Key Insights

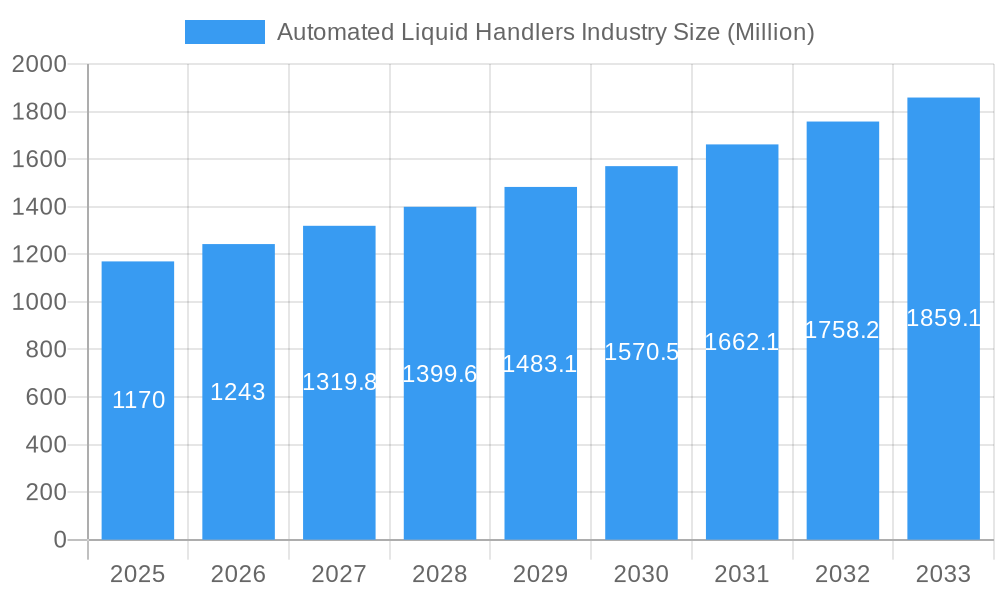

The global Automated Liquid Handlers market is poised for significant expansion, projected to reach a substantial valuation in the coming years. This growth is fueled by the increasing demand for high-throughput screening and automation across various life science sectors, including drug discovery and development, genomic research, and biotechnology. The inherent advantages of automated liquid handlers, such as enhanced precision, reduced human error, and accelerated workflow efficiency, are driving their adoption in contract research organizations (CROs), pharmaceutical and biotechnology companies, and academic and research institutions. The market is witnessing a steady Compound Annual Growth Rate (CAGR) of 6.24%, indicating a robust and sustained upward trajectory. Key drivers include the escalating R&D investments in personalized medicine, the growing burden of chronic diseases necessitating faster drug development cycles, and the continuous innovation in automation technologies offering greater accuracy and versatility.

Automated Liquid Handlers Industry Market Size (In Billion)

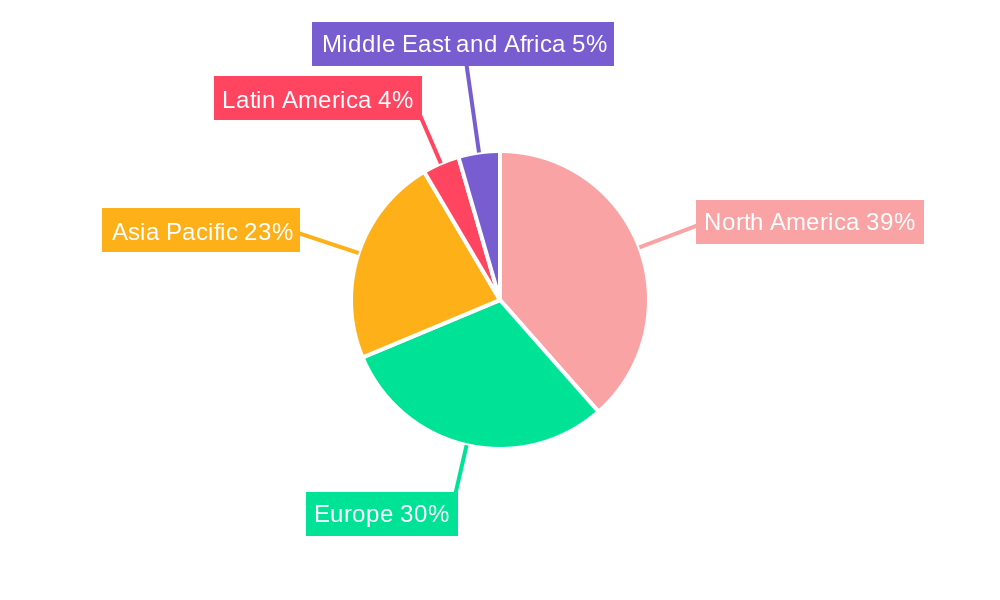

Further propelling this market forward are the emerging trends in advanced robotics, artificial intelligence integration for optimized lab processes, and the increasing focus on miniaturization and microfluidics for more cost-effective and efficient sample handling. While the market exhibits strong growth potential, certain restraints may temper this expansion, including the high initial investment costs for sophisticated systems and the need for skilled personnel to operate and maintain them. However, the long-term benefits in terms of increased throughput, improved data quality, and reduced operational costs are expected to outweigh these challenges. The market is segmented by application, with Drug Discovery and Cancer and Genomic Research representing the dominant segments due to the high volume of experimental procedures involved. Geographically, North America and Europe are anticipated to lead the market, driven by established research infrastructure and substantial R&D spending, with the Asia Pacific region showing rapid growth potential due to expanding biopharmaceutical industries and increasing government support for scientific research.

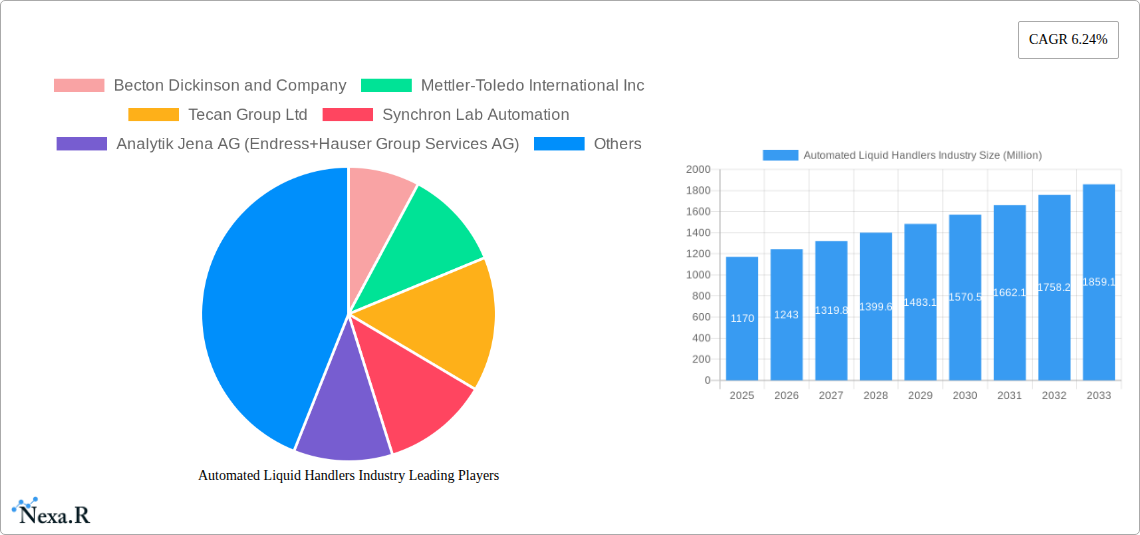

Automated Liquid Handlers Industry Company Market Share

Comprehensive Report: Automated Liquid Handlers Industry Analysis (2019–2033)

This in-depth report offers a strategic overview of the global Automated Liquid Handlers market, encompassing a detailed analysis of market dynamics, growth trends, key players, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides critical insights for stakeholders navigating the evolving landscape of laboratory automation. The report meticulously analyzes market segmentation, regional dominance, product innovations, and the interplay of drivers, barriers, and opportunities. With a focus on million-unit values and high-traffic keywords, this report is optimized for maximum search engine visibility and industry professional engagement.

Automated Liquid Handlers Industry Market Dynamics & Structure

The Automated Liquid Handlers market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive technological innovation. The increasing demand for high-throughput screening in drug discovery and genomic research, coupled with advancements in robotics and artificial intelligence, are significant technological innovation drivers. Stringent regulatory frameworks for pharmaceutical development and diagnostics also shape market strategies, emphasizing precision and reproducibility. Competitive product substitutes, such as manual pipetting and less sophisticated automation solutions, are being steadily displaced by advanced liquid handling systems. End-user demographics are shifting towards a greater reliance on outsourced research services, benefiting contract research organizations and driving demand from pharmaceutical and biotechnology companies. Mergers and acquisitions (M&A) continue to play a vital role in market consolidation and expansion, with a notable volume of deals aimed at acquiring new technologies or expanding market reach. Barriers to entry include high initial investment costs for sophisticated systems and the need for specialized technical expertise for operation and maintenance.

- Market Concentration: Moderately concentrated, with strategic consolidation through M&A.

- Technological Innovation Drivers: High-throughput screening, advanced robotics, AI integration.

- Regulatory Frameworks: FDA, EMA regulations impacting accuracy and validation requirements.

- Competitive Product Substitutes: Manual pipetting, semi-automated systems.

- End-User Demographics: Growing reliance on CROs and expansion in Pharma/Biotech.

- M&A Trends: Active consolidation to acquire technology and market share.

- Innovation Barriers: High capital expenditure, need for skilled personnel.

Automated Liquid Handlers Industry Growth Trends & Insights

The global Automated Liquid Handlers market is poised for significant expansion, driven by an escalating need for efficiency, accuracy, and throughput across various life science applications. The market size is projected to witness a substantial Compound Annual Growth Rate (CAGR) over the forecast period, reflecting increasing adoption rates in academic institutions, research laboratories, and commercial entities. Technological disruptions, including the integration of artificial intelligence for predictive analytics and advanced robotic arms for intricate liquid handling tasks, are redefining market capabilities. Consumer behavior shifts are characterized by a growing preference for fully integrated laboratory automation solutions that minimize manual intervention and reduce the risk of human error. The penetration of automated liquid handlers is rapidly increasing, moving beyond specialized laboratories to become a standard component in diverse research and diagnostic workflows. This evolution is further fueled by the development of more compact, user-friendly, and cost-effective systems catering to a broader spectrum of users. The continuous pursuit of personalized medicine and advanced therapeutic development necessitates precise and reproducible sample handling, a core strength of these automated systems.

Dominant Regions, Countries, or Segments in Automated Liquid Handlers Industry

The Pharmaceutical and Biotechnology end-user vertical is the dominant segment driving growth in the Automated Liquid Handlers industry. This dominance is attributed to the substantial investments these sectors make in drug discovery, development, and manufacturing processes that demand high-throughput, precise, and reproducible liquid handling. The sheer volume of research and development activities, coupled with the stringent regulatory requirements for pharmaceutical products, necessitates the adoption of advanced automation solutions to ensure data integrity and accelerate timelines.

- Pharmaceutical and Biotechnology: This sector accounts for a significant portion of the global market share, estimated at over 50 million units annually. Key drivers include the accelerated demand for new drug development, personalized medicine initiatives, and the growing complexity of biological assays. Economic policies that incentivize pharmaceutical innovation and research, along with robust intellectual property protection, further bolster this segment.

- Contract Research Organizations (CROs): CROs represent another substantial growth area, experiencing a surge in demand as pharmaceutical and biotech companies increasingly outsource their research and development activities. CROs leverage automated liquid handlers to offer scalable and cost-effective services to a diverse clientele, thereby expanding their operational capacity and market reach.

- Academic and Research Institutes: While historically a significant segment, academic and research institutes are witnessing steady growth, driven by government funding for basic and translational research. These institutions often adopt automated liquid handlers to enhance research productivity and explore novel scientific frontiers.

The North America region, particularly the United States, is a leading geographical market due to its strong presence of pharmaceutical giants, burgeoning biotechnology sector, and significant government investment in life sciences research.

Automated Liquid Handlers Industry Product Landscape

The product landscape of Automated Liquid Handlers is characterized by continuous innovation, focusing on enhanced precision, speed, and versatility. Advanced systems now offer non-contact dispensing technologies to minimize cross-contamination and reagent waste, catering to sensitive applications like genomics and proteomics. Integration with robotics and artificial intelligence is enabling sophisticated workflows, from sample preparation to complex assay execution. Performance metrics are constantly being pushed, with higher throughput capacities and improved accuracy of sub-microliter dispensing becoming standard. Unique selling propositions revolve around modular designs for scalability, user-friendly software for streamlined operation, and the ability to handle a wide range of liquid types and volumes, thereby supporting diverse research and diagnostic needs.

Key Drivers, Barriers & Challenges in Automated Liquid Handlers Industry

Key Drivers:

- Growing Demand for High-Throughput Screening: Accelerating drug discovery and development pipelines.

- Advancements in Life Sciences Research: Increasing complexity and volume of experiments in genomics, proteomics, and personalized medicine.

- Need for Reproducibility and Accuracy: Reducing human error in critical laboratory processes.

- Increasing Outsourcing to CROs: Driving demand for scalable automation solutions.

- Technological Innovations: Integration of AI, robotics, and advanced dispensing technologies.

Barriers & Challenges:

- High Initial Investment Cost: Restricting adoption for smaller laboratories and academic institutions.

- Complexity of Operation and Maintenance: Requiring specialized trained personnel.

- Standardization and Interoperability Issues: Challenges in integrating different vendor systems.

- Supply Chain Disruptions: Impacting manufacturing and availability of components.

- Stringent Regulatory Compliance: Requiring significant validation and documentation efforts.

Emerging Opportunities in Automated Liquid Handlers Industry

Emerging opportunities lie in the development of more compact and affordable automated liquid handlers tailored for smaller research labs and point-of-care diagnostics. The growing field of single-cell analysis and advanced cell-based assays presents a significant demand for highly precise and miniaturized liquid handling. Furthermore, the integration of machine learning for intelligent workflow optimization and predictive maintenance in these systems offers a promising avenue for innovation. Untapped markets in emerging economies, with increasing healthcare investments and a growing life sciences research base, also represent substantial growth potential.

Growth Accelerators in the Automated Liquid Handlers Industry Industry

Long-term growth in the Automated Liquid Handlers industry will be significantly accelerated by continuous technological breakthroughs, such as miniaturization of dispensing technologies, enhanced robotic dexterity for complex sample manipulation, and the widespread adoption of AI-driven software for automated experimental design and data analysis. Strategic partnerships between instrument manufacturers and reagent suppliers will streamline workflow integration, offering comprehensive solutions to end-users. Market expansion into new application areas, like environmental monitoring and food safety testing, will also provide substantial growth impetus.

Key Players Shaping the Automated Liquid Handlers Industry Market

- Becton Dickinson and Company

- Mettler-Toledo International Inc

- Tecan Group Ltd

- Synchron Lab Automation

- Analytik Jena AG (Endress+Hauser Group Services AG)

- Hudson Robotics Inc

- Aurora Biomed Inc

- Eppendorf AG

- Formulatrix Inc

- Agilent Technologies Inc

- Hamilton Company

- Thermo Fisher Scientific

- Danaher Corporation (Beckman Coulter Inc )

- Perkin Elmer Inc

Notable Milestones in Automated Liquid Handlers Industry Sector

- February 2022: DISPENDIX, a BICO company, introduced the I.DOT HT Non-contact Dispenser and the L.DROP Liquid Handler at SLAS 2022, aiming to commoditize laboratory automation.

- March 2021: Beckman Coulter Life Sciences launched the Biomek NGeniuS workstation at the virtual AGBT General Meeting. This workstation is purpose-built for NGS library preparation, significantly reducing manual transfers and hands-on time for advanced next-generation sequencing technology.

- February 2021: Thermo Fisher Scientific released the Amplitude Solution, a highly automated molecular diagnostic testing system capable of analyzing up to 8,000 COVID-19 specimens in 24 hours, enabling rapid scaling of testing workflows to combat disease spread.

In-Depth Automated Liquid Handlers Industry Market Outlook

The future outlook for the Automated Liquid Handlers industry is exceptionally robust, driven by an unyielding demand for precision and efficiency in life sciences. Growth accelerators will continue to stem from miniaturization trends, AI-powered workflow optimization, and strategic collaborations. The increasing complexity of research, particularly in areas like genomics, proteomics, and personalized medicine, will necessitate sophisticated automation capabilities. The market is expected to witness further penetration into diverse application areas beyond traditional pharmaceutical research, including diagnostics, environmental science, and food safety. Strategic market expansion into underserved geographies and the development of application-specific solutions will be crucial for sustained growth.

Automated Liquid Handlers Industry Segmentation

-

1. Application

- 1.1. Drug Discovery

- 1.2. Cancer and Genomic Research

- 1.3. Biotechnology

- 1.4. Other Applications

-

2. End-user Vertical

- 2.1. Contract Research Organizations

- 2.2. Pharmaceutical and Biotechnology

- 2.3. Academic and Research Institutes

Automated Liquid Handlers Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automated Liquid Handlers Industry Regional Market Share

Geographic Coverage of Automated Liquid Handlers Industry

Automated Liquid Handlers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Flexibility and Adaptability of Lab Automation Systems

- 3.3. Market Restrains

- 3.3.1. Slower Adoption Rates in Small- and Medium-sized Organizations

- 3.4. Market Trends

- 3.4.1. Clinical Diagnostics to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automated Liquid Handlers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drug Discovery

- 5.1.2. Cancer and Genomic Research

- 5.1.3. Biotechnology

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Contract Research Organizations

- 5.2.2. Pharmaceutical and Biotechnology

- 5.2.3. Academic and Research Institutes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automated Liquid Handlers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drug Discovery

- 6.1.2. Cancer and Genomic Research

- 6.1.3. Biotechnology

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Contract Research Organizations

- 6.2.2. Pharmaceutical and Biotechnology

- 6.2.3. Academic and Research Institutes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Automated Liquid Handlers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drug Discovery

- 7.1.2. Cancer and Genomic Research

- 7.1.3. Biotechnology

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Contract Research Organizations

- 7.2.2. Pharmaceutical and Biotechnology

- 7.2.3. Academic and Research Institutes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Automated Liquid Handlers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drug Discovery

- 8.1.2. Cancer and Genomic Research

- 8.1.3. Biotechnology

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Contract Research Organizations

- 8.2.2. Pharmaceutical and Biotechnology

- 8.2.3. Academic and Research Institutes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Automated Liquid Handlers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drug Discovery

- 9.1.2. Cancer and Genomic Research

- 9.1.3. Biotechnology

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Contract Research Organizations

- 9.2.2. Pharmaceutical and Biotechnology

- 9.2.3. Academic and Research Institutes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Automated Liquid Handlers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drug Discovery

- 10.1.2. Cancer and Genomic Research

- 10.1.3. Biotechnology

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Contract Research Organizations

- 10.2.2. Pharmaceutical and Biotechnology

- 10.2.3. Academic and Research Institutes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mettler-Toledo International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tecan Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Synchron Lab Automation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Analytik Jena AG (Endress+Hauser Group Services AG)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hudson Robotics Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aurora Biomed Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eppendorf AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Formulatrix Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Agilent Technologies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hamilton Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Thermo Fisher Scientific

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Danaher Corporation (Beckman Coulter Inc )

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Perkin Elmer Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Automated Liquid Handlers Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automated Liquid Handlers Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Automated Liquid Handlers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Automated Liquid Handlers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Automated Liquid Handlers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Automated Liquid Handlers Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automated Liquid Handlers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automated Liquid Handlers Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Automated Liquid Handlers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Automated Liquid Handlers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Automated Liquid Handlers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Automated Liquid Handlers Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automated Liquid Handlers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automated Liquid Handlers Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Automated Liquid Handlers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Automated Liquid Handlers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Automated Liquid Handlers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Automated Liquid Handlers Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automated Liquid Handlers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Automated Liquid Handlers Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Automated Liquid Handlers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Automated Liquid Handlers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Latin America Automated Liquid Handlers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Latin America Automated Liquid Handlers Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Automated Liquid Handlers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automated Liquid Handlers Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Automated Liquid Handlers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Automated Liquid Handlers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Middle East and Africa Automated Liquid Handlers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Middle East and Africa Automated Liquid Handlers Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automated Liquid Handlers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Automated Liquid Handlers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Automated Liquid Handlers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Automated Liquid Handlers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Automated Liquid Handlers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Automated Liquid Handlers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Automated Liquid Handlers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Automated Liquid Handlers Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated Liquid Handlers Industry?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Automated Liquid Handlers Industry?

Key companies in the market include Becton Dickinson and Company, Mettler-Toledo International Inc, Tecan Group Ltd, Synchron Lab Automation, Analytik Jena AG (Endress+Hauser Group Services AG), Hudson Robotics Inc *List Not Exhaustive, Aurora Biomed Inc, Eppendorf AG, Formulatrix Inc, Agilent Technologies Inc, Hamilton Company, Thermo Fisher Scientific, Danaher Corporation (Beckman Coulter Inc ), Perkin Elmer Inc.

3. What are the main segments of the Automated Liquid Handlers Industry?

The market segments include Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Flexibility and Adaptability of Lab Automation Systems.

6. What are the notable trends driving market growth?

Clinical Diagnostics to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Slower Adoption Rates in Small- and Medium-sized Organizations.

8. Can you provide examples of recent developments in the market?

February 2022 - DISPENDIX, a BICO company, announced the introduction of the I.DOT HT Non-contact Dispenser and the L.DROP Liquid Handler at SLAS 2022. The initiative was taken in line with the company's goal to commoditize laboratory automation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automated Liquid Handlers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automated Liquid Handlers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automated Liquid Handlers Industry?

To stay informed about further developments, trends, and reports in the Automated Liquid Handlers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence