Key Insights

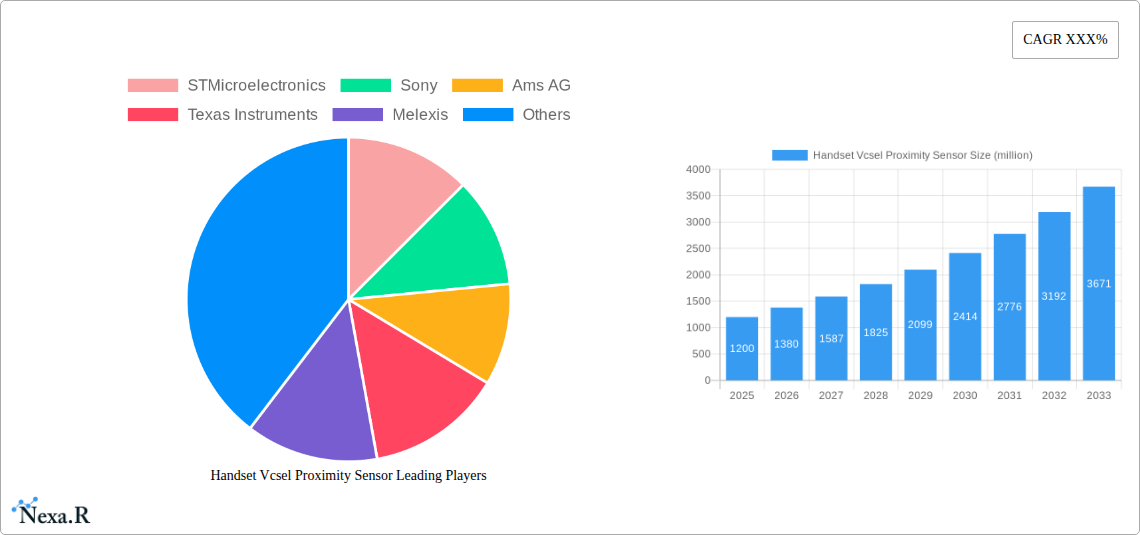

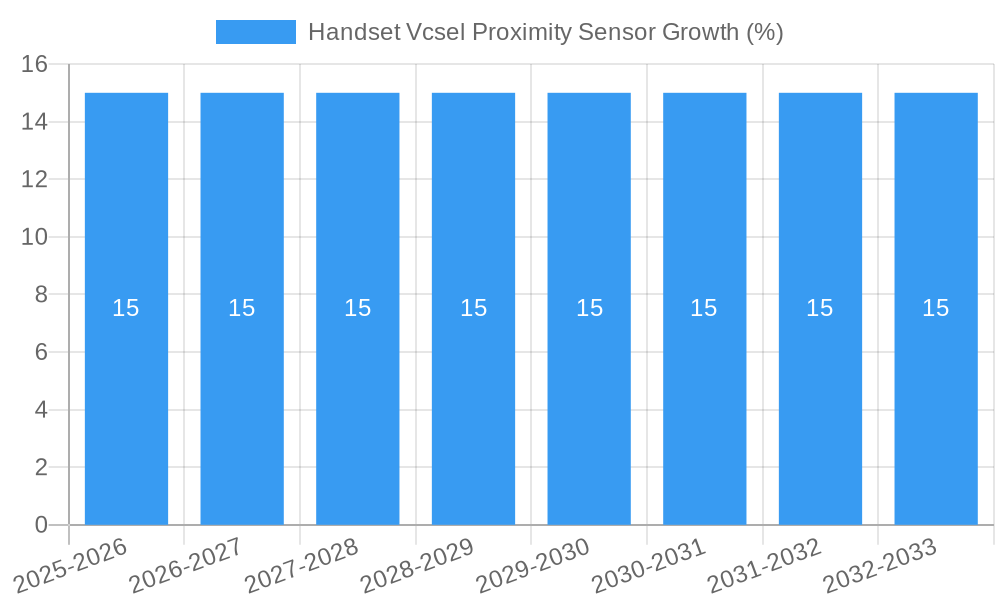

The Handset VCSEL Proximity Sensor market is experiencing robust growth, projected to reach an estimated $1,200 million by 2025, with a strong Compound Annual Growth Rate (CAGR) of 15% anticipated through 2033. This expansion is primarily fueled by the escalating demand for advanced smartphone features, including enhanced proximity sensing for improved user experience in facial recognition, automatic screen dimming, and gesture control. The increasing adoption of True Tone displays, which dynamically adjust screen color temperature based on ambient light, further drives the integration of sophisticated proximity sensors. Furthermore, the burgeoning wearables market, encompassing smartwatches and fitness trackers, is a significant growth contributor, as these devices rely heavily on accurate proximity detection for various functionalities like wrist-raise gestures and auto-sleep tracking. The shift towards edge computing and the integration of AI within mobile devices also necessitates more efficient and responsive sensors, positioning VCSELs as a preferred technology due to their speed, precision, and low power consumption.

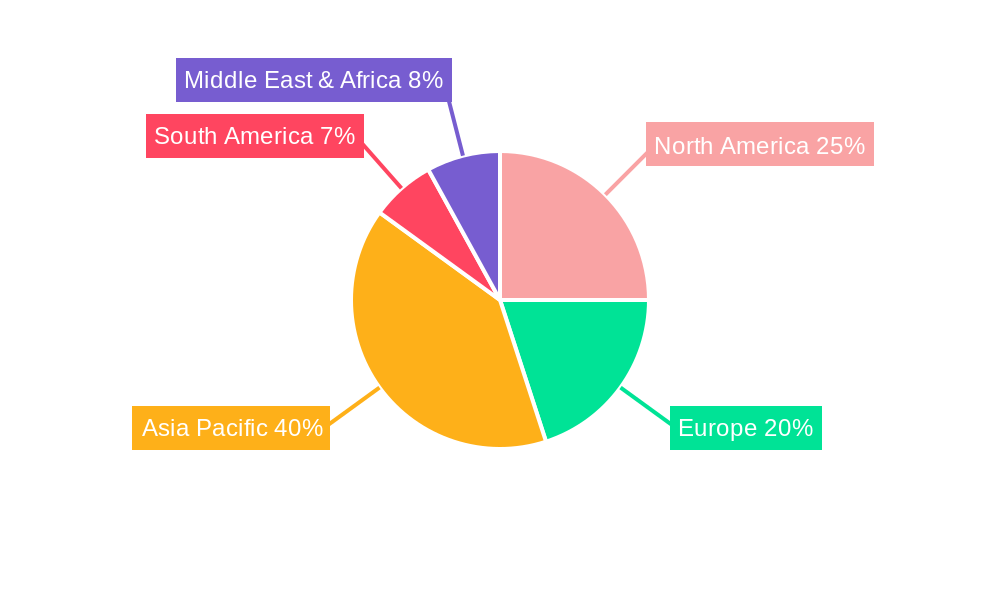

The market is segmented by application into Android, iOS, and Windows platforms, with Android currently dominating due to its larger market share in global smartphone shipments. However, the iOS ecosystem's strong focus on premium features and consistent adoption of cutting-edge technology presents substantial opportunities. By type, Direct Time-of-Flight (dToF) sensors are gaining traction over Indirect Time-of-Flight (iToF) due to their superior accuracy and range, particularly for augmented reality (AR) and virtual reality (VR) applications increasingly being explored within mobile ecosystems. Geographically, Asia Pacific, led by China and India, is the largest and fastest-growing market, driven by a massive consumer base and rapid technological adoption. North America and Europe follow, with a strong emphasis on innovation and high-end device penetration. Restraints include the potential for component cost fluctuations and intense competition among key players like STMicroelectronics, Sony, and Texas Instruments, who are continuously innovating to offer more compact, power-efficient, and feature-rich VCSEL solutions.

Comprehensive Report: Handset VCSEL Proximity Sensor Market Analysis (2019-2033)

This in-depth report provides a thorough analysis of the global Handset VCSEL Proximity Sensor market, covering historical trends, current dynamics, and future projections. It offers critical insights into market size, growth drivers, key players, technological advancements, and emerging opportunities. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate this rapidly evolving industry.

Handset VCSEL Proximity Sensor Market Dynamics & Structure

The global handset VCSEL proximity sensor market exhibits a moderately concentrated structure, with a few key players holding significant market shares. Technological innovation serves as a primary driver, fueled by the relentless demand for enhanced smartphone features like advanced biometrics, augmented reality (AR), and gesture recognition. Robust regulatory frameworks, primarily focused on safety standards and material compliance, are also shaping product development and market entry strategies. Competitive product substitutes, such as infrared (IR) LEDs and other optical sensing technologies, pose a challenge, but VCSELs' superior performance in terms of speed, efficiency, and beam control offer a distinct advantage. End-user demographics are characterized by a strong preference for premium smartphone features among younger, tech-savvy consumers and a growing adoption in mid-range devices seeking to differentiate. Mergers and acquisitions (M&A) trends are notable, with larger semiconductor manufacturers acquiring specialized VCSEL technology firms to bolster their portfolios and gain market access. For instance, strategic acquisitions in the 2019-2024 historical period have seen key players consolidate their positions. Innovation barriers include the complexity of wafer fabrication, the need for high-precision manufacturing, and the significant R&D investment required to develop next-generation VCSEL arrays.

- Market Concentration: Moderately concentrated with key players holding substantial market influence.

- Technological Innovation Drivers: Demand for advanced biometrics (Face ID), AR/VR integration, gesture control, and improved power efficiency.

- Regulatory Frameworks: Compliance with safety standards (e.g., laser safety), material restrictions (e.g., RoHS), and regional certifications.

- Competitive Product Substitutes: IR LEDs, other optical sensing technologies, and ultrasonic sensors.

- End-User Demographics: Young, tech-savvy consumers, mid-range smartphone users seeking advanced features.

- M&A Trends: Strategic acquisitions to gain IP, market share, and R&D capabilities. Notable deal volumes in the historical period averaged approximately 2-3 significant transactions per year, with values ranging from tens to hundreds of millions of dollars.

Handset VCSEL Proximity Sensor Growth Trends & Insights

The global handset VCSEL proximity sensor market is poised for substantial growth, projected to expand at a compound annual growth rate (CAGR) of approximately 15.2% from 2025 to 2033. The market size, estimated at roughly $2.8 billion units in 2025, is expected to reach approximately $8.5 billion units by 2033. This impressive trajectory is underpinned by a confluence of factors, including the escalating adoption of advanced sensing technologies in smartphones, the increasing integration of 3D sensing capabilities, and the burgeoning demand for immersive user experiences. Technological disruptions, such as the refinement of direct flight time-of-flight (dToF) and indirect flight-of-flight (iToF) VCSEL sensors, are enabling more precise depth mapping and object detection, paving the way for novel applications. Consumer behavior shifts are also playing a pivotal role; users are increasingly valuing features that enhance convenience, security, and entertainment, directly benefiting VCSEL-powered functionalities. Market penetration is expected to rise significantly as these sensors move beyond high-end flagship devices into broader market segments. The push towards miniaturization and lower power consumption in VCSELs is further accelerating adoption by enabling their integration into sleeker and more battery-efficient handset designs. Innovations in laser array technology and sophisticated signal processing algorithms are continuously improving sensor accuracy, range, and reliability, driving higher consumer acceptance and manufacturer integration. The expanding ecosystem of AR/VR applications and the growing sophistication of AI-driven features on mobile devices will continue to create new avenues for VCSEL proximity sensor integration, solidifying their indispensable role in future handset development.

Dominant Regions, Countries, or Segments in Handset VCSEL Proximity Sensor

The Asia-Pacific region, particularly China, is emerging as the dominant force in the handset VCSEL proximity sensor market. This dominance is driven by a confluence of factors, including its status as the world's largest smartphone manufacturing hub, robust government support for the semiconductor industry, and a massive consumer base with a high demand for the latest mobile technologies. Within the Application segment, the Android ecosystem is expected to lead market growth. This is primarily due to the sheer volume of Android devices manufactured globally and the increasing adoption of advanced sensing features by a wide array of manufacturers across various price points. The market share for Android-based VCSEL proximity sensor integration is estimated to capture over 60% of the total market by 2033. In terms of Type, Direct Flight Time-of-Flight (dToF) VCSEL proximity sensors are poised to exhibit the highest growth rate. While Indirect Flight Time-of-Flight (iToF) has been a staple, the superior accuracy, range, and efficiency of dToF technology are making it increasingly attractive for advanced applications like precise depth sensing for AR, LiDAR integration, and advanced autofocus mechanisms. The market share of dToF is projected to grow from an estimated 35% in 2025 to over 55% by 2033. Key drivers for Asia-Pacific's dominance include favorable economic policies encouraging local manufacturing and R&D, significant investments in advanced semiconductor infrastructure, and the rapid pace of technological adoption by consumers. China's ambitious plans to become a leader in advanced chip manufacturing, coupled with the presence of major handset manufacturers and their extensive supply chains, further solidify its leading position. The country’s large domestic market provides a significant testing ground and demand driver for new sensor technologies.

- Dominant Region: Asia-Pacific (particularly China).

- Leading Application Segment: Android.

- Market Share (Android): Estimated >60% by 2033.

- Key Drivers: High production volume, diverse price points, rapid tech adoption.

- Fastest Growing Type: Direct Flight Time-of-Flight (dToF).

- Market Share (dToF): Projected to grow from ~35% in 2025 to >55% by 2033.

- Growth Factors: Superior accuracy, extended range, efficiency for AR/LiDAR.

- Country-Specific Drivers (China): Government incentives for semiconductor industry, extensive manufacturing ecosystem, large consumer demand, rapid innovation cycles.

- Infrastructure: Advanced semiconductor fabrication facilities, R&D centers, and a well-established supply chain network.

Handset VCSEL Proximity Sensor Product Landscape

The product landscape of handset VCSEL proximity sensors is characterized by continuous innovation focused on miniaturization, power efficiency, and enhanced performance metrics. Manufacturers are actively developing smaller, lower-profile VCSEL modules that can be seamlessly integrated into increasingly slim smartphone designs. Performance enhancements include improvements in optical power output, wavelength stability, and beam divergence, leading to more accurate and reliable distance measurements. Key applications now extend beyond simple proximity detection for screen activation to sophisticated functionalities like advanced 3D depth mapping, facial recognition systems (e.g., Face ID), augmented reality overlays, and gesture control interfaces. Unique selling propositions often revolve around the precision of the optical beam, the speed of the response time, and the robust immunity to ambient light interference. Technological advancements are pushing towards multi-element VCSEL arrays for more detailed spatial sensing and the integration of specialized optics for tailored illumination patterns.

Key Drivers, Barriers & Challenges in Handset VCSEL Proximity Sensor

Key Drivers: The Handset VCSEL Proximity Sensor market is propelled by the escalating demand for enhanced smartphone functionalities, including advanced biometrics for secure authentication, immersive augmented reality (AR) and virtual reality (VR) experiences, and intuitive gesture control interfaces. The increasing integration of 3D sensing technologies in mid-range devices, driven by consumer expectations for premium features across all price tiers, acts as a significant catalyst. Furthermore, advancements in VCSEL technology itself, leading to higher efficiency, smaller form factors, and improved performance in varying lighting conditions, are crucial growth enablers. The competitive landscape, where manufacturers constantly seek differentiation, also fuels innovation and adoption of VCSEL-based solutions.

Barriers & Challenges: Despite its growth potential, the market faces several challenges. The high cost of advanced VCSEL wafer fabrication and precision manufacturing remains a significant barrier to entry for smaller players and can impact the overall cost of devices. Supply chain disruptions, particularly for specialized semiconductor components and raw materials, can lead to production delays and increased costs. Intense competition from alternative sensing technologies, such as improved IR LEDs and ultrasonic sensors, necessitates continuous innovation and cost reduction efforts. Moreover, evolving regulatory requirements, especially concerning laser safety standards and electromagnetic compatibility (EMC), add complexity to product development and market access. The need for sophisticated algorithm development to interpret sensor data also presents an ongoing technical hurdle.

Emerging Opportunities in Handset VCSEL Proximity Sensor

Emerging opportunities in the handset VCSEL proximity sensor market lie in the expansion of 3D sensing capabilities beyond facial recognition. This includes widespread adoption of LiDAR-like functionalities for improved camera autofocus in low-light conditions, enhanced object and scene understanding for advanced AR applications, and more sophisticated gesture recognition for device interaction. The integration of VCSEL sensors into wearables, smart home devices, and automotive interiors represents a significant untapped market. Furthermore, the development of highly energy-efficient VCSELs optimized for always-on sensing applications in the Internet of Things (IoT) ecosystem presents a substantial growth avenue. The increasing demand for personalized user experiences driven by AI will also create new opportunities for sensors that can provide richer contextual data about the user's environment and interactions.

Growth Accelerators in the Handset VCSEL Proximity Sensor Industry

Long-term growth in the handset VCSEL proximity sensor industry is being significantly accelerated by continuous technological breakthroughs in VCSEL array design, enabling higher resolution and more complex 3D imaging. Strategic partnerships between VCSEL manufacturers, chipset providers, and handset OEMs are crucial for seamless integration and co-development of innovative features. Market expansion strategies, targeting emerging economies and the mid-range smartphone segment, are broadening the addressable market. The increasing sophistication of AR/VR content and applications, which rely heavily on accurate spatial sensing, directly drives demand for advanced VCSEL solutions. Furthermore, the push towards greater computational photography and AI-powered features on smartphones necessitates the richer data provided by proximity and depth sensors, acting as a powerful growth accelerator.

Key Players Shaping the Handset VCSEL Proximity Sensor Market

- STMicroelectronics

- Sony

- ams OSRAM

- Texas Instruments

- Melexis

- Infineon Technologies

- TDK Corporation

Notable Milestones in Handset VCSEL Proximity Sensor Sector

- 2019: Introduction of advanced dToF sensors for improved facial recognition in flagship smartphones.

- 2020: Significant advancements in miniaturization, allowing VCSEL sensors to be integrated into smaller device form factors.

- 2021: Increased adoption of VCSELs for Time-of-Flight (ToF) camera modules in mid-range Android devices.

- 2022: Development of multi-element VCSEL arrays for enhanced 3D depth mapping and AR capabilities.

- 2023: Growing focus on power efficiency and lower cost VCSEL solutions to broaden market penetration.

- 2024: Emergence of VCSEL-based LiDAR for enhanced smartphone photography and AR experiences, with initial deployments in premium models.

In-Depth Handset VCSEL Proximity Sensor Market Outlook

The future outlook for the Handset VCSEL Proximity Sensor market remains exceptionally strong, driven by relentless technological innovation and expanding application horizons. Growth accelerators such as the maturation of AR/VR technologies, sophisticated AI integrations, and the increasing demand for advanced user interfaces will continue to propel market expansion. Strategic collaborations between industry leaders are expected to foster greater standardization and accelerate the adoption of next-generation VCSEL solutions across a wider spectrum of mobile devices. The market is poised for sustained growth, with future opportunities likely to emerge from the integration of VCSEL sensors into emerging consumer electronics beyond smartphones, capitalizing on their precise and efficient sensing capabilities.

Handset Vcsel Proximity Sensor Segmentation

-

1. Application

- 1.1. Android

- 1.2. ios

- 1.3. Windows

-

2. Type

- 2.1. Direct flight time TOF

- 2.2. Indirect flight time TOF

Handset Vcsel Proximity Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Handset Vcsel Proximity Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Handset Vcsel Proximity Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Android

- 5.1.2. ios

- 5.1.3. Windows

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Direct flight time TOF

- 5.2.2. Indirect flight time TOF

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Handset Vcsel Proximity Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Android

- 6.1.2. ios

- 6.1.3. Windows

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Direct flight time TOF

- 6.2.2. Indirect flight time TOF

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Handset Vcsel Proximity Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Android

- 7.1.2. ios

- 7.1.3. Windows

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Direct flight time TOF

- 7.2.2. Indirect flight time TOF

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Handset Vcsel Proximity Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Android

- 8.1.2. ios

- 8.1.3. Windows

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Direct flight time TOF

- 8.2.2. Indirect flight time TOF

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Handset Vcsel Proximity Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Android

- 9.1.2. ios

- 9.1.3. Windows

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Direct flight time TOF

- 9.2.2. Indirect flight time TOF

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Handset Vcsel Proximity Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Android

- 10.1.2. ios

- 10.1.3. Windows

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Direct flight time TOF

- 10.2.2. Indirect flight time TOF

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 STMicroelectronics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sony

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ams AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Texas Instruments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Melexis

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Infineon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TDK Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 STMicroelectronics

List of Figures

- Figure 1: Global Handset Vcsel Proximity Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Handset Vcsel Proximity Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Handset Vcsel Proximity Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Handset Vcsel Proximity Sensor Revenue (million), by Type 2024 & 2032

- Figure 5: North America Handset Vcsel Proximity Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Handset Vcsel Proximity Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Handset Vcsel Proximity Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Handset Vcsel Proximity Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Handset Vcsel Proximity Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Handset Vcsel Proximity Sensor Revenue (million), by Type 2024 & 2032

- Figure 11: South America Handset Vcsel Proximity Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Handset Vcsel Proximity Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Handset Vcsel Proximity Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Handset Vcsel Proximity Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Handset Vcsel Proximity Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Handset Vcsel Proximity Sensor Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Handset Vcsel Proximity Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Handset Vcsel Proximity Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Handset Vcsel Proximity Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Handset Vcsel Proximity Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Handset Vcsel Proximity Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Handset Vcsel Proximity Sensor Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Handset Vcsel Proximity Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Handset Vcsel Proximity Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Handset Vcsel Proximity Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Handset Vcsel Proximity Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Handset Vcsel Proximity Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Handset Vcsel Proximity Sensor Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Handset Vcsel Proximity Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Handset Vcsel Proximity Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Handset Vcsel Proximity Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Handset Vcsel Proximity Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Handset Vcsel Proximity Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Handset Vcsel Proximity Sensor?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Handset Vcsel Proximity Sensor?

Key companies in the market include STMicroelectronics, Sony, Ams AG, Texas Instruments, Melexis, Infineon, TDK Corporation.

3. What are the main segments of the Handset Vcsel Proximity Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Handset Vcsel Proximity Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Handset Vcsel Proximity Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Handset Vcsel Proximity Sensor?

To stay informed about further developments, trends, and reports in the Handset Vcsel Proximity Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence