Key Insights

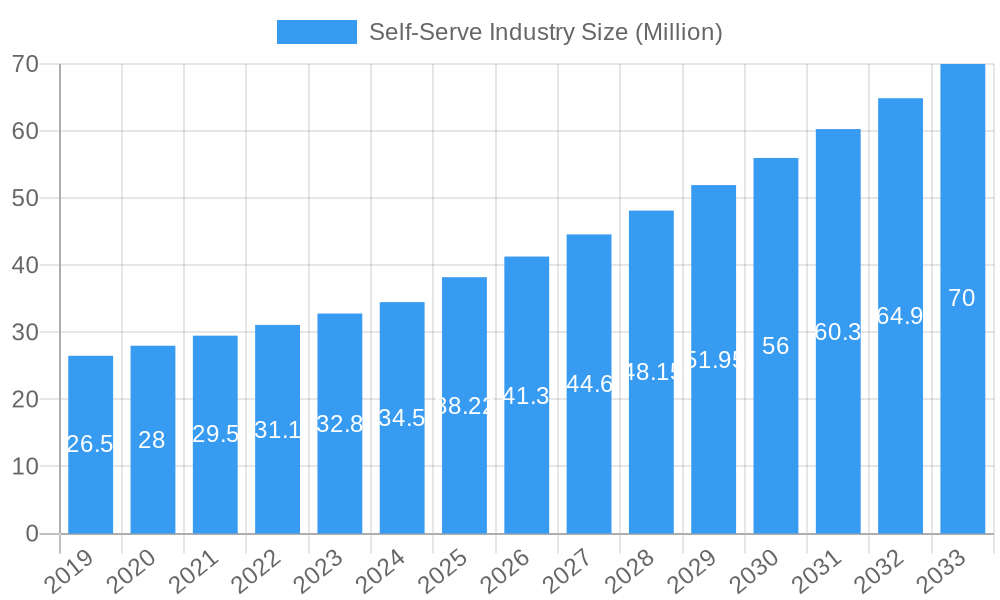

The global Self-Serve Industry is poised for significant expansion, projected to reach a market size of USD 38.22 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 7.79% through 2033. This growth is primarily propelled by the increasing demand for enhanced customer convenience and operational efficiency across various sectors. Key drivers include the pervasive adoption of self-service kiosks in BFSI for banking transactions, retail and fast-food chains for streamlined ordering and payment, and healthcare for patient check-ins and information access. The travel and transportation sector also significantly contributes, leveraging self-service for ticketing and information dissemination. Furthermore, technological advancements, such as AI-powered interfaces, touchless technologies, and integrated payment systems, are revolutionizing the self-serve landscape, making solutions more intuitive and secure. The industry's trajectory is strongly influenced by the desire to reduce labor costs, improve customer throughput, and offer personalized experiences.

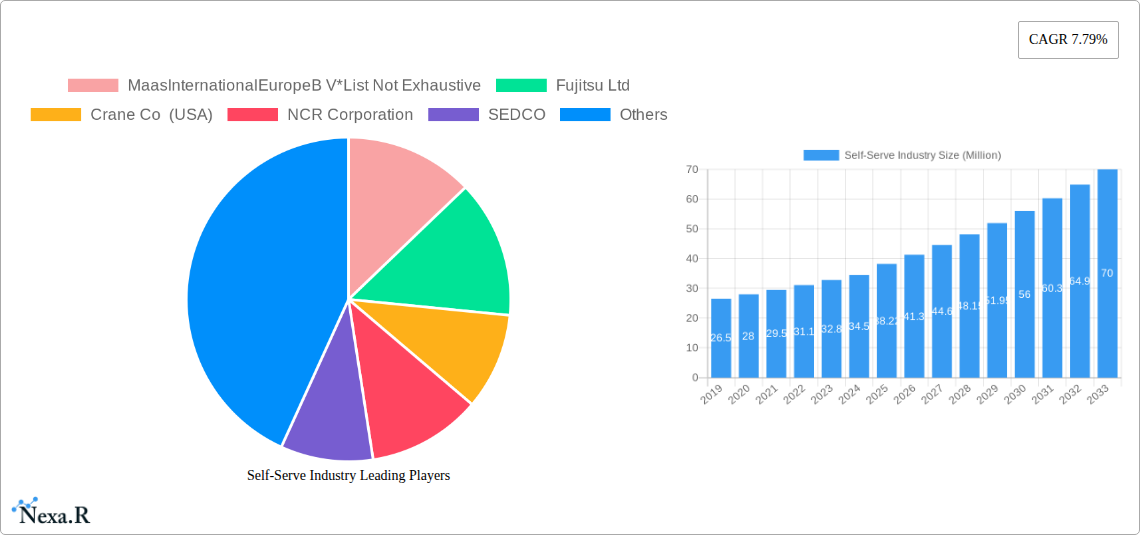

Self-Serve Industry Market Size (In Million)

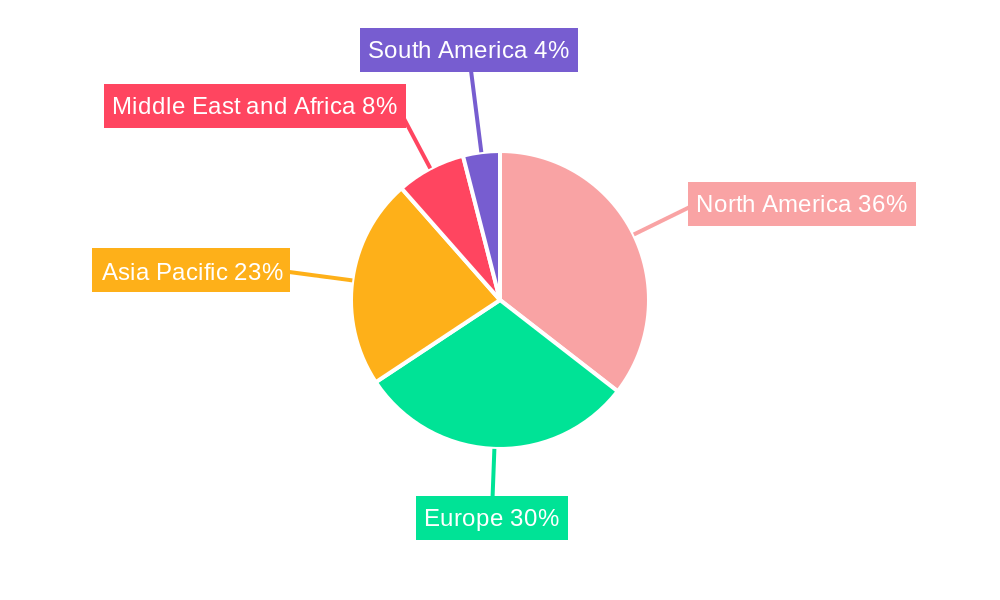

The Self-Serve Industry encompasses a diverse range of solutions, including advanced kiosks, automated teller machines (ATMs), and sophisticated vending machines, catering to a broad spectrum of end-users. While North America and Europe have historically dominated the market due to early adoption and advanced technological infrastructure, the Asia Pacific region is emerging as a significant growth engine, driven by rapid digitalization, a burgeoning middle class, and a strong focus on enhancing customer experiences in retail and financial services. Restraints such as initial investment costs for advanced systems and concerns over data security and privacy are being actively addressed through technological innovation and regulatory frameworks. Emerging trends point towards greater integration of self-serve technologies with mobile platforms, the proliferation of smart vending machines offering personalized recommendations, and the development of highly customizable kiosk solutions tailored to specific industry needs, all contributing to a dynamic and expanding market.

Self-Serve Industry Company Market Share

Self-Serve Industry: Market Dynamics, Growth Forecasts (2019-2033), and Competitive Landscape

This comprehensive report offers an in-depth analysis of the global Self-Serve Industry, a dynamic market driven by technological advancements and evolving consumer preferences. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market size, growth trends, dominant regions, product innovations, key players, and emerging opportunities. We explore the intricate relationship between parent and child markets, offering a holistic view of the self-serve ecosystem and its future trajectory. This analysis is essential for industry professionals, investors, and stakeholders seeking to understand and capitalize on the burgeoning self-serve market. All values are presented in Million units.

Self-Serve Industry Market Dynamics & Structure

The Self-Serve Industry is characterized by a moderately concentrated market, with a few key players holding significant market share, alongside a growing number of specialized innovators. Technological innovation is the primary driver, fueled by advancements in AI, IoT, and cloud computing, enabling more sophisticated and personalized self-serve experiences. Regulatory frameworks, particularly concerning data privacy and accessibility, are shaping deployment strategies across various end-user segments. Competitive product substitutes are emerging, ranging from enhanced mobile payment solutions to fully automated retail concepts, pushing established self-serve hardware providers to innovate continuously. End-user demographics are shifting, with increasing demand for convenience and speed across BFSI, Retail & Fast Food Chains, Hospitality, Healthcare, and Travel & Transportation sectors. Mergers and acquisitions (M&A) are a consistent feature, driven by the pursuit of technological integration and market consolidation.

- Market Concentration: Top 5 players account for approximately 45% of the market share.

- Technological Innovation Drivers: AI-powered personalization, IoT integration for remote monitoring, and advanced analytics for operational efficiency.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR, CCPA) and accessibility standards for public kiosks.

- Competitive Substitutes: Mobile ordering apps, contactless payment solutions, and cashier-less retail formats.

- End-User Demographics: Growing adoption in emerging economies and by younger consumer segments seeking immediate service.

- M&A Trends: Focus on acquiring companies with strong software capabilities and data analytics expertise.

Self-Serve Industry Growth Trends & Insights

The Self-Serve Industry is poised for substantial growth, driven by an increasing global demand for efficiency, convenience, and contactless solutions. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated XX Million units by the end of the forecast period. This growth is fueled by a confluence of factors including escalating labor costs, the persistent need for operational cost reduction, and a significant shift in consumer behavior towards self-service options across various touchpoints. Adoption rates are accelerating across all end-user segments, with Retail & Fast Food Chains and BFSI leading the charge due to the inherent benefits of self-checkout and self-service banking. Technological disruptions, such as the integration of AI for personalized recommendations and predictive maintenance of machines, are further enhancing the appeal and functionality of self-serve solutions. Consumer preference for instant gratification and reduced human interaction, especially post-pandemic, is a critical behavioral shift that the industry is adeptly capitalizing on. The expansion of e-commerce has also indirectly boosted the self-serve sector, as consumers seek seamless omnichannel experiences that bridge online and offline retail environments. Furthermore, the increasing availability of advanced, user-friendly interfaces and robust payment gateways are lowering the barrier to adoption for both businesses and consumers. The evolving landscape of payments, with a greater reliance on digital and contactless methods, perfectly aligns with the inherent nature of self-serve technologies.

Dominant Regions, Countries, or Segments in Self-Serve Industry

The Retail & Fast Food Chain segment stands as the dominant force within the Self-Serve Industry, driven by its pervasive adoption of self-checkout kiosks and order automation solutions. This segment's growth is propelled by an urgent need to streamline operations, reduce wait times, and enhance customer throughput, especially during peak hours. The sheer volume of transactions and the direct consumer interface make it a prime candidate for self-service implementation.

- Key Drivers in Retail & Fast Food Chains:

- Labor Cost Reduction: Automating repetitive tasks significantly cuts down on staffing requirements.

- Improved Customer Experience: Faster checkout and order placement leads to higher customer satisfaction.

- Increased Order Accuracy: Reduced human error in order taking and payment processing.

- Data Collection & Analytics: Self-serve touchpoints generate valuable data on customer preferences and purchasing habits.

- Space Optimization: Kiosks often require less physical space than traditional manned counters.

Regionally, North America currently leads the market, with countries like the United States spearheading innovation and adoption. This dominance is attributed to a mature retail infrastructure, high disposable income, and a tech-savvy consumer base readily embracing self-service technologies. Favorable economic policies that encourage automation and investment in advanced technologies further bolster its position. The presence of major self-serve technology providers and a strong focus on customer-centric solutions contribute to North America's leadership.

- Dominance Factors in North America:

- Early Adoption Culture: Consumers and businesses are generally receptive to new technologies.

- Strong Economic Foundation: Significant investment capacity in advanced self-serve solutions.

- Presence of Key Players: Home to leading manufacturers and solution providers.

- Infrastructure Readiness: Well-developed retail and service sector infrastructure supports widespread deployment.

- Government Support: Incentives for technological adoption and business efficiency.

The BFSI segment, particularly the adoption of ATMs and self-service banking kiosks, represents another substantial contributor to the self-serve market's growth. Financial institutions are increasingly leveraging these technologies to reduce operational costs associated with traditional branch networks, enhance customer accessibility for basic transactions, and provide a more secure and convenient banking experience.

Self-Serve Industry Product Landscape

The Self-Serve Industry product landscape is rich with innovative solutions, including advanced self-checkout kiosks, intelligent ATMs, and sophisticated vending machines designed for diverse applications. Innovations focus on enhancing user experience through intuitive interfaces, touchless operation, and personalized interactions powered by AI. Applications span from retail and banking to healthcare and hospitality, offering contactless payment, self-ordering, information access, and automated dispensing. Performance metrics are driven by increased transaction speed, reduced operational costs, and improved customer satisfaction. Unique selling propositions include modular designs for easy customization, robust security features, and seamless integration with existing enterprise systems. Technological advancements are continually pushing the boundaries, enabling greater functionality and broader market reach for self-serve solutions.

Key Drivers, Barriers & Challenges in Self-Serve Industry

The Self-Serve Industry is propelled by a confluence of powerful drivers. Technological advancements in AI, IoT, and contactless payment systems enable more intuitive and efficient user experiences. The persistent demand for operational cost reduction and improved labor efficiency across sectors like retail and banking further fuels adoption. Evolving consumer preferences for convenience, speed, and reduced human interaction, amplified by recent global health concerns, are critical growth catalysts. Furthermore, government initiatives promoting digital transformation and automation in various economies provide a supportive policy environment.

- Key Drivers:

- AI and IoT Integration

- Contactless Payment Technology

- Labor Cost Optimization

- Consumer Demand for Convenience

- Digital Transformation Initiatives

Conversely, the industry faces significant barriers and challenges. High initial investment costs for deploying advanced self-serve hardware and software can be a restraint, particularly for small and medium-sized enterprises. Concerns regarding data security and privacy, especially with the collection of sensitive customer information, require robust cybersecurity measures. Regulatory hurdles and compliance requirements, such as accessibility standards and payment processing regulations, can also complicate deployment. Supply chain disruptions, as seen in recent years, can impact the availability and cost of essential components, leading to production delays and increased pricing. Finally, resistance to change from certain customer demographics or workforce segments can present adoption challenges.

- Key Barriers & Challenges:

- High Initial Investment

- Data Security and Privacy Concerns

- Complex Regulatory Compliance

- Supply Chain Vulnerabilities

- Customer and Workforce Resistance to Change

Emerging Opportunities in Self-Serve Industry

Emerging opportunities in the Self-Serve Industry lie in the untapped potential of specialized niche markets and innovative applications. The expansion of self-serve solutions into emerging economies, where infrastructure is developing and demand for accessible services is high, presents a significant growth avenue. The integration of advanced AI and machine learning for hyper-personalization, offering tailored recommendations and services based on user behavior, is another key opportunity. Furthermore, the development of interactive and experiential self-serve kiosks, moving beyond transactional functions to provide engaging brand experiences, is gaining traction. The increasing adoption of self-serve technology in healthcare for patient check-in, appointment scheduling, and even medication dispensing, points to a rapidly expanding segment with substantial growth potential.

Growth Accelerators in the Self-Serve Industry Industry

Several key growth accelerators are shaping the long-term trajectory of the Self-Serve Industry. Continued advancements in artificial intelligence and machine learning are enabling self-serve solutions to become more intelligent, predictive, and personalized, thereby enhancing customer engagement and operational efficiency. Strategic partnerships between technology providers, software developers, and end-user industries are fostering innovation and accelerating market penetration. For instance, collaborations between kiosk manufacturers and payment gateway providers are streamlining the integration of secure and diverse payment options. Market expansion strategies, including targeting underserved geographical regions and developing tailored solutions for specific industry verticals, are also critical growth drivers. The increasing focus on sustainability and eco-friendly designs in self-serve hardware will also attract environmentally conscious consumers and businesses, further propelling growth.

Key Players Shaping the Self-Serve Industry Market

- MaasInternationalEuropeB V

- Fujitsu Ltd

- Crane Co (USA)

- NCR Corporation

- SEDCO

- Frank Mayer & Associates Inc

- Advanced Kiosks

- Azkoyen Group

- Advantech Co Limited

- ProtouchUK

- Zebra Technologies

- HESS Cash systems GmbH & Co

- Diebold Nixdorf

- Embross

- IER Group

Notable Milestones in Self-Serve Industry Sector

- January 2024: NCR Corporation announced the launch of its Next Generation Self-Checkout Solution on the NCR Voyix commerce platform. This evolution significantly enhances the checkout experience for retailers and shoppers, catering to changing shopper journeys, driving demographic and payment inclusion, and offering an agile, modern SaaS technology stack with flexible hardware.

- June 2023: Gem OpenCube Technologies Pvt Ltd designed the World's 1st Water, Tea, and Coffee (WTC) Automatic vending machine. This fully automated machine functions as a 24/7 street-corner shop, dispensing water, tea, coffee, and biscuits without human intervention.

In-Depth Self-Serve Industry Market Outlook

The Self-Serve Industry is on an upward trajectory, with future market potential driven by ongoing technological advancements and a sustained shift in consumer behavior towards convenience and efficiency. AI-powered personalization, contactless solutions, and the expansion into new application areas like healthcare and smart cities are key growth accelerators. Strategic opportunities lie in developing integrated self-serve ecosystems that seamlessly connect various touchpoints, offering a unified and enhanced customer journey. The increasing demand for data-driven insights from self-serve interactions will also spur innovation in analytics and business intelligence solutions. The industry is well-positioned to capitalize on these trends, offering significant returns for stakeholders who can adapt to the evolving landscape and leverage emerging technologies.

Self-Serve Industry Segmentation

-

1. Type

- 1.1. Kiosk

- 1.2. ATM

- 1.3. Vending Machine

-

2. End-user

- 2.1. BFSI

- 2.2. Retail & Fast Food Chain

- 2.3. Hospitality

- 2.4. Healthcare

- 2.5. Travel & Transportation

- 2.6. Other End-users

Self-Serve Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Self-Serve Industry Regional Market Share

Geographic Coverage of Self-Serve Industry

Self-Serve Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing emphasis on ensuring customer satisfaction to drive demand in the Retail & Food sector; High investments in the infrastructure developments (new & refurbishments) and smart city initiatives; Technological investments to enable greater support for the differently abled populace & new users

- 3.3. Market Restrains

- 3.3.1. Cost and maintenance remains a key consideration

- 3.4. Market Trends

- 3.4.1. Automated Teller Machine (ATM) to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Serve Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Kiosk

- 5.1.2. ATM

- 5.1.3. Vending Machine

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. BFSI

- 5.2.2. Retail & Fast Food Chain

- 5.2.3. Hospitality

- 5.2.4. Healthcare

- 5.2.5. Travel & Transportation

- 5.2.6. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Self-Serve Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Kiosk

- 6.1.2. ATM

- 6.1.3. Vending Machine

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. BFSI

- 6.2.2. Retail & Fast Food Chain

- 6.2.3. Hospitality

- 6.2.4. Healthcare

- 6.2.5. Travel & Transportation

- 6.2.6. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Self-Serve Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Kiosk

- 7.1.2. ATM

- 7.1.3. Vending Machine

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. BFSI

- 7.2.2. Retail & Fast Food Chain

- 7.2.3. Hospitality

- 7.2.4. Healthcare

- 7.2.5. Travel & Transportation

- 7.2.6. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Self-Serve Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Kiosk

- 8.1.2. ATM

- 8.1.3. Vending Machine

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. BFSI

- 8.2.2. Retail & Fast Food Chain

- 8.2.3. Hospitality

- 8.2.4. Healthcare

- 8.2.5. Travel & Transportation

- 8.2.6. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Self-Serve Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Kiosk

- 9.1.2. ATM

- 9.1.3. Vending Machine

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. BFSI

- 9.2.2. Retail & Fast Food Chain

- 9.2.3. Hospitality

- 9.2.4. Healthcare

- 9.2.5. Travel & Transportation

- 9.2.6. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Self-Serve Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Kiosk

- 10.1.2. ATM

- 10.1.3. Vending Machine

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. BFSI

- 10.2.2. Retail & Fast Food Chain

- 10.2.3. Hospitality

- 10.2.4. Healthcare

- 10.2.5. Travel & Transportation

- 10.2.6. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MaasInternationalEuropeB V*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fujitsu Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Crane Co (USA)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NCR Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SEDCO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Frank Mayer & Associates Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Advanced Kiosks

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Azkoyen Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Advantech Co Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ProtouchUK

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zebra Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HESS Cash systems GmbH & Co

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Diebold Nixdorf

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Embross

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IER Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 MaasInternationalEuropeB V*List Not Exhaustive

List of Figures

- Figure 1: Global Self-Serve Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Self-Serve Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Self-Serve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Self-Serve Industry Revenue (Million), by End-user 2025 & 2033

- Figure 5: North America Self-Serve Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Self-Serve Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Self-Serve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Self-Serve Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Self-Serve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Self-Serve Industry Revenue (Million), by End-user 2025 & 2033

- Figure 11: Europe Self-Serve Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Self-Serve Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Self-Serve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Self-Serve Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Self-Serve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Self-Serve Industry Revenue (Million), by End-user 2025 & 2033

- Figure 17: Asia Pacific Self-Serve Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Self-Serve Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Self-Serve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Self-Serve Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Self-Serve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Self-Serve Industry Revenue (Million), by End-user 2025 & 2033

- Figure 23: South America Self-Serve Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: South America Self-Serve Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Self-Serve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Self-Serve Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Self-Serve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Self-Serve Industry Revenue (Million), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Self-Serve Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Self-Serve Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Self-Serve Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Serve Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Self-Serve Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 3: Global Self-Serve Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Self-Serve Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Self-Serve Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 6: Global Self-Serve Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Self-Serve Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Self-Serve Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 9: Global Self-Serve Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Self-Serve Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Self-Serve Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 12: Global Self-Serve Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Self-Serve Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Self-Serve Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 15: Global Self-Serve Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Self-Serve Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Self-Serve Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 18: Global Self-Serve Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Serve Industry?

The projected CAGR is approximately 7.79%.

2. Which companies are prominent players in the Self-Serve Industry?

Key companies in the market include MaasInternationalEuropeB V*List Not Exhaustive, Fujitsu Ltd, Crane Co (USA), NCR Corporation, SEDCO, Frank Mayer & Associates Inc, Advanced Kiosks, Azkoyen Group, Advantech Co Limited, ProtouchUK, Zebra Technologies, HESS Cash systems GmbH & Co, Diebold Nixdorf, Embross, IER Group.

3. What are the main segments of the Self-Serve Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing emphasis on ensuring customer satisfaction to drive demand in the Retail & Food sector; High investments in the infrastructure developments (new & refurbishments) and smart city initiatives; Technological investments to enable greater support for the differently abled populace & new users.

6. What are the notable trends driving market growth?

Automated Teller Machine (ATM) to Witness the Growth.

7. Are there any restraints impacting market growth?

Cost and maintenance remains a key consideration.

8. Can you provide examples of recent developments in the market?

In Januray 2024 - NCR Corporation announced the launch of its Next Generation Self-Checkout Solution NCR Voyix commerce platform, WHere the NCR Voyix Next Generation Self-Checkout Solution is a significant evolution in the checkout experience for retailers and shoppers alike. It caters to changing shopper journeys, drives inclusion of demographics and payments, and provides an agile, modern software-as-a-service (SaaS) technology stack with a flexible, fabric-like hardware approach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Serve Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Serve Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Serve Industry?

To stay informed about further developments, trends, and reports in the Self-Serve Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence