including automotive, aerospace, and energy. As of the base year 2025, the market is estimated at 404.38 million. The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 6. This growth is propelled by the increasing complexity of manufactured components, the drive for enhanced production efficiency, and cost reduction initiatives. Technological advancements in ICT, such as superior image resolution, accelerated scanning capabilities, and intuitive software, are further stimulating market penetration. Europe's robust manufacturing ecosystem and commitment to precision engineering and innovation make it a prime region for ICT adoption.

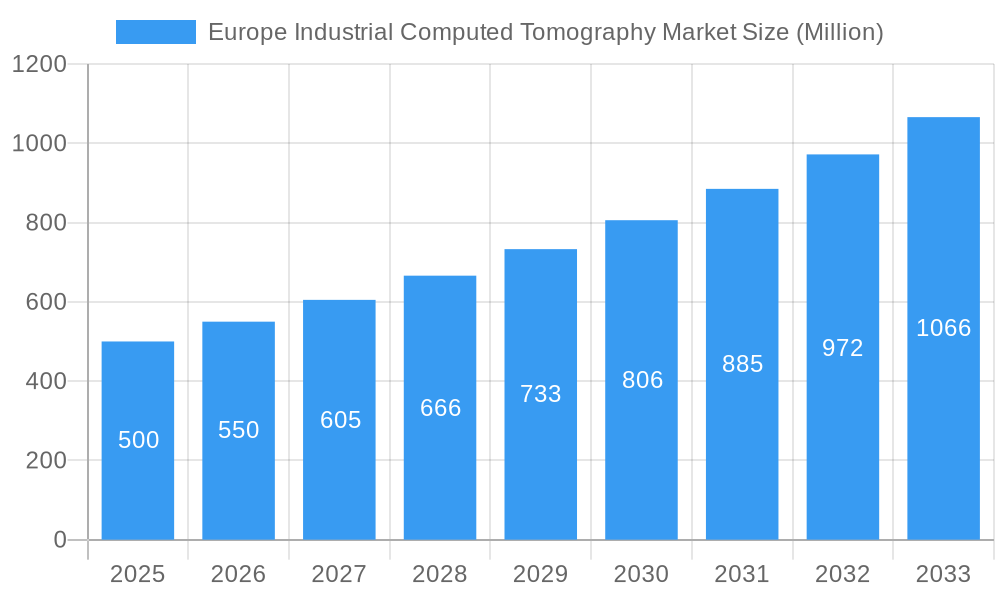

Europe Industrial Computed Tomography Market Market Size (In Million)

The ongoing integration of Industry 4.0 principles, including automation and digitalization, is a key driver for sustained growth. Stringent product safety standards and regulatory compliance requirements will also bolster demand for advanced ICT solutions. Innovations in AI-powered data analysis and sophisticated algorithms will unlock novel applications, thereby amplifying the value proposition of ICT for European manufacturers.

Europe Industrial Computed Tomography Market Company Market Share

Europe Industrial Computed Tomography Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Industrial Computed Tomography (CT) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by application (Flaw Detection and Inspection, Failure Analysis, Assembly Analysis, Other Applications), end-user industry (Aerospace, Automotive, Electronics, Oil and Gas, Other End-user Industries), and country (United Kingdom, Germany, France, Italy, Rest of Europe). The report's findings are invaluable for industry professionals, investors, and strategic decision-makers seeking a comprehensive understanding of this dynamic market. The market size is presented in Million units.

Europe Industrial Computed Tomography Market Dynamics & Structure

The European industrial computed tomography market exhibits a moderately concentrated structure, with key players like Zeiss International, Wenzel Group, and Baker Hughes Company holding significant market share. Technological advancements, particularly in microfocus X-ray CT and software algorithms, are primary growth drivers. Stringent quality control regulations across various end-user industries, especially aerospace and automotive, fuel demand. Competitive substitutes, such as ultrasonic testing and magnetic particle inspection, exist but offer limited resolution and detail compared to CT. The market witnesses consistent M&A activity, with xx deals recorded between 2019 and 2024, primarily driven by consolidation and technological expansion. End-user demographics indicate a high concentration in technologically advanced sectors, with ongoing adoption in emerging applications.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Continuous advancements in X-ray sources, detectors, and reconstruction algorithms drive higher resolution and faster scan times.

- Regulatory Framework: Stringent quality control standards in aerospace and automotive sectors stimulate demand for non-destructive testing (NDT) techniques like CT.

- Competitive Substitutes: Ultrasonic testing and magnetic particle inspection pose limited competition due to inferior resolution.

- M&A Trends: xx M&A deals recorded between 2019 and 2024, indicating market consolidation and expansion.

- Innovation Barriers: High initial investment costs and specialized expertise required for operation and interpretation.

Europe Industrial Computed Tomography Market Growth Trends & Insights

The European industrial computed tomography market witnessed a CAGR of xx% during 2019-2024, reaching a market size of xx Million units in 2024. This growth is attributed to rising demand for quality control and assurance in manufacturing across various sectors. The adoption rate of CT technology is steadily increasing, driven by its superior resolution and detailed analysis capabilities compared to traditional methods. Technological disruptions, such as the introduction of advanced reconstruction algorithms and compact systems, are further accelerating market growth. Shifts in consumer behavior towards higher-quality products and increased emphasis on product safety are driving demand. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Market penetration is expected to increase significantly across various end-user industries, particularly in aerospace and automotive.

Dominant Regions, Countries, or Segments in Europe Industrial Computed Tomography Market

Germany and the United Kingdom currently represent the largest segments of the European industrial computed tomography market, driven by established manufacturing hubs and robust automotive and aerospace sectors. The Flaw Detection and Inspection application segment holds the largest market share due to the widespread need for quality control in manufacturing. The automotive industry is a key end-user, accounting for xx% of the market.

- Key Drivers (Germany & UK):

- Established manufacturing base in automotive and aerospace sectors.

- Strong focus on quality control and product safety.

- Favorable government policies promoting technological adoption.

- Dominance Factors: High industrial output, technological advancements, and stringent regulatory frameworks.

- Growth Potential: Expanding applications in electronics and oil & gas industries.

Europe Industrial Computed Tomography Market Product Landscape

Recent advancements in industrial computed tomography include the development of more compact systems, such as the Zeiss Metrotom, which reduces space requirements and improves accessibility. The introduction of improved reconstruction algorithms increases image resolution and scan speed, leading to quicker analysis and improved productivity. Unique selling propositions of modern CT systems focus on ease of use, precision, non-destructive testing capabilities, and high-resolution imaging.

Key Drivers, Barriers & Challenges in Europe Industrial Computed Tomography Market

Key Drivers: The Europe Industrial Computed Tomography (CT) market is experiencing robust growth fueled by the escalating demand for advanced non-destructive testing (NDT) solutions across a diverse range of industries. This includes automotive, aerospace, electronics, and energy, where the need for precise quality control and defect detection is paramount. Technological advancements are playing a pivotal role, with manufacturers continuously introducing CT systems that offer higher resolutions, faster scan times, and improved data processing capabilities. Furthermore, increasingly stringent quality control regulations and standards imposed by industry bodies and governmental agencies are compelling businesses to adopt sophisticated inspection methods like industrial CT to ensure product integrity and safety.

Barriers & Challenges: Despite the positive growth trajectory, the market faces several significant barriers and challenges. The substantial initial investment required for acquiring industrial CT systems, coupled with ongoing maintenance and operational costs, can be a deterrent for smaller and medium-sized enterprises (SMEs). Moreover, the operation and interpretation of complex CT data necessitate specialized expertise and skilled personnel, leading to a talent gap in many organizations. Competition from alternative NDT methods, such as ultrasonic testing and X-ray radiography, which may offer lower entry costs or be perceived as simpler for certain applications, also presents a challenge. Additionally, the global supply chain disruptions, particularly impacting the procurement of critical and specialized components, have led to increased lead times and price volatility. For instance, these disruptions contributed to an estimated 10-15% increase in component prices during 2022, directly affecting the overall cost of CT equipment and services.

Emerging Opportunities in Europe Industrial Computed Tomography Market

The landscape of industrial CT in Europe is ripe with emerging opportunities, driven by innovation and evolving industrial demands. The increasing adoption of advanced materials, such as composites and high-performance alloys, alongside the rapid growth of additive manufacturing (3D printing), presents a significant boon for industrial CT. These technologies often require meticulous internal defect analysis, porosity assessment, and dimensional verification, areas where CT excels. The burgeoning electronics and medical device sectors are also major growth engines, with a continuous demand for high-resolution imaging to inspect miniaturized components, intricate circuitry, and complex medical implants. Furthermore, the ongoing development of artificial intelligence (AI) and machine learning (ML) algorithms for automated data analysis and defect recognition is set to revolutionize the field. These intelligent software solutions promise to enhance inspection efficiency, reduce the dependency on highly specialized human interpretation, and accelerate the entire quality assurance process.

Growth Accelerators in the Europe Industrial Computed Tomography Market Industry

Strategic partnerships between CT manufacturers and software developers are creating integrated solutions that improve efficiency and data analysis. The expansion into new markets, like renewable energy and advanced materials processing, further boosts growth. Ongoing technological innovation, such as the development of faster X-ray detectors and improved reconstruction algorithms, is a key accelerator for the market.

Key Players Shaping the Europe Industrial Computed Tomography Market Market

- Wenzel Group

- High Value Manufacturing Catapult

- Aegleteq Ltd

- Zeiss International

- Comet

- VJ Group Inc

- Hamamatsu Photonics

- Werth Inc

- Baker Hughes Company

Notable Milestones in Europe Industrial Computed Tomography Market Sector

- June 2021: Zeiss Company launched Zeiss Metrotom, an entry-level computed tomography product designed to make advanced CT inspection more accessible to a wider range of industrial users.

- May 2021: Nikon Metrology introduced a sophisticated new offset computed tomography reconstruction algorithm. This innovation significantly enhanced image resolution and improved scan speeds, allowing for more detailed and efficient analysis of complex geometries.

- October 2022: Volume Graphics introduced its latest software update, VGS7.0, featuring advanced AI-driven defect detection and quantification capabilities, further streamlining the analysis of industrial CT data.

- March 2023: A consortium of European research institutions announced a project focused on developing portable and cost-effective CT solutions for on-site inspection of critical infrastructure, aiming to broaden the application scope of the technology.

In-Depth Europe Industrial Computed Tomography Market Market Outlook

The European industrial computed tomography market is poised for continued growth, driven by technological advancements, increasing demand for quality control, and expansion into new applications. Strategic partnerships and investments in R&D are crucial for maintaining competitiveness. The market presents significant opportunities for companies focusing on innovative solutions, advanced software capabilities, and streamlined workflows. The long-term outlook is optimistic, anticipating sustained growth in the coming years.

Europe Industrial Computed Tomography Market Segmentation

-

1. Application

- 1.1. Flaw Detection and Inspection

- 1.2. Failure Analysis

- 1.3. Assembly Analysis

- 1.4. Other Applications

-

2. End User Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Electronics

- 2.4. Oil and Gas

- 2.5. Other End-user Industries

Europe Industrial Computed Tomography Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Industrial Computed Tomography Market Regional Market Share

Geographic Coverage of Europe Industrial Computed Tomography Market

Europe Industrial Computed Tomography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment

- 3.3. Market Restrains

- 3.3.1. High Product Cost

- 3.4. Market Trends

- 3.4.1. Aerospace to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Computed Tomography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Flaw Detection and Inspection

- 5.1.2. Failure Analysis

- 5.1.3. Assembly Analysis

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Electronics

- 5.2.4. Oil and Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wenzel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 High Value Manufacturing Catapult

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aegleteq Ltd *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zeiss International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VJ Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hamamatsu Photonics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Werth Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baker Hughes Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wenzel Group

List of Figures

- Figure 1: Europe Industrial Computed Tomography Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Computed Tomography Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 3: Europe Industrial Computed Tomography Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 6: Europe Industrial Computed Tomography Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Computed Tomography Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Industrial Computed Tomography Market?

Key companies in the market include Wenzel Group, High Value Manufacturing Catapult, Aegleteq Ltd *List Not Exhaustive, Zeiss International, Comet, VJ Group Inc, Hamamatsu Photonics, Werth Inc, Baker Hughes Company.

3. What are the main segments of the Europe Industrial Computed Tomography Market?

The market segments include Application, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 404.38 million as of 2022.

5. What are some drivers contributing to market growth?

Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment.

6. What are the notable trends driving market growth?

Aerospace to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Product Cost.

8. Can you provide examples of recent developments in the market?

June 2021 - Zeiss Company unveiled Zeiss Metrotom, its entry-level computed tomography product. The non-destructive inspection of components using this solution is at the entry level. Additionally, this system is a compact computed tomography system that yields precise results and is simple to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Computed Tomography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Computed Tomography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Computed Tomography Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Computed Tomography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence