Key Insights

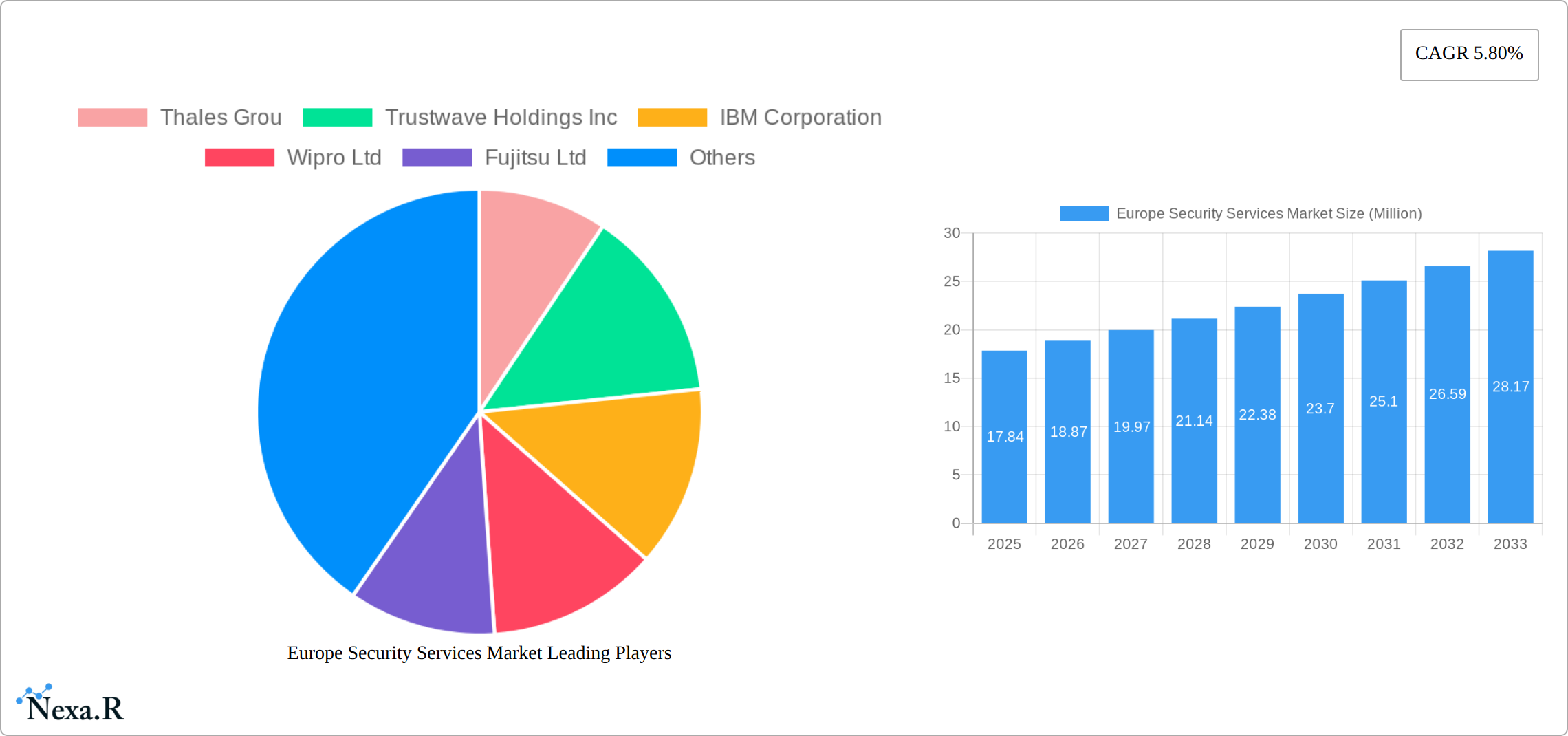

The Europe Security Services Market is poised for steady growth, with a projected market size of $17.84 million in 2025 and a compound annual growth rate (CAGR) of 5.80% through the forecast period ending in 2033. This growth trajectory is driven by increasing cybersecurity threats, stringent regulatory requirements, and the rising adoption of cloud-based security solutions across various industries. Key market drivers include the expansion of the IT and infrastructure sector, heightened security needs in government and industrial sectors, and the growing importance of data protection in healthcare and banking. Additionally, the market is influenced by technological advancements and the integration of AI and machine learning in security services, enhancing threat detection and response capabilities.

The market is segmented by mode of deployment, end-user industry, country, and service type. On-premise and cloud deployments are both significant, with cloud solutions gaining traction due to scalability and cost-effectiveness. End-user industries such as IT and infrastructure, government, industrial, healthcare, transportation and logistics, and banking are major contributors to market demand. Geographically, Germany, France, Italy, the United Kingdom, and other European countries are key markets. Service types include managed security services, professional security services, consulting services, and threat intelligence security services, each catering to different aspects of security needs. Leading companies such as Thales Group, IBM Corporation, Wipro Ltd, and Palo Alto Networks are at the forefront, continuously innovating to meet evolving security challenges.

Europe Security Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Security Services Market, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this rapidly evolving landscape. The market is segmented by deployment mode (on-premise, cloud), end-user industry (IT & Infrastructure, Government, Industrial, Healthcare, Transportation & Logistics, Banking, Others), country (United Kingdom, Germany, France, Italy, Spain), and service type (Managed Security Services, Professional Security Services, Consulting Services, Threat Intelligence Security Services). The market value is presented in million units.

Europe Security Services Market Dynamics & Structure

The European security services market is characterized by moderate concentration, with several large multinational players alongside a multitude of smaller, specialized firms. Technological innovation, particularly in areas like AI-driven threat detection and cloud-based security solutions, is a primary growth driver. Stringent data privacy regulations (GDPR, etc.) and increasing cybersecurity threats are shaping the market landscape. Mergers and acquisitions (M&A) activity is significant, with larger companies consolidating their market positions and expanding their service portfolios. Substitute products, such as open-source security tools, pose a competitive challenge, but the need for comprehensive, managed services often favors established players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Significant advancements in AI, ML, and cloud security are driving market expansion. Innovation barriers include high R&D costs and integration complexities.

- Regulatory Framework: GDPR and other data privacy regulations are major influences, driving demand for compliant solutions.

- M&A Activity: xx major M&A deals recorded between 2019-2024, demonstrating consolidation trends.

- End-User Demographics: Growing digitalization across all sectors increases demand for robust security solutions.

Europe Security Services Market Growth Trends & Insights

The European security services market demonstrated robust growth from 2019 to 2024, fueled by a surge in cyber threats, escalating data volumes, and the widespread adoption of cloud technologies. Market projections indicate a substantial expansion, reaching an estimated xx million by 2025, and maintaining a CAGR of xx% throughout the forecast period (2025-2033). This growth trajectory is primarily driven by the increasing adoption of cloud-based security solutions, heightened awareness of cybersecurity risks, and a noticeable shift in consumer behavior towards proactive security measures and integrated security solutions. The emergence of disruptive technologies, such as quantum computing and edge security, presents both significant opportunities and considerable challenges for market players.

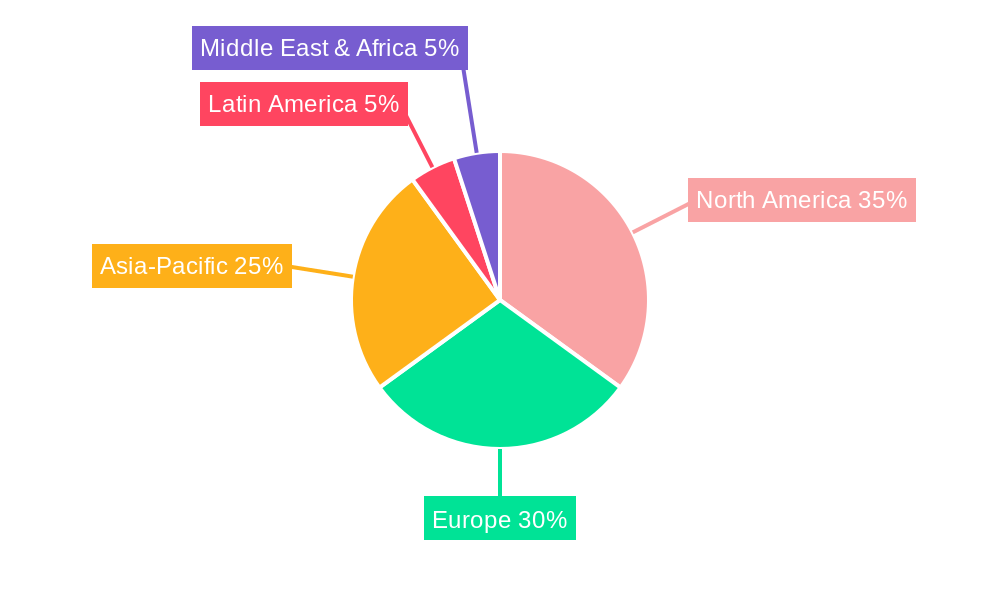

Dominant Regions, Countries, or Segments in Europe Security Services Market

The United Kingdom currently commands the largest market share within Europe, followed closely by Germany and France. This dominance is attributable to factors such as robust technological infrastructure, advanced digitalization initiatives, and well-established regulatory frameworks. Within the service landscape, Managed Security Services emerges as the leading segment, primarily due to its cost-effectiveness and comprehensive suite of security offerings. Cloud-based deployments are experiencing significantly faster growth rates compared to their on-premise counterparts, driven by enhanced scalability and cost-efficiency. The IT and Infrastructure sector represents the most substantial end-user industry, reflecting the heightened security concerns prevalent within this digitally reliant segment.

- Key Drivers (UK): Strong digital infrastructure, high cybersecurity awareness among consumers and businesses, and a thriving technology sector.

- Key Drivers (Germany): Robust industrial base, increasing government investments in cybersecurity infrastructure, and stringent data privacy regulations (GDPR compliance).

- Key Drivers (France): Significant investments in national digital transformation initiatives, increasing cloud adoption across various sectors, and proactive government policies supporting cybersecurity.

- Dominant Segment (Service Type): Managed Security Services (xx% market share in 2024) due to its comprehensive and cost-effective approach.

- Dominant Segment (Deployment): Cloud deployment exhibits higher growth potential due to scalability, flexibility, and cost advantages.

- Dominant Segment (End-User): IT & Infrastructure due to heightened cybersecurity threats and pervasive digital reliance.

Europe Security Services Market Product Landscape

The market offers a wide range of security services, including threat intelligence, vulnerability management, incident response, security audits, and compliance consulting. Products are increasingly integrated and automated, leveraging AI and machine learning to enhance threat detection and response capabilities. Unique selling propositions focus on reducing operational costs, improving security posture, and ensuring regulatory compliance. Technological advancements, such as advanced threat analytics and zero-trust security models, are shaping the product landscape.

Key Drivers, Barriers & Challenges in Europe Security Services Market

Key Drivers: Rising cyberattacks, stringent data privacy regulations (GDPR), increasing adoption of cloud computing, growing awareness of cybersecurity risks, and government initiatives promoting cybersecurity investments.

Challenges: High initial investment costs for implementing security solutions, skills gap in cybersecurity professionals, and the complexity of integrating diverse security tools. Supply chain vulnerabilities, impacting the availability of hardware and software components, also present a challenge, potentially resulting in xx% delays in project implementation in 2025. Regulatory hurdles and intense competition further complicate market entry.

Emerging Opportunities in Europe Security Services Market

Emerging opportunities lie in the expansion of managed detection and response (MDR) services, adoption of AI-powered security solutions, and growth in the IoT security sector. Untapped markets exist within smaller and medium-sized enterprises (SMEs) that lack internal cybersecurity expertise. Growing demand for specialized security solutions for specific industries (e.g., healthcare, finance) presents further opportunities. The evolving landscape of remote work presents new challenges and opportunities for security providers.

Growth Accelerators in the Europe Security Services Market Industry

Technological breakthroughs in areas like AI and quantum computing are significant growth accelerators. Strategic partnerships between security providers and technology vendors are expanding market reach and improving service offerings. Government initiatives promoting cybersecurity awareness and investment are creating a favorable environment for market expansion. The increasing adoption of cloud technologies presents significant opportunities for growth within cloud-based security services.

Key Players Shaping the Europe Security Services Market Market

- Thales Group

- Trustwave Holdings Inc

- IBM Corporation

- Wipro Ltd

- Fujitsu Ltd

- Allied Universal

- Broadcom Inc

- Palo Alto Networks

- Digital Pathways Ltd

- G4S Limited

- SecurityHQ

- Cybaverse Ltd

- Fortra LLC

- Securitas Inc

Notable Milestones in Europe Security Services Market Sector

- August 2023: Fortra announced significant new integrations to its offensive security solutions, enhancing vulnerability management and penetration testing capabilities. This proactive approach improves overall security posture by enabling faster remediation before potential exploitation.

- June 2023: Thales Group launched a new, innovative data security platform as a service (DaaS), offering scalable data security solutions without the need for substantial hardware investments. This addresses the growing demand for efficient and flexible data protection in increasingly diverse cloud environments.

- [Add other relevant milestones with dates and brief descriptions]

In-Depth Europe Security Services Market Market Outlook

The Europe Security Services Market exhibits strong growth potential, driven by sustained investments in cybersecurity, technological advancements, and evolving regulatory landscapes. Strategic partnerships, focusing on integrated solutions and expanding into underserved markets (SMEs), present key opportunities for future market expansion. The continuous evolution of cyber threats necessitates ongoing innovation and adaptation, ensuring the long-term viability and growth of the market. The market is poised for sustained growth, exceeding xx million by 2033, driven primarily by increasing digitalization, stringent regulatory requirements and proactive security strategies adopted across industries.

Europe Security Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Services

- 1.2. Professional Security Services

- 1.3. Consulting Services

- 1.4. Threat Intelligence Security Services

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. IT and Infrastructure

- 3.2. Government

- 3.3. Industrial

- 3.4. Healthcare

- 3.5. Transportation and Logistics

- 3.6. Banking

- 3.7. Other End-User Industries

Europe Security Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Proliferation of Internet of Things (IoT) Devices; The Integration of Artificial Intelligence (AI) and Automation in Security Services; Increasing Investments by Organizations to Protect Against Country-sponsored Attacks

- 3.3. Market Restrains

- 3.3.1 Moderation

- 3.3.2 Privacy

- 3.3.3 accessibility & regulatory challenges

- 3.4. Market Trends

- 3.4.1. Cloud Adoption to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Services

- 5.1.2. Professional Security Services

- 5.1.3. Consulting Services

- 5.1.4. Threat Intelligence Security Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Infrastructure

- 5.3.2. Government

- 5.3.3. Industrial

- 5.3.4. Healthcare

- 5.3.5. Transportation and Logistics

- 5.3.6. Banking

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Germany Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Security Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Thales Grou

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Trustwave Holdings Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Wipro Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fujitsu Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Allied Universal

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Broadcom Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Palo Alto Networks

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Digital Pathways Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 G4S Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 SecurityHQ

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cybaverse Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Fortra LLC

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Securitas Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Thales Grou

List of Figures

- Figure 1: Europe Security Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Security Services Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Security Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Europe Security Services Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 4: Europe Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Security Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Security Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 15: Europe Security Services Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 16: Europe Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe Security Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Security Services Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Security Services Market?

Key companies in the market include Thales Grou, Trustwave Holdings Inc, IBM Corporation, Wipro Ltd, Fujitsu Ltd, Allied Universal, Broadcom Inc, Palo Alto Networks, Digital Pathways Ltd, G4S Limited, SecurityHQ, Cybaverse Ltd, Fortra LLC, Securitas Inc.

3. What are the main segments of the Europe Security Services Market?

The market segments include Service Type, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.84 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Proliferation of Internet of Things (IoT) Devices; The Integration of Artificial Intelligence (AI) and Automation in Security Services; Increasing Investments by Organizations to Protect Against Country-sponsored Attacks.

6. What are the notable trends driving market growth?

Cloud Adoption to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Moderation. Privacy. accessibility & regulatory challenges.

8. Can you provide examples of recent developments in the market?

August 2023: Fortra announced new integrations to its offensive security solutions. These integrations streamline the ability to manage vulnerabilities, conduct penetration testing, and conduct red teaming. By working together, the solutions leverage the same tactics threat actors employ to detect and exploit vulnerabilities in an organization's security posture. This proactive security strategy allows customers to identify and remediate vulnerabilities before they are used. The layered approach unifies the capabilities of each solution for a more comprehensive security evaluation, testing, and control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Security Services Market?

To stay informed about further developments, trends, and reports in the Europe Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence