Key Insights

The European sortation system market is set for significant growth, projected to reach $9.3 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This expansion is fueled by the surge in e-commerce and increasing parcel volumes. Key sectors like Food & Beverages and Pharmaceuticals are driving demand due to stringent handling needs and the imperative for error-free operations. Automation in retail logistics and evolving airport operations for baggage and cargo management are also contributing factors. Leading companies are investing in AI-powered sorting and robotics to enhance efficiency and accuracy, with a growing emphasis on adaptable, sophisticated sortation solutions across industries.

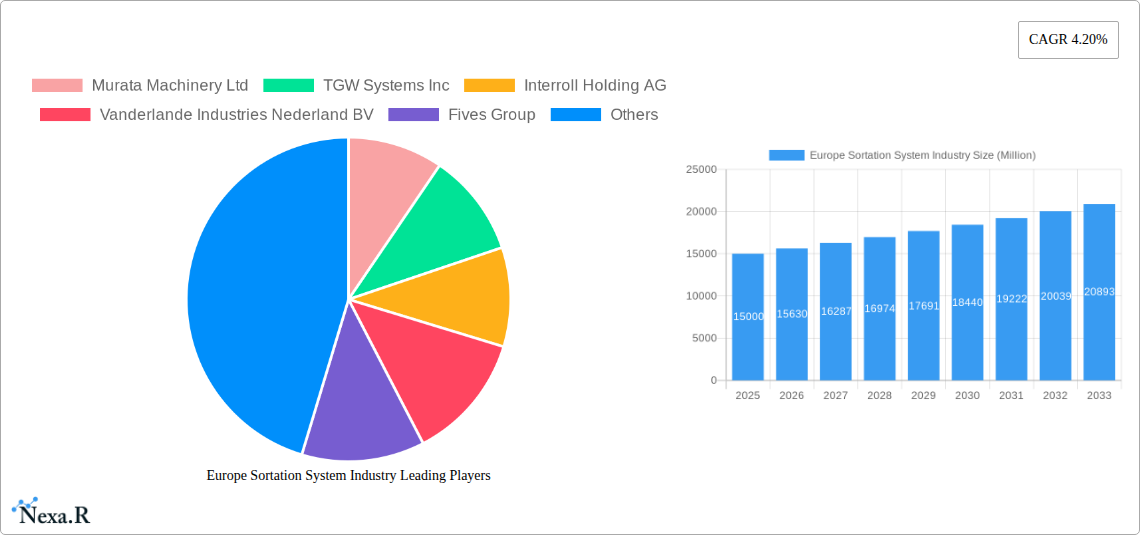

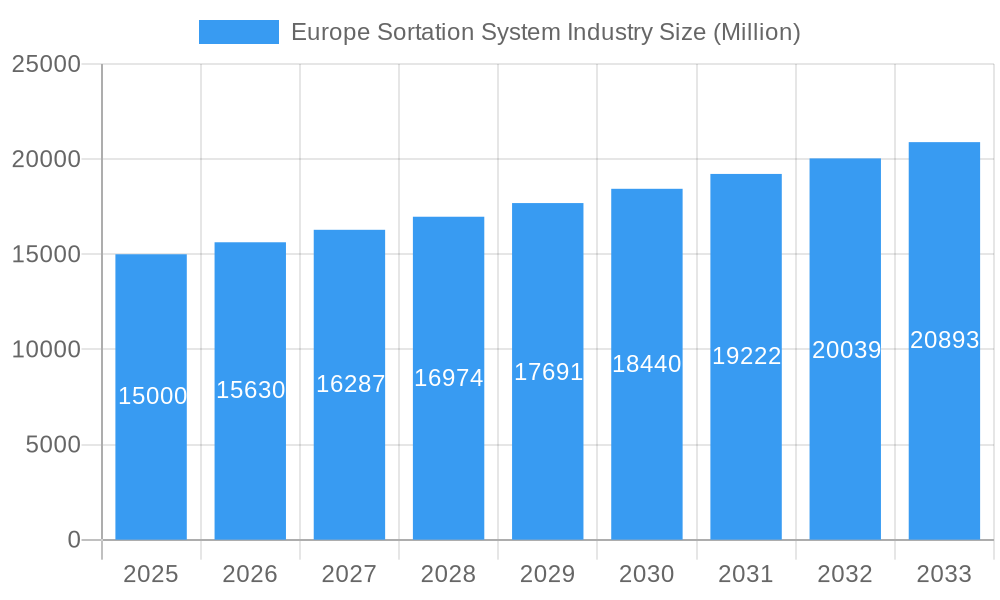

Europe Sortation System Industry Market Size (In Billion)

While substantial initial investment for automated systems presents a challenge for smaller businesses, the European sortation system market is also addressing this through modular and scalable solutions. Government initiatives supporting industrial automation are further mitigating these barriers. A strong focus on energy efficiency and sustainability is evident, with manufacturers developing power-conscious systems. The United Kingdom, Germany, and France are at the forefront of adoption, leveraging their advanced logistics infrastructure and high e-commerce penetration. Digital transformation, encompassing real-time data analytics and predictive maintenance, will continue to shape the competitive landscape and drive market evolution.

Europe Sortation System Industry Company Market Share

Europe Sortation System Industry Market Analysis: Unlocking Efficiency and Automation in Logistics

The Europe Sortation System Industry report provides a comprehensive analysis of the rapidly evolving market for automated sorting solutions across the continent. With a forecast period extending from 2025 to 2033, this report delves into market dynamics, growth trends, dominant regions, product landscapes, key drivers, barriers, opportunities, and the strategic initiatives of leading players. This in-depth research is crucial for industry stakeholders seeking to capitalize on the growing demand for efficient and scalable logistics operations driven by e-commerce expansion, evolving consumer expectations, and the need for optimized supply chains.

Europe Sortation System Industry Market Dynamics & Structure

The Europe Sortation System Industry is characterized by a moderately concentrated market, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by advancements in robotics, AI-powered analytics, and IoT integration, enhancing sorting speed, accuracy, and flexibility. Regulatory frameworks, particularly concerning workplace safety and environmental impact, influence system design and adoption. Competitive product substitutes, such as manual sorting or less sophisticated automation, exist but are increasingly being outpaced by the efficiency gains of modern sortation systems. End-user demographics are shifting, with a notable rise in demand from e-commerce and the postal sector, necessitating scalable and adaptable solutions. Mergers and acquisitions (M&A) are prevalent, as larger companies aim to consolidate market presence and acquire innovative technologies.

- Market Concentration: Dominated by key players, but with room for specialized solution providers.

- Technological Innovation Drivers: AI, robotics, IoT, machine learning for predictive maintenance and optimized routing.

- Regulatory Frameworks: Emphasis on safety standards (e.g., CE marking), data privacy, and energy efficiency.

- Competitive Product Substitutes: Manual sorting, basic conveyor systems, older generation automated sorters.

- End-User Demographics: Strong growth in e-commerce, postal services, and food & beverage sectors.

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

Europe Sortation System Industry Growth Trends & Insights

The Europe Sortation System Industry is poised for robust growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is fundamentally driven by the exponential growth of e-commerce, which has placed immense pressure on logistics networks to handle increasing volumes of parcels efficiently. The adoption rate of automated sortation systems is accelerating as businesses recognize the tangible benefits of increased throughput, reduced operational costs, and enhanced accuracy. Technological disruptions, including the integration of sophisticated AI for intelligent sorting, real-time data analytics for performance optimization, and the increasing use of collaborative robots, are reshaping the industry. Consumer behavior shifts, such as the demand for faster delivery times and more flexible return policies, further necessitate the deployment of advanced sortation solutions. Market penetration of automated sortation systems, while already significant, has substantial room for growth, especially in emerging economies and smaller distribution centers within established markets. The total market size in terms of units is estimated to reach approximately 150 million units by 2033.

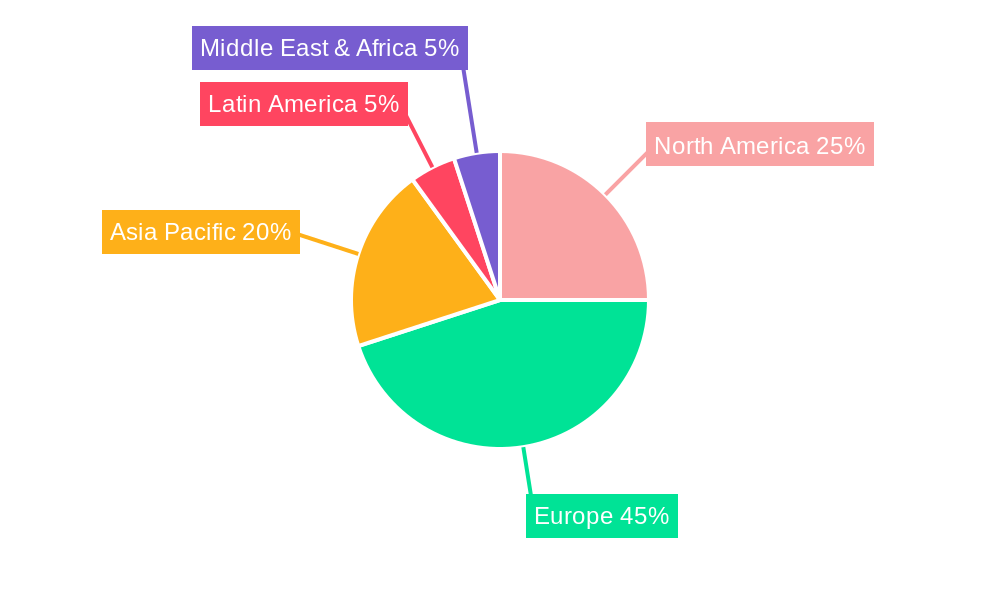

Dominant Regions, Countries, or Segments in Europe Sortation System Industry

The Post and Parcel end-user segment is unequivocally the dominant force driving growth within the Europe Sortation System Industry. This dominance is fueled by several interconnected factors, including the persistent surge in e-commerce activities across the continent, leading to an unprecedented volume of parcels requiring rapid and accurate sorting. Government initiatives promoting digital economies and cross-border trade further amplify the demand for sophisticated postal and parcel handling infrastructure. Leading countries like Germany, the United Kingdom, France, and the Netherlands are at the forefront of adopting advanced sortation technologies within this segment, driven by their extensive logistics networks and high consumer spending power. The market share for sortation systems within the Post and Parcel sector is estimated to be around 45% of the total market.

Key Drivers in Post and Parcel:

- E-commerce growth and increasing parcel volumes.

- Demand for same-day and next-day delivery services.

- Globalization of trade and cross-border logistics.

- Technological advancements in tracking and tracing.

- Automation of manual processes to reduce labor costs and improve speed.

Growth Potential: The segment is expected to witness sustained high growth as postal operators and logistics providers continue to invest in modernizing their infrastructure to meet evolving customer demands and operational efficiencies.

Europe Sortation System Industry Product Landscape

The Europe Sortation System Industry is witnessing a wave of product innovations focused on enhancing throughput, accuracy, and flexibility. Linear sorters, cross-belt sorters, and shoe sorters remain foundational, but are now integrated with advanced software for intelligent routing and real-time performance monitoring. Furthermore, the emergence of modular sorters and flexible pouch systems, like the BEUMER BG Line Sorter and BG Pouch System, caters to mid-size volume operations by offering scalability and space optimization. The integration of AI and machine learning is enabling predictive maintenance, anomaly detection, and dynamic route optimization, leading to greater operational uptime and reduced human intervention. Applications span from high-speed parcel sorting in distribution centers to intricate item handling in pharmaceutical or food and beverage facilities, demonstrating the versatile performance metrics of these advanced systems.

Key Drivers, Barriers & Challenges in Europe Sortation System Industry

Key Drivers:

- E-commerce Boom: The sustained growth of online retail is the primary catalyst, demanding faster and more accurate sorting of increasing parcel volumes.

- Labor Shortages & Costs: Automation addresses the escalating costs and scarcity of manual labor in warehousing and logistics.

- Demand for Efficiency: Businesses across sectors are seeking to optimize operational efficiency, reduce errors, and improve delivery times.

- Technological Advancements: Continuous innovation in AI, robotics, and IoT drives the development of smarter and more capable sortation systems.

Barriers & Challenges:

- High Initial Investment: The upfront cost of advanced sortation systems can be a significant barrier for small and medium-sized enterprises (SMEs).

- Integration Complexity: Integrating new sortation systems with existing warehouse management systems (WMS) and IT infrastructure can be complex and time-consuming.

- Space Constraints: Retrofitting existing facilities, particularly older warehouses, with large-scale automated sortation systems can be challenging due to space limitations.

- Skilled Workforce Requirements: Operating and maintaining sophisticated automated systems requires a skilled workforce, leading to potential training and recruitment challenges.

- Supply Chain Disruptions: Global supply chain disruptions can impact the availability of components and increase lead times for new installations.

Emerging Opportunities in Europe Sortation System Industry

Emerging opportunities within the Europe Sortation System Industry are manifold, driven by evolving market needs and technological breakthroughs. The increasing adoption of micro-fulfillment centers (MFCs) for last-mile delivery presents a significant opportunity for compact and highly automated sortation solutions. Furthermore, the demand for specialized sortation systems in niche sectors like high-value goods, medical supplies, and reverse logistics is on the rise. The integration of sustainability into logistics operations is creating opportunities for energy-efficient sortation systems and solutions that minimize waste. The ongoing digital transformation across industries will also fuel the demand for data-driven sortation and predictive analytics capabilities.

Growth Accelerators in the Europe Sortation System Industry Industry

Several catalysts are accelerating long-term growth in the Europe Sortation System Industry. The pervasive trend towards digitalization and Industry 4.0 principles is fostering greater investment in intelligent automation. Strategic partnerships between technology providers, logistics companies, and end-users are crucial for developing tailored solutions and expanding market reach. Furthermore, market expansion strategies, including the penetration into less automated regions within Europe and the development of solutions for smaller parcel sizes and varied product types, are key growth drivers. The increasing focus on supply chain resilience in the wake of recent global events will also spur investment in robust and flexible automation solutions.

Key Players Shaping the Europe Sortation System Industry Market

- Murata Machinery Ltd

- TGW Systems Inc

- Interroll Holding AG

- Vanderlande Industries Nederland BV

- Fives Group

- Bastian Solutions Inc

- Siemens AG

- Viastore Systems Gmbh

- KNAPP AG

- Honeywell Intelligrated

- Dematic Corp (KION Group)

- Daifuku Co Ltd

- Beumer Group GmbH

Notable Milestones in Europe Sortation System Industry Sector

- July 2022: BEUMER launched its new BG Line Sorter and BG Pouch System, utilizing next-generation technology for enhanced flexibility and scalability in mid-size-volume operations. This solution extends parcel and material handling capabilities with a modular design for optimal space utilization.

- May 2022: OPEX Corporation participated for the first time in LogiMAT, showcasing its Sure Sort sorting system and other warehouse automation solutions, highlighting their commitment to innovation in intralogistics.

In-Depth Europe Sortation System Industry Market Outlook

The outlook for the Europe Sortation System Industry remains exceptionally strong, driven by a confluence of powerful growth accelerators. The continued expansion of e-commerce, coupled with an increasing demand for faster and more efficient delivery services, will sustain high demand for automated sortation solutions. Technological advancements, particularly in artificial intelligence, machine learning, and robotics, will continue to redefine the capabilities of sorting systems, offering greater precision, speed, and adaptability. Strategic collaborations and the development of integrated logistics solutions will further unlock market potential. Furthermore, the growing emphasis on supply chain resilience and sustainability will drive investments in advanced automation that optimizes resource utilization and minimizes operational disruptions, positioning the industry for sustained and significant growth in the coming years.

Europe Sortation System Industry Segmentation

-

1. End User

- 1.1. Post and Parcel

- 1.2. Airport

- 1.3. Food and Beverages

- 1.4. Retail

- 1.5. Pharmaceuticals

- 1.6. Other End-user Industries

Europe Sortation System Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sortation System Industry Regional Market Share

Geographic Coverage of Europe Sortation System Industry

Europe Sortation System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Improving Order Accuracy and SKU Proliferation; Increasing Concerns About Labor Costs and Industrial Automation; Growth in E-commerce

- 3.3. Market Restrains

- 3.3.1. High Deployment and Maintenance Costs; Real-time Technical Challenges and the Need for Skilled Workforce

- 3.4. Market Trends

- 3.4.1. The Post and Parcel Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sortation System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Post and Parcel

- 5.1.2. Airport

- 5.1.3. Food and Beverages

- 5.1.4. Retail

- 5.1.5. Pharmaceuticals

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Murata Machinery Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TGW Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interroll Holding AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vanderlande Industries Nederland BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fives Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bastian Solutions Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viastore Systems Gmbh

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KNAPP AG*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honeywell Intelligrated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dematic Corp (KION Group)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Daifuku Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Beumer Group GmbH

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Murata Machinery Ltd

List of Figures

- Figure 1: Europe Sortation System Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Sortation System Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Sortation System Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Europe Sortation System Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Sortation System Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Sortation System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Sortation System Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sortation System Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Sortation System Industry?

Key companies in the market include Murata Machinery Ltd, TGW Systems Inc, Interroll Holding AG, Vanderlande Industries Nederland BV, Fives Group, Bastian Solutions Inc, Siemens AG, Viastore Systems Gmbh, KNAPP AG*List Not Exhaustive, Honeywell Intelligrated, Dematic Corp (KION Group), Daifuku Co Ltd, Beumer Group GmbH.

3. What are the main segments of the Europe Sortation System Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Improving Order Accuracy and SKU Proliferation; Increasing Concerns About Labor Costs and Industrial Automation; Growth in E-commerce.

6. What are the notable trends driving market growth?

The Post and Parcel Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High Deployment and Maintenance Costs; Real-time Technical Challenges and the Need for Skilled Workforce.

8. Can you provide examples of recent developments in the market?

July 2022 - BEUMER launched its new BG Line Sorter and BG Pouch System, which utilizes next-generation technology to deliver enhanced flexibility and scalability for mid-size-volume operations. As claimed by the company, the BG Line Sorter solution extends the parcel and material handling operations by helping them sort a wide range of items while utilizing a modular design to ensure flexibility and optimize the use of space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sortation System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sortation System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sortation System Industry?

To stay informed about further developments, trends, and reports in the Europe Sortation System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence