Key Insights

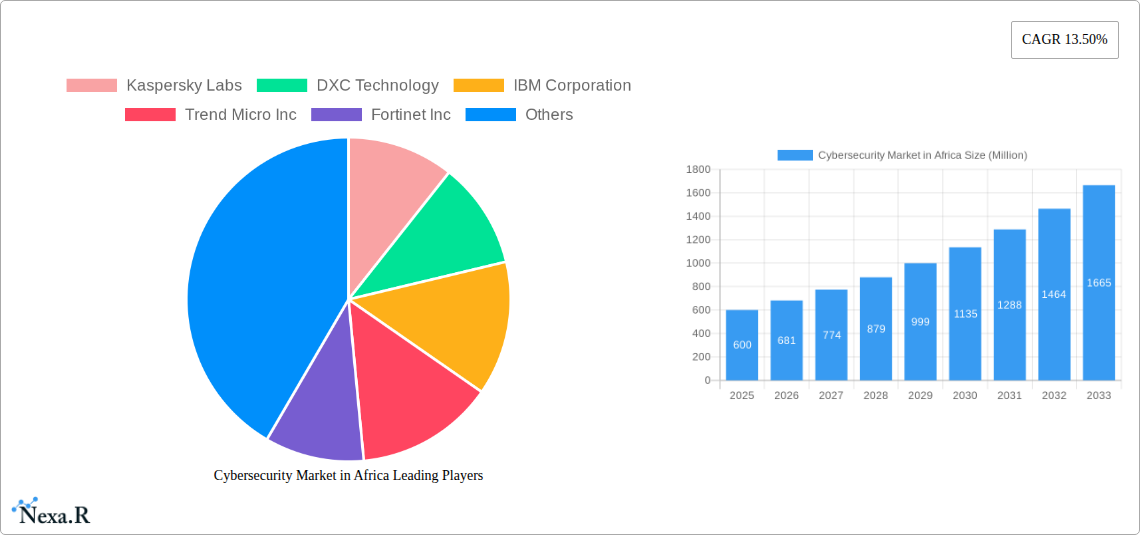

The African cybersecurity market is poised for substantial growth, projected to expand from a current valuation of approximately USD 0.6 billion to a significantly larger figure by 2033. This remarkable expansion is underpinned by a robust Compound Annual Growth Rate (CAGR) of 13.50%, indicating a dynamic and rapidly maturing landscape. The primary drivers for this surge include the escalating adoption of digital technologies across various sectors, the increasing sophistication of cyber threats targeting African businesses and governments, and a growing awareness of the critical need for robust data protection and digital infrastructure security. Cloud security, data security, and identity and access management are emerging as key segments, reflecting the evolving threat landscape and the shift towards cloud-based solutions. The increasing prevalence of cyberattacks necessitates greater investment in advanced security solutions, further fueling market expansion.

Cybersecurity Market in Africa Market Size (In Million)

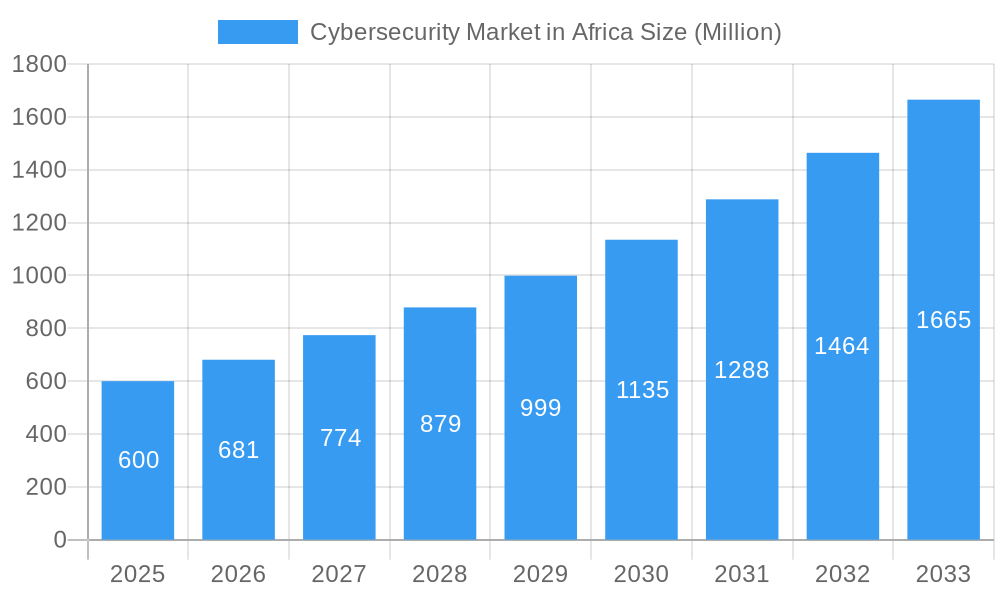

This vibrant growth trajectory is further supported by key trends such as the proliferation of IoT devices, the rise of remote workforces, and the digital transformation initiatives being undertaken by governments and enterprises. As more sensitive data is digitized and transmitted, the demand for comprehensive security services, including network security and infrastructure protection, will only intensify. While the market is expanding, certain restraints such as a shortage of skilled cybersecurity professionals and varying levels of regulatory maturity across different African nations may pose challenges. However, the strong economic development and increasing internet penetration across the continent are expected to outweigh these limitations. Key players like Kaspersky Labs, IBM Corporation, and Fortinet Inc. are actively investing in regional expansion and tailored solutions to cater to the unique needs of the African market, which includes significant segments like BFSI, Healthcare, and Government & Defense.

Cybersecurity Market in Africa Company Market Share

Cybersecurity Market in Africa: Comprehensive Growth, Trends, and Strategic Outlook (2019–2033)

This in-depth report offers a panoramic view of the burgeoning Cybersecurity Market in Africa, meticulously analyzing its dynamics, growth trajectories, and strategic landscape from 2019 to 2033. We delve into the core components of this rapidly evolving sector, including crucial cybersecurity solutions, cloud security, data security, identity and access management, network security, consumer security, and infrastructure protection. The report quantifies market evolution with projections for 2025 and a detailed forecast period from 2025 to 2033, informed by historical data spanning 2019 to 2024. Gain unparalleled insights into market concentration, technological innovation drivers, regulatory frameworks, competitive landscapes, and the impact of prominent players like Kaspersky Labs, DXC Technology, IBM Corporation, Trend Micro Inc, Fortinet Inc, Check Point Software Technologies Ltd, AVG TECHNOLOGIES (AVAST SOFTWARE), Cisco Systems Inc, Symantec Corporation, and Dell Technologies Inc. This report is indispensable for stakeholders seeking to understand and capitalize on the immense opportunities within the African cybersecurity domain.

Cybersecurity Market in Africa Market Dynamics & Structure

The Cybersecurity Market in Africa is characterized by a dynamic and evolving structure, influenced by a confluence of factors shaping its competitive landscape. Market concentration remains moderate, with a mix of global cybersecurity giants and emerging local players vying for market share. Technological innovation serves as a primary driver, with increasing adoption of advanced solutions such as AI-powered threat detection and proactive security measures. Regulatory frameworks are steadily maturing across the continent, fostering greater demand for compliance-driven cybersecurity investments. Competitive product substitutes are numerous, ranging from comprehensive enterprise solutions to specialized niche offerings, forcing vendors to constantly innovate and differentiate. End-user demographics are expanding, with a notable surge in demand from the BFSI, Healthcare, Manufacturing, and Government & Defense sectors, alongside the robust IT and Telecommunication industry. Mergers and acquisitions (M&A) activity, while still nascent compared to developed markets, is showing an upward trend as larger entities seek to consolidate market presence and acquire specialized capabilities. Barriers to innovation include limited skilled cybersecurity professionals, inconsistent internet infrastructure in certain regions, and budget constraints for smaller enterprises. For instance, the demand for cloud security solutions is projected to grow by an estimated 18% annually, driven by digital transformation initiatives across industries.

- Market Concentration: Moderate, with a growing presence of both global leaders and regional specialists.

- Technological Innovation Drivers: AI/ML for threat intelligence, zero-trust architecture, endpoint detection and response (EDR).

- Regulatory Frameworks: Increasing focus on data privacy laws (e.g., POPIA in South Africa) and critical infrastructure protection.

- Competitive Product Substitutes: Wide array, from integrated security platforms to point solutions.

- End-User Demographics: Rapid expansion in BFSI, Healthcare, Manufacturing, Government & Defense, and IT/Telecommunication.

- M&A Trends: Emerging trend for strategic acquisitions to enhance capabilities and market reach.

- Barriers to Innovation: Talent shortages, infrastructure limitations, and affordability concerns for SMEs.

Cybersecurity Market in Africa Growth Trends & Insights

The Cybersecurity Market in Africa is poised for exceptional growth, propelled by escalating cyber threats and increasing digital adoption across the continent. The market size is projected to witness a significant upward trajectory, driven by an estimated Compound Annual Growth Rate (CAGR) of xx% over the forecast period. Adoption rates for advanced cybersecurity solutions are accelerating as businesses and governments recognize the critical need for robust digital defenses. Technological disruptions, such as the widespread implementation of IoT devices and the increasing sophistication of ransomware attacks, are compelling organizations to invest proactively in security measures. Consumer behavior shifts are also playing a role, with individuals and businesses becoming more aware of online risks and demanding greater protection for their data and digital assets. The market penetration of advanced cybersecurity solutions is still relatively low in many African nations, presenting a substantial opportunity for market expansion. Cloud security is a particularly strong growth area, expected to reach a market value of xx Million units by 2028, as more organizations migrate their operations to the cloud. Identity and Access Management solutions are also experiencing robust demand, with an estimated market size of xx Million units in 2025, as organizations focus on securing their digital identities.

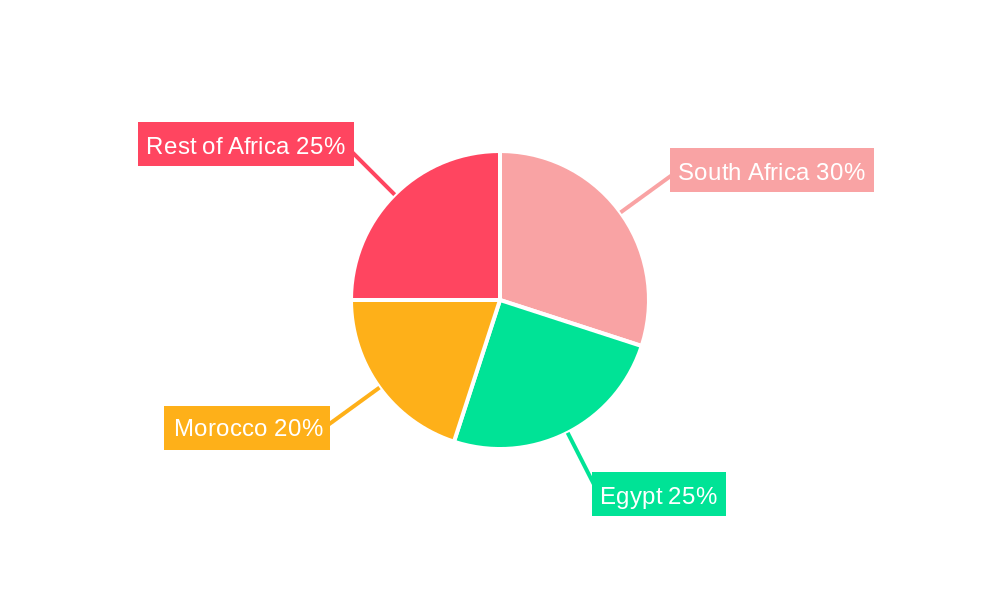

Dominant Regions, Countries, or Segments in Cybersecurity Market in Africa

The Cybersecurity Market in Africa is witnessing significant growth drivers across various regions, countries, and segments. South Africa consistently emerges as a dominant market due to its relatively advanced economy, robust digital infrastructure, and proactive approach to cybersecurity regulation and adoption. The IT and Telecommunication sector is a leading end-user segment, consistently investing in sophisticated cybersecurity solutions to protect critical networks and vast amounts of sensitive data. Within offerings, Network Security and Cloud Security are experiencing the most substantial demand. Network security is paramount for protecting the foundational infrastructure of digital operations, while the increasing adoption of cloud services necessitates robust cloud security measures to safeguard data and applications in distributed environments.

Key drivers for South Africa's dominance include its well-established regulatory frameworks, such as the Protection of Personal Information Act (POPIA), which mandates strong data protection measures. The country also boasts a higher concentration of large enterprises and government entities that are prime targets for cyberattacks and thus invest heavily in comprehensive security solutions. The BFSI sector in South Africa is another significant contributor to market growth, driven by the need to protect sensitive financial data and maintain customer trust amidst rising online banking and digital payment adoption.

Egypt is emerging as a rapidly growing market, fueled by government initiatives to digitize services and enhance national cybersecurity capabilities. Investments in smart city projects and e-governance are creating substantial demand for infrastructure protection and identity management solutions. Morocco is also showing promising growth, particularly in the Government & Defense and IT and Telecommunication sectors, with a focus on securing national digital assets and critical infrastructure.

Across segments, the Services component of the cybersecurity market, including managed security services, threat intelligence, and incident response, is experiencing a significant surge. This is attributed to the shortage of in-house cybersecurity expertise and the increasing complexity of cyber threats, leading organizations to outsource their security operations. The growth potential in Data Security is also immense, as data breaches become more prevalent and costly.

- Dominant Country: South Africa, driven by advanced infrastructure, regulatory compliance, and high threat perception.

- Leading End-User Segment: IT and Telecommunication, followed closely by BFSI and Government & Defense.

- Key Offering Segments: Network Security, Cloud Security, and Services are experiencing the highest demand.

- Emerging Growth Markets: Egypt and Morocco, propelled by digitization initiatives and government investments.

- Dominance Factors: Economic development, regulatory landscape, digital transformation pace, and threat landscape.

- Market Share (Estimated): South Africa accounts for approximately xx% of the total African cybersecurity market.

- Growth Potential: High potential for cloud security and managed services across the continent.

Cybersecurity Market in Africa Product Landscape

The Cybersecurity Market in Africa is characterized by a dynamic product landscape focused on delivering comprehensive and adaptive security solutions. Key innovations include AI-driven threat detection platforms that proactively identify and neutralize emerging cyber threats with unparalleled speed and accuracy. Advanced data security solutions are offering end-to-end encryption, data loss prevention (DLP), and granular access controls to protect sensitive information across its lifecycle. Identity and Access Management (IAM) solutions are evolving with features like multi-factor authentication (MFA), single sign-on (SSO), and privileged access management (PAM) to strengthen user authentication and authorization processes. Network security is seeing the widespread adoption of next-generation firewalls (NGFW), intrusion detection/prevention systems (IDPS), and secure web gateways. Consumer security offerings are becoming more user-friendly and comprehensive, encompassing antivirus, VPNs, and identity theft protection. Infrastructure protection solutions are designed to secure critical national infrastructure and industrial control systems (ICS) from sophisticated attacks. The focus is increasingly on integrated security suites and platforms that offer centralized management and visibility across diverse IT environments.

Key Drivers, Barriers & Challenges in Cybersecurity Market in Africa

The Cybersecurity Market in Africa is propelled by several key drivers, primarily the escalating frequency and sophistication of cyberattacks targeting businesses and governments across the continent. The rapid digital transformation and increasing adoption of cloud technologies necessitate robust security measures to protect sensitive data and critical infrastructure. Growing awareness among organizations regarding the financial and reputational impact of cyber incidents is also a significant driver. Furthermore, the implementation of data privacy regulations in various African nations is compelling organizations to invest in compliance-driven cybersecurity solutions.

However, the market faces considerable barriers and challenges. A persistent shortage of skilled cybersecurity professionals across Africa hinders the effective deployment and management of advanced security solutions. The cost of implementing and maintaining comprehensive cybersecurity programs can be prohibitive for many small and medium-sized enterprises (SMEs), limiting their ability to adopt necessary protections. Inconsistent and underdeveloped internet infrastructure in some regions poses challenges for real-time threat detection and response. Additionally, the diverse regulatory landscapes across different African countries can create complexities for vendors offering pan-African solutions. Supply chain issues can also impact the availability of specialized hardware and software.

- Key Drivers:

- Rising cyber threat landscape (ransomware, phishing, data breaches).

- Accelerated digital transformation and cloud adoption.

- Increased organizational awareness of cybersecurity risks.

- Evolving data privacy and protection regulations.

- Key Barriers & Challenges:

- Talent shortage of skilled cybersecurity professionals.

- High implementation and maintenance costs for SMEs.

- Inconsistent digital infrastructure across regions.

- Complex and fragmented regulatory environments.

- Supply chain disruptions for security hardware/software.

Emerging Opportunities in Cybersecurity Market in Africa

Emerging opportunities within the Cybersecurity Market in Africa are vast and diverse, fueled by the continent's rapid digitalization and increasing connectivity. The growing adoption of mobile technologies presents significant opportunities for mobile security solutions and services. The burgeoning fintech sector across Africa requires specialized cybersecurity to protect financial transactions and customer data, creating a demand for robust payment security and fraud prevention solutions. Furthermore, the increasing deployment of IoT devices in sectors like smart cities, agriculture, and healthcare opens up a new frontier for IoT security solutions. Government initiatives aimed at developing national cybersecurity strategies and creating digital economies present substantial opportunities for infrastructure protection, threat intelligence sharing, and cybersecurity consulting services. The untapped potential in Consumer Security for individual users, particularly in emerging middle-class populations, also represents a significant growth area for user-friendly and affordable security products.

Growth Accelerators in the Cybersecurity Market in Africa Industry

Several key catalysts are accelerating the growth of the Cybersecurity Market in Africa. The strategic expansion of critical digital infrastructure, including fiber optic networks and data centers, is laying the groundwork for enhanced cybersecurity adoption. Increasing investments in cybersecurity by multinational corporations operating in Africa, driven by global compliance mandates and risk mitigation strategies, are significantly boosting market growth. Furthermore, government-led cybersecurity initiatives and the establishment of national Computer Emergency Response Teams (CERTs) are fostering a more secure digital ecosystem and encouraging private sector participation. Strategic partnerships between global cybersecurity vendors and local African companies are also playing a crucial role in expanding market reach and tailoring solutions to regional needs. The growing emphasis on digital governance and the protection of national digital assets by African governments is creating a sustained demand for advanced cybersecurity solutions.

Key Players Shaping the Cybersecurity Market in Africa Market

- Kaspersky Labs

- DXC Technology

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- Check Point Software Technologies Ltd

- AVG TECHNOLOGIES (AVAST SOFTWARE)

- Cisco Systems Inc

- Symantec Corporation

- Dell Technologies Inc

Notable Milestones in Cybersecurity Market in Africa Sector

- July 2022: Cassava Technologies' Liquid Cyber Security division launched the first Cyber Security Fusion Centre in Johannesburg, South Africa, aiming to bolster the nation's cybersecurity resilience against growing threats to governments and businesses.

- May 2022: Dell Technologies introduced new cloud experiences, an expanded ecosystem, and innovative products designed to assist clients in managing and safeguarding applications across data centers and multi-cloud environments, enhancing enterprise control over data and applications.

In-Depth Cybersecurity Market in Africa Market Outlook

The Cybersecurity Market in Africa is poised for sustained and accelerated growth, driven by a combination of evolving threat landscapes, rapid digital transformation, and increasing regulatory focus on data protection. Strategic partnerships between global security providers and local African enterprises will be critical in expanding market reach and delivering tailored solutions. The growing demand for cloud security, identity and access management, and managed security services presents significant opportunities for market players. Furthermore, government-led initiatives to enhance national cybersecurity capabilities and promote digital economies will act as powerful growth accelerators. As African economies continue to digitize, the imperative for robust cybersecurity will only intensify, making this market a critical area for investment and innovation. The development of a skilled cybersecurity workforce and the adoption of advanced technologies like AI and machine learning will be pivotal in addressing the continent's unique security challenges and unlocking its full digital potential.

Cybersecurity Market in Africa Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

-

4. Geography

- 4.1. South Africa

- 4.2. Egypt

- 4.3. Morocco

Cybersecurity Market in Africa Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Morocco

Cybersecurity Market in Africa Regional Market Share

Geographic Coverage of Cybersecurity Market in Africa

Cybersecurity Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth digitization across the region; Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparednes

- 3.4. Market Trends

- 3.4.1. Growth digitization across the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cybersecurity Market in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Morocco

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Egypt

- 5.5.3. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. South Africa Cybersecurity Market in Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Security Type

- 6.1.1.1. Cloud Security

- 6.1.1.2. Data Security

- 6.1.1.3. Identity Access Management

- 6.1.1.4. Network Security

- 6.1.1.5. Consumer Security

- 6.1.1.6. Infrastructure Protection

- 6.1.1.7. Other Types

- 6.1.2. Services

- 6.1.1. Security Type

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Manufacturing

- 6.3.4. Government & Defense

- 6.3.5. IT and Telecommunication

- 6.3.6. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Egypt

- 6.4.3. Morocco

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Egypt Cybersecurity Market in Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Security Type

- 7.1.1.1. Cloud Security

- 7.1.1.2. Data Security

- 7.1.1.3. Identity Access Management

- 7.1.1.4. Network Security

- 7.1.1.5. Consumer Security

- 7.1.1.6. Infrastructure Protection

- 7.1.1.7. Other Types

- 7.1.2. Services

- 7.1.1. Security Type

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Manufacturing

- 7.3.4. Government & Defense

- 7.3.5. IT and Telecommunication

- 7.3.6. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Egypt

- 7.4.3. Morocco

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Morocco Cybersecurity Market in Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Security Type

- 8.1.1.1. Cloud Security

- 8.1.1.2. Data Security

- 8.1.1.3. Identity Access Management

- 8.1.1.4. Network Security

- 8.1.1.5. Consumer Security

- 8.1.1.6. Infrastructure Protection

- 8.1.1.7. Other Types

- 8.1.2. Services

- 8.1.1. Security Type

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Manufacturing

- 8.3.4. Government & Defense

- 8.3.5. IT and Telecommunication

- 8.3.6. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Egypt

- 8.4.3. Morocco

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Kaspersky Labs

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 DXC Technology

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 IBM Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Trend Micro Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fortinet Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Check Point Software Technologies Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 AVG TECHNOLOGIES (AVAST SOFTWARE)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Cisco Systems Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Symantec Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Dell Technologies Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Kaspersky Labs

List of Figures

- Figure 1: Cybersecurity Market in Africa Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cybersecurity Market in Africa Share (%) by Company 2025

List of Tables

- Table 1: Cybersecurity Market in Africa Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Cybersecurity Market in Africa Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Cybersecurity Market in Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Cybersecurity Market in Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Cybersecurity Market in Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Cybersecurity Market in Africa Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Cybersecurity Market in Africa Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Cybersecurity Market in Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Cybersecurity Market in Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Cybersecurity Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Cybersecurity Market in Africa Revenue Million Forecast, by Offering 2020 & 2033

- Table 12: Cybersecurity Market in Africa Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Cybersecurity Market in Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Cybersecurity Market in Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Cybersecurity Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Cybersecurity Market in Africa Revenue Million Forecast, by Offering 2020 & 2033

- Table 17: Cybersecurity Market in Africa Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Cybersecurity Market in Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Cybersecurity Market in Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Cybersecurity Market in Africa Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cybersecurity Market in Africa?

The projected CAGR is approximately 13.50%.

2. Which companies are prominent players in the Cybersecurity Market in Africa?

Key companies in the market include Kaspersky Labs, DXC Technology, IBM Corporation, Trend Micro Inc, Fortinet Inc, Check Point Software Technologies Ltd, AVG TECHNOLOGIES (AVAST SOFTWARE), Cisco Systems Inc, Symantec Corporation, Dell Technologies Inc.

3. What are the main segments of the Cybersecurity Market in Africa?

The market segments include Offering, Deployment, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.6 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth digitization across the region; Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting.

6. What are the notable trends driving market growth?

Growth digitization across the region.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparednes.

8. Can you provide examples of recent developments in the market?

July 2022 - Cassava Technologies' Liquid Cyber Security division has opened the first of its matrix of Cyber Security Fusion Centres in Johannesburg, South Africa. Liquid's Fusion Centre intends to strengthen the country's cyber security industry by controlling the growing threat of cyberattacks on governments and businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cybersecurity Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cybersecurity Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cybersecurity Market in Africa?

To stay informed about further developments, trends, and reports in the Cybersecurity Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence