Key Insights

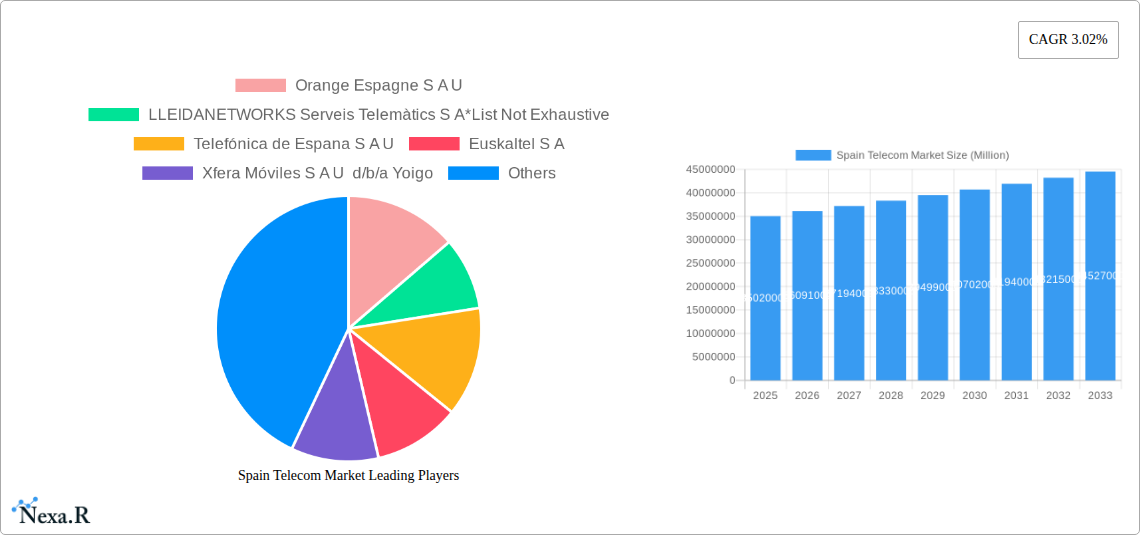

The Spanish telecommunications market is poised for steady expansion, with an estimated market size of €35.02 million in 2025, growing at a Compound Annual Growth Rate (CAGR) of 3.02% through 2033. This growth is propelled by robust demand across voice services, encompassing both wired and wireless technologies, and a significant uptake in data services, driven by increasing internet penetration and mobile data consumption. The burgeoning Over-The-Top (OTT) and Pay-TV segments are further fueling market dynamics, as consumers increasingly rely on digital platforms for entertainment and communication. Key industry players like Telefónica, Orange, and Vodafone are actively investing in network infrastructure and service innovation to capture market share, while emerging companies like MasMovil and Euskaltel are intensifying competition. This competitive landscape, coupled with ongoing technological advancements and evolving consumer preferences, creates a dynamic environment for the Spanish telecom sector.

Spain Telecom Market Market Size (In Million)

Several factors are shaping the trajectory of the Spanish telecom market. The increasing adoption of 5G technology is a significant growth driver, promising enhanced connectivity and enabling new service paradigms. Furthermore, the continuous demand for high-speed broadband and reliable mobile data services, particularly in urban and increasingly in rural areas, underscores the fundamental importance of telecommunications infrastructure. However, the market also faces certain restraints. Intense price competition among established and new entrants can put pressure on profit margins, necessitating a focus on value-added services and customer retention. Regulatory policies and the ongoing need for substantial capital investment in network upgrades also present challenges. Despite these hurdles, the Spanish telecom market demonstrates resilience and a clear path towards sustained growth, driven by innovation and the indispensable role of telecommunications in modern society.

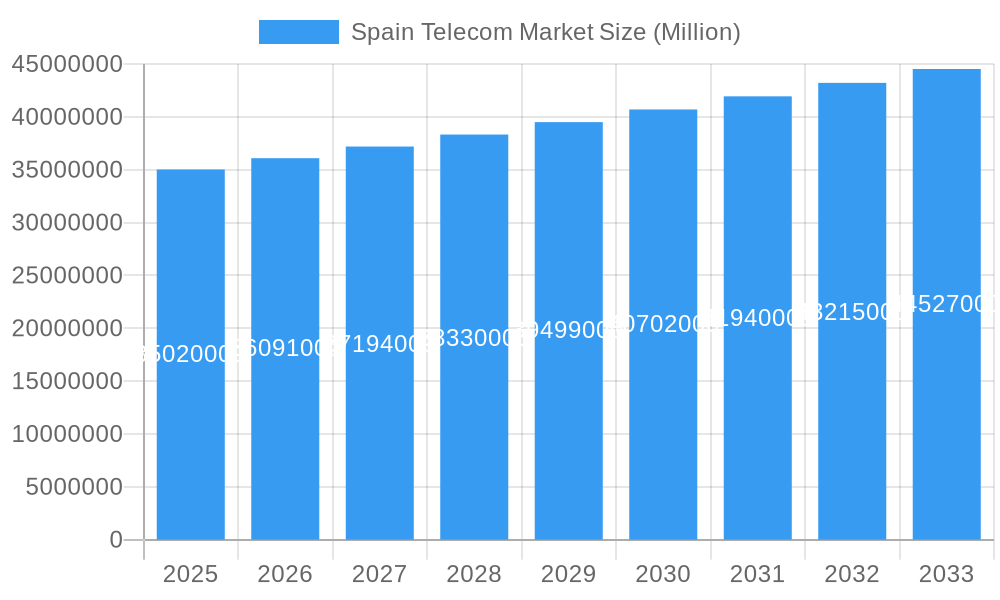

Spain Telecom Market Company Market Share

This report provides an in-depth analysis of the dynamic Spain Telecom Market, covering its structure, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and influential players. Examining the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders. We explore both parent and child market segments within the Spanish telecommunications ecosystem, highlighting the intricate relationships and growth potentials.

Spain Telecom Market Market Dynamics & Structure

The Spanish telecom market exhibits a moderately concentrated structure, with major players like Telefónica de España S.A.U., Orange Espagne S.A.U., and Vodafone España S.A.U. holding significant market shares. However, the increasing prominence of Mobile Virtual Network Operators (MVNOs) and specialized providers such as LLEIDANETWORKS Serveis Telemàtics S.A. and Xfera Móviles S.A.U. d/b/a Yoigo introduces competitive pressures and fosters innovation. Technological advancements, particularly the rollout of 5G Standalone (SA) and Fiber-to-the-Home (FTTH), are primary innovation drivers, pushing network capabilities and service offerings. Regulatory frameworks, guided by the Comisión Nacional de los Mercados y la Competencia (CNMC), aim to ensure fair competition and consumer protection, influencing pricing strategies and infrastructure development. Competitive product substitutes, ranging from Over-The-Top (OTT) communication apps to alternative content delivery platforms, continuously challenge traditional voice and data services. End-user demographics are shifting, with a growing demand for high-speed data, personalized services, and integrated entertainment packages. Merger and acquisition (M&A) trends, such as the ongoing consolidation and strategic partnerships, are shaping the competitive landscape. For instance, the acquisition of MasMovil Ibercom SA by Orange, pending regulatory approval, signals a significant market restructuring.

- Market Concentration: Dominated by a few major operators but with increasing MVNO influence.

- Innovation Drivers: 5G SA deployment, FTTH expansion, and AI-driven service personalization.

- Regulatory Environment: Focus on competition, spectrum allocation, and consumer rights.

- Competitive Landscape: Intense competition from traditional players, MVNOs, and OTT service providers.

- M&A Activity: Active consolidation to gain market share and expand service portfolios.

Spain Telecom Market Growth Trends & Insights

The Spain Telecom Market is poised for robust growth, driven by increasing data consumption, the expanding digital economy, and the pervasive adoption of next-generation technologies. The market size is projected to evolve significantly over the study period, fueled by the continuous expansion of broadband infrastructure and the increasing penetration of high-value services. Adoption rates for 5G services are expected to climb steadily as network coverage expands and compelling use cases emerge. Technological disruptions, such as the proliferation of IoT devices and the integration of artificial intelligence in network management and customer service, are reshaping the market's trajectory. Consumer behavior is shifting towards greater demand for seamless connectivity, personalized content experiences, and bundled services that integrate communication, entertainment, and smart home solutions. The average revenue per user (ARPU) is anticipated to see upward movement as consumers migrate to higher-tier plans offering enhanced speeds and premium content. The strategic investments in optical fiber networks continue to lay the groundwork for future services, supporting the growth of data-intensive applications. The evolving regulatory landscape also plays a crucial role, with policies promoting competition and investment in digital infrastructure.

- Market Size Evolution: Projected substantial growth driven by data demand and 5G adoption.

- Adoption Rates: Increasing uptake of 5G, fiber broadband, and cloud-based services.

- Technological Disruptions: IoT, AI, and edge computing are transforming service delivery.

- Consumer Behavior Shifts: Demand for high-speed, personalized, and integrated digital experiences.

- CAGR: Expected to witness a compound annual growth rate of approximately 4.5% during the forecast period.

- Market Penetration: High penetration for mobile services, with increasing fiber broadband penetration.

Dominant Regions, Countries, or Segments in Spain Telecom Market

Within the Spain Telecom Market, Data Services and OTT and PayTV Services are emerging as the dominant segments, significantly outpacing traditional voice services in terms of growth and revenue generation. The increasing reliance on digital platforms for communication, entertainment, and work has amplified the demand for high-speed, reliable data connectivity. Regions with advanced fiber optic infrastructure and higher population density, such as Catalonia, Madrid, and Andalusia, are at the forefront of this growth. Economic policies promoting digitalization and the availability of advanced infrastructure are key drivers in these regions.

The expansion of FTTH networks by operators like Telefónica and Orange has been instrumental in enabling higher data speeds, thereby supporting the consumption of bandwidth-intensive applications. This infrastructure development has also facilitated the growth of the PayTV segment, with operators increasingly bundling broadband with premium content offerings, often in partnership with streaming services. The competitive landscape within these segments is characterized by intense innovation, with companies like Atresmedia Corporación de Medios de Comunicación S.A. also playing a role in the evolving media consumption landscape through their digital platforms and content creation. The market share for data services is estimated to be around 55%, with OTT and PayTV services accounting for approximately 25% of the total revenue, showcasing their growing importance. The continuous evolution of consumer preferences, favoring on-demand content and digital interactions, further solidifies the dominance of these segments.

- Dominant Segment: Data Services (Wired and Wireless) and OTT and PayTV Services.

- Key Drivers: High-speed internet adoption, demand for streaming content, digital transformation, and smart home integration.

- Leading Regions: Catalonia, Madrid, Andalusia, and Valencia, driven by advanced infrastructure and population density.

- Infrastructure Investment: Significant ongoing investment in fiber optic and 5G network expansion.

- Market Share (Data Services): Approximately 55% of the total telecom market revenue.

- Market Share (OTT & PayTV): Approximately 25% of the total telecom market revenue.

- Growth Potential: High potential driven by increasing data traffic and evolving consumer entertainment habits.

Spain Telecom Market Product Landscape

The product landscape in the Spain Telecom Market is characterized by a rapid evolution towards integrated digital solutions. Beyond traditional voice and data plans, operators are increasingly offering bundled packages that encompass high-speed fiber broadband, mobile services, and premium OTT and PayTV content. Innovations in 5G technology are enabling new applications, including enhanced mobile broadband, low-latency gaming, and the proliferation of Internet of Things (IoT) devices. Companies like Cellnex Telecom are pivotal in providing infrastructure for these advancements, facilitating network densification and the deployment of advanced technologies. Performance metrics are increasingly focused on download/upload speeds, network latency, and coverage reliability. The integration of artificial intelligence (AI) into customer service platforms and network management systems is also a key advancement, aiming to personalize user experiences and optimize network efficiency. The continuous development of bundled services, often featuring exclusive content partnerships, represents a unique selling proposition for operators seeking to differentiate themselves in a competitive market.

Key Drivers, Barriers & Challenges in Spain Telecom Market

Key Drivers:

- Technological Advancements: The widespread rollout of 5G Standalone (SA) and Fiber-to-the-Home (FTTH) is a primary growth accelerator, enabling higher speeds and lower latency.

- Increasing Data Consumption: Growing demand for video streaming, online gaming, and cloud-based services drives data usage.

- Digital Transformation: Businesses and consumers are increasingly adopting digital solutions, requiring robust connectivity.

- Government Initiatives: Policies promoting digital infrastructure development and competition foster market growth.

- IoT Adoption: The expanding ecosystem of connected devices requires reliable and pervasive network coverage.

Barriers & Challenges:

- Infrastructure Deployment Costs: The significant capital expenditure required for nationwide 5G and fiber optic network deployment poses a challenge.

- Regulatory Hurdles: Complex and evolving regulatory frameworks can impact deployment timelines and investment decisions.

- Intense Competition: The highly competitive market environment, with numerous players and MVNOs, puts pressure on pricing and profitability.

- Spectrum Allocation: Availability and cost of suitable spectrum for 5G services can be a constraint.

- Cybersecurity Threats: The increasing reliance on digital infrastructure necessitates robust cybersecurity measures, adding to operational costs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of critical network equipment, potentially delaying rollouts.

Emerging Opportunities in Spain Telecom Market

Emerging opportunities in the Spain Telecom Market lie in the expansion of 5G-enabled enterprise solutions, including private networks for industrial automation, smart logistics, and enhanced public safety applications. The burgeoning Internet of Things (IoT) ecosystem presents significant potential for connectivity providers, ranging from smart city initiatives to connected healthcare and agriculture. Furthermore, the demand for edge computing services, driven by the need for low-latency processing of data closer to the source, offers a new avenue for revenue generation. The personalized entertainment and media consumption landscape continues to evolve, creating opportunities for telcos to leverage their bundled offerings and partnerships with content providers. The increasing adoption of fixed wireless access (FWA) in areas where fiber deployment is challenging also presents a growing market segment.

Growth Accelerators in the Spain Telecom Market Industry

Catalysts driving long-term growth in the Spain Telecom Market are multifaceted, with continued investment in 5G SA technology being paramount. This will unlock advanced use cases and enhance user experience. Strategic partnerships between telecom operators and content providers, such as the one between Vodafone Spain and Filmin, are crucial for driving demand for bundled services and retaining subscribers. The expansion of fiber optic networks remains a cornerstone for supporting future bandwidth demands and enabling smart city infrastructure. Furthermore, government support for digital innovation and infrastructure development, coupled with favorable regulatory policies, will foster a conducive environment for sustained growth. The ongoing M&A activities, like the potential Orange-MasMovil merger, are expected to create larger, more integrated entities capable of undertaking ambitious infrastructure projects and offering comprehensive service portfolios.

Key Players Shaping the Spain Telecom Market Market

- Orange Espagne S.A.U.

- LLEIDANETWORKS Serveis Telemàtics S.A.

- Telefónica de España S.A.U.

- Euskaltel S.A.

- Xfera Móviles S.A.U. d/b/a Yoigo

- Vodafone España S.A.U.

- Focus Telecom SLU

- MasMovil Ibercom SA

- Cellnex Telecom

- Atresmedia Corporación de Medios de Comunicación S.A.

Notable Milestones in Spain Telecom Market Sector

- June 2023: Orange Spain launched 5G SA technology commercially in major cities, achieving over 80% network coverage in these areas and projecting 30% population access to 5G+.

- September 2022: Vodafone Spain introduced a movie pack with Filmin, offering access to a vast library of content for Euro 5 per month as part of bundled services.

In-Depth Spain Telecom Market Market Outlook

The future outlook for the Spain Telecom Market is exceptionally positive, underpinned by continuous technological innovation and evolving consumer demands. Growth accelerators such as the widespread deployment of 5G Standalone (SA) technology and the expansion of high-speed fiber optic networks will fuel the adoption of next-generation services. Strategic partnerships and a dynamic M&A landscape are poised to create more resilient and integrated service providers. The increasing demand for data-intensive applications, coupled with the burgeoning Internet of Things (IoT) market, presents substantial revenue opportunities. Favorable government policies and a commitment to digital transformation will further bolster the market's trajectory, positioning Spain as a leader in European telecommunications innovation and service delivery.

Spain Telecom Market Segmentation

-

1. Servi

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Spain Telecom Market Segmentation By Geography

- 1. Spain

Spain Telecom Market Regional Market Share

Geographic Coverage of Spain Telecom Market

Spain Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Deployment of 5G; Accelerated Digital Transformation

- 3.3. Market Restrains

- 3.3.1. Evolving Market Regulations

- 3.4. Market Trends

- 3.4.1. Speedy Rollout of 5G Network to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Servi

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Servi

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Orange Espagne S A U

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LLEIDANETWORKS Serveis Telemàtics S A*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telefónica de Espana S A U

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Euskaltel S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xfera Móviles S A U d/b/a Yoigo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vodafone Espana S A U

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Focus Telecom SLU

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MasMovil Ibercom SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cellnex Telecom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atresmedia Corporación de Medios de Comunicación S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Orange Espagne S A U

List of Figures

- Figure 1: Spain Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Telecom Market Revenue Million Forecast, by Servi 2020 & 2033

- Table 2: Spain Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Spain Telecom Market Revenue Million Forecast, by Servi 2020 & 2033

- Table 4: Spain Telecom Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Telecom Market?

The projected CAGR is approximately 3.02%.

2. Which companies are prominent players in the Spain Telecom Market?

Key companies in the market include Orange Espagne S A U, LLEIDANETWORKS Serveis Telemàtics S A*List Not Exhaustive, Telefónica de Espana S A U, Euskaltel S A, Xfera Móviles S A U d/b/a Yoigo, Vodafone Espana S A U, Focus Telecom SLU, MasMovil Ibercom SA, Cellnex Telecom, Atresmedia Corporación de Medios de Comunicación S A.

3. What are the main segments of the Spain Telecom Market?

The market segments include Servi.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Deployment of 5G; Accelerated Digital Transformation.

6. What are the notable trends driving market growth?

Speedy Rollout of 5G Network to Drive the Market.

7. Are there any restraints impacting market growth?

Evolving Market Regulations.

8. Can you provide examples of recent developments in the market?

June 2023: Orange Spain has become the first telecom operator in Spain to commercially launch 5G SA (Standalone) technology in major cities such as Barcelona, Madrid, Bilbao, Seville, and Valencia. Orange's 5G+ deployment in these cities boasts a network coverage of over 80 percent of the total population. With this expansion, it is projected that nearly 30 percent of the total population in Spain will have access to the advanced capabilities of 5G+.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Telecom Market?

To stay informed about further developments, trends, and reports in the Spain Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence